Current Report Filing (8-k)

April 21 2015 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 21, 2015

PARKERVISION, INC.

(Exact Name of Registrant as Specified in Charter)

|

Florida

|

000-22904

|

59-2971472

|

|

(State or Other Jurisdiction

|

(Commission

|

(IRS Employer

|

|

of Incorporation)

|

File Number)

|

Identification No.)

|

|

7915 Baymeadows Way, Jacksonville, Florida

|

32256

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(904) 732-6100

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

| Item 3.01. |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

On April 21, 2015, ParkerVision, Inc. (the “Company”) received a notice from the Listing Qualifications Department of The Nasdaq Stock Market (“Nasdaq”) stating that, for the last 30 consecutive business days, the closing bid price for the Company’s common stock had been below the minimum of $1.00 per share required for continued inclusion on the Nasdaq Capital Market under Nasdaq Listing Rule 5550(a)(2). The notification letter stated that the Company would be afforded 180 calendar days (until October 19, 2015) to regain compliance with the minimum bid price requirement. In order to regain compliance, the bid price for shares of the Company’s common stock must close at $1.00 per share or more for a minimum of ten consecutive business days. The notification letter also states that in the event the Company does not regain compliance within the 180 day period, the Company may be eligible for additional time.

The Nasdaq notification has no effect at this time on the listing of the Company’s common stock, and the stock will continue to trade uninterrupted under the symbol “PRKR”. The Company intends to actively monitor the bid price for its common stock between now and October 19, 2015, and will consider all available options to regain compliance with the Nasdaq minimum bid price requirement.

On April 21, 2015, the Company issued a press release announcing receipt of the notice from Nasdaq. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: April 21, 2015

| |

PARKERVISION, INC.

|

| |

|

|

|

| |

By:

|

/s/ Cynthia Poehlman

|

|

| |

|

Cynthia Poehlman

|

|

| |

|

Chief Financial Officer

|

|

3

NEWS RELEASE

FOR IMMEDIATE RELEASE:

ParkerVision, Inc. Receives NASDAQ Notice of Minimum Bid Price Non-Compliance

JACKSONVILLE, Fla., April 21, 2015 – ParkerVision, Inc. (Nasdaq: PRKR), a developer and marketer of semiconductor technology solutions for wireless applications, announced today that it received a letter from the Nasdaq Listing Qualifications Department of The Nasdaq Capital Market (“Nasdaq”) notifying the Company that the minimum bid price for the Company’s common stock was below $1.00 per share for a period of 30 consecutive business days, and that the Company did not meet the minimum bid price requirement set forth under Nasdaq Listing Rule 5550(a)(2).

The Nasdaq notification has no effect at this time on the listing of the Company’s common stock, and the stock will continue to trade uninterrupted under the symbol “PRKR”. ParkerVision management intends to actively monitor the bid price for its common stock and will consider all available options to regain compliance with the Nasdaq minimum bid price requirement.

The Company has a compliance period of 180 calendar days (until October 19, 2015) to regain compliance with the minimum bid price requirement. If at any time during the 180 day compliance period, the closing bid price per share of the Company’s common stock is at least $1.00 for at least ten consecutive business days, Nasdaq will provide the Company a written confirmation of compliance and the matter will be closed.

In the event the Company does not regain compliance with Rule 5550(a)(2) within this compliance period, it may be eligible for additional time. To qualify, the Company will be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for Nasdaq, with the exception of the bid price requirement, and will need to provide written notice of its intention to cure the deficiency during the second compliance period, by effecting a reverse stock split, if necessary. If the Nasdaq staff concludes that the Company will not be able to cure the deficiency or if the Company is otherwise not eligible, the Company’s common stock will be subject to delisting by Nasdaq.

About ParkerVision, Inc.

ParkerVision, Inc. designs, develops and markets its proprietary radio-frequency (RF) technologies that enable advanced wireless solutions for current and next generation communications networks. Protected by a highly-regarded, worldwide patent portfolio, the Company’s solutions for wireless transfer of RF waveforms address the needs of a broad range of wirelessly connected devices for high levels of RF performance coupled with best-in-class power consumption. For more information please visit www.parkervision.com. (PRKR-G)

Safe Harbor Statement

This press release contains forward-looking information. Readers are cautioned not to place undue reliance on any such forward-looking statements, each of which speaks only as of the date made. Such statements are subject to certain risks and uncertainties which are disclosed in ParkerVision’s SEC reports, including the Form 10-K for the year ended December 31, 2014. These risks and uncertainties could cause actual results to differ materially from those currently anticipated or projected.

Contact:

|

Cindy Poehlman

|

Don Markley or

|

|

Chief Financial Officer or

|

Glenn Garmont

|

|

ParkerVision, Inc.

|

The Piacente Group

|

|

904-732-6100, cpoehlman@parkervision.com

|

212-481-2050, parkervision@tpg-ir.com

|

###

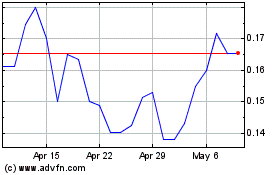

ParkerVision (QB) (USOTC:PRKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

ParkerVision (QB) (USOTC:PRKR)

Historical Stock Chart

From Apr 2023 to Apr 2024