Asciano Bidding Saga Ends With $6.7 Billion Offer

March 15 2016 - 12:50AM

Dow Jones News

SYDNEY—Canada's Brookfield Infrastructure Partners LP has teamed

up with Australia's Qube Holdings Ltd. and several global funds to

acquire rail-and-port operator Asciano Ltd. in a deal worth 8.92

billion Australian dollars (US$6.71 billion), putting an end to a

long bidding war.

Australian infrastructure assets have been fiercely coveted by

global investors because they are perceived to offer stable

long-term returns. Recent deals have included power grids and

commodity ports.

In addition, Australian port infrastructure has been attracting

particular interest from investors eager to exploit the world's

sharpening focus on building transport networks to facilitate

trade.

Brookfield Infrastructure began its pursuit of Asciano in late

June. Four months later, a group led by Qube Holdings signaled it

was considering a rival bid, saying that a tie-up between Asciano's

and its ports businesses would improve the Australian

transportation market.

On Tuesday, the pair said they and their partners—a group of

specialist infrastructure, pension and sovereign-wealth funds,

including from Qatar and China—agreed on a joint binding cash offer

for Asciano worth A$9.15 a share. Asciano shareholders will also

get a previously declared dividend of A$0.13.

Directors at Asciano—which handles nearly half of all container

traffic entering or leaving Australia—have recommended that

shareholders accept the deal.

"I believe the agreement we have now reached represents the most

common sense resolution to the ownership of Asciano and delivers

the best result for all stakeholders," said Maurice James, Qube's

managing director, in a statement.

According to the agreement, Asciano's main business units will

be broken up. A group of investors, including a unit of China

Investment Corp. and Singapore's GIC Private Ltd., will own the

Pacific National rail business that hauls freight—including coal—to

port for export.

Qube, Brookfield and investors including the Qatar Investment

Authority will create a joint venture to buy Asciano's Patrick

container terminals business, which runs ports in cities including

Sydney and Melbourne and is the largest handler of container cargo

entering or leaving the country, for A$2.92 billion. Brookfield and

its co-investors will buy Asciano's bulk and automotive ports

services business, which transports everything from cars to grain,

for A$925 million.

In recent months, Qube and Brookfield Infrastructure made

competing bids to buy Asciano. Both groups purchased large bundles

of Asciano stock. Last month, Qube and Brookfield said they were

considering jointly buying Asciano and planned to break the

company up.

The partners expect to seek shareholder approval at a meeting in

June. The partners have already "had extensive engagement" with the

Australian Competition and Consumer Commission, the country's

competition regulator, on their past individual proposals "and the

likely areas of ACCC interest are well understood," Qube said.

Brookfield faced antitrust challenges when it was considering a

lone bid: The Australian regulator raised concerns that a proposed

takeover by the company, which operates another rail network here,

could hurt competition for rail services in some of the country's

main resource-production hubs.

On Tuesday, Brookfield Infrastructure said the joint bid was

"clearly superior to any previous offer" and would be beneficial to

its own operations.

"With this new transaction, we will globalize our container

terminal business, and expect to have opportunities for further

optimization given Qube's expertise in the Australian logistics

industry and its history with these assets," Brookfield

Infrastructure Chief Executive Sam Pollock said.

The Brookfield Infrastructure-led investor group includes

British Columbia Investment Management Corp., Qatar Investment

Authority and GIC Private.

The group led by Qube—which has a market value of about A$2.4

billion—includes Global Infrastructure Partners LLC, Canada Pension

Plan Investment Board and China Investment Corp.

Last year, China's Landbridge Group bought a long-term lease in

the Port of Darwin in Australia's north, saying it intended to

increase two-way trade between Australia and Asia. A year earlier,

China Merchants Group teamed up with Australian fund-manager

Hastings Funds Management to buy the lease on the Port of Newcastle

in New South Wales state, the world's biggest coal export

terminal.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

March 15, 2016 00:35 ET (04:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

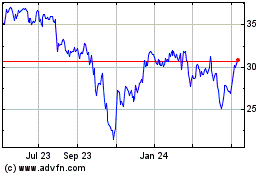

Brookfield Infrastructur... (NYSE:BIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

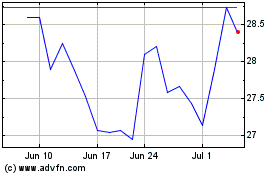

Brookfield Infrastructur... (NYSE:BIP)

Historical Stock Chart

From Apr 2023 to Apr 2024