Jamba Loss Widened Slightly, Revenue Misses Expectations

March 14 2016 - 5:50PM

Dow Jones News

Jamba Inc. said its fourth-quarter loss widened slightly as

revenue fell more than analysts expected.

However, the California-based juice-café chain's new chief

executive, David Pace, said in prepared remarks Monday that he

believes the best days are to come for the company, which has

shifted the vast majority of its locations to franchisees in an

effort to bolster its performance.

Mr. Pace was named as the company's CEO in January, succeeding

James White, who retired after roughly seven years at the helm.

Though the CEO appointment was effective immediately, Jamba in

January had said Mr. Pace wouldn't start with the company until

March 14, when he finished at Bloomin' Brands Inc., where he most

recently had been president of Carrabba's Italian Grill since

2014.

During Mr. White's tenure as CEO, which began in December 2008,

Jamba struggled to remain consistently profitable and shifted more

of its business to franchisees. Jamba had come under pressure from

activist investor Engaged Capital LLC during 2014 to cut costs,

close unprofitable New York shops and sell more of its

company-owned stores to franchisees, a move the company had said it

already was considering.

In November, Mr. White said the company had "virtually

finalized" its transition— with 91% of its locations operated by

franchisees—citing the progress as an influence in the timing of

his retirement.

At the end of 2008, Jamba had 729 total juice shops, 70% of

which the company owned. At the end of last year, the company had a

total of 893 juice shops, 92% of which were owned by

franchisees.

Over all, Jamba reported a loss of $8.3 million, or 55 cents a

share, compared with a year-earlier loss of $8 million, or 47 cents

a share, a year earlier. Excluding refranchising and severance

costs and other items, the adjusted per-share loss was 28 cents,

compared with a year-earlier adjusted loss of 27 cents.

Revenue slumped 56 % to $19.5 million, mostly owing to the

reduction in the number of company-owned stores.

Analysts polled by Thomson Reuters expected a per-share loss of

seven cents and revenue of $18 million.

In the latest quarter, systemwide comparable sales, or sales at

locations open at least a year, rose 3.9% including growth of 5.4%

at company-owned stores and an increase of 3.7% at franchisees.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

March 14, 2016 17:35 ET (21:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

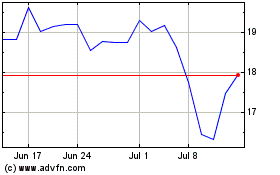

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

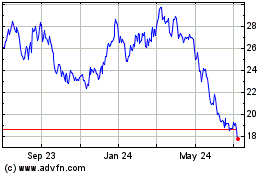

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Apr 2023 to Apr 2024