SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 12, 2015

OptimizeRx Corporation

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-53605 |

|

26-1265381 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 400

Water Street, Suite 200, Rochester, MI |

|

48307 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 248-651-6568

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section

8 – Other Events

Item

8.01 Other Events

On

November 12, 2015, the Company held a conference call to discuss the Company’s third quarter earnings and other matters

of business, a transcript of which is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The

information in Item 8.01 of this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange

Act, except as expressly set forth by specific reference in such a filing.

Section

9 – Financial Statements and Exhibits

Item

9.01 Financial Statements and Exhibits

| 99.1 | | Conference call transcript

dated November 12, 2015 |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| OptimizeRx

Corporation |

|

| |

|

| /s/

Doug Baker |

|

Doug

Baker

Chief Financial Officer |

|

| |

|

| Date:

November 18, 2015 |

|

3

Exhibit

99.1

OptimizeRx

Corporation

Third

Quarter 2015 Conference Call

November

12, 2015 4:30 pm Eastern

Good afternoon,

and thank you for joining us today to discuss OptimizeRx's third quarter ended September 30, 2015. With us today are David Harrell,

the company's Chief Executive Officer; and Doug Baker, OptimizeRx's Chief Financial Officer. We would like to remind everyone

that this call is available for replay through December 3 starting later this evening. And now I would like to turn the call over

to the Chief Financial Officer of OptimizeRx, Mr. Doug Baker. Sir, please go ahead.

Doug

Baker

Thanks,

Lisa. I'd like to welcome everybody today to our third quarter conference call, and thank everyone for joining. Before we start,

though, I'm going to read the safe harbor statement.

This conference

call contains forward-looking statements within the definition of Section 27A of the Securities Act of 1933 as amended and Section

21E of the Securities Act of 1934 as amended. These forward-looking statements should not be used to make an investment decision.

The words estimate, possible, seeking and similar expressions identify forward-looking statements, which speak only as of the

date the statement was made.

The company

undertakes no obligation to publicly update or revise any forward-looking statements whether because of new information, future

events or otherwise. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted

or quantified. Future events and actual results could differ materially from those set forth and contemplated by or underlying.

Operator

And ladies

and gentlemen, we are experiencing a momentary interruption in today's conference.

And

sir, you're live with the audience.

Doug

Baker

Thanks,

Lisa. Sorry, we have some technical issues with the conference client company there. So I'll start over. I'd like to welcome everybody

today to our third quarter conference call, and thank you for joining. Before we start, I'm going to read the safe harbor statement.

This conference

call contains forward-looking statements within the definition of Section 27A of the Securities Act of 1933 as amended and Section

21E of the Securities Act of 1934 as amended. These forward-looking statements should not be used to make an investment decision.

The words estimate, possible and seeking and similar expressions identify forward-looking statements, which speak only to the

date that the statement was made.

The company

undertakes no obligation to publicly update or revise any forward-looking statements whether because of new information, future

events or otherwise. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted

or quantified. Future events and actual results could differ materially from those set forth in and contemplated by or underlying

the forward-looking statements.

The risks

and uncertainties, to which forward-looking statements are subject that could affect our business and financial results, are included

in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, which is available on our website and on the SEC

website at sec.gov.

With all

that out of the way, I'm going to hit some of the financial highlights before I turn it over to our CEO, Dave Harrell, to add

some detail to our progress.

Our

net revenue in the third quarter of 2015 increased 10% to a record $2.0 million from $1.8 million in the same year-ago quarter.

Our revenues for the 9 months ended September 30 increased 15% from $4.5 million to a record $5.2 million.

That

increase is due to both increased promotion of pharmaceutical brands and expanded distribution channel.

We achieved

GAAP profitability for the third quarter with net income of $88,000 compared with the loss of $295,000 for the same quarter last

year.

Our loss

for the 9-month period was reduced to $180,000 compared with a loss of $1.3 million for the same period last year. Once again,

we have positive cash flow from operations in an amount of $488,000 at 2015 9-month period compared with cash used in operations

of $329,000 in the same period last year.

When removing

the effective working capital fluctuations on cash flow from operations, we had income, excluding noncash expense, of $524,000

in the 2015 period compared with $17,000 in the same period last year.

Turning

to the balance sheet, our cash increased to $8.2 million at September 30, 2015 as compared to $3.4 million at December 31, 2014.

The increase in cash was primarily due to the equity investment of our marketing partner, WPP, of $4.3 million that Dave's going

to address in greater detail in a few minutes. We also generated positive cash flow from operations of approximately $500,000,

and we continue to operate debt-free.

Now with

that background, I'd like to turn the call over to Dave.

Dave

Harrell

Good afternoon,

everybody. Thanks for taking the time. As Doug mentioned, we achieved record revenue and obtained profitability in the third quarter.

We achieved these results through continued progress in both segments of our business. This included adding new brands to our

channel and expanding agreements with pharmaceutical companies, who are looking for new ways to market their products and reach

doctors and patients right at point-of-prescribe.

We also

expanded our agreement with Allscripts to work with us exclusively to manage their patient savings across all of their EHR platforms.

This includes their largest platform, Touchworks, which will be integrated in 2016.

With Allscripts,

we now are the exclusive delivery platform for more than 200 EHRs. And with this exclusivity, this represents about 2/3 of our

network.

OptimizeRx

has now created the largest network of its kind, with promotional programs incorporated in the more than 350 leading EHRs, electronic

health records. We have also engaged more healthcare providers at point-of-prescribe than any network that's available in the

United States. This broad market reach and this exclusivity provides us substantial, competitive barrier-to-entry beyond us being

first movers.

We also

had some network interruptions with IntrinsiQ that we have mentioned that had a negative impact on further revenue growth, as

expected and discussed last period, as well as slower uptake with our promotions in NextGen due to the limited uptake of that

version that was released to its users.

We expect

IntrinsiQ to restore our services within the next release in 2016 and NextGen to be bigger revenue drivers as the next release

gets pushed out, which will likely be utilized conservatively more based on government requirements included.

Thus, despite

our growth, it could have been accelerated more if these elements beyond our control had not occurred.

We remain

in additional talks with other key EHRs and health systems that we anticipate can have very meaningful impact on 2016 revenue.

We are also preparing to roll out a downloadable desk application for nurses and support staff that will give us new touch points

in transaction as well as consumer and healthcare provider mobile platforms that we are in development that should be released

first quarter 2016.

Now in regard

to our marketing partner, WPP, and the large strategic investment they made in us within the last quarter, it's very important

to note that WPP is the largest marketing service company in the world with 3,000 offices and 170,000 associates. We anticipate

their investment and our deeper relationship to help us in a number of ways: number one, this obviously includes increasing the

number of participating brands; number two, helping us expand our point-of-care EHR promotional network and service offerings

as well as enhancing our management and infrastructure to support this further anticipated growth.

Moreover,

through this relationship, we now have access to virtually every pharmaceutical company in the world. The key relationship is

being championed through WPP's subsidiary, Grey Healthcare Group's CEO Lynn Vos, who's joined our Board of Directors and incidentally

spent most of the afternoon talking about the strategic plan to help us grow. And he has personally a relationship between OptimizeRx

and WPP and their agencies. We certainly welcome her guidance and insights on our content-delivery platform, which enables pharmaceutical

companies to provide on-demand, patient-care services.

WPP and

OptimizeRx will also continue to develop new platforms to deliver vital information to physicians and patients and help expand

our EHR network and services.

To further

support our pharmaceutical sales efforts, earlier today, we announced the appointment of David Smith as our new VP of Client Services.

David will be responsible for leveraging our relationship with WPP and focus on developing monetization strategies and pursuing

the multitude of new opportunities this relationship presents.

We're also

continuing to ramp up our marketing, and again, spent a significant time talking about that today through our partnership with

WPP. However, last month, we sponsored for the second time the largest EHR pharmaceutical conference, which provided us significant

leads for our sales force.

In all,

we see the key partnership and sales efforts supporting our continued growth and profitability in the current quarter and certainly

beyond. Now I'd like to open it up to your questions.

Operator

And we will

take our first question from Brian Murphy from Merriman Capital.

Brian

Murphy

Merriman

Capital, Inc., Research Division

So maybe

just a couple of quick housekeeping things for Doug. Doug, what was the D&A in the third quarter? About $80,000?

Doug

Baker

Sorry, what

was the question?

Brian

Murphy

Merriman

Capital, Inc., Research Division

What was

depreciation and amortization in the September quarter?

Doug

Baker

Yes, that's

about the right number.

Brian

Murphy

Merriman

Capital, Inc., Research Division

Okay. And

could you just give me the stock comp for the third quarter, too?

Doug

Baker

I don't

have that one right in front of me, but I'll give it to you after the call.

Brian

Murphy

Merriman

Capital, Inc., Research Division

Okay, great.

And Dave, you talked a little bit about tying up some of these important distribution channels, such as the Touchworks channel

with Allscripts. And you guys seem to have some exclusives, enjoy some exclusivity in a pretty high percentage of the overall

distribution channels now. Can you just talk a little bit more about what that means in terms of -- what that means from a competitive

standpoint? And just maybe a little bit more color on what kind of barriers-to-entry these provide?

Dave

Harrell

Sure. I

mean, over the last 4.5 years, we've been developing our network and, at the same time, developing our pharmaceutical partnerships,

which again in this industry have taken a significant [indiscernible] through legal aspects, master services agreements, et cetera.

But the key to our barriers is, number one, I would still say is our leadership position as the first-mover advantage. Working

with both of these sizes of business is extremely complex within these multi-billion-dollar companies. That being said, as we

continue to grow the market and grow the profitability in revenue, naturally, there's always an opportunity for others to come

in. These exclusive relationships makes it very, very difficult for any company to take a leadership position since, again, we

not only have a market leadership with 20 pharma companies, but certainly the exclusiveness within these key EHR systems, which

are very excited about what we're doing and the fact that we've proven value to them and, frankly, their belief in both our internal

sales expectations and growth with the pharmaceutical companies as well as, frankly, only becoming more positive as we partner

with the largest marketing and advertising agency in the world, WPP.

Operator

And we'll

now take our question from Randy Rageth, private investor.

Randy

Rageth

Question

for you on WPP. So they bought about is it 20% of the outstanding shares? Is that correct?

Dave

Harrell

Yes.

Randy

Rageth

And so where

do you see that relationship going as you kind of progress with them? Do you see them becoming a larger and larger shareholder

over time?

Dave

Harrell

Not necessarily,

but I see certainly their commitment to wanting to help us ramp up for, number one, in inverse order, the fact that they're a

major shareholder. But number two, maybe more importantly, they see the strategic advantage to supporting their business. I think

WPP, and certainly their agencies, which represent some of the largest brands in the room, clearly are recognizing that the landscape

to pharmaceutical marketing is changing, in particular the fact that reps now have 60% restricted access to doctors. So they really

see us as a strategic channel to not only promote our current programs, but help us develop new programs that can actually provide

them a new marketing channel to reach these doctors right at point-of-prescribe. So again, they are -- within the first 30 days,

I'm very pleased with the commitment, certainly not only at Grey Healthcare, but Ogilvy, Sudler, CMI and about 8 other agencies

that are all part of WPP that call them the pharmaceutical companies and manage their budget and marketing strategies. So again,

my immediate opportunity, obviously, on why this deal was, in fact, that they could help us not only reach more pharmaceutical

companies, but better position our services from a marketing perspective, and help us with additional strategies to accelerate

growth and, in essence, to develop new technologies. I don't necessarily see any increase in terms of their stock position unless

it was based on other private transactions in their current stock base.

Operator

I will now

take a question from Neal Feagans private investor.

Neal

Feagans

Listen,

before I ask a couple of questions, you really quickly mentioned something technical that held back the quarterly revenue from

being more than it could have been, and you mentioned that it had been previously discussed anew to the company. Could you go

back and elaborate on that? And I believe you said it won't be rectified until next year. Help me understand what that is.

Dave

Harrell

Sure, sure.

So one of our leading urology EHRs, which is actually a combination of 2, formerly referred to as HealthTronics and now is IntrinsiQ,

which is part of AmerisourceBergen. Unfortunately, they made the decision to turn off our services due to some of the external

conditions relating to their overall workflow. They were doing roughly $250,000 a quarter with us. But the good news is they have

committed to us that their next release will resolve those and restore our coupon functionality. And again, the next release,

unfortunately, is going to happen to March, maybe early April. So again, something that was certainly beyond our control.

Neal

Feagans

Okay. And

when you answered the last question and said you didn't anticipate WPP increasing their share ownership, don't they have the right

to convert the revenue share with us into stock?

Dave

Harrell

Yes, that's

a good point. So we have further incentivized their team upon them reaching some revenue, helping them acquire more and more brands.

They can get some form of compensation, both either in revenue or in additional stocks. So thank you for supplying that.

Neal

Feagans

Okay, all

right. And listen, I understand the low-hanging-fruit philosophy with the brand name and how much running room you have there

with brand name drugs. But I'm curious, is the WPP relationship at all going to assist us with generics or animal medicine markets?

Dave

Harrell

Well, generics

is an interesting play, and that would likely come from the payer side of the business. But certainly, they are strong. Interesting

enough, Grey Healthcare manages some of the leading animal health brands. But the reality, though, is beyond the animal health,

which is a growth segment for us that seems to be gaining traction, the reality is, they have -- they do -- they actually manage

marketing budgets and strategies for hundreds of leading brands. So we think that they are going to be a very, very significant

part of our -- increasing our promotional reach beyond our small sales force that we have.

Neal

Feagans

Okay. And

can you elaborate at all -- I'm sorry, I didn't mean to interrupt, but I understand their ability to open doors and facilitate

growth within the pharma industry. That's pretty obvious. Their news release focused exclusively on developing new platforms and

delivering new types of information. It implied to me that one of the major focuses they have is things that we don't currently

do. I wonder if you could expand just a little bit on the new platforms and information that we want to work with them on providing,

and maybe a little bit of color on the timing of that and the cost to build platforms and launch initiatives. Is that being borne

exclusively by us with the money they provided from the stock sale earmarked to fund that? Or are they participating in the cost

to develop these new platforms and launch them and so forth?

Dave

Harrell

I mean,

clearly, our focus is clear on eCoupon and messaging, which we already have that core competency built. They've also recognized

our ability to instantly access the rep via phone or text. They look at ways -- they've determined some additional ways that would

make the deal accelerate that launch. Beyond that, though, what they want to do is start to do some major market research to define

some additional opportunities that both pharmaceutical companies want to engage as well as in the other side, healthcare providers.

So I think, clearly, as this channel becomes less of a secondary alternative channel into what I think is going to be the primary

support channel for pharma and into healthcare practices, again, there's a lot of opportunities to help them. For example, prior

authorization request, additionally, formulary, coverage information at point-of-care of a product. Certainly, patient education

could be a bigger play as well. But again, I don't see us taking our eye off the ball. And any investment we make -- we would

make certainly will leverage our on-demand rule-based content system that certainly isn't exclusive to delivering coupons, but

can deliver any type of information. So we would certainly look at each independently and look at the ROI a bit. But the reality

is, pharma is looking for not only an aggregator in eCoupons, but I think WPP recognizes that we can leverage further our digital

highway that we've built right into doctors prescribing processes that is meaningful for all stakeholders.

Operator

And at this

time, this does conclude our question-and-answer session. I would now like to turn the call over to Mr. Harrell for closing comments.

Sir, please go ahead.

Dave

Harrell

Yes.

In summary, we continue to grow, and I see that certainly continuing as well. I think the big news here is that over the last

year and a half, there's been major due diligence, including certainly key analysts from WPP London coming in. And I think that

after exhaustive reviews, they see us clearly as the leaders and are very interested in committing to help us accelerate what

we all know is a huge opportunity, both from a promotional perspective, a marketing perspective, a pharmaceutical reach as well

as a strategic partner. And beyond that, I think we're very excited about that. We're looking to expand our team as well. And

so I look forward to very exciting things in the future, and I thank everybody for all their participation today and their interest

in OptimizeRx.

Operator

And

I would like to remind everyone that this call will be available for replay through December 3, 2015 starting later this afternoon.

Please refer to today's press release for dial-in replay instructions. The webcast replay will also be available via the company's

website at www.optimizerxcorp.com. Thank you for joining us for our presentation, and this does conclude today's call. You may

now disconnect.

7

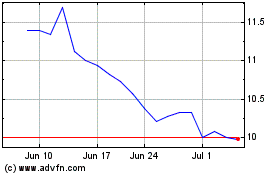

OptimizeRx (NASDAQ:OPRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

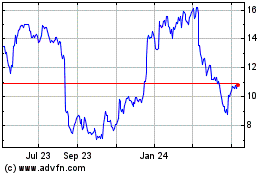

OptimizeRx (NASDAQ:OPRX)

Historical Stock Chart

From Apr 2023 to Apr 2024