As filed with the Securities and Exchange Commission on August 20, 2015

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

TEEKAY TANKERS LTD.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

| Republic of The Marshall Islands |

|

4400 |

|

Not Applicable |

| (State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

4th Floor, Belvedere Building,

69 Pitts Bay Road,

Hamilton HM 08, Bermuda

Telephone: (441) 298-2530

Fax: (441) 292-3931

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive office)

Watson Farley & Williams LLP

Attention: Daniel C. Rodgers

1133 Avenue of the Americas

New York, New York 10036

(212) 922-2200

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

David S. Matheson

Perkins Coie LLP

1120

N.W. Couch Street, Tenth Floor

Portland, OR 97209-4128

(503) 727-2008

Approximate date of

commencement of proposed sale to the public: From time to time after this registration statement becomes effective, as determined by market conditions.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the

following box. ¨

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

Title of Each Class of

Securities to be Registered |

|

Amount

to be

Registered(1) |

|

Proposed

Maximum

Offering Price

Per Share(2) |

|

Proposed

Maximum

Aggregate

Offering Price |

|

Amount of

Registration Fee |

| Class A common stock, par value $0.01 per share |

|

7,180,083 |

|

$6.13 |

|

$44,013,908.79 |

|

$5,114.42(2) |

| |

| |

| (1) |

Pursuant to Rule 416(a), the number of shares of Class A common stock being registered shall be adjusted to include any additional shares that may become issuable as a result of any stock distribution, split,

combination or similar transaction. |

| (2) |

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended. The price per share and proposed maximum aggregate offering price are

based on the average of the high and low sale prices of the registrant’s Class A common stock on August 20, 2015, as reported on the New York Stock Exchange. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the U.S. Securities Act of 1933, as amended, or until the Registration

Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PROSPECTUS

7,180,083 Shares

Teekay Tankers Ltd.

Class A Common Stock

This prospectus

relates solely to the possible offer or resale, from time to time, of up to 7,180,083 shares of Class A common stock of Teekay Tankers Ltd. by the selling securityholder identified in this prospectus. These shares of Class A common stock

are being issued pursuant to the Memoranda of Agreement, each dated as of August 4, 2015, between wholly owned subsidiaries of us and affiliates of the selling securityholder in transactions exempt from the registration requirements of the

Securities Act of 1933, as amended. We will not receive any of the proceeds from the sale of these shares of Class A common stock by the selling securityholder.

The selling securityholder identified in this prospectus, or its donees, pledgees, transferees or other successors-in-interest, may sell the

Class A common shares at various times and in various types of transactions, including sales in the open market, sales in negotiated transactions, sales in underwritten offerings and sales by a combination of these methods. The selling

securityholder may sell the Class A common shares to or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions. For additional information on the methods of sale that

may be used by the selling securityholder, please read “Plan of Distribution.”

This prospectus describes some of the general

terms that may apply to the shares of Class A common stock and the general manner in which they may be offered. The specific terms of any common stock to be offered, and the specific manner in which they may be offered, will be described in one

or more supplements to this prospectus. A prospectus supplement may also add, update or change information contained in this prospectus.

Our Class A common stock trades on the New York Stock Exchange under the symbol “TNK.” On August 19, 2015, the last

reported sale price of our Class A common stock on the New York Stock Exchange was $6.27 per share.

Investing in

our securities involves a high degree of risk. You should carefully consider the section entitled “Forward-Looking Statements” beginning on page 2 and each of the factors described under “Risk

Factors” beginning on page 4 of this prospectus before you make an investment in our Class A common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this

prospectus is August 20, 2015

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus, any prospectus supplement and the

documents incorporated by reference into this prospectus. We have not authorized anyone else to give you different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. This prospectus

may only be used where it is legal to sell our Class A common stock. You should not assume that the information in this prospectus or any prospectus supplement, as well as the information we previously filed or hereafter file with the U.S.

Securities and Exchange Commission (or SEC) that is incorporated by reference into this prospectus, is accurate as of any date other than its respective date. We will disclose material changes in our affairs in an amendment to this

prospectus, a prospectus supplement or a future filing with the SEC incorporated by reference in this prospectus.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-3 that we filed with the SEC, being a

“shelf” registration or continuous offering process. The selling securityholder referred to in the prospectus may offer and resell from time to time up to 7,180,083 shares of our Class A common stock.

This prospectus does not cover the issuance of any of our Class A common shares by us to the selling securityholder, and we will not

receive any of the proceeds from any sale of shares by the selling securityholder. We have agreed to pay the expenses incurred in connection with the registration of the Class A common shares owned by the selling securityholder covered by this

prospectus, other than any underwriting discounts or selling commissions, any transfer taxes, the fees and expenses of the selling securityholder’s own counsel, and any reasonably incurred and documented out-of-pocket expenses we incur in

connection with any underwritten offering, each of which are to be paid by the selling securityholder.

Unless otherwise indicated,

references in this prospectus to “Teekay Tankers Ltd.,” “we,” “us” and “our” and similar terms refer to Teekay Tankers Ltd. and/or one or more of its subsidiaries, except that those terms, when used in this

prospectus in connection with the Class A common stock described herein, shall mean specifically Teekay Tankers Ltd. References in this prospectus to “Teekay Corporation” refer to Teekay Corporation and/or any one or more of its

subsidiaries. References to “our Manager” are to Teekay Tankers Management Services Ltd., a subsidiary of Teekay Corporation.

Unless otherwise indicated, all references in this prospectus to “dollars” and “$” are to, and amounts are presented in,

U.S. Dollars, and financial information presented in this prospectus is prepared in accordance with accounting principles generally accepted in the United States (or GAAP).

You should read carefully this prospectus, any prospectus supplement, and the additional information described below under the headings

“Where You Can Find More Information” and “Incorporation of Documents by Reference.”

- 1 -

FORWARD-LOOKING STATEMENTS

All statements, other than statements of historical fact, included in or incorporated by reference into this prospectus and any prospectus

supplements are “forward-looking statements.” The Private Securities Litigation Reform Act of 1995, as amended, provides a “safe harbor” for forward-looking statements to encourage companies to provide prospective information

about themselves so long as they identify these statements as forward-looking and provide meaningful cautionary statements identifying important factors that could cause actual results to differ from the projected results. In addition, we and our

representatives may from time to time make other oral or written statements that are also forward-looking statements. Such statements include, in particular, statements about our plans, strategies, business prospects, changes and trends in our

business, and the markets in which we operate. In some cases, you can identify the forward-looking statements by the use of words such as “may,” “will,” “could,” “should,” “would,”

“expect,” “plan,” “anticipate,” “intend,” “forecast,” “believe,” “estimate,” “predict,” “propose,” “potential,” “continue” or the negative

of these terms or other comparable terminology.

Forward-looking statements are made based upon management’s current plans,

expectations, estimates, assumptions and beliefs concerning future events affecting us. Forward-looking statements are subject to risks, uncertainties and assumptions, including those risks discussed in “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” set forth in other reports we file with the SEC and that are incorporated into this prospectus by reference. The risks, uncertainties and

assumptions involve known and unknown risks and are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. We caution that forward-looking statements are not guarantees and that actual results could

differ materially from those expressed or implied in the forward-looking statements.

We undertake no obligation to update any

forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict all of

these factors. In addition, we cannot assess the effect of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking

statement, and accordingly, you should not place undue reliance on forward-looking statements.

- 2 -

TEEKAY TANKERS LTD.

We are an international provider of marine transportation to global oil industries. Our business is to own crude oil and product tankers and

we employ a chartering strategy that seeks to capture upside opportunities in the spot market while using fixed-rate time charters to reduce downside risks. Teekay Corporation (NYSE: TK), which formed us in 2007, is a leading provider of marine

services to the global oil and natural gas industries and the world’s largest operator of medium-sized oil tankers. We believe we benefit from Teekay Corporation’s expertise, relationships and reputation as we operate our fleet and pursue

growth opportunities. We have acquired a substantial majority of our current operating fleet from Teekay Corporation at various times since our inception and we anticipate additional opportunities to expand our fleet through acquisitions of tankers

from third parties, or additional tankers that Teekay Corporation may offer to us from time to time. These tankers may include crude oil and product tankers.

Under the supervision of our executive officers and Board of Directors, our operations are managed by Teekay Tankers Management Services Ltd.

(our Manager), a subsidiary of Teekay Corporation which provides to us commercial, technical, administrative and strategic services under a long-term management agreement. We employ our chartering strategy based on the outlook of our Manager

for freight rates, oil tanker market conditions and global economic conditions. We employ our vessels on fixed rate time-charter out contracts and in various pooling arrangements, the majority of which are managed by wholly or partially owned

subsidiaries of Teekay Corporation and which employ vessels on the spot market. By employing some of our vessels in these pooling arrangements with Teekay, we believe we benefit from Teekay Corporation’s expertise in commercial management of

oil tankers and economies of scale of a larger fleet, including higher vessel utilization and daily revenues.

We are incorporated under

the laws of the Republic of The Marshall Islands as Teekay Tankers Ltd. Our principal executive offices are located at 4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton HM 08, Bermuda, and our phone number is (441) 298-2530. Our

website address is www.teekaytankers.com. The information contained in our website is not part of this prospectus.

- 3 -

RISK FACTORS

Before investing in our Class A common stock, you should carefully consider all of the information included or incorporated by

reference into this prospectus. When evaluating an investment in any of our securities, you should carefully consider the following risk factors together with all other information included in this prospectus, including those risks discussed under

the caption “Risk Factors” in our latest Annual Report on Form 20-F filed with the SEC, which are incorporated by reference into this prospectus, and information included in any applicable prospectus supplement.

If any of these risks were to occur, our business, financial condition, operating results or cash flows could be materially adversely

affected. In that case, the trading price of our Class A common stock could decline, we might be unable to pay dividends on shares of our Class A common stock and you could lose all or part of your investment. In addition to the following

risk factors, please read “Material United States Federal Income Tax Considerations” in this prospectus for a more complete discussion of expected material U.S. federal income tax consequences of owning and disposing of our securities.

Risks Inherent in an Investment in our Class A Common Stock

If the share price of our Class A common stock fluctuates after any offering related to this prospectus, you could lose a significant part of your

investment.

The market price of our Class A common stock may be influenced by many factors, many of which are beyond our

control, including those described under the caption “Risk Factors” in our latest Annual Report on Form 20-F filed with the SEC, and the following:

| |

• |

|

the failure of securities analysts to publish research about us after the offering, or analysts making changes in their financial estimates; |

| |

• |

|

announcements by us or our competitors of significant contracts, acquisitions or capital commitments; |

| |

• |

|

variations in quarterly operating results; |

| |

• |

|

general economic or financial market conditions; |

| |

• |

|

future sales of shares of our Class A common stock or other securities; and |

| |

• |

|

investors’ perception of us and the seaborne oil transportation industry. |

As a result of

these factors, investors in our Class A common stock may not be able to resell their shares at or above any offering price of the securities covered by this prospectus. These broad market and industry factors may materially reduce the market

price of shares of our Class A common stock regardless of our operating performance.

Anti-takeover provisions in our organizational documents

could make it difficult for our shareholders to replace or remove our current board of directors or have the effect of discouraging, delaying or preventing a merger or acquisition, which may adversely affect the market price of our Class A

common stock.

Several provisions of our articles of incorporation and bylaws could make it difficult for our shareholders to

change the composition of our board of directors, preventing them from changing the composition of management. In addition, the same provisions may discourage, delay or prevent a merger or acquisition that our shareholders may consider favorable.

These provisions include:

| |

• |

|

a dual-class common stock structure that currently gives Teekay Corporation and its affiliates control over matters requiring shareholder approval, including the election of directors and significant corporate

transactions, such as a merger or other sale of our company or its assets; |

- 4 -

| |

• |

|

authorizing our board of directors to issue “blank check” preferred shares without shareholder approval; |

| |

• |

|

prohibiting cumulative voting in the election of directors; |

| |

• |

|

authorizing the removal of directors, with or without cause, only by the affirmative vote of the holders of a majority of the voting power of our outstanding capital stock or by directors constituting at least

two-thirds of the entire board of directors, unless Teekay Corporation and its affiliates no longer hold a majority of the voting power of our outstanding capital stock, in which case directors may only be removed for cause and only by the

affirmative vote of the holders of not less than 80% of the total voting power of our outstanding capital stock; |

| |

• |

|

limiting the persons who may call special meetings of shareholders; and |

| |

• |

|

establishing advance notice requirements for nominations for election to our board of directors or for proposing matters that can be acted on by shareholders at shareholder meetings. |

These anti-takeover provisions could substantially impede the ability of our Class A common shareholders to benefit from a change in

control and, as a result, may adversely affect the market price of our Class A common stock and your ability to realize any potential change-in-control premium.

We may issue additional shares of Class A common stock, Class B common stock or other securities without your approval, which would dilute your

ownership interests and may depress the market price of the Class A common stock.

We may issue additional shares of

Class A common stock, Class B common stock and other equity securities of equal or senior rank, without shareholder approval, in a number of circumstances.

The issuance by us of additional shares of Class A common stock, Class B common stock or other equity securities of equal or senior rank

will have the following effects:

| |

• |

|

our existing shareholders’ proportionate ownership interest in us will decrease; |

| |

• |

|

the amount of cash available for dividends payable on our common stock may decrease; |

| |

• |

|

the relative voting strength of each previously outstanding share may be diminished; and |

| |

• |

|

the market price of our Class A common stock may decline. |

Tax Risks

U.S. tax authorities could treat us as a “passive foreign investment company,” which could have adverse U.S. federal income tax consequences to

U.S. shareholders.

A non-U.S. entity treated as a corporation for U.S. federal income tax purposes will be treated as a

“passive foreign investment company” (or PFIC) for such purposes in any taxable year for which either (a) at least 75% of its gross income consists of “passive income,” or (b) at least 50% of the average value of

the entity’s assets is attributable to assets that produce or are held for the production of “passive income.” For purposes of these tests, “passive income” includes dividends, interest, gains from the sale or exchange of

investment property and rents and royalties other than rents and royalties that are received from unrelated parties in connection with the active conduct of a trade or business. By contrast, income derived from the performance of services does not

constitute “passive income.”

There are legal uncertainties involved in determining whether the income derived from our

time-chartering activities constitutes rental income or income derived from the performance of services, including the decision in Tidewater Inc. v. United States, 565 F.3d 299 (5th Cir. 2009), which held that income derived from certain

time-chartering activities should be treated as rental income rather than services income for purposes of a foreign sales

- 5 -

corporation provision of the U.S. Internal Revenue Code of 1986, as amended (or the Code). However, the Internal Revenue Service (or IRS) stated in an Action on Decision (AOD

2010-01) that it disagrees with, and will not acquiesce to, the way that the rental versus services framework was applied to the facts in the Tidewater decision, and in its discussion stated that the time charters at issue in Tidewater

would be treated as producing services income for PFIC purposes. The IRS’s statement with respect to Tidewater cannot be relied upon or otherwise cited as precedent by taxpayers. Consequently, in the absence of any binding legal

authority specifically relating to the statutory provisions governing PFICs, there can be no assurance that the IRS or a court would not follow the Tidewater decision in interpreting the PFIC provisions of the Code. Nevertheless, based on the

current composition of our assets and operations (and those of our subsidiaries), we intend to take the position that we are not now and have never been a PFIC, and our counsel, Perkins Coie LLP, is of the opinion that it is more likely than not we

are not a PFIC based on representations we have made to them regarding the composition of our assets, the source of our income and the nature of our activities and operations. No assurance can be given, however, that the opinion of Perkins Coie LLP

would be sustained by a court if contested by the IRS, or that we would not constitute a PFIC for any future taxable year if there were to be changes in our assets, income or operations.

If the IRS were to determine that we are or have been a PFIC for any taxable year during which a U.S. Holder (as defined below under

“Material United States Federal Income Tax Considerations”) held stock,, such U.S. Holder would face adverse U.S. federal income tax consequences. For a more comprehensive discussion regarding our status as a PFIC and the tax consequences

to U.S. Holders if we are treated as a PFIC, please read “Material United States Federal Income Tax Considerations—United States Federal Income Taxation of U.S. Holders—Consequences of Possible PFIC Classification.”

We may be subject to taxes, which reduces our cash available for distribution to our shareholders.

We or some of our subsidiaries may be subject to tax in the jurisdictions in which we or our subsidiaries are organized or operate, reducing

the amount of our cash available for distribution. In computing our tax obligation in these jurisdictions, we are required to take various tax accounting and reporting positions on matters that are not entirely free from doubt and for which we have

not received rulings from the governing authorities. We cannot assure you that upon review of these positions the applicable authorities will agree with our positions. A successful challenge by a tax authority could result in additional tax imposed

on us or our subsidiaries in jurisdictions in which operations are conducted. For example, if Teekay Tankers Ltd. was not able to meet the criteria specified by Section 883 of the U.S. Internal Revenue Code, our U.S. source income may become

subject to taxation.

- 6 -

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of Class A common shares by the selling securityholder under this prospectus and

any related prospectus supplement. Please read “Selling Securityholder.”

- 7 -

DESCRIPTION OF CAPITAL STOCK

Authorized Capitalization

Our authorized

capital stock consists of 400,000,000 shares, of which:

| |

• |

|

200,000,000 shares are designated as Class A common stock, par value $0.01 per share; |

| |

• |

|

100,000,000 shares are designated as Class B common stock, par value $0.01 per share; and |

| |

• |

|

100,000,000 shares are designated as preferred stock, par value $0.01 per share. |

Common Stock

Voting Rights

Holders of our

Class A and Class B common stock have identical rights, except that holders of our Class A common stock are entitled to one vote per share and holders of our Class B common stock are entitled to five votes per share. However, the voting

power of the Class B common stock is limited such that the aggregate voting power of all shares of outstanding Class B common stock can at no time exceed 49% of the voting power of our outstanding Class A common stock and Class B common stock,

voting together as a single class. Except as otherwise provided by the Business Corporations Act of the Republic of The Marshall Islands (or the Marshall Islands Act), holders of shares of Class A common stock and Class B common stock

will vote together as a single class on all matters submitted to a vote of shareholders, including the election of directors.

Marshall

Islands law generally provides that the holders of a class of stock are entitled to a separate class vote on any proposed amendment to our articles of incorporation that would change the aggregate number of authorized shares or the par value of that

class of shares or alter or change the powers, preferences or special rights of that class so as to affect it adversely.

Dividends

Subject to preferences that may apply to any shares of preferred stock outstanding at the time, the holders of Class A common stock and

Class B common stock shall be entitled to share equally in any dividends that our board of directors may declare from time to time out of funds legally available for dividends. In the event a dividend is paid in the form of shares of common stock or

rights to acquire shares of common stock, the holders of Class A common stock shall receive Class A common stock, or rights to acquire Class A common stock, as the case may be, and the holders of Class B common stock shall receive

Class B common stock, or rights to acquire Class B common stock, as the case may be.

Marshall Islands law generally prohibits the payment

of a dividend when a company is insolvent or would be rendered insolvent by the payment of such a dividend or when the declaration or payment would be contrary to any restrictions contained in the company’s articles of incorporation. Dividends

may be declared and paid out of surplus only, but if there is no surplus, dividends may be declared or paid out of the net profits for the fiscal year in which the dividend is declared and for the preceding fiscal year.

Liquidation Rights

Upon our

liquidation, dissolution or winding-up, the holders of Class A common stock and Class B common stock shall be entitled to receive the same amount per share of common stock of all our assets remaining after the payment of any liabilities and the

satisfaction of any liquidation preferences on any outstanding preferred stock.

Conversion

Shares of our Class A common stock are not convertible into any other shares of our capital stock.

- 8 -

Each share of Class B common stock is convertible at any time at the option of the holder thereof

into one share of Class A common stock. In addition:

| |

• |

|

upon any transfer of shares of Class B common stock to a holder other than Teekay Corporation (or any of its affiliates (not including us and our subsidiaries) or any successor to Teekay Corporation’s business or

to all or substantially all of its assets), such transferred shares of Class B common stock shall automatically convert into Class A common stock upon such transfer; and |

| |

• |

|

all shares of our Class B common stock will automatically convert into shares of our Class A common stock if the aggregate number of outstanding shares of Class A common stock and Class B common stock

beneficially owned by Teekay Corporation and its affiliates (not including us and our subsidiaries) or any successor to Teekay Corporation’s business or all or substantially all of its assets falls below 15% of the aggregate number of

outstanding shares of our common stock. |

All such conversions will be effected on a one-for-one basis.

Once converted into Class A common stock, shares of Class B common stock shall not be reissued. No class of common stock may be

subdivided or combined unless the other class of common stock concurrently is subdivided or combined in the same proportion and in the same manner.

Other Rights

Holders of our

common stock do not have redemption or preemptive rights to subscribe for any of our securities. The rights, preferences and privileges of holders of our common stock are subject to the rights of the holders of any shares of preferred stock that we

may issue in the future.

Preferred Stock

Our articles of incorporation authorize our board of directors to establish one or more series of preferred stock and to determine, with

respect to any series of preferred stock, the terms and rights of that series, including:

| |

• |

|

the designation of the series; |

| |

• |

|

the number of shares of the series; |

| |

• |

|

the preferences and relative, participating, optional or other special rights, if any, and any qualifications, limitations or restrictions of such series; and |

| |

• |

|

the voting rights, if any, of the holders of the series. |

Directors

Our directors are elected by a plurality of the votes cast by shareholders entitled to vote. There is no provision for cumulative voting.

Our articles of incorporation provide that our board of directors must consist of at least three members. Our board of directors may change

the number of directors within a range of three to twelve directors pursuant to resolution. Shareholders may change the number of directors only by the affirmative vote of holders of a majority of the voting power of all outstanding shares of our

capital stock. However, from and after the date that Teekay Corporation and its subsidiaries (other than us and our subsidiaries) cease to beneficially own shares representing a majority of the total voting power of our outstanding capital stock,

shareholders may change the number of directors only by the affirmative vote of not less than 80% of the total voting power of our outstanding capital stock. The board of directors may change the number of directors only by a majority vote of the

entire board.

Shareholder Meetings

Under our bylaws, annual general meetings will be held at a time and place selected by our board of directors. The meetings may be held in or

outside of the Marshall Islands. If we fail to hold an annual meeting

- 9 -

within 90 days of the designated date or if no date has been designated for a period of 13 months after our last annual meeting, a special meeting in lieu of an annual meeting may be called by

shareholders holding not less than 10% of the voting power of all outstanding shares entitled to vote at such meeting. Other than such a meeting in lieu of an annual meeting, special meetings of shareholders may be called only by the chairman of our

board of directors or our chief executive officer, at the direction of our board of directors as set forth in a resolution stating the purpose or purposes thereof approved by a majority of the entire board of directors, or by Teekay Corporation so

long as Teekay Corporation and its affiliates (other than us and our subsidiaries) beneficially own at least a majority of the total voting power of our outstanding capital stock. Our board of directors may set a record date between 15 and 60 days

before the date of any meeting to determine the shareholders that will be eligible to receive notice of and vote at the meeting.

Dissenters’

Rights of Appraisal and Payment

Under the Marshall Islands Act, our shareholders have the right to dissent from various corporate

actions, including certain mergers or consolidations or sales of all or substantially all of our assets, and receive payment of the fair value of their shares. The right of a dissenting shareholder to receive payment of the fair value of his shares

shall not be available if for the shares of any class or series of stock, which shares or depository receipts in respect thereof, at the record date fixed to determine the shareholders entitled to receive notice of and to vote at the meeting of

shareholders to act upon the agreement of merger or consolidation, were either (i) listed on a securities exchange or admitted for trading on an interdealer quotation system or (ii) held of record by more than 2,000 holders. The right of a

dissenting shareholder to receive payment of the fair value of his or her shares shall not be available for any shares of stock of the constituent corporation surviving a merger if the merger did not require for its approval the vote of the

shareholders of the surviving corporation. In the event of any amendment of our articles of incorporation, a shareholder also has the right to dissent and receive payment for the shareholder’s shares if the amendment alters certain rights in

respect of those shares. The dissenting shareholder must follow the procedures set forth in the Marshall Islands Act to receive payment. If we and any dissenting shareholder fail to agree on a price for the shares, the Marshall Islands Act

procedures involve, among other things, the institution of proceedings in any appropriate court in any jurisdiction in which our shares are primarily traded on a local or national securities exchange.

Shareholders’ Derivative Actions

Under the Marshall Islands Act, any of our shareholders may bring an action in our name to procure a judgment in our favor, also known as a

derivative action, provided that the shareholder bringing the action is a holder of common stock both at the time the derivative action is commenced and at the time of the transaction to which the action relates, or that his shares devolved upon him

by operation of law.

Limitations on Director Liability and Indemnification of Directors and Officers

The Marshall Islands Act restricts corporations from limiting or eliminating the personal liability of directors to corporations and their

shareholders for monetary damages for certain breaches of directors’ fiduciary duties. Our articles of incorporation include a provision that eliminates the personal liability of directors for monetary damages for actions taken as a director to

the fullest extent permitted by law.

Our articles of incorporation also provide that we must indemnify our directors and officers to the

fullest extent permitted by law. We are also expressly authorized to advance certain expenses (including attorneys’ fees) to our directors and offices and to carry directors’ and officers’ insurance providing indemnification for our

directors and officers for some liabilities. We believe that these indemnification provisions and insurance are useful to attract and retain qualified directors and officers.

The limitation of liability and indemnification provisions in our articles of incorporation may discourage shareholders from bringing a

lawsuit against directors for breach of their fiduciary duty. These provisions may also have the effect of reducing the likelihood of derivative litigation against directors and officers, even though

- 10 -

such an action, if successful, might otherwise benefit us and our shareholders. In addition, your investment may be adversely affected to the extent that we pay the costs of settlement and damage

awards against our directors and officers pursuant to these indemnification provisions.

Our articles of incorporation also renounce in

favor of Teekay Corporation business opportunities that may be attractive to both Teekay Corporation and us. This provision effectively limits the fiduciary duties we or our shareholders otherwise may be owed regarding these business opportunities

by our directors and officers who also serve as directors or officers of Teekay Corporation or its other affiliates. If Teekay Corporation or its affiliates (other than us and our subsidiaries) no longer beneficially own shares representing at least

20% of the total voting power of our outstanding capital stock, and no person who is an officer or director of us is also an officer or director of Teekay Corporation or its other affiliates (other than us and our subsidiaries), then this business

opportunity provision of our articles of incorporation will terminate.

There is currently no pending litigation or proceeding involving

any of our directors, officers or employees for which indemnification is being sought.

Anti-Takeover Effect of Certain Provisions of Our Articles of

Incorporation and Bylaws

Several provisions of our articles of incorporation and bylaws, which are summarized below, may have

anti-takeover effects. These provisions are intended to avoid costly takeover battles, lessen our vulnerability to a hostile change of control and enhance the ability of our board of directors to maximize shareholder value in connection with any

unsolicited offer to acquire us. However, these anti-takeover provisions, which are summarized below, could also discourage, delay or prevent (1) the merger or acquisition of us by means of a tender offer, a proxy contest or otherwise that a

shareholder may consider in its best interest and (2) the removal of incumbent officers and directors.

Dual-Class Structure

As discussed above, our Class B common stock has five votes per share, subject to a 49% aggregate Class B common stock voting power maximum,

while our Class A common stock has one vote per share. Teekay Corporation controls all of our outstanding Class B common stock, in addition to shares of Class A common stock it controls. Because of our dual-class structure, Teekay

Corporation is able to continue to control all matters submitted to our shareholders for approval even though it and its affiliates own significantly less than 50% of the shares of our outstanding common stock. This concentrated control could

discourage others from initiating any potential merger, takeover or other change of control transaction that other shareholders may view as beneficial.

Blank Check Preferred Stock

Under

the terms of our articles of incorporation, our board of directors has authority, without any further vote or action by our shareholders, to issue up to 100 million shares of “blank check” preferred stock. Our board could authorize

the issuance of preferred stock with voting or conversion rights that could dilute the voting power or rights of the holders of common stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and

other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in control of us or the removal of our management and might harm the market price of our Class A common stock. We have no current

plans to issue any shares of preferred stock.

Election and Removal of Directors

Our articles of incorporation prohibit cumulative voting in the election of directors. Our bylaws require parties other than the board of

directors to give advance written notice of nominations for the election of directors. These provisions may discourage, delay or prevent the removal of incumbent officers and directors.

- 11 -

Our bylaws provide that shareholders are required to give us advance notice of any person they

wish to propose for election as a director at an annual general meeting if that person is not proposed by our board of directors. These advance notice provisions provide that the shareholder must have given written notice of such proposal not less

than 90 days nor more than 120 days prior to the anniversary date of the immediately preceding annual general meeting. In the event the annual general meeting is called for a date that is not within 30 days before or after such anniversary date,

notice by the shareholder must be given not later than 10 days following the earlier of the date on which notice of the annual general meeting was mailed to shareholders or the date on which public disclosure of the date of the annual general

meeting was made.

Our shareholders may not call special meetings for the purpose of electing directors except in lieu of an annual

meeting as discussed above or to replace a director being removed by the shareholders. Our articles of incorporation provide that any director or our entire board of directors may be removed at any time, with or without cause, by the affirmative

vote of the holders of a majority of the total voting power of our outstanding capital stock or by directors constituting at least two-thirds of the entire board of directors. However, from and after the date that Teekay Corporation and its

affiliates (other than us and our subsidiaries) cease to beneficially own shares representing a majority of the total voting power of our outstanding capital stock, directors may only be removed for cause and only by the affirmative vote of the

holders of not less than 80% of the total voting power of our outstanding capital stock.

Limited Actions by Shareholders

Our bylaws provide that any action required or permitted to be taken by our shareholders must be effected at an annual or special meeting of

shareholders or by the unanimous written consent of our shareholders, provided that if the Marshall Islands Act in the future permits action to be taken by less than unanimous written consent of our shareholders, the holders of voting power

sufficient to take such specified action at a meeting at which all voting stock was present and voted, or as otherwise set forth in the Marshall Islands Act as so amended, may do so by written consent so long as Teekay Corporation and its affiliates

(other than us and our subsidiaries) beneficially own shares representing a majority of the total voting power of our outstanding capital stock. Our bylaws provide that, subject to certain limited exceptions, only (a) our Chairman or Chief

Executive Officer, at the direction of the board of directors, or (b) Teekay Corporation, so long as Teekay Corporation and its affiliates (other than us and our subsidiaries) beneficially own at least a majority of the total voting power of

our outstanding capital stock, may call special meetings of our shareholders, and the business transacted at the special meeting is limited to the purposes stated in the notice. Accordingly, a shareholder may be prevented from calling a special

meeting for shareholder consideration of a proposal over the opposition of our board of directors and shareholder consideration of a proposal may be delayed until the next annual general meeting.

Transfer Agent

The registrar and

transfer agent for our common stock is Computershare Inc.

- 12 -

PRICE RANGE OF CLASS A COMMON STOCK AND DIVIDENDS

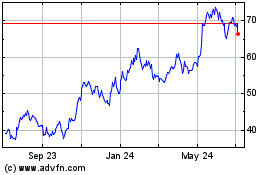

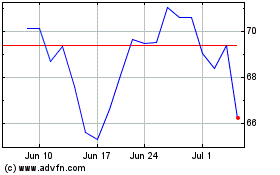

Our Class A common stock is traded on the New York Stock Exchange under the symbol “TNK.”

The following table sets forth, for the periods indicated, the high and low sales prices for shares of our Class A common stock as

reported on the New York Stock Exchange, and quarterly cash distributions declared per share. The closing sale price of our Class A common stock on the New York Stock Exchange on August 19, 2015 was $6.27 per share.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Price ranges |

|

|

Quarterly

cash

dividend

per share(1) |

|

| |

|

High |

|

|

Low |

|

|

| Years Ended |

|

|

|

|

|

|

|

|

|

|

|

|

| December 31, 2014 |

|

$ |

5.95 |

|

|

$ |

3.18 |

|

|

|

|

|

| December 31, 2013 |

|

|

4.02 |

|

|

|

2.38 |

|

|

|

|

|

| December 31, 2012 |

|

|

6.33 |

|

|

|

2.38 |

|

|

|

|

|

| December 31, 2011 |

|

|

12.99 |

|

|

|

3.36 |

|

|

|

|

|

| December 31, 2010 |

|

|

13.96 |

|

|

|

8.50 |

|

|

|

|

|

| Quarters Ended |

|

|

|

|

|

|

|

|

|

|

|

|

| September 30, 2015(2) |

|

$ |

7.88 |

|

|

$ |

6.32 |

|

|

|

|

|

| June 30, 2015 |

|

|

7.88 |

|

|

|

5.70 |

|

|

$ |

0.03 |

|

| March 31, 2015 |

|

|

7.05 |

|

|

|

4.82 |

|

|

|

0.03 |

|

| December 31, 2014 |

|

|

5.95 |

|

|

|

3.30 |

|

|

|

0.03 |

|

| September 30, 2014 |

|

|

4.44 |

|

|

|

3.55 |

|

|

|

0.03 |

|

| June 30, 2014 |

|

|

4.50 |

|

|

|

3.18 |

|

|

|

0.03 |

|

| March 31, 2014 |

|

|

5.08 |

|

|

|

3.18 |

|

|

|

0.03 |

|

| December 31, 2013 |

|

|

4.02 |

|

|

|

2.55 |

|

|

|

0.03 |

|

| September 30, 2013 |

|

|

3.09 |

|

|

|

2.49 |

|

|

|

0.03 |

|

| June 30, 2013 |

|

|

3.06 |

|

|

|

2.38 |

|

|

|

0.03 |

|

| March 31, 2013 |

|

|

3.43 |

|

|

|

2.40 |

|

|

|

0.03 |

|

| Months Ended |

|

|

|

|

|

|

|

|

|

|

|

|

| August 30, 2015(2) |

|

$ |

7.37 |

|

|

$ |

6.19 |

|

|

|

|

|

| July 31, 2015 |

|

|

7.88 |

|

|

|

6.32 |

|

|

|

|

|

| June 30, 2015 |

|

|

7.88 |

|

|

|

6.55 |

|

|

|

|

|

| May 31, 2015 |

|

|

7.30 |

|

|

|

5.72 |

|

|

|

|

|

| April 30, 2015 |

|

|

6.89 |

|

|

|

5.70 |

|

|

|

|

|

| March 31, 2015 |

|

|

5.93 |

|

|

|

5.05 |

|

|

|

|

|

| February 28, 2015 |

|

|

6.30 |

|

|

|

5.07 |

|

|

|

|

|

| (1) |

Dividends are shown for the quarter with respect to which they were declared. |

| (2) |

Period ending August 19, 2015. |

- 13 -

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The following is a discussion of certain material U.S. federal income tax considerations that may be relevant to prospective shareholders and,

unless otherwise noted in the following discussion, is the opinion of Perkins Coie LLP, our U.S. counsel, insofar as it relates to matters of U.S. federal income tax law and legal conclusions with respect to those matters. The opinion of our counsel

is dependent on the accuracy of representations made by us to them, including descriptions of our operations contained herein. This discussion is based upon the provisions of the Internal Revenue Code of 1986, as amended (or the Code),

legislative history, applicable U.S. Treasury Regulations (or Treasury Regulations), judicial authority and administrative interpretations, all as in effect on the date of this prospectus, and which are subject to change, possibly with

retroactive effect, or are subject to different interpretations. Changes in these authorities may cause the tax consequences to vary substantially from the consequences described below. Unless the context otherwise requires, references in this

section to “we,” “our” or “us” are references to Teekay Tankers Ltd.

This discussion is limited to

shareholders who hold their common stock as a capital asset for tax purposes. This discussion does not address all tax considerations that may be important to a particular shareholder in light of the shareholder’s circumstances, or to certain

categories of shareholders that may be subject to special tax rules, such as:

| |

• |

|

dealers in securities or currencies; |

| |

• |

|

traders in securities that have elected the mark-to-market method of accounting for their securities; |

| |

• |

|

persons whose functional currency is not the U.S. dollar; |

| |

• |

|

persons holding our common stock as part of a hedge, straddle, conversion or other “synthetic security” or integrated transaction; |

| |

• |

|

certain U.S. expatriates; |

| |

• |

|

financial institutions; |

| |

• |

|

persons subject to the alternative minimum tax; |

| |

• |

|

persons that actually or under applicable constructive ownership rules own 10% or more of our common stock; and |

| |

• |

|

entities that are tax-exempt for U.S. federal income tax purposes. |

If a partnership

(including any entity or arrangement treated as a partnership for U.S. federal income tax purposes) holds our common shares, the tax treatment of a partner generally will depend upon the status of the partner and the activities of the partnership.

Partners in partnerships holding our common stock should consult their own tax advisors to determine the appropriate tax treatment of the partnership’s ownership of our common stock.

No ruling has been or will be requested from the IRS regarding any matter affecting us or our unitholders. Instead, we will rely on the

opinion of Perkins Coie LLP. Unlike a ruling, an opinion of counsel represents only that counsel’s legal judgment and does not bind the IRS or the courts. Accordingly, the opinions and statements made herein may not be sustained by a court if

contested by the IRS.

This discussion does not address any U.S. estate tax considerations or tax considerations arising under the laws of

any state, local or non-U.S. jurisdiction. Each shareholder is urged to consult its own tax advisor regarding the U.S. federal, state, local and other tax consequences of the ownership or disposition of our common stock.

- 14 -

United States Federal Income Taxation of U.S. Holders

As used herein, the term U.S. Holder means a beneficial owner of our common stock that is, for U.S. federal income tax purposes: (a) a

U.S. citizen or U.S. resident alien (or a U.S. Individual Holder), (b) a corporation or other entity taxable as a corporation, that was created or organized under the laws of the United States, any state thereof or the District of

Columbia, (c) an estate whose income is subject to U.S. federal income taxation regardless of its source, or (d) a trust that either is subject to the supervision of a court within the United States and has one or more U.S. persons with

authority to control all of its substantial decisions or has a valid election in effect under applicable Treasury Regulations to be treated as a U.S. person.

Distributions

Subject to the discussion

of passive foreign investment companies (or PFICs) below, any distributions made by us with respect to our common stock to a U.S. Holder generally will constitute dividends, which may be taxable as ordinary income or “qualified dividend

income” as described in more detail below, to the extent of our current and accumulated earnings and profits, as determined under U.S. federal income tax principles. Distributions in excess of our earnings and profits will be treated first as a

nontaxable return of capital to the extent of the U.S. Holder’s tax basis in its common stock and thereafter as capital gain, which will be either long term or short term capital gain depending upon whether the U.S. Holder has held the shares

for more than one year. U.S. Holders that are corporations for U.S. federal income tax purposes generally will not be entitled to claim a dividends received deduction with respect to any distributions they receive from us. For purposes of computing

allowable foreign tax credits for U.S. federal income tax purposes, dividends paid with respect to our common stock will be treated as foreign source income and generally will be treated as “passive category income.”

Dividends paid on our common stock to a U.S. Holder who is an individual, trust or estate (or a Non-Corporate U.S. Holder) will be

treated as “qualified dividend income” that is taxable to such Non-Corporate U.S. Holder at preferential capital gain tax rates provided that: (a) our common stock is readily tradable on an established securities market in the United

States (such as the New York Stock Exchange on which our common stock is traded); (b) we are not classified as a PFIC for the taxable year during which the dividend is paid or the immediately preceding taxable year (we intend to take the

position that we are not now and have never been classified as a PFIC, as discussed below); (c) the Non-Corporate U.S. Holder has owned the common stock for more than 60 days in the 121–day period beginning 60 days before the date on which

the common stock becomes ex–dividend; (d) the Non-Corporate U.S. Holder is not under an obligation to make related payments with respect to positions in substantially similar or related property; and (e) certain other conditions are

met. There is no assurance that any dividends paid on our common shares will be eligible for these preferential rates in the hands of a Non-Corporate U.S. Holder. Any dividends paid on our common shares not eligible for these preferential rates will

be taxed as ordinary income to a Non-Corporate U.S. Holder.

Special rules may apply to any “extraordinary dividend” paid by us.

Generally, an extraordinary dividend is a dividend with respect to a share of common stock if the amount of the dividend is equal to or in excess of 10% of a common stockholder’s adjusted tax basis (or fair market value in certain

circumstances) in such common stock. In addition, extraordinary dividends include dividends received within a one year period that, in the aggregate, equal or exceed 20% of a stockholder’s adjusted tax basis (or fair market value in certain

circumstances). If we pay an “extraordinary dividend” on our common stock that is treated as “qualified dividend income,” then any loss recognized by a Non-Corporate U.S. Holder from the sale or exchange of such common stock will

be treated as long–term capital loss to the extent of such dividend.

Certain Non-Corporate U.S. Holders are subject to a 3.8% tax on

certain investment income, including dividends. Non-Corporate U.S. Holders should consult their tax advisors regarding the effect, if any, of this tax on their ownership of our common stock.

- 15 -

Sale, Exchange or Other Disposition of Common Stock

Subject to the discussion of PFICs below, a U.S. Holder generally will recognize capital gain or loss upon a sale, exchange or other

disposition of our common stock in an amount equal to the difference between the amount realized by the U.S. Holder from such sale, exchange or other disposition and the U.S. Holder’s tax basis in such stock. Subject to the discussion of

extraordinary dividends above, such gain or loss generally will be treated as (a) long–term capital gain or loss if the U.S. Holder’s holding period is greater than one year at the time of the sale, exchange or other disposition, or

short term capital gain or loss otherwise and (b) U.S. source gain or loss, as applicable, for foreign tax credit purposes. Non-Corporate U.S. Holders may be eligible for preferential rates of U.S. federal income tax in respect of long-term

capital gains. A U.S. Holder’s ability to deduct capital losses is subject to certain limitations.

Certain Non-Corporate U.S.

Holders are subject to a 3.8% tax on certain investment income, including capital gains from the sale or other disposition of stock. Non-Corporate U.S. Holders should consult their tax advisors regarding the effect, if any, of this tax on their

disposition of our common stock.

Consequences of Possible PFIC Classification

A non–U.S. entity treated as a corporation for U.S. federal income tax purposes will be treated as a PFIC in any taxable year in which,

after taking into account the income and assets of the corporation and certain subsidiaries pursuant to a “look through” rule, either: (a) at least 75% of its gross income is “passive” income; or (b) at least 50% of the

average value of its assets is attributable to assets that produce or are held for the production of passive income. For purposes of these tests, “passive income” includes dividends, interest, gains from the sale or exchange of investment

property and rents and royalties other than rents and royalties that are received from unrelated parties in connection with the active conduct of a trade or business. By contrast, income derived from the performance of services does not constitute

“passive income.”

There are legal uncertainties involved in determining whether the income derived from our time-chartering

activities constitutes rental income or income derived from the performance of services, including legal uncertainties arising from the decision in Tidewater Inc. v. United States, 565 F.3d 299 (5th Cir. 2009), which held that income derived

from certain time-chartering activities should be treated as rental income rather than services income for purposes of a foreign sales corporation provision of the Code. However, the IRS stated in an Action on Decision (AOD 2010-01) that it

disagrees with, and will not acquiesce to, the way that the rental versus services framework was applied to the facts in the Tidewater decision, and in its discussion stated that the time charters at issue in Tidewater would be treated

as producing services income for PFIC purposes. The IRS’s statement with respect to Tidewater cannot be relied upon or otherwise cited as precedent by taxpayers. Consequently, in the absence of any binding legal authority specifically

relating to the statutory provisions governing PFICs, there can be no assurance that the IRS or a court would not follow the Tidewater decision in interpreting the PFIC provisions of the Code. Nevertheless, based on our and our

subsidiaries’ current assets and operations, we intend to take the position that we are not now and have never been a PFIC, and our counsel, Perkins Coie LLP, is of the opinion that it is more likely than not that we are not a PFIC based on

applicable law, including the Code, legislative history, published revenue rulings and court decisions, and representations we have made to them regarding the composition of our assets, the source of our income and the nature of our activities and

other operations, including:

| |

• |

|

the total payments due to us under each of our time charters are substantially in excess of the current bareboat charter rate for comparable vessels |

| |

• |

|

the income derived from our participation in pooling arrangements and from our other time and voyage charters will be greater than 25% of our total gross income at all relevant times; and |

| |

• |

|

the gross value of our vessels participating in pooling arrangements and servicing our other time and voyage charters will exceed the gross value of all other assets we own at all relevant times. |

- 16 -

An opinion of counsel represents only that counsel’s best legal judgment and does not bind

the IRS or the courts. Accordingly, the opinion of Perkins Coie LLP may not be sustained by a court if contested by the IRS. Further, no assurance can be given that we would not constitute a PFIC for any future taxable year if there were to be

changes in our or our subsidiaries’ assets, income or operations.

As discussed more fully below, if we were to be treated as a PFIC

for any taxable year, a U.S. Holder generally would be subject to different taxation rules depending on whether the U.S. Holder makes a timely and effective election to treat us as a “Qualified Electing Fund” (a QEF election). As an

alternative to making a QEF election, a U.S. Holder should be able to make a “mark–to–market” election with respect to our common stock, as discussed below.

Taxation of U.S. Holders Making a Timely QEF Election. If a U.S. Holder makes a timely QEF election (an Electing Holder), the Electing Holder

must report each taxable year for U.S. federal income tax purposes the Electing Holder’s pro rata share of our ordinary earnings and net capital gain, if any, for each taxable year for which we are a PFIC that ends with or within the Electing

Holder’s taxable year, regardless of whether or not the Electing Holder received distributions from us in that year. Such income inclusions would not be eligible for the preferential tax rates applicable to qualified dividend income. The

Electing Holder’s adjusted tax basis in our common stock will be increased to reflect taxed but undistributed earnings and profits. Distributions of earnings and profits that were previously taxed will result in a corresponding reduction in the

Electing Holder’s adjusted tax basis in our common stock and will not be taxed again once distributed. An Electing Holder generally will recognize capital gain or loss on the sale, exchange or other disposition of our common stock. A U.S.

Holder makes a QEF election with respect to any year that we are a PFIC by filing IRS Form 8621 with the U.S. Holder’s timely filed U.S. federal income tax return (including extensions).

If a U.S. Holder has not made a timely QEF election with respect to the first year in the U.S. Holder’s holding period of our common

stock during which we qualified as a PFIC, the U.S. Holder may be treated as having made a timely QEF election by filing a QEF election with the U.S. Holder’s timely filed U.S. federal income tax return (including extensions) and, under the

rules of Section 1291 of the Code, a “deemed sale election” to include in income as an “excess distribution” (described below) the amount of any gain that the U.S. Holder would otherwise recognize if the U.S. Holder sold the

U.S. Holder’s common stock on the “qualification date.” The qualification date is the first day of our taxable year in which we qualified as a “qualified electing fund” with respect to such U.S. Holder. In addition to the

above rules, under very limited circumstances, a U.S. Holder may make a retroactive QEF election if the U.S. Holder failed to file the QEF election documents in a timely manner. If a U.S. Holder makes a timely QEF election for one of our taxable

years, but did not make such election with respect to the first year in the U.S. Holder’s holding period of our common stock during which we qualified as a PFIC and the U.S. Holder did not make the deemed sale election described above, the U.S.

Holder also will be subject to the more adverse rules described below.

A U.S. Holder’s QEF election will not be effective unless we

annually provide the U.S. Holder with certain information concerning our income and gain, calculated in accordance with the Code, to be included with the U.S. Holder’s U.S. federal income tax return. We have not provided our U.S. Holders with

such information in prior taxable years and do not intend to provide such information in the current taxable year. Accordingly, U.S. Holders will not be able to make an effective QEF election at this time. If, contrary to our expectations, we

determine that we are or will be a PFIC for any taxable year, we will provide U.S. Holders with the information necessary to make an effective QEF election with respect to our common stock.

Taxation of U.S. Holders Making a “Mark–to–Market” Election. If we were to be treated as a PFIC for any taxable year and, as we

anticipate, our stock were treated as “marketable stock,” then, as an alternative to making a QEF election, a U.S. Holder would be allowed to make a “mark–to–market” election with respect to our common stock, provided

the U.S. Holder completes and files IRS Form 8621 in accordance with the relevant instructions and related Treasury Regulations. If that election is made for the first year a U.S. Holder holds or is deemed to hold our common stock and for which we

are a PFIC, the U.S. Holder generally would include as

- 17 -

ordinary income in each taxable year that we are a PFIC the excess, if any, of the fair market value of the U.S. Holder’s common stock at the end of the taxable year over the U.S.

Holder’s adjusted tax basis in the common stock. The U.S. Holder also would be permitted an ordinary loss in respect of the excess, if any, of the U.S. Holder’s adjusted tax basis in the common stock over the fair market value thereof at

the end of the taxable year that we are a PFIC, but only to the extent of the net amount previously included in income as a result of the mark–to–market election. A U.S. Holder’s tax basis in our common stock would be adjusted to

reflect any such income or loss recognized. Gain recognized on the sale, exchange or other disposition of our common stock in taxable years that we are a PFIC would be treated as ordinary income, and any loss recognized on the sale, exchange or

other disposition of our common stock in taxable years that we are a PFIC would be treated as ordinary loss to the extent that such loss does not exceed the net mark–to–market gains previously included in income by the U.S. Holder. Because

the mark–to–market election only applies to marketable stock, however, it would not apply to a U.S. Holder’s indirect interest in any of our subsidiaries that were also determined to be PFICs.

If a U.S. Holder makes a mark-to-market election for one of our taxable years and we were a PFIC for a prior taxable year during which such

U.S. Holder held our common stock and for which (a) we were not a QEF with respect to such U.S. Holder and (b) such U.S. Holder did not make a timely mark-to-market election, such U.S. Holder would also be subject to the more adverse rules

described below in the first taxable year for which the mark-to-market election is in effect and also to the extent the fair market value of the U.S. Holder’s common stock exceeds the U.S. Holder’s adjusted tax basis in the common stock at

the end of the first taxable year for which the mark-to-market election is in effect.

Taxation of U.S. Holders Not Making a Timely QEF or

Mark–to–Market Election. If we were to be treated as a PFIC for any taxable year, a U.S. Holder who does not make either a QEF election or a “mark–to–market” election for that year (a Non–Electing Holder

) would be subject to special rules resulting in increased tax liability with respect to (a) any “excess distribution” (i.e., the portion of any distributions received by the Non–Electing Holder on our common stock in a taxable

year in excess of 125% of the average annual distributions received by the Non–Electing Holder in the three preceding taxable years, or, if shorter, the Non–Electing Holder’s holding period for our common stock), and (b) any gain

realized on the sale, exchange or other disposition of our common stock. Under these special rules:

| |

• |

|

the excess distribution or gain would be allocated ratably over the Non-Electing Holder’s aggregate holding period for our common stock; |

| |

• |

|

the amount allocated to the current taxable year and any taxable year prior to the taxable year we were first treated as a PFIC with respect to the Non-Electing Holder would be taxed as ordinary income in the current

taxable year; |

| |

• |

|

the amount allocated to each of the other taxable years would be subject to U.S. federal income tax at the highest rate of tax in effect for the applicable class of taxpayer for that year; and |

| |

• |

|

an interest charge for the deemed deferral benefit would be imposed with respect to the resulting tax attributable to each such other taxable year. |

Additionally, for each year during which a U.S. Holder owns shares, we are a PFIC, and the total value of all PFIC stock that such U.S. Holder

directly or indirectly holds exceeds certain thresholds, such U.S. Holder will be required to file IRS Form 8621 with its annual U.S. federal income tax return to report its ownership of our common stock. In addition, if a Non–Electing Holder

who is an individual dies while owning our common stock, such Non-Electing Holder’s successor generally would not receive a step–up in tax basis with respect to such common stock.

- 18 -

U.S. Holders are urged to consult their own tax advisors regarding the PFIC rules, including the PFIC

annual reporting requirements, as well as the applicability, availability and advisability of, and procedure for, making QEF, Mark-to-Market Elections and other available elections with respect to us, and the U.S. federal income tax consequences of

making such elections.

Consequences of Possible Controlled Foreign Corporation Classification

If CFC Shareholders (generally, U.S. Holders who each own, directly, indirectly or constructively, 10% or more of the total combined voting

power of our outstanding shares entitled to vote) own directly, indirectly or constructively more than 50% of either the total combined voting power of our outstanding shares entitled to vote or the total value of all of our outstanding shares, we

generally would be treated as a controlled foreign corporation (or a CFC ).

CFC Shareholders are treated as receiving current

distributions of their respective share of certain income of the CFC without regard to any actual distributions and are subject to other burdensome U.S. federal income tax and administrative requirements but generally are not also subject to the

requirements generally applicable to shareholders of a PFIC. In addition, a person who is or has been a CFC Shareholder may recognize ordinary income on the disposition of shares of the CFC. Although we do not believe we are or will become a CFC,

U.S. persons owning a substantial interest in us should consider the potential implications of being treated as a CFC Shareholder in the event we become a CFC in the future.

The U.S. federal income tax consequences to U.S. Holders who are not CFC Shareholders would not change in the event we become a CFC in the

future.

U.S. Return Disclosure Requirements for U.S. Individual Holders

U.S. Individual Holders who hold certain specified foreign financial assets, including stock in a foreign corporation that is not held in an

account maintained by a financial institution with an aggregate values in excess of $50,000 on the last day of a taxable year, or $75,000 at any time during that taxable year, may be required to report such assets on IRS Form 8938 with their U.S.

federal income tax return for that taxable year. This reporting requirement does not apply to U.S. Individual Holders who report their ownership of our stock under the PFIC annual reporting rules described above. Penalties apply for failure to

properly complete and file IRS Form 8938. Investors are encouraged to consult with their own tax advisor regarding the possible application of this disclosure requirement to their investment in our common stock.

United States Federal Income Taxation of Non-U.S. Holders

A beneficial owner of our common stock (other than a partnership, including any entity or arrangement treated as a partnership for U.S. federal

income tax purposes) that is not a U.S. Holder is a Non–U.S. Holder.

Distributions

In general, a Non–U.S. Holder will not be subject to U.S. federal income tax on distributions received from us with respect to our common

stock unless the distributions are effectively connected with the Non-U.S. Holder’s conduct of a trade or business in the United States (and, if required by an applicable income tax treaty, are attributable to a permanent establishment that the

Non-U.S. Holder maintains in the United States). If a Non–U.S. Holder is engaged in a trade or business in the United States and the distributions are deemed to be effectively connected to that trade or business, the Non-U.S. Holder generally

will be subject to U.S. federal income tax on those distributions in the same manner as if it were a U.S. Holder.

Sale, Exchange or Other Disposition

of Common Stock

In general, a Non-U.S. Holder is not subject to U.S. federal income tax on any gain resulting from the disposition of

our common stock unless (a) such gain is effectively connected with the Non-U.S. Holder’s conduct of a trade or business in the United States (and, if required by an applicable income tax treaty, is

- 19 -

attributable to a permanent establishment that the Non-U.S. Holder maintains in the United States) or (b) the Non-U.S. Holder is an individual who is present in the United States for 183

days or more during the taxable year in which such disposition occurs and meets certain other requirements. If a Non-U.S. Holder is engaged in a trade or business in the United States and the disposition of our common stock is deemed to be