As filed with the Securities and Exchange Commission on

December 23, 2015.

| Registration No.

333-208506 |

| |

U.S. SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

Amendment No. 1

to

Form F-10

REGISTRATION

STATEMENT UNDER

THE SECURITIES ACT OF 1933

___________________________________

B2Gold Corp.

(Exact name of Registrant as specified in its charter)

| British Columbia, Canada |

1040 |

n/a |

| (Province or other Jurisdiction of |

(Primary Standard Industrial

Classification |

(I.R.S. Employer Identification Number, if

|

| Incorporation or Organization) |

Code Number) |

any) |

| Suite 3100, Three Bentall Centre |

| 595 Burrard Street |

| Vancouver, British Columbia, Canada, V7X 1J1

|

| (604) 681-8371 |

| (Address and telephone number of Registrant’s

principal executive offices) |

| |

| DL Services, Inc. |

| 701 Fifth Avenue, Suite 6100 |

| Seattle, Washington 98104 |

| (206) 903-8800 |

| (Name, address (including zip code) and telephone

number (including area code) of agent for service in the United States)

|

| ___________________________________ |

| |

| With a copy to: |

| Christopher L. Doerksen |

| Dorsey & Whitney LLP |

| 701 Fifth Avenue |

| Suite 6100 |

| Seattle, Washington 98104 |

| (206) 903-8800 |

| ___________________________________ |

| |

| Approximate date of commencement of proposed sale to

the public: |

| From time to time after the effective date of this

Registration Statement. |

| |

| |

| Province of British Columbia, Canada |

| (Principal jurisdiction regulating this offering)

|

| ___________________________________ |

| It is proposed that this filing shall become

effective (check appropriate box below): |

| A. |

[ ] upon filing with the Commission, pursuant to Rule

467(a) (if in connection with an offering being made contemporaneously in

the United States and Canada). |

| B. |

[X] at some future date (check appropriate box

below) |

|

1. |

[ ] pursuant to Rule 467(b) on ( ) at ( ) (designate a

time not sooner than seven calendar days after filing). |

|

2. |

[ ] pursuant to Rule 467(b) on ( ) at ( ) (designate a

time seven calendar days or sooner after filing) because the securities

regulatory authority in the review jurisdiction has issued a receipt or

notification of clearance on ( ). |

|

3. |

[ ] pursuant to Rule 467(b) as soon as practicable after

notification of the Commission by the Registrant or the Canadian

securities regulatory authority of the review jurisdiction that a receipt

or notification of clearance has been issued with respect

hereto. |

|

4. |

[X] after the filing of the next amendment to this Form

(if preliminary material is being filed). |

If any of the securities being

registered on this form are to be offered on a delayed or continuous basis

pursuant to the home jurisdiction’s shelf prospectus offering procedures, check

the following box. [X]

___________________________________

The Registrant hereby amends this Registration Statement on

such date or dates as may be necessary to delay its effective date until the

Registration Statement shall become effective as provided in Rule 467 under the

Securities Act of 1933 or on such date as the Commission, acting pursuant to

Section 8(a) of the Act, may determine.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR

PURCHASERS

I-1

A copy of this preliminary short form base shelf prospectus has been filed with the securities regulatory authorities in each of the provinces of

Canada, but has not yet become final for the purpose of the sale of securities. Information contained in this preliminary short

form base shelf prospectus may not be complete and may have to be amended. The securities may not be sold until a receipt for the short form base

shelf prospectus is obtained from the securities regulatory authorities.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This preliminary short

form base shelf prospectus has been filed under legislation in each of the provinces of Canada that permits certain

information about these securities to be determined after this prospectus has become final and that permits the omission from this prospectus of

that information. The legislation requires the delivery to purchasers of a prospectus supplement containing the omitted information within a

specified period of time after agreeing to purchase any of these securities.

Information has been incorporated by reference in this

preliminary short form base shelf prospectus from documents

filed with securities commissions or similar authorities in Canada.

Copies of the documents incorporated herein by reference

may be obtained on request, without charge, from the Corporate

Secretary of B2Gold Corp. at Suite 3100, Three Bentall Centre, 595

Burrard Street, Vancouver, British Columbia, Canada V7X 1J1, telephone (604)

681-8371 and are also available electronically at www.sedar.com.

AMENDED AND RESTATED PRELIMINARY SHORT FORM BASE SHELF PROSPECTUS

(AMENDING AND RESTATING THE PRELIMINARY SHORT FORM BASE SHELF PROSPECTUS DATED DECEMBER 11,

2015)

| New Issue |

December 23, 2015 |

B2GOLD CORP.

US$300,000,000

Debt

Securities

Warrants

Subscription Receipts

Units

Common Shares

B2Gold Corp. (“B2Gold” or the “Company”) may offer and sell, from time to time, debt securities (“Debt Securities”), warrants to purchase common shares of the Company (“Warrants”), subscription receipts (“Subscription Receipts”) or common shares of the Company (“Common Shares”) or any combination of such securities (“Units”) (all of the foregoing collectively, the “Securities) up to an aggregate initial offering price of US$300,000,000 (or its equivalent in Canadian dollars) during the 25-month period that this amended and restated short form base shelf prospectus (the “Prospectus”), including any amendments hereto, remains effective. Securities may be offered in amounts, at prices and on terms to be determined based on market conditions at the time of sale and set forth in an accompanying prospectus supplement (a “Prospectus Supplement”). In addition, Securities may be offered and issued in consideration for the acquisition of other businesses, assets or securities by us or one of our subsidiaries. The consideration for any such acquisition may consist of any of the Securities separately, a combination of Securities or any combination of among other things, Securities, cash and assumption of liabilities.

Investing in the Securities involves significant risks.

Prospective investors should carefully consider the risk factors described under

the heading “Risk Factors” and elsewhere in this Prospectus and in the documents

incorporated by reference in this Prospectus.

This offering is made by a Canadian issuer that is permitted

under a multijurisdictional disclosure system adopted by the United States to

prepare this Prospectus in accordance with Canadian disclosure requirements.

Prospective investors should be aware that such requirements are different from

those applicable to issuers in the United States. Financial statements

incorporated herein by reference have been prepared in accordance with

International Financial Reporting Standards, as issued by the International

Accounting Standards Board (“IFRS”), and thus may not be comparable to financial

statements of United States companies.

Prospective investors should be aware that the acquisition

of the Securities may have tax consequences both in the United States and in

Canada. Such consequences for investors who are resident in, or citizens of, the

United States or who are resident in Canada may not be described fully herein or

in any applicable Prospectus Supplement. Prospective investors should read the

tax discussion contained in the applicable Prospectus Supplement with respect to

a particular offering of Securities and consult their own tax advisors with

respect to their own particular circumstances.

The enforcement by investors of civil liabilities under the

U.S. federal securities laws may be affected adversely by the fact that the

Company is incorporated or organized under the laws of British Columbia, Canada,

that the majority of the Company’s officers and directors and some or all of the

experts named in this Prospectus are residents of a country other than the

United States, and that a substantial portion of the assets of the Company and

said persons are located outside the United States.

Neither the United States Securities and Exchange Commission

(the “SEC”) nor any state securities regulator has approved or disapproved of

the Securities offered hereby, passed upon the accuracy or adequacy of this

Prospectus or determined if this Prospectus is truthful or complete. Any

representation to the contrary is a criminal offense.

No underwriter has been involved in the preparation of this

Prospectus or performed any review of the content of this Prospectus.

The specific terms of the Securities with respect to a

particular offering will be set out in the applicable Prospectus Supplement and

may include, where applicable (i) in the case of Common Shares, the number of

Common Shares offered, the offering price, whether the Common Shares are being

offered for cash, and any other terms specific to the Common Shares being

offered, (ii) in the case of Debt Securities, the specific designation, the

aggregate principal amount, the currency or the currency unit for which the Debt

Securities may be purchased, the maturity, the interest provisions, the

authorized denominations, the offering price, whether the Debt Securities are

being offered for cash, the covenants, the events of default, any terms for

redemption or retraction, any exchange or conversion rights attached to the Debt

Securities and any other terms specific to the Debt Securities being offered,

(iii) in the case of Warrants, the offering price, whether the Warrants are

being offered for cash, the designation, the number and the terms of the Common

Shares or Debt Securities purchasable upon exercise of the Warrants, any

procedures that will result in the adjustment of these numbers, the exercise

price, the dates and periods of exercise, the currency in which the Warrants are

issued and any other terms specific to the Warrants being offered, (iv) in the

case of Subscription Receipts, the number of Subscription Receipts being

offered, the offering price, whether the Subscription Receipts are being offered

for cash, the procedures for the exchange of the Subscription Receipts for

Common Shares, Debt Securities or Warrants, as the case may be, and any other

terms specific to the Subscription Receipts being offered, and (v) in the case

of Units, the designation, number and terms of the Common Shares, Warrants,

Subscription Receipts or Debt Securities comprising the Units. Where required by

statute, regulation or policy, and where Securities are offered in currencies

other than Canadian dollars, appropriate disclosure of foreign exchange rates

applicable to the Securities will be included in the Prospectus Supplement

describing the Securities.

This Prospectus does not qualify for issuance debt securities

in respect of which the payment of principal and/or interest may be determined,

in whole or in part, by reference to one or more underlying interests,

including, for example, an equity or debt security, or a statistical measure of

economic or financial performance (including, but not limited to, any currency,

consumer price or mortgage index, or the price or value of one or more

commodities, indices or other items, or any other item or formula, or any

combination or basket of the foregoing items). For greater certainty, this

Prospectus may qualify for issuance debt securities, including Debt Securities

convertible into other Securities of the Company, in respect of which the

payment of principal and/or interest may be determined, in whole or in part, by

reference to published rates of a central banking authority or one or more

financial institutions, such as a prime rate or bankers’ acceptance rate, or to

recognized market benchmark interest rates such as LIBOR, EURIBOR or a U.S.

federal funds rate.

All shelf information permitted under applicable laws to be

omitted from this Prospectus will be contained in one or more Prospectus

Supplements that will be delivered to purchasers together with this Prospectus.

Each Prospectus Supplement will be incorporated by reference into this

Prospectus for the purposes of securities legislation as of the date of the

Prospectus Supplement and only for the purposes of the distribution of the

Securities to which the Prospectus Supplement pertains.

This Prospectus constitutes a public offering of the Securities

only in those jurisdictions where they may be lawfully offered for sale and only

by persons permitted to sell the Securities in such jurisdictions. We may offer

and sell Securities to, or through, underwriters or dealers, directly to one or

more other purchasers, or through agents pursuant to exemptions from

registration or qualification under applicable securities laws. A Prospectus Supplement relating to

each issue of Securities will set forth the names of any underwriters, dealers

or agents involved in the offering and sale of the Securities and will set forth

the terms of the offering of the Securities, the method of distribution of the

Securities, including, to the extent applicable, the proceeds to us and any

fees, discounts, concessions or other compensation payable to the underwriters,

dealers or agents, and any other material terms of the plan of distribution.

ii

In connection with any offering of the Securities, other than

an “at-the-market distribution” (as defined under applicable Canadian securities

legislation) unless otherwise specified in a Prospectus Supplement, the

underwriters or agents may over-allot or effect transactions which stabilize or

maintain the market price of the Securities offered at a higher level than that

which might exist in the open market. Such transaction, if commenced, may be

interrupted or discontinued at any time. See “Plan of Distribution”.

No underwriter or dealer involved in an “at-the-market

distribution” under this Prospectus, no affiliate of such an underwriter or

dealer and no person or company acting jointly or in concert with such an

underwriter or dealer will over-allot securities in connection with such

distribution or effect any other transactions that are intended to stabilize or

maintain the market price of the Securities.

Our outstanding Common Shares are listed and posted for trading

on the Toronto Stock Exchange (the “TSX”) under the symbol “BTO” and on

the NYSE MKT LLC (“NYSE MKT”) under the symbol “BTG”. On December 22,

2015, the last trading day of the Common Shares prior to the date of this

Prospectus, the closing price of the Common Shares on the TSX and NYSE MKT was

C$1.47 and US$1.05, respectively. Unless otherwise specified in the

applicable Prospectus Supplement, the Debt Securities, the Warrants, the

Subscription Receipts and the Units will not be listed on any securities

exchange. There is no market through which these Securities may be sold and

purchasers may not be able to resell these Securities purchased under this

Prospectus. This may affect the pricing of these Securities in the secondary

market, the transparency and availability of trading prices, the liquidity of

these Securities, and the extent of issuer regulation.

Our head office is located at Suite 3100, Three Bentall Centre,

595 Burrard Street, Vancouver, British Columbia, V7X 1J1. Our registered and

records office is located at 1600 – 925 West Georgia Street, Vancouver, British

Columbia, V6C 3L2.

Mr. Rayment, Mr. Korpan, Mr. Mtshisi and Mr. Connelly all being

directors of the Company reside outside Canada. Mr. Rayment, Mr. Korpan, Mr.

Mtshisi and Mr. Connelly have appointed B2Gold Corp., Suite 3100, Three Bentall

Centre, 595 Burrard Street, Vancouver, British Columbia, Canada V7X 1J1, as

their agent for service of process in Canada. Prospective investors are advised

that it may not be possible for investors to enforce judgments obtained in

Canada against Mr. Rayment, Mr. Korpan, Mr. Mtshisi and Mr. Connelly, even

though they have appointed an agent for service of process.

iii

TABLE OF CONTENTS

You should rely only on the information contained in or

incorporated by reference in this Prospectus and any applicable Prospectus

Supplement in connection with an investment in Securities. We have not

authorized anyone to provide you with different information. We are not making

an offer of the Securities in any jurisdiction where such offer is not

permitted. You should assume that the information appearing in this Prospectus

or any Prospectus Supplement is accurate only as of the date on the front of

those documents and that information contained in any document incorporated by

reference is accurate only as of the date of that document unless specified

otherwise. Our business, financial condition, results of operations and

prospects may have changed since those dates.

In this Prospectus and any Prospectus Supplement, unless the

context otherwise requires, the terms “we”, “our”, “us”, the “Company” and

“B2Gold” refer to B2Gold Corp., and unless the context otherwise requires, our

direct and indirect subsidiaries.

Market data and certain industry forecasts used in this

Prospectus or any applicable Prospectus Supplement and the documents

incorporated by reference herein or therein were obtained from market research,

publicly available information and industry publications. We believe that these

sources are generally reliable, but the accuracy and completeness of the

information is not guaranteed. We have not independently verified this

information and do not make any representation as to the accuracy of this

information.

iv

CAUTIONARY NOTE TO UNITED STATES INVESTORS

We are permitted under a multi-jurisdictional disclosure system

adopted by the securities regulatory authorities in Canada and the United States

to prepare this Prospectus, including the documents incorporated by reference

and any Prospectus Supplement, in accordance with the requirements of Canadian

securities laws, which differ from the requirements of United States securities

laws. All mineral resource and reserve estimates included in this Prospectus,

including the documents incorporated by reference, have been prepared in

accordance with National Instrument 43-101 Standards of Disclosure for

Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the

Canadian Securities Administrators that establishes standards for all public

disclosure an issuer makes of scientific and technical information concerning

mineral projects. These standards differ significantly from the mineral reserve

disclosure requirements of the SEC set out in Industry Guide 7. Consequently,

mineral reserve and mineral resource information included and incorporated by

reference in this Prospectus and any Prospectus Supplement is not comparable to

similar information that would generally be disclosed by U.S. companies in

accordance with the rules of the SEC.

In particular, the SEC’s Industry Guide 7 applies different

standards in order to classify mineralization as a reserve. As a result, the

definitions of proven and probable mineral reserves used in NI 43-101 differ

from the definitions in SEC Industry Guide 7. Under SEC standards,

mineralization may not be classified as a “reserve” unless the determination has

been made that the mineralization could be economically and legally produced or

extracted at the time the reserve determination is made. Among other things, all

necessary permits would be required to be in hand or issuance imminent in order

to classify mineralized material as reserves under the SEC standards.

Accordingly, mineral reserve estimates included and incorporated by reference in

this Prospectus and any Prospectus Supplement may not qualify as “reserves”

under SEC standards.

In addition, the information included and incorporated by

reference in this Prospectus uses the terms “mineral resources”, “measured

mineral resources”, “indicated mineral resources” and “inferred mineral

resources” to comply with the reporting standards in Canada. The SEC’s Industry

Guide 7 does not recognize mineral resources and U.S. companies are generally

not permitted to disclose mineral resources in documents they file with the SEC.

Investors are specifically cautioned not to assume that any part or all of the

mineral deposits in these categories will ever be converted into SEC defined

mineral reserves. Further, “inferred mineral resources” have a great amount of

uncertainty as to their existence and as to whether they can be mined legally or

economically. Therefore, investors are also cautioned not to assume that all or

any part of an inferred mineral resource exists. In accordance with Canadian

rules, estimates of “inferred mineral resources” cannot form the basis of

feasibility or, except in limited circumstances, other economic studies. It

cannot be assumed that all or any part of “measured mineral resources”,

“indicated mineral resources” or “inferred mineral resources” will ever be

upgraded to a higher category or mineral resources or that mineral resources

will be classified as mineral reserves. Investors are cautioned not to assume

that any part of the reported “measured mineral resources”, “indicated mineral

resources” or “inferred mineral resources” included and incorporated by

reference in this Prospectus and any Prospectus Supplement is economically or

legally mineable. Disclosure of “contained ounces” in a resource is permitted

under NI 43-101; however, the SEC normally only permits issuers to report

mineralization that does not constitute “reserves” by SEC standards as in-place

tonnage and grade without reference to unit measures. In addition, the documents

incorporated by reference in this Prospectus include information regarding

adjacent or nearby properties on which we have no right to mine. The SEC does

not normally allow U.S. companies to include such information in their filings

with the SEC. For the above reasons, information included and incorporated by

reference in this Prospectus and any Prospectus Supplement that describes our

mineral reserve and resource estimates or that describes the results of

pre-feasibility or other studies is not comparable to similar information made

public by U.S. companies subject to the reporting and disclosure requirements of

the SEC.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information included and incorporated by reference in this

Prospectus includes certain “forward-looking information” and “forward-looking

statements” (collectively “forward-looking statements”) within the

meaning of applicable Canadian and United States securities legislation,

including projections of future financial and operational performance;

statements with respect to future events or future performance, production

estimates, anticipated operating and production costs and revenue, estimates of

capital expenditures; recovery and grade estimates; anticipated exploration,

development, construction, production, permitting and other activities on the

Company’s properties, including finalizing the Mining Convention and the

ownership of the entity that will hold the Fekola project with the Government of

Mali, the potential development and potential production from the Fekola project

and the anticipated arrival of the permanent camp there; the life of mine at the

Fekola project; estimated financial returns from the Fekola project; completion

of a mining study for the Otjikoto mine as well as a new geologic model for the

Otjikoto Pit and the Wolfshag zone, updating the Kiaka feasibility study; the

projections included in existing technical reports, economic assessments and

feasibility studies, including the feasibility study for the Fekola project; the

potential for expansion of mineral resources and mineral reserves, including at

the Masbate mine; the potential for expansion of production capacity, including

the cost reduction and continued ramp up, improvements and expansion of gold production at the Otjikoto

mine and development of the adjacent Wolfshag zone, potential expansion options

for the Masbate mine, the completion of permitting in respect of the Jabali

Antenna Pit, production from the Jabali Antenna Pit and increased production at

La Libertad, and the potential to extend the mine life of the La Libertad and

Limon mines; projected capital investments and exploration; and the adequacy of

capital, financing needs and the potential availability of and potential for

receiving further commitments under our new revolving credit facility; the

potential availability of flexible financing arrangements, including our new

revolving credit facility; the availability of the accordion feature under our

new revolving credit facility and the potential increase in available funds

under it; the repayment of our previous credit facility; and whether our new

revolving credit facility will provide sufficient funds for the construction of

the Fekola project and to meet our objective of having $100 million on hand.

Estimates of mineral resources and mineral reserves are also forward looking

statements because they constitute projections, based on certain estimates and

assumptions, regarding the amount of minerals that may be encountered in the

future and/or the anticipated economics of production, should a production

decision be made. All statements included and incorporated by reference herein

that address events or developments that we expect to occur in the future are

forward-looking statements. Forward-looking statements are statements that are

not historical facts and are generally, although not always, identified by words

such as “expect”, “plan”, “anticipate”, “project”, “target”, “potential”,

“schedule”, “forecast”, “budget”, “estimate”, “intend” or “believe” and similar

expressions or their negative connotations, or that events or conditions “will”,

“would”, “may”, “could”, “should” or “might” occur. All such forward-looking

statements are based on the opinions and estimates of management as of the date

such statements are made. Forward-looking statements necessarily involve

assumptions, risks and uncertainties, certain of which are beyond our control,

including risks associated with the volatility of metal prices; risks and

dangers inherent in exploration, development and mining activities; risks of not

achieving production or cost estimates; uncertainty of mineral reserve and

mineral resource estimates; material differences for reporting mineralized

material between United States reporting standards and the Canadian standards;

financing risks; risks related to hedging activities and ore purchase

commitments; the ability to obtain and maintain any necessary permits, consents

or authorizations required for mining activities; inability to comply with

Philippines regulations related to ownership of natural resources and operation,

management and control of our business; risks related to environmental

regulations or hazards and compliance with complex regulations associated with

mining activities; the ability to replace mineral reserves and identify

acquisition opportunities or complete desirable acquisitions; the failure to

integrate business and assets that we have acquired or may acquire in the

future; unknown liabilities of companies that we have acquired; fluctuations in

exchange rates; availability of financing and financing risks; risks related to

operations in foreign countries and compliance with foreign laws including

changes in such laws, risks related to remote operations and the availability of

adequate infrastructure, fluctuations in price and availability of energy and

other inputs necessary for mining operations; shortages or cost increases in

necessary equipment, supplies and labour; regulatory, political and country

risks including the risk of terrorist activity; climate change risks; volatility

of global financial conditions; disruptions arising from conflicts with small

scale miners in certain countries; risks related to reliance upon contractors,

third parties and joint venture partners; challenges to title or surface rights;

dependence on key personnel; risks associated with conflicts of interest among

our directors and officers; the risk of an uninsurable or uninsured loss;

litigation risk; taxation, including changes in tax laws and interpretation of

tax laws; difficulty in achieving and maintaining the adequacy of internal

control over financial reporting as required by the Sarbanes-Oxley Act; risks

related to the ongoing epidemic of the Ebola virus disease in West Africa; and

community support for our operations including risks related to strikes and the

halting of such operations, from time to time, as well as other factors

identified and as described in more detail under the heading “Risk Factors” in

our most recent annual information form and this Prospectus and in the documents

incorporated by reference herein. The list is not exhaustive of the factors that

may affect our forward-looking statements. There can be no assurance that such

statements will prove to be accurate, and actual results, performance or

achievements could differ materially from those expressed in, or implied by,

these forward-looking statements. Accordingly, no assurance can be given that

any events anticipated by the forward-looking statements will transpire or

occur, or if any of them do, what benefits or liabilities we will derive

therefrom. Our forward looking statements reflect current expectations regarding

future events and operating performance and speak only as of the date hereof and

we do not assume any obligation to update forward-looking statements if

circumstances or management's beliefs, expectations or opinions should change

other than as required by applicable law. For the reasons set forth above, undue

reliance should not be placed on forward-looking statements.

PRESENTATION OF FINANCIAL INFORMATION

The financial statements included or incorporated by reference

in this Prospectus or any Prospectus Supplement are presented in United States

dollars and have been prepared in accordance with IFRS as issued by the

International Accounting Standards Board, including IAS 34, Interim Financial

Reporting, as appropriate.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

All dollar amounts in this Prospectus and any Prospectus

Supplement are or will be in United States dollars, unless otherwise indicated.

All references to “$” or “US$” refer to U.S. dollars and “C$” refers to Canadian

dollars. On December 22, 2015, the noon spot rate for Canadian dollars in terms of the United States

dollar, as quoted by the Bank of Canada, was US$1.00=C$ 1.39 or C$1.00=US$ 0.72.

2

The following table sets forth, for each period indicated, the

exchange rates of the Canadian dollar to the U.S. dollar for the end of period

and the high, low and average (based on the exchange rate on the last day of

each month during such period) exchange rates for such period (such rates, which

are expressed in Canadian dollars are based on the noon buying rate for U.S.

dollars reported by the Bank of Canada).

| |

|

|

Year

ended |

|

| |

|

|

December 31, |

|

| |

|

|

2012 |

|

|

2013 |

|

|

2014 |

|

| |

Rate at the end of period |

$ |

0.9949 |

|

$ |

1.0636 |

|

$ |

1.1601 |

|

| |

Average rate during period |

$ |

0.9996 |

|

$ |

1.0299 |

|

$ |

1.1045 |

|

| |

Highest rate during period

|

$ |

1.0418 |

|

$ |

1.0697 |

|

$ |

1.1643 |

|

| |

Lowest rate during period |

$ |

0.9710 |

|

$ |

0.9839 |

|

$ |

1.0614 |

|

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this

Prospectus from documents filed with securities commissions or similar

authorities in Canada and filed with, or furnished to, the SEC. Copies of

the documents incorporated herein by reference may be obtained on request

without charge from the Corporate Secretary of the Company at Suite 3100, Three

Bentall Centre, 595 Burrard Street, Vancouver, British Columbia, Canada V7X 1J1,

telephone: (604) 681-8371. These documents are also available through the

internet on SEDAR, which can be accessed online at www.sedar.com.

The following documents of the Company filed with the

securities commissions or similar authorities in Canada are specifically

incorporated by reference in, and form an integral part of, this Prospectus:

| |

(a) |

annual information form, dated March 27, 2015, for the

year ended December 31, 2014; |

| |

|

|

| |

(b) |

audited consolidated financial statements for the years

ended December 31, 2014 and 2013, together with the notes thereto and the

auditor’s report thereon; |

| |

|

|

| |

(c) |

management’s discussion and analysis of the financial

position and results of operations for the year ended December 31,

2014; |

| |

|

|

| |

(d) |

management information circular, dated May 8, 2015,

prepared in connection with our annual general and special meeting of

shareholders held on June 12, 2015; |

| |

|

|

| |

(e) |

unaudited condensed interim consolidated financial

statements for the three and nine months ended September 30, 2015,

together with the notes thereto; |

| |

|

|

| |

(f) |

management’s discussion and analysis of the financial

position and results of operations for the three and nine months ended

September 30, 2015; |

| |

|

|

| |

(g) |

press release dated May 20, 2015, relating to the Company

securing a new revolving credit facility; and |

| |

|

|

| |

(h) |

press release dated June 11, 2015, relating to the

results of the optimized feasibility study for the Fekola project and the

closing of the Company’s new revolving credit

facility. |

Any document of the types referred to in the preceding

paragraph (excluding press releases and confidential material change reports) or

of any other type required to be incorporated by reference into a short form

prospectus pursuant to National Instrument 44-101 – Short Form Prospectus

Distributions that are filed by us with a securities commission or similar

authority in Canada after the date of this Prospectus and prior to the

termination of the offering under any Prospectus Supplement shall be deemed to

be incorporated by reference in this Prospectus. In addition, any document filed

by us with the SEC or furnished to the SEC on Form 6-K or otherwise after the date of this Prospectus shall be deemed

to be incorporated by reference into this Prospectus if, and to the extent, so

provided.

3

Any statement contained in this Prospectus or in a document

incorporated or deemed to be incorporated by reference herein shall be deemed to

be modified or superseded for purposes of this Prospectus to the extent that a

statement contained herein or in any other subsequently filed document which

also is or is deemed to be incorporated by reference herein modifies or

supersedes such statement. The modifying or superseding statement need not state

that it has modified or superseded a prior statement or include any other

information set forth in the document it modifies or supersedes. The making of a

modifying or superseding statement shall not be deemed an admission for any

purposes that the modified or superseded statement, when made, constituted a

misrepresentation, an untrue statement of a material fact or an omission to

state a material fact that is required to be stated or that is necessary to make

a statement not misleading in light of the circumstances in which it was made.

Any statement so modified or superseded shall not constitute a part of this

Prospectus, except as so modified or superseded.

A Prospectus Supplement containing the specific terms of an

offering of Securities will be delivered to purchasers of such Securities

together with this Prospectus and will be deemed to be incorporated by reference

into this Prospectus as of the date of such Prospectus Supplement, but only for

the purposes of the offering of Securities covered by that Prospectus

Supplement.

Upon a new annual information form and related annual financial

statements being filed by us with, and where required, accepted by, the

applicable securities regulatory authority during the currency of this

Prospectus, the previous annual information form, the previous annual financial

statements and all interim financial statements, material change reports and

information circulars and all Prospectus Supplements filed prior to the

commencement of our financial year in which a new annual information form is

filed shall be deemed no longer to be incorporated into this Prospectus for

purposes of future offers and sales of Securities hereunder.

AVAILABLE INFORMATION

We have filed with the SEC a registration statement on Form

F-10 relating to the Securities. This Prospectus, which constitutes a part of

the registration statement, does not contain all of the information contained in

the registration statement, certain items of which are contained in the exhibits

to the registration statement as permitted by the rules and regulations of the

SEC. Statements included or incorporated by reference in this Prospectus about

the contents of any contract, agreement or other documents referred to are not

necessarily complete, and in each instance you should refer to the exhibits for

a more complete description of the matter involved. Each such statement is

qualified in its entirety by such reference.

We are subject to the information requirements of the United

States Securities Exchange Act of 1934 as amended (the “Exchange

Act”), and applicable Canadian securities legislation, and in accordance

therewith file reports and other information with the SEC and with the

securities regulators in Canada. Under a multi-jurisdictional disclosure system

adopted by the United States, documents and other information that we file with

the SEC may be prepared in accordance with the disclosure requirements of

Canada, which are different from those of the United States. As a foreign

private issuer, we are exempt from the rules under the Exchange Act prescribing

the furnishing and content of proxy statements, and our officers, directors and

principal shareholders are exempt from the reporting and short-swing profit

recovery provisions contained in Section 16 of the Exchange Act. In addition, we

are not required to publish financial statements as promptly as U.S. companies.

You may read any document that we have filed with the SEC at

the SEC’s public reference room in Washington, D.C. You may also obtain copies

of those documents from the public reference room of the SEC at 100 F Street,

N.E., Washington, D.C. 20549 by paying a fee. You should call the SEC at

1-800-SEC-0330 or access its website at www.sec.gov for further information

about the public reference rooms. You may read and download the documents we

have filed with the SEC’s Electronic Data Gathering and Retrieval System at

www.sec.gov. You may read and download any public document that we have filed

with the Canadian securities regulatory authorities under our corporate profile

on the SEDAR website at www.sedar.com.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been or will be filed with the SEC

as part of the registration statement of which this Prospectus forms a part: (i)

the documents referred to under the heading “Documents Incorporated by

Reference”; (ii) consents of auditor, engineers and geologists; (iii) powers of

attorney from certain directors and officers of the Company; and (iv) the form

of Indenture (as defined below). A copy of the form of warrant indenture,

subscription receipt agreement or statement of eligibility of trustee on Form T-1, as applicable, will be filed by post-effective

amendment or by incorporation by reference to documents filed or furnished with

the SEC under the Exchange Act.

4

THE COMPANY

We are a Vancouver-based gold producer with four operating

mines (two mines in Nicaragua, one mine in the Philippines and one mine in

Namibia) and one mine under construction in Mali. In addition, the Company has a

portfolio of other evaluation and exploration projects in several countries

including Mali, Colombia, Burkina Faso and Nicaragua. The Company currently

operates the La Libertad mine and the Limon mine in Nicaragua, the Masbate mine

in the Philippines and the Otjikoto mine in Namibia.

More detailed information regarding the business of the

Company, its operations and its assets and properties can be found in our annual

information form and other documents which are incorporated herein by reference.

See “Documents Incorporated by Reference”.

MANAGEMENT AND BOARD OF DIRECTORS

The following is a brief description of the principal business

activities and experience of our senior management and directors:

Clive Johnson

Clive Johnson has served as a Director and the President of

B2Gold since December 2006 and Chief Executive Officer since March 2007. Mr.

Johnson oversees our long-term strategy and development as well as the

day-to-day activities of B2Gold. Previously, Mr. Johnson was involved with Bema

Gold Corporation (“Bema”) and its predecessor companies since 1977. Mr.

Johnson was appointed the President and Chief Executive Officer of Bema after it

was created by the amalgamation of three Bema group companies in 1988. He was

the driving force in Bema’s transition from a junior exploration company to an

international intermediate gold producer. Mr. Johnson is currently a director of

Uracan Resources Ltd.

Roger Richer

Roger Richer has served as our Executive Vice President,

General Counsel since March 2007 and our Secretary since December 2006. Mr.

Richer manages the legal affairs, corporate records and corporate governance of

B2Gold. Mr. Richer has over 30 years of experience in mining law, corporate

finance and international business transactions and practices. Mr. Richer was

with Bema Gold from its inception in 1988 until 2007. He has a Bachelor of Arts

and a Bachelor of Law degree from the University of Victoria.

Michael Cinnamond

Michael Cinnamond has served as our Senior Vice President of

Finance and Chief Financial Officer since April 1, 2014. Mr. Cinnamond oversees

the financial reporting, cash management and tax planning of B2Gold as well as

financial compliance and reporting to the regulatory authorities. Prior to

joining us, Mr. Cinnamond was an audit partner at PricewaterhouseCoopers LLP

where he was the BC Resources Leader for the Mining, Forestry and Energy and

Utilities practices. Mr. Cinnamond has 16 years of experience in the mining

industry sector. Mr. Cinnamond holds an LL.B designation from the University of

Exeter.

Tom Garagan

Tom Garagan has served as our Senior Vice President of

Exploration since March 2007. Mr. Garagan is responsible for all aspects of our

exploration, including technical review of new acquisitions. Mr. Garagan is a

geologist with over 30 years of experience. Mr. Garagan was with Bema from 1991

to 2007 and was appointed Vice President of Exploration in 1996. He has worked

in North and South America, East and West Africa and Russia. He was instrumental

in several discoveries, including the Cerro Casale and Kupol deposits. Mr.

Garagan currently serves as a director of Uracan Resources Ltd. Mr. Garagan has

a Bachelor of Science (Honours) degree in geology from the University of Ottawa.

Dennis Stansbury

Dennis Stansbury has served as our Senior Vice President of

Engineering and Project Evaluations (and prior to that our Senior Vice President

of Development and Production) since March 2007. Mr. Stansbury is a mining

engineer with over 35 years of engineering, construction, production and management experience

at surface and underground mines in ten different countries. After working for a

number of gold mining companies in South America and the United States, he

joined Bema as Vice President South America in 1994 and was appointed Vice

President of Development and Production in 1996. Mr. Stansbury has a Bachelor of

Science degree in mining engineering from Montana College of Mineral Science and

Technology.

5

Robert Cross

Robert Cross was appointed to our board of directors and as

Chairman of the board in October 2007. Mr. Cross has over 25 years of experience

as a financier in the mining and oil & gas sectors. Mr. Cross is a

co-founder, director and Non-Executive Chairman of Bankers Petroleum Ltd., and a

co-founder, director and Chairman of Petrodorado Energy Ltd., and until October

2007, was the Non-Executive Chairman of Northern Orion Resources Inc. Mr. Cross

also serves as director of BNK Petroleum Inc. and Petro-Victory Energy Corp. Mr.

Cross served as Chairman and Chief Executive Officer of Yorkton Securities Inc.

between 1996 and 1998, a director of LNG Energy Ltd. from 2007 to 2011, and a

director of Athabasca Potash Inc. from 2009 to 2010. He also served as an

Investment Banking Partner with Gordon Capital Corporation in Toronto from 1987

to 1994. Mr. Cross holds a degree in Engineering from the University of Waterloo

and received his MBA from Harvard Business School in 1987.

Robert Gayton

Dr. Robert Gayton was appointed to our board of directors in

October 2007. Dr. Gayton is a Chartered Accountant and has acted as a consultant

to various public companies since 1990. He was the Chief Financial Officer of

Western Silver Corporation from 1995 to 2004 and served as a director of Western

Silver Corporation from 2004 to 2006. From 2003 to 2007, Dr. Gayton served as a

director of Bema. Dr. Gayton was Vice President of Finance of Doublestar

Resources Ltd. from 2003 to 2006 and a director from 1999 to 2007. He was a

director of Northern Orion Resources Inc. from 2004 to 2007, LNG Energy Ltd.

from 2011 to 2012, Palo Duro Energy Inc. from 2007 to 2012, Northisle Copper and

Gold Inc. from 2011 to 2012, Copper North Mining Corp. from 2011 to 2012,

Quaterra Resources Inc. from 1997 to 2012, Intrinsyc Software International,

Inc. from 1992 to 2010, and IMN Resources Inc. from 2008 to 2009. Each of these

companies was subsequently acquired by way of takeover. Dr. Gayton is currently

a director and the chair or a member of the audit and/or other committees of

Nevsun Resources Ltd., Amerigo Resources Ltd., Eastern Platinum Ltd. and Western

Copper and Gold Corporation.

Jerry Korpan

Jerry Korpan was appointed to our board of directors in

November 2007. Mr. Korpan served as Managing Director of Yorkton Securities UK

until 1999 and a director of Bema from 2002 to 2007. Until 2011, he was the

Executive Director of Emergis Capital S.A., a company based in Antwerp, Belgium.

Currently, Mr. Korpan serves as a director of Mitra Energy Limited, an

independent oil company operating in South East Asia, and Midas Gold

Corporation.

Barry Rayment

Dr. Barry Rayment was appointed to our board of directors in

October 2007. Dr. Rayment is a mining geologist with 40 years of experience in

base and precious metal exploration and development. Between 1990 and 1993, he

served as the President of Bema and also served as a director of Bema from 1988

to 2007. Dr. Rayment served as President of Mining Assets Corporation, a private

company that provides consulting services to the mining industry between 1993

and 2010. He is currently a director of Golden Predator Mining Corp. Dr. Rayment

was a director of EMC Metals Corp. between 2008 and 2009. Dr. Rayment obtained

his Ph.D. in Mining Geology at the Royal School of Mines, London.

Bongani Mtshisi

Bongani Mtshisi was appointed to our board of directors in

December 2011, following B2Gold’s acquisition of Auryx Gold Corp.

(“Auryx”) in 2011. Mr. Mtshisi is a Mining Engineer by training with more

than 12 years of experience working in key commodity sectors such as platinum,

gold, diamond, nickel and copper (Anglo American Platinum Limited, Debeers/HUF

joint venture and Sub Nigel Gold Mining Company). Mr. Mtshisi is currently the

CEO of BSC Resources Ltd., a company that is involved in the exploration and

development of copper and nickel commodities in South Africa. Mr. Mtshisi was

also a founder and Chairman of Auryx. Mr. Mtshisi has a National diploma in

Metalliferous Mining from Damelin College and a National Certificate in Project

Management from The Technikon Witwatersrand, both in South Africa.

6

Kevin Bullock

Kevin Bullock was appointed to our board of directors in

December 2013, following our acquisition of Volta Resources Inc. Mr. Bullock is

a mining engineer with over 25 years of experience at senior levels in mining

exploration, mine development and mine operations. Prior to joining our board,

Mr. Bullock was the President and CEO of Volta Resources Inc. and its

predecessor company, Goldcrest Resources Ltd. since its inception in 2002. Prior

to Volta and Goldcrest Resources Ltd., Mr. Bullock was Vice President Operations

for Kirkland Lake Gold Ltd. and was instrumental in the reopening of its Macassa

Gold Mine in Kirkland Lake, Ontario. Mr. Bullock is currently a director of

Metallum Resources, New Millenium Iron Corp. and Anaconda Mining Inc.

Mark Connelly

Mark Connelly was appointed to our board of directors in

October 2014, following our acquisition of Papillon. Prior to joining our board,

Mr. Connelly was Managing Director and CEO of Papillon. With over 25 years of

experience in the mining industry, Mr. Connelly held senior executive positions

with Adamus Resources Limited, Newmont Mining Corporation and Inmet Mining

Corporation prior to Papillon. Mr. Connelly has extensive experience with the

development, construction and operation of mining projects for a variety of

commodities, including gold, base metals and other resources in West Africa,

Australia, North America and Europe. Mr. Connelly is currently a director of

West African Resources Limited.

RISK FACTORS

An investment in our Securities involves risks. In addition to

the risk factors set forth below, you should carefully consider the risks

described in the sections entitled “Risk Factors” in any Prospectus Supplement

and those set forth in documents incorporated by reference in this Prospectus

and any applicable Prospectus Supplement, as well as other information in this

Prospectus and any applicable Prospectus Supplement, before purchasing any of

our Securities. Each of the risks described herein and in these sections and

documents could materially and adversely affect our business, financial

condition, results of operations and prospects, cause actual events to differ

materially from those described in forward looking statements and information

relating to the Company and could result in a loss of your investment.

Additional risks and uncertainties not known to us or that we currently deem

immaterial may also impair our business, financial condition, results of

operations and prospects. See “Documents Incorporated by Reference.”

There is an absence of a public market for certain of the

Securities

There is no public market for the Debt Securities, Warrants,

Subscription Receipts or Units and, unless otherwise specified in the applicable

Prospectus Supplement, we do not intend to apply for listing of the Debt

Securities, Warrants, Subscription Receipts or Units on any securities

exchanges. If the Debt Securities, Warrants, Subscription Receipts or Units are

traded after their initial issue, they may trade at a discount from their

initial offering prices depending on prevailing interest rates (as applicable),

the market for similar securities and other factors, including general economic

conditions and our financial condition. There can be no assurance as to the

liquidity of the trading market for the Debt Securities, Warrants, Subscription

Receipts or Units, or that a trading market for these securities will develop.

The Debt Securities will be structurally subordinated to any

indebtedness of our subsidiaries

We carry on our business through corporate subsidiaries, and

the majority of our assets are held in corporate subsidiaries. Our results of

operations and ability to service indebtedness, including the Debt Securities,

are dependent upon the results of operations of these subsidiaries and the

payment of funds by these subsidiaries to us in the form of loans, dividends or

otherwise. Our subsidiaries will not have an obligation to pay amounts due

pursuant to any debt securities or to make any funds available for payment on

debt securities, whether by dividends, interest, loans, advances or other

payments. In addition, the payment of dividends and the making of loans,

advances and other payments to us by our subsidiaries may be subject to

statutory or contractual restrictions. The Indenture (as defined below) does not

limit our ability or the ability of our subsidiaries to incur indebtedness. Such

indebtedness of our subsidiaries would be structurally senior to the Debt

Securities. In the event of the liquidation of any subsidiary, the assets of the

subsidiary would be used first to repay the obligations of the subsidiary,

including indebtedness and trade payables, prior to being used by us to pay our

indebtedness, including any Debt Securities.

7

Changes in interest rates may cause the market price or

value of the Debt Securities to decline

Prevailing interest rates will affect the market price or value

of the Debt Securities. The market price or value of the Debt Securities may

decline as prevailing interest rates for comparable debt instruments rise, and

increase as prevailing interest rates for comparable debt instruments

decline.

Fluctuations in foreign currency markets may cause the value

of the Debt Securities to decline

Debt Securities denominated or payable in foreign currencies

may entail significant risk. These risks include, without limitation, the

possibility of significant fluctuations in the foreign currency markets, the

imposition or modification of foreign exchange controls and potential liquidity

in the secondary market. These risks will vary depending upon the currency or

currencies involved and will be more fully described in the applicable

Prospectus Supplement.

USE OF PROCEEDS

Unless otherwise specified in a Prospectus Supplement, the net

proceeds from the sale of Securities will be used for general corporate

purposes, including funding ongoing operations and/or working capital

requirements, to repay indebtedness outstanding from time to time, discretionary

capital programs and potential future acquisitions. Each Prospectus Supplement

will contain specific information concerning the use of proceeds from that sale

of Securities.

All expenses relating to an offering of Securities and any

compensation paid to underwriters, dealers or agents, as the case may be, will

be paid out of the proceeds from the sale of Securities, unless otherwise stated

in the applicable Prospectus Supplement.

EARNINGS COVERAGE RATIO

Earnings coverage ratios will be provided as required in the

applicable Prospectus Supplement with respect to the issuance of Debt Securities

pursuant to this Prospectus.

CONSOLIDATED CAPITALIZATION

Since the date of the unaudited condensed interim consolidated

financial statements of the Company as at and for the nine months ended

September 30, 2015 which are incorporated by reference in this Prospectus, the

only material change to the share and loan capital of the Company on a

consolidated basis, was the drawdown of US$50 million under the Company’s new

US$350 million revolving credit facility (the “Credit Facility”).

DESCRIPTION OF EXISTING INDEBTEDNESS

We entered into the Credit Facility with a syndicate of

international banks pursuant to a credit agreement made as of May 20, 2015. The

Credit Facility also allows for an accordion feature whereby upon receipt of

additional binding commitments, the facility may be increased to US$450 million

any time prior to the maturity date. HSBC, as sole lead arranger and sole

bookrunner, is the administrative agent. The syndicate includes The Bank of Nova

Scotia, Société Générale and ING Bank N.V, as mandated lead arrangers. Proceeds

from the Credit Facility were used to repay our previous US$200 million

revolving credit facility and for general corporate purposes. The Credit

Facility bears interest on a sliding scale of between Libor plus 2.25% to 3.25%

based on our consolidated net leverage ratio. Commitment fees for the undrawn

portion of the facility will also be on a similar sliding scale basis of between

0.5% and 0.925% . The term for the Credit Facility is four years, maturing on

May 20, 2019, except that it shall become due on July 1, 2018 in the event that

our 3.25% convertible senior subordinated notes (the “Convertible Notes”)

due on October 1, 2018 remain outstanding or the maturity date of the

Convertible Notes has not been extended to at least 90 days after May 20, 2019.

Upon closing of the Credit Facility, an initial drawdown of US$150 million was

made which was used to repay the cumulative amount drawn under our previous

credit facility. A subsequent drawdown of US$50 million was made for general

corporate purposes.

We have outstanding as of December 22, 2015, US$258.75 million

Convertible Notes. Proceeds from the sale of the Convertible Notes were for

general corporate purposes. The Convertible Notes bear interest at 3.25% payable

semi-annually in arrears on April 1 and October 1 of each year, beginning on

April 1, 2014, and mature on October 1, 2018, unless earlier redeemed,

repurchased or converted. The Convertible Notes are convertible by holders into

our Common Shares, based on an initial conversion rate of 254.2912 Common Shares

per US$1,000 principal amount.

8

PLAN OF DISTRIBUTION

We may sell the Securities, separately or together: (a) to one

or more underwriters or dealers; (b) through one or more agents; or (c) directly

to one or more other purchasers. Each Prospectus Supplement will set forth the

terms of the offering, including the name or names of any underwriters or

agents, the purchase price or prices of the Securities and the proceeds to the

Company from the sale of the Securities. In addition, Securities may be offered

and issued in consideration for the acquisition (an “Acquisition”) of

other businesses, assets or securities by us or our subsidiaries. The

consideration for any such Acquisition may consist of any of the Securities

separately, a combination of Securities or any combination of, among other

things, securities, cash and assumption of liabilities.

The Securities may be sold from time to time in one or more

transactions at a fixed price or prices which may be changed or at market prices

prevailing at the time of sale, at prices related to such prevailing market

prices or at negotiated prices, including sales in transactions that are deemed

to be “at-the-market distributions” as defined in National Instrument 44-102 -

Shelf Distributions, including sales made directly on the TSX, NYSE MKT

or other existing trading markets for the Common Shares. The prices at which the

Securities may be offered may vary as between purchasers and during the period

of distribution. If, in connection with the offering of Securities at a fixed

price or prices, the underwriters have made a bona fide effort to sell all of

the Securities at the initial offering price fixed in the applicable Prospectus

Supplement, the public offering price may be decreased and thereafter further

changed, from time to time, to an amount not greater than the initial public

offering price fixed in such Prospectus Supplement, in which case the

compensation realized by the underwriters will be decreased by the amount that

the aggregate price paid by purchasers for the Securities is less than the gross

proceeds paid to us by the underwriters.

Underwriters, dealers or agents who participate in the

distribution of Securities may be entitled under agreements to be entered into

with the Company to indemnification by us against certain liabilities, including

liabilities under the United States Securities Act of 1933, as amended, and

applicable Canadian securities legislation, or to contribution with respect to

payments which such underwriters, dealers or agents may be required to make in

respect thereof. The underwriters, dealers or agents with whom we enter into

agreements may be customers of, engage in transactions with, or perform services

for, us in the ordinary course of business.

In connection with any offering of Securities, except as

otherwise set out in a Prospectus Supplement relating to a particular offering

of Securities, the underwriters or dealers, as the case may be, may over-allot

or effect transactions intended to fix or stabilize the market price of the

Securities at a level above that which might otherwise prevail in the open

market. Such transactions, if commenced, may be discontinued at any time.

PRIOR SALES

During the 12 month period before the date of this

Prospectus, we have issued the following Common Shares and securities

convertible into Common Shares:

| |

|

|

Number of |

| |

Price per |

Security

|

Securities Issued or

|

| Date of Issue |

Security (C$)

|

|

Granted |

| December 18, 2014 |

2.00 |

Stock Options |

500,000 |

| January 19, 2015 |

2.40 |

Stock Options |

50,000 |

| January 26, 2015 |

2.30 |

Common Shares |

3,110,950 |

| February 2, 2015 |

2.49 |

Restricted Share Units |

75,000 |

| February 11, 2015 |

2.16 |

Restricted Share Units |

90,000 |

| February 18, 2015 |

2.10 |

Stock Options |

1,140,000 |

| March 23, 2015 |

1.90 |

Restricted Share Units |

1,259,910 |

| March 30, 2015 |

2.00 |

Stock Options |

20,521,500 |

| April 1, 2015 |

1.93 |

Restricted Share Units |

90,000 |

| April 10, 2015 |

2.01 |

Common Shares |

313,059 |

| April 15, 2015 |

2.01 |

Common Shares |

125,224 |

| April 23, 2015 |

1.92 |

Common Shares |

2,557,083 |

| April 23, 2015 |

1.90 |

Stock Options |

170,000 |

| June 11, 2015 |

2.01 |

Stock Options |

212,000 |

| June 18, 2015 |

2.01 |

Stock Options |

250,000 |

| July 2, 2015 |

1.87 |

Restricted Share Units |

150,000 |

9

| |

Price per |

|

Number of |

| |

Security (C$) |

Security |

Securities Issued or |

| Date of Issue |

|

|

Granted |

| August 28, 2015 |

1.62 |

Restricted Share Units |

50,000 |

| August 31, 2015 |

1.65 |

Stock Options |

175,000 |

| September 23, 2015 |

1.49 |

Common Shares |

50,000 |

| December 15, 2015 |

1.63 |

Common Shares |

125,144 |

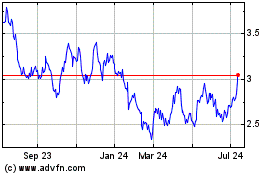

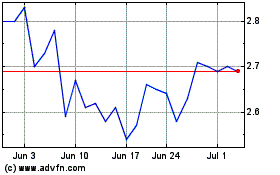

PRICE RANGE AND TRADING VOLUME

Our Common Shares are listed and posted for trading on the TSX

and NYSE MKT under the trading symbols “BTO” and “BTG”, respectively. The

following tables set out the market price range and trading volumes of our

Common Shares on the TSX and NYSE MKT for the periods indicated.

Toronto Stock Exchange (prices in Canadian dollars)

| Year |

|

|

High |

|

|

Low |

|

|

Volume |

|

| |

|

|

(C$) |

|

|

(C$) |

|

|

(no. of shares)

|

|

| 2015 |

December 1 - 22

|

|

1.69 |

|

|

1.41 |

|

|

83,832,096 |

|

| |

November |

|

1.51 |

|

|

1.31 |

|

|

88,246,740 |

|

| |

October |

|

1.88 |

|

|

1.37 |

|

|

92,462,882 |

|

| |

September |

|

1.75 |

|

|

1.35 |

|

|

70,145,106 |

|

| |

August |

|

1.79 |

|

|

1.30 |

|

|

73,025,399 |

|

| |

July |

|

1.98 |

|

|

1.34 |

|

|

72,352,487 |

|

| |

June |

|

2.21 |

|

|

1.90 |

|

|

48,159,947 |

|

| |

May |

|

2.18 |

|

|

1.86 |

|

|

63,718,986 |

|

| |

April |

|

2.04 |

|

|

1.86 |

|

|

54,618,270 |

|

| |

March |

|

2.17 |

|

|

1.79 |

|

|

96,223,177 |

|

| |

February |

|

2.47 |

|

|

1.99 |

|

|

77,092,854 |

|

| |

January |

|

2.88 |

|

|

1.84 |

|

|

143,470,405 |

|

| 2014 |

December |

|

2.15 |

|

|

1.74 |

|

|

97,703,461 |

|

| |

November |

|

2.18 |

|

|

1.65 |

|

|

97,794,214 |

|

On December 22, 2015, the closing price of our Common Shares on

the TSX was C$1.47 per share.

NYSE MKT (prices in U.S. dollars)

| Year |

|

|

High |

|

|

Low |

|

|

Volume |

|

| |

|

|

(US$) |

|

|

(US$) |

|

|

(no. of shares)

|

|

| 2015 |

December 1 - 22 |

|

1.26 |

|

|

1.03 |

|

|

181,496,106 |

|

| |

November |

|

1.14 |

|

|

0.989 |

|

|

43,924,312 |

|

| |

October |

|

1.46 |

|

|

1.03 |

|

|

40,716,298 |

|

| |

September |

|

1.29 |

|

|

1.00 |

|

|

68,403,358 |

|

| |

August |

|

1.37 |

|

|

0.98 |

|

|

49,556,383 |

|

| |

July |

|

1.57 |

|

|

1.02 |

|

|

40,234,259 |

|

| |

June |

|

1.77 |

|

|

1.52 |

|

|

42,892,809 |

|

| |

May |

|

1.79 |

|

|

1.53 |

|

|

38,194,045 |

|

| |

April |

|

1.71 |

|

|

1.48 |

|

|

33,974,902 |

|

| |

March |

|

1.73 |

|

|

1.39 |

|

|

59,877,340 |

|

| |

February |

|

1.96 |

|

|

1.57 |

|

|

28,815,762 |

|

10

| Year |

|

|

High |

|

|

Low |

|

|

Volume |

|

| |

|

|

(US$) |

|

|

(US$) |

|

|

(no. of shares)

|

|

| |

January |

|

2.38 |

|

|

1.57 |

|

|

63,293,381 |

|

| 2014 |

December |

|

1.89 |

|

|

1.50 |

|

|

143,961,155 |

|

| |

November |

|

1.94 |

|

|

1.44 |

|

|

52,021,108 |

|

On December 22, 2015, the closing price of our Common Shares on

NYSE MKT was US$1.05 per share.

DIVIDEND POLICY

We have not declared any dividends or distributions on our

Common Shares since our incorporation. We intend to retain our earnings, if any,

to finance the growth and development of our operations and do not presently

anticipate paying any dividends or distributions in the foreseeable future. Our

board of directors may, however, declare from time to time such cash dividends

or distributions out of the monies legally available for dividends or

distributions as the board of directors considers advisable. Any future

determination to pay dividends or make distributions will be at the discretion

of the board of directors and will depend on our capital requirements, results

of operations and such other factors as the board of directors considers

relevant.

DESCRIPTION OF DEBT SECURITIES

In this section describing the Debt Securities, the terms

“Company” and “B2Gold Corp.” refer only to B2Gold Corp. without any of its

subsidiaries. This section describes the general terms that will apply to any

Debt Securities issued pursuant to this Prospectus. The specific terms of the

Debt Securities, and the extent to which the general terms described in this

section apply to those Debt Securities, will be set forth in the applicable

Prospectus Supplement. The Debt Securities will be issued in one or more series

under an indenture (the “Indenture”) to be entered into between the

Company and one or more trustees (the “Trustee”) that will be named in a

Prospectus Supplement for a series of Debt Securities. To the extent applicable,

the Indenture will be subject to and governed by the United States Trust

Indenture Act of 1939, as amended. A copy of the form of the Indenture to be

entered into has been filed with the SEC as an exhibit to the registration statement of which

this Prospectus forms a part. The description of certain provisions of the

Indenture in this section is not intended to be complete and is qualified in its

entirety by reference to the provisions of the Indenture. Terms used in this

summary that are not otherwise defined herein have the meaning ascribed to them

in the Indenture.

We may issue Debt Securities and incur additional indebtedness

other than through the offering of Debt Securities pursuant to this Prospectus.

We may be required to obtain the consent of our lenders for the issuance of

certain Debt Securities, depending on their specific terms.

General

The Indenture does not limit the amount of Debt Securities

which we may issue under the Indenture, and we may issue Debt Securities in one

or more series. Debt Securities may be denominated and payable in any currency.

Unless otherwise indicated in the applicable Prospectus Supplement, the

Indenture permits us, without the consent of the holders of any Debt Securities,

to increase the principal amount of any series of Debt Securities we have

previously issued under the Indenture and to issue such increased principal

amount.

The applicable Prospectus Supplement will set forth the

following terms relating to the Debt Securities offered by such Prospectus

Supplement (the “Offered Securities”):

| |

• |

the specific designation of the Offered Securities; any

limit on the aggregate principal amount of the Offered Securities; the

date or dates, if any, on which the Offered Securities will mature and the

portion (if less than all of the principal amount) of the Offered

Securities to be payable upon declaration of acceleration of maturity; |

| |

|

|

| |

• |

the rate or rates at which the Offered Securities will

bear interest, if any, the date or dates on which any such interest will

begin to accrue and on which any such interest will be payable and the

record dates for any interest payable on the Offered Securities which are

in registered form; |

| |

|

|

| |

• |

the terms and conditions under which we may be obligated

to redeem, repay or purchase the Offered Securities pursuant to any

sinking fund or analogous provisions or otherwise; |

11

| |

• |

the terms and conditions upon which we may redeem the

Offered Securities, in whole or in part, at our option; |

| |

|

|

| |

• |

whether the Offered Securities will be issuable in

registered form or bearer form or both, and, if issuable in bearer form,

the restrictions as to the offer, sale and delivery of the Offered

Securities which are in bearer form and as to exchanges between registered

form and bearer form; |

| |

|

|

| |

• |

whether the Offered Securities will be issuable in the

form of registered global securities (“Global Securities”), and, if

so, the identity of the depositary for such registered Global Securities; |

| |

|

|

| |

• |

the denominations in which registered Offered Securities

will be issuable, if other than denominations of US$1,000 and any multiple

thereof, and the denominations in which bearer Offered Securities will be

issuable, if other than US$1,000; |

| |

|

|

| |

• |