SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 2)

AMERICAN CANNABIS COMPANY,

INC.

(Name of Issuer)

Common Stock

(Title of Class of Securities)

105856108

(CUSIP Number)

Michael Novielli

1110 Rt. 55, Suite 206

LaGrangeville, NY 12540

(845) 575-6770

(Name, Address and Telephone

Number of Person

Authorized to Receive Notices

and Communications)

March 28, 2016

(Date of Event Which Requires

Filing of this Statement)

If the filing person

has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box [ ].

Note

: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

The information required on the remainder of this cover page shall not be deemed to

be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject

to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see

the

Notes).

1

|

NAME OF REPORTING PERSON

Dutchess Opportunity Fund II LP

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) [ ]

(b) [X]

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

1,711,200

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

1,711,200

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

1,711,200

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.75%*

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

_________________

|

|

*

|

Based on the 45,642,064 shares of Common

Stock most recently reported by the Company as issued and outstanding, as of April 13,

2016.

|

1

|

NAME OF REPORTING PERSON

Michael Novielli

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) [ ]

(b) [X]

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

WC/AF

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

296,278

†

|

|

8

|

SHARED

VOTING POWER

1,760,948

Ω

|

|

9

|

SOLE

DISPOSITIVE POWER

296,278

†

|

|

10

|

SHARED

DISPOSITIVE POWER

1,760,948

Ω

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

2,057,226

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.51%*

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

________________

|

|

*

|

Based on the 45,642,064 shares of Common

Stock most recently reported by the Company as issued and outstanding, as of April 13,

2016.

|

|

|

†

|

All 296,278 shares of Common Stock

are held in the name of Dutchess Global Strategies Fund LLC, a private investment vehicle.

As the sole Manager, all the shares of Common Stock are beneficially owned solely by

Novielli, who has sole power to vote and to dispose or direct the disposition of the

shares of Common Stock.

|

|

|

Ω

|

The 1,760,948 shares of Common Stock

are held in the name of Dutchess Opportunities Fund II LLC, Dutchess Advisors LLC, Dutchess

Private Equities Fund Ltd. and Dutchess Private Equities Fund II LP (the “Dutchess

Entities”). As Directors, Managers or Managing Partners, as the case may be, of

the Dutchess Entities, Messrs. Novielli and Leighton may be deemed to be indirect beneficial

owners of the shares of Common Stock directly beneficially owned by the Dutchess Entities,

and both may be deemed to have shared power to vote such shares of Common Stock and shared

power to dispose or direct the disposition of such shares of Common Stock.

|

1

|

NAME OF REPORTING PERSON

Douglas Leighton

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) [ ]

(b) [X]

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

WC/AF

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

50,578

†

|

|

8

|

SHARED

VOTING POWER

1,760,948

Ω

|

|

9

|

SOLE

DISPOSITIVE POWER

50,578

†

|

|

10

|

SHARED

DISPOSITIVE POWER

1,760,948

Ω

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

1,811,526

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.97%*

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

_________________

|

|

*

|

Based on the 45,642,064 shares of Common

Stock most recently reported by the Company as issued and outstanding, as of April 13,

2016.

|

|

|

†

|

All 50,578 shares of Common Stock

are held in the name of Bass Point Capital LLC, a private investment vehicle. As the

sole Manager, all the shares of Common Stock are beneficially owned solely by Leighton,

who has sole power to vote and to dispose or direct the disposition of the shares of

Common Stock.

|

|

|

Ω

|

The 1,760,948 shares of Common Stock

are held in the name the Dutchess Entities. As Directors, Managers or Managing Partners,

as the case may be, of the Dutchess Entities, Messrs. Novielli and Leighton may be deemed

to be indirect beneficial owners of the shares of Common Stock directly beneficially

owned by the Dutchess Entities, and both may be deemed to have shared power to vote such

shares of Common Stock and shared power to dispose or direct the disposition of such

shares of Common Stock.

|

Item 1. Security and Issuer.

This statement relates to

the common stock, $.00001 par value per share (the “Common Stock”), of American Cannabis Company, Inc., a Delaware

corporation (the “Issuer” or, the “Company”), with its principal executive offices at 5690 Logan St. Unit

A, Denver, Colorado 80216.

Item 2. Identity and Background.

|

|

(a)

|

This statement on Schedule 13D,

as amended, is being filed by Dutchess Opportunity Fund II LP (“Dutchess II”),

Michael Novielli (“Novielli”) and Douglas Leighton (“Leighton”)

(each a “Reporting Person” and, collectively, the “Reporting Persons”).

Novielli and Leighton are the Directors of Dutchess Opportunity Fund II LP (“Dutchess

II”) and may be deemed indirect beneficial owners of the Common Stock directly

beneficially owned by Dutchess II, pursuant to Section 13(d) of the Securities Exchange

Act of 1934, as amended, and the rules thereunder. Further, Novielli and Leighton are

the Managers of Dutchess Advisors LLC (“Advisors”), the Directors of Dutchess

Private Equities Fund Ltd. (“DPEF”), and the Managing Partners of Equities

Fund II LP (“DPEF II”, together with Dutchess II, Advisors and DPEF, the

“Dutchess Entities”), and thus may be deemed indirect beneficial owners of

the Common Stock directly beneficially owned by Advisors, DPEF and DPEF II. Each of the

Reporting Persons disclaims beneficial ownership of the securities reported herein except

to the extent of its pecuniary interest therein.

|

|

|

(b)

|

The business addresses of the Reporting

Persons is 50 Commonwealth Avenue, Suite 2, Boston, Massachusetts 02116.

|

|

|

(c)

|

The Reporting Persons have not,

during the last five years, been convicted in a criminal proceeding (excluding traffic

violations or similar misdemeanors).

|

|

|

(d)

|

The Reporting Persons have not,

during the last five years, been a party to a civil proceeding of a judicial or administrative

body of competent jurisdiction and as a result of such proceeding was or is subject to

a judgment, decree or final order enjoining future violations of, or prohibiting or mandating

activities subject to, federal or state securities laws or finding any violation with

respect to such laws.

|

|

|

(e)

|

Dutchess II is a limited partnership

organized under the laws of Delaware. Novielli and Leighton are both citizens of the

United States of America.

|

Item 3. Source and Amount of Funds or Other Consideration.

All purchases of the Common Stock reported

herein, and all purchases of other securities which may from time to time have been converted into Common Stock were made using

working capital of the relevant Reporting Person.

As of the date hereof, Novielli has used approximately

$60,000 of his personal working capital to purchase shares of Common Stock, Leighton has used approximately $10,000 of his personal

working capital to purchase shares of Common Stock, and both Novielli and Leighton have directed the use of approximately $346,524

of working capital of the Dutchess Entities to purchase shares of Common Stock, both directly and through the exercise of certain

debentures held by Dutchess II. As previously disclosed in Item 5 of this Schedule 13D, as amended, certain shares of the Common

Stock were acquired in exchange for other securities of the Company in transactions with the Company or to settle certain previously

contracted debts with the Company.

Except as noted above, no other funds or other

consideration were used in making any purchases of Common Stock.

Item 4. Purpose of Transaction.

Each of the Reporting Persons acquired beneficial ownership of the Common Stock to

which this statement relates for investment purposes. Each of the Reporting Persons may in the future determine to purchase

more Common Stock and/or dispose of Common Stock of the Company in the ordinary course of their investment activities, as

market and other conditions dictate.

Item 5. Interest in Securities of the Issuer.

|

|

(a)

|

Each Reporting Person’s beneficial

ownership of shares of Common Stock is as follows:

|

|

|

(i)

|

Novielli beneficially owns 2,057,226

shares of Common Stock, constituting 4.51% of all shares of Common Stock issued and outstanding,

such shares consisting of (1) 296,278 shares of Common Stock held by Dutchess Global

Strategies Fund LLC, (2) 1,711,200 shares of Common Stock beneficially owned by Dutchess

II, (3) 2,952 shares of Common Stock held by Advisors, (4) 45,776 shares of Common Stock

held by DPEF, and (5) 1,020 shares of Common Stock held by DPEF II.

|

|

|

(ii)

|

Leighton beneficially owns 1,811,526

shares of Common Stock, constituting 3.97% of all shares of Common Stock issued and outstanding,

such shares consisting of (1) 50,578 shares of Common Stock held by Bass Point Capital

LLC, (2) 1,711,200 shares of Common Stock beneficially owned by Dutchess II, (3) 2,952

shares of Common Stock held by Advisors, (4) 45,776 shares of Common Stock held by DPEF,

and (5) 1,020 shares of Common Stock held by DPEF II.

|

|

|

(iii)

|

Dutchess II beneficially owns 1,711,200

shares of Common Stock, constituting 3.75% of all shares of Common Stock issued and outstanding,

such shares consisting of (1) 1,542,450 shares of Common Stock held by Dutchess II, and

(2) 168,750 shares of Common Stock exercisable by Dutchess II under the Debentures (as

defined below).

|

|

|

(iv)

|

On May 16, 2014, Dutchess II acquired

$71,500 face value of convertible debentures (the “Debentures”) for a purchase

price of $71,500. On April 11, 2016, the Company and Dutchess II entered into an Amendment

No. 1 to Debenture, solely to extend the date of maturity of the Debenture by two (2)

years, to April 24, 2018. The Debentures are convertible into shares of Common Stock

at a conversion price of $0.08 per share; however, the Debentures are subject to a provision

stating that the holder is not entitled to convert, and that the Company will not permit

such conversion, into that number of shares which, when added to the number of shares

of Common Stock already beneficially owned by the converting party (as such term is defined

under Section 13(d) of the Act and Rule 13d-3 thereunder), would exceed 4.99 percent

of the number of shares of Common Stock then issued and outstanding. Prior to March 28,

2016, Dutchess II beneficially owned in excess of 4.99 percent of the number of shares

of Common Stock issued and outstanding, which made the Debentures unexercisable in the

hands of Dutchess II and were deemed not to be beneficially owned. However, as of March

28, 2016, Dutchess II ceased to hold in excess of 4.99 percent of the number of shares

of Common Stock issued and outstanding, and thus the Debentures became exercisable into

that number of shares which, when added to the number of shares of Common Stock held

by Dutchess, II, would not exceed 4.99 percent of the number of shares of Common Stock

issued and outstanding.

|

On April 14, 2016, Dutchess II converted

the Debentures into 725,000 shares of Common Stock, at the exercise price of $0.08 per share. Presently, Dutchess II may convert

the entire outstanding balance of the Debentures into up to 168,750 shares of Common Stock.

Additional information regarding

the Debentures is provided in the Company’s Current Report on Form 8-K filed with the SEC on May 15, 2014, which is expressly

incorporated by reference herein and made a part hereof.

|

|

(v)

|

Each percentage ownership of shares

of Common Stock set forth in this statement is based on the 45,642,064 shares of issued

and outstanding Common Stock as of April 13, 2016, as reported by the Company

on its Annual Report on Form 1-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on April 13, 2016.

|

|

|

(b)

|

Each Reporting Persons has voting

power and dispositive control their shares of Common Stock beneficially owned, as follows:

|

|

|

(i)

|

Novielli has sole power to vote and

sole power to dispose or direct the disposition over the 296,278 shares of Common Stock

held in the name of Dutchess Global Strategies Fund LLC, a private investment vehicle

the investments in which are beneficially owned solely by Novielli.

|

|

|

(ii)

|

Leighton has sole power to vote

and sole power to dispose or direct the disposition over the 50,578 shares of Common

Stock held in the name of Bass Point Capital LLC, a private investment vehicle the investments

in which are beneficially owned solely by Leighton.

|

|

|

(iii)

|

As Directors of Dutchess II, each

of. Novielli and Leighton may be deemed to be indirect beneficial owners of the 1,711,200

shares of Common Stock directly beneficially owned by Dutchess II. As a result, each

of the Reporting Persons may be deemed to have shared power to vote such shares of Common

Stock and shared power to dispose or direct the disposition of such shares of Common

Stock.

|

|

|

(iv)

|

As Managers of Advisors, each of

Novielli and Leighton may be deemed to be indirect beneficial owners of the 2,952 shares

of Common Stock directly beneficially owned by Advisors. As a result, each of the Reporting

Persons may be deemed to have shared power to vote such shares of Common Stock and shared

power to dispose or direct the disposition of such shares of Common Stock.

|

|

|

(v)

|

As Directors of DPEF, each of Novielli

and Leighton may be deemed to be indirect beneficial owners of the 45,776 shares of Common

Stock directly beneficially owned by DPEF. As a result, each of the Reporting Persons

may be deemed to have shared power to vote such shares of Common Stock and shared power

to dispose or direct the disposition of such shares of Common Stock.

|

|

|

(vi)

|

As Managing Partners of DPEF II,

each of Novielli and Leighton may be deemed to be indirect beneficial owners of the 1,020

shares of Common Stock directly beneficially owned by DPEF II. As a result, each of the

Reporting Persons may be deemed to have shared power to vote such shares of Common Stock

and shared power to dispose or direct the disposition of such shares of Common Stock.

|

|

|

(c)

|

The following transactions involving

Common Stock of the Issuer and effected by the Reporting Persons since their most recent

filing of Schedule 13D, are as follows:

|

|

|

(i)

|

Between September 3, 2015 and April

28, 2016, Dutchess II sold 2,613,719 shares of Common Stock in a series of open-market

transactions at prices ranging from $0.0806 to $0.2320 per share. The Reporting Persons

undertake to provide upon request to the staff of the SEC, full information regarding

the number of shares sold at each separate price within the ranges set forth above.

|

|

|

(ii)

|

On April 14, 2016, Dutchess II exercised

the Debenture in part, converting $58,000 of the face value of the Debentures into 725,000

shares of Common Stock at a conversion price of $0.08 per share.

|

|

|

(iii)

|

Other than the matters referred

to herein, there have been no other transactions in the Common Stock effected by the

Reporting Persons during the sixty days preceding the filing of this statement on Schedule

13D, as amended.

|

|

|

(d)

|

Except as set forth herein, no

other person is known to have the right to receive or the power to direct the receipt

of dividends from, or any proceeds from the sale of, securities of the Issuer beneficially

owned by the Reporting Persons.

|

|

|

(e)

|

Each of the following transactions

caused the Reporting Person described therein to cease to be a beneficial owner of more

than five percent (5%) of Common Stock of the Issuer:

|

|

|

(i)

|

On March 28, 2016, Dutchess II sold

761,934 shares of Common Stock in an open-market transaction at a price per share of

$0.1679, thereby representing a disposition in the aggregate constituting a material

change of shares of Common Stock held since the Reporting Persons’ most recent

filing of a statement on Schedule 13D, and causing Dutchess II’s beneficial ownership

of Common Stock of the Issuer to fall below five percent (5%).

|

|

|

(ii)

|

On April 19, 2016, Dutchess II sold

93,900 shares of Common Stock in an open-market transaction at a price per share of $0.2320,

thereby causing Leighton’s beneficial ownership of Common Stock of the Issuer to

fall below five percent (5%).

|

|

|

(iii)

|

On April 21, 2016, Dutchess II

sold 101,868 shares of Common Stock in an open-market transaction at a price per share

of $0.2030, thereby causing Novielli’s beneficial ownership of Common Stock of

the Issuer to fall below five percent (5%).

|

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

Other than the matters discussed

herein, including but not limited to the matters discussed in Item 5 of this statement on Schedule 13D, as amended, none of the

Reporting Persons has any contracts, arrangements, understandings or relationships (legal or otherwise), including, but not limited

to, transfer or voting of any of the securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls,

guarantees of profits, division of profits or loss, or the giving or withholding of proxies, between such Reporting Person and

any other person, with respect to any securities of the Company, including any securities pledged or otherwise subject to a contingency

the occurrence of which would give another person voting power or investment power over such securities other than standard default

and similar provisions contained in such agreements.

Item 7. Material to Be Filed as Exhibits.

The following documents are filed as exhibits:

|

Exhibit Ref.

|

|

Description

|

|

Exhibit A

|

|

Joint Filing Agreement

|

|

Exhibit B

|

|

Information regarding the Debentures (incorporated herein by reference to the Company’s current report on Form 8-K and related exhibits filed with the SEC on May 15, 2014).

|

SIGNATURES

After reasonable inquiry

and to the best of our knowledge and belief, the undersigned certify that the information set forth in this statement on Schedule

13D, as amended, is true, complete and correct.

Dated: May 3, 2016

DUTCHESS OPPORTUNITY FUND II LP

/s/ Michael Novielli

Name: Michael Novielli

Title: Director

DUTCHESS OPPORTUNITY FUND II LP

/s/ Douglas Leighton

Name: Douglas Leighton

Title: Director

/s/ Michael Novielli

Michael Novielli

/s/ Douglas Leighton

Douglas Leighton

EXHIBIT A TO SCHEDULE 13D/A

May 3, 2016

In accordance with Rule 13d-1(k)(1) under

the Securities Exchange Act of 1934, as amended, DUTCHESS OPPORTUNITY FUND II LP, MICHAEL NOVIELLI and DOUGLAS LEIGHTON hereby

agree to the joint filing of this statement on Schedule 13D (including any and all amendments hereto). In addition, each party

to this Joint Filing Agreement expressly authorizes each other party to this Joint Filing Agreement to file on its behalf any

and all amendments to such statement on Schedule 13D. A copy of this Joint Filing Agreement shall be attached as an exhibit to

the statement on Schedule 13D, as amended, filed on behalf of each of the parties hereto, to which this Joint Filing Agreement

relates.

This Joint Filing Agreement may be executed

in multiple counterparts, each of which shall constitute an original, one and the same instrument.

DUTCHESS OPPORTUNITY FUND II LP

/s/ Michael Novielli

Name: Michael Novielli

Title: Director

DUTCHESS OPPORTUNITY FUND II LP

/s/ Douglas Leighton

Name: Douglas Leighton

Title: Director

/s/ Michael Novielli

Michael Novielli

/s/ Douglas Leighton

Douglas Leighton

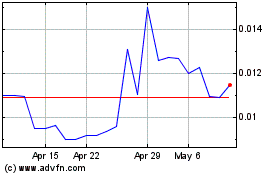

American Cannabis (QB) (USOTC:AMMJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

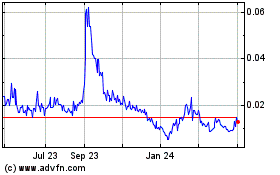

American Cannabis (QB) (USOTC:AMMJ)

Historical Stock Chart

From Apr 2023 to Apr 2024