UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL

REPORT UNDER SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December

31, 2014

OR

¨ TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from _______________

to ________________

Commission File Number: 000-52593

SAKER AVIATION SERVICES, INC.

(Exact name of registrant as specified in its

charter)

| Nevada |

87-0617649 |

| (State or other jurisdiction of |

(I.R.S. Employer |

| incorporation or organization) |

Identification No.) |

| 20 South Street, Pier 6 East River |

|

| New York, NY |

10004 |

| (Address of principal executive offices) |

(Zip Code) |

(212) 776-4046

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section 12(b)

of the Act:

None

Securities registered pursuant to Section 12(g)

of the Act:

Title of each class

Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned

issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files).

Indicate by check mark if disclosure of delinquent filers pursuant

to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of

registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K

or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

¨ |

Non-accelerated filer |

¨ |

Smaller Reporting Company |

x |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Act).

As of June 30, 2014 (the last business day of the registrant’s

most recently completed second fiscal quarter), the aggregate market value of the voting and non-voting common equity held by non-affiliates

computed by reference to the price at which the common equity was last sold as of the close of such business day was $1,270,044.

As of March 31, 2015, the Registrant had 33,107,610 shares of its

Common Stock, par value $.001 per share, issued and outstanding.

Documents incorporated by reference: None

SAKER AVIATION SERVICES, INC. AND SUBSIDIARIES

FORM 10-K

INDEX

THIS FORM 10-K CONTAINS FORWARD-LOOKING STATEMENTS

WITHIN THE MEANING OF SECTION 27A OF THE SECURITIES ACT OF 1933, AS AMENDED, AND SECTION 21E OF THE SECURITIES EXCHANGE ACT OF

1934, AS AMENDED. OUR ACTUAL RESULTS COULD DIFFER MATERIALLY FROM THOSE SET FORTH IN SUCH FORWARD-LOOKING STATEMENTS. CERTAIN FACTORS

THAT MIGHT CAUSE SUCH A DIFFERENCE ARE DISCUSSED IN ITEM 1A, “RISK FACTORS” AND ITEM 7, “MANAGEMENT’S DISCUSSION

AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION” OF THIS ANNUAL REPORT ON FORM 10-K. SEE ALSO “FORWARD-LOOKING

STATEMENTS” WITHIN SUCH ITEM 7 OF THIS ANNUAL REPORT ON FORM 10-K.

PART I

ITEM 1. BUSINESS

General

Saker Aviation Services,

Inc. (“we”, “us”, “our”) is a Nevada corporation. Our common stock, $0.001 par value per share

(the “common stock”), is publicly traded on the OTCQB Marketplace (“OTCQB”) under the symbol “SKAS”.

Through our subsidiaries, we operate in the aviation services segment of the general aviation industry, in which we serve as the

operator of a heliport, a fixed base operation (“FBO”), as a provider of aircraft maintenance, repair and overhaul

(“MRO”) services, and as a consultant for a seaplane base that we do not own. FBOs provide ground-based services, such

as fueling and aircraft storage for general aviation, commercial and military aircraft, and other miscellaneous services.

We were formed on January

17, 2003 as a proprietorship and were incorporated in Arizona on January 2, 2004. We became a public company as a result of a reverse

merger transaction on August 20, 2004 with Shadows Bend Development, Inc., an inactive public Nevada corporation, and subsequently

changed our name to FBO Air, Inc. On December 12, 2006, we changed our name to FirstFlight, Inc. On September 2, 2009, we changed

our name to Saker Aviation Services, Inc.

Our business activities

are carried out as the operator of the Downtown Manhattan (New York) Heliport, as an FBO at the Garden City (Kansas) Regional Airport,

as an MRO at the Bartlesville (Oklahoma) Municipal Airport, and as a consultant to the operator of a seaplane base in New York

City.

The Garden City facility

became part of our company as a result of our acquisition of the FBO assets of Central Plains Aviation, Inc. (“CPA”)

in March 2005.

Our business activities

at the Downtown Manhattan (New York) Heliport facility (the “Heliport”) commenced as a result of the Company’s

award of the Concession Agreement by the City of New York to operate the Heliport, which we assigned to our subsidiary, FirstFlight

Heliports, LLC d/b/a Saker Aviation Services (“FFH”).

The Bartlesville facility

became part of our company as a result of our acquisition of all of the outstanding stock of Phoenix Rising Aviation, Inc. (“PRA”)

on August 15, 2013.

The FBO segment of the

general aviation industry is highly fragmented. According to the National Air Transportation Association (“NATA”),

there are over 3,000 FBOs that serve customers at one or more of over 3,000 airport facilities across the country that have at

least one paved 3,000-foot runway. The vast majority of these companies are single location operators. NATA characterizes companies

with operations at three or more airports as “chains.” An operation with FBOs in at least two distinctive regions of

the country is considered a “national” chain while an operation with FBOs in multiple locations within a single region

is considered a “regional” chain.

We believe the general

aviation market has been historically cyclical, with revenue correlated to general U.S. economic conditions. Although not truly

seasonal in nature, the spring and summer months tend to generate higher levels of revenue and our operations generally follow

that trend.

Discontinued Operations

As disclosed in a Report

on Form 8-K we filed with the Securities and Exchange Commission (the “SEC”) on August 21, 2013, and as further described

in “Note 7 – Subsequent Events” in our June 30, 2013 Form 10-Q, effective August 31, 2013, we no longer serve

as a fixed base operator (“FBO Operator”) at the Wilkes-Barre/Scranton International Airport. Accordingly, the results

of business activities previously conducted by us at the Wilkes-Barre/Scranton International Airport have been recorded in this

Annual Report on Form 10-K as Discontinued Operations.

Suppliers and Raw Materials

Our principal materials

are aviation fuel and aircraft parts. We obtain aviation fuel, component parts and other supplies from a variety of sources, generally

from more than one supplier. Our suppliers and sources are both domestic and foreign, and we believe that our sources of materials

are adequate to meet our needs for the foreseeable future. We do not believe the loss of any one supplier would have a material

adverse effect on our business or results of operations. We generally purchase our supplies on the open market, where certain commodities

have fluctuated in price significantly in recent years. We have not experienced any significant shortage of our key supplies.

Marketing and Sales

The main goal of our marketing

and sales efforts is to increase traffic at our facilities, which would then drive revenue through the incremental sale of our

products and services. Our primary marketing tactic in this regard is to focus advertising efforts in the environments (web, periodical

and industry publications) where the pilot and aviation-user community might be introduced to our brand name and locations. We

intend to continue to invest in improvements to our sales and marketing strategies to drive revenue growth.

Government Approvals

The aviation services that

we provide are generally performed on municipal or other government owned real estate properties. Accordingly, at times we will

need to obtain certain consents or approvals from governmental entities in conjunction with our operations. These consents and

approvals are typically in the form of a lease agreement, as is the case at our Kansas facility, or a concession agreement, as

is the case with our New York facility. There can be no assurance that we will obtain further consents or approvals on favorable

terms or be able to renew existing consents or approvals on favorable terms, if at all.

Government Regulation

We are subject to a variety

of governmental laws and regulations that apply to companies in the aviation industry. These include compliance with the Federal

Aviation Administration (“FAA”) rules and regulations, and local, regional and national rules and regulations as they

relate to environmental matters. We believe we are in compliance with, and intend to continue to comply with, all applicable government

regulations. The adoption of new regulations could result in increased costs and have an adverse impact on our results of operations.

In the event we are unable to remain compliant with applicable rules and regulations, our business may be adversely affected.

Customers

For the fiscal

year ended December 31, 2014, three customers represented approximately 57% of our revenue. The loss of any of these three

customers could represent a significant decrease in revenue that may adversely affect our business and result of

operations. Additionally, four accounts represented approximately 77% of the balance of accounts receivable at December 31,

2014. Accounts receivable are carried at their estimated collectible amounts and are periodically evaluated for

collectability. We depend significantly on our business with these four customers.

Competition

The FBO segment of the

aviation services industry is competitive in both pricing and service because aircraft in transit are able to choose from a number

of FBO options within a 300-mile radius. The vast majority of FBO operators are independent, single location operators. We are

the sole FBO at each of our current facilities. As such, we face no direct on-airport competition. However, we face competitive

pressure on pricing and services from FBO facilities at other airports, depending on aircraft travel flexibility.

We plan to grow our business

through both internal development of existing resources and facilities and through the potential acquisition of other related business.

We anticipate that growing our business will provide us with greater buying power from suppliers and, therefore, result in lower

costs. Lower costs would allow us to implement a more aggressive pricing policy against some competitors. We believe that the higher

level of customer service offered in our facilities will allow us to draw additional aircraft traffic and thus compete successfully

against other FBOs of all sizes. However, there can be no assurance that we will be able to compete successfully in the highly

competitive aviation industry.

Costs and Effects of Complying With Environmental Laws

We are subject to a variety

of federal, state and local environmental laws and regulations, including those that govern health and safety requirements, the

discharge of pollutants into the air or water, the management and disposal of hazardous substances and wastes and the responsibility

to investigate and clean-up contaminated sites that are or were owned, leased, operated or used by us or our predecessors. Some

of these laws and regulations require us to obtain permits, which contain terms and conditions that impose limitations on our ability

to emit and discharge hazardous materials into the environment and may be periodically subject to modification, renewal and revocation

by issuing authorities. Fines and penalties may be imposed for non-compliance with applicable environmental laws and regulations

and the failure to have or to comply with the terms and conditions of required permits. We intend to comply with these laws and

regulations. However, from time to time, our operations may not be in full compliance with the terms and conditions of our permits

or licenses. We periodically review our procedures and policies for compliance with environmental laws and requirements. We believe

that our operations are in material compliance with applicable environmental laws and requirements and that any potential non-compliance

would not be expected to result in us incurring material liability or cost to achieve compliance. Although the cost of achieving

and maintaining compliance with environmental laws and requirements has not been material, we can provide no assurance that such

cost will not become material in the future.

Employees

As of December 31, 2014,

we employed 57 persons, 42 of which were employed on a full-time basis, and one of which was an executive officer. All of our personnel

are employed in connection with our operations in New York, Oklahoma and Kansas.

Available Information

We are subject to the informational

requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Therefore, we file periodic reports,

proxy statements and other information with the Securities and Exchange Commission (the “SEC”). Such reports may be

read and copied at the SEC’s Public Reference Room at 100 F Street NE, Washington, D.C. 20549. Information regarding the

operation of the Public Reference Room may be obtained by calling the SEC at (800) SEC-0330. The SEC also maintains a website (www.sec.gov)

that includes our reports, proxy statements and other information. We maintain a website at www.sakeraviation.com where we make

available, free of charge, documents that we file with, or furnish to, the SEC, including our Annual Reports on Form 10-K, Quarterly

Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements, registration statements and any amendments to those reports.

Our SEC reports can be found under “Financial Reporting” tab on our website. The other information found on our website

is not part of this or any other report we file with, or furnish to, the SEC.

ITEM 1A. RISK

FACTORS

The following risk factors relate

to our operations:

Additional financing to expand our business.

Certain potential aviation

services firms which we may seek to acquire in the future may accept shares of our common stock or other securities as payment

by us for the acquisition. However, we believe that most will likely prefer cash payments, whether paid at the closing or in post-closing

installment payments. There can be no assurance that our operations will generate sufficient cash flow to meet these acquisition

obligations. Accordingly, we anticipate the need to seek additional equity or debt financing to meet any cash requirements for

acquisitions. Any such financing will be dependent on general market conditions and the stock market’s evaluation of our

performance and potential. Accordingly, we can give no assurance that we will obtain such equity or debt financing and, even if

we do, that the terms would be satisfactory to us.

We could be adversely affected by increases in the price,

or decreases in the availability, of jet fuel.

Our operations could be

significantly affected by the availability and price of jet fuel. A significant increase in the price of jet fuel would most likely

have a material impact on our ability to achieve and maintain profitability unless we are able to pass on such costs to our customers.

Due to the competitive nature of the industry, our ability to pass on increased fuel prices by increasing our rates is uncertain.

Likewise, any potential benefit of lower fuel prices may be offset by increased competition and lower revenue, in general. While

we do not currently anticipate a significant reduction in fuel availability, dependency on foreign imports of crude oil and the

possibility of changes in government policy on jet fuel production, transportation and marketing make it impossible to predict

the future availability of jet fuel. If there are new outbreaks of hostility or other conflicts in oil producing areas or elsewhere,

there could be a reduction in the availability of jet fuel or significant increases in costs to our business, as well as to the

entire aviation industry, which in turn would adversely affect our business and results of operations.

We could be adversely affected by the

loss of certain key customers or the inability of such key customers to pay amounts due to us.

For the fiscal year ended

December 31, 2014, three customers represented approximately 57% of our revenue. Additionally, four accounts represented approximately

77% of the balance of accounts receivable at December 31, 2014. Accounts receivable are carried at their estimated collectible

amounts and are periodically evaluated for collectability. The loss of any of our key customers, or the inability of such customers

to pay amounts due to us, could result in a significant decrease in revenue that may adversely affect our business and result of

operations.

The continued threat of terrorist actions may result in less

demand for private aviation and, as a result, our revenue may be adversely affected and we may not be able to continue successful

operations.

Terrorist actions involving

public and private aircraft may have a significant adverse impact on us. As a result of these actions, individuals and corporate

customers may cease using private aircraft as a means of transportation or reduce their use of such aircraft, or we could become

subject to burdensome regulations that would have an adverse effect on our results of operations. In either event, we would be

unable to maintain sales and may be unable to continue our operations on a successful basis.

The FBO segment of the aviation services industry in which

we operate is fiercely competitive.

We compete with national,

regional, and local FBO operators. Many of our competitors have been in business longer than we have and have greater financial

resources available to them. Having greater financial resources will make it easier for these competitors to absorb an increase

in fuel prices and other expenses. In addition, these competitors might seek acquisitions in regions and markets competitive to

us, which could have an adverse effect on our business and results of operations. Accordingly, we can give no assurance that we

will be able to successfully compete in our industry.

Our business as an FBO is subject to extensive governmental

regulation.

FBOs are subject to extensive

regulatory requirements that could result in significant costs. For example, the FAA, from time to time, issues directives and

other regulations relating to the management, maintenance and operation of facilities. Compliance with those requirements may cause

us to incur significant expenditures. The proposal and enactment of additional laws and regulations, as well as any charges that

we have not complied with any such laws and regulations, could significantly increase the cost of our operations and reduce overall

revenue. We cannot provide assurance that compliance with existing laws and regulations or that laws or regulations enacted in

the future will not adversely affect our business and results of operations.

We must maintain and add key management and other personnel.

Our future success is heavily

dependent on the performance of our managers. Our growth and future success depends, in large part, on the continued contributions

of management and our ability to retain management. Our growth and future success also depends on other key individuals, as well

as our ability to motivate and retain these personnel or hire other persons. Although we believe we will be able to retain and

hire qualified personnel, we can give no assurance that we will be successful in retaining and recruiting such personnel in sufficient

numbers to increase revenue, maintain profitability or successfully implement our growth strategy. If we lose the services of management

or any of our key personnel or are not able to retain or hire qualified personnel, our business could be adversely affected.

We are subject to environmental laws that could impose significant

costs on us and the failure to comply with such laws could subject us to sanctions and material fines and expenses.

We are subject to a variety

of federal, state and local environmental laws and regulations, including those governing the discharge of pollutants into the

air or water, the management and disposal of hazardous substances and wastes and the responsibility to investigate and clean-up

contaminated sites that are or were owned, leased, operated or used by us or our predecessors. Some of these laws and regulations

require us to obtain permits, which contain terms and conditions that impose limitations on our ability to emit and discharge hazardous

materials into the environment and may be periodically subject to modification, renewal and revocation by issuing authorities.

Fines and penalties may be imposed for non-compliance with applicable environmental laws and regulations, the failure to have required

permits or the failure to comply with the terms and conditions of such permits. We intend to comply with all laws and regulations,

however, from time to time, our operations may not be in full compliance with the terms and conditions of our permits. We periodically

review our procedures and policies for compliance with environmental laws and requirements. We believe that our operations are

in material compliance with applicable environmental laws, requirements and permits and any lapses in compliance are not expected

to result in us incurring material liability or cost to achieve compliance. However, there can be no assurance that our operations

will remain in material compliance with applicable environmental laws and requirements. Historically, the costs of achieving and

maintaining compliance with environmental laws, requirements and permits have not been material; however, the operation of our

business entails risks in these areas and a failure by us to comply with applicable environmental laws, regulations or permits

could result in civil or criminal fines, penalties, enforcement actions, third party claims for property damage and personal injury,

requirements to clean up property or to pay for the costs of cleanup and/or regulatory or judicial orders enjoining or curtailing

operations or requiring corrective measures. Moreover, if applicable environmental laws and regulations, or the interpretation

or enforcement thereof, become more stringent in the future, we could incur capital or operating costs beyond those currently anticipated

and our business and results of operations could be harmed.

The following risk factors relate to our common stock:

There is no active market for our common

stock, which makes our common stock less liquid.

To date, trading of our

common stock has been sporadic and nominal in volume. In addition, there are only a limited number of broker-dealers trading our

common stock. As a result, there is little, if any, liquidity in our common stock. We can provide no assurance that an active trading

market will ever develop.

Our common stock is subject to the penny stock rules, which

makes our common stock less liquid.

The Securities and Exchange

Commission (the “Commission”) has adopted a set of rules called the “penny stock rules” that regulate broker-dealers

with respect to trading in securities with a bid price of less than $5.00. These rules do not apply to securities registered on

certain national securities exchanges (including the Nasdaq Stock Market), provided that current price and volume information

regarding transactions in such securities is provided by the exchange or system. Our stock is not listed on such an exchange and

we have no expectation that our common stock will be listed on such an exchange in the future. The penny stock rules also require

a broker-dealer to deliver to the customer a standardized risk disclosure document prepared by the Commission that provides information

about penny stocks and the nature and level of risks in the penny stock market. Additionally, the broker-dealer must provide the

customer with other information. The penny stock rules require that, prior to a transaction in a penny stock, the broker-dealer

must determine in writing that the penny stock is a suitable investment for the purchaser. The broker-dealer must also receive

the purchaser’s written agreement to the transaction. These disclosure requirements have the effect of reducing the level

of trading activity in the secondary market for a stock such as ours that is subject to the penny stock rules.

Potential additional financings, the granting of additional

stock options and anti-dilution provisions in our warrants could further dilute our existing stockholders.

As of March 31, 2015, there

were 33,107,610 shares of our common stock outstanding. If all of our outstanding common stock purchase warrants and options were

exercised, there would be 35,357,610 shares outstanding, an increase of 6.8%. Any further issuances due to additional equity financings,

the granting of additional options or the anti-dilution provisions in our warrants could further dilute our existing stockholders,

which could cause the value of our common stock to decline.

We do not anticipate paying dividends on our common stock

in the foreseeable future.

We intend to retain future

earnings, if any, to fund our operations and to expand our business. Accordingly, we do not anticipate paying cash dividends on

shares of our common stock in the foreseeable future and an investment in our common stock might not generate any return.

Our Board of Directors’ right to

issue shares of preferred stock could adversely impact the rights of holders of our common stock.

Our Board of Directors

currently has the right to authorize the issuance of up to 9,999,154 shares of one or more series of our preferred stock with such

voting, dividend and other rights as our directors determine. Such action can be taken by our Board of Directors without the approval

of our shareholders. Accordingly, the holders of any new series of preferred stock could be granted voting rights that reduce the

voting power of the holders of our common stock. For example, the preferred holders could be granted the right to vote on a merger

as a separate class even if the merger would not have an adverse effect on their rights. This right, if granted, would give such

preferred holders a veto with respect to any merger proposal. Alternatively, such preferred holders could be granted a large number

of votes per share while voting as a single class with the holders of our common stock, thereby diluting the voting power of the

holders of our common stock. In addition, the holders of any new series of preferred stock could be given the option to redeem

their shares for cash in the event of a merger. This would make acquiring us less attractive to a potential buyer. Thus, our board

could authorize the issuance of shares of the new series of preferred stock in order to defeat a proposal for the acquisition of

our company that a majority of the holders of our common stock otherwise favor.

Our common stock may not continue to be traded on the OTCQB.

We cannot provide any assurance

that our common stock will continue to be eligible to trade on the OTCQB Marketplace (“OTCQB”). Should our common stock

cease to trade on the OTCQB and fail to qualify for listing on a stock exchange (including Nasdaq), our common stock would only

trade in the “pink sheets” which generally provides an even less liquid market than the OTCQB. In such event, stockholders

may find it more difficult to trade their shares of our common stock or to obtain accurate and current information concerning market

prices for our common stock.

Our management team currently has influential voting power.

As of March 31, 2015, our

executive officer, directors and their family members and associates, collectively, are entitled to vote 7,540,033 shares, or 22.8%,

of the 33,107,610 shares of our outstanding shares of common stock. Accordingly, and, because there is no cumulative voting for

directors, our executive officers and directors are currently in a position to influence the election of all of our Board of Directors.

The management of our company is controlled by our Board of Directors, which is currently comprised of one independent director,

a director who is a managing partner of a law firm which provides legal services to us, and two executive officer/directors.

ITEM 1B. UNRESOLVED

STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

As of March 31, 2015, we lease office space

at the following locations:

| Location | |

Purpose | |

Space | |

Annual Rental | | |

Expiration |

| | |

| |

| |

| | |

|

2117 S. Air Service Road

Garden City, Kansas | |

Kansas

FBO location | |

17,640

square feet | |

$ | 26,244 | | |

December 31,

2030 |

| | |

| |

| |

| | | |

|

406 NW Wiley Post Rd

Bartlesville, Oklahoma | |

Oklahoma

MRO location | |

33,302

square feet | |

$ | 61,680 | | |

April 1,

2022 |

| | |

| |

| |

| | | |

|

600 Hayden Circle

Allentown, Pennsylvania | |

Pennsylvania

Office location | |

360

square feet | |

$ | 6,214 | | |

Month-to-

Month |

We believe that our space

is adequate and suitable for our immediate needs. Additional hangar space may be required for our operations in the future. No

definitive plans to lease any additional space have been developed at the time of this report. Should additional hangar space be

required, there can be no assurance that such space will be available or available on commercially reasonable terms or at all.

ITEM 3. LEGAL

PROCEEDINGS

From time to time, we may

be a party to one or more claims or disputes which may result in litigation. We do not, however, presently expect that any such

matters will have a material adverse effect on our business, financial condition or results of operations.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM

5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES

Market for Common Equity

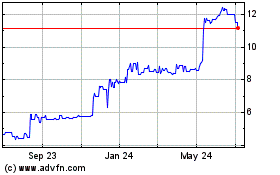

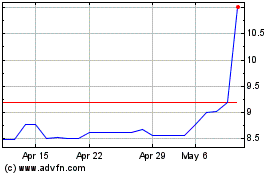

Our common stock is traded

on the OTCQB Marketplace (“OTCQB”) under the symbol SKAS. The OTCQB is a regulated quotation service that displays

real-time quotes, last-sale prices and volume information in over-the-counter (“OTC”) equity securities. Our common

stock is only traded on a limited or sporadic basis and should not be deemed to constitute an established public trading market.

OTC quotations reflect intra-dealer prices, without retail mark-up, mark-down, or commission and may not necessarily represent

actual transactions.

The following table sets

forth the high and low closing sale prices for the common stock as reported on the OTCQB for the past two most recent fiscal years.

| | |

Common Stock | |

| Quarterly Period Ended | |

High | | |

Low | |

| | |

| | |

| |

| March 31, 2013 | |

$ | 0.100 | | |

$ | 0.067 | |

| | |

| | | |

| | |

| June 30, 2013 | |

$ | 0.112 | | |

$ | 0.078 | |

| | |

| | | |

| | |

| September 30, 2013 | |

$ | 0.100 | | |

$ | 0.030 | |

| | |

| | | |

| | |

| December 31, 2013 | |

$ | 0.095 | | |

$ | 0.050 | |

| | |

| | | |

| | |

| March 31, 2014 | |

$ | 0.098 | | |

$ | 0.080 | |

| | |

| | | |

| | |

| June 30, 2014 | |

$ | 0.095 | | |

$ | 0.050 | |

| | |

| | | |

| | |

| September 30, 2014 | |

$ | 0.070 | | |

$ | 0.040 | |

| | |

| | | |

| | |

| December 31, 2014 | |

$ | 0.088 | | |

$ | 0.050 | |

Holders

As of March 31, 2015, there

were approximately 285 holders of record of our common stock. This number does not include beneficial owners of the common stock

whose shares are held in the names of various broker-dealers, clearing agencies, banks and other fiduciaries.

Dividends

Since our inception we

have never declared or paid any cash dividends on our common stock. We intend to retain future earnings to finance the growth and

development of our business and future operations. Therefore, we do not anticipate paying any cash dividends on shares of our common

stock in the foreseeable future.

ITEM 6. SELECTED

FINANCIAL DATA

ITEM 7. MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

Forward-looking Statements

This Annual Report on Form

10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,”

“seeks,” “believes,” “estimates,” “expects” and similar references to future periods.

These statements may include projections of revenue, provisions for doubtful accounts, income or loss, capital expenditures, repayment

of debt, other financial items, statements regarding our plans and objectives for future operations, acquisitions, divestitures

and other transactions, statements of future economic performance, statements of the assumptions underlying or relating to any

of the foregoing statements and statements other than statements of historical fact.

Forward-looking statements

are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances

that are difficult to predict. Our actual results may differ materially from those contemplated by such forward-looking statements.

We therefore caution you against relying on any of these forward-looking statements because they are neither statements of historical

fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially

from those in the forward-looking statements include our services and pricing, general economic conditions, our ability to raise

additional capital, our ability to obtain the various approvals and permits for the acquisition and operation of FBOs and the other

risk factors contained in Item 1A of this report.

Any forward-looking statement

made by us in this report speaks only as of the date on which it is made. Factors or events that could cause our actual results

to differ may emerge from time to time and it is not possible for us to predict all of them. We undertake no obligation to publicly

update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be

required by law.

Overview

Our

long-term strategy is to increase our sales through growth within our aviation services operations. To do so, we may expand our

geographic reach and product offering through strategic acquisitions and improved market penetration within the markets we serve.

We expect that any future acquisitions or product offerings would be to complement and/or augment our current aviation services

operations.

If we are able to grow

our business as planned, we anticipate that our larger size would provide us with greater buying power from suppliers, resulting

in lower costs. We expect that lower costs would allow for a more aggressive pricing policy against some competition. More importantly,

we believe that the higher level of customer service offered in our facilities will allow us to draw additional aircraft to our

facilities and thus allow us to compete against other FBOs of varying sizes.

Summary Financial Information

The summary financial data set forth below is

derived from and should be read in conjunction with the consolidated financial statements, including the notes thereto, filed as

part of this report.

Consolidated Statement of Operations Data: | |

Year Ended

December 31,

2014 | | |

Year Ended

December 31,

2013 | |

| (in thousands, except for share and per share data) | |

| | |

| |

| Revenue from Continuing Operations | |

$ | 18,288 | | |

$ | 14,762 | |

| Income from Continuing Operations, before income tax expense | |

$ | 324 | | |

$ | 828 | |

| Income tax (expense) | |

$ | (190 | ) | |

$ | (463 | ) |

| Income from Continuing Operations, net of income taxes | |

$ | 134 | | |

$ | 365 | |

| Discontinued operations, net of income taxes | |

$ | 0 | | |

$ | (2,188 | ) |

| Net income (loss) | |

$ | 134 | | |

$ | (1,823 | ) |

| Net income (loss) per share – basic | |

$ | 0.00 | | |

$ | (0.06 | ) |

| Net income (loss) per share – diluted | |

$ | 0.00 | | |

$ | (0.06 | ) |

| Weighted average number of shares – basic | |

| 33,106,788 | | |

| 33,050,688 | |

| Weighted average number of shares – diluted | |

| 33,327,817 | | |

| 33,050,688 | |

Balance Sheet Data: (in thousands) | |

December 31,

2014 | | |

December 31,

2013 | |

| Working capital surplus | |

$ | 846 | | |

$ | 303 | |

| Total assets | |

$ | 6,706 | | |

$ | 6,910 | |

| Total liabilities | |

$ | 3,516 | | |

$ | 3,890 | |

| Stockholders’ equity | |

$ | 3,190 | | |

$ | 3,020 | |

| Total liabilities and Stockholders’ equity | |

$ | 6,706 | | |

$ | 6,910 | |

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

Discontinued Operations

As disclosed in a Report

on Form 8-K we filed with the Securities and Exchange Commission (the “SEC”) on August 21, 2013, and as further described

in “Note 7 – Subsequent Events” in our June 30, 2013 Form 10-Q, effective August 31, 2013, we no longer serve

as a fixed base operator (“FBO Operator”) at the Wilkes-Barre/Scranton International Airport. Accordingly, the results

of business activities previously conducted by us at the Wilkes-Barre/Scranton International Airport have been recorded in this

Annual Report on Form 10-K as Discontinued Operations.

Comparison of Continuing Operations for the Years Ended December

31, 2014 and December 31, 2013.

REVENUE

Revenue from continuing

operations increased by 23.9 percent to $18,287,784 for the twelve months ended December 31, 2014 as compared with corresponding

prior-year period revenue of $14,761,991.

For the twelve months ended

December 31, 2014, revenue from continuing operations associated with services and supply items increased by 35.3 percent to approximately

$11,000,000 as compared to approximately $8,100,000 in the twelve months ended December 31, 2013. The increase was driven by higher

levels of activity and related revenue in Heliport operations, full-year revenue from our MRO in Oklahoma in comparison with a

partial year in 2013, and increased revenues from the development of aircraft deicing services in our Kansas facility.

For the twelve months ended

December 31, 2014, revenue from continuing operations associated with the sale of jet fuel, aviation gasoline and related items

increased by 10.4 percent to approximately $7,100,000 as compared to approximately $6,500,000 in the twelve months ended December

31, 2013. The increase was related to a combination of higher volume of gallons along with higher average fuel prices as compared

with the prior year. We generally price our fuel products on a fixed dollar margin basis. As the cost of fuel increases, the corresponding

customer price increases as well. If volume is constant, this methodology yields higher revenue but at comparable gross margins.

For the twelve months ended

December 31, 2014, all other revenue decreased by 11.3 percent to approximately $134,000 as compared to approximately $151,000

in the twelve months ended December 31, 2013 as certain one-time revenue events from 2013 did not recur in 2014.

GROSS PROFIT

Total gross profit increased

23.6 percent to $8,218,612 in the twelve months ended December 31, 2014 as compared to $6,651,091 in the twelve months ended December

31, 2013. Gross profit as a percent of revenue was 45 percent in the twelve months ended December 31, 2014 and 2013. The increase

in gross profit is related to higher levels of activity and related revenue in our Heliport operations as well as a full year of

operations at our MRO in Oklahoma as compared to a partial year in 2013.

OPERATING EXPENSE

Selling, General and Administrative

Total selling, general

and administrative, or SG&A, expenses were $7,092,654 in the twelve months ended December 31, 2014, an increase of approximately

$1,488,000 or 26.5 percent, as compared to the same period in 2013.

SG&A associated

with our Heliport, MRO and FBO operations were approximately $6,731,000 in the twelve months ended December 31, 2014, an

increase of approximately $1,685,000, or 33.4 percent, as compared to the twelve months ended December 31, 2013. The primary

source of the increased operating expense was due to a full year of operations at our MRO in Oklahoma as compared to a

partial year in 2013. SG&A associated with our FBO operations, as a percentage of revenue, was 36.8 percent for

the twelve months ended December 31, 2014, as compared with 34.2 percent in the corresponding prior year period.

Corporate SG&A was

approximately $361,000 for the twelve months ended December 31, 2014, representing a decrease of approximately $198,000 as compared

with the corresponding prior year period.

OPERATING INCOME

Operating income from continuing

operations for the year ended December 31, 2014 was $1,125,958 as compared to $1,045,997 in the year ended December 31, 2013. The

increase in a year-over-year basis is primarily due to a combination of higher levels of revenue leading to increased gross profit,

as described above.

Depreciation and Amortization

Depreciation and amortization

was approximately $627,000 and $488,000 for the twelve months ended December 31, 2014 and 2013, respectively. The increase in 2014

was largely attributed to the full year of amortization in 2014 of certain intangibles related to the purchase of our Oklahoma

MRO as well as depreciation recorded in connection with the capital improvement program at the Heliport.

Interest Income/Expense

Interest income

for the year ended December 31, 2014 was $6,693, as compared to $17,617 in year ended December 31, 2013. Interest expense for

the year ended December 31, 2014 was $85,929, as compared to $121,476 in the same period in 2013, with the decrease

largely attributable to less interest associated with the Redemption Agreement, due to the remaining balance being

paid down in 2014, as further described in notes to the financial statements included in Item 8 of this Report under the

heading “Related Parties.”

Other Expense – Hurricane Sandy

Other expenses of approximately

$111,000 were recorded for the 12 months ended December 31, 2013 in connection with reconstruction efforts in the aftermath of

Hurricane Sandy, as described in greater detail in Part II of our Annual Report on Form 10-K for the year ended December 31, 2012.

There were no comparable expenses in the current year period.

Impairment of Goodwill and Other Intangibles

The Company had $530,000 and $1,080,380 of goodwill

at December 31, 2014 and 2013, respectively. The Company assessed its goodwill using the qualitative approach and determined it

was more likely than not that the fair value of its goodwill resulting from the purchase of PRA was less than its carrying value

and recorded a $550,380 impairment charge at December 31, 2014. Due to macroeconomic, industry and market conditions, the PRA facility

has not been able to establish positive cash flow and that future cash flows were insufficient to support any value of goodwill

or indefinite live intangibles and has taken an impairment charge in the audited financial statements for their remaining value.

As

of December 31, 2014, intangible assets consist of a non-compete agreement ($107,500) and a charter certificate ($35,000). At December

31, 2013, intangible assets consisted of a non-compete agreement ($150,000), trade name ($100,000) customer relationships ($75,000)

and a charter certificate ($35,000). At December 31, 2014, the Company recorded an impairment charge of $139,583 for the trade

name and customer relationships at the PRA facility using the aforementioned procedures.

Income Tax

Income tax expense for

the twelve months ended December 31, 2014 was $190,000, as compared to $463,000 in the same period in 2013. Included in these amounts

are paid actual or estimated federal, state and local income taxes along with a charge for deferred income tax at our estimated

blended effective tax rate of 39 percent. Paid actual or estimated tax expenses were $693,000 and deferred income tax benefits

were $503,000 for the twelve months ended December 31, 2014. Paid actual or estimated tax expenses were $526,000 and deferred income

tax benefits were $63,000 for the twelve months ended December 31, 2013.

Net Income (Loss) Per Share

Net income for the twelve

months ended December 31, 2014 was $133,747 as compared to net loss of $1,823,092 in the twelve months ended December 31, 2013.

The swing was primarily related to the loss associated with discontinued operations in 2013.

Basic and diluted net income

per share for the twelve months ended December 31, 2014 was $0.00. Basic and diluted net loss per share for the twelve months ended

December 31, 2013 was $0.06.

Liquidity and Capital Resources

As of December 31, 2014,

we had cash and cash equivalents of $531,003 and a working capital surplus of $846,407. We generated revenue from continuing operations

of $18,287,784 and had net income from continuing operations of $133,747 for the twelve months ended December 31, 2014. For the

twelve months ended December 31, 2014, cash flows included net cash provided by operating activities of $1,156,041, net cash provided

by investing activities of $1,373, and net cash used in financing activities of $772,816.

On May 17, 2013, we entered

into a loan agreement with PNC Bank (the “PNC Loan Agreement”). The PNC Loan Agreement contains three components: (i)

a $2,500,000 non-revolving acquisition line of credit (the “PNC Acquisition Line”); (ii) a $1,150,000 working capital

line (the “PNC Working Capital Line”); and (iii) a $280,920 term loan (the “PNC Term Loan”).

Proceeds of the PNC Acquisition Line were able

to be dispersed, based on parameters defined in the PNC Loan Agreement, until May 17, 2014 (the “Conversion Date”).

As of the Conversion Date, there was $1,350,000 outstanding under the PNC Acquisition Line. The payment terms provide that 30 days

following the Conversion Date, and continuing on the same day of each month thereafter, the Company is required to make equal payments

of principal over a 60 month period. Interest on the outstanding principal continues to accrue at a rate equal to one-month LIBOR

plus 275 basis points (2.91% as of December 31, 2014). An unused commitment fee had been applied at a rate of 1.5% on the unused

portion of the PNC Acquisition Line and was charged for each fiscal quarter through the Conversion Date. As of December 31, 2014,

there was $1,192,500 outstanding under the PNC Acquisition Line.

The PNC Working Capital

Line may be dispersed for working capital and general corporate purposes. Interest on outstanding principal accrues at a rate equal

to daily LIBOR plus 250 basis points (2.67% as of December 31, 2014) and is annually renewable at PNC Bank’s option. As of

December 31, 2014, the outstanding balance of the PNC Working Capital Line was $550,000.

The PNC Term Loan was utilized

to retire our previously outstanding miscellaneous debt of the same amount. Interest on outstanding principal accrues at a rate

equal to one-month LIBOR plus 275 basis points (2.91% as of December 31, 2014) and principal and interest payments shall be made

over a thirty-four month period. At December 31, 2014, $128,420 was outstanding.

We are party to a concession

agreement, dated as of November 1, 2008, with the City of New York for the operation of the Downtown Manhattan Heliport (the “Concession

Agreement”). Pursuant to the terms of the Concession Agreement, we must pay the greater of 18% of the first $5,000,000 in

program year gross receipts and 25% of gross receipts in excess of $5 million or minimum annual guaranteed payments. We paid the

City of New York $1,200,000 in the first year of the term and minimum payments are scheduled to increase to approximately $1,700,000

in the final year of Concession Agreement, which expires on October 31, 2018. During the twelve months ended December 31, 2014

and 2013, we incurred approximately $2,810,000 and $2,300,000, respectively, in concession fees which are recorded in the cost

of revenue.

Our anticipated capital

expenditures in 2015 are approximately $50,000 - $100,000.

During the twelve months

ended December 31, 2014, we had a net increase in cash of $384,598. Our sources and uses of funds during this period were as follows:

Cash from Operating Activities

For the year ended December

31, 2014, net cash provided by operating activities was $1,156,041. This amount included an increase in operating cash related

to net income of $133,747 and additions for the following items: (i) depreciation and amortization, $626,919; (ii) stock-based

compensation expense, $36,675; (iii) inventories, $39,174; (iv) accounts payable, $126,463, (v) deposits, $4,873; (vi) accrued

expenses, $408,893; (vii) impaired goodwill and other intangibles, $689,963, and (viii) prepaid expenses, $15,537. The increase

in cash provided by operating activities in 2014 was offset by the following items: (i) accounts receivable, $423,203; and deferred

income taxes, $503,000. For the year ended December 31, 2013, net cash provided by operating activities was $591,928. This amount

included a decrease in operating cash related to net loss of $1,823,092 and additions for the following items: (i) depreciation

and amortization, $487,764; (ii) stock-based compensation expense, $33,064; (iii) accounts receivable, insurance recovery, $147,928;

(iv); loss on disposal of property and equipment, $251,132; (v) accounts receivable, trade, $113,188; (vi) inventories, $156,789;

and (vii) impaired goodwill and trade name, discontinued operations, $1,938,284. The increase in cash used by operating activities

in 2013 was offset by the following items: (i) prepaid expenses, $358,461; (ii) deferred income taxes, $63,000; (iii) accounts

payable, $184,129; (iv) accrued expenses, $106,735; and (v) customer deposits, $804.

Cash from Investing Activities

For the year ended December

31, 2014, net cash provided by investing activities was $1,373 and was attributable to the purchase of property and equipment that

cost $190,956 offset by the payment of notes receivable of $192,329. For the year ended December 31, 2013, net cash used in investing

activities was $1,674,184, consisting of: (i) payment of note receivable, $108,384; and (ii) accounts receivable, insurance recovery,

$315,014; offset by (iii) purchase of property and equipment, $759,378; and (iv) purchase of assets, net of liabilities, $1,338,204.

Cash from Financing Activities

For the year ended December

31, 2014, net cash used in financing activities was $772,816, consisting of (i) repayment of notes payable, $947,866; (ii) offset

by borrowings on the line of credit, $175,000; and (iii) issuance of common stock, $50. For the year ended December 31, 2013, net

cash provided by financing activities was $978,253, consisting of (i) borrowings from notes payable, $1,644,495; (ii) line of credit,

net, $375,000; and (iii) issuance of common stock, $17; offset by (iv) payment of notes payable, $1,041,259.

Off-Balance Sheet Arrangements

We have not entered into

any transactions with unconsolidated entities in which we have financial guarantees, subordinated retained interests, derivative

instruments or other contingent arrangements that expose us to material continuing risks, contingent liabilities or any other obligations

under a variable interest in an unconsolidated entity that provides us with financing, liquidity, market risk or credit risk support.

Critical Accounting Estimates

Discussion and analysis

of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared

in accordance with generally accepted accounting principles in the United States. The preparation of these consolidated financial

statements requires us to make estimates and judgments that affect the amounts reported in the consolidated financial statements

and the accompanying notes. We evaluate our estimates on an ongoing basis, including those estimates related to product returns,

product and content development expenses, bad debts, inventories, intangible assets, income taxes, contingencies and litigation.

We base our estimates on experience and on various assumptions that we believe to be reasonable under the circumstances, the results

of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent

from other sources. Actual results may differ from these estimates under different assumptions or conditions.

The critical accounting

policies which we believe affect our more significant judgments and estimates used in the preparation of our consolidated financial

statements are provided as follows:

Accounts Receivable, Trade

We

extend credit to large and mid-size companies for products and services. We have concentrations of credit risk in that 77% of the

balance of our accounts receivable at December 31, 2014 is made up of only four customers. At December 31, 2014, accounts receivable

from our four largest accounts amounted to approximately $685,000 (33.4%), $359,000 (17.5%), $292,000 (14.2%), and $233,000 (11.4%),

respectively. We have in place a security in connection with each of these receivables. Accounts receivable are carried at their

estimated collectible amounts. Accounts receivable are periodically evaluated for collectability and the allowance for doubtful

accounts is adjusted accordingly. We determine collectability based on our management experience and knowledge of the customers.

Goodwill and Intangible Assets

Goodwill and intangibles

that are deemed to have indefinite lives are not amortized but, instead, are to be reviewed at each reporting period for impairment.

We assessed potential impairment of goodwill using qualitative factors by considering various factors including macroeconomic conditions,

industry and market conditions, cost factors, a sustained share price or market capitalization decrease and any reporting unit

specific events. We performed an analysis of our goodwill and intangible assets at December 31, 2014 and 2013. In addition to amounts

recorded in 2013 with respect to discontinued operations, we recorded an impairment charge in 2014 related to intangibles recorded

in connection with the purchase of our MRO in Oklahoma. Management has communicated this with the Audit Committee.

Income Taxes

We account for income taxes

under “Accounting for Income Taxes”. Deferred tax assets and liabilities are recognized for the future tax consequences

attributable to differences between their financial statement carrying amounts and their respective tax bases. Deferred tax assets

and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary

differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates

is recognized in income in the period that includes the enactment date.

Deferred tax assets are

subject to a valuation allowance because it is more likely than not that certain of the deferred tax assets will not be realized

in future periods. We file income tax returns in the United States (federal) and in various state and local jurisdictions. In most

instances, we are no longer subject to federal, state and local income tax examinations by tax authorities for years prior to 2011.

Stock Based Compensation

Stock-based compensation

expense for all share-based payment awards are based on the grant-date fair value. We recognize these compensation costs over the

requisite service period of the award, which is generally the option vesting term.

Option valuation models

require the input of highly subjective assumptions, including the expected life of the option. Because our employee stock options

have characteristics significantly different from those of traded options, and because changes in the subjective input assumptions

can materially affect the fair value estimate, in management's opinion, the existing models do not necessarily provide a reliable

single measure of the fair value of its employee stock options.

Recent Accounting Pronouncements

In April 2014, the FASB issued Accounting Standards

Update No. 2014-08 “Presentation of Financial Statements (Topic 205) and Property, Plant and Equipment (Topic 360) –

Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity” (ASU 2014-08) which requires entities

to change the criteria for reporting discontinued operations and enhance convergence of the FASB’s and International Accounting

Standard Board’s (IASB) reporting requirements for discontinued operations so as not to be overly complex or difficult to

apply to stakeholders. Only those disposals of components of an entity that represent a strategic shift that has (or will have)

a major effect on the entity’s operations and financial results will be reported as discontinued operations in the financial

statements. ASU 2014-08 is effective for fiscal years beginning on or after December 15, 2014 and interim periods thereafter. ASU

2014-08 will be effective for the Company’s financial statements for fiscal years beginning January 1, 2015. Based on the

Company’s evaluation of ASU 2014-08, the adoption of this statement on January 1, 2015 will not have a material impact on

the Company’s financial statements.

ITEM 7A. QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 8. FINANCIAL

STATEMENTS

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Audit Committee of the Board of Directors and Stockholders

of

Saker Aviation Services, Inc.

We have audited the accompanying consolidated balance sheets of

Saker Aviation Services, Inc. and Subsidiaries (the “Company”) as of December 31, 2014 and 2013, and the related consolidated

statements of operations, stockholders’ equity and cash flows for the years then ended. These consolidated financial statements

are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial

statements based on our audits.

We conducted our audits in accordance with the standards of the

Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain

reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have,

nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of

internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances,

but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting.

Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and

disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management,

as well as evaluating the overall consolidated financial statement presentation. We believe that our audits provide a reasonable

basis for our opinion.

In our opinion, the consolidated financial statements referred to

above present fairly, in all material respects, the financial position of Saker Aviation Services, Inc. and Subsidiaries as of

December 31, 2014 and 2013, and the results of their operations and their cash flows for the years then ended, in conformity with

accounting principles generally accepted in the United States of America.

| /s/ Kronick Kalada Berdy & Co. |

|

| |

|

| Kingston, PA |

|

| March 31, 2015 |

|

SAKER AVIATION SERVICES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| | |

December 31,

2014 | | |

December 31,

2013 | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash | |

$ | 531,003 | | |

$ | 146,405 | |

| Accounts receivable | |

| 2,049,842 | | |

| 1,626,639 | |

| Inventories | |

| 299,339 | | |

| 338,513 | |

| Note receivable – current portion, less discount | |

| — | | |

| 116,219 | |

| Prepaid expenses and other current assets | |

| 524,942 | | |

| 540,479 | |

| Total current assets | |

| 3,405,126 | | |

| 2,768,255 | |

| | |

| | | |

| | |

| PROPERTY AND EQUIPMENT, net | |

| | | |

| | |

| of accumulated depreciation and amortization of $1,711,543 and $1,249,362 respectively | |

| 2,086,794 | | |

| 2,444,840 | |

| | |

| | | |

| | |

| OTHER ASSETS | |

| | | |

| | |

| Deposits | |

| 178,524 | | |

| 180,184 | |

| Note receivable, less current portion and discount | |

| — | | |

| 76,110 | |

| Intangible assets | |

| 142,500 | | |

| 360,000 | |

| Goodwill | |

| 530,000 | | |

| 1,080,380 | |

| Deferred income taxes | |

| 363,000 | | |

| — | |

| Total other assets | |

| 1,214,024 | | |

| 1,696,674 | |

| TOTAL ASSETS | |

$ | 6,705,944 | | |

$ | 6,909,769 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 996,431 | | |

$ | 869,968 | |

| Line of credit | |

| 550,000 | | |

| 375,000 | |

| Customer deposits | |

| 134,761 | | |

| 131,548 | |

| Accrued expenses | |

| 505,070 | | |

| 96,177 | |

| Notes payable – current portion | |

| 372,457 | | |

| 992,862 | |

| Total current liabilities | |

| 2,558,719 | | |

| 2,465,555 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES | |

| | | |

| | |

| Notes payable - less current portion | |

| 956,979 | | |

| 1,284,440 | |

| Deferred income taxes | |

| — | | |

| 140,000 | |

| Total liabilities | |

| 3,515,698 | | |

| 3,889,995 | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Preferred stock - $.001 par value; authorized 9,999,154; | |

| | | |

| | |

| none issued and outstanding | |

| — | | |

| — | |

| Common stock - $.001 par value; authorized 100,000,000; | |

| | | |

| | |

33,107,610 and 33,057,610 shares issued and outstanding

in 2014 and 2013, respectively | |

| 33,107 | | |

| 33,057 | |

| Additional paid-in capital | |

| 19,962,482 | | |

| 19,925,807 | |

| Accumulated deficit | |

| (16,805,343 | ) | |

| (16,939,090 | ) |

| TOTAL STOCKHOLDERS’ EQUITY | |

| 3,190,246 | | |

| 3,019,774 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 6,705,944 | | |

$ | 6,909,769 | |

See accompanying notes to consolidated

financial statements.

SAKER AVIATION SERVICES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

| | |

For the Years Ended

December 31, | |

| | |

2014 | | |

2013 | |

| | |

| | |

| |

| REVENUE | |

$ | 18,287,784 | | |

$ | 14,761,991 | |

| COST OF REVENUE | |

| 10,069,172 | | |

| 8,110,900 | |

| GROSS PROFIT | |

| 8,218,612 | | |

| 6,651,091 | |

| | |

| | | |

| | |

| SELLING, GENERAL AND ADMINISTRATIVE EXPENSES | |

| 7,092,654 | | |

| 5,605,094 | |

| | |

| | | |

| | |

| OPERATING INCOME FROM CONTINUING OPERATIONS | |

| 1,125,958 | | |

| 1,045,997 | |

| | |

| | | |

| | |

| OTHER INCOME (EXPENSE): | |

| | | |

| | |

| OTHER (EXPENSE) INCOME, net | |

| (33,012 | ) | |

| (3,488 | ) |

| OTHER EXPENSE – HURRICANE SANDY | |

| — | | |

| (111,145 | ) |

| IMPAIRMENT OF GOODWILL AND OTHER INTANGIBLES | |

| (689,963 | ) | |

| — | |

| INTEREST INCOME | |

| 6,693 | | |

| 17,617 | |

| INTEREST EXPENSE | |

| (85,929 | ) | |

| (121,476 | ) |

| | |

| | | |

| | |

| TOTAL OTHER EXPENSE, net | |

| (802,211 | ) | |

| (218,492 | ) |

| INCOME FROM CONTINUING OPERATIONS, before income taxes | |

| 323,747 | | |

| 827,505 | |

| | |

| | | |

| | |

| INCOME TAX (EXPENSE) BENEFIT | |

| | | |

| | |

| CURRENT | |

| (693,000 | ) | |

| (526,000 | ) |

| DEFERRED | |

| 503,000 | | |

| 63,000 | |

| | |

| | | |

| | |

| INCOME TAX EXPENSE | |

| (190,000 | ) | |

| (463,000 | ) |

| INCOME FROM CONTINUING OPERATIONS | |

| 133,747 | | |

| 364,505 | |

| DISCONTINUED OPERATIONS, net of income taxes | |

| — | | |

| (2,187,597 | ) |

| NET INCOME (LOSS) | |

$ | 133,747 | | |

$ | (1,823,092 | ) |

| | |

| | | |

| | |

| Basic Net Income (Loss) Per Common Share | |

$ | 0.00 | | |

$ | (0.06 | ) |

| | |

| | | |

| | |

| Diluted Net Income (Loss) Per Common Share | |

$ | 0.00 | | |

$ | (0.06 | ) |

| | |

| | | |

| | |

| Weighted Average Number of Common Shares – Basic | |

| 33,106,788 | | |

| 33,050,688 | |

| Weighted Average Number of Common Shares – Diluted | |

| 33,327,817 | | |

| 33,050,688 | |

See accompanying notes to consolidated

financial statements.

SAKER AVIATION SERVICES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS'

EQUITY

For the Years Ended December 31, 2014 and

2013

| | |

| | |

| | |

Additional | | |

| | |

Total | |

| | |

Common Stock | | |

Paid-in | | |

Accumulated | | |

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| BALANCE – January 1, 2013 | |

| 33,040,422 | | |

$ | 33,040 | | |

$ | 19,892,743 | | |

$ | (15,115,998 | ) | |

$ | 4,809,785 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock | |

| 17,188 | | |

| 17 | | |

| | | |

| | | |

| 17 | |

| Amortization of stock based compensation | |

| | | |

| | | |

| 33,064 | | |

| | | |

| 33,064 | |

| Net loss | |

| | | |

| | | |

| | | |

| (1,823,092 | ) | |

| (1,823,092 | ) |

| BALANCE – December 31, 2013 | |

| 33,057,610 | | |

| 33,057 | | |

| 19,925,807 | | |

| (16,939,090 | ) | |

| 3,019,774 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock | |

| 50,000 | | |

| 50 | | |

| | | |

| | | |

| 50 | |

| Amortization of stock based compensation | |

| | | |

| | | |

| 36,675 | | |

| | | |

| 36,675 | |

| Net income | |

| | | |

| | | |

| | | |

| 133,747 | | |

| 133,747 | |

| BALANCE – December

31, 2014 | |

| 33,107,610 | | |

$ | 33,107 | | |

$ | 19,962,482 | | |

$ | (16,805,343 | ) | |

$ | 3,190,246 | |

See accompanying notes to consolidated

financial statements.

SAKER AVIATION SERVICES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | |

For the Years Ended

December 31, | |

| | |

2014 | | |

2013 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net income (loss) | |

$ | 133,747 | | |

$ | (1,823,092 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 626,919 | | |

| 487,764 | |

| Loss on disposal property and equipment | |

| — | | |

| 251,132 | |

| Stock based compensation | |

| 36,675 | | |

| 33,064 | |

| Impaired goodwill and other intangibles | |

| 689,963 | | |

| 1,938,284 | |

| Changes in operating assets and liabilities, net of effects from purchase of PRA in 2013: | |

| | | |

| | |

| Accounts receivable, trade | |

| (423,203 | ) | |

| 113,188 | |

| Accounts receivable, insurance recovery | |

| — | | |

| 147,928 | |

| Inventories | |

| 39,174 | | |

| 156,789 | |

| Prepaid expenses and other current assets | |

| 15,537 | | |

| (358,461 | ) |

| Deposits | |

| 1,660 | | |

| — | |

| Deferred income taxes | |

| (503,000 | ) | |

| (63,000 | ) |

| Accounts payable | |

| 126,463 | | |

| (184,129 | ) |

| Customer deposits | |

| 3,213 | | |

| (804 | ) |

| Accrued expenses | |

| 408,893 | | |

| (106,735 | ) |

| TOTAL ADJUSTMENTS | |

| 1,022,294 | | |

| 2,415,020 | |

| | |

| | | |

| | |

| NET CASH PROVIDED BY OPERATING ACTIVITIES | |

| 1,156,041 | | |

| 591,928 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Payment of note receivable | |

| 192,329 | | |

| 108,384 | |

| Purchase of property and equipment | |

| (190,956 | ) | |

| (759,378 | ) |

| Purchase of assets, net of liabilities of PRA acquisition | |

| — | | |

| (1,338,204 | ) |

| Accounts receivable, insurance recovery | |

| — | | |

| 315,014 | |

| NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES | |

| 1,373 | | |

| (1,674,184 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Borrowings from notes payable | |

| — | | |

| 1,644,495 | |

| Issuance of common stock | |

| 50 | | |

| 17 | |

| Line of credit, net | |

| 175,000 | | |

| 375,000 | |

| Repayment of notes payable | |

| (947,866 | ) | |

| (1,041,259 | ) |

| NET CASH (USED IN) PROVIDED BY FINANCING ACTIVITIES | |

| (772,816 | ) | |

| 978,253 | |

| | |

| | | |

| | |

| NET CHANGE IN CASH | |

| 384,598 | | |

| (104,003 | ) |

| | |

| | | |

| | |

| CASH – Beginning | |

| 146,405 | | |

| 250,408 | |

| CASH – Ending | |

$ | 531,003 | | |

$ | 146,405 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | |

| | | |

| | |

| Cash paid during the periods for: | |

| | | |

| | |

| Interest | |

$ | 85,929 | | |

$ | 121,476 | |

| Income taxes | |

$ | 260,287 | | |

$ | 248,666 | |

See accompanying notes to consolidated

financial statements.

SAKER AVIATION SERVICES, INC. AND SUBSIDIARIES

Notes To Consolidated Financial Statements

NOTE 1 - Nature of Operations

Saker Aviation Services, Inc. (“Saker”), through

its subsidiaries (collectively the “Company”), operates in the aviation services segment of the general aviation industry,

in which it serves as the operator of a heliport, a fixed base operation (“FBO”), as a provider of aircraft maintenance,

repair and overhaul (“MRO”) services, and as a consultant for a non-owned seaplane base. FBOs provide ground-based

services, such as fueling and aircraft storage for general aviation, commercial and military aircraft, and other miscellaneous

services.

FirstFlight Heliports, LLC d/b/a Saker Aviation Services (“FFH”),

a wholly-owned subsidiary, operates the Downtown Manhattan Heliport via a concession agreement executed by the Company with the

City of New York. FBO Air Garden City, Inc. d/b/a Saker Aviation Services (“FBOGC”), a wholly-owned subsidiary provides

FBO services in Garden City, Kansas. Phoenix Rising Aviation, Inc. (“PRA”), a wholly-owned subsidiary provides MRO

services in Bartlesville, Oklahoma. FBO Air Wilkes-Barre, Inc. d/b/a Saker Aviation Services (“FBOWB”), a wholly-owned