Current Report Filing (8-k)

June 08 2015 - 8:52AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 5, 2015

|

|

|

(Exact name of registrant as specified in its charter)

|

| |

|

|

|

|

|

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

17802 IH 10 West, Suite 400, San Antonio, Texas

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (210) 344-3400

|

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

On June 4 2015, The Lion Fund II, L.P. (“Lion Fund II”) commenced a tender offer to acquire up to 575,000 shares of the common stock of Biglari Holdings Inc. (“Biglari Holdings) not otherwise owned by affiliates of Lion Fund II at a price of $420.00 in cash per share. On June 5, 2015, Biglari Holdings issued a press release concerning the process by which Biglari Holdings’ board of directors and Governance, Compensation and Nominating Committee will determine the Company’s position with respect to the tender offer. A copy of the press release related to this announcement is attached hereto as Exhibit 99.1 and incorporated by reference herein

Item 9.01 Financial Statements and Exhibits

| |

|

|

|

|

|

|

|

99.1

|

|

Press Release dated June 5, 2015

|

.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BIGLARI HOLDINGS INC.

|

|

| |

|

|

| |

By /s/ Bruce Lewis

Name: Bruce Lewis

Title: Controller

|

|

|

Date June 5, 2015

|

|

|

Exhibit Index

| |

|

|

|

|

|

|

|

99.1

|

|

Press Release dated June 5, 2015

|

Exhibit 99.1

Biglari Holdings News Release

SAN ANTONIO, TX – 06/5/15 – On June 4, 2015, The Lion Fund II, L.P. ("The Lion Fund II") commenced a tender offer to purchase for cash up to 575,000 shares of the common stock of Biglari Holdings Inc. (“Biglari Holdings” or the “Company”) at a purchase price of $420.00 per share. Affiliates of The Lion Fund II beneficially own approximately 19.6% of the outstanding shares of Biglari Holdings' common stock.

The Company’s Governance, Compensation and Nominating Committee (the "Governance Committee") of the board of directors will make a recommendation to the full board concerning the tender offer. The members of the Governance Committee are all independent directors of the board.

NOTICE TO SHAREHOLDERS

The tender offer proposed by The Lion Fund II referred to in this release has commenced. Biglari Holdings will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC within 10 business days from the date of the commencement of the tender offer. Shareholders of Biglari Holdings are strongly advised to read the Solicitation/Recommendation Statement because it will contain information the Company believes should be considered by its shareholders in evaluating the tender offer. Biglari Holdings requests that its shareholders defer making a determination whether to accept or reject the tender offer until they have been advised of the position of the Company. Shareholders may obtain the Solicitation/Recommendation Statement (when it becomes available) and any other materials filed by Biglari Holdings Inc. with the SEC at the SEC's web site, www.sec.gov. Shareholders may also obtain, without charge, a copy of the Solicitation/Recommendation Statement and other materials (if and when they become available) by directing a request to Biglari Holdings Inc., 17802 IH 10 West, Suite 400, San Antonio, Texas 78257.

About Biglari Holdings Inc. (NYSE: BH)

Biglari Holdings Inc. is a holding company owning, subsidiaries engaged in a number of diverse business activities, including media, property and casualty insurance, as well as restaurants. The Company’s largest operating subsidiaries are involved in the franchising and operating of restaurants. The Company also owns interests in The Lion Fund II and in funds affiliated with The Lion Fund II.

Forward-Looking Statements

This news release may include "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These statements are based on current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ markedly from those projected or discussed here. Biglari Holdings cautions readers not to place undue reliance upon any such forward-looking statements, for actual results may differ materially from expectations. Biglari Holdings does not update publicly or revise any forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. Further information on the types of factors that could affect Biglari Holdings and its business can be found in the Company's filings with the SEC.

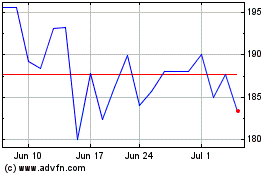

Biglari (NYSE:BH)

Historical Stock Chart

From Mar 2024 to Apr 2024

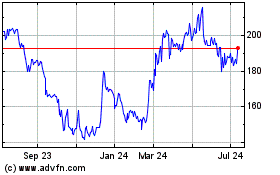

Biglari (NYSE:BH)

Historical Stock Chart

From Apr 2023 to Apr 2024