UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 27, 2015

Wabash National Corporation

(Exact name of registrant

as specified in its charter)

| Delaware |

1-10883 |

52-1375208 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File No.) |

Identification No.) |

| 1000 Sagamore Parkway South, Lafayette, Indiana |

47905 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code:

(765) 771-5300

__________________

Not applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

INFORMATION TO BE INCLUDED IN THE REPORT

Section 2 – Financial Information

Item 2.02 Results of Operations and Financial Condition.

On October 27, 2015, Wabash National Corporation

(the “Company”) issued a press release announcing its financial results for the quarter ended September 30, 2015. A

copy of the Registrant’s press release is attached as Exhibit 99.1 and is incorporated herein by reference.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

99.1 Wabash National Corporation press release

dated October 27, 2015.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

WABASH NATIONAL CORPORATION |

|

| |

|

|

| Date: October 27, 2015 |

By: |

/s/ Jeffery L. Taylor |

|

| |

|

Jeffery L. Taylor |

|

| |

|

Senior Vice President and Chief Financial Officer

|

EXHIBIT INDEX

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Wabash National Corporation Press Release

dated October 27, 2015 |

Exhibit 99.1

| Media Contact: |

|

| Dana Stelsel |

| Corporate Communications Manager |

| (765) 771-5766 |

| dana.stelsel@wabashnational.com |

| |

| Investor Relations: |

| Mike Pettit |

| Vice President, Finance & Investor Relations |

| (765) 771-5581 |

| michael.pettit@wabashnational.com |

FOR IMMEDIATE RELEASE

Wabash National Corporation Announces

Third Quarter 2015 Results;

Achieves Record Profitability and Increases

Full-Year Outlook

| · | Record net sales of $531 million for

third quarter 2015, up 8 percent year over year |

| · | Record operating income of $56.4 million,

up 61 percent year over year |

| · | Both GAAP earnings and non-GAAP adjusted

earnings of $0.47 per diluted share reflect improvements year over year of 88 percent and 81 percent, respectively |

| · | Non-GAAP adjusted earnings guidance

for full year 2015 increases to $1.38 - $1.43 per diluted share, which would represent a year over year improvement of 58 percent

at the midpoint of the range |

LAFAYETTE, Ind. – October 27, 2015

– Wabash National Corporation (NYSE: WNC), a diversified industrial manufacturer and

North America’s leading producer of semi-trailers and liquid transportation systems, today reported results for the third

quarter ended September 30, 2015.

Net income for the third quarter of 2015

was $31.9 million, or $0.47 per diluted share, compared to third quarter 2014 net income of $18.3 million, or $0.25 per diluted

share. Third quarter 2015 non-GAAP adjusted earnings increased $13.3 million to $31.9 million, or $0.47 per diluted share, from

$18.6 million, or $0.26 per diluted share, for the third quarter 2014. Non-GAAP adjusted earnings for the third quarter of 2014

includes an early extinguishment of debt charge of $0.5 million incurred with regards to the Company’s term loan prepayment.

For the third quarter of 2015, the Company’s

net sales increased 8 percent to a record $531 million from $492 million in the prior year quarter, and operating income increased

61 percent to a record quarter of $56.4 million compared to operating income of $34.9 million for the third quarter of 2014. Operating

EBITDA, a non-GAAP measure that excludes the effects of certain recurring and non-recurring items, for the third quarter of 2015

was $68.0 million, an increase of $21.4 million compared to the prior year period. On a trailing twelve month basis through September

30, 2015, the Company’s net sales exceeded $2.0 billion, net income totaled $90.1 million and Operating EBITDA increased

to $207.0 million, or 10.3 percent of net sales.

The following is a summary of select operating

and financial results for the past five quarters:

| | |

Three Months Ended | |

| (Dollars in thousands, except | |

September 30, | | |

December 31, | | |

March 31, | | |

June 30, | | |

September 30, | |

| per share amounts) | |

2014 | | |

2014 | | |

2015 | | |

2015 | | |

2015 | |

| | |

| | |

| | |

| | |

| | |

| |

| Net Sales | |

$ | 491,697 | | |

$ | 527,477 | | |

$ | 437,597 | | |

$ | 514,831 | | |

$ | 531,350 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross Profit Margin | |

| 12.5 | % | |

| 11.9 | % | |

| 13.1 | % | |

| 14.1 | % | |

| 16.2 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income from Operations | |

$ | 34,929 | | |

$ | 34,137 | | |

$ | 27,263 | | |

$ | 42,054 | | |

$ | 56,389 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Income | |

$ | 18,307 | | |

$ | 19,088 | | |

$ | 10,474 | | |

$ | 28,649 | | |

$ | 31,880 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted EPS | |

$ | 0.25 | | |

$ | 0.27 | | |

$ | 0.15 | | |

$ | 0.41 | | |

$ | 0.47 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP Measures(1): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating EBITDA | |

$ | 46,619 | | |

$ | 46,147 | | |

$ | 39,135 | | |

$ | 53,655 | | |

$ | 68,030 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating EBITDA Margin | |

| 9.5 | % | |

| 8.7 | % | |

| 8.9 | % | |

| 10.4 | % | |

| 12.8 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted Earnings | |

$ | 18,630 | | |

$ | 19,088 | | |

$ | 13,788 | | |

$ | 23,586 | | |

$ | 31,880 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted Diluted EPS | |

$ | 0.26 | | |

$ | 0.27 | | |

$ | 0.19 | | |

$ | 0.33 | | |

$ | 0.47 | |

Notes:

| (1) | See “Non-GAAP Measures” below for a discussion of how the Company

uses and defines non-GAAP financial measures. |

Dick Giromini, president and chief executive

officer, stated, “We are very pleased with the continued strong performance and our ability to deliver third quarter results

that represent record achievement levels for net sales, gross profit, income from operations, operating margin and Operating EBITDA.

The overall strength in the Company’s operating performance demonstrates that both the operational improvement initiatives

and the transformative nature of our strategic growth efforts are paying strong dividends. All segments contributed significantly

to the record performance this quarter as Commercial Trailer Products’ ongoing commitment to margin improvement and manufacturing

excellence resulted in record level gross profit and operating income while Diversified Products’ performance provided significant

year over year and sequential improvements. Through the first nine months of 2015 we have continued the momentum generated last

year with strong operational execution and an accelerated pace of improvement from our record breaking 2014.”

Mr. Giromini continued, “New trailer

shipments for the third quarter were approximately 16,500, just within the range of our previous guidance of 16,500 to 17,500 trailers.

With three quarters now complete and a full order book for the remainder of the year, we fully expect to finish 2015 with the Company’s

fourth consecutive year of record performance. As such, we are now updating and tightening our full-year trailer shipment guidance

to 63,000 to 64,000 trailers and increasing our adjusted earnings guidance to $1.38 to $1.43 per diluted share. Longer term, supported

by a healthy backlog of $1.1 billion, we believe the demand environment for trailers will remain strong as customer profitability,

fleet age and regulatory compliance requirements all support an extended trailer cycle. Additionally, we expect continued growth

from our strategic initiatives through new product introductions and market expansion opportunities.”

Third Quarter Business Segment Highlights

The table below is a summary of select

segment operating and financial results prior to the elimination of intersegment sales for the third quarter of 2015 and 2014,

respectively. A complete disclosure of the results by individual segment is included in the tables following this release.

| (dollars in thousands) | |

Commercial | | |

Diversified | | |

| |

| | |

Trailer Products | | |

Products | | |

Retail | |

| Three months ended September 30, 2015 | |

| | |

| | |

| |

| | |

| | |

| | |

| |

| New trailers shipped | |

| 15,500 | | |

| 1,000 | | |

| 600 | |

| Net sales | |

$ | 387,032 | | |

$ | 120,219 | | |

$ | 41,911 | |

| Gross profit | |

$ | 52,497 | | |

$ | 28,857 | | |

$ | 5,310 | |

| Gross profit margin | |

| 13.6 | % | |

| 24.0 | % | |

| 12.7 | % |

| Income from operations | |

$ | 45,610 | | |

$ | 16,789 | | |

$ | 1,322 | |

| Income from operations margin | |

| 11.8 | % | |

| 14.0 | % | |

| 3.2 | % |

| | |

| | | |

| | | |

| | |

| 2014 | |

| | | |

| | | |

| | |

| New trailers shipped | |

| 14,700 | | |

| 850 | | |

| 800 | |

| Net sales | |

$ | 351,951 | | |

$ | 115,838 | | |

$ | 45,166 | |

| Gross profit | |

$ | 30,994 | | |

$ | 24,691 | | |

$ | 4,896 | |

| Gross profit margin | |

| 8.8 | % | |

| 21.3 | % | |

| 10.8 | % |

| Income from operations | |

$ | 25,166 | | |

$ | 13,071 | | |

$ | 859 | |

| Income from operations margin | |

| 7.2 | % | |

| 11.3 | % | |

| 1.9 | % |

Commercial Trailer Products achieved new

quarterly records for gross profit, operating income and operating margin. Net sales were $387 million, an increase of $35 million,

or 10.0 percent, on shipments of 15,500 trailers, or 800 more trailers than the prior year period. This increase in revenue was

primarily due to a 5.4 percent increase in trailer shipments during the quarter as well as the ongoing commitment to improve the

financial performance within the core trailer business. Driven by higher volumes, an improved pricing environment and continued

operational improvements, gross profit and gross profit margin increased $21.5 million and 480 basis points, respectively, as compared

to the same period last year. Operating income increased by $20.4 million from the third quarter last year to $45.6 million.

Diversified Products’ net sales increased

$4 million, or 3.8 percent, as compared to the previous year period as the increase in tank trailer shipments was partially offset

by lower sales of aviation and other non-trailer equipment-related offerings. Gross profit margin for the third quarter of 24.0

percent improved 270 basis points from the prior year period. In addition, gross profit and operating income increased $4.2 million

and $3.7 million, respectively, compared to the prior year period. These year-over-year improvements are due primarily to increased

tank trailer shipments, strong demand for the Company’s composite products, product mix and the successful execution of diversification

initiatives to profitably grow the business.

Retail’s net sales of $42 million

decreased 7.2 percent compared with the prior year period primarily due to lower shipments of new trailers, which were partially

offset by the continued healthy demand for parts and service throughout the quarter. Gross profit margin improved 190 basis points

compared to the prior year period due to a shift in product mix favoring higher-margined parts and service sales. Operating income

of $1.3 million increased $0.5 million from the same period last year.

Non-GAAP Measures

In addition to disclosing financial results

calculated in accordance with United States generally accepted accounting principles (GAAP), the financial information included

in this release contain non-GAAP financial measures, including Operating EBITDA, Operating EBITDA margin, adjusted earnings and

adjusted earnings per diluted share.

These non-GAAP measures should not be considered

a substitute for, or superior to, financial measures and results calculated in accordance with GAAP, including net income, and

reconciliations to GAAP financial statements should be carefully evaluated.

Operating EBITDA is defined as earnings

before interest, taxes, depreciation, amortization, stock-based compensation, and other non-operating income and expense. Management

believes Operating EBITDA provides useful information to investors regarding our results of operations. The Company provides this

measure because we believe it is useful for investors to understand our performance period to period with the exclusion of the

recurring and non-recurring items identified above. Management believes the presentation of Operating EBITDA, when combined with

the primary GAAP presentation of operating income, is beneficial to an investor’s understanding of the Company’s operating

performance. A reconciliation of Operating EBITDA to net income is included in the tables following this release.

Adjusted earnings and adjusted earnings

per diluted share reflect adjustments for non-recurring income recognized on the sale of former retail branch locations as well

as charges related to losses incurred in connection with the Company’s extinguishment of debt. Historically, we have excluded

from these measures the revaluation of deferred income tax assets due to changes in statutory tax rates. Management believes providing

this measure and excluding these items facilitate comparisons to the Company’s prior year periods and, when combined with

the primary GAAP presentation of net income and diluted net income per share, is beneficial to an investor’s understanding

of the Company’s performance. A reconciliation of adjusted earnings and adjusted earnings per diluted share to net income

and diluted net income per share is included in the tables following this release.

Third Quarter 2015 Conference Call

Wabash National

will conduct a conference call to review and discuss its third quarter results on October 28, 2015, at 10:00 a.m. EDT. Access

to the live webcast will be available on the Company’s website at www.wabashnational.com.

For those unable to participate in the live webcast, the call will be archived at www.wabashnational.com

within three hours of the conclusion of the live call and will remain available through January 20, 2016. Meeting access

also will be available via conference call at 888-771-4371, participant code 40935749.

About Wabash National Corporation

Headquartered in Lafayette, Indiana, Wabash

National Corporation (NYSE: WNC) is a diversified industrial manufacturer and North America’s leading producer of semi-trailers

and liquid transportation systems. Established in 1985, the company manufactures a diverse range of products including: dry freight

and refrigerated trailers, platform trailers, bulk tank trailers, truck-mounted tanks, intermodal equipment, aircraft refueling

equipment, structural composite panels and products, trailer aerodynamic solutions, and specialty food grade and pharmaceutical

equipment. Its innovative products are sold under the following brand names: Wabash National(R), Beall(R),

Benson(R), Brenner(R) Tank, Bulk Tank International, DuraPlate(R), Extract Technology(R),

Garsite, Progress Tank, Transcraft(R), TST(R), Walker Barrier Systems, Walker Engineered Products, and Walker

Transport. Visit www.wabashnational.com to learn more.

Safe Harbor Statement

This press release contains certain forward-looking

statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements convey the Company’s

current expectations or forecasts of future events. All statements contained in this press release other than statements of historical

fact are forward-looking statements. These forward-looking statements include, among other things, statements regarding the Company’s

outlook for trailer shipments, backlog, expectations regarding demand levels for trailers, non-trailer equipment and our other

engineered products, profitability and earnings, opportunity to capture higher margin sales, and the expectations regarding the

Company’s growth and diversification strategies. These and the Company’s other forward-looking statements are subject

to certain risks and uncertainties that could cause actual results to differ materially from those implied by the forward-looking

statements. Without limitation, these risks and uncertainties include the uncertain economic conditions including the possibility

that demand expectations may not result in order increases for us, increased competition, reliance on certain customers and corporate

partnerships, risks of customer pick-up delays, shortages and costs of raw materials, risks in implementing and sustaining improvements

in the Company’s manufacturing capacity and cost containment, dependence on industry trends and timing and costs of indebtedness.

Readers should review and consider the various disclosures made by the Company in this press release and in the Company’s

reports to its stockholders and periodic reports on Forms 10-K and 10-Q.

# # #

WABASH NATIONAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in thousands, except per share amounts)

(Unaudited)

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

| | |

| | |

| | |

| |

| Net sales | |

$ | 531,350 | | |

$ | 491,697 | | |

$ | 1,483,778 | | |

$ | 1,335,838 | |

| Cost of sales | |

| 445,328 | | |

| 430,069 | | |

| 1,268,153 | | |

| 1,165,925 | |

| Gross profit | |

| 86,022 | | |

| 61,628 | | |

| 215,625 | | |

| 169,913 | |

| | |

| | | |

| | | |

| | | |

| | |

| General and administrative expenses | |

| 17,855 | | |

| 14,957 | | |

| 53,758 | | |

| 44,890 | |

| Selling expenses | |

| 6,462 | | |

| 6,271 | | |

| 20,216 | | |

| 20,361 | |

| Amortization of intangibles | |

| 5,316 | | |

| 5,471 | | |

| 15,945 | | |

| 16,413 | |

| Income from operations | |

| 56,389 | | |

| 34,929 | | |

| 125,706 | | |

| 88,249 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (4,784 | ) | |

| (5,454 | ) | |

| (14,759 | ) | |

| (16,904 | ) |

| Other, net | |

| (187 | ) | |

| (610 | ) | |

| 2,500 | | |

| (1,626 | ) |

| Income before income taxes | |

| 51,418 | | |

| 28,865 | | |

| 113,447 | | |

| 69,719 | |

| Income tax expense | |

| 19,538 | | |

| 10,558 | | |

| 42,445 | | |

| 27,877 | |

| Net income | |

$ | 31,880 | | |

$ | 18,307 | | |

$ | 71,002 | | |

$ | 41,842 | |

| Basic net income per share | |

$ | 0.48 | | |

$ | 0.26 | | |

$ | 1.05 | | |

$ | 0.60 | |

| Diluted net income per share | |

$ | 0.47 | | |

$ | 0.25 | | |

$ | 1.01 | | |

$ | 0.58 | |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive income | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 31,880 | | |

$ | 18,307 | | |

$ | 71,002 | | |

$ | 41,842 | |

| Foreign currency translation adjustment | |

| (496 | ) | |

| (295 | ) | |

| (743 | ) | |

| (45 | ) |

| Net comprehensive income | |

$ | 31,384 | | |

$ | 18,012 | | |

$ | 70,259 | | |

$ | 41,797 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic net income per share: | |

| | | |

| | | |

| | | |

| | |

| Net income applicable to common stockholders | |

$ | 31,880 | | |

$ | 18,307 | | |

$ | 71,002 | | |

$ | 41,842 | |

| Undistributed earnings allocated to participating securities | |

| - | | |

| (103 | ) | |

| - | | |

| (340 | ) |

| Net income applicable to common stockholders excluding amounts | |

| | | |

| | | |

| | | |

| | |

| applicable to participating securities | |

$ | 31,880 | | |

$ | 18,204 | | |

$ | 71,002 | | |

$ | 41,502 | |

| Weighted average common shares outstanding | |

| 66,524 | | |

| 68,976 | | |

| 67,608 | | |

| 68,862 | |

| Basic net income per share | |

$ | 0.48 | | |

$ | 0.26 | | |

$ | 1.05 | | |

$ | 0.60 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted net income per share: | |

| | | |

| | | |

| | | |

| | |

| Net income applicable to common stockholders | |

$ | 31,880 | | |

$ | 18,307 | | |

$ | 71,002 | | |

$ | 41,842 | |

| Undistributed earnings allocated to participating securities | |

| - | | |

| (103 | ) | |

| - | | |

| (340 | ) |

| Net income applicable to common stockholders excluding | |

| | | |

| | | |

| | | |

| | |

| amounts applicable to participating securities | |

$ | 31,880 | | |

$ | 18,204 | | |

$ | 71,002 | | |

$ | 41,502 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding | |

| 66,524 | | |

| 68,976 | | |

| 67,608 | | |

| 68,862 | |

| Dilutive shares from assumed conversion of convertible senior notes | |

| 611 | | |

| 1,949 | | |

| 1,462 | | |

| 1,806 | |

| Dilutive stock options and restricted stock | |

| 907 | | |

| 994 | | |

| 1,019 | | |

| 855 | |

| Diluted weighted average common shares outstanding | |

| 68,042 | | |

| 71,919 | | |

| 70,089 | | |

| 71,523 | |

| Diluted net income per share | |

$ | 0.47 | | |

$ | 0.25 | | |

$ | 1.01 | | |

$ | 0.58 | |

WABASH NATIONAL CORPORATION

SEGMENTS AND RELATED INFORMATION

(Dollars in thousands)

(Unaudited)

| | |

Commercial | | |

Diversified | | |

| | |

Corporate and | | |

| |

| Three Months

Ended September 30, | |

Trailer Products | | |

Products | | |

Retail | | |

Eliminations | | |

Consolidated | |

| 2015 | |

| | |

| | |

| | |

| | |

| |

| New trailers shipped | |

| 15,500 | | |

| 1,000 | | |

| 600 | | |

| (600 | ) | |

| 16,500 | |

| Used trailers shipped | |

| 250 | | |

| 50 | | |

| 250 | | |

| (50 | ) | |

| 500 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| New Trailers | |

$ | 375,999 | | |

$ | 64,360 | | |

$ | 15,456 | | |

$ | (13,565 | ) | |

$ | 442,250 | |

| Used Trailers | |

| 5,397 | | |

| 921 | | |

| 3,785 | | |

| (741 | ) | |

| 9,362 | |

| Components, parts and service | |

| 1,658 | | |

| 25,289 | | |

| 21,856 | | |

| (3,172 | ) | |

| 45,631 | |

| Equipment and other | |

| 3,978 | | |

| 29,649 | | |

| 814 | | |

| (334 | ) | |

| 34,107 | |

| Total net external sales | |

$ | 387,032 | | |

$ | 120,219 | | |

$ | 41,911 | | |

$ | (17,812 | ) | |

$ | 531,350 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

$ | 52,497 | | |

$ | 28,857 | | |

$ | 5,310 | | |

$ | (642 | ) | |

$ | 86,022 | |

| Income (Loss) from operations | |

$ | 45,610 | | |

$ | 16,789 | | |

$ | 1,322 | | |

$ | (7,332 | ) | |

$ | 56,389 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| 2014 | |

| | | |

| | | |

| | | |

| | | |

| | |

| New trailers shipped | |

| 14,700 | | |

| 850 | | |

| 800 | | |

| (750 | ) | |

| 15,600 | |

| Used trailers shipped | |

| 200 | | |

| 50 | | |

| 350 | | |

| - | | |

| 600 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| New Trailers | |

$ | 344,416 | | |

$ | 53,689 | | |

$ | 20,701 | | |

$ | (17,737 | ) | |

$ | 401,069 | |

| Used Trailers | |

| 1,956 | | |

| 908 | | |

| 4,164 | | |

| - | | |

| 7,028 | |

| Components, parts and service | |

| 954 | | |

| 24,220 | | |

| 19,430 | | |

| (3,623 | ) | |

| 40,981 | |

| Equipment and other | |

| 4,625 | | |

| 37,021 | | |

| 871 | | |

| 102 | | |

| 42,619 | |

| Total net external sales | |

$ | 351,951 | | |

$ | 115,838 | | |

$ | 45,166 | | |

$ | (21,258 | ) | |

$ | 491,697 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

$ | 30,994 | | |

$ | 24,691 | | |

$ | 4,896 | | |

$ | 1,047 | | |

$ | 61,628 | |

| Income (Loss) from operations | |

$ | 25,166 | | |

$ | 13,071 | | |

$ | 859 | | |

$ | (4,167 | ) | |

$ | 34,929 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nine Months Ended September 30, | |

| | | |

| | | |

| | | |

| | | |

| | |

| 2015 | |

| | | |

| | | |

| | | |

| | | |

| | |

| New trailers shipped | |

| 45,250 | | |

| 2,650 | | |

| 2,050 | | |

| (2,200 | ) | |

| 47,750 | |

| Used trailers shipped | |

| 650 | | |

| 100 | | |

| 750 | | |

| (50 | ) | |

| 1,450 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| New Trailers | |

$ | 1,067,326 | | |

$ | 169,612 | | |

$ | 54,431 | | |

$ | (52,168 | ) | |

$ | 1,239,201 | |

| Used Trailers | |

| 13,588 | | |

| 3,412 | | |

| 10,650 | | |

| (2,157 | ) | |

| 25,493 | |

| Components, parts and service | |

| 4,629 | | |

| 72,047 | | |

| 63,362 | | |

| (9,391 | ) | |

| 130,647 | |

| Equipment and other | |

| 10,511 | | |

| 77,077 | | |

| 2,072 | | |

| (1,223 | ) | |

| 88,437 | |

| Total net external sales | |

$ | 1,096,054 | | |

$ | 322,148 | | |

$ | 130,515 | | |

$ | (64,939 | ) | |

$ | 1,483,778 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

$ | 128,259 | | |

$ | 73,864 | | |

$ | 15,468 | | |

$ | (1,966 | ) | |

$ | 215,625 | |

| Income (Loss) from operations | |

$ | 107,394 | | |

$ | 36,383 | | |

$ | 3,811 | | |

$ | (21,882 | ) | |

$ | 125,706 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| 2014 | |

| | | |

| | | |

| | | |

| | | |

| | |

| New trailers shipped | |

| 37,800 | | |

| 2,550 | | |

| 2,500 | | |

| (2,400 | ) | |

| 40,450 | |

| Used trailers shipped | |

| 3,050 | | |

| 100 | | |

| 1,300 | | |

| - | | |

| 4,450 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| New Trailers | |

$ | 880,541 | | |

$ | 162,626 | | |

$ | 65,283 | | |

$ | (54,681 | ) | |

$ | 1,053,769 | |

| Used Trailers | |

| 21,788 | | |

| 3,345 | | |

| 12,970 | | |

| - | | |

| 38,103 | |

| Components, parts and service | |

| 2,404 | | |

| 81,360 | | |

| 61,562 | | |

| (10,809 | ) | |

| 134,517 | |

| Equipment and other | |

| 11,112 | | |

| 95,904 | | |

| 2,571 | | |

| (138 | ) | |

| 109,449 | |

| Total net external sales | |

$ | 915,845 | | |

$ | 343,235 | | |

$ | 142,386 | | |

$ | (65,628 | ) | |

$ | 1,335,838 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

$ | 73,952 | | |

$ | 76,822 | | |

$ | 16,025 | | |

$ | 3,114 | | |

$ | 169,913 | |

| Income (Loss) from operations | |

$ | 55,948 | | |

$ | 40,643 | | |

$ | 3,190 | | |

$ | (11,532 | ) | |

$ | 88,249 | |

WABASH NATIONAL CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollars in thousands)

| | |

September 30, | | |

December 31, | |

| | |

2015 | | |

2014 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 197,187 | | |

$ | 146,113 | |

| Accounts receivable | |

| 138,950 | | |

| 135,206 | |

| Inventories | |

| 227,510 | | |

| 177,144 | |

| Deferred income taxes | |

| 19,772 | | |

| 16,993 | |

| Prepaid expenses and other | |

| 18,265 | | |

| 10,203 | |

| Total current assets | |

$ | 601,684 | | |

$ | 485,659 | |

| | |

| | | |

| | |

| Property, plant and equipment | |

| 136,533 | | |

| 142,892 | |

| | |

| | | |

| | |

| Deferred income taxes | |

| 1,429 | | |

| - | |

| | |

| | | |

| | |

| Goodwill | |

| 149,676 | | |

| 149,603 | |

| | |

| | | |

| | |

| Intangible assets | |

| 121,081 | | |

| 137,100 | |

| | |

| | | |

| | |

| Other assets | |

| 13,968 | | |

| 13,397 | |

| | |

$ | 1,024,371 | | |

$ | 928,651 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS'

EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Current portion of long-term debt | |

$ | 2,440 | | |

$ | 496 | |

| Current portion of capital lease obligations | |

| 853 | | |

| 1,458 | |

| Accounts payable | |

| 131,513 | | |

| 96,213 | |

| Other accrued liabilities | |

| 111,855 | | |

| 88,690 | |

| Total current liabilities | |

$ | 246,661 | | |

$ | 186,857 | |

| | |

| | | |

| | |

| Long-term debt | |

| 327,639 | | |

| 324,777 | |

| | |

| | | |

| | |

| Capital lease obligations | |

| 2,065 | | |

| 5,796 | |

| | |

| | | |

| | |

| Deferred income taxes | |

| 1,764 | | |

| 2,349 | |

| | |

| | | |

| | |

| Other noncurrent liabilities | |

| 19,551 | | |

| 18,040 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders' equity | |

| 426,691 | | |

| 390,832 | |

| | |

$ | 1,024,371 | | |

$ | 928,651 | |

WABASH NATIONAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in thousands)

(Unaudited)

| | |

| Nine Months Ended September 30, | |

| | |

| 2015 | | |

| 2014 | |

| | |

| | | |

| | |

| Cash flows from operating activities | |

| | | |

| | |

| Net income | |

$ | 71,002 | | |

$ | 41,842 | |

| Adjustments to reconcile net income to net cash provided by

operating activities | |

| | | |

| | |

| Depreciation | |

| 12,514 | | |

| 12,730 | |

| Amortization of intangibles | |

| 15,945 | | |

| 16,413 | |

| Net gain on the sale of assets | |

| (8,315 | ) | |

| (43 | ) |

| Deferred income taxes | |

| (4,772 | ) | |

| 14,571 | |

| Loss on debt extinguishment | |

| 5,620 | | |

| 1,042 | |

| Stock-based compensation | |

| 6,655 | | |

| 5,509 | |

| Accretion of debt discount | |

| 3,366 | | |

| 3,624 | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (3,744 | ) | |

| (31,263 | ) |

| Inventories | |

| (50,366 | ) | |

| (79,534 | ) |

| Prepaid expenses and other | |

| (2,704 | ) | |

| 2,721 | |

| Accounts payable and accrued liabilities | |

| 58,465 | | |

| 25,094 | |

| Other, net | |

| 1,025 | | |

| 2,004 | |

| Net cash provided by operating activities | |

$ | 104,691 | | |

$ | 14,710 | |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Capital expenditures | |

| (12,554 | ) | |

| (9,017 | ) |

| Proceeds from the sale of property, plant & equipment | |

| 13,180 | | |

| 86 | |

| Other, net | |

| (5,358 | ) | |

| 4,142 | |

| Net cash used in investing activities | |

$ | (4,732 | ) | |

$ | (4,789 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Proceeds from exercise of stock options | |

| 1,959 | | |

| 1,789 | |

| Borrowings under revolving credit facilities | |

| 665 | | |

| 565 | |

| Payments under revolving credit facilities | |

| (613 | ) | |

| (565 | ) |

| Principal payments under capital lease obligations | |

| (3,964 | ) | |

| (1,492 | ) |

| Proceeds from issuance of term loan credit facility | |

| 192,845 | | |

| - | |

| Principal payments under term loan credit facility | |

| (193,809 | ) | |

| (42,078 | ) |

| Principal payments under industrial revenue bond | |

| (370 | ) | |

| (354 | ) |

| Debt issuance costs paid | |

| (2,581 | ) | |

| - | |

| Stock repurchase | |

| (43,017 | ) | |

| (1,497 | ) |

| Net cash used in financing activities | |

$ | (48,885 | ) | |

$ | (43,632 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash and cash equivalents | |

$ | 51,074 | | |

$ | (33,711 | ) |

| Cash and cash equivalents at beginning of period | |

| 146,113 | | |

| 113,262 | |

| Cash and cash equivalents at end of period | |

$ | 197,187 | | |

$ | 79,551 | |

WABASH NATIONAL CORPORATION

RECONCILIATION OF GAAP FINANCIAL MEASURES TO

NON-GAAP FINANCIAL MEASURES

(Dollars in thousands, except per share amounts)

(Unaudited)

Operating

EBITDA1:

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Net income | |

$ | 31,880 | | |

$ | 18,307 | | |

$ | 71,002 | | |

$ | 41,842 | |

| Income tax expense | |

| 19,538 | | |

| 10,558 | | |

| 42,445 | | |

| 27,877 | |

| Interest expense | |

| 4,784 | | |

| 5,454 | | |

| 14,759 | | |

| 16,904 | |

| Depreciation and amortization | |

| 9,525 | | |

| 9,779 | | |

| 28,459 | | |

| 29,143 | |

| Stock-based compensation | |

| 2,116 | | |

| 1,911 | | |

| 6,655 | | |

| 5,509 | |

| Other non-operating (income) expense | |

| 187 | | |

| 610 | | |

| (2,500 | ) | |

| 1,626 | |

| Operating EBITDA | |

$ | 68,030 | | |

$ | 46,619 | | |

$ | 160,820 | | |

$ | 122,901 | |

| | |

Three Months Ended | | |

Trailing

Twelve

Months | |

| | |

December 31,

2014 | | |

March 31,

2015 | | |

June 30,

2015 | | |

September 30,

2015 | | |

September 30,

2015 | |

| Net income | |

$ | 19,088 | | |

$ | 10,474 | | |

$ | 28,649 | | |

$ | 31,880 | | |

$ | 90,091 | |

| Income tax expense | |

| 9,655 | | |

| 6,234 | | |

| 16,672 | | |

| 19,538 | | |

| 52,099 | |

| Interest expense | |

| 5,261 | | |

| 5,173 | | |

| 4,802 | | |

| 4,784 | | |

| 20,020 | |

| Depreciation and amortization | |

| 9,686 | | |

| 9,452 | | |

| 9,482 | | |

| 9,525 | | |

| 38,145 | |

| Stock-based compensation | |

| 2,324 | | |

| 2,420 | | |

| 2,119 | | |

| 2,116 | | |

| 8,979 | |

| Other non-operating (income) expense | |

| 133 | | |

| 5,382 | | |

| (8,069 | ) | |

| 187 | | |

| (2,367 | ) |

| Operating EBITDA | |

$ | 46,147 | | |

$ | 39,135 | | |

$ | 53,655 | | |

$ | 68,030 | | |

$ | 206,967 | |

Adjusted

Earnings2:

| | |

Three

Months Ended September 30, | | |

Nine

Months Ended September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

$ | | |

Per

Share | | |

$ | | |

Per

Share | | |

$ | | |

Per

Share | | |

$ | | |

Per

Share | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net Income | |

$ | 31,880 | | |

$ | 0.47 | | |

$ | 18,307 | | |

$ | 0.25 | | |

$ | 71,002 | | |

$ | 1.01 | | |

$ | 41,842 | | |

$ | 0.59 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revaluation of net deferred income tax assets due to changes in statutory

tax rates | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,041 | | |

| 0.01 | |

| Branch Transactions, net of

taxes | |

| - | | |

| - | | |

| - | | |

| - | | |

| (5,274 | ) | |

| (0.08 | ) | |

| 365 | | |

| 0.01 | |

| Loss on

debt extinguishment, net of taxes | |

| - | | |

| - | | |

| 323 | | |

| - | | |

| 3,525 | | |

| 0.05 | | |

| 625 | | |

| 0.01 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted earnings | |

$ | 31,880 | | |

$ | 0.47 | | |

$ | 18,630 | | |

$ | 0.26 | | |

$ | 69,253 | | |

$ | 0.99 | | |

$ | 43,873 | | |

$ | 0.61 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted Average # of Diluted Shares O/S | |

| 68,042 | | |

| | | |

| 71,919 | | |

| | | |

| 70,089 | | |

| | | |

| 71,523 | | |

| | |

| | |

Three

Months Ended | |

| | |

December

31, 2014 | | |

March

31, 2015 | | |

June

30, 2015 | |

| | |

$ | | |

Per

Share | | |

$ | | |

Per

Share | | |

$ | | |

Per

Share | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net Income | |

$ | 19,088 | | |

$ | 0.27 | | |

$ | 10,474 | | |

$ | 0.15 | | |

$ | 28,649 | | |

$ | 0.41 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss on debt extinguishment,

net of taxes | |

| - | | |

| - | | |

| 3,314 | | |

| 0.05 | | |

| 211 | | |

| - | |

| Branch

Transactions, net of taxes | |

| - | | |

| - | | |

| - | | |

| - | | |

| (5,274 | ) | |

| (0.07 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted earnings | |

$ | 19,088 | | |

$ | 0.27 | | |

$ | 13,788 | | |

$ | 0.19 | | |

$ | 23,586 | | |

$ | 0.33 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted Average # of Diluted Shares O/S | |

| 69,685 | | |

| | | |

| 71,557 | | |

| | | |

| 70,694 | | |

| | |

1Operating EBITDA is defined as earnings before interest, taxes, depreciation, amortization, stock-based compensation, and other non-operating income and expense.

2Adjusted earnings and adjusted earnings per diluted share reflect adjustments for non-recurring income recognized on the sale of former retail branch locations as well as charges related to losses incurred in connection with the Company’s extinguishment of debt. Historically, we have excluded from these measures the revaluation of deferred income tax assets due to changes in statutory tax rates.

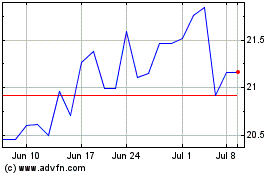

Wabash National (NYSE:WNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

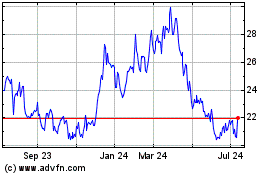

Wabash National (NYSE:WNC)

Historical Stock Chart

From Apr 2023 to Apr 2024