UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

November 5, 2015

Ekso Bionics Holdings, Inc.

(Exact Name of Registrant as specified in

its charter)

| Nevada |

333-181229 |

99-0367049 |

(State or Other Jurisdiction of

Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

1414 Harbour Way South, Suite 1201

Richmond, California 94804

(Address of principal executive offices,

including zip code)

(203) 723-3576

(Registrant’s telephone number, including

area code)

Not Applicable

(Registrant’s name or former address,

if change since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| o | Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 | Results of Operations and

Financial Condition |

On November 5, 2015, Ekso Bionics Holdings,

Inc. (the “Company”) reported its financial results for the quarter and nine

months ended September 30, 2015. The full text of the press release announcing such results is attached as Exhibit 99.1 to

this Current Report on Form 8-K and is incorporated herein by reference.

The

information contained in this report, including the information contained in Exhibit 99.1, is being furnished and shall not be

deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or incorporated

by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation

language in such filing.

| Item 9.01 | Financial Statements and

Exhibits |

(d) Exhibits

|

Number |

|

Description |

| |

|

| 99.1 |

|

Press Release dated November 5, 2015. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

| |

EKSO BIONICS HOLDINGS, INC. |

|

| |

|

|

| |

|

|

| |

By: |

/s/ Max Scheder-Bieschin |

|

| |

Name: |

Max Scheder-Bieschin |

|

| |

Title: |

Chief Financial Officer |

|

| |

|

|

|

| Dated: November 5, 2015 |

|

|

|

Exhibit 99.1

FOR IMMEDIATE RELEASE

Ekso Bionics Reports Third Quarter 2015

Financial Results

Provides Update on 510(k) Premarket

Notification

RICHMOND, Calif., November 5, 2015 (GLOBE

NEWSWIRE) – Ekso Bionics Holdings, Inc. (OTCQB:EKSO), a robotic exoskeleton company, today reported financial results for

the quarter ended September 30, 2015 as well as recent highlights.

“I am pleased to share the progress

Ekso Bionics continued to make this past quarter, our highest revenue quarter ever. On the medical front, we continue to grow the

number of our multi-unit centers and we see utilization by customers accelerating in the form of steps taken in our Ekso medical

rehabilitation devices,” shared Nathan Harding, chief executive officer and co-founder of Ekso Bionics. “On the able-bodied

front, we continue to win cutting-edge projects with our government partners and we are seeing prospective customers experiencing

quantifiable outcomes from using our industrial exoskeleton prototypes in the field.”

“Our vision, however, is to do more.

We are striving to make exoskeleton use in the hospital and in the home ubiquitous. We are expecting the industrial workplace to

be transformed. This will take time, and this past quarter we kicked off a number of initiatives and made some important changes

to strengthen our path towards commercial, financial and technological success,” added Harding.

THIRD

Quarter and Recent HighlightS

| · | We recognized revenue of $2.9 million

for the third quarter and $6.7 million year-to-date, an increase of 84% and 75% for the same periods in 2014, respectively. |

| · | We shipped a net 12 new units in the third

quarter, plus had three rental units converted to a purchase. At the end of September, we had sold or rented a net total of 156

medical devices to over 100 customers. |

| · | We have recorded over 25,000 patient sessions

with a total of over 33 million steps, an increase of 163% from one year ago. |

| · | We hired Ruediger Hausherr as President

of Europe to lead our expansion into the European, Middle Eastern and African Markets. |

| · | We hired Russ DeLonzor as VP of Operations

to lead our medical engineering, manufacturing and procurement teams. |

| · | We continue to have a premarket notification

submission pending before the U.S. Food and Drug Administration seeking clearance for our medical exoskeleton. We received a letter

from the FDA requesting additional information regarding our clinical data and other information in support of our requested 510(k)

clearance for our medical exoskeleton. |

Third

Quarter 2015 Financial Results

Revenue

For the three months ended September 30, 2015

Medical device revenue increased $0.3 million,

or 39%, as compared to the three months ended September 30, 2014, primarily due to the near doubling of the number of medical device

sales being recognized to revenue during the three months ended September 30, 2015, as compared to the same period in the prior

year. Engineering services revenue increased by $1.0 million, or 128%, as compared to the three months ended September 30, 2014,

primarily due to an overall increase in Ekso Labs projects period over period.

For the nine months ended September 30, 2015

Medical device revenue increased $1.1 million,

or 56%, as compared to the nine months ended September 30, 2014, primarily due to the more than doubling of the number of medical

device sales being recognized to revenue during the nine months ended September 30, 2015, as compared to the same period in the

prior year. Engineering services revenue increased by $1.7 million, or 95%, as compared to the nine months ended September 30,

2014, primarily due to an overall increase in Ekso Labs projects period over period.

Gross Profit

For the three months and nine months ended September 30,

2015

Overall our gross profit remained relatively

unchanged as compared to the three months ended September 30, 2014, and increased $0.4 million or 37%, as compared to the nine

months ended September 30, 2014.

Our medical device segment has experienced

increased service related expenses related to an accelerated maintenance program, field corrections and the implementation of technological

improvements developed subsequent to many of our units being placed into service. We recognize service expense on an as-incurred

basis, which exceeded the increase in associated revenue during the same periods. The Company continues to evaluate this level

of increased cost associated with fleet enhancements and expects increased costs for the next quarter or two.

The decrease in gross profit and margins

for our medical devices was more than offset by improvements in gross profit and margins for our engineering services business

during the three and nine months ended September 30, 2015. The improvement in this segment was driven primarily by a better balance

of higher margin projects compared to the prior year.

Operating Expenses

For the three months ended September 30, 2015

Sales and marketing expenses increased

$0.7 million, or 45%, as compared to the three months ended September 30, 2014, due to an increase in sales and marketing personnel

and related resources, the greatest of which is an increase of $0.3 million in compensation related costs.

Research and development expenses increased

$0.6 million, or 56%, as compared to the three months ended September 30, 2014, primarily due to an increase of $0.5 million in

compensation related expenses as a result of increases in headcount and $0.1 million in development of our industrial business.

General and administrative expenses were

relatively unchanged as compared to the three months ended September 30, 2014.

For the nine months ended September 30, 2015

Sales and marketing expenses increased $1.7 million, or 34%,

as compared to the nine months ended September 30, 2014, due to an increase in sales and marketing personnel, and regulatory and

public relations expenses, the greatest of which is an increase of $0.7 million in compensation related costs.

Research and development expenses increased

$1.9 million, or 73%, as compared to the nine months ended September 30, 2014, primarily due to an increase of $1.5 million in

compensation related expenses as a result of increases in headcount to support our increase in government projects

and $0.3 million in expenses related to the development of our industrial business.

General and administrative expenses were

relatively unchanged as compared to the nine months ended September 30, 2014.

Other Income (Expense), Net

For the three months ended September

30, 2015

Total other income (expenses), net decreased

$15.8 million, as compared to the three months ended September 30, 2014. The decrease was primarily attributable to a non-cash

benefit in the 2014 period relating to outstanding warrants, with no comparable amount in the 2015 period. Due to the price-based

anti-dilution provision in the warrants, the Company was required to classify the warrants as a liability and to adjust their fair

value to market at each measurement period. In November 2014, the holders of a majority of the warrants approved an amendment

to remove the price-based anti-dilution provisions in the warrants. As a result, the warrants are no longer recorded as a liability

effective November 2014 because they met the criteria for equity treatment.

For the nine months ended September

30, 2015

Total other expense, for the nine months

ended September 30, 2015, reflected a decrease of $1.6 million as compared to the

nine months period ended September 30, 2014, primarily due to a $1.2 million

non-cash charge in the 2014 period relating to outstanding warrants, with no comparable amount in the 2015 period. The $1.2 million

of prior year warrant liability charges was attributable to warrants issued in the private placement offering in the first quarter

of 2014. Interest expense decreased by $0.4 million during the nine months ended September 30, 2015, as compared to the prior year

periods due to the repayment of outstanding debt in January 2014.

Net

Loss

The net loss for the three months ended

September 30, 2015 was $5.2 million, or ($0.05) per basic and diluted share, compared to net income of $12.0 million or $0.15 per

basic share and ($0.04) per diluted share for the same period of 2014. The net income in the 2014 period was primarily due to a

non-cash gain of $15.8 million related to warrant liabilities.

The net loss for the nine months period

ended September 30, 2015 was $14.9 million, or ($0.15) per basic and diluted share, compared to a net loss of $13.6 million or

($0.18) per basic and diluted share for the same period of 2014. The net loss in the 2014 period included a $1.2 million non-cash

warrant liability related charge.

Cash

and Cash Equivalents

Since the Company’s inception, we

have incurred recurring net losses and negative cash flows from operations. We incurred net losses of $33.8 million for the year

ended December 31, 2014, and $14.9 million for the nine months ended September 30, 2015. In addition, our operating activities

used $15.0 million for the year ended December 31, 2014, and $13.1 million for the nine months ended September 30, 2015.

Regulatory

Update

By letter dated September 11, 2015, the

US Food and Drug Administration (“FDA”) has requested that the Company provide additional information regarding its

clinical data and other information in support of the Company’s requested 510(k) clearance for the Ekso robotic exoskeleton.

The Company is working diligently to provide the information requested by the FDA, including information pertaining to the Company’s

requested indications for use and the Company’s clinical data supporting the requested indications for use, information pertaining

to mechanical and electromagnetic compatibility testing, electrical safety and software, information pertaining to medical device

reports related to adverse events involving the Ekso robotic exoskeleton, and other requested information.

The Company has up to 180 days from September

11, 2015 to respond to the FDA’s requests for additional information. The Company intends to request a submission issue meeting

with the FDA to be held in advance of the Company’s formal submission of its response to the FDA’s request for additional

information to discuss the Company’s response strategy and seek the FDA’s input on that strategy. Although there is

the possibility that the Company could receive FDA clearance in 2015, we believe that it is much more likely that the Company will

receive a determination from the FDA sometime in 2016. However, if the Company were to decide, or be required, to conduct additional

clinical testing in support of its request for clearance, the Company may decide to withdraw its pending 510(k) notification and

resubmit a 510(k) notification following completion of the additional clinical testing, which could further delay receipt of clearance.

The Company intends to continue marketing

the Ekso robotic exoskeleton under its current Class I registration and listing with its current indications for use until 510(k)

clearance is either granted or denied by the FDA or the Company is otherwise notified by the FDA to cease such activities. If the

FDA disagrees with our decision, we may be required to cease marketing or to recall our products in the U.S. until we obtain clearance

or approval, and we may be subject to regulatory fines or penalties.

Conference

call and webcast details

Ekso Bionics will hold a conference call

and audio webcast to discuss financial results for its third quarter 2015 and provide a general business update on Thursday November

5, 2015, at 4:30pm ET.

Date: November 5, 2015

Time: 4:30pm ET

Listen via Internet: http://eksobionics.equisolvewebcast.com/q3-2015

Toll-free (US and Canada): 877-407-3036

International: 201-378-4919

A webcast replay will be available on the

Ekso Bionics website for 30 days.

About

Ekso Bionics

Since 2005, Ekso Bionics has been pioneering

the field of robotic exoskeletons, or wearable robots, to augment human strength, endurance and mobility. The Company’s first

commercially available product, called the Ekso device, has helped thousands of people with paralysis take millions of steps not

otherwise possible. By designing and creating some of the most forward-thinking and innovative solutions for people looking to

augment human capabilities, Ekso Bionics is helping people rethink current physical limitations and achieve the remarkable.

Ekso Bionics is headquartered in Richmond,

CA and is listed on the OTC QB under the symbol EKSO. To learn more about Ekso Bionics please visit us at www.eksobionics.com

Facebook:www.facebook.com/eksobionics

Twitter:@eksobionics

YouTube: http://www.youtube.com/user/EksoBionics/

Forward-Looking

Statements

Any statements

contained in this press release that do not describe historical facts may constitute forward-looking statements. Forward-looking

statements may include, without limitation, statements regarding (i) the plans and objectives of management for future operations,

including plans or objectives relating to the design, development and commercialization of human exoskeletons, (ii) a projection

of financial results, financial condition, capital expenditures, capital structure or other financial items, (iii) the Company’s

future financial performance and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or

(iii) above. Such forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances

and may not be realized because they are based upon the Company’s current projections, plans, objectives, beliefs, expectations,

estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which the Company

has no control over. Actual results and the timing of certain events and circumstances may differ materially from those described

by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the

inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may

include, without limitation, the Company’s inability to obtain adequate financing to fund the Company’s operations and necessary

to develop or enhance our technology, the significant length of time and resources associated with the development of the Company’s

products, the Company’s failure to achieve broad market acceptance of the Company’s products, the failure of our sales and marketing

organization or partners to market our products effectively, adverse results in future clinical studies of the Company’s medical

device products, the failure to obtain or maintain patent protection for the Company’s technology, failure to obtain or maintain

regulatory approval to market the Company’s medical devices, lack of product diversification, existing or increased competition,

and the Company’s failure to implement the Company’s business plans or strategies. These and other factors are identified and described

in more detail in the Company’s filings with the SEC. The Company does not undertake to update these forward-looking statements.

To learn more about Ekso Bionics please visit us at www.eksobionics.com. The Company

does not undertake to update these forward-looking statements.

- Financial Information

Follows -

###

Media Contact:

Heidi Darling, Director of Marketing Communications

Phone: 510-984-1761 x317

E-mail: hdarling@eksobionics.com

Investor Contact:

Chad Rubin, Senior Vice President

Phone: 646 378-2947

E-mail: crubin@troutgroup.com

Ekso Bionics Holdings, Inc.

Condensed Consolidated Balance Sheets

(in thousands, except share and par value amounts)

| | |

September 30, | | |

December 31, | |

| | |

2015 | | |

2014 | |

| | |

(unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 11,238 | | |

$ | 25,190 | |

| Accounts receivable | |

| 2,185 | | |

| 1,549 | |

| Inventories, net | |

| 1,179 | | |

| 622 | |

| Prepaid expenses and other current assets | |

| 726 | | |

| 388 | |

| Deferred cost of revenue, current | |

| 1,920 | | |

| 1,551 | |

| Total current assets | |

| 17,248 | | |

| 29,300 | |

| Property and equipment, net | |

| 2,399 | | |

| 2,102 | |

| Deferred cost of revenue, non-current portion | |

| 2,424 | | |

| 2,017 | |

| Other assets | |

| 55 | | |

| 55 | |

| Total assets | |

$ | 22,126 | | |

$ | 33,474 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 2,148 | | |

$ | 783 | |

| Accrued liabilities | |

| 2,190 | | |

| 2,378 | |

| Deferred revenues, current portion | |

| 3,839 | | |

| 3,412 | |

| Capital lease obligation, current | |

| 79 | | |

| 41 | |

| Total current liabilities | |

| 8,256 | | |

| 6,614 | |

| Deferred revenues, non-current portion | |

| 4,399 | | |

| 3,895 | |

| Other non-current liabilities | |

| 225 | | |

| 165 | |

| Total liabilities | |

| 12,880 | | |

| 10,674 | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock | |

| 102 | | |

| 102 | |

| Additional paid-in capital | |

| 95,890 | | |

| 94,499 | |

| Accumulated deficit | |

| (86,746 | ) | |

| (71,801 | ) |

| Total stockholders’ equity | |

| 9,246 | | |

| 22,800 | |

| Total liabilities and stockholders’ equity | |

$ | 22,126 | | |

$ | 33,474 | |

Ekso Bionics Holdings, Inc.

Condensed Consolidated Statement of Operations

(in thousands, except share and per share amounts)

(unaudited)

| | |

Three months ended | | |

Nine months ended | |

| | |

September 30, | | |

September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Revenue | |

| | | |

| | | |

| | | |

| | |

| Medical devices | |

$ | 1,095 | | |

$ | 789 | | |

$ | 3,128 | | |

$ | 2,006 | |

| Engineering services | |

| 1,820 | | |

| 799 | | |

| 3,590 | | |

| 1,841 | |

| Total revenue | |

| 2,915 | | |

| 1,588 | | |

| 6,718 | | |

| 3,847 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue | |

| | | |

| | | |

| | | |

| | |

| Medical devices | |

| 1,095 | | |

| 578 | | |

| 2,863 | | |

| 1,410 | |

| Engineering services | |

| 1,352 | | |

| 530 | | |

| 2,482 | | |

| 1,432 | |

| Total cost of revenue | |

| 2,447 | | |

| 1,108 | | |

| 5,345 | | |

| 2,842 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 468 | | |

| 480 | | |

| 1,373 | | |

| 1,005 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing | |

| 2,380 | | |

| 1,642 | | |

| 6,754 | | |

| 5,022 | |

| Research and development | |

| 1,713 | | |

| 1,096 | | |

| 4,438 | | |

| 2,564 | |

| General and administrative | |

| 1,556 | | |

| 1,474 | | |

| 5,090 | | |

| 5,354 | |

| Total operating expenses | |

| 5,649 | | |

| 4,212 | | |

| 16,282 | | |

| 12,940 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (5,181 | ) | |

| (3,732 | ) | |

| (14,909 | ) | |

| (11,935 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (4 | ) | |

| (3 | ) | |

| (10 | ) | |

| (433 | ) |

| Gain (loss) on warrant liability | |

| - | | |

| 15,773 | | |

| - | | |

| (1,206 | ) |

| Interest income | |

| 2 | | |

| 1 | | |

| 9 | | |

| 4 | |

| Other expense, net | |

| (2 | ) | |

| (15 | ) | |

| (35 | ) | |

| (44 | ) |

| Total other income (expense), net | |

| (4 | ) | |

| 15,756 | | |

| (36 | ) | |

| (1,679 | ) |

| Net income (loss) | |

$ | (5,185 | ) | |

$ | 12,024 | | |

$ | (14,945 | ) | |

$ | (13,614 | ) |

| Basic net income (loss) per share | |

$ | (0.05 | ) | |

$ | 0.15 | | |

$ | (0.15 | ) | |

$ | (0.18 | ) |

| Weighted-average shares used in computing basic per share amounts | |

| 102,239,868 | | |

| 78,513,144 | | |

| 102,043,392 | | |

| 74,943,169 | |

| Diluted net loss per share | |

$ | (0.05 | ) | |

$ | (0.04 | ) | |

$ | (0.15 | ) | |

$ | (0.18 | ) |

| Weighted-average shares used in computing diluted per share amounts | |

| 102,239,868 | | |

| 83,336,371 | | |

| 102,043,392 | | |

| 74,943,169 | |

Ekso Bionics Holdings, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | |

Nine months ended | |

| | |

September 30, | |

| | |

2015 | | |

2014 | |

| Net cash used in operating activities | |

$ | (13,082 | ) | |

$ | (12,296 | ) |

| Net cash used in investing activities | |

| (962 | ) | |

| (813 | ) |

| Net cash provided by financing activities | |

| 92 | | |

| 19,480 | |

| Net increase (decrease) in cash | |

| (13,952 | ) | |

| 6,371 | |

| Cash at beginning of the period | |

| 25,190 | | |

| 805 | |

| Cash at end of the period | |

$ | 11,238 | | |

$ | 7,176 | |

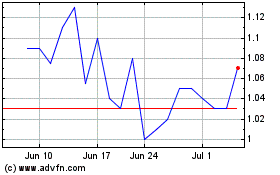

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Apr 2023 to Apr 2024