UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

CV Sciences, Inc. (formerly CannaVEST Corp.)

(Name of Issuer)

Common Stock

(Title of Class of Securities)

137653101

(CUSIP Number)

Michael Joseph Mona, Jr.

2688 South Rainbow Boulevard, Suite B

Las Vegas, Nevada 89146

866-290-2157

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 8, 2014

(Date of Event Which Requires Filing of this

Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ¨

* The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

CUSIP No. 137653101

| |

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Michael Joseph Mona, Jr. |

|

|

| 2. |

|

CHECK THE APPROPRIATE

BOX IF A MEMBER OF A GROUP (See Instructions)

(a) o

(b) x |

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS (See Instructions)

OO |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

o |

|

|

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

|

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE VOTING POWER

3,000,000 |

| |

8. |

|

SHARED VOTING POWER

3,000,000 |

| |

9. |

|

SOLE DISPOSITIVE POWER

3,000,000 |

| |

10. |

|

SHARED DISPOSITIVE POWER

3,000,000 |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,000,000 |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

o |

|

|

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

13.0% (1) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON (See Instructions)

IN |

|

|

| |

|

|

|

|

|

|

|

|

| (1) | Based on 46,210,159 shares of common stock outstanding as of December 30, 2015, based on 35,210,159

shares of common stock outstanding as of November 16, 2015, as reported in the Issuer’s Quarterly Report on Form 10-Q filed

on November 16, 2015, the issuance of 5,000,000 shares of common stock by the Issuer on December 30, 2015, as reported in the Issuer’s

Current Report on Form 8-K filed on January 4, 2016, and assuming the exercise of the 6,000,000 stock options to purchase shares

of Common Stock of the Issuer by the Reporting Person. |

ITEM 1. SECURITY AND ISSUER

This statement on Schedule 13D (“Statement”)

relates to the common stock, no par value per share (the “Common Stock”), of CV Sciences, Inc., formerly CannaVEST

Corp., a Delaware corporation (the “Issuer”). The address of the principal executive office of the Issuer is 2688 South

Rainbow Boulevard, Suite B, Las Vegas, Nevada 89146.

ITEM 2. IDENTITY AND BACKGROUND

(a) This Statement is filed on behalf of Mr.

Michael J. Mona, Jr., a natural person (the “Reporting Person”).

(b) The Reporting Person’s business address

is 2688 South Rainbow Boulevard, Suite B, Las Vegas, Nevada 89146.

(c) The Reporting Person is the Chief Executive

Officer and President of the Issuer and serves as a director on the Board of Directors of the Issuer.

(d) During the past five years, the Reporting

Person has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the past five years, the Reporting

Person has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction as a result of

which such person was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating

activities subject to, federal or state securities laws or finding any violation of such laws.

(f) The Reporting Person is a citizen of the

United States.

ITEM 3. SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

The Reporting Person is the Chief Executive

Officer and President of the Issuer and serves as a director on the Board of Directors of the Issuer. On December 8, 2014, the

Compensation Committee of the Board of Directors of the Issuer approved a grant of 4,000,000 stock options to purchase shares of

Common Stock (the “December 2014 Option”) to the Reporting Person pursuant to a Stock Option Grant Notice, dated December

8, 2014, under the Issuer’s Amended and Restated 2013 Equity Incentive Plan (the “Plan”). The December 2014 Option

has a term of ten (10) years, with 67% vested as of the date of grant and the remainder vesting in twelve (12) equal monthly installments

measured from January 31, 2015, and was granted with an exercise price equal to the fair market value of the Common Stock at the

time of the grant, which was $2.64 per share. On September 23, 2015, the Board of Directors of the Issuer approved a grant of 1,470,000

stock options to purchase shares of Common Stock (the “September 2015 Option”) to the Reporting Person pursuant to

a Stock Option Grant Notice, dated September 23, 2015, under the Plan. The September 2015 Option has a term of ten (10) years,

was 100% vested as of the date of grant and was granted with an exercise price equal to the fair market value of the Common Stock

at the time of the grant, which was $0.73 per share. On December 28, 2015, the Board of Directors of the Issuer approved a grant

of 530,000 stock options to purchase shares of Common Stock (the “December 2015 Option”) to the Reporting Person pursuant

to a Stock Option Grant Notice, dated December 28, 2015, under the Plan. The December 2015 Option has a term of ten (10) years,

was 100% vested as of the date of grant and was granted with an exercise price equal to the fair market value of the Common Stock

at the time of the grant, which was $0.155 per share.

Pursuant to that certain Decree of Divorce,

dated July 23, 2015 (the “Decree”), issued by the District Court, Clark County, Nevada (the “Court”), the

Court awarded 3,000,000 shares of the December 2014 Option to Ms. Rhonda Mona, the ex-wife of the Reporting Person. Pursuant to

the Plan the stock options to purchase shares of Common Stock granted under the Plan may not be transferred, however, pursuant

to the Decree the Reporting Person believes that Ms. Mona has shared beneficial ownership of 3,000,000 of the shares of Common

Stock that would be acquired upon exercise of the December 2014 Option.

ITEM 4. PURPOSE OF TRANSACTION

The Reporting Person is a control person of

the Issuer. The securities of the Issuer were acquired by the Reporting Person for investment and not with the purpose nor with

the effect of changing or influencing control of the Issuer nor in connection with or as a participant in any transaction having

such purpose or effect. See Item 3 of this Statement, which is hereby incorporated by reference in this Item 4.

Except to the extent the foregoing may be

deemed a plan or proposal, the Reporting Person has no present plan or proposal which relates to, or could result in, any of the

events referred to in paragraphs (a) through (j), inclusive, of Item 4 of Schedule 13D. The Reporting Person may, at any time

and from time to time, review or reconsider his position and/or change his purpose.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

(a) As of the date of this Statement, the Reporting

Person may be deemed to beneficially own an aggregate of 6,000,000 unexercised stock options to purchase shares of Common Stock,

which constitutes 13.0% of the shares of Common Stock outstanding. The percentages set forth in Row 13 of the cover pages and this

Item 5(a) assumes that 40,210,159 shares of Common Stock were outstanding as of the date of this Statement, based on 35,210,159

shares of Common Stock outstanding as of November 16, 2015, as reported in the Issuer’s Quarterly Report on Form 10-Q filed

on November 16, 2015, the issuance of 5,000,000 shares of Common Stock by the Issuer on December 30, 2015, as reported in the Issuer’s

Current Report on Form 8-K filed on January 4, 2016, and assuming the exercise of the 6,000,000 stock options to purchase shares

of Common Stock by the Reporting Person.

(b) The Reporting Person has sole voting power

and sole dispositive power with respect to 3,000,000 shares of Common Stock. The Reporting Person and his ex-spouse, Ms. Rhonda

Mona, have shared voting power and shared dispositive power with respect to 3,000,000 shares of Common Stock. As stated in Item

3 above, pursuant to the Decree, the Court awarded 3,000,000 shares of the December 2014 Option to Ms. Mona. Pursuant to the Plan

the stock options to purchase shares of Common Stock granted under the Plan may not be transferred, however, pursuant to the Decree

the Reporting Person believes that Ms. Mona has shared beneficial ownership of 3,000,000 of the shares of Common Stock that would

be acquired upon exercise of the December 2014 Option. The business address for Ms. Mona is 2688 South Rainbow Boulevard, Suite

B, Las Vegas, Nevada 89146. Ms. Mona is currently unemployed and is a United States citizen. During the past five years, Ms. Mona

has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) nor has she been a party

to a civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which such person was or is

subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to,

federal or state securities laws or finding any violation of such laws

See Item 2 of this Statement, which is hereby

incorporated by reference in this Item 5(b).

(c) Other than as set forth above and

in Items 3 and 4 of this Statement, which are hereby incorporated by reference in this Item 5(c), the Reporting Person and any

persons named in Item 5(a) above have not effected any transaction relating to the Issuer’s Common Stock during the past

60 days.

(d) To the Reporting Person’s knowledge,

except as set forth in Item 3 and Item 5(a) above, no other person has the right to receive or the power to direct the receipt

of dividends from, or the proceeds from the sale of, his shares of Common Stock of the Issuer.

(e) Not applicable.

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS

WITH RESPECT TO SECURITIES OF THE ISSUER

Other than as set forth in Item 3 and Item

5 of this Statement, the Reporting Person is not subject to any contracts, arrangements, understandings or relationships with respect

to the securities of the Issuer.

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

Exhibit 1 Stock Option Grant Notice, dated December 8, 2014.

Exhibit 2 Stock Option Grant Notice, dated September 23, 2015.

Exhibit 3 Stock Option Grant Notice, dated December 28, 2015.

Exhibit 4 Decree of Divorce, dated

July 23, 2015, issued by the District Court, Clark County, Nevada.+

+This exhibit has been omitted pursuant to a request for confidential

treatment and filed separately with the Securities Exchange Commission.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief,

I certify that the information set forth in this statement is true, complete and correct.

February 12, 2016

Date

/s/ Michael J. Mona, Jr.

Michael J. Mona, Jr.

Exhibit 1

CannaVEST

Corp.

Stock Option Grant Notice

Amended and Restated 2013 Equity Incentive Plan

FOR GOOD AND VALUABLE CONSIDERATION,

CannaVEST Corp. (the “Company”), hereby grants to the Optionee named below, a stock option (the “Option”)

to purchase any part or all of the specified number of shares of its Common Stock (“Option Shares”),

upon the terms and subject to the conditions set forth in this Stock Option Grant Notice (the “Grant Notice”),

at the specified purchase price per share without commission or other charge. The Option is granted pursuant to the Company’s

Amended and Restated 2013 Equity Incentive Plan (the “Plan”) and the Stock Option Agreement (the “Option

Agreement”), promulgated under the Plan and in effect as of the date of this Grant Notice.

| Optionee: |

Michael Mona, Jr. |

| Date of Grant: |

December 8, 2014 |

| Vesting Commencement Date: |

December 8, 2014 |

| Number of Option Shares : |

4,000,000 |

| Exercise Price (Per Share): |

$2.64 |

| Total Exercise Price: |

$10,560,000.00 |

| Expiration Date: |

Ten years after Date of

Grant |

Type of Grant: x Incentive

Stock Option1 o Nonstatutory Stock Option

Exercise Schedule: x

Same as Vesting Schedule o Early Exercise Permitted

Vesting Schedule: Except as otherwise

provided in the Option Agreement, the number of Option Shares that are vested (disregarding any resulting fractional share) as

of any date shall be determined as follows: (i) 2,666,667 Option Shares will be vested on the Vesting Commencement Date; and (ii)

1,333,333 of the Option Shares will be vested in a series of twelve (12) successive equal monthly installments measured from January

31, 2015, provided, however, that there has not been a Termination of Service as of each such date. In no event will the

Option become exercisable for any additional Option Shares after a Termination of Service.

Payment: By one or a combination of the

following items (described in the Plan):

| x | By cash or check |

| | | |

| | o | By

net exercise, if the Company has established procedures for net exercise |

Additional Terms/Acknowledgements:

The undersigned Optionee acknowledges receipt of, and understands and agrees to, this Stock Option Grant Notice, the Option Agreement,

and the Plan.

Further, by their signatures below,

the Company and the Optionee agree that the Option is governed by this Grant Notice and by the provisions of the Plan and Option

Agreement, both of which are attached to and made a part of this Grant Notice. Optionee acknowledges receipt of copies of the Plan

and the Option Agreement, represents that the Optionee has read and is familiar with their provisions, and hereby accepts the Option

subject to all of their terms and conditions. Optionee further acknowledges that, as of the Date of Grant, this Grant Notice, the

Option Agreement and the Plan set forth the entire understanding between Optionee and the Company regarding the acquisition of

stock in the Company and supersede all prior oral and written agreements on that subject, with the exception of options previously

granted under the Plan.

___________________

1

If this is an Incentive Stock Option, it (plus other outstanding Incentive Stock Options) cannot be first exercisable

for more than $100,000 in value (measured by exercise price) in any calendar year. Any excess over $100,000 is a Nonstatutory

Stock Option.

|

CannaVEST Corp.

By:/s/ Joseph Dowling

Joseph Dowling, Chief Financial Officer

Date: December 8, 2014 |

Optionee: Michael

Mona, Jr.

/s/ Michael Mona, Jr.

Signature

Date: December 8, 2014 |

Attachments:

(I) Option Agreement; (II) Amended and Restated 2013 Equity Incentive Plan; and (III) Notice of Exercise

Attachment I

Option

Agreement

Incorporated

by reference from an exhibit to the Company’s

Form S-8 filed on October 6, 2014.

Attachment II

Amended

and Restated 2013 Equity Incentive Plan

Incorporated

by reference from an appendix to the Company’s Proxy Statement on Schedule 14A filed on July 2, 2014.

Attachment III

Notice

Of Exercise

CannaVEST Corp.

2688 South Rainbow Blvd.

Suite B

Las Vegas, Nevada 89146

Date of Exercise: _______________

Ladies and Gentlemen:

This constitutes

notice under my stock option that I elect to purchase the number of shares for the price set forth below.

| Type of option (check one): |

Incentive x |

Nonstatutory o |

| Stock option dated: |

_______________ |

_______________ |

| Number of shares as to which option is

exercised: |

_______________ |

_______________ |

| Certificates to be issued in name of: |

_______________ |

_______________ |

| Total exercise price: |

$______________ |

$______________ |

| Cash or check payment delivered herewith: |

$______________ |

$______________ |

By this exercise,

I agree (i) to provide such additional documents as you may require pursuant to the terms of the Amended and Restated 2013

Equity Incentive Plan, (ii) to provide for the payment by me to you (in the manner designated by you) of your withholding

obligation, if any, relating to the exercise of this option, and (iii) if this exercise relates to an incentive stock option,

to notify you in writing within fifteen (15) days after the date of any disposition of any of the shares of Common Stock (the “Shares”)

issued upon exercise of this option that occurs within two (2) years after the date of grant of this option or within one (1) year

after such shares of Common Stock are issued upon exercise of this option.

I acknowledge that

all certificates representing any of the Shares subject to the provisions of the Option shall have endorsed thereon appropriate

legends reflecting restrictions pursuant to the Option Agreement, the Company’s Certificate of Incorporation, Bylaws and/or

applicable securities laws.

Very truly yours,

______________________________

Exhibit 2

CannaVEST

Corp.

Stock Option Grant Notice

Amended and Restated 2013 Equity Incentive Plan

FOR GOOD AND VALUABLE CONSIDERATION,

CannaVEST Corp. (the “Company”) hereby grants to the Optionee named below, a stock option (the “Option”)

to purchase any part or all of the specified number of shares of its Common Stock (“Option Shares”),

upon the terms and subject to the conditions set forth in this Stock Option Grant Notice (the “Grant Notice”),

at the specified purchase price per share without commission or other charge. The Option is granted pursuant to the Company’s

Amended and Restated 2013 Equity Incentive Plan (the “Plan”) and the Stock Option Agreement (the “Option

Agreement”), promulgated under the Plan and in effect as of the date of this Grant Notice.

| Optionee: |

Michael Mona, Jr. |

| Date of Grant: |

September 23, 2015 |

| Vesting Commencement Date: |

September 23, 2015 |

| Number of Option Shares: |

1,470,000 |

| Exercise Price (Per Share): |

$0.73 |

| Total Exercise Price: |

$1,073,100.00 |

| Expiration Date: |

Ten years after Date of

Grant |

Type of Grant: x Incentive

Stock Option1 o Nonstatutory Stock Option

Exercise Schedule: x

Same as Vesting Schedule o Early Exercise Permitted

Vesting Schedule: The Option

Shares are fully vested on the Date of Grant.

Payment: By one or a combination of the following

items (described in the Plan):

| x | By cash or check |

| | | |

| | o | By

net exercise, if the Company has established procedures for net exercise |

Additional Terms/Acknowledgements:

The undersigned Optionee acknowledges receipt of, and understands and agrees to, this Stock Option Grant Notice, the Option Agreement,

and the Plan.

Further, by their signatures below,

the Company and the Optionee agree that the Option is governed by this Grant Notice and by the provisions of the Plan and Option

Agreement, both of which are attached to and made a part of this Grant Notice. Optionee acknowledges receipt of copies of the Plan

and the Option Agreement, represents that the Optionee has read and is familiar with their provisions, and hereby accepts the Option

subject to all of their terms and conditions. Optionee further acknowledges that, as of the Date of Grant, this Grant Notice, the

Option Agreement and the Plan set forth the entire understanding between Optionee and the Company regarding the acquisition of

stock in the Company and supersede all prior oral and written agreements on that subject, with the exception of options previously

granted under the Plan.

___________________

1

If this is an Incentive Stock Option, it (plus other outstanding Incentive Stock Options) cannot be first exercisable

for more than $100,000 in value (measured by exercise price) in any calendar year. Any excess over $100,000 is a Nonstatutory

Stock Option.

|

CannaVEST Corp.

By:/s/ Joseph Dowling

Joseph Dowling, Chief Financial Officer

Date: September 24, 2015 |

Optionee: Michael

Mona, Jr.

/s/ Michael Mona, Jr.

Signature

Date: September 24, 2015 |

Attachments: (I) Option Agreement; (II) Amended and Restated 2013 Equity Incentive Plan; and (III) Notice of Exercise

Attachment I

Option

Agreement

Incorporated

by reference from an exhibit to the Company’s Form S-8 filed on October 6, 2014.

Attachment II

Amended

and Restated 2013 Equity Incentive Plan

Incorporated

by reference from an appendix to the Company’s Proxy Statement on Schedule 14A filed on July 2, 2014.

Attachment III

Notice

Of Exercise

CannaVEST Corp.

2688 South Rainbow Blvd.

Suite B

Las Vegas, Nevada 89146

Date of Exercise: _______________

Ladies and Gentlemen:

This constitutes

notice under my stock option that I elect to purchase the number of shares for the price set forth below.

| Type of option (check one): |

Incentive x |

Nonstatutory o |

| Stock option dated: |

_______________ |

_______________ |

| Number of shares as to which option is exercised: |

_______________ |

_______________ |

| Certificates to be issued in name of: |

_______________ |

_______________ |

| Total exercise price: |

$______________ |

$______________ |

| Cash or check payment delivered herewith: |

$______________ |

$______________ |

By this exercise,

I agree (i) to provide such additional documents as you may require pursuant to the terms of the Amended and Restated 2013

Equity Incentive Plan, (ii) to provide for the payment by me to you (in the manner designated by you) of your withholding

obligation, if any, relating to the exercise of this option, and (iii) if this exercise relates to an incentive stock option,

to notify you in writing within fifteen (15) days after the date of any disposition of any of the shares of Common Stock (the “Shares”)

issued upon exercise of this option that occurs within two (2) years after the date of grant of this option or within one (1) year

after such shares of Common Stock are issued upon exercise of this option.

I acknowledge that

all certificates representing any of the Shares subject to the provisions of the Option shall have endorsed thereon appropriate

legends reflecting restrictions pursuant to the Option Agreement, the Company’s Certificate of Incorporation, Bylaws and/or

applicable securities laws.

Very truly yours,

______________________________

Exhibit 3

CannaVEST

Corp.

Stock Option Grant Notice

Amended and Restated 2013 Equity Incentive Plan

FOR GOOD AND VALUABLE CONSIDERATION,

CannaVEST Corp. (the “Company”) hereby grants to the Optionee named below, a stock option (the “Option”)

to purchase any part or all of the specified number of shares of its Common Stock (“Option Shares”),

upon the terms and subject to the conditions set forth in this Stock Option Grant Notice (the “Grant Notice”),

at the specified purchase price per share without commission or other charge. The Option is granted pursuant to the Company’s

Amended and Restated 2013 Equity Incentive Plan (the “Plan”) and the Stock Option Agreement (the “Option

Agreement”), promulgated under the Plan and in effect as of the date of this Grant Notice.

| Optionee: |

Michael Mona, Jr. |

| Date of Grant: |

December 28, 2015 |

| Vesting Commencement Date: |

December 28, 2015 |

| Number of Option Shares: |

530,000 |

| Exercise Price (Per Share): |

$0.155 |

| Total Exercise Price: |

$82,150.00 |

| Expiration Date: |

Ten years after Date of

Grant |

Type of Grant: x Incentive

Stock Option1 o Nonstatutory Stock Option

Exercise Schedule: x

Same as Vesting Schedule o Early Exercise Permitted

Vesting Schedule: The Option

Shares are fully vested on the Date of Grant.

Payment: By one or a combination of the following

items (described in the Plan):

| x | By cash or check |

| | | |

| | o | By

net exercise, if the Company has established procedures for net exercise |

Additional Terms/Acknowledgements:

The undersigned Optionee acknowledges receipt of, and understands and agrees to, this Stock Option Grant Notice, the Option Agreement,

and the Plan.

Further, by their signatures below,

the Company and the Optionee agree that the Option is governed by this Grant Notice and by the provisions of the Plan and Option

Agreement, both of which are attached to and made a part of this Grant Notice. Optionee acknowledges receipt of copies of the Plan

and the Option Agreement, represents that the Optionee has read and is familiar with their provisions, and hereby accepts the Option

subject to all of their terms and conditions. Optionee further acknowledges that, as of the Date of Grant, this Grant Notice, the

Option Agreement and the Plan set forth the entire understanding between Optionee and the Company regarding the acquisition of

stock in the Company and supersede all prior oral and written agreements on that subject, with the exception of options previously

granted under the Plan.

|

CannaVEST Corp.

By:/s/ Joseph Dowling

Joseph Dowling, Chief Financial Officer

Date: December 28, 2015 |

Optionee: Michael

Mona, Jr.

/s/ Michael Mona, Jr.

Signature

Date: December 28, 2015 |

Attachments:

(I) Option Agreement; (II) Amended and Restated 2013 Equity Incentive Plan; and (III) Notice of Exercise

Attachment I

Option

Agreement

Incorporated

by reference from an exhibit to the Company’s

Form S-8 filed on October 6, 2014.

Attachment II

Amended

and Restated 2013 Equity Incentive Plan

Incorporated

by reference from an appendix to the Company’s Proxy Statement on Schedule 14A filed on November 6, 2015.

Attachment III

Notice

Of Exercise

CannaVEST Corp.

2688 South Rainbow Blvd.

Suite B

Las Vegas, Nevada 89146

Date of Exercise: _______________

Ladies and Gentlemen:

This constitutes

notice under my stock option that I elect to purchase the number of shares for the price set forth below.

| Type of option (check one): |

Incentive ý |

Nonstatutory ¨ |

| Stock option dated: |

_______________ |

_______________ |

| Number of shares as to which option is exercised: |

_______________ |

_______________ |

| Certificates to be issued in name of: |

_______________ |

_______________ |

| Total exercise price: |

$______________ |

$______________ |

| Cash or check payment delivered herewith: |

$______________ |

$______________ |

By this exercise,

I agree (i) to provide such additional documents as you may require pursuant to the terms of the Amended and Restated 2013

Equity Incentive Plan, (ii) to provide for the payment by me to you (in the manner designated by you) of your withholding

obligation, if any, relating to the exercise of this option, and (iii) if this exercise relates to an incentive stock option,

to notify you in writing within fifteen (15) days after the date of any disposition of any of the shares of Common Stock (the “Shares”)

issued upon exercise of this option that occurs within two (2) years after the date of grant of this option or within one (1) year

after such shares of Common Stock are issued upon exercise of this option.

I acknowledge that

all certificates representing any of the Shares subject to the provisions of the Option shall have endorsed thereon appropriate

legends reflecting restrictions pursuant to the Option Agreement, the Company’s Certificate of Incorporation, Bylaws and/or

applicable securities laws.

Very truly yours,

______________________________

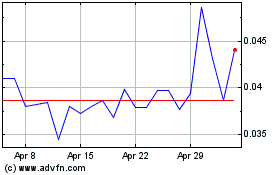

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Aug 2024 to Sep 2024

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Sep 2023 to Sep 2024