Asian Shares Rally Slows Ahead of Bank of England Rate Decision

July 13 2016 - 11:40PM

Dow Jones News

A week-long rally across Asian stocks hit the brakes Thursday,

with investors waiting to see whether the Bank of England's

interest-rate decision would make or break further equity

gains.

Japan's Nikkei Stock Average remained the biggest outperformer

in the region, gaining 0.4% to add to its 7.7% ascent this week.

Investors' hopes for fiscal-stimulus policies helped set the

benchmark on track to scoring its best weekly performance so far

this year.

Shares of videogame maker Nintendo Co. continued to soar, rising

9.8% on the craze around its "Poké mon Go" app. That brings

Nintendo's total gain this week to more 50%. Nintendo has a

minority stake in the augmented-reality game.

But the euphoria in Asian equities from earlier in the week

mostly dissipated on Thursday as investors stayed more cautious

before the Bank of England's Monetary Policy Committee meets after

Asian markets close.

The meeting "will probably will be the deciding factor on how

the markets will react later today," said Tareck Horchani, a senior

sales trader at Saxo Capital Markets in Singapore. "The market is

pricing a cut."

In the rest of the Asia-Pacific region, Australia's S&P/ASX

200 was up 0.2%, Korea's Kospi was down 0.2% and Hong Kong's Hang

Seng Index edged down 0.1%. China's Shanghai Composite Index lost

0.3%, and Singapore's Straits Times Index was off 0.1%.

Energy shares in Hong Kong, China and Australia sank after crude

oil prices slumped overnight. U.S. oil prices plummeted to a

two-month low after data showed U.S. inventories of crude oil and

refined products were at a record high. Brent was recently trading

at $46.67 per barrel in early Asia trade.

Meanwhile, Malaysian stocks fell after the country's central

bank on Wednesday unexpectedly cut the overnight policy rate for

the first time in seven years. The FTSE Bursa Malaysia KLCI was

last down 0.3%.

In other markets, some sovereign Asian government bonds rallied,

in another sign of investors' anticipation of fresh policy easing

by global central banks. The yield on the 10-year Australian note

slipped to 1.92%, while the yield on the 10-year Malaysian note

sank to 3.56%. Yields sink when bond prices rise.

Asian sovereign bonds are rallying "on expectation that rates

will stay low for a while and [investors] need the yield," Mr.

Horchani said.

Write to Dominique Fong at Dominique.Fong@wsj.com

(END) Dow Jones Newswires

July 13, 2016 23:25 ET (03:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

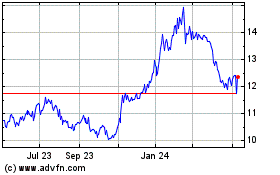

Nintendo (PK) (USOTC:NTDOY)

Historical Stock Chart

From Apr 2024 to May 2024

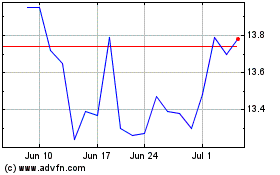

Nintendo (PK) (USOTC:NTDOY)

Historical Stock Chart

From May 2023 to May 2024