UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 28, 2015

DOCUMENT SECURITY SYSTEMS, INC.

(Exact name of registrant as specified

in its charter)

| New York |

001-32146 |

16-1229730 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

First Federal Plaza, Suite 1525

28 East Main Street

Rochester, NY |

14614 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (585) 325-3610

______________________________________________________________

(Former name or former address, if changed

since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

As previously reported

in a Current Report on Form 8-K filed on July 29, 2011, Premier Packaging Corporation (“PPC”), a wholly-owned subsidiary

of Document Security Systems, Inc. (“DSS”), entered into a Second Amended and Restated Credit Facility Agreement with

RBS Citizens, N.A. (“Citizens”), a national banking association (the “Second Credit Facility Agreement”),

on July 26, 2011, for the purpose of amending the Amended and Restated Credit Facility Agreement dated as of October 8, 2010, as

amended on February 24, 2011 (the “Original Credit Facility Agreement”). The Second Credit Facility Agreement provided

for a revolving line of credit up to $1,000,000 and a loan of $1,075,000 to PPC. The Second Credit Facility Agreement contained

certain customary affirmative and financial covenants and negative covenants against incurring indebtedness, liens, liabilities

and certain corporate actions. In addition, PPC’s affiliates, including DSS, are guarantors of all of PPC’s payment

and other obligations to Citizens.

Also, as previously

reported in the same Current Report on Form 8-K filed on July 29, 2011, PPC entered into an Amended and Restated Revolving Line

Note with Citizens (the “Revolving Note”) on July 26, 2011, for the purpose of restating and confirming an indebtedness

of PPC to Citizens in the amount of $1,000,000, as evidenced by the Revolving Line Note dated February 12, 2010 (the “Original

Revolving Note”), given by PPC to Citizens in the amount of $1,000,000. Under the Revolving Note, PPC may request advances

from time to time provided PPC is not in default under the Revolving Note. The Second Credit Facility Agreement and the Revolving

Note, and all other documents and instruments executed in connection therewith, are referred to collectively as the “Loan

Documents.”

On April 28, 2015,

PPC and Citizens entered in to a Modification/Extension to the Amended and Restated Revolving Line Note and the Second Amended

and Restated Credit Facility Agreement (the “Modification Agreement”) for purposes of (i) extending the maturity date

of the Revolving Note to May 31, 2016, (ii) reducing the amount available under the Revolving Note from $1,000,000 to $800,000,

(iii) amending certain covenants contained in the Loan Documents (as described below and in the Modification Agreement), and (iv)

amending certain terms and conditions of the Loan Documents (as described below and in the Modification Agreement).

The Modification Agreement

deletes the previous financial covenants, and replaces them with a covenant that precludes PPC from permitting the ratio of its

EBITDA (as defined in Schedule 1.5 to the Modification Agreement), minus taxes paid in cash (including any tax payments to its

affiliates), minus dividends and distributions and unfinanced CAPEX (as defined in Schedule 1.5 to the Modification Agreement),

minus loans and advances to any related individuals, partnership, corporation, limited liability company, trust or other organization

or person plus non cash stock based compensations which are converted to capital, to interest expense plus CMLTD (as defined in

Schedule 1.5 to the Modification Agreement), to be less than 1.15 to 1.0, tested every quarter on a rolling four quarters basis

commencing with the quarter ending June 30, 2015.

The Modification Agreement

also modifies the Second Credit Facility Agreement by adding to Article IX entitled “Negative Covenants of Borrower”,

a new subsection 9.14 in its entirety, as set forth in Schedule 1.6 to the Modification Agreement, which in effect precludes PPC

from paying any dividends or distributions in cash or property on its capital stock, except that so long as PPC is not in default

under the Loan Documents, distributions not to exceed $100,000 per fiscal quarter may be made to PPC’s

parent, DSS.

The Modification Agreement

also provides that except for the amendments contained in the Modification Agreement, all the other terms, provisions,

representations, warranties, and conditions of the Loan Documents will continue in full force and effect.

The forgoing description

is a summary only, does not purport to set forth the complete terms of the Modification Agreement, and is qualified in its entirety

by reference to such document, which is attached as Exhibit 10.1 to this Current Report on Form 8-K.

Item 2.03 Creation of a Direct Financial Obligation or an

Obligation under an Off-Balance Sheet Arrangement of Registrant.

The information provided

in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 9.01 Financial Statements and Exhibits.

| 10.1 | Modification/Extension to the Amended and Restated Revolving

Line Note and the Second Amended and Restated Credit Facility Agreement, dated April 28, 2015. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

DOCUMENT SECURITY SYSTEMS, INC. |

|

| |

|

|

|

| Dated: April 29, 2015 |

By: |

/s/ Jeffrey Ronaldi |

|

| |

|

Jeffrey Ronaldi |

|

| |

|

Chief Executive Officer |

|

Exhibit 10.1

modification/EXTENSION

to the Amended and Restated Revolving line note and the second amended and restated credit facility agreement

This MODIFICATION/EXTENSION

AGREEMENT is entered into at Albany, New York, as of April 28, 2015, between Premier Packaging Corporation, a New York

corporation, with an address of 6 Framark Drive, Victor, New York 14564 (the "Borrower")

and Citizens Bank, N.A., a national banking association with an address of 833 Broadway, Albany, New York 12207 (the "Bank"),

(formerly known as RBS Citizens, N.A. ("Predecessor"))

WHEREAS, Predecessor

established a revolving line of credit (the "Revolving Loan") for Borrower which matures on May 31, 2015 (the

"Maturity Date") respecting which Bank agreed to lend to Borrower upon Borrower’s request, but subject to the terms

and conditions set forth in various loan documents, of up to One Million Dollars and Zero Cents ($1,000,000.00) (the

"Revolving Loan Amount");

WHEREAS, the Revolving

Loan is evidenced by that certain Amended and Restated Revolving Line Note, dated July 26, 2011 (as previously amended,

modified or supplemented, the "Note"), by the Borrower in favor of Predecessor in the face amount of the Revolving Loan

Amount;

WHEREAS, in connection

with the Revolving Loan, Borrower entered into that certain Second Amended and Restated Credit Facility Agreement, dated July

26, 2011 (as previously amended, modified or supplemented, the "Loan Agreement");

WHEREAS, as further

security for the Loan, Document Security Systems, Inc., Plastic Printing Professionals, Inc. and Secuprint Inc. issued a Guaranty

and Indemnity Agreement, dated February 12, 2010 (as previously amended, modified or supplemented, the "Document Security

Systems, Inc., Plastic Printing Professionals, Inc. and Secuprint Inc. Guaranty and Indemnity Agreement"), pursuant to which

Document Security Systems, Inc., Plastic Printing Professionals, Inc. and Secuprint Inc. guaranteed to Predecessor the payment

and performance of all of the Borrower's obligations with respect to the Loan and the other Loan Documents (as hereinafter defined);

WHEREAS, the Loan Agreement,

the Note, the Document Security Systems, Inc. Guaranty, the Plastic Printing Professionals, Inc. Guaranty and the Secuprint Inc.

Guaranty and all other documents and instruments executed in connection with or relating to the Loan are referred to herein, collectively,

as the "Loan Documents"; and all collateral granted to the Predecessor and the Bank to secure the Loan is referred to

herein, collectively, as the "Collateral";

WHEREAS, the Bank was

formerly known as Predecessor with respect to the Loan and the Loan Documents, is the owner and holder of the Loan and the Loan

Documents and, as such, the Borrower is indebted to the Bank therefor and thereunder;

WHEREAS, the Borrower

has requested and the Bank has agreed to extend the Maturity Date of the Loan;

WHEREAS, the Borrower

has requested and the Bank has agreed to amend certain of the covenants applicable to the Loan;

WHEREAS, the Borrower

has requested and the Bank has agreed to amend certain of Terms and Conditions applicable to the Loan;

WHEREAS, the Borrower

has requested and the Bank has agreed to reduce the amount of availability under the Loan Documents;

WHEREAS, the Borrower

and the Bank have agreed to modify the Loan and the Loan Documents in accordance with the terms of this Agreement.

NOW THEREFORE, for

good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Bank and the Borrower mutually

agree as follows:

1.

EXTENSION

1.1

Recitals and Representations Accurate. The above recitals are hereby made a part of this Agreement and the

Borrower acknowledges and agrees that each of the recitals is true and correct.

1.2

Ratification. All of the terms, covenants, provisions, representations, warranties, and conditions of the

Loan Documents, as amended or modified hereby, are ratified, acknowledged, confirmed, and continued in full force and effect as

if fully restated herein.

1.3

Maturity Date. The Bank hereby agrees to extend the Maturity Date of the Note to May 31, 2016 (the

"New Maturity Date"). On the New Maturity Date, the Loan and all fees, costs, expenses and other amounts owing by the

Borrower to the Bank shall be due and payable, in full, without further notice or demand. All references to the Maturity Date in

the Loan Documents shall be modified accordingly. The Borrower hereby agrees to pay to the Bank all payments due prior to the New

Maturity Date in accordance with the terms of the Note, as affected hereby, and that any failure to make any such payments in accordance

with the terms of the Note shall be a default under this Agreement, the Note and each of the Loan Documents.

1.4

Reduced Availability. Availability under the Loan Documents shall be reduced from One Million Dollars and

Zero Cents ($1,000,000.00) to Eight Hundred Thousand Dollars and Zero Cents ($800,000.00) (the "Revised

Borrowing Limit") and all references to availability in the Loan Documents shall be modified accordingly. All amounts outstanding

under the Loan Documents in excess of the Revised Borrowing Limit, and all fees due and owing under the Loan Documents, shall be

paid to the Bank simultaneously with the execution of this Agreement.

1.5

Amendment to Covenants. Notwithstanding anything to the contrary contained in the Loan Documents, the Borrower

will not at any time or during any fiscal period (as applicable) fail to be in compliance with any of the financial covenants set

forth in Schedule 1.5, attached hereto (the "Amended Covenants").

1.6

Amendment to Terms and Conditions. Notwithstanding anything to the contrary contained in the Loan Documents,

the Borrower will not at any time or during any fiscal period (as applicable) fail to be in compliance with any of the terms and

conditions set forth in Schedule 1.6, attached hereto (the "Amended Terms and Conditions").

1.7

Representations and Warranties. The Borrower hereby represents and warrants to the Bank that:

| (a) | The person executing this Agreement is duly authorized to do so and to bind the Borrower to the

terms hereof; |

| (b) | Each of the Loan Documents is a valid and legal binding obligation of the Borrower, enforceable

in accordance with its terms, and is not subject to any defenses, counterclaims, or offsets of any kind; |

| (c) | All financial statements delivered to the Bank were true, accurate and complete, in all material

respects, as of the date of delivery to the Bank; |

| (d) | Since the date of the Loan Documents there has been no material adverse change in the condition,

financial or otherwise, of the Borrower, except as disclosed to the Bank in writing; |

| (e) | There exists no action, suit, proceeding or investigation, at law or in equity, before any court,

board, administrative body or other entity, pending or threatened, affecting the Borrower or its property, wherein an unfavorable

decision, ruling or finding would materially adversely affect the business operations, property or financial condition of the Borrower;

and |

| (f) | There exists no event of default, or other circumstance that with the passage of time or giving

of notice or both will become an event of default, under any of the Loan Documents. |

1.8

Interest, Fees, Costs and Expenses. The Borrower shall, simultaneously with the execution of this Agreement,

pay to the Bank all accrued interest owing on the Loan as of the date of this Agreement together with all fees, costs and expenses

due and owing to the Bank by the Borrower under the Loan Documents.

2.

Miscellaneous

2.1

Set-Off. The Borrower hereby grants to the Bank a continuing lien and security interest in any and all deposits

or other sums at any time credited by or due from the Bank or any Bank Affiliate (as hereinafter defined) to the Borrower and any

cash, securities, instruments or other property of the Borrower in the possession of the Bank or any Bank Affiliate, whether for

safekeeping or otherwise, or in transit to or from the Bank or any Bank Affiliate (regardless of the reason the Bank or Bank Affiliate

had received the same or whether the Bank or any Bank Affiliate has conditionally released the same) as security for the full and

punctual payment and performance of all of the liabilities and obligations of the Borrower to the Bank or any Bank Affiliate and

such deposits and other sums may be applied or set off against such liabilities and obligations of the Borrower to the Bank or

any Bank Affiliate at any time, whether or not such are then due, whether or not demand has been made and whether or not other

collateral is then available to the Bank or any Bank Affiliate.

The term "Bank

Affiliate" as used in this Agreement shall mean any "Affiliate" of the Bank or any lender acting as a participant

under any loan arrangement between the Bank and the Borrower. The term "Affiliate" shall mean with respect to any person,

(a) any person which, directly or indirectly through one or more intermediaries controls, or is controlled by, or is under common

control with, such person, or (b) any person who is a director or officer (i) of such person, (ii) of any subsidiary of such person,

or (iii) any person described in clause (a) above. For purposes of this definition, control of a person shall mean the power, direct

or indirect, (x) to vote 5% or more of the Capital Stock having ordinary voting power for the election of directors (or comparable

equivalent) of such person, or (y) to direct or cause the direction of the management and policies of such person whether by contract

or otherwise. Control may be by ownership, contract, or otherwise.

2.2

Release of the Bank. The Borrower hereby confirms that as of the date hereof it has no claim, set-off, counterclaim,

defense, or other cause of action against the Bank including, but not limited to, a defense of usury, any claim or cause of action

at common law, in equity, statutory or otherwise, in contract or in tort, for fraud, malfeasance, misrepresentation, financial

loss, usury, deceptive trade practice, or any other loss, damage or liability of any kind, including, without limitation, any claim

to exemplary or punitive damages arising out of any transaction between the Borrower and the Bank. To the extent that any such

set-off, counterclaim, defense, or other cause of action may exist or might hereafter arise based on facts known or unknown that

exist as of this date, such set-off, counterclaim, defense and other cause of action is hereby expressly and knowingly waived and

released by the Borrower. The Borrower acknowledges that this release is part of the consideration to the Bank for the financial

and other accommodations granted by the Bank in this Agreement.

2.3

Costs and Expenses. The Borrower shall pay to the Bank on demand any and all costs and expenses (including,

without limitation, reasonable attorneys' fees and disbursements, court costs, litigation and other expenses) incurred or paid

by the Bank in establishing, maintaining, protecting or enforcing any of the Bank's rights or any of the obligations owing by the

Borrower to the Bank, including, without limitation, any and all such costs and expenses incurred or paid by the Bank in defending

the Bank's security interest in, title or right to, the Collateral or in collecting or attempting to collect or enforcing or attempting

to enforce payment of the Loan.

2.4

Indemnification. The Borrower shall indemnify, defend and hold the Bank and the Bank Affiliates and their

directors, officers, employees, agents and attorneys (each an "Indemnitee") harmless against any claim brought or threatened

against any Indemnitee by the Borrower or any guarantor or endorser of the obligations of the Borrower to the Bank, or any other

person (as well as from attorneys' fees and expenses in connection therewith) on account of the Bank's relationship with the Borrower,

or any guarantor or endorser of the obligations of the Borrower to the Bank (each of which may be defended, compromised, settled

or pursued by the Bank with counsel of the Bank's election, but at the expense of the Borrower), except for any claim arising out

of the gross negligence or willful misconduct of the Bank. The within indemnification shall survive payment of the obligations

of the Borrower to the Bank, and/or any termination, release or discharge executed by the Bank in favor of the Borrower.

2.5

Severability. If any provision of this Agreement or portion of such provision or the application thereof to

any person or circumstance shall to any extent be held invalid or unenforceable, the remainder of this Agreement (or the remainder

of such provision) and the application thereof to other persons or circumstances shall not be affected thereby.

2.6

Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be an original,

but all of which shall constitute but one agreement.

2.7

Bank's Predecessor(s). All references in the Loan Documents to Bank and RBS Citizens, N.A. shall hereafter

mean Citizens Bank, N.A., its successors and assigns. The Bank's address, for all purposes, shall be as set forth in the first

paragraph of this Agreement.

2.8

Complete Agreement. This Agreement and the other Loan Documents constitute the entire agreement and understanding

between and among the parties hereto relating to the subject matter hereof, and supersedes all prior proposals, negotiations, agreements

and understandings among the parties hereto with respect to such subject matter.

2.9

Binding Effect of Agreement. This Agreement shall be binding upon and inure to the benefit of the respective

heirs, executors, administrators, legal representatives, successors and assigns of the parties hereto, and shall remain in full

force and effect (and the Bank shall be entitled to rely thereon) until released in writing by the Bank. The Bank may transfer

and assign this Agreement and deliver the Collateral to the assignee, who shall thereupon have all of the rights of the Bank; and

the Bank shall then be relieved and discharged of any responsibility or liability with respect to this Agreement and the Collateral.

Except as expressly provided herein or in the other Loan Documents, nothing, expressed or implied, is intended to confer upon any

party, other than the parties hereto, any rights, remedies, obligations or liabilities under or by reason of this Agreement or

the other Loan Documents.

2.10

Further Assurances. The Borrower will from time to time execute and deliver to the Bank such documents, and

take or cause to be taken, all such other further action, as the Bank may request in order to effect and confirm or vest more securely

in the Bank all rights contemplated by this Agreement (including, without limitation, to correct clerical errors) or to vest more

fully in or assure to the Bank the security interest in the Collateral or to comply with applicable statute or law and to facilitate

the collection of the Collateral (including, without limitation, the execution of stock transfer orders and stock powers, endorsement

of promissory notes and instruments and notifications to obligors on the Collateral). To the extent permitted by applicable law,

the Borrower authorizes the Bank to file financing statements, continuation statements or amendments without the Borrower's signature

appearing thereon, and any such financing statements, continuation statements or amendments may be signed by the Bank on behalf

of the Borrower, if necessary, and may be filed at any time in any jurisdiction. The Bank may at any time and from time to time

file financing statements, continuation statements and amendments thereto which contain any information required by the New York

Uniform Commercial Code as amended from time to time (the "Code") for the sufficiency or filing office acceptance of

any financing statement, continuation statement or amendment, including whether the Borrower is an organization, the type of organization

and any organization identification number issued to the Borrower. The Borrower agrees to furnish any such information to the Bank

promptly upon request. In addition, the Borrower shall at any time and from time to time take such steps as the Bank may reasonably

request for the Bank (i) to obtain an acknowledgment, in form and substance satisfactory to the Bank, of any bailee having possession

of any of the Collateral that the bailee holds such Collateral for the Bank, (ii) to obtain "control" (as defined in

the Code) of any Collateral comprised of deposit accounts, electronic chattel paper, letter of credit rights or investment property,

with any agreements establishing control to be in form and substance satisfactory to Bank, and (iii) otherwise to insure the continued

perfection and priority of the Bank's security interest in any of the Collateral and the preservation of its rights therein. The

Borrower hereby constitutes the Bank its attorney-in-fact to execute, if necessary, and file all filings required or so requested

for the foregoing purposes, all acts of such attorney being hereby ratified and confirmed; and such power, being coupled with an

interest, shall be irrevocable until this Agreement terminates in accordance with its terms, all obligations of the Borrower to

the Bank are irrevocably paid in full and the Collateral is released.

2.11

Amendments and Waivers. This Agreement may be amended and the Borrower may take any action herein prohibited,

or omit to perform any act herein required to be performed by it, if the Borrower shall obtain the Bank's prior written consent

to each such amendment, action or omission to act. No delay or omission on the part of the Bank in exercising any right hereunder

shall operate as a waiver of such right or any other right and waiver on any one or more occasions shall not be construed as a

bar to or waiver of any right or remedy of the Bank on any future occasion.

2.12

Terms of Agreement. This Agreement shall continue in force and effect so long as any obligation of the Borrower

to Bank shall be outstanding and is supplementary to each and every other agreement between the Borrower and Bank and shall not

be so construed as to limit or otherwise derogate from any of the rights or remedies of Bank or any of the liabilities, obligations

or undertakings of the Borrower under any such agreement, nor shall any contemporaneous or subsequent agreement between the Borrower

and the Bank be construed to limit or otherwise derogate from any of the rights or remedies of Bank or any of the liabilities,

obligations or undertakings of the Borrower hereunder, unless such other agreement specifically refers to this Agreement and expressly

so provides.

2.13

Notices. Any notices under or pursuant to this Agreement shall be deemed duly received and effective if delivered

in hand to any officer or agent of the Borrower or Bank, or if mailed by registered or certified mail, return receipt requested,

addressed to the Borrower or Bank at the address set forth in this Agreement or as any party may from time to time designate by

written notice to the other party.

2.14

New York Law. This Agreement shall be governed by federal law applicable to the Bank and, to the extent not

preempted by federal law, the laws of the State of New York.

2.15

Reproductions. This Agreement and all documents which have been or may be hereinafter furnished by Borrower

to the Bank may be reproduced by the Bank by any photographic, photostatic, microfilm, xerographic or similar process, and any

such reproduction shall be admissible in evidence as the original itself in any judicial or administrative proceeding (whether

or not the original is in existence and whether or not such reproduction was made in the regular course of business).

2.16

Venue. Borrower irrevocably submits to the nonexclusive jurisdiction of any Federal or state court sitting

in New York, over any suit, action or proceeding arising out of or relating to this Agreement. Borrower irrevocably waives to the

fullest extent it may effectively do so under applicable law, any objection it may now or hereafter have to the laying of the venue

of any such suit, action or proceeding brought in any such court and any claim that the same has been brought in an inconvenient

forum. Borrower irrevocably appoints the Secretary of State of the State of New York as its authorized agent to accept and acknowledge

on its behalf any and all process which may be served in any such suit, action or proceeding, consents to such process being served

(i) by mailing a copy thereof by registered or certified mail, postage prepaid, return receipt requested, to Borrower’s address

shown above or as notified to the Bank and (ii) by serving the same upon such agent, and agrees that such service shall in every

respect be deemed effective service upon Borrower.

2.17

JURY WAIVER. BORROWER AND BANK EACH HEREBY KNOWINGLY, VOLUNTARILY AND INTENTIONALLY, AND AFTER AN OPPORTUNITY

TO CONSULT WITH LEGAL COUNSEL, WAIVE (A) ANY AND ALL RIGHTS TO A TRIAL BY JURY IN ANY ACTION OR PROCEEDING IN CONNECTION WITH THIS

AGREEMENT, THE OBLIGATIONS, ALL MATTERS CONTEMPLATED HEREBY AND DOCUMENTS EXECUTED IN CONNECTION HEREWITH AND (B) AGREE NOT TO

SEEK TO CONSOLIDATE ANY SUCH ACTION WITH ANY OTHER ACTION IN WHICH A JURY TRIAL CAN NOT BE, OR HAS NOT BEEN WAIVED. THE BORROWER

CERTIFIES THAT NEITHER THE BANK NOR ANY OF ITS REPRESENTATIVES, AGENTS OR COUNSEL HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT

THE BANK WOULD NOT IN THE EVENT OF ANY SUCH PROCEEDING SEEK TO ENFORCE THIS WAIVER OF RIGHT TO TRIAL BY JURY.

Executed on this day

28 of April, 2015.

| |

Borrower: |

|

| |

|

|

|

| |

|

|

|

| |

Premier Packaging Corporation |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/S/ Robert B. Bzdick |

|

| |

|

Robert B. Bzdick, Chief Executive Officer |

|

Accepted:

Citizens Bank, N.A.

| By: | /S/ Lynn Ryan |

|

| Name: | Lynn Ryan |

|

| Title: | Vice President |

|

For good and valuable

consideration, the receipt and sufficiency of which are hereby acknowledged, the undersigned guarantor(s) hereby irrevocably and

unconditionally acknowledge and confirm to the Bank that the guaranty of the obligations of the Borrower including without limitation

respecting the Note continues in full force and effect and is a valid and binding obligation of the undersigned guarantor(s) in

accordance with its terms, that no defenses, offsets, claims, counterclaims exist with respect to such guaranty(s), and that each

such guaranty is enforceable in accordance with its terms, and guarantees and shall continue to guarantee in accordance with its

terms the performance of all amounts guaranteed thereby including without limitation in addition to all other liabilities and obligations

guaranteed thereby, all liabilities and obligations of the Borrower to the Bank respecting the Note and the other Loan Documents

as affected hereby.

Executed on this day

28 of April, 2015

| |

Guarantor: |

|

| |

|

|

|

| |

Document Security Systems, Inc. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/S/ Robert B. Bzdick |

|

| |

|

Robert B. Bzdick, President |

|

| |

|

|

|

| |

|

|

|

| |

Guarantor: |

|

| |

|

|

|

| |

Plastic Printing Professionals, Inc. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/S/ Robert B. Bzdick |

|

| |

|

Robert B. Bzdick, Secretary |

|

| |

|

|

|

| |

|

|

|

| |

Guarantor: |

|

| |

|

|

|

| |

Secuprint Inc. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/S/ Robert B. Bzdick |

|

| |

|

Robert B. Bzdick, President |

|

SCHEDULE 1.5

AMENDED COVENANTS

The Second Amended

and Restated Credit Facility Agreement is hereby modified by deleting from Article X entitled "Financial Covenants",

Subsection (10.1) in its entirety and substituting in lieu thereof the following:

Covenant Definitions:

(i)

"GAAP" shall mean generally accepted accounting principles in effect from time to time in the United States.

(ii)

"Capital Expenditures" ("CAPEX") shall mean for any period, all acquisitions of machinery, equipment,

land, leaseholds, buildings, improvements and all other expenditures considered to be for fixed assets under GAAP, consistently

applied. Where an asset is acquired under a capital lease, the amount required to be capitalized shall be considered a capital

expenditure during the first year of the lease

(iii)

"Current Maturity of Long-Term Debt" ("CMLTD") shall mean, for any period, the current scheduled

principal or capital lease payments required to be paid during the applicable period.

(iv)

"Distributions" shall mean all cash dividends to shareholders, and all cash distributions to shareholders

of Subchapter S corporations, to partners of partnerships, to members of limited liability companies or to beneficiaries of trusts.

(v)

"Earnings" shall mean earnings as defined under GAAP.

(vi)

"EBITDA" shall mean, for any period, Earnings from continuing operations before payment of federal, state

and local income taxes, plus Interest Expense, depreciation and amortization, in each case for such period, computed and calculated

in accordance with GAAP.

(vii)

"Interest Expense" shall mean, for any period, ordinary, regular, recurring and continuing expenditures

for interest on all borrowed money.

(viii)

"Unfinanced CAPEX" shall mean, for any period, Capital Expenditures less new long-term Indebtedness issued

during such period to fund the Capital Expenditures.

EBITDA (after Taxes,

Distributions and Unfinanced CAPEX) to Interest Expense plus CMLTD. The Borrower shall not permit the ratio of its EBITDA,

minus taxes paid in cash(including any tax payments to its affiliates), minus Dividends and Distributions and Unfinanced CAPEX,

minus loans and advances to any related individuals, partnership, corporation, limited liability company, trust or other organization

or person plus non cash stock based compensations which are converted to capital, to Interest Expense plus CMLTD, to be less than

1.15 to 1.0, tested every quarter on a rolling four quarter basis commencing with the quarter ending June 30, 2015.

SCHEDULE 1.6

AMENDED TERMS AND

CONDITIONS

The Second Amended

and Restated Credit Facility Agreement is hereby modified by deleting from Article I entitled “Definitions”, the definition

entitled “Fixed Charge Coverage Ratio” in its entirety.

The Second Amended and Restated

Credit Facility Agreement is hereby modified by adding to Article IX entitled "Negative Covenants of the Borrower", a

new subsection 9.14 in its entirety:

| 9.14 | Dividends and Distributions. Borrower shall not, without prior written consent of the

Bank, pay any dividends on or make any distribution on account of any class of Borrower's capital stock in cash or in property

(other than additional shares of such stock), or redeem, purchase or otherwise acquire, directly or indirectly, any of such stock,

except, so long as Borrower is not in default hereunder, distributions not to exceed $100,000.00 during any fiscal quarter

and, if Borrower is a Subchapter S corporation, under the regulations of the Internal Revenue Service of the United States, distributions

to the Shareholders of Borrower in such amounts as are necessary to pay the tax liability of such Shareholders due as a result

of such Shareholders' interest in the Borrower. |

The Second Amended and Restated Credit Facility Agreement is

hereby modified by deleting from Article I entitled “Definitions”, the definition entitled “Letters of Credit”

in its entirety.

The Second Amended and Restated Credit Facility Agreement is

hereby modified by deleting from Article II entitled “Revolving Line”, Subsection (2.7) entitled “Letter of Credit

Sub-facility” in its entirety.

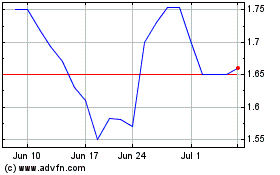

DSS (AMEX:DSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

DSS (AMEX:DSS)

Historical Stock Chart

From Apr 2023 to Apr 2024