SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities and Exchange Act of 1934

Date of Report (Date of earliest event reported): March 26, 2015

CARDIFF INTERNATIONAL, INC.

(Exact name

of Registrant as specified in its charter)

| Florida |

000-49709 |

84-1044583 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

411 N New River Drive

E, Unit 2202

Ft. Lauderdale, FL 33301

(Address of principal executive

offices, including zip code)

(818) 783-2100

(Registrant's telephone

number, including area code) 411 N New River Drive E

Suite 2202

Ft. Lauderdale, FL 33301

_________________________________

(Former name or former

address, if changed since last report)

Check the appropriate box below

if the 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| o | | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b)) |

| o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c)). |

Item 3.03 Material Modification to Rights of Security Holders

On March 26, 2015 a special meeting of Preferred Class “B”

shareholders (the “Special Meeting”) approved to extend the HOLDING PERIOD for minimum of 12 months or following the

successful filing of an S-1 Registration Statement. (the “Plan” ). The results of the shareholder vote on the Plan

are set forth further below under Item 5.07 of this Current Report on Form 8-K.

A description of the Plan is included as part of Proposal #__ in

the Company’s Proxy Statement that was filed with the Securities and Exchange Commission on February 27, 2015 and is incorporated

herein by reference. Such description is qualified in its entirety by reference to the text of the Plan, a copy of which is filed

as Exhibit 10.1 to this Current Report on Form 8-K.

Item 5.07. Submission of Matters to a Vote of Security Holders

The Company held its Special Meeting on March 26, 2015. A total

of 3,070,288 shares of Preferred “B” Stock, representing approximately 60% of the

shares outstanding and eligible to vote and constituting a quorum, were represented in person or by valid proxies at the Special

Meeting. The final results for each of the matters submitted to a vote of shareholders at the Special Meeting is as follows:

Proposal: To approve an amendment to our series B Preferred

Stock rights and privileges to increase our Holding Period of one year or lengthened to one month past our S-1 Registration Statement

| For |

Against |

Abstain |

Broker Non-Votes |

| 3,067,888 |

2,400 |

2,018,271 |

0 |

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

CARDIFF INTERNATIONAL, INC. |

| |

|

| |

|

| |

By /s/Daniel R Thompson |

| |

Daniel R Thompson |

| |

Chairman/Secretary |

Date: March 26, 2015

EXHIBIT INDEX

| No. |

Exhibit |

| |

|

| 99.1 |

CARDIFF INTERNATIONAL, INC. 2015 Extension Plan |

EXHIBIT 99.1

CARDIFF INTERNATIONAL,

INC.

2015 EXTENSION PLAN

PROXY STATEMENT FOR SPECIAL MEETING

OF THE SHAREHOLDERS OF

CARDIFF INTERNATIONAL, INC.

411 N New River Drive E

Unit 2202

Fort Lauderdale, FL 33301

This proxy statement is first being mailed on

or about Thursday February 26, 2015 by Cardiff International, Inc. The proxy accompanying this proxy statement is being

solicited on behalf of our board of directors.

Record Date, Voting Securities, Quorum and Voting Tabulation

Our board of directors has fixed the close

of business on February 11th, 2015 as the record date for determining the shareholders entitled to receive notice of,

and to vote at, the Special Meeting, or any adjournments or postponements thereof. As of the record date, we had 5,088,559

shares of Preferred B Series stock issued and outstanding and entitled to vote on the matters described herein (the “Voting

Shares”). Each whole Voting Share entitles the holder thereof to one vote and each fractional Voting Share entitles the

holder thereof to a factional vote. The presence, in person or by proxy, of the holders of a majority of the Voting Shares is

necessary to constitute a quorum for the transaction of business at the Special Meeting. If a quorum exists, action on each matter

is approved if the votes cast in favor of the action exceed the votes cast opposing the action. Unless otherwise marked

or indicated on the proxy, the shares will be voted “FOR” the approval of each of the proposals discussed herein.

Votes cast by proxy or in person at the Special

Meeting will be tabulated by the inspector of election in conjunction with information received from our transfer agent. The

inspector of election will also determine whether or not a quorum is present.

Shares which abstain from voting as to the proposals

and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary

authority to vote such shares as to any proposal (“broker non-votes”), will be counted for purposes of determining

whether the affirmative vote of a majority of the shares present at the meeting and entitled to vote on the proposal has been obtained,

but will have the effect of reducing the number of affirmative votes required to achieve the majority vote on the proposal.

Revocability of Proxy

Any proxy given pursuant to this proxy solicitation

may be revoked by the person giving it at any time prior to its use by delivering to us a written notice of revocation, a duly

executed proxy bearing a later date or by attending the Special Meeting and voting in person.

Interest of Certain Persons in Matters to be Acted Upon

No director, executive officer, nominee for

election as a director, associate of any director, executive officer, nominee for election as a director or any other person has

any substantial interest, direct or indirect, through security holdings or otherwise, in the actions described in this proxy statement

which is not shared by all other shareholders.

Dissenters’ Right of Appraisal

There are no rights of appraisal or other similar

rights of dissenters under the laws of the State of Florida with respect to any of the matters proposed to be acted upon herein.

Submission of Shareholder Proposals

All shareholder proposals should be submitted

to the attention of our Secretary at the address of our principal executive offices. We urge you to submit any such

proposal by a means which will permit proof of the date of delivery, such as certified mail, return receipt requested.

Expenses of this Proxy Statement

We will pay all expenses associated with the

distribution of this proxy statement, including, without limitation, all expenses associated with printing and mailing. We

will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in connection

with sending this proxy statement to the beneficial owners of shares of our common stock.

We will only deliver one proxy statement

to multiple shareholders sharing one address unless we have received prior instructions to the contrary from one or more of

such shareholders. Upon written or verbal request, we will promptly deliver a separate copy of this proxy statement and any

future annual reports and proxy statements to any shareholder at a shared address to which a single copy of this proxy

statement was delivered, or deliver a single copy of this proxy statement and any future annual reports and proxy statements

to any shareholder or holders sharing an address to which multiple copies are now delivered. Any such requests in

writing should be directed to our principal executive offices at the following address:

CARDIFF INTERNATIONAL, INC.

411 N New River Drive E

Unit 2202

Fort Lauderdale, FL 33301

Telephone (818) 879-9722

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth information regarding

the beneficial ownership of our Preferred B Series stock as of February 11th, 2015. The information in this

table provides ownership information for:

| · | | each person known by us to be the beneficial owner of more than 5% of our common stock; |

| · | | each of our directors and executive officers; and |

| · | | all of our directors and executive officers as a group. |

Beneficial ownership has been determined in

accordance with the rules and regulations of the United States Securities and Exchange Commission (the “SEC” or “Commission”)

and includes voting or investment power with respect to our securities. A person (or group of persons) is deemed to

be the “beneficial owner” of our securities if he or she, directly or indirectly, has or shares the power to vote or

to direct the voting of, or to dispose or direct the disposition of such securities. Accordingly, more than one person

may be deemed to be the beneficial owner of the same security. Unless otherwise indicated, the persons named in the

table below have sole voting and/or investment power with respect to the number of shares of common stock indicated as beneficially

owned by them. A person is also deemed to be a beneficial owner of any security which that person has the right to acquire

within 60 days, such as options or warrants to purchase shares of our Preferred B Series of stock. Preferred B Series

stock beneficially owned and percentage ownership are based on 5,088,559 shares outstanding as of February 11th, 2015.

Unless otherwise indicated, the address of each person listed is in care of Cardiff International, Inc., 411 N New River Drive

E, Unit 2202, Fort Lauderdale, FL 33301.

| Name and Address of |

Amount and Nature of |

|

Percent |

| Beneficial Owner |

Beneficial Owner |

|

Of Class(1) |

| |

|

|

|

| Daniel Thompson, Chairman |

720,000 |

|

14.1% |

| Officer, Director |

|

|

|

|

Kathy Roberton, CEO

Officer, Director

Jason A Levy

Officer, Director |

300,000

300,000

|

|

6.%

6.% |

| |

|

|

|

| |

|

|

|

| All officers and directors as a group (3 persons) |

1,320,000 |

|

26.1% |

PROPOSAL – TO APPROVE AN AMENDMENT TO OUR ARTICLES OF INCORPORATION

TO EXTEND THE LOCK-UP/LEAK-OUT HOLDING PERIOD FOR A MAXIMUM OF ONE YEAR.

General

As more fully explained below, we believe that it is in the best

interests of our company and our shareholders to amend section 1 & 1.1 of the Lock-Up/Leak-Out Agreement increasing the holding

period for Series B Preferred Shares. On February 5, 2015, our board of directors approved an amendment to the Lock Up/Leak

Out Agreement for Series B Preferred Shareholder to amend the Lock-Up/Leak-Out Agreement for Series B Shareholders to increase

the Holding Period until after an S1 Registration Statement is filed or a maximum of 12 months following this filing; The proposed

amendment is referred to in this proxy statement as the “Authorized Amendment”. If approved by our shareholders,

the Authorized Amendment will become effective when it is filed with the Secretary of State of Florida.

Reasons for the Increase Holding Period

As of February 11th, 2015, 5,088,559

shares of Preferred B Series stock have been issued and outstanding. If the Authorized Amendment is approved by our shareholders,

it will protect our common stock shareholders, stabilize share price, attract investors, and allow the Company to acquire larger

businesses. If the Authorized Amendment is not approved our Common Shareholders will suffer significant loss. We know that our

growth depends on the use of Preferred shares as part of financing transactions pursuant to which we would issue shares of our

common stock.

Effects of the Increase Holding Period

The amendment will increase the holding period

of Series B Preferred Stock until after our S-1 Registration Statement becomes effective or a maximum of 12 months following this

filing. While Cardiff believes the company will qualify for a Secondary Public Offering, uplifting to a qualified Exchange within

the next 12 months, we cannot guarantee this. Currently Cardiff’s Assets/Revenue/Cash/Debt do not qualify for an underwriting,

the NYSE-AMEX Exchange or NASDAQ. However, Cardiff anticipates meeting the requirements of the NYSE-AMEX Exchange within the next

6 month period.

Our

common stock is traded on OTC Markets which is a quotation service, not an exchange. OTC Markets does not reserve the right to

refuse to list or to de-list

any stock which has unusual voting provisions that nullify or restrict its voting.

Advantages and Disadvantages of amending Section 1 & 1.1

of the Lock-Up/Leak-Out

As noted above, increasing the holding period

will protect our common shareholders, stabilize share price, attract investors, attempt to move to the NYSE-AMEX Exchange and provide

the Company with the ability to acquire larger acquisitions. There is no disadvantage to existing Preferred B Series shareholders

unless the Company fails as this Amendment protects their investment.

Consequences to the Company of Failure to

Approve the Authorized Amendment to amend Section 1 of the Lock-Up/Leak-Out Agreement governing Preferred B Series Shares

As noted above, the Company

believes if not approved, it would have long-term negative effects --- both on capital formation as well as negatively impacting

companies existing public shareholders. Holding periods are the mechanisms that enable companies who raise capital privately, to

use that capital to grow the company for an established time period before new investors can “cash out” which would

impact the market for the company’s shares. It is Cardiff’s opinion, that without an extension of the holding period,

Cardiff could face three major negative impacts: First, it will greatly dilute common shareholders; Second, it will depress the

price of shares significantly; Third, it will effect long-term investors which would deprive the Company of funding.

Vote by Board of Directors

On February 5th, the board of directors

voted to approve the Authorized Amendment in order to amend section 1 of the Lock-Up/Leak-Out Agreement governing Preferred B Series

shares.

Based on the foregoing discussion, the board

of directors requests that shareholders approve the following resolution:

RESOLVED, that paragraph 1 & 1.1 of the Lock-Up/Leak-Out

Agreement to read as follows:

1.

Except as otherwise expressly provided herein, Preferred B Series shareholders will not be allowed to convert their B certificates

until after an S1 Registration Statement becomes effective and/or hold their certificates for an additional 12 month period following

this filing. Following the amended holding period, the shareholder may sell as agreed to in the Lock-Up/Leak-Out Agreement as follows:

2.

The Shareholder shall be allowed to convert to Common Shares and sell an amount of the Shareholder’s Preferred Stock

equal to 1% (one percent) of the total number of Preferred shares owned, on a monthly basis, for a period of four (4) years. Beginning

in the first (1st) month of the fifth (5th) year, the Leak-Out agreement shall cease and the shareholder

may liquidate the balance of their Preferred shares remaining. Shareholders understands that a “conversion” shall

not exceed 4.9% of the issued and outstanding securities of the Company (to be defined for all purposes hereof as the amount indicated

in the Company’s most recent filing with the SEC) during each month of the four (4) calendar years, (the “Leak-Out

Period”).

Form of Amendment

Assuming that our shareholders approve this

proposal, we intend to file the Authorized Amendment, the form of which is attached to this proxy statement as Annex 1, with the

Secretary of State of the State of Florida as soon as practicable.

Effective Date

The Authorized Amendment will become effective

upon filing amendment to the Articles of Incorporation.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU

VOTE “FOR” THE APPROVAL OF

AMENDING THE LOCK-UP/LEAK-OUT

AGREEMENT SECTION 1 & 1.1

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING

INFORMATION

This Proxy Statement may contain "forward-looking

statements." All statements other than statements of historical fact are "forward-looking statements" for purposes

of these provisions, including any projections of earnings, revenues or other financial items, any statement of the plans and objectives

of management for future operations, and any statement of assumptions underlying any of the foregoing. These statements may contain

words such as “expects," "anticipates," "plans," "believes," "projects," and

words of similar meaning. These statements relate to our future business and financial performance.

Actual outcomes may differ materially from

these statements. The risks listed in this Proxy Statement as well as any cautionary language in this Proxy Statement, provide

examples of risks, uncertainties and events that may cause our actual results to differ materially from any expectations we describe

in our forward-looking statements. There may be other risks that we have not described that may adversely affect our business and

financial condition. We disclaim any obligation to update or revise any of the forward-looking statements contained in this Proxy

Statement. We caution you not to rely upon any forward-looking statement as representing our views as of any date after the date

of this Proxy Statement. You should carefully review the information and risk factors set forth in other reports and documents

that we file from time to time with the SEC.

ADDITIONAL INFORMATION

This Proxy Statement should be read in conjunction

with certain reports that we previously filed with the SEC, including our:

* Annual Report on Form

10-K for the year ended December 31, 2013; and

* Quarterly Reports on

Form 10-Q for the periods ended March 31, 2014, June 30, 2014 and September 30, 2014.

The reports we file with the SEC and the accompanying

exhibits may be inspected without charge at the Public Reference Section of the Commission at 100 F Street, N.E., Washington, DC

20549. Copies of such materials may also be obtained from the SEC at prescribed rates. The SEC also maintains a Web site that contains

reports, proxy and information statements and other information regarding public companies that file reports with the SEC. Copies

of the Reports may be obtained from the SEC's EDGAR archives at http://www.sec.gov. We will also mail copies of our prior reports

to any stockholder upon written request.

By Order of the Board of Directors

| |

|

| |

|

| |

/s/ Daniel Thompson |

| |

Daniel Thompson, Chairman, CEO and Director |

| |

Encino, California |

| |

February 9, 2015 |

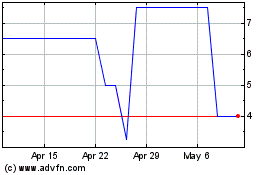

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

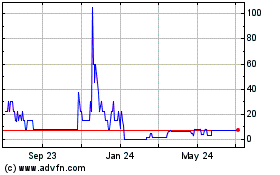

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Apr 2023 to Apr 2024