Fannie, Freddie Ease Rules for Mortgage Lenders

October 07 2015 - 6:00PM

Dow Jones News

Mortgage lenders on Wednesday received new assurances from

mortgage-finance giants Fannie Mae and Freddie Mac that they won't

be slammed with onerous penalties for what they say are relatively

minor errors made when underwriting loans.

Fannie and Freddie released new guidelines detailing the

remedies lenders will be responsible for providing should errors be

found in loans they sell to the companies. The goal, the companies

say, is to persuade the lenders to expand mortgage access to

riskier borrowers.

Fannie and Freddie don't make loans. Instead, they buy mortgages

that meet certain requirements, wrap them into securities and

provide guarantees to make investors whole if the mortgages

default.

After the financial crisis, Fannie and Freddie found billions of

dollars of mortgages they said contained errors, prompting the

mortgage companies to demand that lenders buy back the loans.

Lenders bristled, believing the punishment sometimes was too

extreme for the errors committed. As a result, they pulled back

from lending to borrowers with weaker credit, even if such

borrowers technically qualified for Fannie- and Freddie-backed

mortgages.

To allay lenders' concerns and broaden mortgage access, Fannie,

Freddie and their federal regulator have worked over the past few

years with lenders to define more clearly the repercussions they

would suffer for making errors. Last fall, for example, the

companies reached an agreement with lenders on what kinds of errors

they'd still be liable for years after making a mortgage.

On Wednesday, Fannie and Freddie said that rather than require

lenders to buy back loans with insignificant defects, it would

require them to pay Fannie or Freddie what would have been paid to

the companies had the details been accurate.

"Lenders consistently tell us that concerns about repurchases

limit their willingness to lend, so we're trying to put those

concerns to rest," said Fannie Mae Executive Vice President Andrew

Bon Salle in a statement.

There are signs the efforts are working. A Fannie Mae survey

released last month said 23% of lenders believed credit standards

on Fannie- and Freddie-eligible loans had eased over the past three

months, versus 12% a year earlier.

On the other hand, merely 13% said that such standards had eased

on loans backed by government agencies including the Federal

Housing Administration, which is currently undergoing a more

contentious effort to clarify lenders' underwriting

liabilities.

In a statement, David Stevens, president of the Mortgage Bankers

Association, a trade group, said Wednesday's release "will add

additional clarity to the broad lending community, which should

help lenders' confidence to lend knowing that nonmaterial errors

that would not lead to default will not expose the lender to

abusive risks."

Write to Joe Light at joe.light@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 07, 2015 17:45 ET (21:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

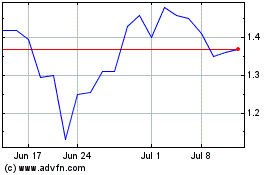

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

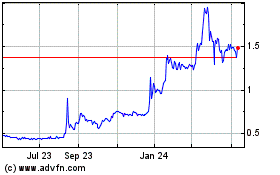

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Apr 2023 to Apr 2024