UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

_______________

FORM 11-K

_______________

(Mark One)

[X] ANNUAL REPORT PURSUANT

TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 30, 2015.

OR

[ ] TRANSITION REPORT

PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period

from to

Commission File Number 1‑10560

A.

Full title of the plan and

the address of the plan, if different from that of the issuer named below:

BENCHMARK ELECTRONICS, INC. 401(K) EMPLOYEE SAVINGS PLAN

B.

Name of issuer of the

securities held pursuant to the plan and the address of its principal executive

office:

BENCHMARK ELECTRONICS, INC.

3000 TECHNOLOGY DRIVE

ANGLETON, TEXAS 77515

REQUIRED INFORMATION

The following financial

statements and schedules have been prepared in accordance with the financial

reporting requirements of the Employee Retirement Income Security Act of 1974,

as amended:

1.

Statements of Net Assets Available

for Benefits as of December 30, 2015 and 2014

2.

Statement of Changes in Net Assets

Available for Benefits for the year ended December 30, 2015

3.

Schedule H, line 4i - Schedule of

Assets (Held at End of Year) - December 30, 2015*

EXHIBITS

23

Consent of Independent Registered Public Accounting Firm

* Other schedules required by section 2520.103-10 are

omitted because they are not applicable.

SIGNATURES

The Plan.

Pursuant to the requirements of the

Securities Exchange Act of 1934, the trustees (or other persons who administer

the employee benefit plan) have duly caused this annual report to be signed by

the undersigned hereunto duly authorized.

|

|

BENCHMARK ELECTRONICS, INC.

|

|

|

401(K) EMPLOYEE SAVINGS PLAN

|

|

|

|

|

|

By:

/s/ Donald F. Adam

|

|

|

Donald F. Adam

|

|

|

Chief Financial Officer

|

|

|

Benchmark Electronics,

Inc.

|

|

|

|

|

|

Date: June 24, 2016

|

BENCHMARK

ELECTRONICS, INC.

401(k) EMPLOYEE SAVINGS PLAN

Financial Statements and Supplemental Schedule

December 30, 2015 and 2014

(With Independent Registered Public Accounting Firm’s

Report Thereon)

BENCHMARK ELECTRONICS, INC.

401(k) EMPLOYEE

SAVINGS PLAN

Table of Contents

Page

|

Report of

Independent Registered Public Accounting Firm

|

1

|

|

|

|

|

|

|

|

Statements of

Net Assets Available for Benefits as of December 30, 2015 and 2014

|

2

|

|

|

|

|

|

Statement of

Changes in Net Assets Available for Benefits for the year ended December 30,

2015

|

3

|

|

|

|

|

|

Notes to

Financial Statements

|

4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental

Schedule

|

|

|

Schedule H,

Line 4i - Schedule of Assets (Held at End of Year) as of December 30, 2015

|

11

|

|

|

|

|

|

|

Report of Independent Registered Public

Accounting Firm

The

Board of Directors

Benchmark

Electronics, Inc.:

We

have audited the accompanying statements of net assets available for benefits

of the Benchmark Electronics, Inc. 401(k) Employee Savings Plan (the Plan) as

of December 30, 2015 and 2014, and the related statement of changes in net

assets available for benefits for the year ended December 30, 2015. These

financial statements are the responsibility of the Plan’s management. Our

responsibility is to express an opinion on these financial statements based on

our audits.

We

conducted our audits in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require that we

plan and perform the audit to obtain reasonable assurance about whether the

financial statements are free of material misstatement. An audit includes

examining, on a test basis, evidence supporting the amounts and disclosures in

the financial statements. An audit also includes assessing the accounting

principles used and significant estimates made by management, as well as

evaluating the overall financial statement presentation. We believe that our

audits provide a reasonable basis for our opinion.

In

our opinion, the financial statements referred to above present fairly, in all

material respects, the net assets available for benefits of the Plan as of

December 30, 2015 and 2014, and the changes in net assets available for

benefits for the year ended December 30, 2015, in conformity with U.S.

generally accepted accounting principles.

The

supplemental information in the accompanying Schedule of Assets (Held at End of

Year) as of December 30, 2015 has been subjected to audit procedures performed

in conjunction with the audit of the Plan’s financial statements. The

supplemental information is presented for the purpose of additional analysis

and is not a required part of the financial statements but includes

supplemental information required by the Department of Labor’s Rules and

Regulations for Reporting and Disclosure under the Employee Retirement Income

Security Act of 1974. The supplemental information is the responsibility of the

Plan’s management. Our audit procedures included determining whether the

supplemental information reconciles to the financial statements or the

underlying accounting and other records, as applicable, and performing

procedures to test the completeness and accuracy of the information presented

in the supplemental information. In forming our opinion on the supplemental

information in the accompanying schedule, we evaluated whether the supplemental

information, including its form and content, is presented in conformity with

the Department of Labor’s Rules and Regulations for Reporting and Disclosure

under the Employee Retirement Income Security Act of 1974. In our opinion, the

supplemental information is fairly stated in all material respects in relation

to the financial statements as a whole.

/s/

Hein & Associates LLP

Houston,

Texas

June

24, 2016

BENCHMARK ELECTRONICS, INC.

401(k) EMPLOYEE SAVINGS PLAN

Statements of Net Assets Available for

Benefits

December 30, 2015 and 2014

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

|

2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

|

Investments at

fair value

|

|

$

|

144,562,088

|

|

$

|

147,400,979

|

|

|

Investments at

contract value

|

|

|

58,434,442

|

|

|

58,331,545

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

|

|

|

|

Employer

contributions

|

|

|

300,756

|

|

|

260,930

|

|

|

|

Participant

contributions

|

|

|

415,863

|

|

|

493,959

|

|

|

|

Notes

receivable from participants

|

|

|

4,731,761

|

|

|

5,073,850

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

receivables

|

|

|

5,448,380

|

|

|

5,828,739

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets

available for benefits

|

|

$

|

208,444,910

|

|

$

|

211,561,263

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See

accompanying notes to the financial statements.

|

|

|

|

|

|

|

BENCHMARK ELECTRONICS, INC.

401(k) EMPLOYEE SAVINGS PLAN

Statement of Changes in Net Assets

Available for Benefits

Year ended December 30, 2015

|

Additions

|

|

|

|

|

Investment

income (loss):

|

|

|

|

|

|

Interest

|

$

|

1,106,245

|

|

|

|

Dividends

|

|

1,697,249

|

|

|

|

Net

depreciation in fair value of investments

|

|

(5,031,915)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2,228,421)

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

on notes receivable from participants

|

|

211,203

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributions:

|

|

|

|

|

|

Employer

|

|

4,915,332

|

|

|

|

Participant

|

|

10,194,404

|

|

|

|

Rollovers

|

|

686,958

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,796,694

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total additions

|

|

13,779,476

|

|

|

|

|

|

|

|

|

|

|

|

Deductions

|

|

|

|

|

Benefits paid

to participants

|

|

(16,879,154)

|

|

|

Administrative

expenses

|

|

(16,675)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

deductions

|

|

(16,895,829)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net decrease in

net assets available for benefits

|

|

(3,116,353)

|

|

|

|

|

|

|

|

|

|

|

|

Net assets

available for benefits:

|

|

|

|

|

Beginning of

year

|

|

211,561,263

|

|

|

|

|

|

|

|

|

|

|

|

|

End of year

|

$

|

208,444,910

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See

accompanying notes to the financial statements.

|

|

|

BENCHMARK ELECTRONICS, INC.

401(k) EMPLOYEE SAVINGS PLAN

Notes to Financial Statements

(1) Description of

Plan

The

following description of the Benchmark Electronics, Inc. 401(k) Employee

Savings Plan (the Plan) provides only general information. Participants should

refer to the Plan agreement for a more complete description of the Plan’s

provisions.

(a) General

The

Plan is a defined contribution plan covering all employees of Benchmark

Electronics, Inc. (the Company) and the following affiliates of the Company:

Benchmark Electronics Huntsville Inc.; Benchmark Electronics California,

Incorporated; Benchmark Electronics Manufacturing Solutions, Inc.; and

Benchmark Electronics Manufacturing Solutions (Moorpark), Inc. The Plan is

subject to the provisions of the Employee Retirement Income Security Act of

1974, as amended (ERISA). Effective December 1, 2009, the Plan adopted the

Prudential Retirement Prototype Plan (the Prototype Plan).

The

Plan is administered by the Company and advised by the board of directors of

the Company and the investment committee. Prudential Bank & Trust, FSB is

trustee of the Plan, and Prudential Retirement Insurance and Annuity Company

(Prudential) is the record keeper.

(b) Contributions

and Investment Options

Participants

may elect to make pre-tax contributions of up to 100% (in 1.0% increments) of

their compensation, as defined. Participant contributions will be matched by

the Company on a 100% basis, not to exceed 4.0% of a participant’s compensation

(referred to as employer contributions) upon completion of one year of service.

The Company may also elect to make an employer discretionary contribution to

all employees employed at the end of the Plan year who have completed 1,000

hours of service during such year. The Company did not make a discretionary

contribution during the 2015 Plan year. Certain Internal Revenue Service (IRS)

limits may apply to both the participants’ contributions and the employers’

contributions. Eligible participants may also elect to roll over distributions

from a former employer’s qualified retirement plan.

Participants

direct the investment of all contributions into various investment options

offered by the Plan. The Plan currently offers 14 mutual funds, Company common

stock and an insurance investment contract as investment options for

participants.

(c) Participant

Accounts

Each

participant’s account is credited with the participant’s contributions and

employer matching contributions and an allocation of discretionary employer

contributions, if any, and plan earnings. Allocations are based on participant

earnings or account balances, as defined. The benefit to which a participant is

entitled is the benefit that can be provided from the participant’s vested

account.

BENCHMARK ELECTRONICS, INC.

401(k) EMPLOYEE SAVINGS PLAN

Notes to Financial Statements

(d) Vesting

Participants

are immediately vested in their contributions, employer matching contributions

and the actual earnings thereon.

(e) Notes

Receivable from Participants

Upon

application by a participant, the Plan administrator may make loans to

participants not to exceed 50% of their 401(k) vested balance, with a minimum

of $1,000 and a maximum of $50,000 less the participant’s highest outstanding

loan balance during the preceding 12 months. Participants’ loans are to be

repaid by level monthly payroll deductions of principal plus interest or may be

prepaid in full or in part without penalty at any time. The interest rate is

set at the prime rate plus 1%. Loan proceeds are reduced by a $75 loan

processing fee.

Notes

receivable from participants are measured at their unpaid principal balance

plus any accrued but unpaid interest. Interest income is recorded on the

accrual basis. Related fees are recorded as administrative expenses and are

expensed when they are incurred. No allowance for credit losses has been

recorded at December 30, 2015, or 2014. Delinquent loans are treated as

distributions based upon the terms of the Plan document.

(f) Administrative

Expenses

Administrative

expenses of the Plan are paid partly by the Company and partly by the Plan.

Mutual fund redemption fees and investment advisory fees paid by participants

are reported in administrative expenses in the accompanying statement of

changes in net assets available for benefits.

Expenses related to the asset management of the investment

funds and recordkeeping services are paid via the expense ratios charged on the

investments, which reduce the investment return reported and credited to

participant accounts. Consequently, these management fees and operating

expenses are reflected as a reduction of investment return for such

investments. In addition, the Company incurs certain expenses administering the

Plan, which are not included in the Plan’s financial statements.

(g) Payment

of Benefits

On

termination of service, a participant may elect to receive either a lump-sum

amount equal to the vested value of his/her account, an annuity with various

terms and rates or roll the vested balance over to another qualified plan.

While

employed, a participant may make withdrawals from his or her account balance

(as allowed under IRS regulations) subject to certain restrictions as described

in the Plan. Certain restrictions associated with withdrawals may be waived in

the event a participant demonstrates financial hardship.

BENCHMARK ELECTRONICS, INC.

401(k) EMPLOYEE SAVINGS PLAN

Notes to Financial Statements

(h) Termination of the Plan

Although

the Company has not expressed any intent to terminate the Plan, it may do so as

provided by the Plan agreement.

(2) Summary

of Accounting Policies

(a) Basis

of Accounting

The

financial statements of the Plan are prepared under the accrual method of

accounting.

Investments

held by a defined contribution plan are required to be reported at fair value,

except for fully benefit-responsive investment contracts. Contract value is the

relevant measure for the portion of the net assets available for benefits of a

defined contribution plan attributable to fully benefit-responsive investment

contracts because contract value is the amount participants normally would

receive if they were to initiate permitted transactions under the Plan.

(b) Investment

Valuation

Investments

are reported at fair value (except for fully benefit-responsive investment

contracts, which are reported at contract value). The common stock of the

Company and mutual funds are valued at their quoted market price. The

investments in common/collective trust funds are valued based upon the quoted

market values of the underlying assets.

Purchases

and sales of securities are recorded on a trade-date basis. Interest and

dividends are recorded as earned. Net depreciation includes the Plan’s gains

and losses on investments purchased and sold as well as held during the year.

(c) Concentration

of Investments

The

Plan’s investment in shares of the Company’s common stock represented 4.3% and

5.3% of the Plan’s net assets as of December 30, 2015 and 2014, respectively.

The Company has been in operation since 1981 and is listed on the New York

Stock Exchange.

(d) Use

of Estimates

The

preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires the Plan

administrator to make estimates and assumptions that affect the reported

amounts of assets and liabilities, disclosure of contingent assets and

liabilities at the date of the financial statements and the reported amounts of

additions to and deductions from net assets during the reporting period. Actual

results could differ from those estimates.

(e) Payment

of Benefits

Benefits

are recorded when paid.

(f)

Subsequent Events

Subsequent

events have been evaluated for potential recognition and disclosure through the

date the Plan financial statements were issued.

BENCHMARK ELECTRONICS, INC.

401(k) EMPLOYEE SAVINGS PLAN

Notes to Financial Statements

(g)

New Accounting Pronouncements

The

Financial Accounting Standards Board (FASB) recently issued Accounting

Standards Update (ASU) 2015-12, “Plan Accounting: Defined Benefit Pension Plans

(Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare

Benefit Plans (Topic 965): (Part I) Fully Benefit-Responsive Investment

Contracts (FBRICs), (Part II) Plan Investment Disclosures, (Part III)

Measurement Date Practical Expedient”. The amendments are effective for fiscal

years beginning after December 15, 2015. Early adoption is permitted for all

parts of ASU 2015-12. This update reduces complexity in employee benefit plan

accounting.

Part

I of ASU 2015-12 designated contract value as the only required measure for

fully benefit-responsive investment contracts.

The

amendment in Part II of ASU 2015-12 required that investments (both

participant-directed and nonparticipant-directed investments) of employee

benefit plans be grouped only by general type, eliminating the need to

disaggregate the investments in multiple ways. Part II also eliminated the

requirement to disclose individual investments that represent five percent or

more of net assets available for benefits and the net appreciation or

depreciation for investments by general type.

Part

III of ASU 2015-12 provides a practical expedient that permits plans to measure

investments and investment-related accounts as of a month end date that is

closest to the plan’s fiscal year end, when the fiscal period does not coincide

with month end.

The

Plan Administrator early adopted this guidance on December 30, 2015, but did

not utilize the practical expedient provided under Part III.

(3) Benchmark

Electronics, Inc. Common Stock

Each

participant is entitled to exercise voting rights attributable to the shares

allocated to his or her account and is notified by the trustee prior to the

time that such rights are to be exercised.

(4) Investments

at Contract Value

The

Plan’s investment in the Guaranteed Income Fund (GIF) is an evergreen group

annuity contract and is valued at contract value as estimated by Prudential.

The GIF’s interest rates are adjusted to market semi-annually. Contract value

represents net contributions plus interest at the contract rate, less funds

used to purchase annuities and pay administrative expenses by Prudential.

The

GIF earned an average yield and credited an interest rate to participants of

2.15% and 2.15%, respectively, for the year ended December 30, 2015. The

minimum crediting rate under the GIF contract is 1.50%. There are no reserves

against contract value for credit risk of the contract issuer or otherwise. The

guarantee is based on Prudential’s ability to meet its financial obligations

from its general assets. Prudential’s ability to meet its contractual

obligations may be affected by future economic and regulatory developments.

BENCHMARK ELECTRONICS, INC.

401(k) EMPLOYEE SAVINGS PLAN

Notes to Financial Statements

(5) Federal Income

Tax Exemption

The

IRS has determined and informed the Company by a letter dated March 31, 2008,

that the Prototype Plan and related trust are designed in accordance with

Section 401(a) of the Internal Revenue Code of 1986, as amended (IRC), and,

accordingly, are entitled to an exemption from federal income taxes under the

provisions of Section 501(a) of the IRC. The Plan administrator believes that

the Plan is designed, and is currently being operated, in compliance with the

appropriate IRC sections. Management has evaluated the Plan’s tax positions and

has concluded that, as of December 30, 2015, the Plan had maintained its tax

exempt status and had taken no uncertain tax positions that require adjustment

to the financial statements. Therefore, no provision or liability for income

taxes has been included in the financial statements. The Plan is subject to

routine audits by taxing jurisdictions; however, there are no audits for any

tax periods in progress. The Plan administrator believes the Plan is no longer

subject to income tax examinations for years prior to 2011.

(6) Reconciliation

of Financial Statements to Form 5500

Reconciliation of the net assets available

for benefits reported in the accompanying statements to the net assets

available for benefits reported per the Form 5500 as of December 30, 2015 and

2014 is as follows:

|

|

|

|

|

|

|

2015

|

|

|

2014

|

|

|

Net assets

available for benefits

|

|

|

|

|

|

|

|

|

reported per

the Form 5500

|

$

|

207,728,291

|

|

$

|

210,806,374

|

|

|

Adjustment in

employer contributions receivable

|

|

300,756

|

|

|

260,930

|

|

|

Adjustment in

participants contributions receivable

|

|

415,863

|

|

|

493,959

|

|

|

|

|

Net assets

available for benefits

|

|

|

|

|

|

|

|

|

|

|

reported in the

accompanying statement

|

$

|

208,444,910

|

|

$

|

211,561,263

|

Reconciliation

of the changes in net assets available for benefits reported in the

accompanying statement to the net changes in net assets available for benefits

reported per the Form 5500 for the year ended December 30, 2015 is as follows:

|

|

Net decrease in

net assets available for benefits

|

|

|

|

|

|

|

|

|

reported per

the Form 5500

|

$

|

(3,078,083)

|

|

|

|

|

|

Adjustment in

contributions from employer

|

|

39,826

|

|

|

|

|

|

Adjustment in

contributions from participants

|

|

(78,096)

|

|

|

|

|

|

|

|

Net decrease in

net assets available for benefits

|

|

|

|

|

|

|

|

|

|

|

reported in the

accompanying statement

|

$

|

(3,116,353)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BENCHMARK ELECTRONICS, INC.

401(k) EMPLOYEE SAVINGS PLAN

Notes to Financial Statements

(7) Party-in-Interest

Transactions

The

Plan engages in investment transactions with funds managed by Prudential

Retirement Insurance and Annuity Company and Prudential Investments LLC. These companies

are all affiliated with Prudential Financial Inc., which is the parent company

for Prudential Bank & Trust, FSB, the trustee. These transactions are

covered by an exemption from the prohibited transaction provisions of ERISA and

IRC.

The

Plan invests in shares of the Company’s common stock. As the Company is the

sponsor of the Plan, these transactions qualify as party-in-interest

transactions, which are also exempt under ERISA.

(8)

Risks and Uncertainties

The

Plan invests in various investment securities. Investment securities are

exposed to various risks such as interest rate, market and credit risks. Due to

the level of risk associated with certain investment securities, it is at least

reasonably possible that changes in the values of investment securities will

occur in the near term and that such changes could materially affect

participants’ account balances and the amounts reported in the statement of net

assets available for benefits.

(9) Fair

Value Measurements

The

framework for measuring fair value provides a fair value hierarchy that

prioritizes the inputs to valuation techniques used to measure fair value.

The hierarchy gives the highest priority

to unadjusted quoted prices in active markets for identical assets or

liabilities (level 1 measurements) and the lowest priority to unobservable

inputs (level 3 measurements). Valuation techniques maximize the use of

relevant observable inputs and minimize the use of unobservable inputs. The

three levels of the fair value hierarchy are described below:

Level 1 Inputs to the valuation

methodology are unadjusted quoted prices for identical assets or liabilities in

active markets that the Plan has the ability to access.

Level 2 Inputs other than quoted prices

included within Level 1 that are observable for the asset or liability, either

directly or indirectly, such as:

• Quoted prices for similar assets or

liabilities in active markets;

• Quoted prices for identical or

similar assets or liabilities in inactive markets;

• Inputs other than quoted prices that

are observable for the asset or liability;

• Inputs that are derived principally

from or corroborated by observable market data by correlation or other means.

If the asset or liability has a specified (contractual) term, the

Level 2 input must be observable for substantially the full term of the asset

or liability.

Level 3 Inputs that are unobservable and

significant for the asset or liability.

BENCHMARK ELECTRONICS, INC.

401(k) EMPLOYEE SAVINGS PLAN

Notes to Financial Statements

The Plan’s investments at fair value, set

forth by level within the fair value hierarchy, were as follows:

|

|

|

|

As of December 30, 2015

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

$

|

112,860,989

|

|

-

|

|

112,860,989

|

|

|

Common stocks

|

|

8,917,909

|

|

-

|

|

8,917,909

|

|

|

Pooled separate

accounts

|

|

18,440,141

|

|

4,343,049

|

|

22,783,190

|

|

|

Investments at

fair value

|

$

|

140,219,039

|

|

4,343,049

|

|

144,562,088

|

|

|

|

|

As of December 30, 2014

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

$

|

114,725,142

|

|

-

|

|

114,725,142

|

|

|

Common stocks

|

|

11,278,213

|

|

-

|

|

11,278,213

|

|

|

Pooled separate

accounts

|

|

17,535,302

|

|

3,862,322

|

|

21,397,624

|

|

|

Investments at

fair value

|

$

|

143,538,657

|

|

3,862,322

|

|

147,400,979

|

(10) Subsequent

Event

Effective March 9, 2016, the net assets of the Suntron Corporate

401(k) Savings Plan (the Suntron Plan) totaling $13,093,517 were merged with

and transferred to the Plan. The investments of the Suntron Plan were

liquidated and invested in investments of the Plan with similar investment

objectives.

|

|

BENCHMARK ELECTRONICS, INC.

|

|

|

401(k) EMPLOYEE SAVINGS PLAN

|

|

|

|

|

|

|

|

|

|

Employer Identification Number

(74-2211011) - Plan Number (001)

|

|

|

|

|

|

|

|

|

|

Schedule H, Line 4i - Schedule of Assets

(Held at End of Year)

|

|

|

|

|

|

|

|

|

|

December 30, 2015

|

|

|

|

|

|

|

(e)

|

|

|

(a) (b)

|

|

(c)

|

|

Current

|

|

|

Identity of issuer

|

|

Description of investment

|

|

value

|

|

|

|

|

|

|

|

|

|

Capital Research

and Management Company

|

|

American Funds

Europacific Growth Fund®, Class R-4

|

$

|

16,998,807

|

|

|

|

|

|

|

|

|

*

|

Prudential

Investments LLC

|

|

Prudential Total

Return Bond Fund, Class Z

|

|

16,543,064

|

|

|

|

|

|

|

|

|

|

Artisan Partners

Holdings LP

|

|

Artisan Mid Cap

Value Fund, Institutional Class

|

|

13,128,713

|

|

|

|

|

|

|

|

|

*

|

Prudential

Investments LLC

|

|

Prudential

Jennison 20/20 Focus Fund, Class Z

|

|

12,076,277

|

|

|

|

|

|

|

|

|

|

JPMorgan

Investment Advisors, Inc.

|

|

JPMorgan Small

Cap Equity Fund, Select Class

|

|

11,307,918

|

|

|

|

|

|

|

|

|

|

J.P. Morgan

Investment Management Inc.

|

|

JPMorgan Growth

Advantage Fund, Class R5

|

|

9,086,725

|

|

|

|

|

|

|

|

|

|

The Dreyfus

Corporation

|

|

Dreyfus

Appreciation Fund, Inc., Investor Class

|

|

8,734,741

|

|

|

|

|

|

|

|

|

|

Massachusetts

Financial Services Company

|

|

MFS® Value Fund,

Class R-4

|

|

8,362,075

|

|

|

|

|

|

|

|

|

|

Hartford Funds

Management Company, LLC

|

|

Hartford

Balanced Income Fund, Class R-5

|

|

7,244,133

|

|

|

|

|

|

|

|

|

|

American Century

Capital Portfolios, Inc.

|

|

American Century

Small Cap Value Fund, Institutional Class

|

|

3,883,498

|

|

|

|

|

|

|

|

|

|

OppenheimerFunds,

Inc.

|

|

Oppenheimer

Developing Markets Fund, Class Y

|

|

2,540,566

|

|

|

|

|

|

|

|

|

|

Pioneer

Investment Management, Inc.

|

|

Oak Ridge Small

Cap Growth Fund, Class Y

|

|

2,954,472

|

|

|

|

|

|

|

|

|

|

|

|

Total Mutual

Funds

|

|

112,860,989

|

|

|

|

|

|

|

|

|

*

|

Prudential

Retirement Insurance and Annuity Company

|

|

Dryden S&P

500® Index Fund

|

|

18,440,141

|

|

|

|

|

|

|

|

|

*

|

Prudential

Retirement Insurance and Annuity Company

|

|

Prudential Day

One IncomeFlex® Target Balanced Fund

|

|

4,343,049

|

|

|

|

|

|

|

|

|

|

|

|

Total Pooled

Separate Accounts

|

|

22,783,190

|

|

|

|

|

|

|

|

|

*

|

Prudential

Retirement Insurance and Annuity Company

|

|

Guaranteed

Income Fund

|

|

58,434,442

|

|

|

|

|

|

|

|

|

*

|

Benchmark

Electronics, Inc.

|

|

Benchmark

Electronics, Inc. Common Stock Fund

|

|

8,917,909

|

|

|

|

|

|

|

|

|

*

|

Participants

|

|

Notes receivable

from participants (rates range from

|

|

|

|

|

|

|

4.25% to 9.5%

at December 30, 2015)

|

|

4,731,761

|

|

|

|

|

|

|

|

|

|

|

|

Total

investments and notes receivable

|

|

|

|

|

|

|

from

participants (Held at End of Year)

|

$

|

207,728,291

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost information

omitted as all investments are participant directed.

|

|

|

|

|

|

|

|

|

|

|

*

|

Represents

party-in-interest transactions.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying

report of independent registered public accounting firm.

|

|

|

|

|

|

|

|

|

|

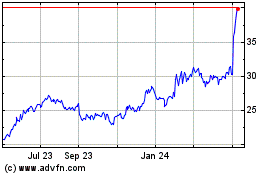

Benchmark Electronics (NYSE:BHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

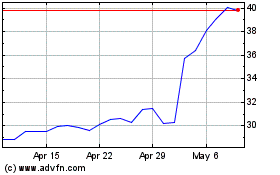

Benchmark Electronics (NYSE:BHE)

Historical Stock Chart

From Apr 2023 to Apr 2024