UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

SCHEDULE 14C

(Rule 14c-101)

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

| ☒ |

Preliminary Information Statement |

| ☐ |

Definitive Information Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

LEGEND OIL

AND GAS, LTD.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| (1) |

Title of each class of securities to which transaction applies: _____________________ |

| (2) |

Aggregate number of securities to which transaction applies: _____________________ |

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): _____________________ |

| (4) |

Proposed maximum aggregate value of transaction: _____________________ |

| (5) |

Total fee paid: _____________________ |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) |

Amount Previously Paid: _____________________ |

| (2) |

Form, Schedule or Registration Statement No.: _____________________ |

| (3) |

Filing Party: _____________________ |

| (4) |

Date Filed: _____________________ |

LEGEND OIL

& GAS, LTD.

555 Northpoint Center East, Suite 400

Alpharetta, GA 30022

(678) 366-4587

NOTICE OF ACTION BY

WRITTEN CONSENT OF MAJORITY

STOCKHOLDERS

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT

TO SEND US A PROXY

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS

AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

We are furnishing this

notice and the accompanying information statement (the “Information Statement”) to the holders of shares of common

stock, par value $0.0001 per share (“Common Stock”), of Legend Oil and Gas, Ltd., a Colorado corporation (the “Company”)

pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Regulation 14C

and Schedule 14C thereunder, in connection with the approval of the action described below (the “Action”) taken by

written consent of the holders of a majority of the issued and outstanding shares of Common Stock:

| |

• |

To increase the number

of authorized shares of the Company’s Common Stock from 1,100,000,000 to 5,000,000,000 authorized shares of Common Stock. |

The purpose of this Information

Statement is to notify our stockholders that on November 4, 2015, the owners of approximately 66.6% of our issued and outstanding

shares of Common Stock and the owner of 100% of our Series B Preferred Stock (the “Majority Stockholders”) executed

a written consent approving the Action. In accordance with Rule 14c-2 promulgated under the Exchange Act, the Action will become

effective no sooner than 20 days after we mail this notice and the accompanying Information Statement to our stockholders.

The written consent that

we received constitutes the only stockholder approval required for the Action under Colorado law and, as a result, no further action

by any other stockholder is required to approve the Action and we have not and will not be soliciting your approval of the Actions.

This notice and the accompanying

Information Statement are being mailed to our stockholders on or about __________, 2015. This notice and the accompanying Information

Statement shall constitute notice to you of the action by written consent in accordance with Rule 14c-2 promulgated under the Exchange

Act.

A copy of this Information

Statement and our 2014 Annual Report are available at www.midconoil.com.

| |

By Order of the Board of Directors,

|

| |

/s/ Andrew Reckles |

| |

Chairman and Chief Executive Officer |

Table

of Contents

LEGEND OIL

& GAS, LTD.

555 Northpoint Center East, Suite 400

Alpharetta, GA 30022

678-366-4400

INFORMATION STATEMENT

Action by Written Consent of Majority Stockholders

WE ARE NOT ASKING YOU FOR A

PROXY AND YOU ARE REQUESTED NOT TO SEND US A

PROXY

GENERAL

This Information Statement

is being furnished to the holders of shares of common stock, par value $0.001 per share (“Common Stock”), of Legend

Oil and Gas, Ltd. in connection with the action by written consent of the holders of a majority of our issued and outstanding shares

of Common Stock taken without a meeting to approve the actions described in this Information Statement. In this Information Statement,

all references to “the Company,” “we,” “us” or “our” refer to Legend Oil and Gas,

Ltd. We are mailing this Information Statement to our stockholders of record on or about _________ _, 2015.

Pursuant to Rule 14c-2

promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), the actions described herein will not become effective until at least 20 calendar days following

the date on which this Information Statement is first mailed to our stockholders.

The entire cost of furnishing

this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and

other like parties to forward this Information Statement to the beneficial owners of the Company’s Common Stock held of record

by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

Action by Board of Directors and Majority Stockholders

On November 4, 2015, the

Board of Directors (the “Board”) and the Majority Stockholders of the Company unanimously adopted resolutions approving

the following action (the “Action”):

| |

• |

To increase the number of authorized shares of the Company’s Common Stock from 1,100,000,000 to 5,000,000,000 authorized shares of Common Stock. |

As of the close of business

on November 4, 2015, we had 936,683,273 shares of Common Stock and 9,643 shares of Series B Convertible Preferred Stock (the “Preferred

Stock”) outstanding and entitled to vote on the Action. Each share of outstanding Common Stock is entitled to one vote. Each

share of Preferred Stock is entitled to 33,333.33 votes.

On November 4, 2015, pursuant

to Section 7-107-104 of the Colorado Revised Statutes (“CSR”) and as provided by the Company’s Restated Articles

of Incorporation, we received written consents approving the Action from stockholders holding an aggregate of 623,763,333 shares

of our Common Stock representing 66.6% of our outstanding shares of Common Stock, and an aggregate of 9,643 shares of our Preferred

Stock representing 100% of our outstanding shares of Preferred Stock (the “Majority Stockholders”). Thus, your consent

is not required and is not being solicited in connection with the approval of the Actions.

INTERESTS OF CERTAIN PERSONS IN

OR OPPOSITION TO MATTERS TO BE ACTED UPON

No officer or director

of the Company has any substantial interest in the Actions, other than in his role as an officer or director of the Company.

QUESTIONS AND ANSWERS REGARDING THE

AMENDMENT TO

OUR RESTATED ARTICLES OF INCORPORATION

| Q: |

What corporate actions were approved by the Action by Written Consent of the Majority Stockholders? |

| A: |

Pursuant to the Action by Written Consent of the Majority Stockholders, holders of a majority of the outstanding shares of our Common Stock and our Preferred Stock approved the Amendment described above, which will (i) increase the total number of authorized shares of the Company’s Common Stock to 5,000,000,000 shares. Previously, the Certificate of Incorporation authorized the Company to issue 1,100,000,000 shares of Common Stock. A copy of the Action by Written Consent of Stockholders is attached as Annex A to this Information Statement and incorporated herein by reference. |

| Q: |

Why is the Company increasing the number of shares of Common Stock that it is authorized to issue? |

| A: |

There are two primary reasons the Board believes that the increase in the number of authorized shares of Common Stock is in the best interests of the Company. First, pursuant to its recent issuance of 9,643 shares of the Preferred Stock in exchange for the cancellation of approximately $9.64 million of indebtedness, the Company is required to authorize a sufficient number of shares of Common Stock for such Preferred Stock to be converted into shares of Common Stock. Second, the increased number of authorized shares of Commons Stock will provide the Company with available shares that may be issued for various corporate purposes, including equity financings, acquisitions, stock options and other derivative securities. The Board also believes that the increase in the number of authorized shares of Common Stock will enable the Company to benefit from market conditions and any favorable financing opportunities in the future without further delay and expense to the Company. |

| Q: |

How many shares of Common Stock were voted in favor of the Amendment? |

| A: |

The approval of the Amendment required the written consent of the holders of at least a majority of the outstanding shares of our Common Stock and of our Preferred Stock. Each share of our Common Stock and Preferred Stock is entitled to one vote and 33,333.33 votes, respectfully, in connection with the Amendment. The Written Consent of Stockholders referenced above, which was executed and delivered to the Company on November 4, 2015, by holders of 623,763,333 shares of our Common Stock (representing approximately 66.6% of the 936,683,273 shares of Common Stock outstanding as of such date) and 9,643 shares of the Preferred Stock (representing 100% of the shares of Preferred Stock outstanding as of such date) was sufficient to approve the proposed Amendment. Consequently, no additional votes are required to approve the Amendment. |

| Q: |

Why is the Company amending its Articles of Incorporation through stockholder action by written consent in lieu of holding a meeting of our stockholders? |

| A: |

Under the Colorado Corporation Code, our Articles of Incorporation and our Bylaws, the Company’s stockholders may take action by written consent in lieu of holding a meeting. To avoid the significant time and expense associated with calling and holding a special meeting of the Company’s stockholders, the stockholders listed above, which held a sufficient number of shares of outstanding Common Stock and Preferred Stock to approve the Amendment without requiring the Company to solicit proxies the proxy of any other stockholder, determined to take action by written consent. Therefore, the Company is not required to solicit the vote or consent of any stockholders to effect the Amendment. However, the Company is obligated by the federal securities laws to provide this Information Statement to you in connection with the Amendment. |

| Q: |

Has the Board approved the Amendment? |

| A: |

Yes. On November 4, 2013, the Board unanimously approved the Amendment, declared its advisability, and recommended that our stockholders approve the Amendment. |

| Q: |

When will the Amendment be effective? |

| A: |

The Amendment will become effective upon filing with the Secretary of State of the State of Colorado. Pursuant to Rule 14c-2(b) promulgated under the Exchange Act, such filing will not occur until at least 20 calendar days following the mailing of this Information Statement to our stockholders. The Company currently anticipates that the Amendment will be filed and take effect on or about December __, 2015. |

| Q: |

Can I dissent or exercise appraisal rights in connection with the Amendment? |

| A: |

Pursuant to the Colorado Corporation Code, our Articles of Incorporation and our Bylaws, our stockholders are not entitled to exercise appraisal or other dissenters’ rights in connection with the Amendment or the other matters described in this Information Statement. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

AND RELATED STOCKHOLDER MATTERS

The following tables set

forth information with respect to the beneficial ownership of our Common Shares as of November 1, 2015 by our directors, named

executive officers, and directors and executive officers as a group, as well as each person (or group of affiliated persons) who

is known by us to beneficially own 5% or more of our Common Shares. As of the latest practical date before filing this mailing

this Information Statement, there were 936,683,273 Common Shares issued and outstanding.

The percentages of Common

Shares beneficially owned are reported on the basis of regulations of the Securities and Exchange Commission governing the determination

of beneficial ownership of securities. Under the rules of the Securities and Exchange Commission, a person is deemed to be a beneficial

owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of the

security, or investment power, which includes the power to dispose of or to direct the disposition of the security. To our knowledge,

unless indicated in the footnotes to the table, each beneficial owner named in the tables below has sole voting and sole investment

power with respect to all shares beneficially owned.

| Title of Class | |

Name of Beneficial Owner | |

Amount and Nature of

Beneficial Ownership | |

Percent of Class |

| Common stock, par value $0.001 | |

Hillair Capital Investments, L.P.

c/o Hillair Capital Management LLC

345 Lorton Ave., Suite 330

Burlingame, CA 94010

| |

600,000,000 | |

| 64 | % |

| | |

| |

| |

| | |

| Common stock, par value $0.001 | |

Warren S. Binderman

President and Chief Financial Officer

555 Northpoint Center East, Suite 400

Alpharetta, GA 30022

| |

7,500,000 | |

| * | |

| Common stock, par value $0.001 | |

Andrew Reckles(1)

555 Northpoint Center East, Suite 400 Alpharetta,

GA 30022 | |

16,263,333 | |

| 1.7 | % |

| | |

| |

| |

| | |

| TOTAL: | |

| |

623,763,333 | |

| 66.6 | % |

|

*Less than one percent.

(1)

Mr. Reckles beneficially owns these shares through

Northpoint Energy Partners, LLC, of which he is the managing member. |

| Title of Class | |

Name of Beneficial Owner | |

Amount and Nature of Beneficial Ownership | |

Percent of Class |

| Series B Preferred Stock, par value $0.001 | |

Hillair Capital Investments, L.P.

c/o Hillair Capital Management LLC

345 Lorton Ave., Suite 330 Burlingame, CA 94010 | |

9,643 | |

| 100 | % |

DELIVERY OF DOCUMENTS TO SECURITY

HOLDERS SHARING AN ADDRESS

If hard copies of the

materials are requested, we will send only one Information Statement and other corporate mailings to stockholders who share a single

address unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,”

is designed to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a

separate copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement

was delivered. You may make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your

shared address and (iii) the address to which the Company should direct the additional copy of the Information Statement, to the

Company at Legend Oil and Gas, Ltd., 555 Northpoint Center East, Suite 400, Alpharetta, GA 30022, 678-366-4400.

If multiple stockholders

sharing an address have received one copy of this Information Statement or any other corporate mailing and would prefer the Company

to mail each stockholder a separate copy of future mailings, you may send notification to or call the Company’s principal

executive offices. Additionally, if current stockholders with a shared address received multiple copies of this Information Statement

or other corporate mailings and would prefer the Company to mail one copy of future mailings to stockholders at the shared address,

notification of such request may also be made by mail or telephone to the Company’s principal executive offices.

WHERE YOU CAN FIND MORE INFORMATION

The Company files annual

reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other information with

the SEC. You may obtain such SEC filings from the SEC’s website at http: //www.sec.gov. You can also read and copy these

materials at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. You can obtain information about

the operation of the SEC’s public reference room by calling the SEC at 1-800-SEC-0330.

ANNEX A

WRITTEN CONSENT

JOINT WRITTEN CONSENT

IN LIEU OF A MEETING OF THE STOCKHOLDERS

AND BOARD OF DIRECTORS

OF

LEGEND OIL AND GAS, LTD.

November 4, 2015

In

lieu of a meeting, the undersigned, being all of the members of the Board (the “Board”) of Legend Oil

and Gas, Ltd. (the “Company”), and the holders of a majority vote of the stockholders of the Company (the “Majority

Stockholders”) waive any and all requirements for the holding of a meeting of the

Board and the Stockholders, including without limitation, any requirements as to notice thereof, and take the following actions

and adopt the following recitals and resolutions by signing this Joint Written Consent in Lieu of a Meeting:

WHEREAS, the

Company desires to adopt the following resolutions (the “Resolutions”); and

WHEREAS,

the undersigned, in their capacity as the Majority Stockholders and all members of the Board, believe the adoption of the Resolutions

is advisable and in the best interests of the Company and its Stockholders.

NOW THEREFORE,

BE IT RESOLVED, that the undersigned, in their capacity as the Majority Stockholders and all members of the Board, hereby authorize,

approve and adopt the following Resolutions:

RESOLVED, that the

Company increase the number of authorized shares of the Company’s Common Stock from 1,100,000,000 to 5,000,000,000 authorized

shares of Common Stock.

FURTHER RESOLVED,

that the appropriate officers of the Company are hereby authorized, empowered and directed to take all such further actions and

to carry out the Resolutions adopted herein;

FURTHER RESOLVED,

that all actions previously taken and all agreements, instruments, documents, and certificates executed and delivered through the

date hereof by any officer of the Company, in connection with the foregoing resolutions, are hereby authorized, approved, ratified

and confirmed in all respects;

FURTHER RESOLVED,

that the officers of the Company each be, and hereby is, authorized and directed to take such additional actions as may be

necessary or desirable to effect the intent of the foregoing Resolutions; and

FURTHER RESOLVED,

that this Joint Written Consent of the Stockholders and Board of the Company may be executed in several counterparts or in counterpart

signature pages, and all so executed shall constitute one Joint Written Consent, notwithstanding that all of the undersigned are

not signatories to the original or the same counterpart or counterpart signature page, and a facsimile of a signature to this Joint

Written Consent shall be deemed and treated for all purposes of execution to be as valid as an original signature thereto; and

FURTHER RESOLVED,

that the Secretary of the Company is hereby directed to file a copy of this Joint Written Consent of the Stockholders and Board

of the Company with the minutes of the proceedings of the Company.

IN WITNESS WHEREOF,

the undersigned, being the Majority Stockholders and all of the members of the Board of the Company, hereby execute the foregoing

Joint Written Consent effective as of the date set forth above, for the purpose of giving consent hereto, thereby agreeing that

the foregoing resolutions shall be of the same force and effect as if regularly adopted at a meeting of the Stockholders and the

Board of the Company held upon due notice.

| |

BOARD OF DIRECTORS |

| |

|

| |

|

| |

|

| |

ANDREW RECKLES |

| |

|

| |

|

| |

|

| |

WARREN S. BINDERMAN |

| |

|

| |

|

| |

|

| |

JEFFREY KAPLIN |

| STOCKHOLDERS |

|

NO. OF SHARES |

| |

|

|

| Hillair Capital Investments, L.P. |

|

|

| |

|

|

| |

|

|

| By: |

|

|

600,000,000 (Common) |

| |

|

|

9,643 Series B Preferred |

| |

|

|

|

| |

|

|

| |

|

|

| |

|

|

| Northpoint Energy Partners, LLC |

|

|

| |

|

|

| |

|

|

| By: |

|

|

16,263,333 (Common) |

|

|

Andrew Reckles |

|

|

| |

Managing Member |

|

|

| |

|

|

| |

|

|

| WARREN S. BINDERMAN |

|

7,500,000 (Common) |

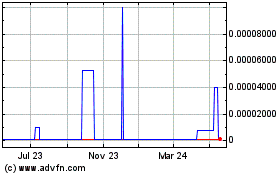

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

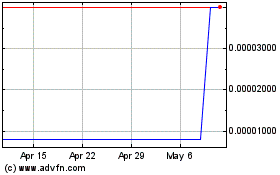

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024