UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) November 3, 2015

BLOOMIN’ BRANDS, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 001-35625 | 20-8023465 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

2202 North West Shore Boulevard, Suite 500, Tampa, Florida 33607

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (813) 282-1225

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On November 3, 2015, Bloomin’ Brands, Inc. issued a press release reporting its financial results for the thirteen weeks ended September 27, 2015. A copy of the release is attached as Exhibit 99.1.

The information contained in this report, including the exhibit attached hereto, is being furnished and shall not be deemed “filed” for any purpose, and shall not be deemed incorporated by reference in any document whether or not filed under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, regardless of any general incorporation language in any such document.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

| | | |

| Exhibit Number | | Description |

| | | |

| 99.1 | | Press Release of Bloomin’ Brands, Inc. dated November 3, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | BLOOMIN’ BRANDS, INC. |

| | | (Registrant) |

| | | |

Date: | November 3, 2015 | By: | /s/ David J. Deno |

| | | David J. Deno |

| | | Executive Vice President and Chief Financial and Administrative Officer (Principal Financial and Accounting Officer) |

|

| | | | |

| | NEWS | | Exhibit 99.1 |

| | | |

| Chris Meyer | | |

| Group Vice President, IR & Finance | | |

| (813) 830-5311 | | |

Bloomin’ Brands Announces 2015 Third Quarter Adjusted Diluted EPS of $0.15 and Diluted EPS of $0.13;

Reaffirms 2015 Guidance for Adjusted Diluted EPS of At Least $1.27;

Repurchases $60 Million of Common Stock in the Quarter;

Declares Quarterly Dividend of $0.06 a Share

TAMPA, Fla., November 3, 2015 - Bloomin’ Brands, Inc. (Nasdaq:BLMN) today reported results for the third quarter (“Q3 2015”) ended September 27, 2015 compared to the third quarter (“Q3 2014”) ended September 28, 2014.

Results for Q3 2015 include the following:

| |

• | Comparable sales for Outback Steakhouse in Brazil and Korea increased 6.1% and 6.0%, respectively |

| |

• | Comparable sales for Company-owned U.S. concepts declined 1.3% |

| |

• | The Company opened 10 new restaurants including six International restaurants |

| |

• | Adjusted restaurant margin was 14.5% versus 13.8% in Q3 2014 and U.S. GAAP restaurant margin was 14.8% versus 13.8% in Q3 2014 |

| |

• | The Company repurchased approximately 2.9 million shares of its common stock for $60 million in Q3 2015 for a total of approximately 7.0 million shares for $160 million year-to-date |

Adjusted Diluted EPS and Diluted EPS

The following table reconciles Adjusted diluted earnings per share to Diluted earnings per share for the periods as indicated below.

|

| | | | | | | | | | | |

| Q3 2015 | | Q3 2014 | | CHANGE |

Adjusted diluted earnings per share | $ | 0.15 |

| | $ | 0.10 |

| | $ | 0.05 |

|

Adjustments | (0.02 | ) | | (0.19 | ) | | 0.17 |

|

Diluted earnings (loss) per share | $ | 0.13 |

| | $ | (0.09 | ) | | $ | 0.22 |

|

| | | | | |

____________________

See Non-GAAP Measures later in this release.

CEO Comments

“Our third quarter results position us well to deliver on our EPS goals for the year. Our International business continues to deliver strong performance and our ongoing productivity efforts led to 70 basis points of restaurant margin expansion in the quarter,” said Elizabeth Smith, CEO. “We knew that our back half trends would be challenged given the high year ago base; however, our marketing programs did not break through as expected. We are preparing for 2016 with significant innovation driven platforms and new levers to drive comp sales.”

Third Quarter Financial Results

The following summarizes the Company’s results for Q3 2015 and Q3 2014:

|

| | | | | | | | | | |

(dollars in millions) | Q3 2015 | | Q3 2014 | | % Change |

Total revenues | $ | 1,026.7 |

| | $ | 1,065.5 |

| | (3.6 | )% |

| | | | | |

Adjusted restaurant level operating margin | 14.5 | % | | 13.8 | % | | 0.7 | % |

U.S. GAAP restaurant level operating margin | 14.8 | % | | 13.8 | % | | 1.0 | % |

| | | | | |

Adjusted operating income margin | 4.0 | % | | 3.2 | % | | 0.8 | % |

U.S. GAAP operating income margin | 3.8 | % | | (0.1 | )% | | 3.9 | % |

| |

• | The decrease in Total revenues was primarily due to the effect of foreign currency translation, partially offset by the net benefit of new restaurant openings and closings. |

| |

• | The increases in Adjusted restaurant-level operating margin and Adjusted operating income margin were primarily due to productivity savings and increased efficiencies in advertising expenses. These increases were partially offset by commodity and wage inflation. |

| |

• | The difference between Adjusted and U.S. GAAP restaurant-level operating margins in Q3 2015 was due to the favorable resolution of a payroll tax audit contingency. |

| |

• | The increase in U.S. GAAP operating income margin in Q3 2015 was primarily due to the lapping of costs related to our International Restaurant Closure Initiative and impairments related to the decision to sell our corporate aircraft and Roy’s. |

Third Quarter Comparable Restaurant Sales

|

| | | |

THIRTEEN WEEKS ENDED SEPTEMBER 27, 2015 | | COMPANY- OWNED |

Comparable restaurant sales (stores open 18 months or more) (1) (2): | | |

U.S. | | |

Outback Steakhouse | | 0.1 | % |

Carrabba’s Italian Grill | | (2.0 | )% |

Bonefish Grill | | (6.1 | )% |

Fleming’s Prime Steakhouse & Wine Bar | | (0.6 | )% |

Combined U.S. | | (1.3 | )% |

| | |

International | | |

Outback Steakhouse - Brazil | | 6.1 | % |

Outback Steakhouse - South Korea | | 6.0 | % |

_________________

| |

(1) | Comparable restaurant sales exclude the effect of fluctuations in foreign currency rates. |

| |

(2) | Relocated international restaurants closed more than 30 days and relocated U.S. restaurants closed more than 60 days are excluded from comparable restaurant sales until at least 18 months after reopening. |

U.S. Segment Operating Results

|

| | | | | | | | | | |

(dollars in millions) | Q3 2015 | | Q3 2014 | | % Change |

U.S. | | | | | |

Total revenues | $ | 902.5 |

| | $ | 915.4 |

| | (1.4 | )% |

| | | | | |

Adjusted restaurant-level operating margin | 13.5 | % | | 13.5 | % | | — | % |

U.S. GAAP restaurant-level operating margin | 13.5 | % | | 13.5 | % | | — | % |

| | | | | |

Adjusted operating income margin | 7.0 | % | | 6.6 | % | | 0.4 | % |

U.S. GAAP operating income margin | 6.7 | % | | 6.0 | % | | 0.7 | % |

| |

• | The increases in Adjusted and U.S. GAAP operating income margin were primarily due to lower headcount due to the Company’s organizational realignment in 2014. The increase in U.S. GAAP operating income margin was also due to lower impairments. |

| |

• | The difference between Adjusted and U.S. GAAP operating income margins in Q3 2015 was primarily due to restaurant relocations and remodel costs. |

International Segment Operating Results

|

| | | | | | | | | | |

(dollars in millions) | Q3 2015 | | Q3 2014 | | % Change |

International | | | | | |

Total revenues | $ | 124.3 |

| | $ | 150.0 |

| | (17.2 | )% |

| | | | | |

Adjusted restaurant-level operating margin | 18.1 | % | | 16.6 | % | | 1.5 | % |

U.S. GAAP restaurant-level operating margin | 18.0 | % | | 16.6 | % | | 1.4 | % |

| | | | | |

Adjusted operating income margin | 8.9 | % | | 6.8 | % | | 2.1 | % |

U.S. GAAP operating income margin | 7.9 | % | | (2.0 | )% | | 9.9 | % |

| |

• | The decrease in Total revenues is primarily due to foreign currency translation, primarily in Brazil, and the impact of the International Restaurant Closure Initiative. This was partially offset by new restaurant openings and an increase in comparable sales in Brazil and South Korea. |

| |

• | The increase in Adjusted and U.S. GAAP restaurant-level operating margin was primarily due to higher average unit volumes and productivity savings partially offset by higher commodity and wage inflation. |

| |

• | The increase in Adjusted operating income margin was primarily due to higher average unit volumes. |

| |

• | The increase in U.S. GAAP operating income margin was driven by higher restaurant-level operating margin and the lapping of expenses related to our International Restaurant Closure Initiative. |

| |

• | Foreign currency translation negatively impacted adjusted income from operations by $4.4 million. |

Unallocated Corporate Operating Expense

Certain expenses are managed centrally and are not allocated to the U.S. or International segment. In Q3 2015, unallocated expenses at the restaurant operating level were $8.9 million lower than Q3 2014 primarily due to lower general liability expenses and the favorable resolution of a payroll tax audit.

System-wide Development

The following summarizes our system-wide development for the thirteen weeks as of September 27, 2015:

|

| | | | | | | | | | | |

| JUNE 28, 2015 | | OPENINGS | | CLOSURES | | SEPTEMBER 27, 2015 |

U.S.: | | | | | | | |

Outback Steakhouse—Company-owned | 649 |

| | 2 |

| | (2 | ) | | 649 |

|

Carrabba’s Italian Grill—Franchised | 2 |

| | 1 |

| | — |

| | 3 |

|

Bonefish Grill—Company-owned | 207 |

| | 1 |

| | — |

| | 208 |

|

| | | | | | | |

International: | | | | | | | |

Company-owned | | | | | | | |

Outback Steakhouse—South Korea | 76 |

| | — |

| | (1 | ) | | 75 |

|

Outback Steakhouse—Brazil | 69 |

| | 2 |

| | — |

| | 71 |

|

Other | 12 |

| | 4 |

| | (2 | ) | | 14 |

|

System-wide development | | | 10 |

| | (5 | ) | | |

Dividend Declaration and Share Repurchases

The Company’s Board of Directors declared a quarterly cash dividend of $0.06 per share to be paid on November 25, 2015 to all stockholders of record as of the close of business on November 13, 2015.

On August 3, 2015, the Company’s Board of Directors approved a new $100.0 million share repurchase program. The authorization will expire on February 3, 2017. During Q3 2015, the Company repurchased $60.0 million of outstanding stock under the program. As of September 27, 2015, $40.0 million remains authorized under the share repurchase program.

Fiscal 2015 Financial Outlook

The Company is reaffirming its full-year 2015 outlook on adjusted diluted earnings per share of at least $1.27.

The Company has revised guidance on the following items:

| |

• | Blended U.S. comparable restaurant sales growth is expected to be 0.5% to 1.0% versus prior guidance of “approximately 1.5%”. |

| |

• | Total Revenues are expected to be approximately $4.37 billion versus prior guidance of approximately $4.43 billion. |

All other elements of the guidance included in the August 4, 2015 release remain intact.

Selected Preliminary 2016 Financial Outlook

Below are the Company’s current expectations for the full-year 2016:

| |

• | An increase in Adjusted EPS within the Company’s long-term target of 10% - 15% growth |

| |

• | Positive comparable U.S. restaurant sales |

| |

• | An increase in Adjusted operating margin |

| |

• | Commodity inflation is expected to be approximately 1% |

| |

• | Foreign exchange headwinds of approximately $12 million dollars, primarily attributable to the depreciation of the Brazilian real. Most of this impact will occur in the first half of 2016. |

The Company will provide detailed 2016 guidance on the fourth quarter earnings call in February 2016.

Non-GAAP Measures

In addition to the results provided in accordance with U.S. GAAP, this press release and related tables include certain non-GAAP measures, which present operating results on an adjusted basis. These are supplemental measures of performance that are not required by or presented in accordance with U.S. GAAP and include the following: (i) Adjusted restaurant-level operating margin, (ii) Adjusted income from operations and the corresponding margin, (iii) Adjusted net income, (iv) Adjusted diluted earnings per share, (v) Adjusted segment restaurant-level operating margin and (vi) Adjusted segment income from operations and the corresponding margin.

Although we believe these non-GAAP measures enhance investors’ understanding of our business and performance, these non-GAAP financial measures are not intended to replace U.S. GAAP financial measures. These metrics are not necessarily comparable to similarly titled measures used by other companies. The use of non-GAAP financial measures permits investors to assess the operating performance of our business relative to our performance based on U.S. GAAP results and relative to other companies within the restaurant industry by isolating the effects of certain items that vary from period to period without correlation to core operating performance or that vary widely among similar companies. However, our inclusion of these adjusted measures should not be construed as an indication that our future results will be unaffected by unusual or infrequent items or that the items for which we have made adjustments are unusual or infrequent. We believe that the disclosure of these non-GAAP measures is useful to investors as they form the basis for how our management team and Board of Directors evaluate our operating performance, allocate resources and establish employee incentive plans.

For reconciliations of the non-GAAP measures used in this release, refer to tables four, five, six and seven included later in this release.

Conference Call

The Company will host a conference call today, November 3, 2015 at 9:00 AM ET. The conference call can be accessed live over the telephone by dialing (888) 523-1225, or (719) 325-2323 for international participants. A replay will be available beginning two hours after the call and can be accessed by dialing (877) 870-5176 or (858) 384-5517 for international callers; the conference ID is 910273. The replay will be available through Tuesday, November 10, 2015. The call will also be webcast live from the Company’s website at http://www.bloominbrands.com under the Investors section. A replay of this webcast will be available on the Company’s website after the call.

About Bloomin’ Brands, Inc.

Bloomin’ Brands, Inc. is one of the largest casual dining restaurant companies in the world with a portfolio of leading, differentiated restaurant concepts. The Company has four founder-inspired brands: Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill and Fleming's Prime Steakhouse & Wine Bar. The Company operates approximately 1,500 restaurants in 48 states, Puerto Rico, Guam and 22 countries, some of which are franchise locations. For more information, please visit bloominbrands.com.

Forward-Looking Statements

Certain statements contained herein, including statements under the headings “CEO Comments,” “Fiscal 2015 Financial Outlook,” and “Selected Preliminary 2016 Financial Outlook,” are not based on historical fact and are “forward-looking statements” within the meaning of applicable securities laws. Generally, these statements can be identified by the use of words such as “guidance,” “believes,” “estimates,” “anticipates,” “expects,” “on track,” “feels,” “forecasts,” “seeks,” “projects,” “intends,” “plans,” “may,” “will,” “should,” “could,” “would” and similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include all matters that are not historical facts. By their nature, forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from the Company’s forward-looking statements. These risks and uncertainties include, but are not limited to: local, regional, national and international economic conditions; consumer confidence and spending patterns; challenges associated with new restaurant development; our ability to preserve the value of our brands; price and availability of commodities; weather, acts of God and other disasters; the seasonality of the Company’s business; increases in unemployment rates and taxes; increases in labor costs; competition; changes in patterns of consumer traffic, consumer tastes and dietary habits; consumer reaction to public health and food safety issues; government actions and policies; foreign currency exchange rates; interruption or breach of our systems or loss of consumer or employee information; interest rate changes, compliance with debt covenants and the Company’s ability to make debt payments; the cost and availability of credit; and our ability to continue to pay dividends. Further information on potential factors that could affect the financial results of the Company and its forward-looking statements is included in its most recent Form 10-K filed with the Securities and Exchange Commission. The Company assumes no obligation to update any forward-looking statement, except as may be required by law. These forward-looking statements speak only as of the date of this release. All forward-looking statements are qualified in their entirety by this cautionary statement.

Note: Numerical figures included in this release have been subject to rounding adjustments.

|

| | | | | | | | | | | | | | | |

TABLE ONE |

BLOOMIN’ BRANDS, INC. |

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) |

(UNAUDITED) |

| THIRTEEN WEEKS ENDED | | THIRTY-NINE WEEKS ENDED |

(dollars in thousands, except per share data) | SEPTEMBER 27, 2015 | | SEPTEMBER 28, 2014 | | SEPTEMBER 27, 2015 | | SEPTEMBER 28, 2014 |

Revenues | | | | | | | |

Restaurant sales | $ | 1,020,131 |

| | $ | 1,059,217 |

| | $ | 3,307,700 |

| | $ | 3,314,179 |

|

Other revenues | 6,590 |

| | 6,237 |

| | 20,677 |

| | 20,046 |

|

Total revenues | 1,026,721 |

| | 1,065,454 |

| | 3,328,377 |

| | 3,334,225 |

|

Costs and expenses | |

| | |

| | |

| | |

Cost of sales | 339,000 |

| | 348,315 |

| | 1,083,923 |

| | 1,080,785 |

|

Labor and other related | 286,628 |

| | 295,532 |

| | 911,653 |

| | 909,422 |

|

Other restaurant operating | 243,609 |

| | 269,480 |

| | 761,928 |

| | 791,277 |

|

Depreciation and amortization | 47,455 |

| | 48,750 |

| | 141,316 |

| | 143,542 |

|

General and administrative | 69,623 |

| | 75,417 |

| | 218,832 |

| | 221,733 |

|

Provision for impaired assets and restaurant closings | 1,682 |

| | 29,081 |

| | 11,715 |

| | 36,170 |

|

Total costs and expenses | 987,997 |

| | 1,066,575 |

| | 3,129,367 |

| | 3,182,929 |

|

Income (loss) from operations | 38,724 |

| | (1,121 | ) | | 199,010 |

| | 151,296 |

|

Loss on extinguishment and modification of debt | — |

| | — |

| | (2,638 | ) | | (11,092 | ) |

Other (expense) income, net | (266 | ) | | 18 |

| | (1,356 | ) | | 171 |

|

Interest expense, net | (14,851 | ) | | (13,837 | ) | | (40,916 | ) | | (45,544 | ) |

Income (loss) before provision (benefit) for income taxes | 23,607 |

| | (14,940 | ) | | 154,100 |

| | 94,831 |

|

Provision (benefit) for income taxes | 6,202 |

| | (4,110 | ) | | 41,557 |

| | 22,839 |

|

Net income (loss) | 17,405 |

| | (10,830 | ) | | 112,543 |

| | 71,992 |

|

Less: net income attributable to noncontrolling interests | 594 |

| | 613 |

| | 2,918 |

| | 3,311 |

|

Net income (loss) attributable to Bloomin’ Brands | $ | 16,811 |

| | $ | (11,443 | ) | | $ | 109,625 |

| | $ | 68,681 |

|

| | | | | | | |

Net income (loss) | $ | 17,405 |

| | $ | (10,830 | ) | | $ | 112,543 |

| | $ | 71,992 |

|

Other comprehensive (loss) income: | | | | | | | |

Foreign currency translation adjustment | (34,157 | ) | | (2,754 | ) | | (85,801 | ) | | 10,969 |

|

Unrealized losses on derivatives, net of tax | (3,884 | ) | | (486 | ) | | (7,052 | ) | | (486 | ) |

Reclassification of adjustment for loss on derivatives included in net income, net of tax | 1,115 |

| | — |

| | 1,115 |

| | — |

|

Comprehensive (loss) income | (19,521 | ) | | (14,070 | ) | | 20,805 |

| | 82,475 |

|

Less: comprehensive (loss) income attributable to noncontrolling interests | (11,380 | ) | | 613 |

| | (9,056 | ) | | 3,311 |

|

Comprehensive (loss) income attributable to Bloomin’ Brands | $ | (8,141 | ) | | $ | (14,683 | ) | | $ | 29,861 |

| | $ | 79,164 |

|

| | | | | | | |

Earnings (loss) per share: | | | | | | | |

Basic | $ | 0.14 |

| | $ | (0.09 | ) | | $ | 0.89 |

| | $ | 0.55 |

|

Diluted | $ | 0.13 |

| | $ | (0.09 | ) | | $ | 0.87 |

| | $ | 0.54 |

|

Weighted average common shares outstanding: | | | | | | | |

Basic | 121,567 |

| | 125,289 |

| | 123,337 |

| | 125,023 |

|

Diluted | 124,733 |

| | 125,289 |

| | 126,610 |

| | 128,148 |

|

| | | | | | | |

Cash dividends declared per common share | $ | 0.06 |

| | $ | — |

| | $ | 0.18 |

| | $ | — |

|

|

| | | | | | | | | | | | | | | |

TABLE TWO |

BLOOMIN’ BRANDS, INC. |

SEGMENT RESULTS |

(UNAUDITED) |

(dollars in thousands) | THIRTEEN WEEKS ENDED | | THIRTY-NINE WEEKS ENDED |

U.S. Segment | SEPTEMBER 27, 2015 | | SEPTEMBER 28, 2014 | | SEPTEMBER 27, 2015 | | SEPTEMBER 28, 2014 |

Revenues | | | | | | | |

Restaurant sales | $ | 897,280 |

| | $ | 910,482 |

| | $ | 2,930,644 |

| | $ | 2,876,965 |

|

Other revenues | 5,173 |

| | 4,953 |

| | 16,801 |

| | 16,139 |

|

Total revenues | $ | 902,453 |

| | $ | 915,435 |

| | $ | 2,947,445 |

| | $ | 2,893,104 |

|

Restaurant-level operating margin | 13.5 | % | | 13.5 | % | | 15.8 | % | | 15.5 | % |

Income from operations | $ | 60,891 |

| | $ | 54,734 |

| | $ | 281,564 |

| | $ | 242,903 |

|

Operating income margin | 6.7 | % | | 6.0 | % | | 9.6 | % | | 8.4 | % |

International Segment | |

Revenues | | | | | | | |

Restaurant sales | $ | 122,851 |

| | $ | 148,735 |

| | $ | 377,056 |

| | $ | 437,214 |

|

Other revenues | 1,417 |

| | 1,284 |

| | 3,876 |

| | 3,907 |

|

Total revenues | $ | 124,268 |

| | $ | 150,019 |

| | $ | 380,932 |

| | $ | 441,121 |

|

Restaurant-level operating margin | 18.0 | % | | 16.6 | % | | 19.0 | % | | 17.9 | % |

Income (loss) from operations | $ | 9,770 |

| | $ | (2,968 | ) | | $ | 24,376 |

| | $ | 21,539 |

|

Operating income (loss) margin | 7.9 | % | | (2.0 | )% | | 6.4 | % | | 4.9 | % |

Reconciliation of Segment Income (Loss) from Operations to Consolidated Income (Loss) from Operations | | | | | | | |

Segment income (loss) from operations | | | | | | | |

U.S. | $ | 60,891 |

| | $ | 54,734 |

| | $ | 281,564 |

| | $ | 242,903 |

|

International | 9,770 |

| | (2,968 | ) | | 24,376 |

| | 21,539 |

|

Total segment income from operations | 70,661 |

| | 51,766 |

| | 305,940 |

| | 264,442 |

|

Unallocated corporate operating expense - Cost of sales, Labor and other related and Other restaurant operating | 7,306 |

| | (1,641 | ) | | 14,995 |

| | 9,681 |

|

Unallocated corporate operating expense - Depreciation and amortization and General and administrative | (39,243 | ) | | (51,246 | ) | | (121,925 | ) | | (122,827 | ) |

Unallocated corporate operating expense | (31,937 | ) | | (52,887 | ) | | (106,930 | ) | | (113,146 | ) |

Total income (loss) from operations | $ | 38,724 |

| | $ | (1,121 | ) | | $ | 199,010 |

| | $ | 151,296 |

|

|

| | | | | | | |

TABLE THREE |

BLOOMIN’ BRANDS, INC. |

SUPPLEMENTAL BALANCE SHEET INFORMATION |

(UNAUDITED) |

(dollars in thousands) | SEPTEMBER 27, 2015 | | DECEMBER 28, 2014 |

Cash and cash equivalents (1) | $ | 135,590 |

| | $ | 165,744 |

|

Net working capital (deficit) (2) | $ | (211,966 | ) | | $ | (239,559 | ) |

Total assets | $ | 3,093,187 |

| | $ | 3,344,286 |

|

Total debt, net | $ | 1,399,673 |

| | $ | 1,315,843 |

|

Total stockholders’ equity | $ | 417,518 |

| | $ | 556,449 |

|

_________________

| |

(1) | Excludes restricted cash. |

| |

(2) | The Company has, and in the future may continue to have, negative working capital balances (as is common for many restaurant companies). The Company operates successfully with negative working capital because cash collected on Restaurant sales is typically received before payment is due on its current liabilities and its inventory turnover rates require relatively low investment in inventories. Additionally, ongoing cash flows from restaurant operations and gift card sales are used to service debt obligations and to make capital expenditures. |

|

| | | | | | | | | | | | | | |

TABLE FOUR |

BLOOMIN’ BRANDS, INC. |

RESTAURANT-LEVEL OPERATING MARGIN NON-GAAP RECONCILIATION |

(UNAUDITED) |

| THIRTEEN WEEKS ENDED | | (UNFAVORABLE) FAVORABLE CHANGE IN ADJUSTED |

| SEPTEMBER 27, 2015 | | SEPTEMBER 28, 2014 | |

| U.S. GAAP | | ADJUSTED (1) | | U.S. GAAP | | ADJUSTED (2) | | QUARTER TO DATE |

Restaurant sales | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | |

| | | | | | | | | |

Cost of sales | 33.2 | % | | 33.2 | % | | 32.9 | % | | 32.9 | % | | (0.3 | )% |

Labor and other related | 28.1 | % | | 28.4 | % | | 27.9 | % | | 27.9 | % | | (0.5 | )% |

Other restaurant operating | 23.9 | % | | 23.9 | % | | 25.4 | % | | 25.4 | % | | 1.5 | % |

| | | | | | | | | |

Restaurant-level operating margin | 14.8 | % | | 14.5 | % | | 13.8 | % | | 13.8 | % | | 0.7 | % |

| | | | | | | | | |

| THIRTY-NINE WEEKS ENDED | | (UNFAVORABLE) FAVORABLE CHANGE IN ADJUSTED |

| SEPTEMBER 27, 2015 | | SEPTEMBER 28, 2014 | |

| U.S. GAAP | | ADJUSTED (1) | | U.S. GAAP | | ADJUSTED (3) | | YEAR TO DATE |

Restaurant sales | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | |

| | | | | | | | | |

Cost of sales | 32.8 | % | | 32.8 | % | | 32.6 | % | | 32.6 | % | | (0.2 | )% |

Labor and other related | 27.6 | % | | 27.7 | % | | 27.4 | % | | 27.4 | % | | (0.3 | )% |

Other restaurant operating | 23.0 | % | | 23.0 | % | | 23.9 | % | | 23.9 | % | | 0.9 | % |

| | | | | | | | | |

Restaurant-level operating margin | 16.6 | % | | 16.5 | % | | 16.1 | % | | 16.0 | % | | 0.5 | % |

_________________

| |

(1) | Includes adjustments for payroll tax audit contingencies of $2.9 million and $5.6 million for the thirteen and thirty-nine weeks ended September 27, 2015, respectively, which were recorded in Labor and other related. |

| |

(2) | No adjustments impacted Restaurant-level operating margin during the thirteen weeks ended September 28, 2014. |

| |

(3) | Includes an adjustment for the deferred rent liability write-off associated with the Domestic Restaurant Closure Initiative, which was recorded in Other restaurant operating during the thirty-nine weeks ended September 28, 2014. |

|

| | | | | | | | | | | | | | |

TABLE FIVE |

BLOOMIN’ BRANDS, INC. |

SEGMENT RESTAURANT-LEVEL OPERATING MARGIN NON-GAAP RECONCILIATION |

(UNAUDITED) |

| THIRTEEN WEEKS ENDED | | (UNFAVORABLE) FAVORABLE CHANGE IN ADJUSTED |

| SEPTEMBER 27, 2015 | | SEPTEMBER 28, 2014 | |

Restaurant-level operating margin: | U.S. GAAP | | ADJUSTED | | U.S. GAAP | | ADJUSTED | | QUARTER TO DATE |

U.S. | 13.5 | % | | 13.5 | % | | 13.5 | % | | 13.5 | % | | — | % |

International (1) | 18.0 | % | | 18.1 | % | | 16.6 | % | | 16.6 | % | | 1.5 | % |

| | | | | | | | | |

| THIRTY-NINE WEEKS ENDED | | (UNFAVORABLE) FAVORABLE CHANGE IN ADJUSTED |

| SEPTEMBER 27, 2015 | | SEPTEMBER 28, 2014 | |

Restaurant-level operating margin: | U.S. GAAP | | ADJUSTED | | U.S. GAAP | | ADJUSTED | | YEAR TO DATE |

U.S. (2) | 15.8 | % | | 15.8 | % | | 15.5 | % | | 15.4 | % | | 0.4 | % |

International (1) | 19.0 | % | | 19.0 | % | | 17.9 | % | | 18.0 | % | | 1.0 | % |

_________________

| |

(1) | Includes adjustments of $0.1 million of Brazil non-cash intangible amortization for the thirteen weeks ended September 27, 2015 and September 28, 2014 and $0.2 million and $0.3 million for the thirty-nine weeks ended September 27, 2015 and September 28, 2014, respectively. |

| |

(2) | The thirty-nine weeks ended September 28, 2014 includes an adjustment for the write-off of $2.1 million of deferred rent liabilities associated with the Domestic Restaurant Closure Initiative. |

|

| | | | | | | | | | | | | | | |

TABLE SIX |

BLOOMIN’ BRANDS, INC. |

INCOME FROM OPERATIONS, NET INCOME AND DILUTED EARNINGS PER SHARE NON-GAAP RECONCILIATION |

(UNAUDITED) |

| THIRTEEN WEEKS ENDED | | THIRTY-NINE WEEKS ENDED |

(in thousands, except per share data) | SEPTEMBER 27, 2015 | | SEPTEMBER 28, 2014 | | SEPTEMBER 27, 2015 | | SEPTEMBER 28, 2014 |

Income (loss) from operations | $ | 38,724 |

| | $ | (1,121 | ) | | $ | 199,010 |

| | $ | 151,296 |

|

Operating income (loss) margin | 3.8 | % | | (0.1 | )% | | 6.0 | % | | 4.5 | % |

Adjustments: | | | | | | | |

Restaurant impairments and closing costs (1) | 185 |

| | 11,573 |

| | 8,992 |

| | 16,502 |

|

Payroll tax audit contingency (2) | (2,916 | ) | | — |

| | (5,587 | ) | | — |

|

Purchased intangibles amortization (3) | 1,047 |

| | 1,545 |

| | 3,453 |

| | 4,535 |

|

Restaurant relocations, remodels and related costs (4) | 1,872 |

| | — |

| | 3,163 |

| | — |

|

Asset impairments and related costs (5) | — |

| | 16,952 |

| | 746 |

| | 16,952 |

|

Transaction-related expenses (6) | 750 |

| | — |

| | 1,065 |

| | 1,118 |

|

Legal and contingent matters (7) | 1,239 |

| | — |

| | 1,239 |

| | — |

|

Severance (8) | — |

| | 5,362 |

| | — |

| | 5,362 |

|

Total income from operations adjustments | 2,177 |

| | 35,432 |

| | 13,071 |

| | 44,469 |

|

Adjusted income from operations | $ | 40,901 |

| | $ | 34,311 |

| | $ | 212,081 |

| | $ | 195,765 |

|

Adjusted operating income margin | 4.0 | % | | 3.2 | % | | 6.4 | % | | 5.9 | % |

| | | | | | | |

Net income (loss) attributable to Bloomin’ Brands | $ | 16,811 |

| | $ | (11,443 | ) | | $ | 109,625 |

| | $ | 68,681 |

|

Adjustments: | | | | | | | |

Income from operations adjustments | 2,177 |

| | 35,432 |

| | 13,071 |

| | 44,469 |

|

Loss on disposal of business and disposal of assets (9) | 298 |

| | — |

| | 1,328 |

| | — |

|

Loss on extinguishment and modification of debt (10) | — |

| | — |

| | 2,638 |

| | 11,092 |

|

Total adjustments, before income taxes | 2,475 |

| | 35,432 |

| | 17,037 |

| | 55,561 |

|

Adjustment to provision for income taxes (11) | (665 | ) | | (11,360 | ) | | (3,245 | ) | | (18,902 | ) |

Net adjustments | 1,810 |

| | 24,072 |

| | 13,792 |

| | 36,659 |

|

Adjusted net income | $ | 18,621 |

| | $ | 12,629 |

| | $ | 123,417 |

| | $ | 105,340 |

|

| | | | | | | |

Diluted earnings (loss) per share | $ | 0.13 |

| | $ | (0.09 | ) | | $ | 0.87 |

| | $ | 0.54 |

|

Adjusted diluted earnings per share | $ | 0.15 |

| | $ | 0.10 |

| | $ | 0.97 |

| | $ | 0.82 |

|

| | | | | | | |

Basic weighted average common shares outstanding | 121,567 |

| | 125,289 |

| | 123,337 |

| | 125,023 |

|

Diluted weighted average common shares outstanding (12) | 124,733 |

| | 128,201 |

| | 126,610 |

| | 128,148 |

|

_________________

| |

(1) | Represents expenses incurred for the International and Domestic Restaurant Closure Initiatives. |

| |

(2) | Relates to a payroll tax audit contingency adjustment, for the employer’s share of FICA taxes related to cash tips allegedly received and unreported by our employees during calendar years 2011 and 2012, which is recorded in Labor and other related expenses. In addition, a deferred income tax adjustment has been recorded for the allowable income tax credits for the employer’s share of FICA taxes expected to be paid, which is included in Provision (benefit) for income taxes and offsets the adjustment to Labor and other related expenses. As a result, there is no impact to Net income from this adjustment. |

| |

(3) | Represents non-cash intangible amortization recorded as a result of the acquisition of our Brazil operations. |

| |

(4) | Represents asset impairment charges and accelerated depreciation incurred in connection with our relocation and remodel programs. |

| |

(5) | Represents asset impairment charges and related costs associated with our decision to sell the Roy’s concept and corporate aircraft. |

| |

(6) | Relates primarily to costs incurred with the secondary offerings of our common stock in March 2015 and March 2014, respectively, and other transaction costs. |

| |

(7) | Fees and expenses related to certain legal and contingent matters, including the Cardoza litigation. |

| |

(8) | Relates to severance expense incurred as a result of our organizational realignment. |

| |

(9) | Primarily represents the sale of our Roy’s business. |

| |

(10) | Relates to the refinancing of our Senior Secured Credit Facility in March 2015 and May 2014, respectively. |

| |

(11) | Income tax effect of adjustments for the thirteen and thirty-nine weeks ended September 27, 2015 and September 28, 2014, respectively, are calculated based on the statutory rate applicable to jurisdictions in which the above non-GAAP adjustments relate. Additionally, for the thirteen and thirty-nine weeks ended September 27, 2015, a deferred income tax adjustment has been recorded for the allowable income tax credits for the employer’s share of FICA taxes expected to be paid. See footnote 2 to this table. |

| |

(12) | Due to the net loss, the effect of dilutive securities was excluded from the calculation of diluted (loss) earnings per share for the thirteen weeks ended September 28, 2014. For adjusted diluted earnings per share, stock options of 2,912 are included in the dilutive calculation. |

Following is a summary of the financial statement line item classification of the net income adjustments:

|

| | | | | | | | | | | | | | | |

| THIRTEEN WEEKS ENDED | | THIRTY-NINE WEEKS ENDED |

(dollars in thousands) | SEPTEMBER 27, 2015 | | SEPTEMBER 28, 2014 | | SEPTEMBER 27, 2015 | | SEPTEMBER 28, 2014 |

Labor and other related | $ | (2,916 | ) | | $ | — |

| | $ | (5,587 | ) | | $ | — |

|

Other restaurant operating expense | 16 |

| | 101 |

| | (100 | ) | | (1,782 | ) |

Depreciation and amortization | 1,310 |

| | 1,444 |

| | 3,802 |

| | 4,239 |

|

General and administrative | 2,129 |

| | 5,726 |

| | 4,017 |

| | 7,879 |

|

Provision for impaired assets and restaurant closings | 1,638 |

| | 28,161 |

| | 10,939 |

| | 34,133 |

|

Other expense, net | 298 |

| | — |

| | 1,328 |

| | — |

|

Provision for income taxes | (665 | ) | | (11,360 | ) | | (3,245 | ) | | (18,902 | ) |

Loss on extinguishment and modification of debt | — |

| | — |

| | 2,638 |

| | 11,092 |

|

Net adjustments | $ | 1,810 |

| | $ | 24,072 |

| | $ | 13,792 |

| | $ | 36,659 |

|

|

| | | | | | | | | | | | | | | |

TABLE SEVEN |

BLOOMIN’ BRANDS, INC. |

SEGMENT INCOME FROM OPERATIONS NON-GAAP RECONCILIATION |

(UNAUDITED) |

U.S. Segment | THIRTEEN WEEKS ENDED | | THIRTY-NINE WEEKS ENDED |

(dollars in thousands) | SEPTEMBER 27, 2015 | | SEPTEMBER 28, 2014 | | SEPTEMBER 27, 2015 | | SEPTEMBER 28, 2014 |

Income from operations | $ | 60,891 |

| | $ | 54,734 |

| | $ | 281,564 |

| | $ | 242,903 |

|

Operating income margin | 6.7 | % | | 6.0 | % | | 9.6 | % | | 8.4 | % |

Adjustments: | | | | | | | |

Restaurant impairments and closing costs (1) | (20 | ) | | — |

| | 1,316 |

| | 4,929 |

|

Restaurant relocations, remodels and related costs (2) | 1,872 |

| | — |

| | 3,163 |

| | — |

|

Asset impairments and related costs (3) | — |

| | 6,112 |

| | — |

| | 6,112 |

|

Adjusted income from operations | $ | 62,743 |

| | $ | 60,846 |

| | $ | 286,043 |

| | $ | 253,944 |

|

Adjusted operating income margin | 7.0 | % | | 6.6 | % | | 9.7 | % | | 8.8 | % |

| | | | | | | |

| | | | | | | |

International Segment | | | | | | | |

(dollars in thousands) | | | | | | | |

Income (loss) from operations | $ | 9,770 |

| | $ | (2,968 | ) | | $ | 24,376 |

| | $ | 21,539 |

|

Operating income (loss) margin | 7.9 | % | | (2.0 | )% | | 6.4 | % | | 4.9 | % |

Adjustments: | | | | | | | |

Restaurant impairments and closing costs (4) | 205 |

| | 11,573 |

| | 7,676 |

| | 11,573 |

|

Purchased intangibles amortization (5) | 1,047 |

| | 1,545 |

| | 3,453 |

| | 4,535 |

|

Adjusted income from operations | $ | 11,022 |

| | $ | 10,150 |

| | $ | 35,505 |

| | $ | 37,647 |

|

Adjusted operating income margin | 8.9 | % | | 6.8 | % | | 9.3 | % | | 8.5 | % |

_________________

| |

(1) | Represents expenses incurred for the Domestic Restaurant Closure Initiative. |

| |

(2) | Represents asset impairment charges and accelerated depreciation incurred in connection with our relocation and remodel programs. |

| |

(3) | Represents asset impairment charges and related costs associated with our decision to sell the Roy’s concept. |

| |

(4) | Represents expenses incurred for the International Restaurant Closure Initiative. |

| |

(5) | Represents non-cash intangible amortization recorded as a result of the acquisition of our Brazil operations. |

|

| | | | | |

TABLE EIGHT |

BLOOMIN’ BRANDS, INC. |

COMPARATIVE STORE INFORMATION |

(UNAUDITED) |

Number of restaurants (at end of the period): | SEPTEMBER 27,

2015 | | SEPTEMBER 28,

2014 |

U.S. | | | |

Outback Steakhouse | | | |

Company-owned | 649 |

| | 648 |

|

Franchised | 105 |

| | 105 |

|

Total | 754 |

| | 753 |

|

Carrabba’s Italian Grill | | | |

Company-owned | 244 |

| | 243 |

|

Franchised | 3 |

| | 1 |

|

Total | 247 |

| | 244 |

|

Bonefish Grill | | | |

Company-owned | 208 |

| | 196 |

|

Franchised | 5 |

| | 5 |

|

Total | 213 |

| | 201 |

|

Fleming’s Prime Steakhouse & Wine Bar | | | |

Company-owned | 66 |

| | 66 |

|

Roy’s (1) | | | |

Company-owned | — |

| | 20 |

|

International | | | |

Company-owned | | | |

Outback Steakhouse - South Korea (2) | 75 |

| | 105 |

|

Outback Steakhouse - Brazil (3) | 71 |

| | 59 |

|

Other | 14 |

| | 11 |

|

Franchised | 57 |

| | 51 |

|

Total | 217 |

| | 226 |

|

System-wide total | 1,497 |

| | 1,510 |

|

____________________

| |

(1) | On January 26, 2015, we sold our Roy’s concept. |

| |

(2) | In Q1 2015, we adopted a policy that relocated international restaurants closed more than 30 days and relocated U.S. restaurants closed more than 60 days are considered a closure. Prior periods for South Korea have been revised to conform to the current year presentation. |

| |

(3) | The restaurant counts for Brazil are reported as of August 2015 and 2014, respectively, to correspond with the balance sheet dates of this subsidiary. |

SOURCE: Bloomin’ Brands, Inc.

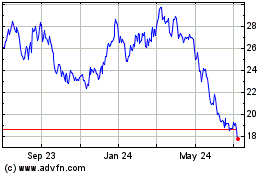

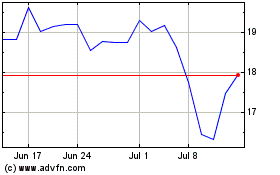

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Apr 2023 to Apr 2024