SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of October 2015

Commission File Number: 001-36744

Cnova N.V.

(Translation of registrant’s name into English)

WTC Schiphol Airport

Tower D, 7th Floor

Schiphol Boulevard 273

1118 BH Schiphol

The Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

EXPLANATORY NOTE

On October 9, 2015, Cnova N.V. issued a press release titled “Cnova — Third Quarter 2015 Activity”. A copy of this press release is furnished herewith as Exhibit 99.1.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

CNOVA N.V. |

|

|

|

|

|

|

|

Date: October 9, 2015 |

By: |

/s/ VITOR FAGÁ DE ALMEIDA |

|

|

Name: Vitor Fagá de Almeida |

|

|

Title: Executive Vice President and Chief Financial Officer |

|

|

(Principal Financial and Accounting Officer) |

3

EXHIBIT INDEX

|

Exhibit |

|

Description |

|

|

|

|

|

99.1 |

|

Press release dated October 9, 2015 titled “Cnova — Third Quarter 2015 Activity” |

4

Exhibit 99.1

|

Press Release |

|

October 9, 2015 |

|

|

|

|

Cnova — Third Quarter 2015 Activity

· GMV: €1,121 million (+17.6% constant currency)

· Marketplace share: 22.7% (+1,032 bps)

· Sales: € 781 million (+9.1% constant currency)

· Traffic: 406 million visits (+27.5%)

· Mobile share: 40.2% (+1,280 bps)

· Click-&-Collect: 21,767 pick-up points (+26.5%)

Amsterdam - October 9, 2015; 07:45 CET — Cnova N.V. (NASDAQ and Euronext Paris: CNV) today announced gross merchandise value (GMV), net sales and other activity data for the quarter ended September 30, 2015.

|

|

|

|

|

|

|

Change |

|

|

Cnova |

|

3Q15(1) |

|

3Q14(1) |

|

Reported |

|

Constant

Currency(2) |

|

|

GMV(3) (€ millions) |

|

1,121.2 |

|

1,094.1 |

|

+2.5 |

% |

+17.6 |

% |

|

Cdiscount |

|

649.1 |

|

555.3 |

|

+16.9 |

% |

+17.1 |

% |

|

France |

|

640.1 |

|

552.4 |

|

+15.9 |

% |

|

|

|

International |

|

9.0 |

|

2.9 |

|

+208.3 |

% |

+244.2 |

% |

|

Cnova Brazil |

|

472.2 |

|

538.8 |

|

-12.4 |

% |

+18.1 |

% |

|

Cnova Brazil (R$ millions) |

|

1,920.0 |

|

1,625.6 |

|

+18.1 |

% |

|

|

|

Marketplace share(4) |

|

22.7 |

% |

12.4 |

% |

+1,032 |

bps |

|

|

|

Cdiscount France |

|

29.8 |

% |

20.5 |

% |

+931 |

bps |

|

|

|

Cnova Brazil |

|

12.8 |

% |

4.2 |

% |

+862 |

bps |

|

|

|

Net sales (€ millions) |

|

781.4 |

|

837.3 |

|

-6.7 |

% |

+9.1 |

% |

|

Cdiscount |

|

410.3 |

|

379.5 |

|

+8.1 |

% |

+8.3 |

% |

|

France |

|

402.5 |

|

377.0 |

|

+6.8 |

% |

|

|

|

International |

|

7.8 |

|

2.5 |

|

+213.7 |

% |

+247.5 |

% |

|

Cnova Brazil |

|

371.1 |

|

457.8 |

|

-18.9 |

% |

+9.8 |

% |

|

Cnova Brazil (R$ millions) |

|

1,515.8 |

|

1,380.6 |

|

+9.8 |

% |

|

|

|

Traffic (visits in millions) |

|

405.8 |

|

318.3 |

|

+27.5 |

% |

|

|

|

Cdiscount France |

|

180.7 |

|

136.0 |

|

+32.8 |

% |

|

|

|

Cnova Brazil |

|

212.9 |

|

179.5 |

|

+18.6 |

% |

|

|

|

Mobile share |

|

40.2 |

% |

27.4 |

% |

+1,280 |

bps |

|

|

|

Cdiscount France |

|

49.8 |

% |

37.2 |

% |

+1,265 |

bps |

|

|

|

Cnova Brazil |

|

32.4 |

% |

20.5 |

% |

+1,189 |

bps |

|

|

|

Click-&-Collect pick-up points |

|

21,767 |

|

17,206 |

|

+26.5 |

% |

|

|

|

Active customers(5) (millions) |

|

15.4 |

|

12.8 |

|

+20.2 |

% |

|

|

|

Number of items sold (millions) |

|

15.3 |

|

13.2 |

|

+16.0 |

% |

|

|

|

Orders(6) (millions) |

|

9.1 |

|

7.8 |

|

+17.0 |

% |

|

|

1

3rd Quarter 2015 Highlights

· Gross merchandise volume (GMV) amounted to €1,121 million for the 3rd quarter 2015, increasing +17.6% on a constant currency basis compared to the same period in 2014. After taking into account the strong negative impact (-15.1%) of the depreciation of the Brazilian real versus the Euro, reported GMV grew by +2.5%. At Cdiscount France, total GMV was up +15.9%. At Cnova Brazil, GMV increased by +18.1% on a constant currency basis as promotional pricing partially compensated for the impacts of the deteriorating Brazilian economic environment.

· The marketplace share of total GMV increased 1,032 basis points for the 3rd quarter 2015 and reached 22.7% compared to 12.4% for the 3rd quarter 2014. Cdiscount France’s marketplace share reached 29.8%, while Cnova Brazil’s was 12.8%. As of September 30, 2015, active marketplace sellers increased by +97% to almost 10,500 while the number of marketplace product offerings expanded from 11.4 million to 26.0 million (+129%).

· Active customers increased by +20.2% and number of items sold increased by +16.0%.

· Net sales totaled €781 million in the 3rd quarter 2015, up +9.1% on a constant currency basis compared to the 3rd quarter of 2014. The rate of change was -6.7% after taking into account the negative exchange rate impact of -15.8%.

· Net sales at Cdiscount were up +8.1% (of which +1.4% was attributable to new international operations) on a high comparison basis, and partly reflected the Group’s emphasis on gross margin improvement during the quarter. Home furnishings and household appliances accounted for close to half of direct sales and recorded double-digit growth. Marketplace commissions increased by +84% y-o-y.

Net sales from international operations were driven primarily by activity in Colombia, Thailand and Vietnam.

· Net sales at Cnova Brazil increased by +9.8% (on a constant currency basis). Development of all product categories to increase the overall portfolio and orient product mix toward higher margin categories continued at a satisfactory rate. Marketplace commissions grew by +255%.

· Traffic rose to 406 million visits during the 3rd quarter 2015 (+27.5% y-o-y), of which approximately 75% is non-paid. Cdiscount’s customer loyalty program in France, Cdiscount à volonté, contributed to this performance. The mobile share of traffic rose 1,280 basis points to 40.2%.

Above all, Cnova’s low-cost “P-S-D” (Purchasing-Storage-Delivery) competitive advantages continue to drive traffic and order volume:

· Volume Purchasing with parent companies allows the Group to be a price leader on its markets,

· Jointly leased distribution centers permit Storage of inventory at a lower cost per square meter,

2

· Delivery offered at over 21,700 pick-up points provides a cost savings of up to 40% per delivery that is passed on to customers. Approximately 65% of Cdiscount orders currently choose this delivery method.

· Customer service enhancements during the quarter centered primarily around:

· The continued roll-out of Click-&-Collect (“C&C”) pick-up points in all markets:

· C&C pick-up points in France surpassed 19,500 and included more than 500 pick-up points for large items (> 30 kg),

· Brazil continued to increase the number of C&C pick-up points (more than 1,250 as of end of September) , while the take up rate in São Paulo state on the Extra.com.br website increased to 15%,

· During the quarter, the three fastest growing international markets, Colombia, Thailand and Vietnam, had more than 800 C&C pick-up points.

· Other product delivery upgrades include:

France:

· Same-day home delivery for large items in the Paris metropolitan area for orders placed by 2:00 pm;

· Next-day C&C delivery (“24h chrono”) for large items in Paris and Lyon for orders placed by 7:00 pm,

Brazil:

· Same-day delivery for small item orders placed by 12:00 pm in the city of São Paulo,

· Next-day delivery for small and large item orders placed by 4:00 pm in the State of São Paulo,

· 2-day C&C delivery for small and large items in the cities and suburbs of São Paulo (for orders placed by 6:00 pm) and Rio de Janeiro (for orders placed by 1:00 pm), and,

· Launch of large item pick-up points in the States of São Paulo and Rio de Janeiro.

· As part of the cost efficiency drive and streamlining as well as in order to further improve the Group’s commercial and operational performances, Cnova has:

· Started to close the Panama and Ecuador sites in order to concentrate efforts in Latin America on Colombia where progress is in line with the initial plan,

· Merged the specialty site MonCornerKids into MonCornerBaby and MonCornerJardin into MonCornerDeco in order to increase commercial and operational dynamics.

· Sold the website MonShowRoom to Monoprix*.

As a result, the Group’s vertical site strategy is reinforced and increases synergies with Cdiscount (platform, IT, purchasing and logistics) with a growing offer and increased margin improvement potential.

*From a legal standpoint, 51% MonShowroom’s capital was sold to Monoprix on September 30, 2015. For the remaining 49% of the capital, a purchase/sale commitment was executed, maturing in October 2016, with an enterprise value, as determined by independent fairness opinions, of between €28 million and €35 million for 100% (depending on the result of an earn-out).

3

End notes:

(1) Financial results for Panama, Ecuador, MonCornerKids and MonCornerJardin were discontinued as of July 1, 2015; there is no impact on 2014 as these activities did not exist at that time. MonShowroom has been re-classified as a discontinued activity (IFRS 5) as of January 1, 2014.

(2) Brazilian real/Euro average exchange rate for the 3rd quarter: 2014 = R$3.01; 2015 = R$3.96.

(3) Gross Merchandise Volume (GMV) = product sales + other revenues + marketplace business volumes (calculated based on approved and sent orders) + taxes.

(4) Includes marketplace share of www.cdiscount.com in France as well as extra.com.br, pontofrio.com, casasbahia.com.br and cdiscount.com.br in Brazil.

(5) Active customers at the end of September having purchased at least once through our sites during the last 12 months, calculated on a website-by-website basis because we operate multiple sites each with unique systems of identifying users, which could result in an individual being counted more than once.

(6) Total placed orders before cancellation due to fraud detection and/or customer non-payment.

***

4

About Cnova N.V.

Cnova N.V., one of the world’s largest e-Commerce companies, serves 15 million active customers via state-of-the-art e-tail websites: Cdiscount in France, Brazil, Colombia, Thailand, Vietnam, Ivory Coast, Senegal, Cameroon, Burkina Faso and Belgium; Extra.com.br, Pontofrio.com and Casasbahia.com.br in Brazil. Cnova N.V.’s product offering of close to 26 million items provides its clients with a wide variety of very competitively priced goods, several fast and customer-convenient delivery options as well as practical payment solutions. Cnova N.V. is part of Groupe Casino, a global diversified retailer. Cnova N.V.’s news releases are available at www.cnova.com/investor-relations.aspx. Information available on, or accessible through, the sites referenced above is not part of this press release.

This press release contains regulated information (gereglementeerde informatie) within the meaning of the Dutch Financial Supervision Act (Wet op het financieel toezicht) which must be made publicly available pursuant to Dutch and French law. This press release is intended for information purposes only.

Forward-Looking Statements

In addition to historical information, this press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the U.S. Securities Act of 1933, and Section 21E of the U.S. Securities Exchange Act of 1934. Such forward-looking statements may include projections regarding Cnova’s future performance and, in some cases, may be identified by words like “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “future,” “will,” “seek” and similar terms or phrases. The forward-looking statements contained in this press release are based on management’s current expectations, which are subject to uncertainty, risks and changes in circumstances that are difficult to predict and many of which are outside of Cnova’s control. Important factors that could cause Cnova’s actual results to differ materially from those indicated in the forward-looking statements include, among others: the ability to grow its customer base; the ability to maintain and enhance its brands and reputation; the ability to manage the growth of Cnova effectively; changes to technologies used by Cnova; changes in global, national, regional or local economic, business, competitive, market or regulatory conditions; and other factors discussed under the heading “Risk Factors” in the U.S. Annual Report on the Form 20-F for the year ended December 31, 2014 filed with the U.S. Securities and Exchange Commission on March 31, 2015 and other documents filed with or furnished to the U.S. Securities and Exchange Commission. Any forward-looking statement made in this press release speaks only as of the date hereof. Factors or events that could cause Cnova’s actual results to differ from the statements contained herein may emerge from time to time, and it is not possible for Cnova to predict all of them. Except as required by law, Cnova undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise.

***

Cnova Investor Relations Contact:

G. Christopher Welton

christopher.welton@cnovagroup.com

investor@cnova.com

Tel: +31 20 795 06 71

Media contact:

Cnova N.V.

Head of Communication: +33 6 80 39 50 71

directiondelacommunication@cnovagroup.com

5

***

Upcoming Events

Cnova plans to release Third Quarter 2015 Financial Results as follows:

|

Wednesday, October 28, 2015 at 07:45 CET |

Cnova Third Quarter 2015 Financial Results |

|

|

|

|

Wednesday, October 28, 2015 at 16:00 CET |

Cnova Third Quarter 2015 Conference Call & Webcast |

Conference Call and Webcast connection details

Conference Call Dial-In Numbers:

|

|

Toll-Free |

|

|

|

Brazil |

0 800 891 6221 |

|

|

France |

0 800 912 848 |

|

|

UK |

0 800 756 3429 |

|

|

USA |

1 877 407 0784 |

|

|

Toll |

1 201 689 8560 |

Conference Call Replay Dial-In Numbers:

|

|

Toll-Free |

1 877 870 5176 |

|

|

Toll |

1 858 384 5517 |

|

Available From: |

October 28, 2015 at 13:00 ET / 18:00 CET |

|

To: |

November 4, 2015 at 23:59 ET |

|

|

November 5, 2015 at 05:59 CET |

|

|

Replay Pin Number: 13612210 |

Webcast:

http://public.viavid.com/index.php?id=116263

Presentation materials to accompany the call will be available at cnova.com on October 28, 2015.

An archive of the conference call will be available for a limited time at cnova.com following its conclusion.

6

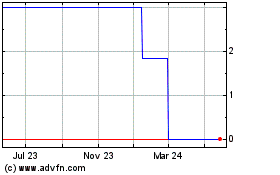

Cnova N V (CE) (USOTC:CNVAF)

Historical Stock Chart

From Aug 2024 to Sep 2024

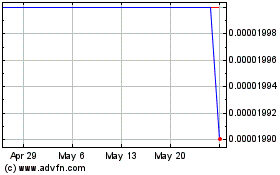

Cnova N V (CE) (USOTC:CNVAF)

Historical Stock Chart

From Sep 2023 to Sep 2024