Current Report Filing (8-k)

November 10 2015 - 1:27PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 10, 2015 (November 4, 2015)

HDS INTERNATIONAL CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-53949

|

26-3988293

|

|

(State or other jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

9272 Olive Boulevard

St. Louis, MO 63132

(Address of principal executive offices)

(401) 400-0028

(Registrant's Telephone Number)

10 Dorrance St., Suite #700, Providence, RI 02003

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

£ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

£ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

£ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

£ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On November 4, 2015, we entered into an Asset Purchase Agreement (the "Agreement") with CMG Holdings, Inc., a Nevada corporation ("CMG"), and SirenGPS, Inc. our controlling shareholder ("Siren") wherein we agreed to purchase certain assets of CMG in consideration of issuing CMG 85,600,000 shares of our Series B Preferred stock and Siren agreed to transfer 14,600,000 shares of our common stock owned by Siren to CMG thereby transferring control of HDS International Corp. to CMG. In addition, CMG is obligated to obtain a commitment to for $300,000. This commitment may be waived by CMG in its sole discretion. Closing of this transaction will take place on November 10, 2015 with the issuance and transfer of the shares aforesaid and CMG transferring the assets to us.

ITEM 7.01 REGULATION FD DISCLOSURE

We announced that on November 4, 2015, we entered into an Asset Purchase Agreement (the "Agreement") with CMG Holdings, Inc., a Nevada corporation ("CMG"), and SirenGPS, Inc. our controlling shareholder ("Siren") wherein we agreed to purchase certain assets of CMG in consideration of issuing CMG 85,600,000 shares of our Series B Preferred stock and Siren agreed to transfer 14,600,000 shares of our common stock owned by Siren to CMG thereby transferring control of HDS International Corp. to CMG. In addition, CMG is obligated to obtain a commitment to for $300,000. This commitment may be waived by CMG in its sole discretion. Closing of this transaction will take place on November 10, 2015 with the issuance and transfer of the shares aforesaid and CMG transferring the assets to us.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

|

Exhibit No.

|

Description of Exhibit

|

| |

|

|

10.1

99.1

|

Asset Purchase Agreement

Press Release

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

HDS International Corp.

|

| |

|

|

|

| |

|

|

|

|

Date:

|

November 10, 2015

|

By:

|

PAUL RAUNER

|

| |

|

Name:

|

Paul Rauner

|

| |

|

Title:

|

President

|

-2-

Exhibit 99.1

HDS International Enters Agreement with CMGO for Good Gaming

ST. LOUIS, MO -- November 9, 2015 -- InvestorsHub NewsWire -- HDS International Corp. (OTC: HDSI), a technology development company, announced today that it has entered into a definitive agreement to acquire Good Gaming from CMG Holdings Group, Inc. (CMGO). CMGO and HDSI have signed an agreement to remove the SirenGPS business from HDSI and to acquire Good Gaming, a majority-owned CMGO subsidiary, into HDSI. The transaction is designed to allow Good Gaming to achieve its potential as a standalone, pure-play cash tournament gaming platform, targeting the over 200 million eSports players and participants worldwide.

A new management team and Board for HDSI will be put in place during a short transition period. Paul Rauner, current CEO and Director of HDSI, will resign his position to complete that transition, with SirenGPS and its employees retaining a small equity ownership in the public entity. As a second step, after this transition period, HDSI will complete an asset purchase of the Good Gaming platform, intellectual property, software code, and other assets. Additionally, CMGO intends to cancel the reverse split recently petitioned by HDSI, and will apply for a new name and ticker change following the completion of the asset purchase later this month.

Departing Chief Executive Officer Paul Rauner explained the transaction saying: We took control of HDSI based on representations from certain finance facilities; commitments to provide the funding our business required to achieve the sort of growth that would support the public company structure. While we were able to achieve significant milestones over the past six months, you simply cannot effectively bring a new business to market without adequate financing. Despite a commitment from our primary funding partner for $600,000 to be invested over a period of six months, we received only $75,000, and a significant portion of that money was paid directly to the vendors that maintain the public vehicle. After deducting payments to maintain HDSIs public company filing obligations and the costs of the change in control, this left approximately $12,500 for operations. Meanwhile our funding partner profited by selling almost 500 million shares through the conversion of aged debt issued by the Company prior to our time with HDSI. Aware of our obligation to HDSIs shareholders, we actively explored every avenue available to create shareholder value including litigation. We are excited that we were able to negotiate a deal with CMGO for Good Gaming. Of the options we considered, Good Gaming represents the greatest potential for HDSI shareholders: a favorable transaction in a really attractive market sector. We are impressed with Good Gamings management team and their prospects and believe that this transaction will mean good things for HDSI and its shareholders.

For additional information about HDSI, please refer to the Companys regulatory filings at www.sec.gov.

Forward-Looking Statements

Statements not historical in nature, are intended, and are hereby identified as, "forward-looking statements". Forward-looking statements may be identified by words including "anticipate," "believe," "intends," "estimates," "expect," and similar expressions. The Company cautions readers that forward-looking statements including, without limitation, those relating to future business prospects are subject to risks and uncertainties that could cause actual results to differ materially from projections, estimates or aspirations, due to factors such as those relating to economic, governmental, technological, and any risks and factors identified from time to time in the Company's reports filed with the SEC.

CONTACT INFORMATION

HDS International Corp.

314-329-5210

info@hdsicorp.com

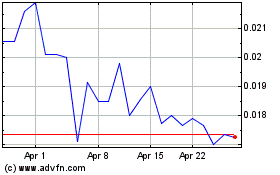

Good Gaming (QB) (USOTC:GMER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Good Gaming (QB) (USOTC:GMER)

Historical Stock Chart

From Apr 2023 to Apr 2024