Charles Schwab Investment Management Changes Money Market Fund Line-up

October 09 2015 - 8:00AM

Business Wire

Charles Schwab Investment Management today announced planned

changes to its money market fund line-up.

To address new SEC regulations, all Schwab Prime and Municipal

Money Market Funds plan to qualify as retail money market funds by

October 14, 2016. As such, these funds will continue to seek to

maintain a constant net asset value (NAV) of $1.00 per share, and

will be subject to potential liquidity fees and redemption gates in

times of extreme market volatility.

Additionally, three Schwab Money Market Fund share classes have

been renamed to reflect that these funds plan to qualify as retail

money market funds by October 14, 2016:

Previous Name New Name Schwab Value

Advantage Money Fund® - Institutional Shares Schwab Value Advantage

Money Fund® - Premier Shares Schwab Value Advantage Money Fund® -

Institutional Prime Shares® Schwab Value Advantage Money Fund® -

Ultra Shares Schwab Municipal Money Fund™ - Institutional Shares

Schwab Municipal Money Fund™ - Premier Shares

Schwab’s Government Money Funds and the Schwab Money Market

Portfolio will be officially designated as government money market

funds under the SEC’s new definition of such funds on April 14,

2016, and as a result, they will continue to seek to maintain a

constant NAV of $1.00 per share. These funds have no plans to adopt

a policy to implement liquidity fees or redemption gates at this

time.

The changes were announced in a prospectus filed today and in a

letter to clients/shareholders posted on the company’s web

site.

About Charles Schwab Investment Management, Inc.

Founded in 1989, Charles Schwab Investment Management, Inc.

(CSIM), a subsidiary of The Charles Schwab Corporation, is one of

the nation's largest asset management companies with more than $269

B in assets under management as of 8/31/15.* It is among the

country's largest money market fund managers and is the

third-largest provider of retail index funds. In addition to

managing Schwab’s proprietary funds, CSIM provides oversight for

the sub-advised Laudus Fund family. CSIM currently manages 74

mutual funds in addition to two separate account model portfolios,

and 21 exchange-traded funds.*

More information is available at CSIMfunds.com.

About Charles Schwab

At Charles Schwab we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us

on Twitter, Facebook, YouTube, and LinkedIn.

Through its operating subsidiaries, The Charles Schwab

Corporation (NYSE:SCHW) provides a full range of securities

brokerage, banking, money management and financial advisory

services to individual investors and independent investment

advisors. Its broker-dealer subsidiary, Charles Schwab & Co.,

Inc. (member SIPC, www.sipc.org), and affiliates offer a complete

range of investment services and products including an extensive

selection of mutual funds; financial planning and investment

advice; retirement plan and equity compensation plan services;

compliance and trade monitoring solutions; referrals to independent

fee-based investment advisors; and custodial, operational and

trading support for independent, fee-based investment advisors

through Schwab Advisor Services. Its banking subsidiary, Charles

Schwab Bank (member FDIC and an Equal Housing Lender), provides

banking and lending services and products. More information is

available at www.schwab.com and www.aboutschwab.com.

DISCLOSURES:

Investors should consider carefully information contained in

the prospectus, including investment objectives, risks, charges,

and expenses. You can request a prospectus by calling 800-435-4000.

Please read the prospectus carefully before investing.

An investment in a money market fund is neither insured nor

guaranteed by the FDIC or any other government agency. Yields will

fluctuate, and, although the fund seeks to preserve the value of

your investment at $1 per share, it is possible to lose money by

investing in the fund. Compared to the total return, the seven-day

yield more closely reflects the current earnings of the

fund.

Charles Schwab Investment Management, Inc. ("CSIM"), the

investment advisor for Schwab's proprietary funds, and Charles

Schwab & Co., Inc. ("Schwab"), the distributor for Schwab

Funds, are separate but affiliated companies and subsidiaries of

The Charles Schwab Corporation.

*Number of Funds and Assets Under Management (AUM) is as of

8/31/2015. CSIM managed approximately $258 B on a discretionary

basis and approximately $11 B on a non-discretionary basis.

(1015-6182)

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151009005046/en/

Charles SchwabAlison

Wertheim, 415-667-0475alison.wertheim@schwab.com

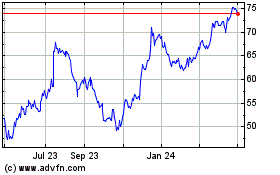

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2024 to May 2024

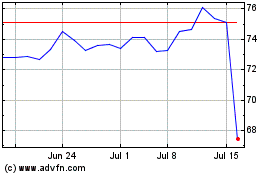

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From May 2023 to May 2024