Highlights:

- Booked $23 million in new orders during Q1; ending

backlog totaled $174 million

- Revenue of $51.1 million, down 13% from Q1 2014 due to

residual production issues in Abilene tower facility and deferral

of revenue associated with West Coast port delays

- Gearing operating loss of $1.2 million reduced by

nearly 60% compared to Q1 2014

- Adjusting operations in response to weak oil and gas

and mining markets; overhead costs reduced $.6 million per

quarter

Broadwind Energy, Inc. (Nasdaq:BWEN) reported sales of $51.1

million for the first quarter of 2015, down 13% compared to $58.8

million in the first quarter of 2014 due mainly to lower tower

sales reflecting the residual effects of production issues in the

Company's Abilene tower plant and production re-sequencing

necessitated by supply shortages caused by labor slowdowns at West

Coast ports.

The Company reported a net loss of $5.0 million or $.34 per

share in the first quarter of 2015, compared to a net loss of $1.0

million or $.07 per share in the first quarter of 2014. The $.27

per share reduction was due to weaker Towers and Weldments segment

results, partially offset by improvements in the Gearing segment.

Towers and Weldments segment operating income was down $4.5 million

from the prior-year period due to lower sales and increased costs

associated with residual production issues in the Abilene tower

plant, as well as increased logistics costs and delayed revenues

attributable to supply shortages due to a port strike on the West

Coast of the United States. Both issues have been substantially

resolved. The Company reported a non-GAAP adjusted EBITDA (earnings

before interest, taxes, depreciation, amortization, share-based

payments and restructuring costs) loss of $1.9 million in the first

quarter of 2015, compared to non-GAAP adjusted EBITDA of $2.8

million in the first quarter of 2014. The $4.7 million decrease was

due mainly to the weakness in Towers and Weldments segment

performance.

Peter Duprey, President and Chief Executive Officer, stated,

"During the quarter, we faced three main challenges that

contributed to our weak performance: restoring our Abilene tower

plant to full capacity, navigating the West Coast port slowdown,

and responding to weaker oil and gas and mining end markets. In the

Abilene tower facility, we produced 18 fewer towers than in the

prior year period, mainly in January and February, but by March the

facility was performing near its targeted production rate,

signaling that we are back on track in this facility. The West

Coast port slowdown required us to produce towers ahead of schedule

for which we had materials on hand. We navigated well through this

challenge and were able to avoid losing production slots. However,

we incurred higher logistics costs and ended the quarter holding

more steel than is typical for our Abilene facility and $5 million

of towers that will not be invoiced until Q2-Q3. Finally, we are

dealing with weak oil and gas and mining demand for gears and

weldments, and have reduced headcount and will idle two satellite

production facilities to reduce overhead expense by approximately

$600,000 per quarter."

Mr. Duprey concluded, "The tower market outlook remains strong

for 2016 and we are firming up our order book this quarter. With

the operational improvements and cost reductions in place, we

expect to have a profitable second quarter on par with Q2

2014."

Orders and Backlog

The Company booked $23.3 million in net new orders in Q1 2015,

up from $15.8 million in Q1 2014. Towers and Weldments orders,

which vary considerably from quarter to quarter, totaled $11.8

million, up from $3.9 million in Q1 2014. Gearing orders totaled

$9.7 million, up 17% from Q1 2014 due in part to a large wind

replacement gearing order during Q1 2015. Services orders totaled

$1.9 million, down from $3.6 million in Q1 2014.

At March 31, 2015, total backlog was $174 million, down 35% from

the backlog at March 31, 2014.

Segment Results

Towers and Weldments

Broadwind Energy produces fabrications for wind, oil and gas,

mining and other industrial applications, specializing in the

production of wind turbine towers.

Towers and Weldments segment sales totaled $41.0 million for Q1

2015, down 15% from $48.3 million in Q1 2014 due to a delay in

recognizing revenue on $5 million of towers in inventory at

quarter-end which will be recognized in Q2-Q3, and due to lower

production at the Abilene tower plant early in the year. The

inventoried towers are for a customer order that will be invoiced

in Q2 and Q3. Towers and Weldments operating income for Q1 2015

totaled $1.1 million, or 3% of sales, down sharply from $5.6

million, or 12% of sales, in Q1 2014. The significant reduction was

due to lower revenues, a lower value production mix, and higher

material and fixed overhead costs to resolve the production issues

in Abilene and to expedite freight and re-sequence production as a

result of the supply disruption triggered by the labor slowdowns at

the ports. These factors were partially offset by the absence of

higher professional fees in Q1 2014.

Non-GAAP adjusted EBITDA in Q1 2015 was $2.1 million, compared

to $6.7 million in Q1 2014, due to the factors described above.

Gearing

Broadwind Energy engineers, builds and remanufactures precision

gears and gearboxes for oil and gas, mining, steel and wind

applications.

Gearing segment sales totaled $8.6 million in Q1 2015, down

slightly from $8.8 million in Q1 2014. Sales to oil and gas

customers were down due to weak demand, but shipments benefited

from a reduction in past due shipments and stronger industrial

sales. The Gearing segment operating loss narrowed to $1.2 million

in Q1 2015 compared to $3.0 million in Q1 2014 due to improved

operating efficiencies, the absence of restructuring expense due to

the completion of the plant consolidation and lower depreciation

expense due to the maturing capital base. Gearing non-GAAP adjusted

EBITDA was $.1 million in Q1 2015, an improvement of $.9 million

compared to Q1 2014, due to the improved operating

efficiencies.

Services

Broadwind Energy specializes in non-routine drivetrain and blade

maintenance services and offers comprehensive field services to the

wind industry.

Services segment revenue was $1.9 million in Q1 2015, compared

to $2.4 million in Q1 2014, due to weak demand for turbine blade

repairs and other field service work. Services' operating loss for

Q1 2015 totaled $2.6 million, compared to $1.3 million in Q1 2014,

due to the low volume and a $.7 million inventory charge associated

with cost reduction actions taken to consolidate our gearbox repair

shops and exit the shrinking kilowatt turbine repair business.

Services' non-GAAP adjusted EBITDA loss for Q1 2015 totaled $2.2

million, compared to a non-GAAP adjusted EBITDA loss of $.9 million

in Q1 2014, due to the factors described above.

Corporate and Other

Corporate and other expenses totaled $2.3 million in Q1 2015,

essentially flat compared to Q1 2014. Lower incentive compensation

was offset by higher professional services expense and the timing

of health insurance costs.

Cash and Liquidity

During the quarter, operating working capital (accounts

receivable and inventory, net of accounts payable and customer

deposits) increased as expected to $29.6 million or 15% of

annualized Q1 2015 sales, due mainly to high steel inventory at the

Abilene facility, delayed invoicing of towers produced during the

quarter and draw-down of customer advances.

Cash assets (cash and short-term investments) totaled $.2

million at March 31, 2015, a decrease of $20 million from December

31, 2014, due to the increase in working capital noted above. Under

the terms of the Company's $20 million credit agreement,

availability varies depending on the balance of qualified

receivables and inventories. At March 31, 2015, the total

availability was $16 million and the Company had drawn $1.2 million

and had letters of credit outstanding of $2.5 million. The Company

expects the record high inventory level during Q1 to normalize and

replenish more than $10 million of cash before year end.

During the quarter, the Company did not repurchase any shares of

its stock.

About Broadwind Energy, Inc.

Broadwind Energy (Nasdaq:BWEN) applies decades of deep

industrial expertise to innovate integrated solutions for customers

in the energy and infrastructure markets. From gears and gearing

systems for wind, steel, oil and gas and mining applications, to

wind towers, to comprehensive remanufacturing of gearboxes and

blades, to operations and maintenance services and industrial

weldments, we have solutions for the energy needs of the future.

With facilities throughout the U.S., Broadwind Energy's talented

team of over 800 employees is committed to helping customers

maximize performance of their investments – quicker, easier and

smarter. Find out more at www.bwen.com.

Forward-Looking Statements

This release contains "forward-looking statements" within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934 that involve risks,

uncertainties and assumptions, such as statements regarding our

future financial condition or results of operations, cash flows,

performance, business prospects, and opportunities, as well as

assumptions made by, and information currently available to, our

management, and our prospects and strategies for future growth,

including with respect to estimated 2015 guidance. Forward-looking

statements include any statement that does not directly relate to a

current or historical fact. We have tried to identify

forward-looking statements by using words such as "anticipate,"

"believe," "expect," "intend," "will," "should," "may," "plan" and

similar expressions, but these words are not the exclusive means of

identifying forward-looking statements. These statements are based

on current expectations, and we undertake no obligation to update

these statements to reflect events or circumstances occurring after

this release. Such statements are subject to various risks and

uncertainties that could cause actual results to vary materially

from those stated. Such risks and uncertainties include, but are

not limited to: expectations regarding our business, end-markets,

relationships with customers and our ability to diversify our

customer base; the impact of competition and economic volatility on

the industries in which we compete; our ability to realize revenue

from customer orders and backlog; the impact of regulation on our

end-markets, including the wind energy industry in particular; the

sufficiency of our liquidity and working capital and our plans to

evaluate alternative sources of funding if necessary; our

restructuring plans and the associated cost savings; our ability to

preserve and utilize our tax net operating loss carry-forwards; our

plans to continue to grow our business through organic growth; our

plans with respect to the use of proceeds from financing activities

and our ability to operate our business efficiently, manage capital

expenditures and costs effectively, and generate cash flow; and

other risks and uncertainties described in our filings with the

Securities and Exchange Commission, including those contained in

Part I, Item 1A "Risk Factors" of our Annual Report on Form 10-K

for the year ended December 31, 2014.

| |

|

|

| BROADWIND ENERGY, INC. AND

SUBSIDIARIES |

| CONSOLIDATED BALANCE

SHEETS |

| (IN THOUSANDS) |

| (UNAUDITED) |

| |

|

|

| |

March 31, |

December 31, |

| |

2015 |

2014 |

| |

(Unaudited) |

|

| ASSETS |

|

|

| CURRENT ASSETS: |

|

|

| Cash and cash equivalents |

$ 150 |

$ 12,149 |

| Short-term investments |

-- |

8,024 |

| Restricted cash |

83 |

83 |

| Accounts receivable, net of allowance for

doubtful accounts of $83 and $82 as of March 31, 2015 and December

31, 2014, respectively |

21,841 |

20,012 |

| Inventories, net |

45,855 |

34,921 |

| Prepaid expenses and other current

assets |

1,614 |

1,815 |

| Assets held for sale |

700 |

738 |

| Total current assets |

70,243 |

77,742 |

| Property and equipment, net |

61,400 |

62,952 |

| Intangible assets, net |

5,348 |

5,459 |

| Other assets |

436 |

464 |

| TOTAL ASSETS |

$ 137,427 |

$ 146,617 |

| |

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

| CURRENT LIABILITIES: |

|

|

| Line of credit and notes payable |

$ 1,238 |

$ -- |

| Current maturities of long-term debt |

64 |

268 |

| Current portions of capital lease

obligations |

667 |

766 |

| Accounts payable |

22,182 |

18,461 |

| Accrued liabilities |

7,875 |

9,553 |

| Customer deposits |

15,894 |

22,619 |

| Total current

liabilities |

47,920 |

51,667 |

| |

|

|

| LONG-TERM LIABILITIES: |

|

|

| Long-term debt, net of current

maturities |

2,612 |

2,650 |

| Long-term capital lease obligations, net

of current portions |

285 |

427 |

| Other |

2,990 |

3,493 |

| Total long-term

liabilities |

5,887 |

6,570 |

| |

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

| |

|

|

| STOCKHOLDERS' EQUITY: |

|

|

| Preferred stock, $0.001 par value;

10,000,000 shares authorized; no shares issued or outstanding |

-- |

-- |

| Common stock, $0.001 par value;

30,000,000 shares authorized; 14,907,552 and 14,844,307 shares

issued and outstanding as of March 31, 2015 and December 31,

2014, respectively |

15 |

15 |

| Treasury stock, at cost, 273,937 shares

at March 31, 2015 and December 31, 2014, respectively |

(1,842) |

(1,842) |

| Additional paid-in capital |

377,440 |

377,185 |

| Accumulated deficit |

(291,993) |

(286,978) |

| Total stockholders'

equity |

83,620 |

88,380 |

| TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY |

$ 137,427 |

$ 146,617 |

| |

|

|

| |

|

|

| BROADWIND ENERGY, INC. AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (IN THOUSANDS, EXCEPT PER SHARE

DATA) |

| (UNAUDITED) |

| |

|

|

| |

Three Months

Ended March 31, |

| |

2015 |

2014 |

| |

|

|

| Revenues |

$ 51,051 |

$ 58,800 |

| Cost of sales |

50,312 |

53,438 |

| Restructuring |

-- |

269 |

| Gross profit |

739 |

5,093 |

| |

|

|

| OPERATING EXPENSES: |

|

|

| Selling, general and administrative |

5,606 |

5,917 |

| Intangible amortization |

111 |

111 |

| Restructuring |

-- |

60 |

| Total operating expenses |

5,717 |

6,088 |

| Operating loss |

(4,978) |

(995) |

| |

|

|

| OTHER (EXPENSE) INCOME,

net: |

|

|

| Interest expense, net |

(172) |

(160) |

| Other, net |

212 |

136 |

| Total other (expense) income, net |

40 |

(24) |

| |

|

|

| Net loss from continuing operations before

provision for income taxes |

(4,938) |

(1,019) |

| Provision for income taxes |

77 |

24 |

| NET LOSS |

$ (5,015) |

$ (1,043) |

| |

|

|

| NET LOSS PER COMMON SHARE - BASIC AND

DILUTED: |

|

|

| Net loss |

$ (0.34) |

$ (0.07) |

| |

|

|

| WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING - Basic and diluted |

14,597 |

14,659 |

| |

|

|

| |

|

|

| BROADWIND ENERGY, INC. AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (IN THOUSANDS) |

| (UNAUDITED) |

| |

|

|

| |

Three Months

Ended March 31, |

| |

2015 |

2014 |

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

| Net loss |

$ (5,015) |

$ (1,043) |

| |

|

|

| Adjustments to reconcile

net cash used in operating activities: |

|

| Depreciation and

amortization expense |

2,578 |

3,114 |

| Impairment charges |

38 |

-- |

| Stock-based

compensation |

255 |

223 |

| Allowance for doubtful

accounts |

-- |

42 |

| Common stock issued under

defined contribution 401(k) plan |

-- |

163 |

| Loss on disposal of

assets |

-- |

5 |

| Changes in operating assets

and liabilities: |

|

|

| Accounts

receivable |

(1,829) |

(4,947) |

|

Inventories |

(10,934) |

(1,980) |

| Prepaid

expenses and other current assets |

102 |

457 |

| Accounts

payable |

3,644 |

(2,672) |

| Accrued

liabilities |

(1,678) |

(788) |

| Customer

deposits |

(6,727) |

(4,266) |

| Other

non-current assets and liabilities |

(472) |

(425) |

| Net cash used in operating activities |

(20,038) |

(12,117) |

| |

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

| Purchases of available for sale

securities |

(1,884) |

(2,543) |

| Sales of available for sale

securities |

5,083 |

1,890 |

| Maturities of available for sale

securities |

4,825 |

-- |

| Purchases of property and equipment |

(840) |

(2,200) |

| Proceeds from disposals of property and

equipment |

-- |

45 |

| Net cash provided by (used in) investing

activities |

7,184 |

(2,808) |

| |

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

| Payments on lines of credit and notes

payable |

(17,304) |

(164) |

| Proceeds from lines of credit and notes

payable |

18,400 |

-- |

| Principal payments on capital leases |

(241) |

(246) |

| Net cash provided by (used in) financing

activities |

855 |

(410) |

| |

|

|

| NET INCREASE (DECREASE) IN CASH AND

CASH EQUIVALENTS |

(11,999) |

(15,335) |

| CASH AND CASH EQUIVALENTS, beginning

of the period |

12,149 |

24,936 |

| CASH AND CASH EQUIVALENTS, end of the

period |

$ 150 |

$ 9,601 |

| |

|

|

| Supplemental cash flow

information: |

|

|

| Interest paid |

$ 102 |

$ 143 |

| Income taxes paid |

$ 1 |

$ 2 |

| Non-cash investing and

financing activities: |

|

| Issuance of restricted stock grants |

$ 225 |

$ 138 |

| |

|

|

| |

|

|

| BROADWIND ENERGY, INC. AND

SUBSIDIARIES |

| SELECTED SEGMENT FINANCIAL

INFORMATION |

| (IN THOUSANDS) |

| |

|

|

| |

Three Months

Ended |

| |

March

31, |

| |

2015 |

2014 |

| ORDERS: |

(unaudited) |

| Towers and Weldments |

$ 11,770 |

$ 3,928 |

| Gearing |

9,654 |

8,277 |

| Services |

1,891 |

3,595 |

| Total revenues |

$ 23,315 |

$ 15,800 |

| |

|

|

| REVENUES: |

(unaudited) |

| Towers and Weldments |

$ 41,028 |

$ 48,294 |

| Gearing |

8,608 |

8,774 |

| Services |

1,938 |

2,438 |

| Corporate and Other |

(523) |

(706) |

| Total revenues |

$ 51,051 |

$ 58,800 |

| |

|

|

| OPERATING (LOSS)

PROFIT: |

(unaudited) |

| Towers and Weldments |

$ 1,135 |

$ 5,612 |

| Gearing |

(1,211) |

(2,966) |

| Services |

(2,624) |

(1,339) |

| Corporate and Other |

(2,278) |

(2,302) |

| Total operating loss |

$ (4,978) |

$ (995) |

| |

|

|

The Company reports its financial results in accordance with

U.S. generally accepted accounting principles (GAAP). However, the

Company's management believes that certain non-GAAP financial

measures may provide users of this financial information with

meaningful comparisons between current results and results in prior

operating periods. Management believes that these non-GAAP

financial measures can provide additional meaningful reflection of

underlying trends of the business because they provide a comparison

of historical information that excludes certain infrequently

occurring or non-operational items that impact the overall

comparability. See the table below for supplemental financial data

and corresponding reconciliations to GAAP financial measures for

the three months ended March 31, 2015 and 2014. Non-GAAP financial

measures should be viewed in addition to, and not as an alternative

for, the Company's reported results prepared in accordance with

GAAP.

| |

|

|

| BROADWIND ENERGY, INC. AND

SUBSIDIARIES |

| RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES |

| (IN THOUSANDS) |

| |

|

|

| Consolidated |

Three Months

Ended March 31, |

| |

2015 |

2014 |

| |

(unaudited) |

| Operating loss |

$ (4,978) |

$ (995) |

| Depreciation and amortization |

2,578 |

3,114 |

| Restructuring |

-- |

329 |

| Other income |

212 |

136 |

| Share-based compensation and other stock

payments |

255 |

223 |

| Total Adjusted EBITDA

(Non-GAAP) |

$ (1,933) |

$ 2,807 |

| |

|

|

| |

|

|

| Towers and Weldments

Segment |

Three Months

Ended March 31, |

| |

2015 |

2014 |

| |

(unaudited) |

| Operating Profit |

$ 1,135 |

$ 5,612 |

| Depreciation |

914 |

985 |

| Share-based compensation and other stock

payments |

15 |

43 |

| Other Income |

72 |

2 |

| Restructuring Expense |

-- |

18 |

| Total Adjusted EBITDA (Non-GAAP) |

$ 2,136 |

$ 6,660 |

| |

|

|

| |

Three Months

Ended March 31, |

| Gearing Segment |

2015 |

2014 |

| |

(unaudited) |

| Operating Loss |

$ (1,211) |

$ (2,966) |

| Depreciation |

1,185 |

1,690 |

| Amortization |

111 |

111 |

| Share-based compensation and other stock

payments |

62 |

59 |

| Other Income (Expense) |

-- |

2 |

| Restructuring Expense |

-- |

311 |

| Total Adjusted EBITDA (Non-GAAP) |

$ 147 |

$ (793) |

| |

|

|

| |

|

|

| Services Segment |

Three Months

Ended March 31, |

| |

2015 |

2014 |

| |

(unaudited) |

| Operating Loss |

$ (2,624) |

$ (1,339) |

| Depreciation |

322 |

313 |

| Share-based compensation and other stock

payments |

10 |

15 |

| Other Income (Expense) |

140 |

133 |

| Total Adjusted EBITDA (Non-GAAP) |

$ (2,152) |

$ (878) |

| |

|

|

| |

|

|

| Corporate and Other |

Three Months

Ended March 31, |

| |

2015 |

2014 |

| |

(unaudited) |

| Operating Loss |

$ (2,278) |

$ (2,302) |

| Depreciation |

46 |

15 |

| Share-based compensation and other stock

payments |

168 |

105 |

| Total Adjusted EBITDA (Non-GAAP) |

$ (2,064) |

$ (2,182) |

CONTACT: BWEN INVESTOR CONTACT:

Joni Konstantelos

708.780.4819

joni.konstantelos@bwen.com

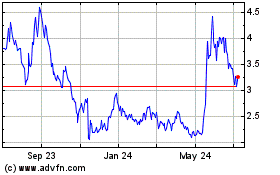

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

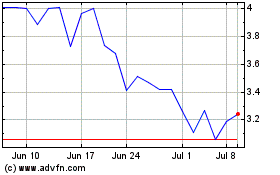

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Apr 2023 to Apr 2024