Current Report Filing (8-k)

May 19 2016 - 2:58PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

May 16, 2016

iSign Solutions Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-19301

|

94-2790442

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

275 Shoreline Drive, Suite 500

Redwood Shores, CA 94065-1413

(Address of principal executive offices)

(650) 802-7888

Registrant’s telephone number, including area code

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On May 16, 2016, iSign Solutions Inc. (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”) with Axiom Capital Management, Inc., as representative (the “Representative”) of the several underwriters identified therein ( the “Underwriters”), pursuant to which the Underwriters agreed to act as underwriters in a public offering of 690,000 shares (the “Shares”) of the Company’s common stock, par value $0.01 per share (the “Common Stock”), at a public offering price $1.74 per share, and warrants (the “Warrants”) to purchase 345,000 shares of Common Stock with an exercise price of $2.175 per share, at a public offering price of $0.01 per Warrant. The Shares and the Warrants are being offered by the Company pursuant to a Registration Statement on Form S-1 which was declared effective by the Securities and Exchange Commission on May 13, 2016 (File No. 333-208601) (the “Offering”). The Underwriters have a 45-day option to purchase up to an additional 103,500 shares of Common Stock, warrants to purchase up to an additional 51,750 shares of Common Stock, or a combination thereof, in each case representing no more than 15% of the Shares or Warrants, as applicable, sold in the Offering, solely to cover over-allotments, if any. The Underwriting Agreement contains representations and warranties and covenants relating to the Offering.

Pursuant to the Underwriting Agreement, in addition to the Underwriters’ discounts and commissions and payment of the Underwriters’ expenses in connection with the Offering (including a non-accountable expense allowance), the Company granted the Representative a warrant (the “Representative’s Warrant”) to purchase 48,300 shares of Common Stock. The Representative’s Warrant has an exercise price of $2.175 per share of Common Stock and expires on May 16, 2021.

In addition, pursuant to the Underwriting Agreement, the Company agreed to indemnify the Underwriters against certain liabilities, including liabilities under the Securities Act of 1933, or to contribute to payments which the Underwriters or such other indemnified parties may be required to make in respect of any such liabilities.

The foregoing descriptions of the Underwriting Agreement, the Warrants and the Representative’s Warrant do not purport to be complete and are qualified in their entirety by reference to the full text of the Form of Underwriting Agreement, the Form of Warrant to Purchase Common Stock and the Form of Representative’s Warrant. The Form of Underwriting is filed as Exhibit 1.1 of Amendment No. 1 on Form S-1 to the Company’s Registration Statement on Form S-1 (File No. 333-208601) and is incorporated herein by reference. The Form of Warrant to Purchase Common Stock is filed as Exhibit 4.30 of Amendment No. 3 on Form S-1 to the Company’s Registration Statement on Form S-1 (File No. 333-208601) and is incorporated herein by reference. The Form of Representative’s Warrant, which is attached hereto as Exhibit 4.1, is incorporated herein by reference.

|

Item 5.03.

|

Amendment to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On May 18, 2016, the Company filed with the Secretary of State of the State of Delaware (i) a Certificate of Amendment to the Third Amended and Restated Certificate of Designation of Series A-1 Cumulative Convertible Preferred Stock (the “Series A-1 Certificate of Amendment”), (ii) a Certificate of Amendment to the Second Amended and Restated Certificate of Designation of Series B Participating Convertible Preferred Stock (the “Series B Certificate of Amendment”), (iii) a Certificate of Amendment to the Amended and Restated Certificate of Designation of Series C Participating Convertible Preferred Stock (the “Series C Certificate of Amendment”), (iv) a Certificate of Amendment to the Certificate of Designation of Series D Convertible Preferred Stock (the “Series D-1 Certificate of Amendment” and (v) a Certificate of Amendment to the Certificate of Designation of Series D Convertible Preferred Stock (the “Series D-2 Certificate of Amendment” and, together with the Series A-1 Certificate of Amendment, the Series B Certificate of Amendment, the Series C Certificate of Amendment and the Series D-1 Certificate of Amendment, the “Certificates of Amendment”), which, provide for (a) the automatic conversion of each share of the applicable series of preferred stock of the Company into shares of the Company’s common stock upon the closing of a firm-commitment underwritten public offering of shares of the Company’s common stock pursuant to a prospectus or an effective registration statement no later than July 31, 2016 and (b) the reduction of the conversion price of the applicable series of preferred stock of the Company. Each of the Certificates of Amendment became effective on its date of filing.

As a result of the Series A-1 Certificate of Amendment and pursuant to the terms thereof, the conversion price of the Company’s Series A-1 Cumulative Convertible Preferred Stock was reduced from $175.0000 per share to $19.4375 per share. As a result of the Series B Certificate of Amendment and pursuant to the terms thereof, the conversion price of the Company’s Series B Participating Convertible Preferred Stock was reduced from $54.1250 per share to $12.9625 per share. As a result of the Series C Certificate of Amendment and pursuant to the terms thereof, the conversion price of the Company’s Series C Participating Convertible Preferred Stock was reduced from $28.1250 per share to $9.7125 per share. As a result of the Series D-1 Certificate of Amendment and pursuant to the terms thereof, the conversion price of the Company’s Series D-1 Convertible Preferred Stock was reduced from $28.1250 per share to $7.2375 per share. As a result of the Series D-2 Certificate of Amendment and pursuant to the terms thereof, the conversion price of the Company’s Series D-2 Convertible Preferred Stock was reduced from $62.5000 to $8.5750. The descriptions of the Certificates of Amendment as described herein are qualified in their entirety by reference to the Series A-1 Certificate of Amendment, which is attached hereto as Exhibit 3.1, the Series B Certificate of Amendment, which is attached hereto as Exhibit 3.2, the Series C Certificate of Amendment, which is attached hereto as Exhibit 3.3, the Series D-1 Certificate of Amendment, which is attached hereto at Exhibit 3.4, and the Series D-2 Certificate of Amendment, which is attached hereto at Exhibit 3.5, each of which is incorporated herein by reference.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On May 16, 2016, the Company issued a press release entitled “iSign Announces Pricing of Public Offering”. On May 19, 2016, the Company issued a press release entitled “iSign Closes Public Offering. Copies of these press releases are hereby filed as Exhibit 99.1 and Exhibit 99.2, respectively, and incorporated by reference into this Item 7.01. The information furnished in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section.

On May 19, 2016, the Company closed the Offering and received gross cash proceeds of approximately $1.204 million. The shares of Common Stock and the Warrants are quoted on the OTC Market Group Inc.’s OTCQB quotation system.

In addition, on May 19, 2016, as a result of consummating the Offering, each series of the Company’s outstanding preferred stock, including accrued but unpaid dividends through May 19, 2016, were converted into a total of 3,651,818 shares of Common Stock.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

3.1

|

|

Certificate of Amendment to the Company’s Third Amended and Restated Certificate of Designation of Series A-1 Cumulative Convertible Preferred Stock filed with Secretary of State of the State of Delaware on May 18, 2016.

|

|

3.2

|

|

Certificate of Amendment to the Company’s Second Amended and Restated Certificate of Designation of Series B Participating Convertible Preferred Stock filed with Secretary of State of the State of Delaware on May 18, 2016.

|

|

3.3

|

|

Certificate of Amendment to the Company’s Amended and Restated Certificate of Designation of Series C Participating Convertible Preferred Stock filed with Secretary of State of the State of Delaware on May 18, 2016.

|

|

3.4

|

|

Certificate of Amendment to the Company’s Certificate of Designation of Series D Convertible Preferred Stock filed with Secretary of State of the State of Delaware on May 18, 2016.

|

|

3.5

|

|

Certificate of Amendment to the Company’s Certificate of Designation of Series D Convertible Preferred Stock filed with Secretary of State of the State of Delaware on May 18, 2016.

|

|

4.1

|

|

Form of Representative’s Warrant.

|

|

99.1

|

Press release dated May 16, 2016.

|

|

99.2

|

Press release dated May 19, 2016.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

iSign Solutions Inc.

|

|

|

|

|

Date: May 19, 2016

|

By:

|

/s/ Andrea Goren

|

|

|

|

|

|

|

Andrea Goren

|

|

|

Chief Financial Officer

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

3.1

|

|

Certificate of Amendment to the Company’s Third Amended and Restated Certificate of Designation of Series A-1 Cumulative Convertible Preferred Stock filed with Secretary of State of the State of Delaware on May 18, 2016.

|

|

3.2

|

|

Certificate of Amendment to the Company’s Second Amended and Restated Certificate of Designation of Series B Participating Convertible Preferred Stock filed with Secretary of State of the State of Delaware on May 18, 2016.

|

|

3.3

|

|

Certificate of Amendment to the Company’s Amended and Restated Certificate of Designation of Series C Participating Convertible Preferred Stock filed with Secretary of State of the State of Delaware on May 18, 2016.

|

|

3.4

|

|

Certificate of Amendment to the Company’s Certificate of Designation of Series D Convertible Preferred Stock filed with Secretary of State of the State of Delaware on May 18, 2016.

|

|

3.5

|

|

Certificate of Amendment to the Company’s Certificate of Designation of Series D Convertible Preferred Stock filed with Secretary of State of the State of Delaware on May 18, 2016.

|

|

4.1

|

|

Form of Representative’s Warrant.

|

|

99.1

|

|

Press release dated May 16, 2016.

|

|

99.2

|

Press release dated May 19, 2016.

|

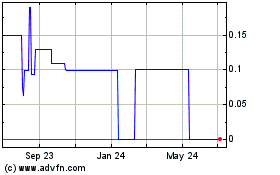

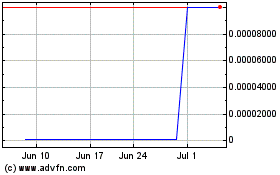

iSign Solutions (CE) (USOTC:ISGN)

Historical Stock Chart

From Aug 2024 to Sep 2024

iSign Solutions (CE) (USOTC:ISGN)

Historical Stock Chart

From Sep 2023 to Sep 2024