UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 4, 2016

______________________________

|

| | | | |

|

| | | | |

LIFEVANTAGE CORPORATION (Exact name of registrant as specified in its charter) |

______________________________

|

| | | | |

|

| | | | |

Colorado | | 001-35647 | | 90-0224471 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

9785 S. Monroe Street, Suite 300, Sandy, UT 84070 |

(Address of Principal Executive Offices and Zip Code) |

| | | | |

Registrant’s telephone number, including area code: (801) 432-9000 |

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

|

| |

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

(d)

Effective January 4, 2016, the Board of Directors (“Board”) of LifeVantage Corporation (the “Company”) increased the number of authorized directors from five to seven and appointed Darren Jensen and Dave Toole as members of the Board to fill the newly created vacancies. Mr. Jensen and Mr. Toole have not been appointed to any committees of the Board. The Company’s January 8, 2016, press release announcing the appointments is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Mr. Jensen has served as the Company’s President and Chief Executive Officer since May 2015. Mr. Jensen will not receive any additional compensation for his service as a director.

Mr. Toole, age 60, is a supply chain, digital media and video expert, and has been the chief executive officer of MediaMobz, a private company that enables brands to increase their capacity to create video centric digital media that drives business results, since 2008. Mr. Toole is also currently the chief executive officer of Outhink Media, an emerging media incubator, which position he has held since 2001. Prior to Outhink Media, Mr. Toole spent 21 years at GaSonics International, a semiconductor capital equipment company, where he worked in various positions, including finally as chief executive officer from 1993 to 2001. As chief executive officer at GaSonics, Mr. Toole led that company’s initial public offering in 1994 and the sale of the company to Novellus Systems in 2001. Mr. Toole began his career at Advance Micro Devices, a manufacturer of early computer chips, where he was a production supervisor from 1976 to 1979. Mr. Toole received his Bachelor of Arts degree in Business from the University of California, Santa Barbara.

Mr. Toole will receive the Company’s standard compensation for non-employee directors, which consists of a $5,000 monthly retainer. In addition, Mr. Toole will receive an initial equity award on the one year anniversary of joining our Board, for that number of shares of our common stock determined as follows: $150,000 divided by the “average stock price” and rounded down to the nearest whole share, with the “average stock price” calculated by averaging the closing prices of a share of our common stock on the last trading day of the month for each of the 12 months prior to the one year anniversary of Mr. Toole joining the Board, which award will be fully vested.

Mr. Jensen and Mr. Toole each entered into the Company’s standard Form of Director and Officer Indemnification Agreement filed herewith as Exhibit 10.1 in connection with their appointments as members of the Board.

There are no arrangements or understandings between either Mr. Jensen or Mr. Toole and any other persons pursuant to which Mr. Jensen and Mr. Toole were appointed as members of the Board. There has been no transaction since the beginning of the Company’s last fiscal year, and there is no currently proposed transaction, in excess of $120,000 in which the Company is or was a participant and in which Mr. Jensen or Mr. Toole or any of their immediate family members (within the meaning of Item 404 of Regulation S-K) had or will have a direct or indirect material interest.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

| | | |

Exhibit No. | | Description |

10.1 | | | Form of Director and Officer Indemnification Agreement |

99.1 | | | Press Release issued January 8, 2016, announcing the appointment of Darren Jensen and Dave Toole as members of the Company’s Board of Directors |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| |

|

| |

Date: January 8, 2016 | LIFEVANTAGE CORPORATION

By: /s/ Beatryx Washington Name: Beatryx Washington Title: Senior Vice President Legal Affairs |

INDEMNITY AGREEMENT

This Indemnity Agreement (this “Agreement”), dated as of _____________, is made by and between LifeVantage Corporation, a Colorado corporation (the “Company”), and ______________ (the “Indemnitee”).

RECITALS

A. The Company is aware that competent and experienced persons may agree to serve as directors, officers or agents of corporations only if they are protected by comprehensive liability insurance and have the right to indemnification.

B. Based upon their experience as business managers, the Board of Directors of the Company (the “Board”) has concluded that, to retain and attract talented and experienced individuals to serve as directors, officers and agents of the Company and its subsidiaries and to encourage such individuals to take the business risks necessary for the success of the Company and its subsidiaries, it is necessary for the Company to contractually indemnify its directors, officers and agents and the directors, officers and agents of its subsidiaries, and to assume for itself maximum liability for expenses and damages in connection with claims against such directors, officers and agents in connection with their service to the Company and its subsidiaries, and has further concluded that the failure to provide such contractual indemnification could result in great harm to the Company and its subsidiaries and the Company’s stockholders.

C. Article 109 of the Colorado Business Corporation Act, under which the Company is organized (“Article 109”), empowers the Company to indemnify its directors, officers, employees and agents by agreement and to indemnify persons who serve, at the request of the Company, as the directors, officers, employees or agents of other corporations or enterprises, and expressly provides that the indemnification provided by Article 109 is not exclusive, but any provision treating the Company's indemnification, except an insurance policy as described in Section 3 below, is valid only to the extent the provision is not inconsistent with Article 9, sections 7-109-101 to 7-109-108.

AGREEMENT

NOW, THEREFORE, the parties hereto, intending to be legally bound, hereby agree as follows:

1.Definitions.

(a) Agent. For the purposes of this Agreement, “agent” of the Company means any person who is or was a director, officer, employee or other agent of the Company or a subsidiary of the Company; or is or was serving at the request of, for the convenience of, or to represent the interests of the Company or a subsidiary of the Company as a director, officer, employee or agent of another foreign or domestic corporation, partnership, joint venture, trust or other enterprise; or was a director, officer, employee or agent of a foreign or domestic corporation which was a predecessor corporation of the Company or a subsidiary of the Company, or was a director, officer,

employee or agent of another enterprise at the request of, for the convenience of, or to represent the interests of such predecessor corporation.

(b) Expenses. For purposes of this Agreement, and except as otherwise provided herein, “expenses” include all out-of-pocket costs of any type or nature whatsoever (including, without limitation, all attorneys’ fees and related disbursements), actually and reasonably incurred by the Indemnitee in connection with either the investigation, defense or appeal of a proceeding or establishing or enforcing a right to indemnification under this Agreement or Article 109 or otherwise; provided, however, that “expenses” shall not include any judgments, fines, ERISA excise taxes or penalties, or amounts paid in settlement of a proceeding.

(c) Proceeding. For the purposes of this Agreement, “proceeding” means any threatened, pending, or completed action, suit or other proceeding, whether civil, criminal, administrative, or investigative and whether formal or informal.

(d) Subsidiary. For purposes of this Agreement, “subsidiary” means any corporation of which more than 50% of the outstanding voting securities is owned directly or indirectly by the Company, by the Company and one or more other subsidiaries, or by one or more other subsidiaries.

2. Agreement to Serve. The Indemnitee agrees to serve and/or continue to serve as agent of the Company, at its will (or under separate agreement, if such agreement exists), in the capacity Indemnitee currently serves as an agent of the Company, so long as he or she is duly appointed or elected and qualified in accordance with the applicable provisions of the Bylaws of the Company or any subsidiary of the Company or until such time as he or she tenders his or her resignation in writing; provided, however, that nothing contained in this Agreement is intended to create any right to continued employment by Indemnitee.

3. Liability Insurance.

(a) Maintenance of D&O Insurance. The Company hereby covenants and agrees that, so long as the Indemnitee shall continue to serve as an agent of the Company and thereafter so long as the Indemnitee shall be subject to any possible proceeding by reason of the fact that the Indemnitee was an agent of the Company, the Company, subject to Section 3(c), shall promptly obtain and maintain in full force and effect directors’ and officers’ liability insurance (“D&O Insurance”) in reasonable amounts from established and reputable insurers.

(b) Rights and Benefits. In all policies of D&O Insurance, the Indemnitee shall have the same rights and benefits as are accorded to the most favorably insured of the Company’s directors, if the Indemnitee is a director; or of the Company’s officers, if the Indemnitee is not a director of the Company but is an officer; or of the Company’s key employees, if the Indemnitee is not a director or officer but is a key employee.

(c) Limitation on Required Maintenance of D&O Insurance. Notwithstanding the foregoing, the Company shall have no obligation to obtain or maintain D&O Insurance if the Company determines in good faith that such insurance is not reasonably available, the premium

costs for such insurance are disproportionate to the amount of coverage provided, the coverage provided by such insurance is limited by exclusions so as to provide an insufficient benefit, or the Indemnitee is covered by similar insurance maintained by a subsidiary of the Company.

4. Mandatory Indemnification. Subject to Section 8 below, the Company shall indemnify the Indemnitee as follows:

(a) Successful Defense. To the extent the Indemnitee has been successful on the merits or otherwise in defense of any proceeding (including, without limitation, an action by or in the right of the Company) to which the Indemnitee was a party by reason of the fact that he or she is or was an agent of the Company at any time, against all expenses of any type whatsoever actually and reasonably incurred by him or her in connection with the investigation, defense or appeal of such proceeding.

(b) Third Party Actions. If the Indemnitee is a person who was or is a party or is threatened to be made a party to any proceeding (other than an action by or in the right of the Company) by reason of the fact that he or she is or was an agent of the Company, or by reason of anything done or not done by him or her in any such capacity, the Company shall indemnify the Indemnitee against any and all expenses and liabilities of any type whatsoever (including, but not limited to, judgments, fines, ERISA excise taxes and penalties, and amounts paid in settlement) actually and reasonably incurred by him or her in connection with the investigation, defense, settlement or appeal of such proceeding, provided the Indemnitee acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the Company and its stockholders, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful.

(c) Derivative Actions. If the Indemnitee is a person who was or is a party or is threatened to be made a party to any proceeding by or in the right of the Company by reason of the fact that he or she is or was an agent of the Company, or by reason of anything allegedly done or not done by him or her in any such capacity, the Company shall indemnify the Indemnitee against all expenses actually and reasonably incurred by him or her in connection with the investigation, defense, settlement, or appeal of such proceeding, provided the Indemnitee acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the Company and its stockholders; except that no indemnification under this subsection 4(c) shall be made in respect to any claim, issue or matter as to which such person shall have been finally adjudged to be liable to the Company by a court of competent jurisdiction unless and only to the extent that the court in which such proceeding was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such amounts which the court shall deem proper.

(d) Actions where Indemnitee is Deceased. If the Indemnitee is a person who was or is a party or is threatened to be made a party to any proceeding by reason of the fact that he or she is or was an agent of the Company, or by reason of anything done or not done by him or her in any such capacity, and if prior to, during the pendency of after completion of such proceeding Indemnitee becomes deceased, the Company shall indemnify the Indemnitee’s heirs, executors and administrators against any and all expenses and liabilities of any type whatsoever (including, but

not limited to, judgments, fines, ERISA excise taxes and penalties, and amounts paid in settlement) actually and reasonably incurred to the extent Indemnitee would have been entitled to indemnification pursuant to Sections 4(a), 4(b), or 4(c) above were Indemnitee still alive.

(e) Notwithstanding the foregoing, the Company shall not be obligated to indemnify the Indemnitee for expenses or liabilities of any type whatsoever (including, but not limited to, judgments, fines, ERISA excise taxes and penalties, and amounts paid in settlement) for which payment is actually made to or on behalf of Indemnitee under a valid and collectible insurance policy of D&O Insurance, or under a valid and enforceable indemnity clause, by-law or agreement.

5. Partial Indemnification. If the Indemnitee is entitled under any provision of this Agreement to indemnification by the Company for some or a portion of any expenses or liabilities of any type whatsoever (including, but not limited to, judgments, fines, ERISA excise taxes and penalties, and amounts paid in settlement) incurred by him or her in the investigation, defense, settlement or appeal of a proceeding, but not entitled, however, to indemnification for all of the total amount hereof, the Company shall nevertheless indemnify the Indemnitee for such total amount except as to the portion hereof to which the Indemnitee is not entitled.

6. Mandatory Advancement of Expenses. Subject to Section 8(a) below, the Company shall advance all expenses incurred by the Indemnitee in connection with the investigation, defense, settlement or appeal of any proceeding to which the Indemnitee is a party or is threatened to be made a party by reason of the fact that the Indemnitee is or was an agent of the Company. Indemnitee hereby undertakes to repay such amounts advanced only if, and to the extent that, it shall be determined ultimately that the Indemnitee is not entitled to be indemnified by the Company as authorized hereby. The advances to be made hereunder shall be paid by the Company to the Indemnitee within twenty (20) days following delivery of a written request therefor by the Indemnitee to the Company. In the event that the Company fails to pay expenses as incurred by the Indemnitee as required by this paragraph, Indemnitee may seek mandatory injunctive relief from any court having jurisdiction to require the Company to pay expenses as set forth in this paragraph. If Indemnitee seeks mandatory injunctive relief pursuant to this paragraph, it shall not be a defense to enforcement of the Company’s obligations set forth in this paragraph that Indemnitee has an adequate remedy at law for damages.

7. Notice and Other Indemnification Procedures.

(a) Promptly after receipt by the Indemnitee of notice of the commencement of or the threat of commencement of any proceeding, the Indemnitee shall, if the Indemnitee believes that indemnification with respect thereto may be sought from the Company under this Agreement, notify the Company of the commencement or threat of commencement thereof.

(b) If, at the time of the receipt of a notice of the commencement of a proceeding pursuant to Section 7(a) hereof, the Company has D&O Insurance in effect, the Company shall give prompt notice of the commencement of such proceeding to the insurers in accordance with the procedures set forth in the respective policies. The Company shall thereafter take all necessary or desirable action to cause such insurers to pay, on behalf of the Indemnitee, all amounts payable as a result of such proceeding in accordance with the terms of such policies.

(c) In the event the Company shall be obligated to pay the expenses of any proceeding against the Indemnitee, the Company, if appropriate, shall be entitled to assume the defense of such proceeding, with counsel reasonably approved by the Indemnitee, upon the delivery to the Indemnitee of written notice of its election so to do. After delivery of such notice, reasonable approval of such counsel by the Indemnitee and the retention of such counsel by the Company, the Company will not be liable to the Indemnitee under this Agreement for any fees of counsel subsequently incurred by the Indemnitee with respect to the same proceeding, provided that (i) the Indemnitee shall have the right to employ his or her counsel in any such proceeding at the Indemnitee’s expense; and (ii) if (A) the employment of counsel by the Indemnitee has been previously authorized by the Company, (B) the Indemnitee shall have reasonably concluded that there may be a conflict of interest between the Company and the Indemnitee in the conduct of any such defense, or (C) the Company shall not, in fact, have employed counsel to assume the defense of such proceeding, then the fees and expenses of Indemnitee’s counsel shall be at the expense of the Company.

8. Exceptions. Any other provision herein to the contrary notwithstanding, the Company shall not be obligated pursuant to the terms of this Agreement:

(a) Claims Initiated by Indemnitee. To indemnify or advance expenses to the Indemnitee with respect to proceedings or claims initiated or brought voluntarily by the Indemnitee and not by way of defense, unless (i) such indemnification is expressly required to be made by law, (ii) the proceeding was authorized by the Board, (iii) such indemnification is provided by the Company, in its sole discretion, pursuant to the powers vested in the Company under the Colorado Business Corporation Act or (iv) the proceeding is brought to establish or enforce a right to indemnification under this Agreement or any other statute or law or otherwise as required under Article 109;

(b) Lack of Good Faith. To indemnify the Indemnitee for any expenses incurred by the Indemnitee with respect to any proceeding instituted by the Indemnitee to enforce or interpret this Agreement, if a court of competent jurisdiction determines that each of the material assertions made by the Indemnitee in such proceeding was not made in good faith or was frivolous; or

(c) Unauthorized Settlements. To indemnify the Indemnitee under this Agreement for any amounts paid in settlement of a proceeding unless the Company consents to such settlement, which consent shall not be unreasonably withheld.

9. Non-exclusivity. The provisions for indemnification and advancement of expenses set forth in this Agreement shall not be deemed exclusive of any other rights which the Indemnitee may have under any provision of law, the Company’s Certificate of Incorporation or Bylaws, the vote of the Company’s stockholders or disinterested directors, other agreements, or otherwise, both as to action in his or her official capacity and to action in another capacity while occupying his or her position as an agent of the Company, and the Indemnitee’s rights hereunder shall continue after the Indemnitee has ceased acting as an agent of the Company and shall inure to the benefit of the heirs, executors and administrators of the Indemnitee.

10. Enforcement. Any right to indemnification or advances granted by this Agreement to Indemnitee shall be enforceable by or on behalf of Indemnitee in any court of competent jurisdiction if (i) the claim for indemnification or advances is denied, in whole or in part, or (ii) no disposition of such claim is made within ninety (90) days of request therefor. Indemnitee, in such enforcement action, if successful in whole or in part, shall be entitled to be paid also the expense of prosecuting his or her claim. It shall be a defense to any action for which a claim for indemnification is made under this Agreement (other than an action brought to enforce a claim for expenses pursuant to Section 6 hereof, provided that the required undertaking has been tendered to the Company) that Indemnitee is not entitled to indemnification because of the limitations set forth in Sections 4 and 8 hereof. Neither the failure of the Company (including its Board or its stockholders) to have made a determination prior to the commencement of such enforcement action that indemnification of Indemnitee is proper in the circumstances, nor an actual determination by the Company (including its Board or its stockholders) that such indemnification is improper, shall be a defense to the action or create a presumption that Indemnitee is not entitled to indemnification under this Agreement or otherwise.

11. Subrogation. In the event the Company is obligated to make a payment under this Agreement, the Company shall be subrogated to the extent of such payment to all of the rights of recovery under an insurance policy or any other indemnity agreement covering the Indemnitee, who shall execute all documents required and shall do all acts that may be necessary to secure such rights and to enable the Company effectively to bring suit to enforce such rights.

12. Survival of Rights.

(a) All agreements and obligations of the Company contained herein shall continue during the period Indemnitee is an agent of the Company and shall continue thereafter so long as Indemnitee shall be subject to any possible claim or threatened, pending or completed action, suit or proceeding, whether civil, criminal, arbitrational, administrative or investigative, by reason of the fact that Indemnitee was serving in the capacity referred to herein.

(b) The Company shall require any successor to the Company (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially all of the business or assets of the Company, expressly to assume and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform if no such succession had taken place.

13. Interpretation of Agreement. It is understood that the parties hereto intend this Agreement to be interpreted and enforced so as to provide indemnification to the Indemnitee to the fullest extent permitted by law including those circumstances in which indemnification would otherwise be discretionary. It is further understood that the parties hereto intend this Agreement to be interpreted and enforced to not require indemnification to Indemnitee in any situation where indemnification is prohibited by law.

14. Severability. If any provision or provisions of this Agreement shall be held to be invalid, illegal or unenforceable for any reason whatsoever, (i) the validity, legality and enforceability of the remaining provisions of the Agreement (including without limitation, all

portions of any paragraphs of this Agreement containing any such provision held to be invalid, illegal or unenforceable, that are not themselves invalid, illegal or unenforceable) shall not in any way be affected or impaired thereby, and (ii) to the fullest extent possible, the provisions of this Agreement (including, without limitation, all portions of any paragraph of this Agreement containing any such provision held to be invalid, illegal or unenforceable, that are not themselves invalid, illegal or unenforceable) shall be construed so as to give effect to the intent manifested by the provision held invalid, illegal or unenforceable and to give effect to Section 13 hereof.

15. Modification and Waiver. No supplement, modification or amendment of this Agreement shall be binding unless executed in writing by both of the parties hereto. No waiver of any of the provisions of this Agreement shall be deemed or shall constitute a waiver of any other provisions hereof (whether or not similar) nor shall such waiver constitute a continuing waiver.

16. Notice. All notices, requests, demands and other communications under this Agreement shall be in writing and shall be deemed duly given (i) if delivered by hand and receipted for by the party addressee or (ii) if mailed by certified or registered mail, return receipt requested, on the third business day after the mailing date. Addresses for notice to either party are as shown on the signature page of this Agreement, or as subsequently modified by written notice.

17. Governing Law. This Agreement shall be governed exclusively by and construed according to the laws of the State of Colorado as applied to contracts between Colorado residents entered into and to be performed entirely within Colorado.

The parties hereto have entered into this Agreement effective as of the date first above written.

LIFEVANTAGE CORPORATION

By: ________________________

Name: _____________________

Title: ______________________

Address: 9785 S. Monroe Street, Suite 300

Sandy, Utah 84070

INDEMNITEE:

___________________________

Name: _____________________

Address: ___________________

___________________

LifeVantage Appoints New Board Members to Board of Directors

Darren Jensen and Dave Toole named to the Board of Directors

SALT LAKE CITY, January 8, 2016 – LifeVantage Corporation (NASDAQ:LFVN), announced today the appointment of Darren Jensen, the company's President and Chief Executive Officer, and Dave Toole, a new independent director, to its Board of Directors. The election of Mr. Jensen and Mr. Toole brings the number of Directors to seven members and retains the independence of the Board.

"It is with pleasure that I accept the election to LifeVantage’s Board of Directors," said Mr. Jensen. "I am honored to work together with our Board to continue to execute our growth plan."

Mr. Toole stated, “I am pleased to join the Board of Directors of LifeVantage. The company has a strong foundation with effective and scientifically-backed products and has a number of exciting growth initiatives in place. I look forward to applying my experience to help LifeVantage maximize its potential.”

Garry Mauro, the company’s Chairman of the Board, added, "We are delighted to have Darren and Dave join our Board of Directors. Since his appointment as CEO, Darren has done a tremendous job outlining and executing a plan that puts LifeVantage on a path to accelerated growth. We also are excited to have someone with Dave's expertise in marketing and leadership of a public company join our Board of Directors. He has a solid track record for developing digital media and driving improved results that will provide a valuable perspective to our Board."

Mr. Jensen has served as the company’s President and Chief Executive Officer since May 2015. Mr. Jensen brings 25 years of global network marketing and direct selling experience to LifeVantage from companies selling a variety of product types including nutritional supplements and personal care products. Mr. Jensen previously served in senior executive roles at some of the largest and most respected direct selling companies in the world, as well as co-founded two thriving multi-level marketing companies. In these roles, he led the development and execution of global sales, product development and service expansion strategies. He was responsible for international business development, performance improvement, and global marketing efforts in more than 100 countries within the Asia Pacific Rim, Latin America, the Caribbean, Europe, the Middle East, and Africa. Mr. Jensen received his Bachelor of Arts in International Relations from Brigham Young University and was named one of Utah Business Magazine's 40 Under Forty honorees in 2009.

Mr. Toole brings over 35 years of experience as a supply chain, digital media and video expert, and has been the chief executive officer of MediaMobz, a private company that enables brands to increase their capacity to create video centric digital media that drives business results, since 2008. Mr. Toole is also currently the chief executive officer of Outhink Media, an

emerging media incubator, which position he has held since 2001. Prior to Outhink Media, Mr. Toole spent 21 years at GaSonics International, a semiconductor capital equipment company, where he worked in various positions, including as chief executive officer from 1993 to 2001. As chief executive officer at GaSonics, Mr. Toole led the company’s initial public offering in 1994 and the sale of the company to Novellus Systems in 2001. Mr. Toole began his career at Advance Micro Devices, a manufacturer of early computer chips, where he was a production supervisor from 1976 to 1979. Mr. Toole received his Bachelor of Arts degree in Business from the University of California, Santa Barbara.

About LifeVantage Corporation

LifeVantage Corporation (Nasdaq:LFVN), is a science based network marketing company dedicated to visionary science that looks to transform health, wellness and anti-aging internally and externally at the cellular level. The company is the maker of Protandim®, the Nrf2 Synergizer® patented dietary supplement, the TrueScience™ Anti-Aging Skin Care Regimen, Canine Health, the AXIO™ energy product line and the PhysIQ™ smart weight management system. LifeVantage was founded in 2003 and is headquartered in Salt Lake City, Utah.

Forward Looking Statements

This document contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words and expressions reflecting optimism, satisfaction or disappointment with current prospects, as well as words such as "believe", "objectives", "hopes", "intends", "estimates", "expects", "projects", "plans", "anticipates", "look forward to", “executing our growth plan”, “path to accelerated growth”, and variations thereof, identify forward-looking statements, but their absence does not mean that a statement is not forward-looking. Examples of forward-looking statements include, but are not limited to, statements we make regarding our leadership in the global market, product and country expansion, and future growth and financial performance. Such forward-looking statements are not guarantees of performance and the Company's actual results could differ materially from those contained in such statements. These forward-looking statements are based on the Company's current expectations and beliefs concerning future events affecting the Company and involve known and unknown risks and uncertainties that may cause the Company's actual results or outcomes to be materially different from those anticipated and discussed herein. These risks and uncertainties include, among others, those discussed in greater detail in the Company's Annual Report on Form 10-K and the Company's Quarterly Report on Form 10-Q under the caption "Risk Factors," and in other documents filed by the Company from time to time with the Securities and Exchange Commission. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this document. All forward-looking statements are based on information currently available to the Company on the date hereof, and the Company undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date of this document, except as required by law.

Investor Relations Contact

Cindy England (801) 432-9036

Director of Investor Relations

-or-

John Mills (646) 277-1254

Partner, ICR INC

Company Relations Contact

John Genna (801) 432-9172

Vice President of Communications &

Corporate Partnerships

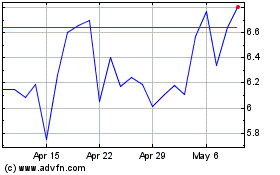

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

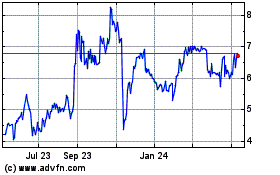

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Apr 2023 to Apr 2024