By Ellie Ismailidou and Sara Sjolin, MarketWatch

U.S. private-payroll gains miss expectations; productivity

falls

Dow industrials futures tumbled over 100 points Wednesday

morning after a flurry of economic data, including a closely

watched report on private-sector employment, painted a picture of

sluggish growth in the U.S. economy.

Futures for the Dow Jones Industrial Average dropped 107 points,

or 0.6%, to 17,565, while those for the S&P 500 index fell 15

points, or 0.7%, to 2,043. Futures for the Nasdaq-100 index lost 32

points, or 0.7%, to 4,302.

The ADP employment number for April

(http://www.marketwatch.com/story/adp-reports-private-sector-job-gains-slowed-in-april-2016-05-04)

came in at 156,000, well short of the 200,000 jobs expected,

showing that private payroll gains slowed markedly in April. The

report is seen as a precursor to the top-tier nonfarm-payrolls data

out on Friday

(http://www.marketwatch.com/story/if-the-economy-springs-back-jobs-and-auto-sales-will-lead-the-way-2016-05-01),

which are closely watched as they are seen as playing a big part in

determining the future path for Federal Reserve interest rates.

Meanwhile, the productivity of U.S. businesses and workers

(http://www.marketwatch.com/story/us-productivity-drops-1-in-first-quarter-2016-05-04)

fell by a 1% annual rate in the first quarter, marking the fourth

decline in the past six quarters.

On the bright side, the U.S. trade deficit shrank in March

(http://www.marketwatch.com/story/us-trade-deficit-sinks-17-in-march-to-404-billion-2016-05-04)

to its lowest level in more than a year, but the plunge still

reflected a tough climate for American exporters and more caution

on the part of consumers.

The flurry of data continued to "paint a picture that can be

described as 'growth purgatory'," said Michael Arone, chief

investment strategist at State Street Global Advisors.

According to Arone, the U.S. economy is "stuck in low and slow

gear" where data constantly miss expectations but they are not bad

enough to indicate a recession is on the horizon.

The U.S. markets also were taking a cue from Asia

(http://www.marketwatch.com/story/asian-stocks-down-on-oil-woes-slow-growth-2016-05-04),

where most global stock benchmarks closed firmly lower after an

earlier fall in oil prices and a plunge in shares of

Anglo-Australian miner BHP Billiton

(http://www.marketwatch.com/story/mining-firms-bhp-vale-face-44b-lawsuit-in-brazil-2016-05-03)(BHP.AU)

(BHP.AU) (BLT.LN).

A decline for U.S. markets on Wednesday would come after stocks

fell to their lowest level in three weeks on Tuesday

(http://www.marketwatch.com/story/stock-futures-slide-as-fear-creeps-into-the-markets-2016-05-03),

after weaker-than-expected manufacturing data in China and a cut of

interest rates in Australia revived worries about an overseas

economic slowdown. The S&P 500 index slumped 0.9%, while the

Dow average closed 0.8% lower.

Economic news: In other economic news, at 10 a.m., the ISM

services reading for April and factory orders for March are

due.

.

Fed speakers: Minneapolis Fed President Neel Kashkari, who isn't

a voting member of the Fed's policy-setting committee this year,

will speak in Rochester, Minn., at 5:30 p.m. Eastern.

Movers and shakers: Shares of Zillow Group Inc.(ZG) rallied 12%

in premarket action after the online real estate database company

late Tuesday lifted its full-year revenue outlook

(http://www.marketwatch.com/story/zillow-beats-expectations-lifts-sales-view-2016-05-03-174851946).

Under Armour Inc.'s stock (UA) dropped 3.9% in premarket trade,

after the athletic gear company announced another round of

executive departures.

U.S.-listed shares of BHP Billiton(BHP.AU) and Vale SA(VALE5.BR)

slumped 5.5% and 3.9%, respectively, in premarket trade. The moves

came after Brazilian federal prosecutors filed a civil lawsuit

Tuesday over a catastrophic dam failure in November. Prosecutors

are seeking up to 155 billion reais ($43.55 billion)

(http://www.marketwatch.com/story/mining-firms-bhp-vale-face-44b-lawsuit-in-brazil-2016-05-03)

for cleanup and remediation. The dam was run by Samarco Mineração,

a joint venture between BHP and Brazilian miner Vale.

Priceline Group Inc.(PCLN) tumbled 7.6% premarket after the

online travel-services company reported first-quarter results that

beat expectations, but provided a second-quarter profit outlook

that was well below analyst projections

(http://www.marketwatch.com/story/pricelines-stock-tumbles-as-profit-outlook-falls-well-short-of-expectations-2016-05-04).

Time Warner Inc.(TWX) picked up ahead of the bell after its

first-quarter earnings beat Wall Street forecasts.

Kate Spade & Co.(KATE) shares were little changed after the

clothing and accessories company affirmed its full-year 2016

revenue guidance

(http://www.marketwatch.com/story/kate-spade-profits-fall-below-estimates-reaffirms-full-year-guidance-2016-05-04).

Other markets: After a wobbly start to the day, European markets

moved lower

(http://www.marketwatch.com/story/european-stocks-wobble-after-earnings-deluge-2016-05-04),

as investors assessed the latest raft of earnings reports.

Crude oil inched higher after ending sharply lower on Tuesday

(http://www.marketwatch.com/story/crude-oil-slammed-13-as-supply-glut-fears-return-2016-05-03)

on renewed fears of a supply glut.

The ICE dollar index rose 0.1% to 93.04 on Wednesday, rebounding

after a sharp slide recently.

Metals dropped across the board, with gold down 0.3% at $1,28.30

an ounce.

(END) Dow Jones Newswires

May 04, 2016 09:08 ET (13:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

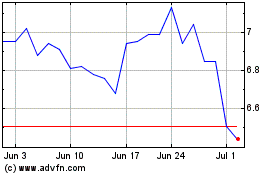

Under Armour (NYSE:UAA)

Historical Stock Chart

From Aug 2024 to Sep 2024

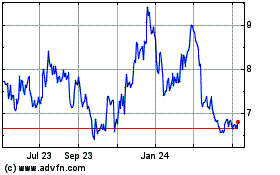

Under Armour (NYSE:UAA)

Historical Stock Chart

From Sep 2023 to Sep 2024