UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary

Proxy Statement

☐ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive

Proxy Statement

☒ Definitive

Additional Materials

☐ Soliciting

Material Pursuant to Section 240.14a-12

Breezer Ventures Inc.

(Name of Registrant as Specified in its Charter)

Not Applicable

(Name of Person(s)

Filing the Information Statement if other than Company)

Payment of Filing Fee (Check the appropriate

box):

☒ No

fee required.

☐ Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies:

35,600,000 Common Stock. 0 Preferred Stock |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

☐ Fee

paid previously with preliminary materials.

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

| |

(1) |

Amount Previously Paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

(3) |

Filing Party: |

| |

(4) |

Date Filed: |

Breezer Ventures Inc.

San Francisco Bay, Torre 200, Apt 25D, Panama

City, Panama

breezerventuresinc@gmail.com

INFORMATION STATEMENT

PURSUANT TO SECTION 14 OF THE SECURITIES

EXCHANGE ACT OF 1934,

AS AMENDED, AND

REGULATION 14C AND SCHEDULE 14C THEREUNDER

WE ARE NOT ASKING

YOU FOR A PROXY

AND YOU ARE REQUESTED

NOT TO SEND US A PROXY

INTRODUCTION

This notice and information

statement (the “Information Statement”) will be mailed on or about December 10 , 2015 to the stockholders of record,

as of October 28, 2015 to shareholders of Breezer Ventures Inc., a Nevada corporation (the “Company”) pursuant to:

Section 14(c) of the Exchange Act of 1934, as amended. This Information Statement is circulated to advise the shareholders

of action already approved and taken without a meeting by written consent of 1 stockholder (consisting of non-solicited

shareholder) holding a majority of the Company’s outstanding voting stock, specifically, representing 20,000,000

voting capital shares (56.179% of the Company’s issued and outstanding voting stock as of the Record Date). Pursuant to Rule 14c-2

under the Securities Exchange Act of 1934, as amended, the corporate action described in this Notice can be taken no sooner than

20 calendar days after the accompanying Information Statement is first sent or given to the Company’s stockholders. Since

the accompanying Information Statement is first being sent or given to security holders on December 10 , 2015 to the corporate

action described therein may be effective on or after December 30, 2015.

Please review the Information Statement included with this Notice

for a more complete description of this matter. This Information Statement is being sent to you for informational purposes only.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE REQUESTED NOT

TO SEND US A PROXY.

The actions to be effective

twenty days after the mailing of this Information Statement are as follows:

To effective a name change

to Fitvia Corp.

To effectuate an 800:1

Reverse Stock Split (pro-rata reduction of outstanding shares) of our issued and outstanding shares of Common Stock and Preferred

Stock (the “Reverse Stock Split”).

The name Change and Reverse

Stock Split described in the accompanying Information Statement, effective as of the filing of amendment to the Company's Articles

of Incorporation with the Nevada Secretary of State, have been duly authorized and approved by the written consent of the holders

of a majority of the voting capital shares of the Company’s issued and outstanding voting securities, your vote or consent

is not requested or required. The accompanying Information Statement is provided solely for your information. The accompanying

Information Statement also serves as the notice required by the Nevada Revised Statutes of the taking of a corporate action without

a meeting by less than unanimous written consent of the Company’s stockholders.

| |

By order of the Board of Directors, |

| |

|

| |

Ali Hussein El-dirani Khirdahi |

| |

Chief Executive Officer |

| |

December 10 , 2015 |

The elimination of the

need for a meeting of stockholders to approve this action is made possible by the Nevada Revised Statutes which provides that the

written consent of the holders of outstanding shares of voting capital stock, having not less than the minimum number of votes

which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present

and voted, may be substituted for such a meeting. In order to eliminate the costs involved in holding a special meeting of our

stockholders, our Board of Directors voted to utilize the written consent of the holders of a majority in interest of our voting

securities. This Information Statement is circulated to advise the shareholders of action already approved by written consent

of the shareholders who collectively hold a majority of the voting power of our capital stock.

THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995 PROVIDES A “SAFE HARBOR” FOR FORWARD LOOKING STATEMENTS. This Information Statement contains

statements that are not historical facts. These statements are called “forward-looking statements” within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements

involve important known and unknown risks, uncertainties and other factors and can be identified by phrases using “estimate,”

“anticipate,” “believe,” “project,” “expect,” “intend,” “predict,”

“potential,” “future,” “may,” “should” and similar expressions or words. Our future

results, performance or achievements may differ materially from the results, performance or achievements discussed in the forward-looking

statements. There are numerous factors that could cause actual results to differ materially from the results discussed in forward-looking

statements, including:

| |

● |

Changes in relationships and market for the development of the business of the Company that would affect our earnings and financial position. |

| |

● |

Considerable financial uncertainties that could impact the profitability of our business. |

| |

● |

Factors that we have discussed in previous public reports and other documents filed with the Securities and Exchange Commission. |

This list provides examples

of factors that could affect the results described by forward-looking statements contained in this Information Statement. However,

this list is not intended to be exhaustive; many other factors could impact our business and it is impossible to predict with any

accuracy which factors could result in which negative impacts. Although we believe that the forward-looking statements contained

in this Information Statement are reasonable, we cannot provide you with any guarantee that the anticipated results will be achieved.

All forward-looking statements in this Information Statement are expressly qualified in their entirety by the cautionary statements

contained in this section and you are cautioned not to place undue reliance on the forward-looking statements contained in this

Information Statement. In addition to the risks listed above, other risks may arise in the future, and we disclaim any obligation

to update information contained in any forward-looking statement.

TABLE OF CONTENTS

| |

|

Page |

| ABOUT THIS INFORMATION STATEMENT |

|

|

| |

|

| General |

|

15 |

| |

|

| Board Approval of the Name Change and Reverse Split |

|

|

| |

|

| The Action by Written Consent |

|

4 |

| |

|

| No Further Voting Required |

|

4 |

| |

|

| Notice Pursuant to Section the Nevada Revised Statutes |

|

4 |

| |

|

| Dissenters’ Rights of Appraisal |

|

4 |

| |

|

| APPROVAL OF THE INCREASE IN THE AUTHORIZED COMMON STOCK |

|

|

| |

|

| INFORMATION ON CONSENTING SHAREHOLDERS |

|

|

| |

|

| DELIVERY OF INFORMATION STATEMENT |

|

33 |

| |

|

| WHERE YOU CAN FIND MORE INFORMATION |

|

33 |

Breezer Ventures Inc.

San Francisco Bay, Torre 200, Apt 25D, Panama

City, Panama

breezerventuresinc@gmail.com

INFORMATION STATEMENT PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

This Information Statement is being furnished

by Breezer Ventures Inc., a Nevada corporation (“we,” “us,” “our” or the “Company”),

in connection with action taken by the holders of a majority of the voting power of the Company’s issued and outstanding

voting securities. By written consent dated October 28, 2015, the holders of a majority of the voting power approved a resolution

to effectuate a name change and a 800:1 Reverse Stock Split. Under the name change, we would change our name to Fitvia

Corp. Under this Reverse Stock Split each 800 shares of our Common Stock will be automatically converted into 1 share of Common

Stock. We are first sending or giving this Information Statement on or about December 10 , 2015 to our stockholders of record as

of the close of business on October 28, 2015 (the “Record Date”). Our principal executive offices are located at San

Francisco Bay, Torre 200, Apt 25D, Panama City, Panama and our main telephone number is 507-6551-0230

.

BOARD AND SHAREHOLDER APPROVAL OF THE REVERSE

STOCK SPLIT

By October 28, 2015, the

Board of Directors and the holders of a majority of the voting power approved a resolution to effectuate the name change and an

800:1 Reverse Stock Split (“Reverse Stock Split”). Under this Reverse Stock Split each 800 shares of our

Common Stock will be automatically converted into 1 share of Common Stock. To avoid the issuance of fractional shares

of Common Stock, the Company will issue an additional share to all holders of fractional shares. The effective date

of the Reverse Stock Split will be on or after December 30, 2015.

PLEASE NOTE THAT THE REVERSE

STOCK SPLIT WILL NOT CHANGE YOUR PROPORTIONATE EQUITY INTERESTS IN THE COMPANY, EXCEPT AS MAY RESULT FROM THE ISSUANCE OF SHARES

PURSUANT TO THE FRACTIONAL SHARES OR ROUNDING UP SUB-ONE HUNDRED LOTS TO ONE HUNDRED.

PLEASE NOTE THAT THE REVERSE

STOCK SPLIT WILL HAVE THE EFFECT OF SUBSTANTIALLY INCREASING THE NUMBER OF SHARES THE COMPANY WILL BE ABLE TO ISSUE TO NEW OR EXISTING

SHAREHOLDERS BECAUSE THE NUMBER OF AUTHORIZED SHARES WILL NOT BE REDUCED WHILE THE NUMBER OF SHARES ISSUED AND OUTSTANDING WILL

BE REDUCED 800-FOLD.

PURPOSE AND MATERIAL EFFECTS OF THE REVERSE STOCK SPLIT

The Board of Directors

believe that among other reasons, the large number of outstanding shares of our Common Stock have contributed to the difficulty

with some business transactions, including attracting other investment opportunities, have contributed to a lack of investor interest

in the Company, and has made it difficult to attract new investors, specialized funds and potential business candidates. As

a result, the Board of Directors has proposed the Reverse Stock Split as one method to attract business and investor opportunities

in the Company and changed the name to Fitvia Corp.

We have no present understandings

or agreements that will involve the issuance of capital stock, apart from understandings and agreement disclosed in our filings

with the Securities and Exchange Commission. However, we are engaged in negotiations with respect to transactions, including financings

and acquisitions, which could involve the issuance of capital stock.

As of the date herein,

there are no definitive agreements, letters of intent of memorandums of understanding with respect to any transactions, financings

or acquisitions for the newly authorized but unissued shares that will become available following our 1-for-800 reverse stock split

and name change.

When a company engages

in a Reverse Stock Split, it substitutes one share of stock for a predetermined amount of shares of stock. It does not increase

the market capitalization of the company. An example of a reverse split is the following. A company has 10,000,000 shares of common

stock outstanding. Assume the market price is $0.01 per share. Assume that the company declares a 1 for 10 reverse stock split.

After the reverse split, that company will have 1/10 as many shares outstanding or 1,000,000 shares outstanding. The stock will

have a market price of $0.10. If an individual investor owned 10,000 shares of that company before the split at $0.01 per share,

he will own 1,000 shares at $0.10 after the split. In either case, his stock will be worth $100. He is no better off before or

after. Except that such company hopes that the higher stock price will make that company look better and thus the company will

be a more attractive investor or merger or purchase target for potential business. There is no assurance that that company's stock

will rise in price after a reverse split or that a suitable investor, merger or purchaser candidate will emerge.

The Board of Directors

believes that the Reverse Stock Split may improve the price level of our Common Stock and that the higher share price could help

generate interest in the Company among investors and other business opportunities. The effect of the reverse split

upon the market price for our Common Stock cannot be predicted, and the history of similar stock split combinations for companies

in like circumstances is varied. There can be no assurance that the market price per share of our Common Stock after the reverse

split will rise in proportion to the reduction in the number of shares of Common Stock outstanding resulting from the reverse split.

The market price of our Common Stock may also be based on our performance and other factors, some of which may be unrelated to

the number of shares outstanding.

The reverse split will

affect all of our stockholders uniformly and will not affect any stockholder's percentage ownership interests in the Company or

proportionate voting power, except to the extent that the reverse split results in any of our stockholders owning a fractional

shares which will be rounded up. All stockholders holding a fractional share shall be issued an additional share to round up their

holdings. The principal effect of the Reverse Stock Split will be that the number of shares of Common Stock issued and outstanding

will be reduced from 35,600,000 shares of Common Stock to approximately 44,500 shares of Common Stock, $0.001 par value (depending

on the number of fractional shares that are issued). The Reverse Stock Split will affect the shares of common stock outstanding.

As a result, on the effective date of the Reverse Stock Split, the stated capital on our balance sheet attributable to our Common

Stock will be reduced to less than the present amount, and the additional paid-in capital account shall be credited with the amount

by which the stated capital is reduced. The per share net income or loss and net book value of our Common Stock will be increased

because there will be fewer shares of our Common Stock outstanding.

The

number of authorized, issued and outstanding, and available shares of common and preferred shares are disclosed in the tables below:

| |

|

Authorized Shares of

Common Stock |

|

Number of Issued and

Outstanding Shares of

Common Stock |

|

Number of Shares of

Common Stock

Available in Treasury

for Issuance |

|

Pre-Reverse

Stock Split

(as of October 28, 2015) |

|

100,000,000 shares of

Common Stock |

|

35,600,000 shares of

Common Stock |

|

64,400,000 shares of

Common Stock |

| |

|

|

|

|

|

|

|

Post-Reverse

Stock Split |

|

100,000,000 shares of

Common Stock |

|

44,500 shares of

Common Stock(1) |

|

99,955,500 shares of

Common Stock(1) |

| |

(1) |

Depending on the number of fractional shares that are issued. |

| |

|

Authorized Shares of

Preferred Stock |

|

Number of Issued and Outstanding Shares of Preferred Stock |

|

Number of Shares of

Preferred Stock

Available in Treasury

for Issuance |

|

Pre-Reverse

Stock Split

(as of October 28, 2015) |

|

50,000,000 shares of

Preferred Stock |

|

0 shares of

Preferred Stock |

|

50,000,000 shares of

Preferred Stock |

| |

|

|

|

|

|

|

|

Post-Reverse

Stock Split |

|

50,000,000 shares of

Preferred Stock |

|

0 shares of

Preferred Stock |

|

50,000,000 shares of

Preferred Stock |

The Reverse Stock Split

will not change the proportionate equity interests of our stockholders, nor will the respective voting rights and other rights

of stockholders be altered. The Common Stock issued pursuant to the Reverse Stock Split will remain fully paid and non-assessable.

The Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction” covered

by Rule 13e-3 under the Securities Exchange Act of 1934. We will continue to be subject to the periodic reporting requirements

of the Securities Exchange Act of 1934.

Stockholders should recognize

that they will own fewer numbers of shares than they presently own (a number equal to the number of shares owned immediately prior

to the filing of the certificate of amendment divided by 10). While we expect that the Reverse Stock Split will result in an increase

in the potential market price of our Common Stock (presuming our common stock is subsequently listed), there can be no assurance

that the Reverse Stock Split will increase the potential market price of our Common Stock by a multiple equal to the exchange number

or result in the permanent increase in any potential market price (which is dependent upon many factors, including our performance

and prospects). Also, should the potential market price of our Common Stock decline (presuming our common stock is subsequently

listed), the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than

would pertain in the absence of a reverse split. Furthermore, the possibility exists that potential liquidity in the market price

of our Common Stock (presuming our common stock is subsequently listed), could be adversely affected by the reduced number of shares

that would be outstanding after the reverse split. Consequently, there can be no assurance that the reverse split will achieve

the desired results.

SUMMARY OF REVERSE STOCK SPLIT

Below is a brief summary

of the Reverse Stock Split:

The issued and outstanding

Common Stock shall be reduced on the basis of one post-split share of the Common Stock for every 800 pre-split shares of the Common

Stock outstanding. The consolidation shall not affect any rights, privileges or obligations with respect to the shares of the Common

Stock existing prior to the consolidation.

Stockholders of record

of the Common Stock the ex-dividend date shall have their total shares reduced on the basis of one post-split share of Common Stock

for every 800 pre-split shares outstanding.

As a result of the reduction

of the Common Stock, the pre-split total of issued and outstanding shares of 35,600,000 shall be consolidated to a total of approximately

44,500 issued and outstanding shares (depending on the number of fractional shares that are be issued).

The Reverse Split of the

Common Stock is expected to become effective after we file our Articles of Amendment to our Articles of Incorporation (the “Effective

Date”). The Reverse Split will take place on the Effective Date without any action on the part of the holders of the Common

Stock and without regard to current certificates representing shares of Common Stock being physically surrendered for certificates

representing the number of shares of Common Stock each shareholder is entitled to receive as a result of the Reverse Split. New

certificates of Common Stock will not be issued at this time.

We do not have any

provisions in our Articles of Incorporation, by laws, or employment or credit agreements to which we are party that have anti-takeover

consequences. We do not currently have any plans to adopt anti-takeover provisions or enter into any arrangements or understandings

that would have anti-takeover consequences.

There are no adverse material

consequences or any anti-takeover provisions in either our Articles of Incorporation or Bylaws that would be triggered as a consequence

of the Reverse Split. The Articles of Incorporation or bylaws do not address any consequence of the Reverse Split. See below for

a discussion on the federal Income Tax consequences of the Reverse Split.

THE ACTION BY WRITTEN CONSENT

By October 28, 2015, Board

of Directors and the holders of a majority of the voting power approved effectuating a 800:1 Reverse Stock Split (pro-rata reduction

of outstanding shares) of our issued and outstanding shares of Common Stock (the “Reverse Stock Split”) and a name

change to Fitvia Corp..

The holders of a majority

of the votes of the Company’s outstanding voting securities are comprised of 1 stockholder (one non-solicited shareholder)

holding a total of holding of over 56.179% of the issued and outstanding shares of common stock. Thus, there would

be a total of 35,600,000 voting capital shares of which 20,000,000 have voted in favor of the actions.

No Further Voting Required

We are not seeking consent,

authorizations, or proxies from you. The Nevada Revised Statutes and our bylaws provide that actions requiring a vote of the stockholders

may be approved by written consent of the holders of outstanding shares of voting capital stock having not less than the minimum

number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon

were present and voted. The approval by at least a majority of the outstanding voting power of our voting securities is required

to approve the increase in the authorized shares of common stock.

Notice Pursuant to the Nevada Revised Statutes

Pursuant to the Nevada

Revised Statutes, we are required to provide prompt notice of the taking of corporate action by written consent to our stockholders

who have not consented in writing to such action. This Information Statement serves as the notice required by the Nevada Revised

Statutes.

Dissenters’ Rights of Appraisal

The Nevada Revised Statutes

does not provide dissenters’ rights of appraisal to our stockholders in connection with the matters approved by the Written

Consent.

As used herein, “we”,

“us”, “our”, “Brezzer”, “Company” or “our company” refers to Breezer

Ventures Inc. and all of its subsidiaries unless the context requires otherwise

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Information Statement

contains certain forward-looking statements regarding management’s plans and objectives for future operations including plans

and objectives relating to our planned marketing efforts and future economic performance. The forward-looking statements and associated

risks set forth in the information statement include or relate to, among other things, acceptance of our proposed services and

the products we expect to market, our ability to establish a customer base, managements’ ability to raise capital in the

future, the retention of key employees and changes in the regulation of our industry. These statements may be found under “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and “Description of Business,” as well

as in the information statement generally. Actual events or results may differ materially from those discussed in forward-looking

statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors”.

In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in the information

statement will in fact occur.

The forward-looking statements

herein are based on current expectations that involve a number of risks and uncertainties. Such forward-looking statements are

based on assumptions described herein. The assumptions are based on judgments with respect to, among other things, future economic,

competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately

and many of which are beyond our control. Accordingly, although we believe that the assumptions underlying the forward-looking

statements are reasonable, any such assumption could prove to be inaccurate and therefore there can be no assurance that the results

contemplated in forward-looking statements will be realized. In addition, as disclosed elsewhere in the “Risk Factors”

section of the information statement, there are a number of other risks inherent in our business and operations which could cause

our operating results to vary markedly and adversely from prior results or the results contemplated by the forward-looking statements.

Management decisions, including budgeting, are subjective in many respects and periodic revisions must be made to reflect actual

conditions and business developments, the impact of which may cause us to alter marketing, capital investment and other expenditures,

which may also materially adversely affect our results of operations. In light of significant uncertainties inherent in the forward-looking

information included in the information statement, the inclusion of such information should not be regarded as a representation

by us or any other person that our objectives or plans will be achieved.

Any statement in the information

statement that is not a statement of an historical fact constitutes a “forward-looking statement”. Further, when we

use the words “may”, “expect”, “anticipate”, “plan”, “believe”, “seek”,

“estimate”, “internal”, and similar words, we intend to identify statements and expressions that may be

forward- looking statements. We believe it is important to communicate certain of our expectations to our investors. Forward-looking

statements are not guarantees of future performance. They involve risks, uncertainties and assumptions that could cause our future

results to differ materially from those expressed in any forward-looking statements. Many factors are beyond our ability to control

or predict. You are accordingly cautioned not to place undue reliance on such forward-looking statements. Important factors that

may cause our actual results to differ from such forward-looking statements include, but are not limited to, the risks outlined

under “Risk Factors” herein. The reader is cautioned that our company does not have a policy of updating or revising

forward-looking statements and thus the reader should not assume that silence by management of our company over time means that

actual events are bearing out as estimated in such forward-looking statements.

Corporate History and Business

Corporate History

The address of our principal executive office is San Francisco Bay,

Torre 200, Apt 25D, Panama City, Panama, China and our telephone number is 507-6551-0230.

Our common stock is quoted on the OTC Markets, Inc. under the symbol

"BRZV".

We were incorporated on May 18, 2005 under the laws of the state

of Nevada, in order to be in the business of natural resources.

On April 7, 2011, we executed an asset purchase agreement (the "Agreement")

with Catalyst Capital Group, Inc., a California corporation whereby pursuant to the terms and conditions of that Agreement we purchased

Catalyst Capital Group, Inc.'s undivided 13/16th interest in and to Firecreek Global, Inc.'s right, title and interest in and to

the following (based on Firecreek Global, Inc.'s 93.75% working interest (for depths above 100 feet below the top of the Ellenburger

Formation) and 70.341796% net revenue interest in the ElmaJackson oil and gas; (i) Well #6 (API# 42-059-04612) together with the

proration units designated for such well by the Texas Railroad Commission and the rights and appurtenances incident to such well

(such well and the associated proration units and rights and appurtenances, arising from the working Interests, hereinafter referred

to as the "Initial Well"); (ii) Firecreek's rights in, to and under, and obligations arising from, agreements relating

to the Lease to the extent the same are applicable to the Initial Well; (iii) Firecreek's interest in fixtures and personal property

used solely in connection with the operation of the Initial Well; and (iv) Firecreek's interest in books, files, data and records

in Seller's possession to the extent the same relate to the Initial Well provided that possession of same will remain with Firecreek;

and the right and option based on certain terms and conditions to acquire a 13/16th interest in and rehabilitate certain other

wells.

As consideration, Catalyst Capital Group, Inc. was provided with

5,000,000 restricted common shares of our company and a one-time payment of $50,000 plus 15/16th of any excess total rehabilitation

cost associated with Well #6, payable to Catalyst capital Group, Inc, pursuant to the terms listed in the Agreement.

The 5,000,000 shares issues to Catalyst were issued at par value

which equates to a value of $5,000.

Catalyst Capital Group Inc. loaned $50,000 to the Company during

the period ended September 30, 2011, which is unsecured, with no specific terms of repayment.

At September 30, 2014, the investment in the oil lease was recorded

at $72,094. This investment is comprised of $5,000 in common stock, a one-time payment of $50,000 plus $17,094 in rehabilitation

costs associated with well #6. The total purchase price paid is $55,000.

On July 24, 2012, the Company entered into an agreement with Firecreek

Global Inc. to exchange its entire interest in Well #6 for an undivided 13/16th interest in Wells #27 and #30 and to Firecreek

Global, Inc.'s right, title and interest in and to the following (based on Firecreek Global, Inc.'s 93.75% working interest (for

depths above 100 feet below the top of the Ellenburger Formation) and 70.341796% net revenue interest in the ElmaJackson oil and

gas; (i) together with the proration units designated for such wells by the Texas Railroad Commission and the rights and appurtenances

incident to such well (such well and the associated proration units and rights and appurtenances, arising from the working Interests,

hereinafter referred to as the "Initial Well"); (ii) Firecreek's rights in, to and under, and obligations arising from,

agreements relating to the Lease to the extent the same are applicable to the Initial Well; (iii) Firecreek's interest in fixtures

and personal property used solely in connection with the operation of the Initial Well; and (iv) Firecreek's interest in books,

files, data and records in Seller's possession to the extent the same relate to the Initial Well provided that possession of same

will remain with Firecreek; and the right and option based on certain terms and conditions to acquire a 13/16th interest in and

rehabilitate certain other wells.. This was a straight exchange with no further consideration changing hands.

Other than as set out herein, we have not been involved in any bankruptcy,

receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase

or sale of a significant amount of assets not in the ordinary course of our business.

Our Current Business

We are in the process of exploring various oil and gas opportunities

to expand our initial lease acquisition.

Employees

Currently, we do not have any employees. We do not expect any material

changes in the number of employees over the next 12 month period. We do and will continue to outsource contract employment as needed.

We engage contractors from time to time to consult with us on specific

corporate affairs or to perform specific tasks in connection with our exploration programs.

Research and Development

We have not spent any amounts on which has been classified as research

and development activities in our financial statements since our inception.

Going Concern

We anticipate that additional funding will be required in the form

of equity financing from the sale of our common stock. At this time, we cannot provide investors with any assurance that we will

be able to raise sufficient funding from the sale of our common stock or through a loan from our directors to meet our obligations

over the next twelve months. We do not have any arrangements in place for any future equity financing.

Subsidiaries

We do not have any subsidiaries.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark.

Legal Proceedings

None.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

This information below contains forward-looking

statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking

statements by terminology such as "may", "should", "expects", "plans", "anticipates",

"believes", "estimates", "predicts", "potential" or "continue" or the negative

of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties

and other factors that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially

different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking

statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities

laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual

results.

The following discussion and analysis provides

information which management of Breezer Ventures Inc. (the "Company") believes to be relevant to an assessment and understanding

of the Company's results of operations and financial condition. This discussion should be read together with the Company's financial

statements and the notes to financial statements, which are included in this report.

Caution About Forward-Looking Statements

This management's discussion and analysis or

plan of operation should be read in conjunction with the financial statements and notes thereto of the Company for the quarter

ended June 30, 2015. Because of the nature of a relatively new and growing company the reported results will not necessarily reflect

the future.

This section includes a number of forward-looking

statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are

often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which,

by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply

only as of the date of this prospectus. These forward-looking statements are subject to certain risks and uncertainties that could

cause actual results to differ materially from historical results or our predictions.

General Overview

Breezer Ventures Inc. was incorporated in the

state of Nevada on May 18, 2005. To date, the Company has been actively involved in the exploration and development of oil and

gas leases in the state of Texas.

As of the end of the period covered by this Report, our principal

executive offices are located at San Francisco Bay, Torre 200, Apt 25D, Panama City, Panama.

Our fiscal year end is September 30th.

Results of Operations

As of the date of this annual report, we have not generated any

revenues from our business activities.

Our expenses were $9,109 and $31,801 for the years ended September

30, 2014 and 2013, respectively. The main expenses were consulting and professional fees of $5,973 and interest expense in the

amount of $3,136 for the year ended September 30, 2014, as compared to consulting and professional fees of $28,703 and interest

expense in the amount of $3,098 for the year ended September 30, 2013, respectively.

The Company has tax losses, which may be applied against future

taxable income. The potential tax benefits arising from these loss carry forwards expire between 2025 and 2028 and are offset by

a valuation allowance due to the uncertainty of profitable operations in the future. The net operating loss carry forward was $274,470

and $265,361 at September 30, 2014 and 2013, respectively.

Liquidity and Capital Resources

Cash Requirements

Cash Requirements

The Company's total current assets as of September 30, 2014 included

a cash balance of $0. We anticipate that our current cash balance will not satisfy our cash needs for the following twelve-month

period. There can be no assurance that we will be successful in finding financing, or even if financing is found, that we will

be successful in proceeding with profitable operations.

It is uncertain how much in additional funds we will require to

commence operations over the next twelve months, as the Company is presently exploring various potential business opportunities.

As we do not have the funds necessary to cover any significant operating expenses for the next twelve month period, we will be

required to raise additional funds through the issuance of equity securities, through loans or through debt financing. There can

be no assurance that we will be successful in raising the required capital or that actual cash requirements will not exceed the

estimates we will make. In the event that the Company is unsuccessful in its financing efforts, the Company may seek to obtain

short term loans.

Our auditors have issued a going concern opinion for the year ended

September 30, 2014. This means that there is substantial doubt that we can continue as an on-going business for the next twelve

months unless we obtain additional capital to pay our bills. This is because we have not generated any significant revenues and

no significant revenues are anticipated until our commercial operations begin.

Our company’s operations have been funded through an equity

financing and a series of debt transactions, primarily with shareholders, directors, and officers of our company. These related

party debt transactions have operated as informal lines of credit since the inception of our company, and related parties have

extended credit as needed which our company has repaid at its convenience. We anticipate that we will incur operating losses in

the foreseeable future and we believe we will need additional cash to support our daily operations while we are attempting to execute

our business plan and produce revenues. If our related parties are unable or unwilling to provide additional capital, we would

likely require financing from third parties. There can be no assurance that any additional financing will be available to us, on

terms we believe to be favorable or at all. The inability to obtain additional capital would have a material adverse effect on

our operations and financial condition and could force us to curtail or discontinue operations entirely and/or file for protection

under bankruptcy laws.

As of September 30, 2014, our total assets were $72,094, which represented

no change from our total assets of $72,094 as of September 30, 2013. Our total current liabilities as of September 30, 2014 were

$ 241,102, which represented an increase from our total current liabilities of $235,129 as of September 30, 2013. The Company has

experienced a net loss of $9,109 and $31,801 for the years ended September 30, 2014 and 2013, respectively, and a net loss of $274,470

for the period from May 18, 2005 (Inception) to September 30, 2014.

The Company has experience a net cash flows used in operating activities

of $1,600 and net cash flows provided by financing activities of $1,600 for the fiscal year ended September 30, 2014. Net cash

flows provided by financing activities resulted from advances from related parties in the amount of $1,600 for the fiscal year

ended September 30, 2014.

The Company has working capital deficit of $169,008 at September

30, 2014 as compared to $163,035 at September 30, 2013.

Purchase of Significant Equipment

As of the end of the period covered by this Report, we did not intend

to purchase any significant equipment over the twelve months ending September 30, 2014.

Employees

Currently our only employee is our sole officer and director. We

do not expect any material changes in the number of employees over the next 12 month period; however, this may change depending

on the business model we may adopt. We may outsource contract employment as needed.

Off Balance Sheet Arrangements

As of September 30, 2014, we did not have any off balance sheet

arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial

condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

ITEM 7A: QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We did not have any operations which implicated market risk as of

the end of the latest fiscal year.

ITEM 8: FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The financial statements required to be filed pursuant to this Item

8 begin on page F-1 of this report.

ITEM 9: CONTROLS AND PROCEDURES

Management's Report on Disclosure Controls and Procedures

Our management has evaluated, under the supervision and with the

participation of our chief executive officer and chief financial officer, the effectiveness of our disclosure controls and procedures

as of the end of the period covered by this report pursuant to Rule 13a-15(b) under the Securities Exchange Act of 1934 (the "Exchange

Act"). Based on that evaluation, our chief executive officer and chief financial officer have concluded that, as of the end

of the period covered by this report, our disclosure controls and procedures are not effective in ensuring that information required

to be disclosed in our Exchange Act reports is (1) recorded, processed, and summarized and reported with the time periods specified

in the Securities and Exchange Commission's rules and forms and (2) accumulated and communicated to our management, including our

chief executive officer and chief financial officer, as appropriate to allow timely decisions regarding required disclosure.

Management's Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate

internal control over financial reporting (as defined in Rule 13a-15(f) under the Securities Exchange Act, as amended). In fulfilling

this responsibility, estimates and judgments by management are required to assess the expected benefits and related costs of control

procedures. The objectives of internal control include providing management with reasonable, but not absolute, assurance that assets

are safeguarded against loss from unauthorized use or disposition, and that transactions are executed in accordance with management's

authorization and recorded properly to permit the preparation of consolidated financial statements in conformity with accounting

principles generally accepted in the United States. Our management assessed the effectiveness of our internal control over financial

reporting as of September 30, 2014. In making this assessment, our management used the criteria set forth by the Committee of Sponsoring

Organizations of the Treadway Commission ("COSO") in Internal Control-Integrated Framework. Our management has concluded

that, as of September 30, 2014, our internal control over financial reporting is not effective in providing reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance

with US generally accepted accounting principles.

Management concluded that the following three deficiencies are considered

material weaknesses in internal controls:

- Failure to properly record negative cash balance as a current

liability

- Failure to properly classify cash balance as other asset as cash

was not maintained in bank account

- Failure to properly record accrued expenses such as audit fees

and consulting services related to fiscal year ending September 30, 2014.

- Failure to properly disclose an Oil Lease exchange agreement entered

by the Company in the footnote

This annual report does not include an attestation report of our

Company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject

to attestation by our Company's registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission

that permit our Company to provide only management's report in this annual report.

Changes in Internal Control Over Financial Reporting

There was no change in the Company's internal control over financial

reporting (as defined in Rule 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934) during the quarter ended September

30, 2014 that has materially affected or is reasonably likely to materially affect the Company's internal control over financial

reporting.

Inherent limitations on effectiveness of controls

Internal control over financial reporting has inherent limitations

which include but is not limited to the use of independent professionals for advice and guidance, interpretation of existing and/or

changing rules and principles, segregation of management duties, scale of organization, and personnel factors. Internal control

over financial reporting is a process which involves human diligence and compliance and is subject to lapses in judgment and breakdowns

resulting from human failures. Internal control over financial reporting also can be circumvented by collusion or improper management

override. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements

on a timely basis, however these inherent limitations are known features of the financial reporting process and it is possible

to design into the process safeguards to reduce, though not eliminate, this risk. Therefore, even those systems determined to be

effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Projections of

any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes

in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

ITEM 9B: OTHER INFORMATION

None.

Market for Registrant's Common Equity

Market Information

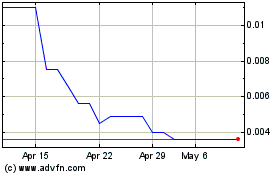

Our

common stock commenced quotation is quoted on the OTC Markets, Inc. under the symbol " BRZV

". The following table sets forth for the periods indicated the range of high and low bid quotations per share as reported

by the OTC Markets. These quotations represent inter-dealer prices, without retail markups, markdowns or commissions and may not

necessarily represent actual transactions. All market prices reflect the effect of a stock dividend.

The high and low bid prices of our common stock for the periods

indicated below are as follows:

| Quarter Ended |

High |

Low |

| |

|

|

| September 30, 2014 |

0.006 |

0.006 |

| June 30, 2014 |

0.002 |

0.002 |

| March 31, 2014 |

0.004 |

0.004 |

| December 301, 2013 |

0.005 |

0.005 |

| September 30, 2013 |

0.009 |

0.009 |

| June 30, 2013 |

0.019 |

0.018 |

| March 31, 2013 |

0.0125 |

0.0075 |

| December 301, 2012 |

0.02 |

0.0075 |

| September 30, 2012 |

0.005 |

0.005 |

Over-the-counter market quotations reflect inter-dealer prices without

retail mark-up, mark-down or commission, and may not represent actual transactions.

Transfer Agent: Our

common shares are issued in registered form. Empire Stock Transfer Inc., 1859 Whitney Mesa Dr. Henderson, NV 89014 (Telephone:

702.818.5898; Facsimile: 702.974.1444) is the registrar and transfer agent for our common shares.

Holders: As

of September 30, 2014, 35,600,000 common shares were issued and outstanding.

Dividends: During the period

covered by this Report, we have not declared or paid cash dividends. The Company does not intend to pay cash dividends on its common

stock in the foreseeable future. We anticipate retaining any earning for use in our continued development. We are not subject to

any restrictions respecting the payment of dividends, except that they may not be paid to render us insolvent.

Securities authorized for issuance under equity compensation

plans: The Company has never issued securities under and does not have any equity compensation plan.

Recent Sales of Unregistered Securities; Use of Proceeds from

Registered Securities

The following sets forth information pertaining to all securities

of the Company sold within the past four years which were not registered under the Securities Act of 1933, as amended. In the three

years ended September 30, 2014, September 30, 2013 and September 30, 2012 no unregistered securities were sold or issued by the

Company.

Directors, Executive Officers and Corporate

Governance

Executive Officers and Directors

Set forth below is information

regarding our executive officers and directors.

All of the directors of our company hold office until the

next annual meeting of the stockholders or until their successors have been elected and qualified. Our officers are appointed by

our board of directors and hold office until their death, resignation or removal from office. Our directors and executive officers,

their ages, positions held, and duration as such, are as follows:

| Name |

|

|

Position |

| Ali Hussein El-dirani Khirdahi |

|

|

Director, Chief Executive Officer, Chief Financial Officer |

Family Relationships

There are currently no

family relationships between any of the members of our board of directors or our executive officers.

Conflicts of Interest

Members of our management

are associated with other firms involved in a range of business activities. Consequently, there are potential inherent conflicts

of interest in their acting as officers and directors of our company. Although the officers and directors are engaged in other

business activities, we anticipate they will devote an important amount of time to our affairs.

Involvement in Certain Legal Proceedings

None of the following events

have occurred during the past ten years and are material to an evaluation of the ability or integrity of any director or officer

of the Company:

| |

1. |

A petition under the Federal bankruptcy laws or any state insolvency law was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing; |

| |

|

|

| |

2. |

Such person was convicted in a criminal proceeding or is a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| |

|

|

| |

3. |

Such person was the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting, the following activities: |

| |

a. |

Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity; |

| |

b. |

Engaging in any type of business practice; or |

| |

|

|

| |

c. |

Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws; |

| |

4. |

Such person was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph (f)(3)(i) of this section, or to be associated with persons engaged in any such activity; |

| |

|

|

| |

5. |

Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated; |

| |

|

|

| |

6. |

Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated; |

| |

7. |

Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of: |

| |

a. |

Any Federal or State securities or commodities law or regulation; or |

| |

|

|

| |

b. |

Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or |

| |

c. |

Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| |

8. |

Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29)), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Audit Committee and Audit Committee Financial Expert

Our board of directors has determined that

it does not have a member of its audit committee that qualifies as an "audit committee financial expert" as defined in

Item 407(d) (5) (ii) of Regulation S-K, and is "independent" as the term is used in Item 7(d) (3) (iv) of Schedule 14A

under the Securities Exchange Act of 1934, as amended.

We believe that the members of our board of

directors are collectively capable of analyzing and evaluating our financial statements and understanding internal controls and

procedures for financial reporting. We believe that retaining an independent director who would qualify as an "audit committee

financial expert" would be overly costly and burdensome and is not warranted in our circumstances given the early stages of

our development and the fact that we have not generated any material revenues to date. In addition, we currently do not have nominating,

compensation or audit committees or committees performing similar functions nor do we have a written nominating, compensation or

audit committee charter. Our board of directors does not believe that it is necessary to have such committees because it believes

the functions of such committees can be adequately performed by our board of directors.

Code of Ethics

The Company has adopted code of ethics for all of the employees,

directors and officers which has been filed with the U.S. Securities and Exchange Commission. The Company will provide to any person

a copy of the Company's code of ethics, without charge, upon request. Requests may be mailed to the Company's offices at: San Francisco

Bay, Torre 200, Apt 25D, Panama City, Panama.

Summary Compensation

The

following table sets forth certain compensation information for: (i) the person who served as the Chief Executive Officer of Breezer

Ventures Inc. during the year ended September 30, 2014, regardless of the compensation level, and

(ii) each of our other executive officers, serving as an executive officer at any time during 2015. The foregoing persons are collectively

referred to in this prospectus as the “Named Executive Officers.” Compensation information is shown for the year ended

September 30, 2014:

Name and

Principal

Position |

|

Year |

|

|

Salary

($) |

|

|

Bonus

($) |

|

|

Stock

Awards

($) |

|

|

Option

Awards

($) |

|

|

Non-

Equity

Incentive

Plan

Comp

($) |

|

|

Non-

Qualified

Deferred

Comp

Earnings

($) |

|

All Other Comp

($) |

|

|

Totals

($) |

| Tang Xu, |

|

|

2014 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

0 |

|

|

0 |

|

|

0 |

| CEO |

|

|

|

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

0 |

|

|

0 |

|

|

0 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tang Xu resigned on October 14, 2015. Ali Hussein El-dirani

Khirdahi was appointed on October 14, 2015, and has no salary to date.

Employment Agreements

None.

Outstanding Stock Awards at Year End

None.

Options Exercises and Stocks Vested

None.

Grants of Plan-Based Awards

None.

Non-Qualified Deferred Compensation

None.

Golden Parachute Compensation

None.

Compensation of Directors

Directors do not receive

fixed fees and other compensation for their services as Directors. The Board of Directors has the authority to fix the compensation

of Directors. No amounts have been paid to, or accrued to, Directors in such capacity.

Indemnification of Officers and Directors

As permitted by Nevada

Revised Statutes, our Articles of Incorporation provide that we will indemnify our directors and officers against expenses and

liabilities they incur to defend, settle, or satisfy any civil or criminal action brought against them on account of their being

or having been Company directors or officers unless, in any such action, they are adjudged to have acted with gross negligence

or willful misconduct.

Pursuant to the foregoing

provisions, we have been informed that, in the opinion of the Securities and Exchange Commission, such indemnification is against

public policy as expressed in that Act and is, therefore, unenforceable.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following tables set

forth certain information as of October 28, 2015 regarding the beneficial ownership of our common stock, based on 35,600,000 shares

of common stock issued to (i) each executive officer and director; (ii) all of our executive officers and directors as a group;

and (iii) each person or entity who, to our knowledge, owns more than 5% of our common stock.

Beneficial ownership is

determined in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons

who possess sole or shared voting power or investment power with respect to those securities and include ordinary shares issuable

upon the exercise of stock options that are immediately exercisable or exercisable within 60 days. Except as otherwise indicated,

all persons listed below have sole voting and investment power with respect to the shares beneficially owned by them, subject

to applicable community property laws. The information is not necessarily indicative of beneficial ownership for any other purpose.

Unless otherwise indicated

in the footnotes to the following table, each person named in the table has sole voting and investment power and that person’s

address, if not otherwise stated, is c/o Breezer Ventures Inc., San Francisco Bay, Torre 200, Apt 25D, Panama City, Panama.

| Name of Beneficial Owner |

|

Number of Shares Beneficially Owned (1) |

|

|

Percentage

Beneficially

Owned (1) |

|

| 5% Owners |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Catalyst Capital Group |

|

|

5,000,000 |

|

|

|

|

14% |

| Address: 2498 West 41st, #232, Vancouver, BC, Canada, V6M2A7 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Officers and Directors

Ali Hussein El-dirani Khirdahi |

|

|

20,000,000 |

|

|

|

56.179% |

|

| All executive officers and directors as a group (one person) |

|

|

20,000,000 |

|

|

|

56.179% |

|

DESCRIPTION OF SECURITIES

The

following is a summary of the rights of our common stock and related provisions of our Articles of Incorporation and By-laws, as

they will be in effect upon the closing of our proposed offering. For more detailed information, please see our Articles of Incorporation

or By-laws in our filings with the Securities and Exchange Commission.

The following statements

relating to the capital stock set forth the material terms of our securities; however, reference is made to the more detailed provisions

of, and such statements are qualified in their entirety by reference to, the Articles of Incorporation and the By-laws, copies

of which are filed as exhibits to prior filings.

Common Stock

The holders of our Common

Stock are entitled to one vote per share on all matters to be voted on by our stockholders, including the election of directors.

Our stockholders are not entitled to cumulative voting rights, and, accordingly, the holders of a majority of the shares voting

for the election of directors can elect the entire board of directors if they choose to do so and, in that event, the holders of

the remaining shares will not be able to elect any person to our board of directors.

The holders of the Company’s

Common Stock are entitled to receive ratably such dividends, if any, as may be declared from time to time by the board of directors,

in its discretion, from funds legally available there for and subject to prior dividend rights of holders of any shares of our

Preferred Stock which may be outstanding. Upon the Company’s liquidation, dissolution or winding up, subject to prior liquidation

rights of the holders of our Preferred Stock, if any, the holders of our Common Stock are entitled to receive on a pro rata basis

our remaining assets available for distribution. Holders of the Company’s Common Stock have no preemptive or other subscription

rights, and there are no conversion rights or redemption or sinking fund provisions with respect to such shares. All outstanding

shares of the Company’s Common Stock are, and all shares being offered by this prospectus will be, fully paid and not liable

to further calls or assessment by the Company.

Preferred Stock

The Company is authorized to issue 50,000,000

shares of preferred stock, par value $0.001, none of which are issued and outstanding. The designations, rights, and preferences

of such preferred stock are to be determined by the Board of Directors.

INFORMATION ON CONSENTING STOCKHOLDERS

Pursuant to the Company’s

Bylaws and the Nevada Revised Statutes, a vote by the holders of at least a majority of the outstanding capital shares of the Company

entitled to vote (the “Voting Shares”) is required to effect the action described herein. The Company’s Articles

of Incorporation does not authorize cumulative voting for this matter. As of the Record Date, the Company had 35,600,000 voting

shares issued and outstanding. The consenting stockholders are the record and beneficial owners of 20,000,000 shares of the Company’s

common voting stock, which represents approximately 56.179% of the total number of Voting Shares. Pursuant to the Nevada Revised

Statutes, the consenting stockholders voted in favor of the actions described herein in a written consent, dated October 28, 2015.

No consideration was paid for the consent. The consenting stockholders‘ names, affiliations with the Company and their beneficial

holdings are as follows:

| Name |

|

|

Voting Shares |

|

|

Percentage (1) |

|

| Ali Hussein El-dirani Khirdahi |

|

|

20,000,000 |

|

|

56.179% |

|

| |

Based upon 35,600,000 “Voting Shares”

outstanding as of December 10 , 2015. |

NAME CHANGE

The Company Board of Directors

and a majority of the voting shares approved a resolution to effectuate a name change to Fitvia Corp.

REVERSE STOCK SPLIT

The Company Board of Directors

approved a resolution to effectuate a 800:1 Reverse Stock Split. Under this Reverse Stock Split each 800 shares of our

Common Stock will be automatically converted into 1 share of Common Stock. To avoid the issuance of fractional shares

of Common Stock, the Company will issue an additional share to all holders of fractional shares.

MATERIAL TERMS, POTENTIAL RISKS AND

PRINCIPAL EFFECTS OF THE REVERSE STOCK SPLIT

PLEASE NOTE THAT THE REVERSE STOCK SPLIT WILL

NOT CHANGE YOUR PROPORTIONATE EQUITY INTERESTS IN THE COMPANY, EXCEPT AS MAY RESULT FROM THE ISSUANCE OR CANCELLATION OF SHARES

PURSUANT TO THE FRACTIONAL SHARES.

PLEASE NOTE THAT THE REVERSE STOCK SPLIT WILL

HAVE THE EFFECT OF SUBSTANTIALLY INCREASING THE NUMBER OF SHARES THE COMPANY WILL BE ABLE TO ISSUE TO NEW OR EXISTING SHAREHOLDERS

BECAUSE THE NUMBER OF SHARES ISSUED AND OUTSTANDING WILL BE REDUCED TO APPROXIMATELY 212,610 .

The Board of Directors

believe that among other reasons, the large number of outstanding shares of our Common Stock have contributed to the difficulty

with some business transactions, have contributed to a lack of investor interest in the Company, and has made it difficult to attract

new investors, specialized funds and potential business candidates. As a result, the Board of Directors has proposed

the Reverse Stock Split as one method to attract business and investor opportunities in the Company.

We have no present understandings

or agreements that will involve the issuance of capital stock. However, we are engaged in negotiations with respect to transactions,

including financings and acquisitions, which could involve the issuance of capital stock. As of the date herein, there are no definitive

agreements, letters of intent of memorandums of understanding with respect to any transactions, financings or acquisitions.

When a company engages

in a Reverse Stock Split, it substitutes one share of stock for a predetermined amount of shares of stock. It does not increase

the market capitalization of the company. An example of a reverse split is the following. A company has 10,000,000 shares of common

stock outstanding. Assume the market price is $.01 per share. Assume that the company declares a 1 for 5 reverse stock split. After

the reverse split, that company will have 1/5 as many shares outstanding, or 2,000,000 shares outstanding. The stock will have

a market price of $0.05. If an individual investor owned 10,000 shares of that company before the split at $.01 per share, he will

own 2,000 shares at $.05 after the split. In either case, his stock will be worth $100. He is no better off before or after. Except

that such company hopes that the higher stock price will make that company look better and thus the company will be a more attractive

investor or merger or purchase target for potential business. There is no assurance that that company's stock will rise in price

after a reverse split or that a suitable investor, merger or purchaser candidate will emerge.

The Board of Directors

believes that the Reverse Stock Split may improve the price level of our Common Stock and that the higher share price could help

generate interest in the Company among investors and other business opportunities. However, the effect of the reverse split upon

the market price for our Common Stock cannot be predicted, and the history of similar stock split combinations for companies in

like circumstances is varied. There can be no assurance that the market price per share of our Common Stock after the reverse split

will rise in proportion to the reduction in the number of shares of Common Stock outstanding resulting from the reverse split.

The market price of our Common Stock may also be based on our performance and other factors, some of which may be unrelated to

the number of shares outstanding.

The reverse split will

affect all of our stockholders uniformly and will not affect any stockholder's percentage ownership interests in the Company or

proportionate voting power, except to the extent that the reverse split results in any of our stockholders owning a fractional

share. All stockholders holding a fractional share shall be issued an additional share. The principal effect of the Reverse Stock

Split will be that the number of shares of Common Stock issued and outstanding will be reduced from 35,600,000 shares of Common

Stock to approximately 44,500 shares of Common Stock. $0.001 par value (depending on the number of fractional shares that are issued

or cancelled). The Reverse Stock Split will affect the shares of common stock outstanding.

The Reverse Stock Split

will not affect the par value of our Common Stock. As a result, on the effective date of the Reverse Stock Split, the stated capital

on our balance sheet attributable to our Common Stock will be reduced to less than the present amount, and the additional paid-in

capital account shall be credited with the amount by which the stated capital is reduced. The per share net income or loss and

net book value of our Common Stock will be increased because there will be fewer shares of our Common Stock outstanding.

The Reverse Stock Split

will not change the proportionate equity interests of our stockholders, nor will the respective voting rights and other rights

of stockholders be altered. The Common Stock issued pursuant to the Reverse Stock Split will remain fully paid and non-assessable.

The Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction” covered

by Rule 13e-3 under the Securities Exchange Act of 1934. We will continue to be subject to the periodic reporting requirements

of the Securities Exchange Act of 1934.

Stockholders should recognize

that they will own fewer numbers of shares than they presently own (a number equal to the number of shares owned immediately prior

to the filing of the certificate of amendment divided by 800). While we expect that the Reverse Stock Split will result in an increase

in the potential market price of our Common Stock, there can be no assurance that the Reverse Stock Split will increase the potential

market price of our Common Stock by a multiple equal to the exchange number or result in the permanent increase in any potential

market price (which is dependent upon many factors, including our performance and prospects). Also, should the market price of

our Common Stock decline, the percentage decline as an absolute number and as a percentage of our overall market capitalization

may be greater than would pertain in the absence of a reverse split. Furthermore, the possibility exists that potential liquidity

in the market price of our Common Stock could be adversely affected by the reduced number of shares that would be outstanding after

the reverse split. In addition, the reverse split will increase the number of stockholders of the Company who own odd lots (less

than 100 shares). Stockholders who hold odd lots typically will experience an increase in the cost of selling their shares, as

well as possible greater difficulty in effecting such sales. Consequently, there can be no assurance that the reverse split will

achieve the desired results that have been outlined above.

The Reverse Split of the