UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

------------

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization)

(IRS Employer Identification Number)

5885 Hollis Street, Suite 100

Emeryville, CA 94608

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

John G. Melo

President and Chief Executive Officer

5885 Hollis Street, Suite 100

Emeryville, CA 94608

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

Please send copies of all correspondence to:

Gordon K. Davidson, Esq.

Daniel J. Winnike, Esq.

Fenwick & West LLP

801 California Street

Mountain View, California 94041

(650) 988-8500

From time to time after the effectiveness of this registration statement.

(Approximate date of commencement of proposed sale to the public)

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer x

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller reporting company ¨

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered

|

Amount to be registered (1)

|

Proposed maximum offering price per unit (2)

|

Proposed maximum aggregate offering price (2)

|

Amount of registration fee

|

|

Common Stock, $0.0001 par value per share

|

105,665,377

|

$1.97

|

$208,160,792.69

|

$24,188.29

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, this Registration Statement shall also cover any additional shares of common stock which become issuable by reason of any stock dividend, stock split or other similar transaction effected without the receipt of consideration that results in an increase in the number of the outstanding shares of our common stock. Of the 105,665,377 shares covered by this Registration Statement, (i) 49,097,424 of such shares represent the maximum amount of shares that may become issuable under the unsecured senior convertible tranche I and tranche II promissory notes held by certain of the selling stockholders, (ii) 1,000,000 of such shares represent the maximum amount of shares that are issuable under the warrant held by a selling stockholder, (iii) 5,796,038 of such shares represent the maximum amount of shares that are issuable under the 6.50% Convertible Senior Notes due 2019 held by certain of the selling stockholders and (iv) 18,316,624 of such shares represent the maximum amount of shares that may become issuable under the 1.5% senior secured convertible notes held by a selling stockholder; provided, however, in each case, that additional shares of common stock may become issuable in the event of any stock dividend, stock split or other similar transaction effected without the receipt of consideration that results in an increase in the number of the outstanding shares of our common stock.

|

|

(2)

|

In accordance with Rule 457(c) under the Securities Act of 1933, the aggregate offering price of our common stock is estimated solely for the purpose of calculating the registration fees due for this filing. For the initial filing of this Registration Statement, this estimate was based on the average of the high and low sales price of our common stock reported by The NASDAQ Global Select Market on May 15, 2015.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

| THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SELLING STOCKHOLDERS MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND THE SELLING STOCKHOLDERS ARE NOT SOLICITING OFFERS TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

SUBJECT TO COMPLETION DATED MAY 21, 2015

PROSPECTUS

105,665,377 Shares

AMYRIS, INC.

Common Stock

This prospectus relates to the offer and sale of up to 105,665,377 shares of our common stock by the selling stockholders identified in the “Selling Stockholders” section of this prospectus (the “Offering”). The shares of common stock registered hereunder consist of (i) outstanding shares held by certain of the selling stockholders, (ii) shares issuable to certain of the selling stockholders at their election upon conversion of certain outstanding senior unsecured tranche I and tranche II convertible promissory notes (the “Tranche Notes”) issued to the selling stockholders pursuant to that Securities Purchase Agreement, dated as of August 8, 2013, as amended by that Amendment No. 1 to Securities Purchase Agreement dated as of October 16, 2013 and that Amendment No. 2 to Securities Purchase Agreement and Tranche I Note Amendment Agreement dated as of December 24, 2013 (as amended, the “Note Agreement”), by and among us and certain of the selling stockholders, (iii) shares issuable to Maxwell (Mauritius) Pte Ltd (“Maxwell”) upon exercise or conversion of a warrant issued to Maxwell on October 16, 2013 (the “Warrant”) pursuant to the Note Agreement, (iv) shares issuable to certain of the selling stockholders at their election upon conversion of the 6.50% Convertible Senior Notes due 2019 (the “144A Notes”) issued to an initial purchaser (the “Initial Purchaser”) pursuant to a Purchase Agreement dated as of May 22, 2014, by and among the Company and the Initial Purchaser and subsequently resold by the Initial Purchaser to certain of the selling stockholders, and (v) shares issuable to Total Energies Nouvelles Activités USA (“Total”) at their election upon conversion of the 1.5% senior secured convertible notes (the “R&D Notes”) issued by us to Total in replacement of 1.5% senior unsecured convertible notes issued by us to Total pursuant to that certain Securities Purchase Agreement dated as of July 30, 2012 by and among the Company and Total.

The selling stockholders may sell the shares of common stock described in this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell shares of common stock in the section titled “Plan of Distribution” on page 11. We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of these shares by the selling stockholders. We will pay the expenses incurred in registering the shares, including legal and accounting fees.

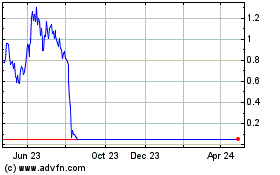

Our common stock is traded on the NASDAQ Global Select Market under the symbol “AMRS.” On May 15, 2015, the closing price of our common stock was $1.97.

Investing in our securities involves risks. See “Risk Factors” commencing on page 4. You should carefully read this prospectus, the documents incorporated herein, and, if applicable, any prospectus supplement subsequently filed with respect to this prospectus, before making any investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 21, 2015.

TABLE OF CONTENTS

|

INFORMATION CONTAINED IN THIS PROSPECTUS

|

1

|

|

SUMMARY

|

2

|

|

RISK FACTORS

|

4

|

|

FORWARD-LOOKING STATEMENTS

|

5

|

|

USE OF PROCEEDS

|

5

|

|

SELLING STOCKHOLDERS

|

6

|

|

PLAN OF DISTRIBUTION

|

11

|

|

DESCRIPTION OF CAPITAL STOCK

|

14

|

|

LEGAL MATTERS

|

17

|

|

EXPERTS

|

17

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

17

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

18

|

INFORMATION CONTAINED IN THIS PROSPECTUS

We have not authorized any dealer, agent or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus and, if applicable, any accompanying prospectus supplement or any free writing prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or, if applicable, any accompanying prospectus supplement or any free writing prospectus. This prospectus and, if applicable, any accompanying prospectus supplement or any free writing prospectus, do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and, if applicable, any accompanying prospectus supplement or any free writing prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus and, if applicable, any accompanying prospectus supplement or any free writing prospectus, is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and, if applicable, any accompanying prospectus supplement or any free writing prospectus, is delivered or securities are sold on a later date.

SUMMARY

The following summary provides an overview of selected information related to this offering and does not contain all the information that you should consider before investing in our securities. You should carefully read this entire prospectus, including the risks of investing discussed under “Risk Factors” beginning on page 4, the financial statements and related notes and other information incorporated by reference in this prospectus, and, if applicable, any prospectus supplement or related free writing prospectus, and the additional information described under the captions “Where You Can Find More Information” and “Incorporation of Certain Information by Reference,” before buying securities in this offering. Unless the context otherwise requires, “AMRS,” the “Company,” “we,” “us,” “our” and similar names refer to Amyris, Inc. References to “selling stockholders” refer to the stockholders listed herein under the heading “Selling Stockholders” on page 6, who may sell shares from time to time as described in this prospectus.

About This Prospectus

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process to register 105,665,377 shares of our common stock, or the Shares. The shares of common stock registered hereunder consist of (i) outstanding shares held by certain of the selling stockholders, (ii) shares issuable to certain of the selling stockholders at their election upon conversion of the Tranche Notes, (iii) shares issuable to Maxwell upon exercise of the Warrant, (iv) shares issuable to certain of the selling stockholders at their election upon conversion of the 144A Notes, and (v) shares issuable to Total upon conversion of the R&D Notes. The Shares are being registered for resale or other disposition by the selling stockholders. We will not receive any proceeds from the sale or other disposition of the Shares registered hereunder, or interests therein.

About Amyris, Inc.

Amyris has industrialized synthetic biology and is delivering renewable products globally into various markets ranging from consumer care to fuels. We believe industrial synthetic biology represents a third industrial revolution bringing together biology and engineering to generate new, more sustainable materials to meet the growing global demand. We have built a powerful technology platform, robust manufacturing capability, and a strong pipeline of ongoing collaborations with world-leading companies in a variety of industries. We are working to build demand for our current portfolio of products through a network of distributors and through direct sales in the cosmetics, flavors and fragrances, performance materials, and transportation fuels and lubricants markets. We are also engaged in collaborations across a variety of markets, including our current product markets and new markets, to drive additional product sales and partnership opportunities.

We were founded in 2003 in the San Francisco Bay Area by a group of scientists from the University of California, Berkeley. Our first major milestone came in 2005 when, through a grant from the Bill & Melinda Gates Foundation, we developed technology capable of creating microbial strains to produce artemisinic acid - a precursor of artemisinin, an effective anti-malarial drug. In 2008, we granted royalty-free licenses to allow Sanofi-Aventis (or Sanofi), to produce artemisinic acid using our technology. Since 2013, Sanofi has been distributing millions of artemisinin-based anti-malarial treatments incorporating this artemisinic acid. Building on our success with artemisinic acid, in 2007 we began applying our technology platform to develop, manufacture and sell sustainable alternatives to a broad range of materials.

We focused our initial development efforts primarily on the production of Biofene®, our brand of renewable farnesene, a long-chain, branched hydrocarbon molecule that we manufacture using engineered microbes in fermentation. Using farnesene as a first commercial building block molecule, we have developed a wide range of renewable products for our various target markets including cosmetics, pharmaceuticals, flavors and fragrances and fuels. Our technology platform allows us to rapidly develop microbial strains to produce other target molecules, and in 2014, we began manufacturing additional molecules for the flavors and fragrances industry.

Amyris' microbial engineering and screening technologies modify the way microorganisms process sugars in a fermentation process. We use our proprietary platform to design microbes, primarily yeast, to serve as living factories in established fermentation processes to convert plant-sourced sugars into high-value hydrocarbon molecules instead of low-value alcohol. The first two molecules we developed through this process were artemisinic acid and farnesene. In 2014, we began production of a third molecule at industrial scale and development of various other molecules in our labs. We and our partners develop products from these hydrocarbon ingredients for several target markets, including cosmetics, flavors and fragrances, performance materials, transportation fuels and lubricants. Further, in connection with our partners we have commercialized products for the cosmetics and flavors and fragrances markets.

We are able to use a wide variety of feedstocks for production, but have focused on accessing Brazilian sugarcane for our large-scale production because of its renewability, low cost and relative price stability. We have also successfully used other feedstocks such as sugar beets, corn dextrose, sweet sorghum and cellulosic sugars at our various manufacturing facilities.

Our mission is to apply inspired science to deliver sustainable solutions for a growing world. We seek to become the world's leading provider of renewable, high-performance alternatives to non-renewable chemicals and fuels. In the past, choosing a renewable product often required producers to compromise on performance or price. With our technology, leading consumer brands can develop products made from renewable sources that offer equivalent or better performance and stable supply with competitive pricing. We call this our No Compromise® value proposition. We aim to improve the world one molecule at a time by providing consumers with the best alternatives.

We have developed and are operating our company under an innovative business model that generates cash from both collaborations and from product sales margins. We believe this combination will enable us to realize our vision of becoming the world’s leading renewable products company.

We were founded in 2003 and completed our initial public offering in 2010. As of January 31, 2015, we had 404 employees (including 245 in the United States and 159 in Brazil). Our corporate headquarters and pilot plant are located in Emeryville, California, and our Brazil headquarters and pilot plant are located in Campinas, Brazil. We have two operating subsidiaries, Amyris Brasil Ltda. (or Amyris Brasil) and Amyris Fuels LLC (or Amyris Fuels). Amyris Brasil oversees establishment and expansion of our production in Brazil. Amyris Fuels was originally established to help us develop fuel distribution capabilities in the United States by selling ethanol and reformulated ethanol-blended gasoline. In the third quarter of 2012, we transitioned out of the ethanol and ethanol-blended gasoline business, to focus our efforts on production and commercialization of renewable products.

Amyris, the Amyris logo, Biofene , Biossance, Dial-A-Blend, Diesel de Cana, Evoshield, µPharm, Myralene, Muck Daddy, Neossance and No Compromise are trademarks or registered trademarks of Amyris, Inc. This prospectus also contains trademarks and trade names of other business that are the property of their respective holders.

Our principal executive offices are located at 5885 Hollis Street, Suite 100, Emeryville, CA 94608 and our telephone number at that address is (510) 450-0761.

_________________

RISK FACTORS

Investing in our common stock involves a high degree of risk. Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed under the heading “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2015 filed with the SEC, which is incorporated herein by reference, and may be amended, supplemented, or superseded from time to time by other reports we file with the SEC in the future. These risk factors should be read together with the financial and other information contained or incorporated by reference in this prospectus before making a decision to buy our common stock. If any of the risks actually occur, our business, financial condition and results of operations could suffer. In these circumstances, the market price of our common stock could decline and you may lose all or part of your investment in our common stock.

Additional risks and uncertainties beyond those set forth in our reports and not presently known to us or that we currently deem immaterial may also affect our operations. Any risks and uncertainties, whether set forth in our reports or otherwise, could cause our business, financial condition, results of operations and future prospects to be materially and adversely harmed. The trading price of our common stock could decline due to any of these risks and uncertainties, and, as a result, you may lose all or part of your investment.

FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement and the other documents we have filed with the SEC that are incorporated herein by reference contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties, including those discussed under the heading “Risk Factors” above, include the possibilities of delays or failures in development, production or commercialization of products, and in our reliance on third parties to achieve our goals.

All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including any projections of financing needs, revenue, expenses, earnings or losses from operations, or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning product research, development and commercialization plans and timelines; any statements regarding expected production capacities, volumes and costs; any statements regarding anticipated benefits of our products and expectations for commercial relationships; any other statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. In addition, the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “plan,” “project,” “will be,” “will continue,” “will result,” “seek,” “could,” “may,” “might,” or any variations of such words or other words with similar meanings generally identify forward-looking statements.

Given these uncertainties, you should not place undue reliance on these forward-looking statements. You should read this prospectus, any supplements to this prospectus and the documents that we reference in this prospectus with the understanding that our actual future results may be materially different from what we expect.

The forward-looking statements in this prospectus and in any prospectus supplement or other document we have filed with the SEC represent our views as of the date thereof. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future or to conform these statements to actual results or revised expectations, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this prospectus.

USE OF PROCEEDS

The proceeds from the sale of the Shares offered pursuant to this prospectus are solely for the accounts of the selling stockholders. Accordingly, we will not receive any of the proceeds from the sale of the Shares offered by this prospectus. See “Selling Stockholders” and “Plan of Distribution” described below.

SELLING STOCKHOLDERS

The 105,665,377 shares of common stock covered by this prospectus, or the Shares, consist of outstanding shares held by the selling stockholders and shares issuable to the selling stockholders at their election upon conversion or exercise, as applicable, of the outstanding Notes, the Warrant, the 144A Notes and the R&D Notes. We have agreements in place with the selling stockholders in which we have agreed to to file a registration statement with the SEC covering the resale of shares of our capital stock, and this registration statement has been filed pursuant to those agreements.

The tables below present information regarding the selling stockholders and the number of Shares each selling stockholder is offering under this prospectus. We have prepared these tables based on information furnished to us by or on behalf of the selling stockholders. Under the rules of the SEC, beneficial ownership includes shares over which the indicated beneficial owner exercises voting or investment power. Beneficial ownership is determined under Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and generally includes voting or investment power with respect to securities, including any securities that grant the selling stockholder the right to acquire common stock within 60 days of April 30, 2015 (the “60-Day Period”). Because neither of the R&D Notes and Warrant are currently convertible or exercisable, and will not be convertible or exercisable during the 60-Day Period, into shares of our common stock, and because the total shares issuable under the Tranche Notes may increase subsequent to the 60-Day Period to the extent the Company chooses to pay interest that may accrue under the Tranche Notes in kind rather than in cash, we have provided two tables below, the first of which shows actual beneficial ownership as of April 30, 2015, as determined in accordance with Section 13(d) of the Exchange Act, and the second of which shows such beneficial ownership and also includes all shares issuable upon conversion of the R&D Notes and exercise of the Warrantand all shares that would be issued to certain of the selling stockholders if all interest that may accrue under the Tranche Notes held by such selling stockholders through their maturity is paid in kind. Unless otherwise indicated in the footnotes below, we believe that the selling stockholders have sole voting and investment power with respect to all shares beneficially owned. The percentage ownership data is based on 79,924,220 shares of our common stock issued and outstanding as of April 30, 2015. Since the date on which they provided us with the information below, the selling stockholders may have sold, transferred or otherwise disposed of some or all of their Shares in transactions exempt from the registration requirements of the Securities Act of 1933, as amended, or the Securities Act.

The conversion terms of the Tranche Notes, R&D Notes, 144A Notes and the exercise terms of the Warrant are as follows:

Tranche Notes: The Tranche Notes were issued in two closings, one in October 2013 (the “Tranche I Notes”) and one in January 2014 (the “Tranche II Notes”). The Tranche I Notes are currently convertible into common stock at a conversion price equal to $2.44 and the Tranche II Notes are currently convertible into common stock at a conversion price equal to $2.87, in each case, subject to adjustment (i) according to proportional adjustments to outstanding common stock in case of certain dividends and distributions, (ii) according to anti-dilution provisions, and (iii) with respect to Convertible Notes held by any purchaser other than Total, in the event that Total exchanges existing convertible notes for new securities of Amyris in connection with future financing transactions in excess of its pro rata amount. The Tranche Notes accrue interest from the date of issuance until repayment or conversion at the rate of (a) in the case of the Tranche I Notes, 5% per six months, compounded semiannually (with graduated interest rates of 6.5% applicable to the first 180 days and 8% applicable thereafter as the sole remedy should the Company fail to maintain NASDAQ listing status or at 6.5% for all other defaults), and (b) in the case of the Tranche II Notes, 10.00%, compounded annually (with graduated interest rates of 13% applicable to the first 180 days and 16% applicable thereafter as the sole remedy should we fail to maintain NASDAQ listing status or at 12% for all other defaults). During the first 30 and 36 months following the issuance of the Tranche I Notes and Tranche II Notes, respectively, interest is payable in kind and added to principal every six-months in the case of the Tranche I Notes and annually in the case of the Tranche II Notes, and thereafter the Company may continue to pay interest in kind or may elect to pay interest in cash. As of May 21, 2015, all accrued interest under the Tranche Notes has been paid in kind.

R&D Notes: There are currently outstanding $30.0 million in principal amount of R&D Notes with a conversion price of $3.08 per share, $21.7 million in principal amount of R&D Notes with a conversion price of $4.11 per share and $23.3 million in principal amount of R&D Notes with a conversion price of $7.0682 per share. As further described below, the R&D Notes become convertible into common stock within 10 days prior to their maturity, subject to acceleration of such right in certain cases. If Total makes “Go” decision with respect to the collaboration between Amyris and Total on a joint venture for the development of certain fuels, which is described in more detail in our Annual Report on Form 10-K for the year ended December 31, 2014, the R&D Notes will convert into equity interests in the joint venture, and will cease to be convertible into shares of our common stock. Specifically, each R&D Note becomes convertible into our common stock (i) within 10 trading days prior to maturity, (ii) on a change of control of Amyris, (iii) if Total is no longer our largest stockholder following its making a “No-Go” decision with respect to the collaboration between Amyris and Total on the joint venture for the development of certain fuels , and (iv) on our default. The conversion price of the R&D Notes is subject to adjustment for proportional adjustments to outstanding common stock and under anti-dilution provisions in case of certain dividends and distributions.

144A Notes: The 144A Notes are convertible into shares of our common stock at any time prior to the close of business day on May 15, 2019. The 144A Notes have an initial conversion rate of 267.0370 shares of common stock per $1,000 principal amount of 144A Notes (subject to adjustment in certain circumstances). This represents an initial effective conversion price of approximately $3.74 per share of common stock. For any conversion on or after May 15, 2015, in the event that the last reported sale price of our common stock for 20 or more trading days (whether or not consecutive) in a period of 30 consecutive trading days ending within five trading days immediately prior to the date we receive a notice of conversion exceeds $3.74 per share on each such trading day, the holders, in addition to the shares deliverable upon conversion, will be entitled to receive a cash payment equal to the present value of the remaining scheduled payments of interest that would have been made on the 144A Notes being converted from the conversion date to the earlier of the date that is three years after the date we receive such notice of conversion and maturity (May 15, 2019). In the event of a fundamental change, as defined in the indenture governing the 144A Notes, holders of the 144A Notes may require us to purchase all or a portion of the 144A Notes at a price equal to 100% of the principal amount of the 144A Notes, plus any accrued and unpaid interest to, but excluding, the fundamental change repurchase date. Holders of the 144A Notes who convert their 144A Notes in connection with a make-whole fundamental change will receive additional shares representing the present value of the remaining interest payments which will be computed using a discount rate of 0.75%. If a holder of 144A Notes elects to convert their 144A Notes prior to the effective date of any make-whole fundamental change, such holder will not be entitled to an increased conversion rate in connection with such conversion. The conversion price of the 144A Notes is subject to adjustment for proportional adjustments to outstanding common stock and under anti-dilution provisions in case of certain dividends and distributions.

Warrant: The Warrant is a warrant to a purchase 1,000,000 shares of our common stock at an exercise price of $0.01 per share and is exercisable to the extent Total converts its R&D Notes that currently have a conversion price of $3.08.

The Shares may be sold by the selling stockholders, by those persons or entities to whom they transfer, donate, devise, pledge or distribute their Shares or by other successors in interest. The information regarding shares beneficially owned after this offering assumes the sale of all Shares offered by each of the selling stockholders. The selling stockholders may sell less than all of the Shares listed in the table. In addition, the Shares listed below may be sold pursuant to this prospectus or in privately negotiated transactions. Accordingly, we cannot estimate the number of Shares the selling stockholders will sell under this prospectus.

The selling stockholders have not held any position or office or had any other material relationship with us or any of our predecessors or affiliates within the past three years, other than: (i) beneficial ownership of the shares described in the table below, (ii) with respect to Total, Philippe Boisseau serves on our Board of Directors and is an officer of Total S.A., an affiliate of a Total entity with which we have a joint venture, and (iii) with respect to Biolding Investment SA (“Biolding”), HH Sheikh Abdullah bin Khalifa Al Thani serves on our Board of Directors and indirectly owns Biolding.

Table I – Actual Beneficial Ownership

|

Name of Selling Stockholder

|

Shares Beneficially Owned before Offering (1)

|

Shares Offered Hereby (2)

|

Shares Beneficially Owned After Offering (2)

|

| |

Number

|

Percentage (%)

|

|

Number

|

Percentage (%)

|

|

Biolding Investment SA (3)

|

7,484,601

|

9.36

|

7,484,601

|

0

|

0

|

|

Total Energies Nouvelles Activités USA (4)

|

22,925,210 (5)

|

25.69

|

44,157,460 (6)

|

0

|

0

|

|

Wolverine Flagship Fund Trading Limited (7)

|

1,696,651 (8)

|

2.08

|

2,228,615 (9)

|

11,300

|

*

|

|

Maxwell (Mauritius) Pte Ltd (10)

|

39,340,967 (11)

|

36.12

|

51,794,701 (12)

|

0

|

0

|

|

*

|

Represents beneficial ownership of less than one percent of the outstanding shares of our common stock.

|

|

(1)

|

The number of Shares beneficially owned by each selling stockholder is based in part on the conversion price applicable to the Tranche Notes, R&D Notes and 144A Notes held by the selling stockholders as of April 30, 2015.

|

|

(2)

|

We do not know when or in what amounts a selling stockholder may offer Shares for sale. The selling stockholders may not sell any or all of the Shares offered by this prospectus. Because the selling stockholders may offer all or some of the Shares pursuant to this offering and because there are currently no agreements, arrangements or undertakings with respect to the sale of any of the Shares, we cannot estimate the number of Shares that will be held by the selling stockholders after completion of this offering. However, for illustrative purposes of this table, we have assumed that, after completion of this offering, none of the Shares covered by this prospectus will be held by the selling stockholders.

|

|

(3)

|

Biolding Investment SA is indirectly owned by HH Sheikh Abdullah bin Khalifa Al Thani, who shares voting and investment control over the shares held by such entity and is a member of our Board of Directors. The address for Biolding Investment SA is 11A Boulevard Prince Henri, L-1724, Luxembourg.

|

|

(4)

|

Total is a wholly owned subsidiary of Total S.A. We have a license, development, research and collaboration agreement with Total that sets forth the terms for the research, development, production and commercialization of chemical and/or fuels products and sets forth the terms under which Total may make a “Go” or “No Go” decision with respect to the collaboration between Amyris and Total on the joint venture for the development of certain fuels. Philippe Boisseau, a member of our Board of Directors, is a member of the Executive Committee of Total S.A. The address for Total is 2, Place Jean Millier, 92078 Paris La Défense CEDEX, France.

|

|

(5)

|

Includes (i) 4,397,707 shares currently issuable upon conversion of Tranche I Notes, (ii) 2,318,697 shares currently issuable upon conversion of Tranche II Notes, and (iii) 2,591,594 shares currently issuable upon conversion of 144A Notes.

|

|

(6)

|

Includes (i) 4,397,707 shares currently issuable upon conversion of Tranche I Notes and 1,821,479 shares that may become issuable upon conversion of Tranche I Notes, (ii) 2,318,697 shares currently issuable upon conversion of Tranche II Notes and 1,094,147 shares that may become issuable upon conversion of Tranche II Notes, (iii) 2,591,594 shares currently issuable upon conversion of 144A Notes, and (iv) 18,316,624 shares that may become issuable upon conversion of R&D Notes.

|

|

(7)

|

Wolverine Flagship Fund Trading Limited is managed by Wolverine Asset Management, LLC (“WAM”). The sole member and manager of WAM is Wolverine Holdings, L.P. (“Wolverine Holdings”). Robert R. Bellick and Christopher L. Gust may be deemed to control Wolverine Trading Partners, Inc., the general partner of Wolverine Holdings. Each of Mr. Bellick and Mr. Gust disclaim beneficial ownership of these securities. The address for Wolverine Flaship Fund Trading Limited is c/o Wolverine Asset Management, LLC, 175 West Jackson Blvd., Suite 340, Chicago, Illinois 60604.

|

|

(8)

|

Includes (i) 1,151,277 shares currently issuable upon conversion of Tranche II Notes, (ii) 534,074 shares currently issuable upon conversion of 144A Notes, and (iii) 10,400 shares issuable pursuant to 104 option contracts.

|

|

(9)

|

Includes (i) 1,151,277 shares currently issuable upon conversion of Tranche II Notes and 543,264 shares that may become issuable upon conversion of Tranche II Notes, and (ii) 534,074 shares currently issuable upon conversion of 144A Notes.

|

|

(10)

|

Maxwell is wholly owned by Cairnhill Investments (Mauritius) Pte Ltd (“Cairnhill”), which is wholly owned by Fullerton Management Pte Ltd (“FMPL”), which is wholly owned by Temasek Holdings (Private) Limited (“Temasek”). Cairnhill, through its ownership of Maxwell, may be deemed to share voting and dispositive power over the shares of common stock beneficially owned or deemed to be beneficially owned by Maxwell. FMPL, through its ownership of Cairnhill, may be deemed to share voting and dispositive power over the shares of common stock beneficially owned or deemed to be beneficially owned by Cairnhill and Maxwell. Temasek, through its ownership of FMPL, may be deemed to share voting and dispositive power over the shares of common stock beneficially owned or deemed to be beneficially owned by FMPL, Cairnhill and Maxwell. The address for each of Maxwell and Cairnhill is C/O IMM, Les Cascades, Edith Cavell Street, Port Louis, Mauritius, 238891. The address for each of Temasek and Fullerton is 60B Orchard Road, #06-18 Tower 2, The Atrium @ Orchard, Singapore 238891.

|

|

(11)

|

Includes (i) 16,723,140 shares currently issuable upon conversion of Tranche I Notes, (ii) 9,593,979 shares currently issuable upon conversion of Tranche II Notes, and (iii) 2,670,370 shares currently issuable upon conversion of 144A Notes.

|

|

(12)

|

Includes (i) 16,723,140 shares currently issuable upon conversion of Tranche I Notes and 6,926,530 shares that may become issuable upon conversion of Tranche I Notes, (ii) 9,593,979 shares currently issuable upon conversion of Tranche II Notes and 4,527,204 shares that may become issuable upon conversion of Tranche II Notes, (iii) 2,670,370 shares currently issuable upon conversion of 144A Notes, and (iv) 1,000,000 shares that may become issuable upon exercise of the Warrant.

|

Table II – Alternative Beneficial Ownership Table

|

Name of Selling Stockholder

|

Shares Beneficially Owned before Offering (1)

|

Shares Offered Hereby (2)

|

Shares Beneficially Owned After Offering (2)

|

| |

Number

|

Percentage (%)

|

|

Number

|

Percentage (%)

|

|

Biolding Investment SA (3)

|

7,484,601

|

9.36

|

7,484,601

|

0

|

0

|

|

Total Energies Nouvelles Activités USA (4)

|

44,157,460 (5)

|

39.97

|

44,157,460

|

0

|

0

|

|

Wolverine Flagship Fund Trading Limited (6)

|

2,239,915 (7)

|

2.73

|

2,228,615 (8)

|

11,300

|

*

|

|

Maxwell (Mauritius) Pte Ltd (9)

|

51,794,701 (10)

|

42.68

|

51,794,701

|

0

|

0

|

|

*

|

Represents beneficial ownership of less than one percent of the outstanding shares of our common stock.

|

|

(1)

|

The number of Shares beneficially owned by each selling stockholder is based in part on the conversion price applicable to the Tranche Notes, R&D Notes and 144A Notes held by the selling stockholders as of April 30, 2015.

|

|

(2)

|

We do not know when or in what amounts a selling stockholder may offer Shares for sale. The selling stockholders may not sell any or all of the Shares offered by this prospectus. Because the selling stockholders may offer all or some of the Shares pursuant to this offering and because there are currently no agreements, arrangements or undertakings with respect to the sale of any of the Shares, we cannot estimate the number of Shares that will be held by the selling stockholders after completion of this offering. However, for illustrative purposes of this table, we have assumed that, after completion of this offering, none of the Shares covered by this prospectus will be held by the selling stockholders.

|

|

(3)

|

Biolding Investment SA is indirectly owned by HH Sheikh Abdullah bin Khalifa Al Thani, who shares voting and investment control over the shares held by such entity and is a member of our Board of Directors. The address for Biolding Investment SA is 11A Boulevard Prince Henri, L-1724, Luxembourg.

|

|

(4)

|

Total is a wholly owned subsidiary of Total S.A. We have a license, development, research and collaboration agreement with Total that sets forth the terms for the research, development, production and commercialization of chemical and/or fuels products and sets forth the terms under which Total may make a “Go” or “No Go” decision with respect to the collaboration between Amyris and Total on the joint venture for the development of certain fuels. Philippe Boisseau, a member of our Board of Directors, is a member of the Executive Committee of Total S.A. The address for Total is 2, Place Jean Millier, 92078 Paris La Défense CEDEX, France.

|

|

(5)

|

Includes (i) 4,397,707 shares currently issuable upon conversion of Tranche I Notes and 1,821,479 shares that may become issuable upon conversion of Tranche I Notes, (ii) 2,318,697 shares currently issuable upon conversion of Tranche II Notes and 1,094,147 shares that may become issuable upon conversion of Tranche II Notes, (iii) 2,591,594 shares currently issuable upon conversion of 144A Notes, and (iv) 18,316,624 shares that may become issuable upon conversion of R&D Notes

|

|

(6)

|

Wolverine Flagship Fund Trading Limited is managed by Wolverine Asset Management, LLC (“WAM”); Wolverine Holdings, L.P. (“Wolverine Holdings”) is the sole member and manager of WAM; and Wolverine Trading Partners, Inc. is the general partner of Wolverine Holdings. The address for Wolverine Flaship Fund Trading Limited is 175 West Jackson Blvd., Suite 340, Chicago, Illinois 60604.

|

|

(7)

|

Includes (i) 1,151,277 shares currently issuable upon conversion of Tranche II Notes and 543,264 shares that may become issuable upon conversion of Tranche II Notes, (ii) 534,074 shares currently issuable upon conversion of 144A Notes, and (iii) 10,400 shares issuable pursuant to 104 option contracts.

|

|

(8)

|

Includes (i) 1,151,277 shares currently issuable upon conversion of Tranche II Notes and 543,264 shares that may become issuable upon conversion of Tranche II Notes, and (ii) 534,074 shares currently issuable upon conversion of 144A Notes

|

|

(9)

|

Maxwell is wholly owned by Cairnhill Investments (Mauritius) Pte Ltd (“Cairnhill”), which is wholly owned by Fullerton Management Pte Ltd (“FMPL”), which is wholly owned by Temasek Holdings (Private) Limited (“Temasek”). Cairnhill, through its ownership of Maxwell, may be deemed to share voting and dispositive power over the shares of common stock beneficially owned or deemed to be beneficially owned by Maxwell. FMPL, through its ownership of Cairnhill, may be deemed to share voting and dispositive power over the shares of common stock beneficially owned or deemed to be beneficially owned by Cairnhill and Maxwell. Temasek, through its ownership of FMPL, may be deemed to share voting and dispositive power over the shares of common stock beneficially owned or deemed to be beneficially owned by FMPL, Cairnhill and Maxwell. The address for each of Maxwell and Cairnhill is C/O IMM, Les Cascades, Edith Cavell Street, Port Louis, Mauritius, 238891. The address for each of Temasek and Fullerton is 60B Orchard Road, #06-18 Tower 2, The Atrium @ Orchard, Singapore 238891.

|

|

(10)

|

Includes (i) 16,723,140 shares currently issuable upon conversion of Tranche I Notes and 6,926,530 shares that may become issuable upon conversion of Tranche I Notes, (ii) 9,593,979 shares currently issuable upon conversion of Tranche II Notes and 4,527,204 shares that may become issuable upon conversion of Tranche II Notes, (iii) 2,670,370 shares currently issuable upon conversion of 144A Notes, and (iv) 1,000,000 shares that may become issuable upon exercise of the Warrant.

|

PLAN OF DISTRIBUTION

The selling stockholders, or their pledgees, donees, transferees, or any of their successors in interest selling Shares received from a named selling stockholders as a gift, partnership distribution or other non-sale-related transfer after the date of this prospectus (all of whom may be selling stockholders), may sell the Shares from time to time on any stock exchange or automated interdealer quotation system on which the Shares are listed, in the over-the-counter market, in privately negotiated transactions or otherwise, at fixed prices that may be changed, at market prices prevailing at the time of sale, at prices related to prevailing market prices or at prices otherwise negotiated. The selling stockholders may sell the Shares by one or more of the following methods, without limitation:

|

|

(a)

|

block trades in which the broker or dealer so engaged will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

(b)

|

purchases by a broker or dealer as principal and resale by the broker or dealer for its own account pursuant to this prospectus;

|

|

|

(c)

|

an exchange distribution in accordance with the rules of any stock exchange on which the securities are listed;

|

|

|

(d)

|

ordinary brokerage transactions and transactions in which the broker solicits purchases;

|

|

|

(e)

|

privately negotiated transactions;

|

|

|

(g)

|

through the writing of options on the securities, whether or not the options are listed on an options exchange;

|

|

|

(h)

|

through the distribution of the securities by any selling stockholder holder to its partners, members or stockholders;

|

|

|

(i)

|

one or more underwritten offerings on a firm commitment or best efforts basis;

|

|

|

(j)

|

any combination of any of these methods of sale; and

|

|

|

(k)

|

through such other method described in any applicable prospectus supplement for such offering.

|

The selling stockholders may also transfer the securities by gift. We do not know of any arrangements by the selling stockholders for the sale of any of the securities.

The selling stockholders may engage brokers and dealers, and any brokers or dealers may arrange for other brokers or dealers to participate in effecting sales of the Shares. These brokers, dealers or underwriters may act as principals, or as an agent of a selling stockholder. Broker-dealers may agree with a selling stockholder to sell a specified number of the Shares at a stipulated price per Share. If the broker-dealer is unable to sell the Shares acting as agent for a selling stockholder, it may purchase as principal any unsold Shares at the stipulated price. Broker-dealers who acquire the Shares as principals may thereafter resell the Shares from time to time in transactions in any stock exchange or automated interdealer quotation system on which the Shares are then listed, at prices and on terms then prevailing at the time of sale, at prices related to the then-current market price or in negotiated transactions. Broker-dealers may use block transactions and sales to and through broker-dealers, including transactions of the nature described above. The selling stockholders may also sell the Shares in accordance with Rule 144 under the Securities Act rather than pursuant to this prospectus, regardless of whether the Shares are covered by this prospectus.

From time to time, one or more of the selling stockholders may pledge, hypothecate or grant a security interest in some or all of the Shares owned by them. The pledgees, secured parties or persons to whom the Shares have been hypothecated will, upon foreclosure in the event of default, be deemed to be selling stockholders. The number of a selling stockholder’s Shares offered under this prospectus will decrease as and when it takes such actions. The plan of distribution for that selling stockholder’s Shares will otherwise remain unchanged. In addition, a selling stockholder may, from time to time, sell the Shares short, and, in those instances, this prospectus may be delivered in connection with the short sales and the Shares offered under this prospectus may be used to cover short sales.

To the extent required under the Securities Act, the aggregate amount of selling stockholders’ Shares being offered and the terms of the offering, the names of any agents, brokers, dealers or underwriters and any applicable commission with respect to a particular offer will be set forth in an accompanying prospectus supplement. Any underwriters, dealers, brokers or agents participating in the distribution of the Shares may receive compensation in the form of underwriting discounts, concessions, commissions or fees from a selling stockholder and/or purchasers of selling stockholders’ Shares, for whom they may act (which compensation as to a particular broker-dealer might be in excess of customary commissions).

The selling stockholders and any underwriters, brokers, dealers or agents that participate in the distribution of the Shares may be deemed to be “underwriters” within the meaning of the Securities Act, and any discounts, concessions, commissions or fees received by them and any profit on the resale of the Shares sold by them may be deemed to be underwriting discounts and commissions.

A selling stockholder may enter into hedging transactions with broker-dealers and the broker-dealers may engage in short sales of the Shares in the course of hedging the positions they assume with that selling stockholder, including, without limitation, in connection with distributions of the Shares by those broker-dealers. A selling stockholder may enter into option or other transactions with broker-dealers that involve the delivery of the Shares offered hereby to the broker-dealers, who may then resell or otherwise transfer those Shares. A selling stockholder may also loan or pledge the Shares offered hereby to a broker-dealer and the broker-dealer may sell the Shares offered hereby so loaned or upon a default may sell or otherwise transfer the pledged Shares offered hereby.

The selling stockholders and other persons participating in the sale or distribution of the Shares will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M. This regulation may limit the timing of purchases and sales of any of the Shares by the selling stockholders and any other person. The anti-manipulation rules under the Exchange Act may apply to sales of securities in the market and to the activities of the selling stockholders and their affiliates. Furthermore, Regulation M may restrict the ability of any person engaged in the distribution of the Shares to engage in market-making activities with respect to the particular Shares being distributed for a period of up to five business days before the distribution. These restrictions may affect the marketability of the Shares and the ability of any person or entity to engage in market-making activities with respect to the Shares.

We have agreed to indemnify in certain circumstances the selling stockholders and any brokers, dealers and agents who may be deemed to be underwriters, if any, of the Shares covered by the registration statement, against certain liabilities, including liabilities under the Securities Act. The selling stockholders have agreed to indemnify us in certain circumstances against certain liabilities, including liabilities under the Securities Act.

The Shares offered hereby are issuable to the selling stockholders pursuant to an exemption from the registration requirements of the Securities Act. We agreed to register the Shares under the Securities Act and to keep the registration statement of which this prospectus is a part effective until the earlier of the date on which the selling stockholders have publicly sold all of the Shares or the date that all the Shares may be sold by non-affiliates without volume or manner-of-sale restrictions pursuant to Rule 144 promulgated under the Securities Act, without the requirement for the Company to be in compliance with the current public information requirement under Rule 144 as determined by counsel to the Company pursuant to a written opinion letter to such effect, addressed and reasonably acceptable to the Company’s transfer agent. We have agreed to pay all expenses in connection with this offering, including the fees and expenses of one counsel to the selling stockholders, but not including underwriting discounts, concessions, commissions or fees of the selling stockholders or any fees and expenses of other counsel or other advisors to the selling stockholders.

We will not receive any proceeds from sales of any Shares by the selling stockholders.

We cannot assure you that the selling stockholders will sell all or any portion of the Shares offered hereby.

DESCRIPTION OF CAPITAL STOCK

Common Stock

As of March 31, 2015, our authorized capital stock included 300,000,000 shares of common stock, par value $0.0001 per share. A description of the material terms and provisions of our restated certificate of incorporation and restated bylaws affecting the rights of holders of our common stock is set forth below. The description is intended as a summary, and is qualified in its entirety by reference to the form of our restated certificate of incorporation and the form of our restated bylaws to that are filed as exhibits to the registration statement relating to this prospectus.

Dividend Rights

Subject to preferences that may apply to shares of preferred stock outstanding at the time, the holders of outstanding shares of our common stock are entitled to receive dividends out of funds legally available if our Board of Directors, in its discretion, determines to issue dividends, and only then at the times and in the amounts that our Board of Directors may determine.

Voting Rights

Each holder of common stock is entitled to one vote for each share of common stock held on all matters submitted to a vote of stockholders. Our restated certificate of incorporation eliminates the right of stockholders to cumulate votes for the election of directors and establishes a classified Board of Directors, divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing in office for the remainder of their respective three-year terms.

No Preemptive or Similar Rights

Our common stock is not entitled to preemptive rights and is not subject to conversion, redemption or sinking fund provisions.

Right to Receive Liquidation Distributions

Upon our dissolution, liquidation or winding-up, the assets legally available for distribution to our stockholders are distributable ratably among the holders of our common stock, subject to prior satisfaction of all outstanding debt and liabilities and the preferential rights and payment of liquidation preferences, if any, on any outstanding shares of preferred stock.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Wells Fargo Bank, National Association.

Stock Exchange Listing

Our common stock is listed on the NASDAQ Global Select Market under the symbol “AMRS.”

Registration Rights

Certain of our stockholders hold registration rights pursuant to (i) the Amended and Restated Investors’ Rights Agreement, dated June 21, 2010, by and between us and certain of our stockholders, as amended by Amendment No. 1 to Amended and Restated Investors’ Rights Agreement dated February 23, 2012, Amendment No. 2 to Amended and Restated Investors’ Rights Agreement dated December 24, 2012, Amendment No. 3 to Amended and Restated Investors’ Rights Agreement dated March 27, 2013, Amendment No. 4 to Amended and Restated Investors’ Rights Agreement dated October 16, 2013 and Amendment No. 5 to Amended and Restated Investors’ Rights Agreement dated December 24, 2013, by and between us and certain of our stockholders (as amended, the “IRA”), (ii) the Registration Rights Agreement dated February 27, 2012, by and between us and certain of our stockholders, (iii) the Registration Rights Agreement dated July 30, 2012 by and between the Company and Total, (iv) the Amended and Restated Letter Agreement, dated May 8, 2014, between us and certain of our stockholders, and/or (v) the Registration Rights Agreement dated February 24, 2015 between the registrant and Nomis Bay Ltd.

Pursuant to the IRA, as modified by a waiver we received from a party thereto on April 1, 2015, we are obligated to file a registration statement on Form S-3 with the SEC registering the resale of all of the shares of our common stock issuable upon conversion of the Notes by a specified date. This prospectus is a part of the registration statement we have filed in order to satisfy our obligations under the IRA.

The IRA provides for various registration rights, all as described below:

Piggyback Registration Rights

If we register any of our securities for public sale, the stockholders with registration rights will have the right to include their shares in the registration statement. However, this right does not apply to a registration relating to any of our employee benefit plans, the offer and sale of debt securities, or a registration on any registration form that does not include the information required for registration of the shares having piggyback registration rights. The managing underwriter of any underwritten offering will have the right to limit, due to marketing reasons, the number of shares registered by these holders to 25% of the total shares covered by the registration statement. The parties to the IRA have waived their respective piggyback rights in connection with the filing of the registration statement relating to this prospectus.

Form S-3 Registration Rights

The holders of shares having registration rights can request that we register all or a portion of their shares on Form S-3 if we are eligible to file a registration statement on Form S-3 and the aggregate price to the public of the shares offered is at least $2,000,000. We are required to file no more than one registration statement on Form S-3 upon exercise of these rights in any 12-month period; provided, however, that the filing of the registration statement relating to this prospectus shall not count against such requirement. We may postpone the filing of a registration statement on Form S-3 for up to 90 days once in a 12-month period if we determine that the filing would be seriously detrimental to us and our stockholders.

Registration Expenses

We will pay all expenses incurred in connection with exercise of demand and piggyback registration rights, except for underwriting discounts and commissions. However, we will not pay for any expenses of any demand registration if the request is subsequently withdrawn by the holders of a majority of the shares requested to be included in such a registration statement, subject to limited exceptions. The expenses associated with exercise of Form S-3 registration rights will be borne pro rata by the holders of the shares registered on such Form S-3.

Expiration of Registration Rights

The registration rights under the IRA described above will expire after February 23, 2017.

Anti-Takeover Provisions

The provisions of Delaware law, our restated certificate of incorporation and our restated bylaws may have the effect of delaying, deferring or discouraging another person from acquiring control of our company.

Delaware Law

Section 203 of the Delaware General Corporation Law prevents some Delaware corporations from engaging, under some circumstances, in a business combination, which includes a merger or sale of at least 10% of the corporation’s assets with any interested stockholder, meaning a stockholder who, together with affiliates and associates, owns or, within three years prior to the determination of interested stockholder status, did own 15% or more of the corporation’s outstanding voting stock, unless:

|

|

·

|

the transaction is approved by the Board of Directors prior to the time that the interested stockholder became an interested stockholder;

|

|

|

·

|

upon consummation of the transaction which resulted in the stockholder’s becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced; or

|

|

|

·

|

at or subsequent to such time that the stockholder became an interested stockholder the business combination is approved by the Board of Directors and authorized at an annual or special meeting of stockholders by at least two-thirds of the outstanding voting stock which is not owned by the interested stockholder.

|

If Section 203 applied to us, the restrictions could prohibit or delay mergers or other takeover or change in control attempts and, accordingly, could discourage attempts to acquire us.

A Delaware corporation may “opt out” of the restrictions on business combinations contained in Section 203 with an express provision in its original certificate of incorporation or an express provision in its certificate of incorporation or bylaws resulting from a stockholders’ amendment approved by at least a majority of the outstanding voting shares. We have agreed to opt out of Section 203 through our certificate of incorporation, but our certificate of incorporation contains substantially similar protections to our company and stockholders as those afforded under Section 203, except that we have agreed with Total that it and its affiliates will not be deemed to be “interested stockholders” under such protections.

Restated Certificate of Incorporation and Restated Bylaw Provisions

Our restated certificate of incorporation and our restated bylaws include a number of provisions that may have the effect of deterring hostile takeovers or delaying or preventing changes in control of our management team, including the following:

|

|

·

|

Board of Directors Vacancies. Our restated certificate of incorporation and restated bylaws authorize only our Board of Directors to fill vacant directorships. In addition, the number of directors constituting our Board of Directors will be set only by resolution adopted by a majority vote of our entire Board of Directors. These provisions prevent a stockholder from increasing the size of our Board of Directors and gaining control of our Board of Directors by filling the resulting vacancies with its own nominees.

|

|

|

·

|

Classified Board. Our restated certificate of incorporation and restated bylaws provide that our Board of Directors is classified into three classes of directors. The existence of a classified board could delay a successful tender offeror from obtaining majority control of our Board of Directors, and the prospect of that delay might deter a potential offeror. Pursuant to Delaware law, the directors of a corporation having a classified board may be removed by the stockholders only for cause. In addition, stockholders will not be permitted to cumulate their votes for the election of directors.

|

|

|

·

|

Stockholder Action; Special Meeting of Stockholders. Our restated certificate of incorporation provides that our stockholders may not take action by written consent, but may only take action at annual or special meetings of our stockholders. Our restated bylaws further provide that special meetings of our stockholders may be called only by a majority of our Board of Directors, the chairman of our Board of Directors, our chief executive officer or our president.

|

|

|

·

|

Advance Notice Requirements for Stockholder Proposals and Director Nominations. Our restated bylaws provide advance notice procedures for stockholders seeking to bring business before our annual meeting of stockholders, or to nominate candidates for election as directors at our annual meeting of stockholders. Our restated bylaws also specify certain requirements regarding the form and content of a stockholder’s notice. These provisions may preclude our stockholders from bringing matters before our annual meeting of stockholders or from making nominations for directors at our annual meeting of stockholders.

|

|

|

·

|

Issuance of Undesignated Preferred Stock. Under our restated certificate of incorporation, our Board of Directors has the authority, without further action by the stockholders, to issue up to 5,000,000 shares of undesignated preferred stock with rights and preferences, including voting rights, designated from time to time by the Board of Directors. The existence of authorized but unissued shares of preferred stock enables our Board of Directors to render more difficult or to discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise.

|

In addition, we have an agreement with Total that, so long as Total holds at least 10% of our voting securities, we are required to notify Total if our Board of Directors seeks to cause the sale of the company or if we receive an offer to acquire us. In the event of such decision or offer, we are required to provide Total with all information given to an offering party and provide Total with an exclusive negotiating period of 15 business days in the event the Board of Directors authorizes us to solicit offers to buy our company, or five business days in the event that we receive an unsolicited offer to purchase us. These rights of Total may have the effect of delaying, deferring or discouraging another person from acquiring our company.

LEGAL MATTERS

The validity of the issuance of the Shares offered hereby will be passed upon for us by Fenwick & West LLP, Mountain View, California. The validity of the Shares will be passed upon for any underwriters or agents by counsel that we will name in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements and management’s assessment of the effectiveness of internal control over financial reporting of Amyris, Inc. (which is included in Management's Report on Internal Control over Financial Reporting) incorporated in this Prospectus by reference to Amyris Inc.’s Annual Report on Form 10-K for the year ended December 31, 2014 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

The financial statements of Novvi LLC incorporated in this Prospectus by reference to Amyris Inc.’s Annual Report on Form 10-K for the year ended December 31, 2014 have been so incorporated in reliance on the report of Pannell Kerr Forster of Texas, P.C., an independent auditor, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the filing requirements of the Securities Exchange Act of 1934, as amended. Therefore, we file periodic reports, proxy statements and other information with the SEC. Such reports, proxy statements and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, D.C. 20549. You may obtain information regarding the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically.

We make our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to such reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 available free of charge through a link on the Investors section of our website located at www.amyris.com (under “Financial Information—SEC Filings”) as soon as reasonably practicable after they are filed with or furnished to the SEC. Information on our website is not incorporated by reference in this prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus the information we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and information in documents that we file later with the SEC will automatically update and supersede information in this prospectus. We incorporate by reference into this prospectus the documents listed below and any future filings made by us with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than those documents or the portions of those documents furnished pursuant to Items 2.02 or 7.01 of any Current Report on Form 8-K filed under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act) until we terminate this offering, including all filings made after the date of the initial registration statement and prior to the effectiveness of the registration statement. We hereby incorporate by reference the following documents:

|

|

·

|

our Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on March 31, 2015;

|

|

|

·

|

our definitive proxy statement for our 2015 Annual Meeting of Stockholders, filed with the SEC on April 6, 2015;

|

|

|

·

|

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2015, filed with the SEC on May 7, 2015;

|

|

|

·

|

our Current Reports on Form 8-K filed on January 15, 2015, January 29, 2015 and February 26, 2015 (two filed on such date); and

|

|

|

·

|

the description of our common stock contained in our registration statement on Form 8-A filed April 16, 2010, under the Securities Act, including any amendment or report filed for the purpose of updating such description.

|

We will provide to each person, including any beneficial holder, to whom a prospectus is delivered, at no cost, upon written or oral request, a copy of any or all information that has been incorporated by reference in this prospectus but not delivered with this prospectus. You may request a copy of these filings by writing or telephoning us at the following address and number:

Amyris, Inc.,

5885 Hollis Street, Suite 100

Emeryville, California

Attention: Investor Relations

+1 (510) 740-7481

Copies of these filings are also available free of charge through a link on the Investors section of our website located at www.amyris.com (under “Financial Information—SEC Filings”) as soon as reasonably practicable after they are filed with the SEC. The information contained on our website is not a part of this prospectus.

PROSPECTUS

105,665,377 shares

AMYRIS, INC.

Common Stock

May 21, 2015

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized any dealer, salesperson or other person to give any information or represent anything not contained in this prospectus. You must not rely on any unauthorized information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not offer to sell any shares in any jurisdiction where it is unlawful. Neither the delivery of this prospectus, nor any sale made hereunder, shall create any implication that the information in this prospectus is correct after the date hereof.

INFORMATION NOT REQUIRED IN PROSPECTUS

|

ITEM 14.

|

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

|

The following table sets forth all expenses to be paid by the registrant, other than estimated underwriting discounts and commissions in connection with this offering. All amounts shown are estimates except for the SEC registration fee:

| |

|

|

|

|

SEC registration fee

|

|

$ |

24,188 |

|

|

Legal fees and expenses

|

|

|

* |

|

|

Accounting fees and expenses

|

|

|

* |

|

|

Transfer agent and registrar fees

|

|

|

* |

|

|

Miscellaneous

|

|

|

* |

|

| |

|

|

|

|

|

Total

|

|

$ |

* |

|

____________

*Estimated expenses not presently known.

|

ITEM 15.

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’s Board of Directors to grant, indemnity to directors and officers under certain circumstances and subject to certain limitations. The terms of Section 145 of the Delaware General Corporation Law are sufficiently broad to permit indemnification under certain circumstances for liabilities, including reimbursement of expenses incurred, arising under the Securities Act of 1933, as amended.

As permitted by the Delaware General Corporation Law, the registrant’s restated certificate of incorporation contains provisions that eliminate the personal liability of its directors for monetary damages for any breach of fiduciary duties as a director, except liability for the following:

| |

·

|

any breach of the director’s duty of loyalty to the registrant or its stockholders;

|

| |

·

|

acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

|

| |

·

|

under Section 174 of the Delaware General Corporation Law (regarding unlawful dividends and stock purchases); or

|