UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 12, 2015 (November 12, 2015)

ARCA biopharma, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware |

000-22873 |

36-3855489 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

11080 CirclePoint Road, Suite 140, Westminster, CO 80020

(Address of Principal Executive Offices) (Zip Code)

(720) 940-2200

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

£ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

£ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

£ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

£ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 2 — Financial Information

|

Item 2.02. |

Results of Operations and Financial Condition. |

On November 12, 2015, ARCA biopharma, Inc. (“ARCA”) issued a press release reporting financial results for the third quarter ended September 30, 2015.

The press release is attached hereto as Exhibit 99.1, which is furnished under Item 2.02 of this report and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filing.

Section 9 — Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

Exhibit Number |

|

Description |

|

|

|

|

99.1 |

|

Press Release titled “ARCA biopharma Announces Third Quarter 2015 Operating Results and Provides Business Update” dated November 12, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Dated: November 12, 2015 |

|

|

|

|

|

|

ARCA biopharma, Inc. |

|

|

(Registrant) |

|

|

|

|

|

|

By: |

/s/ Brian L. Selby |

|

|

|

Name: |

Brian L. Selby |

|

|

|

Title: |

Vice President, Finance and Chief Accounting Officer |

INDEX TO EXHIBITS

|

|

|

|

|

Exhibit Number |

|

Description |

|

|

|

|

99.1 |

|

Press Release titled “ARCA biopharma Announces Third Quarter 2015 Operating Results and Provides Business Update” dated November 12, 2015.

|

|

|

|

|

Exhibit 99.1

ARCA Biopharma announces third quarter 2015 financial results and provides business update

--------------------------------------------------------------------------------------------------

GENETIC-AF Trial Evaluating Gencaro as a Potential Treatment for Atrial Fibrillation

--------------------------------------------------------------------------------------------------

Interim Analysis of Phase 2B Efficacy Data Planned for the First Half of 2017

Westminster, CO, November 12, 2015 – ARCA biopharma, Inc. (Nasdaq: ABIO), a biopharmaceutical company developing genetically-targeted therapies for cardiovascular diseases, today reported financial results for the quarter ended September 30, 2015, and provided a business update.

“This has been a productive quarter as we continue enrollment in the GENETIC-AF trial evaluating Gencaro as a potential treatment for atrial fibrillation,” commented Dr. Michael Bristow, ARCA’s President and CEO. “We currently have 58 sites in the United States and Canada recruiting patients for the trial, with all of the sites now operating under the revised trial protocol, which expanded the target patient population. We expect the DSMB interim analysis of Phase 2B efficacy data to occur in the first half of 2017.”

Third Quarter 2015 Summary Financial Results

Cash and cash equivalents totaled $41.5 million as of September 30, 2015, compared to $15.4 million as of December 31, 2014. The Company believes that its current cash and cash equivalents will be sufficient to fund its operations, at its projected cost structure, through at least the end of 2017. ARCA had approximately 9.0 million outstanding shares of common stock as of September 30, 2015.

Research and development (R&D) expense for the three months ended September 30, 2015 was $1.7 million compared to $1.3 million for the corresponding period of 2014, an increase of approximately $0.4 million. R&D expense for the nine months ended September 30, 2015 was $5.2 million compared to $4.0 million for the corresponding period of 2014, an increase of approximately $1.1 million. The increase in R&D expense in the three and nine month periods ended September 30, 2015 is primarily due to the increased clinical expense of the GENETIC-AF clinical trial. The Company expects R&D expense in 2015 to be higher than 2014 as it activates new clinical sites and enrolls additional patients in the GENETIC-AF clinical trial and incurs incremental costs associated with transitioning to the protocol amended in the first quarter of 2015.

General and administrative (G&A) expense for the three months ended September 30, 2015 was $1.1 million compared to $1.0 million for the corresponding period in 2014. G&A expense for the nine months ended September 30, 2015 was $3.1 million compared to $3.0 million for the corresponding period in 2014. ARCA expects that G&A expense in 2015 will be higher than in 2014 as the Company increases administrative activities to support our GENETIC-AF clinical trial.

Total operating expense for the three months ended September 30, 2015 was $2.8 million compared to $2.3 million for the corresponding period in 2014. Total operating expense for the nine months ended September 30,

2015 was $8.3 million compared to $7.1 million for the corresponding period in 2014. The increase in total operating expense for three and nine month periods ended September 30, 2015 is primarily due to the increase in R&D expense due to the increased clinical expense of the GENETIC-AF clinical trial.

Net loss was $2.8 million, or $0.31 per share, for the third quarter of 2015 and $8.3 million, or $1.54, for the nine months ended September 30, 2015, compared to $2.3 million, or $0.76 per share, for the third quarter of 2014 and $7.1 million, or $2.44 per share, for the nine months ended September 30, 2014.

Key Accomplishments

|

|

· |

Continued implementation of a previously announced protocol amendment for GENETIC-AF, which expanded the trial’s target population. |

|

|

· |

Additional investigative clinical sites were approved, trained and began adopting the revised protocol, with all of the clinical sites now operating under the revised protocol. |

There are currently 58 clinical trial sites in the United States and Canada. The Company anticipates that the trial will enroll patients at approximately 65 sites for the Phase 2B portion of GENETIC-AF. The Company believes the DSMB interim analysis could be finished in the first half of 2017. Although all of the clinical sites are now operating under the revised protocol, the Company does not yet know how the protocol changes will impact enrollment or if its enrollment projections will prove to be accurate.

GENETIC-AF Trial Phase 2B Projected Timeline

|

|

ü |

Revised protocol distributed to participating clinical trial sitesMarch 2015 |

|

|

ü |

GENETIC-AF Trial Investigators meeting and trainingMay |

|

|

ü |

First trial sites operating under revised protocolMay |

|

|

- |

Approximately 65 clinical trial sites active in U.S. & CanadaQ4 2015 |

|

|

- |

Completion of Enrollment for Phase 2B DSMB Interim AnalysisYE 2016 |

|

|

- |

DSMB Interim Analysis Decision1H 2017 |

The Company’s forecast of the time periods to achieve these milestones is a forward-looking statement and involves risks and uncertainties, and actual results are likely to vary as a result of a number of factors, including the factors discussed in “Risk Factors” in the Company’s periodic SEC filings.

GENETIC-AF Clinical Trial

GENETIC-AF is a Phase 2B/3, multi-center, randomized, double-blind clinical trial comparing the safety and efficacy of Gencaro to Toprol-XL (metoprolol succinate) for the treatment of atrial fibrillation (AF) in patients with heart failure and left ventricular systolic dysfunction (HFREF patients). The primary endpoint of GENETIC-AF is time to symptomatic AF/atrial flutter (AFL). ARCA is enrolling only HFREF patients with the genetic variant of the cardiac beta-1 adrenergic receptor, which the Company believes responds most favorably to Gencaro, the 389 arginine homozygous genotype (ADRB1 Arg389Arg). GENETIC-AF has an adaptive design, under which the Company initiated the trial as a Phase 2B trial seeking to enroll approximately 200 patients. The GENETIC-AF Data Safety Monitoring Board (DSMB) will analyze certain data from the Phase 2B portion of the trial and recommend, based on a comparison to the pre-trial statistical assumptions, whether the trial should proceed to Phase 3 and seek to enroll an additional 420 patients.

Atrial Fibrillation (AF)

Atrial fibrillation, the most common sustained cardiac arrhythmia, is considered an epidemic cardiovascular disease and a major public health burden. The estimated number of individuals with AF globally in 2010 was 33.5 million. According to the 2015 American Heart Association report on Heart Disease and Stroke Statistics, the estimated number of individuals with AF in the United States in 2010 ranged from 2.7 million to 6.1 million people. Hospitalization rates for AF increased by 23% among U.S. adults from 2000 to 2010 and hospitalizations account for the majority of the economic cost burden associated with AF.

About ARCA biopharma

ARCA biopharma is dedicated to developing genetically-targeted therapies for cardiovascular diseases. The Company's lead product candidate, GencaroTM (bucindolol hydrochloride), is an investigational, pharmacologically unique beta-blocker and mild vasodilator being developed for atrial fibrillation. ARCA has identified common genetic variations that it believes predict individual patient response to Gencaro, giving it the potential to be the first genetically-targeted atrial fibrillation prevention treatment. ARCA has a collaboration with Medtronic, Inc. for support of the GENETIC-AF trial. For more information please visit www.arcabiopharma.com.

Safe Harbor Statement

This press release contains "forward-looking statements" for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements regarding, potential timing for patient enrollment in the GENETIC-AF trial, potential timeline for GENETIC-AF trial activities, the sufficiency of the Company’s capital to support its operations, the potential for genetic variations to predict individual patient response to Gencaro, Gencaro’s potential to treat atrial fibrillation, future treatment options for patients with atrial fibrillation, and the potential for Gencaro to be the first genetically-targeted atrial fibrillation prevention treatment. Such statements are based on management's current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors, including, without limitation, the risks and uncertainties associated with: the Company's financial resources and whether they will be sufficient to meet the Company's business objectives and operational requirements; results of earlier clinical trials may not be confirmed in future trials, the protection and market exclusivity provided by the Company’s intellectual property; risks related to the drug discovery and the regulatory approval process; and, the impact of competitive products and technological changes. These and other factors are identified and described in more detail in ARCA’s filings with the SEC, including without limitation the Company’s annual report on Form 10-K for the year ended December 31, 2014, and subsequent filings. The Company disclaims any intent or obligation to update these forward-looking statements.

Investor & Media Contact:

Derek Cole

720.940.2163

derek.cole@arcabiopharma.com

###

(Tables Follow)

ARCA BIOPHARMA, INC.

BALANCE SHEET DATA

(in thousands)

|

|

|

|

|

|

September 30, 2015 |

December 31, 2014 |

|

Cash and cash equivalents |

$41,482 |

$15,354 |

|

Working capital |

$40,383 |

$14,100 |

|

Total assets |

$42,397 |

$16,132 |

|

Total stockholders’ equity |

$41,093 |

$14,741 |

ARCA BIOPHARMA, INC.

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

|

(in thousands, except share and per share amounts) |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

1,716 |

|

|

$ |

1,335 |

|

|

$ |

5,170 |

|

|

$ |

4,043 |

|

|

General and administrative |

|

1,101 |

|

|

|

950 |

|

|

|

3,110 |

|

|

|

3,038 |

|

|

Total costs and expenses |

|

2,817 |

|

|

|

2,285 |

|

|

|

8,280 |

|

|

|

7,081 |

|

|

Loss from operations |

|

(2,817 |

) |

|

|

(2,285 |

) |

|

|

(8,280 |

) |

|

|

(7,081 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other income |

|

4 |

|

|

|

2 |

|

|

|

7 |

|

|

|

6 |

|

|

Interest expense |

|

(1 |

) |

|

|

(1 |

) |

|

|

(4 |

) |

|

|

(3 |

) |

|

Net loss and comprehensive loss |

$ |

(2,814 |

) |

|

$ |

(2,284 |

) |

|

$ |

(8,277 |

) |

|

$ |

(7,078 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(0.31 |

) |

|

$ |

(0.76 |

) |

|

$ |

(1.54 |

) |

|

$ |

(2.44 |

) |

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

9,034,016 |

|

|

|

3,004,163 |

|

|

|

5,358,629 |

|

|

|

2,897,568 |

|

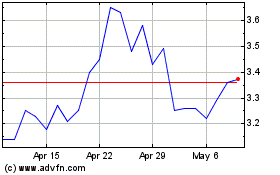

ARCA Biopharma (NASDAQ:ABIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

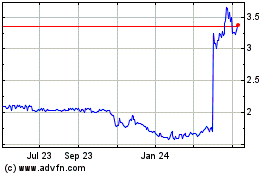

ARCA Biopharma (NASDAQ:ABIO)

Historical Stock Chart

From Apr 2023 to Apr 2024