UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT OF FOREIGN PRIVATE

ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE

ACT OF 1934

For the month of March,

2015

Commission File Number: 001-34152

WESTPORT INNOVATIONS INC.

(Translation of registrant's name into

English)

1750 West 75th

Avenue, Suite 101, Vancouver, British Columbia, Canada, V6P 6G2

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

☐ Form

20-F ☒

Form 40-F

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether

by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If

"Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

EXHIBIT

INDEX

| Exhibit |

|

Description |

| 99.1 |

|

MANAGEMENT PROXY MATERIALS |

| 99.2 |

|

FORM OF PROXY |

| 99.3 |

|

NOTICE & ACCESS |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

Westport Innovations Inc. |

|

| |

(Registrant) |

|

| |

|

|

|

| Date: March 27, 2015 |

By: |

/s/ Ashoka Achuthan |

|

| |

|

Ashoka Achuthan

Chief Financial Officer |

|

| |

|

|

|

Exhibit 99.1

|

Westport Innovations Inc.

Information for Shareholders |

Annual and Special Meeting

of Shareholders: |

|

|

| April 30, 2015 |

|

Management Information

Circular |

|

| Dated March 11, 2015 |

|

TABLE OF CONTENTS

| NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS |

ii |

| |

|

|

| SECTION 1: VOTING |

1 |

| SOLICITATION OF PROXIES |

2 |

| COMMUNICATION PROCESS FOR PROXY-RELATED MATERIALS |

3 |

| VOTING OF COMMON SHARES |

3 |

| MATTERS TO BE ACTED UPON |

6 |

| 1. |

Receipt of 2014 Financial Statements |

6 |

| 2. |

Election of Directors |

6 |

| 3. |

Appointment of Auditors |

6 |

| |

|

|

| SECTION 2: BOARD OF DIRECTORS |

10 |

| NOMINEES FOR ELECTION TO THE BOARD |

11 |

| MANDATE AND CHARTER OF THE BOARD OF DIRECTORS |

18 |

| STRUCTURE AND COMPOSITION OF THE BOARD & ELECTION OF DIRECTORS |

18 |

| DIRECTOR COMPENSATION |

21 |

| ADDITIONAL DISCLOSURE RELATING TO THE DIRECTORS |

25 |

| |

|

|

| SECTION 3: CORPORATE GOVERNANCE |

27 |

| STATEMENT OF CORPORATE GOVERNANCE PRACTICES |

28 |

| BOARD OF DIRECTORS COMMITTEES |

28 |

| ADVISORY BOARD |

31 |

| CODE OF CONDUCT AND ETHICS |

31 |

| DISCLOSURE POLICY |

32 |

| |

|

| SECTION 4: COMPENSATION OF EXECUTIVE OFFICERS |

34 |

| COMPENSATION DISCUSSION AND ANALYSIS |

35 |

| EXECUTIVE COMPENSATION FIGURES AND TABLES |

46 |

| PERFORMANCE GRAPHS |

53 |

| EQUITY COMPENSATION PLAN INFORMATION |

56 |

| |

|

| SECTION 5: ADDITIONAL INFORMATION |

67 |

| ADDITIONAL INFORMATION |

68 |

| |

|

| SECTION 6: SCHEDULES AND ATTACHMENTS |

69 |

| |

|

| SCHEDULE "A" BOARD OF DIRECTORS' CHARTER |

A-1 |

| Board Leadership |

A-3 |

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON THURSDAY, APRIL 30, 2015

TO SHAREHOLDERS OF WESTPORT INNOVATIONS INC.

Notice is hereby given that the annual and special

meeting (the "Meeting") of the holders ("Shareholders") of common shares ("Common Shares")

of Westport Innovations Inc. ("Westport") will be held at 1750 West 75th Avenue, Suite 101, Vancouver,

British Columbia on Thursday, April 30, 2015 at 2:00 p.m. (Pacific time). The purpose of the Meeting is to consider,

and to take action with respect to, the following matters:

| 1. | the receipt of the audited consolidated financial statements of Westport for the year ended December

31, 2014, together with the auditors' report on those statements; |

| 2. | the election of directors of Westport for the next year; |

| 3. | the appointment of auditors for Westport for the next year and the authorization of the directors

to fix their remuneration; |

| 4. | the approval of certain amendments to Westport's Omnibus Incentive Plan; and |

| 5. | the transaction of such other business as may properly be brought before the Meeting or any adjournment

or adjournments of the Meeting. |

Shareholders are referred to the accompanying management

information circular dated March 11, 2015 (the "Circular") for more detailed information with respect to the matters

to be considered at the Meeting.

Individuals, corporations or other persons directly

registered as Shareholders on the share register maintained by Computershare Trust Company of Canada ("Computershare")

as Shareholders of Westport on March 11, 2015 ("Registered Owners") may attend the Meeting in person and vote.

Shareholders owning Common Shares through a brokerage firm or in any other manner who are not directly registered with Computershare

on March 11, 2015 ("Beneficial Owners") who wish to attend the Meeting and vote should enter their own names in

the blank space on the instrument of proxy provided to them by their broker (or the broker's agent) and return that proxy to their

broker (or the broker's agent) in accordance with the instructions provided by their broker (or agent), well in advance of the

Meeting. Registered and Beneficial Owners who do not wish to attend the Meeting or to vote their Common Shares in person may be

represented by proxy. A person appointed as proxyholder does not need to be a shareholder of Westport. Shareholders who are unable

to attend the Meeting in person are requested to date, sign and return the accompanying instrument of proxy (the "Proxy"),

or other appropriate form of proxy, in accordance with the instructions set forth in the Circular. For Registered Owners, the

Proxy, or form of proxy, will not be valid unless it is deposited at the offices of Computershare Trust Company of Canada, Proxy

Department, 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1, (fax numbers: 1-866-249-7775 toll free North America, or

1-416-263-9524 international) not less than forty-eight (48) hours (excluding Saturdays, Sundays and holidays) before the Meeting,

or any adjournment thereof. Registered owners may also vote by telephone or over the internet as described in the accompanying

Proxy. For Beneficial Owners, the instrument of proxy provided by your broker (or the broker's agent) can be mailed to Broadridge

Financial Solutions, Inc. ("Broadridge") at the address set forth on such instrument of proxy or, alternatively, a Beneficial

Owner can either call Broadridge's toll-free telephone line to vote, or access Broadridge's dedicated voting website at www.proxyvote.com.

Only persons registered as holders of Common Shares

on the records of Westport as of the close of business on March 11, 2015, are entitled to receive notice of the Meeting.

Dated as of the 11th day of March, 2015.

| |

By the order of the Board of Directors |

| |

|

| |

(Signed) Ashoka Achuthan |

| |

|

| |

Ashoka Achuthan

Chief Financial Officer |

SECTION 1:

VOTING

SOLICITATION

OF PROXIES

This management information circular (the "Circular")

is furnished in connection with the solicitation by the management of Westport Innovations Inc. ("Westport" or

the "Corporation") of proxies to be used at the annual and special meeting (the "Meeting") of

the holders ("Shareholders") of common shares ("Common Shares") of Westport. This Meeting is

to be held at 1750 West 75th Avenue, Suite 101, Vancouver, British Columbia, on Thursday, April 30, 2015 at 2:00

p.m. (Pacific time) for the purposes set forth in the accompanying notice of Meeting (the "Notice"). Solicitation

of proxies will be primarily by mail but may also be by way of telephone, facsimile or oral communication by the directors, officers,

or regular employees of Westport, at no additional compensation to them. The costs of the solicitation of proxies will be borne

by Westport.

Appointment of Proxyholders and Revocation of Proxies

An instrument of proxy (the "Proxy")

accompanies this Circular. The persons named in the Proxy are an officer of Westport and Westport's external legal counsel, who

is expected to act as secretary for purposes of the Meeting. A Shareholder, however, has the right to appoint another person

(who does not need to be a Shareholder) to represent him or her at the Meeting. To exercise this right, a Shareholder should

strike out the names on the Proxy and insert the name of his or her appointee in the blank space provided. Alternatively, a Shareholder

may complete a Proxy in an appropriate written form of his or her own choosing ("Alternative Form of Proxy").

The Proxy or an Alternative Form of Proxy will not be valid unless it is deposited at the offices of Computershare Trust Company

of Canada ("Computershare"), Proxy Department, 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 (fax

numbers: 1-866-249-7775 toll free North America, or 1-416-263-9524 international) not less than forty-eight (48) hours (excluding

Saturdays, Sundays, and holidays) before the time of the Meeting or any adjournment of the Meeting.

A Shareholder who has submitted a Proxy or Alternative

Form of Proxy may revoke it by means of a written document signed by the Shareholder or by his or her duly authorized attorney,

or if the Shareholder is a corporation, by a duly authorized officer or officers or attorney of such corporation. The document

must be deposited either: (i) at the registered office of Westport (being Suite 4500, 855 2nd Street S.W., Calgary,

Alberta, T2P 4K7) at any time up to and including the last business day preceding the day of the Meeting, or any adjournment of

the Meeting at which the Proxy or Alternative Form of Proxy is to be used; or (ii) with the Chairman of the Meeting on the day

of, but prior to, the Meeting or any adjournment of the Meeting. In addition, a Proxy or Alternative Form of Proxy may be revoked:

(i) by the Shareholder personally attending at the Meeting and voting the securities represented by the Proxy, or, if the Shareholder

is a corporation, by a duly authorized officer or officers or attorney of such corporation attending at the Meeting and voting

the securities; or (ii) in any other manner permitted by law.

Exercise of Discretion by Proxyholders

The persons named in the Proxy will vote or withhold

from voting the Common Shares in respect of which they are appointed, on any ballot that may be called for, in accordance with

the direction of the Shareholder appointing them. In the absence of such specification, the Proxyholder shall be deemed to have

been granted the authority to vote the relevant Common Shares FOR: (i) the election of the directors, as set forth in this Circular;

(ii) the appointment of auditors, as set forth in this Circular, at such remuneration as may be determined by the board of directors

of Westport (the "Board of Directors" or the "Board"); and (iii) the amendments to Westport's Omnibus Incentive

Plan (the "Omnibus Plan"), as set forth in this Circular. The Proxy also confers discretionary authority upon the persons

named in the Proxy with respect to amendments to, or variations of, the matters identified in the Notice and with respect to other

matters that may properly be brought before the Meeting. As of the date of this Circular, the management of Westport knows

of no such amendment, variation or other matter to come before the Meeting other than the matters referred to in the Notice.

Signing of Proxy

A Proxy signed by a person acting as an attorney or

in some other representative capacity (including a representative of a corporate Shareholder) should indicate his or her capacity

(following his or her signature) and should provide the appropriate documentation confirming qualification and authority to act

(unless such documentation has previously been filed with Westport or Computershare).

COMMUNICATION PROCESS FOR PROXY-RELATED MATERIALS

Westport uses the notice-and-access process as its

method of communication with beneficial shareholders for shareholder voting and proxy-related materials.

Notwithstanding the notice-and-access process, the

Business Corporations Act (Alberta) ("ABCA") requires Westport to deliver a written copy of the annual

financial statements to registered shareholders unless such registered shareholders provide Westport with written consent to electronic

delivery.

Broadridge Financial Solutions, Inc. ("Broadridge")

is the approved intermediary for mailing proxy-related materials to beneficial owners (both objecting and non-objecting). Computershare,

Westport`s transfer agent, is the approved intermediary for mailing proxy related materials to registered shareholders.

The notice-and-access method is consistent with Westport's

sustainability objectives to reduce environmental impact and allows Westport to significantly reduce costs associated with printing

and mail delivery.

VOTING

OF COMMON SHARES

Voting of Common Shares - General

As at March 11, 2015, there were 63,917,009 Common

Shares issued and outstanding, each of which carries the right to one vote at meetings of Shareholders. Only persons registered

as Shareholders on the share register maintained by Computershare ("Registered Shareholders") as of the close of business

on March 11, 2015 (the "Record Date") are entitled to receive notice of and to vote at the Meeting. Shareholders who

do not hold Common Shares in their own name on the share register maintained by Computershare are not entitled to receive notice

of the Meeting or to vote in respect of such Common Shares at the Meeting and should refer to the section entitled "Advice

to Beneficial Holders of Common Shares" immediately below for details regarding how they may exercise voting rights. Any

person who acquires Common Shares from a Shareholder after the Record Date may vote those Common Shares if, not later than 10 days

prior to the Meeting, that person makes a request in a satisfactory written form to Computershare to have his or her name included

as a Registered Shareholder on the list of Shareholders for the Meeting and establishes that he or she owns such Common Shares.

Advice to Beneficial Holders of Common Shares

The information set forth in this section is of

significant importance as most Shareholders do not hold Common Shares in their own name. Shareholders who do not hold Common

Shares in their own name ("Beneficial Shareholders") should note that only proxies deposited by Shareholders whose

names appear on the share register maintained by Computershare as the registered holders of Common Shares can be recognized and

acted upon at the Meeting. If the Common Shares are listed in an account statement provided to a Shareholder by a broker, then

in almost all cases those Common Shares will not be registered in the Shareholder's own name on the share register maintained by

Computershare. Such Common Shares will more likely be registered in the name of the Shareholder's broker or an agent of that broker.

In Canada, the vast majority of these Common Shares are registered in the name of CDS & Co. (the registration name for CDS

Clearing and Depository Services Inc., which acts as nominee for many Canadian brokerage firms). Common Shares held by brokers

or their agents or nominees can only be voted (for or against resolutions) upon the instructions of the Beneficial Shareholder.

Without specific instructions, brokers and their agents and nominees are prohibited from voting Common Shares for the broker's

clients. Therefore, Beneficial Shareholders cannot be recognized at the Meeting for purposes of voting their Common Shares in

person or by way of proxy unless their brokers or agents are given specific instructions. If you are a Beneficial Shareholder and

wish to vote in person at the Meeting, please contact your broker or agent well in advance of the Meeting to determine how you

can do so.

Applicable regulatory policy requires brokers to seek

voting instructions from Beneficial Shareholders in advance of Shareholders' meetings. Every brokerage has its own mailing procedures

and provides its own return instructions to its clients, which should be carefully followed by Beneficial Shareholders if they

wish to ensure their Common Shares are voted at the Meeting. In certain cases, the form of proxy supplied to a Beneficial Shareholder

by his or her broker (or the agent of the broker) is identical to the Proxy provided to Registered Shareholders. However, its purpose

is limited to instructing the Registered Shareholder (i.e., the broker or agent of the broker) how to vote on behalf of the Beneficial

Shareholder. The majority of Canadian brokers now delegate responsibility for obtaining instructions from clients to Broadridge.

Broadridge typically prepares a machine-readable voting instruction form, mails that form to Beneficial Shareholders and asks them

to return the instruction forms to Broadridge. Alternatively, Beneficial Shareholders can either call Broadridge's toll-free telephone

line or access Broadridge's dedicated voting website at www.proxyvote.com to deliver their voting instructions. Broadridge then

tabulates the results of all instructions received and provides instructions respecting the voting of Common Shares to be represented

at the Meeting. A Beneficial Shareholder receiving a voting instruction form from Broadridge cannot use that form to vote Common

Shares directly at the Meeting – voting instructions must be provided to Broadridge (in accordance with the instructions

set forth on the Broadridge form) well in advance of the Meeting in order to have the Common Shares voted.

Although a Beneficial Shareholder may not be recognized

directly at the Meeting for the purposes of voting Common Shares registered in the name of his or her broker (or agent of the broker),

a Beneficial Shareholder may attend at the Meeting as proxyholder for the Registered Shareholder and vote the Common Shares in

that capacity. Beneficial Shareholders who wish to attend the Meeting and indirectly vote their Common Shares as Proxyholder

for the Registered Shareholder should enter their own names in the blank space on the Proxy and return the Proxy to their broker

(or the broker's agent) in accordance with the instructions provided by such broker (or agent) well in advance of the Meeting.

Beneficial Shareholders fall into two categories –

those who object to their identity being made known to the issuers of securities which they own ("Objecting Beneficial

Owners" or "OBOs") and those who do not object to their identity being made known to the issuers of the

securities they own ("Non-Objecting Beneficial Owners" or "NOBOs"). Subject to the provisions

of National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer ("NI

54-101") issuers may request and obtain a list of their NOBOs from intermediaries via their transfer agents. Pursuant

to NI 54-101, issuers may obtain and use the NOBO list for distribution of proxy-related materials directly (not via Broadridge)

to such NOBOs.

These proxy-related materials are being sent to registered

and, through use of the notice-and-access process, non-registered owners of Common Shares. Non-registered owners of Common Shares

will receive these proxy-related materials through the use of the notice-and-access process (see "Communication Process for

Proxy-Related Materials").

Westport's OBOs can expect to receive their materials

related to the meeting through use of the notice-and-access process with a notice describing how to access such materials being

delivered from Broadridge or their brokers or their broker's agents as set out above.

Principal Holders of Common

Shares

As at March 11, 2015, Mr. Kevin Douglas, through and

on behalf of K&M Douglas Trust, Douglas Family Trust, James E. Douglas III and Douglas Irrevocable Descendents Trust maintains

direct or indirect control or direction over 9,848,559 common shares, representing approximately 15.4% of the

issued and outstanding Common Shares.

To the knowledge of the directors and executive officers

of Westport, as of the effective date of this Circular, there are no other persons who beneficially own, or control or direct,

directly or indirectly, more than 10% of the outstanding Common Shares.

MATTERS TO BE ACTED UPON

| 1. | Receipt of 2014 Financial Statements |

Westport's financial statements for the fiscal year

ended December 31, 2014 will be forwarded to Registered Shareholders. No formal action will be taken at the Meeting to approve

the financial statements, with the requirements of the ABCA being met with the advance circulation of such financial statements.

If any Shareholders have questions respecting such financial statements, the questions may be brought forward at the Meeting.

In 2014, Westport elected nine directors. The Board

of Directors has fixed the number of directors to be nominated at the Meeting for 2015 at 10. Each director will be elected individually

and not as a slate. All of the current nominees, with the exception of Mr. Caron and Mr. Pearce, were elected as directors by the

Shareholders at last year's annual and special meeting of Shareholders. Mr. Caron joined the Westport Board of Directors effective

August 14, 2014. All of the proposed nominees, with the exception of Mr. Pearce, are currently directors of the Corporation and

have agreed to serve as directors if elected. Each director elected will hold office until the next annual meeting of Shareholders

or until his successor is duly elected, unless his office is vacated earlier in accordance with the by-laws of Westport or applicable

law.

Unless otherwise directed, the persons named in the

Proxy intend to vote in favor of the election, as directors of Westport, of the nominees whose names are set forth in this Circular

in Section 2 – Board of Directors.

Majority Voting Policy

The Board of Directors has adopted a majority voting

policy that requires that any nominee for director who receives a greater number of votes "withheld" than votes "for"

his or her election as a director shall submit his or her resignation to the Chairman of the Board of Directors who will provide

notice of such resignation to the Nominating and Corporate Governance ("NCG") Committee of the Board of Directors

for consideration promptly following the Meeting. This policy applies only to uncontested elections, meaning elections where the

number of nominees for directors is equal to the number of directors to be elected. The NCG Committee shall consider the resignation

and shall provide a recommendation with respect to such resignation to the Board of Directors. The Board of Directors will consider

the recommendation of the NCG Committee and determine whether to accept the resignation within 90 days of the applicable meeting

and a news release will be issued by Westport announcing the Board of Director's determination. A director who tenders his or her

resignation will not participate in any meetings to consider whether the resignation shall be accepted.

Shareholders should note that, as a result of the majority

voting policy, a "withhold" vote is effectively the same as a vote against a director nominee in an uncontested election.

| 3. | Appointment of Auditors |

The firm of KPMG LLP served as independent auditor

for Westport for the period January 1, 2014 to April 24, 2014. The firm of Deloitte LLP was nominated and subsequently elected

and appointed as the auditor of the Corporation effective April 24, 2014.

Upon the unanimous recommendation of the Audit Committee,

the Board of Directors has proposed that Deloitte LLP be nominated for appointment as independent auditor for the current fiscal

year.

Unless otherwise instructed, the proxies given pursuant

to this solicitation will be voted for the appointment of Deloitte LLP, Chartered Accountants, of 1055 Dunsmuir Street, British

Columbia, as the auditor of the Corporation to hold office for the ensuing year at remuneration to be fixed by the Board of Directors.

| 4. | Amendment to the Omnibus Plan |

At the Meeting, Shareholders will be asked to approve

an ordinary resolution authorizing an annual extension to the authorized Common Shares reserved for issuance under the Omnibus

Plan. For further detail on this issue and Westport’s compensation programs, see Section 4 starting on page 34. Typically,

the majority of senior executive compensation is tied to Westport long-term shareholder value through equity-based awards that

vest over time, and include performance share units ("PSUs") that are based on pre-determined performance metrics

aligned with shareholder value. Equity-based grants, in general, are used deep into the organization to align and incentivize key

employees with the interests of shareholders.

The shareholder-approved Omnibus Plan is not a so-called

"evergreen" plan. For further clarity, when share options ("Options"), share units (restricted share

units ("RSUs") and PSUs together, "Units") and related equity-based incentives are issued, vested

and eventually exercised they are not automatically replenished in the pool (the "Omnibus Pool"). Faced with the

challenge of retaining and incentivizing employees and the Corporation’s goal of reducing cash used in operations, regular

extensions to the Omnibus Pool are required to allow the Board to continue to use equity-based long term incentives. The outcome

is an incentive plan with a stronger alignment with shareholder interests in ultimate share price performance which helps preserve

the necessary capital throughout this period of uncertainty with both current volatile energy prices and macroeconomic impacts

and which aids in the retention and fair compensation of key employees in the process.

Since 2010, as indicated in the table below, historically

Westport has been well below the 25th percentile of share dilution from compensation plan usage amongst its peers. These

amounts include PSUs that may in fact never vest unless the underlying performance metrics are achieved.

| |

2014 |

2013 |

2012 |

2011 |

2010 |

| Peer

75th Percentile |

4.10% |

4.44% |

4.49% |

3.93% |

4.34% |

| Peer

50th Percentile |

2.90% |

2.72% |

3.42% |

2.77% |

3.01% |

| Peer

25th Percentile |

2.10% |

1.76% |

2.38% |

2.18% |

2.17% |

| Westport

Share Usage |

2.7%* |

1.29% |

1.77% |

0.56% |

1.00% |

* 2014

share dilution refers to the sum of typical January long term incentive grant of 1.22% plus the October top-up grant of

1.5% approved by the Board. This amount excludes the one-time salary adjustment and 2015 pull-ahead grant approved in

October. See below for discussion.

Peer data for

2010 to 2014 provided by Frederic W. Cook & Co., Inc. |

In late 2014, due to the reduction in energy prices,

the related industry impact and the desire to preserve cash, the Corporation took action to eliminate programs, reduce staff and

institute tight expense controls. Executives accepted reduced salaries, and waived cash bonuses for 2014 and 2015 in return for

Common Shares to be issued over three years. The Board also pulled ahead the normal course of business January 2015 long-term equity

grant as a retention incentive.

This, combined with the significant drop in Westport's

share price, resulted in a grant in October 2014 that was significantly higher than usual at 2.7% plus an extraordinary 2015 pull-ahead

and special one-time salary adjustment grant that totaled 4.3%. 62% of these grants for named executive officers ("Named

Executive Officers" or "NEOs") were in the form of PSUs. The 2.7% is still well within the average and

only reaches the 50th percentile from previous years’ peer group results. The Board expects that equity-based

compensation will continue to be an important motivation and retention tool as we adjust the business plan to reflect the new market

conditions, but there are no current plans to repeat the special and extraordinary grants of 2014. We expect Omnibus Plan utilization

to move toward the median, or about 3% per year on average, due to the need to continue to offer competitive retention and performance

awards and to continue to attract and retain the global industry leaders we need to execute our strategic plan.

The proposed amendments to the Omnibus Plan are intended

to: (i) provide Westport with flexibility in issuing awards to its employees, officers, contractors and directors as Westport's

business expands; (ii) provide more flexibility to award recipients with respect to the date for settlement of vested RSUs and

PSUs; and (iii) to address certain housekeeping changes. We are seeking approval by Shareholders to increase the number of Common

Shares reserved for issuance pursuant to awards available for grant pursuant to awards under the Omnibus Plan by 1,900,000, being

an amount that will allow the Board to grant equity awards at roughly the 3.0% annual rate (1,900,000 shares for 2014) as seen

in our peer group between 2010 and 2013.

Additionally, prior to amendment the Omnibus Plan provided

that, unless otherwise determined by the Human Resources and Compensation Committee of the Board (the "HRC" Committee),

all RSUs and PSUs were to be settled in exchange for shares or cash, as applicable, as soon as practicable following vesting. The

proposed amendments to the Omnibus Plan would amend such provision to require instead that all vested RSUs and PSUs be settled

for shares or cash, as applicable, as soon as practicable following receipt by Westport of notice of exercise of such award, provided

that settlement and payment in respect of RSUs and PSUs be made: (i) to participants who are U.S. taxpayers by the date that is

2 ½ months after the end of Westport's first taxable year in which the RSU and/or PSU is no longer subject to substantial

risk of forfeiture; and (ii) to Canadian participants by the date that is no later than December 15 of the third calendar year

following the calendar year in which the participant rendered the employment services in respect of which the award is made.

Additional amendments to the Omnibus Plan proposed

for approval include certain housekeeping changes. More information on the amendment to the Omnibus Plan can be found on page 44.

The Board of Directors has approved the proposed amendment

to the Omnibus Plan, subject to receipt of applicable regulatory and shareholder approvals. At the Meeting, shareholders will be

asked to consider and, if thought fit, approve the following resolution:

"BE IT RESOLVED THAT:

| 1. | Westport Innovations Inc.'s (the "Corporation's") Omnibus Incentive Plan (the

"Plan") shall be amended: (a) to allow the Corporation to issue up to an additional 1,900,000 equity-based incentive

awards; (b) to allow Restricted Share Units and Performance Share Units to be settled as soon as practicable following receipt

by the Corporation of a notice of exercise of such awards, subject to the maximum limits described in the Corporation's management

information circular dated March 11, 2015 (the "Circular"); and (c) to provide for certain other housekeeping

changes, all as further described in the Circular. |

| 2. | Any director or officer of the Corporation is hereby authorized and directed, for and on behalf

of the Corporation, to execute and deliver all such documents and instruments and to do all such acts and things as in the opinion

of such director or officer may be necessary or desirable to give effect to the foregoing resolution." |

Approval Requirements

In order to be effective, the foregoing resolution

must be approved by a majority of the votes cast by shareholders, present in person or by proxy, at the Meeting.

Unless otherwise instructed, the persons named in the

form of proxy enclosed with this management proxy circular intend to vote FOR the resolution approving the proposed amendment to

the Omnibus Plan.

Interest of Certain Persons or Companies in Matters to be Acted Upon

Except as otherwise set forth herein, management of

Westport is not aware of any material interest, direct or indirect, by way of beneficial ownership of Common Shares or otherwise

of any director or proposed nominee for election as director, or executive officer or anyone who has held office as such since

January 1, 2014, or of any associate or affiliate of any of the foregoing in any matter to be acted upon at the Meeting other than

the election of directors.

Currency and Nomenclature in this Management Information

Circular

Unless otherwise specified, all currency amounts are

stated in United States dollars. All references to “dollars”, “$” or “US$” are United States

dollars, and all references to “C$” or “CDN$” are Canadian Dollars.

Unless otherwise stated, references to "we",

"us", "our", "Westport" or the "Corporation" are to Westport Innovations Inc. and all of

its wholly-owned and majority-owned subsidiaries and consolidated joint ventures.

SECTION 2:

BOARD OF DIRECTORS

NOMINEES

FOR ELECTION TO THE BOARD

Westport has not established strict term limits for

members of its Board of Directors however Westport is, and has historically been, committed to renewing, on a measured basis,

the Board of Directors. A review and assessment of Westport's Board of Directors is conducted annually and Westport periodically

reviews and rotates both Chair and Committee Chair succession in an effort to ensure a diversity of views. The NCG Committee regularly

reviews and discusses Board succession and Westport has historically utilized its Advisory Board as a means of assessing and integrating

new members into the Board of Directors. By means of example, each of Brenda Eprile and Joseph Caron were members of Westport's

Advisory Board prior to becoming Westport Board members. The nominees proposed for election as directors below further reflects

Westport's commitment to Board renewal and succession.

The following table and accompanying notes set forth

the names and municipalities of residence of all persons proposed to be nominated for election as directors, the positions with

Westport now held by them, their principal occupations or employment for the preceding five years, the dates on which they became

directors of Westport, and the number of securities of Westport owned by them or over which they exercised control or direction

as at the Record Date.

Dr. Warren J. Baker (76), a US citizen,

of Avila Beach, California, USA, joined the Board of Directors in September of 2002. He is currently Chair of the

Innovation Committee. Helping drive Westport's innovation and technology path, Dr. Baker has led a distinguished career

in science and technology including the US National Science Board under President Reagan. More recently, Dr. Baker retired

as President Emeritus of California Polytechnic State University in San Luis Obispo, California, having served

as President from 1979 until August 1, 2010. Dr. Baker is a Fellow of the American Society of Civil Engineers,

a Fellow in the Engineering Society of Detroit, a former member of the board of directors of the California Council for

Science and Technology, and a former member of the US Business-Higher Education Forum. Dr. Baker has served

as a member of the US National Science Board appointed by President Reagan serving two terms from 1985 to 1994. He has

served as Chair of the board of directors of the ASCE Civil Engineering Research Foundation. From 1994 to September

2012, Dr. Baker was a member of the board of directors of John Wiley & Sons, Inc. of Hoboken, New Jersey, a New York

Stock Exchange listed global publisher of print and electronic products, specializing in scientific, technical, and medical

books and journals, where he also served terms as Chair of the Audit Committee, the Governance Committee, and Human Resources

and Compensation Committee. Dr. Baker also served on the board of directors of the Society of Manufacturing Engineers'

Education Foundation, and is currently Chair of the Board of Governors, US – Mexico Foundation for Science. |

Chair of the Innovation Committee

Member of the Human Resources and Compensation

Committee

Member of the Nominating and Corporate Governance

Committee

41,027 Common Shares(2)

17,889 Units(2)

8,570 Options(2)

|

| M.A.

(Jill) Bodkin (71), a Canadian citizen, of Vancouver, British Columbia, Canada, became Chairman of the Board on August

1, 2014 Helping Westport invest and grow has been a passion for Ms. Bodkin since she joined the board in July of

2008. Ms. Bodkin brings a significant amount of public company and venture capital markets expertise and a distinguished background

with the BC Securities Commission and Ernst & Young LLP. She has been Corporate Director and Chair and Chief Executive

Officer of Golden Heron Enterprises since 1996. A director of public and private companies, Ms. Bodkin is also

the President of Yaletown Venture Partners VCC, Vancouver, and on boards of Valemount Glacier Destinations, Exro Technologies,

Syracuse University's Maxwell School of Citizenship and Public Affairs, and Vancouver Opera. From 2004 to 2011, Ms. Bodkin

was Director for Canada for KCTS 9 Television, the Seattle based Pacific Northwest PBS station. She is a Governor and former

Chair of the Vancouver Board of Trade, as well as a former Director of the Laurentian Bank of Canada and President of the

Board of Pacific Coast Public Television. She has served on the Audit Oversight Council for the Canadian Institute of Chartered

Accountants, advisory boards on investment and trade to Canadian and British Columbia Cabinet Ministers, and as a Trustee

of policy think tanks, including the Thailand Development Research Institute, the Institute for Research in Public Policy

in Canada, and the Canada West Foundation. After her early career in trade and finance in Canada's capital, Ms. Bodkin was

appointed, in 1981, British Columbia's first woman Deputy Minister, responsible for financial institutions, then served as

founding Chair of the BC Securities Commission. From 1987 to 1996, she was a Corporate Finance Partner with Ernst & Young

LLP, advising on financing technology companies and capital projects in North America and Asia. Her mid-career graduate studies

were in public finance at the Maxwell School, and she has been an Executive in Residence at UBC's Faculty of Business. |

Chairman of the Board of Directors

Member of the Audit Committee(1)

Member of the Human Resources and Compensation

Committee

Member of the Innovation Committee

Member of the Nominating and Corporate Governance

Committee

Member of the Strategy Committee

11,218 Common Shares(2)

20,168 Units(2) |

| Joseph

P. Caron (67), a Canadian citizen, of West Vancouver, British Columbia, Canada, joined the Board of Directors in August,

2014. Mr. Caron provides an international business and government perspective with a career as Canadian Ambassador

to the People's Republic of China and for the Canadian Embassy as Minister Plenipotentiary and Head of Chancery in Japan.

With operations on five continents and 10 countries, Mr. Caron's experience is a great addition. Mr. Caron began his international

relations career in 1972 as a member of the Trade Commissioner Service. His knowledge of the Japanese language led to assignments

in Japan for over 17 years in government and business, including the Canadian Embassy as Minister Plenipotentiary and Head

of Chancery. He also subsequently held several positions related to Asian and international economic affairs for the Canadian

Government, including serving the Foreign and Defence Policy Secretariat of the Privy Council Office. From 2001 to 2005, he

served as Canadian Ambassador to the People's Republic of China with concurrent accreditation in the Democratic People's Republic

of Korea (North Korea) and Mongolia. In 2005, he was named Canadian Ambassador to Japan and, in 2008, he served as High Commissioner

to the Republic of India. Mr. Caron has been awarded an Honorary Doctorate from Meiji Gakuin University in Tokyo and has also

been named a Distinguished Fellow of the Asia Pacific Foundation of Canada as well as a Honorary Fellow of the Institute of

Asian Research of the University of British Columbia. Mr. Caron is a Board member of Manulife Financial Corporation and Vancouver

International Airport. He is also Vice-Chair of the Board of the Canada China Business Council, B.C. Branch. Mr. Caron

was also a Strategic Advisor, Asia Pacific at Heenan Blaikie LLP. Mr. Caron obtained a Bachelor of Arts degree

with Honours from the University of Ottawa in 1970. |

Member of the Human Resources and Compensation

Committee

10,211 Common Shares(2)

11,899 Units(2) |

| David

R. Demers (59), a Canadian citizen, of Vancouver, British Columbia, Canada, is a founder of Westport and has been Chief

Executive Officer and a member of the Board of Directors since the Corporation was formed in March of 1995. Mr. Demers brings

an entrepreneurial spirit and an unmatched drive to make Westport's technology and company a global success. Mr. Demers holds

a Bachelor of Science (Physics) degree and a Juris Doctor (Law), both from the University of Saskatchewan. Mr.

Demers started his career at IBM Canada and has been involved in the formation and growth of several successful technology

companies. He is currently a member of the board of directors of Primero Mining Corp. (NYSE:PPP) and ECRI, a private software

company, as well as several Westport subsidiaries and ventures in which Westport has an equity interest. |

Chief Executive Officer

Member of the Innovation Committee

Member of the Strategy Committee

127,257 Common Shares(2)

423,172 Units(2)(3)

|

| Brenda

J. Eprile (60), a Canadian citizen of North York, Ontario, Canada was appointed to Westport's Board of Directors in October

of 2013 and brings extensive financial experience and acumen. Ms. Eprile is Chair of the Human Resources and Compensation

Committee. Ms. Eprile's familiarity with Westport as a former Advisory Board member and her deep understanding

of public companies is valuable to Westport as it continues to grow and business evolves. Ms. Eprile is the owner and principal

at Eprile & Company Inc., a boutique consulting firm serving a wide variety of clients on a range of regulatory and compliance

issues. Prior to this, Ms. Eprile was the Managing Director of Sanford Eprile and Company from 2012 until June

2014. From 2000 to 2012, Ms. Eprile was a Senior Partner at PricewaterhouseCoopers and led the Risk Advisory Services

practice. From 1998 to 2000, Ms. Eprile was a Partner at Deloitte LLP and created a regulatory advisory practice for the Canadian

member firm of Deloitte LLP focusing on public companies and financial services firms. From 1985 to 1997, Ms. Eprile had a

distinguished career as a securities regulator in Canada, having held the positions of both Executive Director and Chief Accountant

at the Ontario Securities Commission. From 1982 to 1985, Ms. Eprile was an audit and accounting staff member at Coopers and

Lybrand serving a variety of industry sectors including financial services and industrial products. Ms. Eprile is a Fellow

Certified Professional Accountant (FCPA), and received an ICD.D from the Institute of Corporate Directors in 2013. She has

an Honours Bachelor of Music from the University of Toronto, as well as a Master of Business Administration from Schulich

School of Business, York University. She is the past Chair of the Board of Canada's National Ballet School. |

Chair of the Human Resources and Compensation

Committee

Member of the Audit Committee(1)

9,200 Common Shares(2)

17,379 Units(2)

|

| Philip

B. Hodge (49), a Canadian citizen, of Calgary, Alberta, Canada has been a member of the Board of Directors since June

of 2012 and is Chair of the Nominating and Corporate Governance Committee. Mr. Hodge has returned to Westport as

a director after working at Westport as Vice-President and General Counsel from 2000 to 2006. Mr. Hodge demonstrated strong

leadership at Westport through developing and managing strategic partnerships with various industry partners, and acted in

a key role in the Cummins Westport and Weichai Westport joint venture formation. Mr. Hodge's diverse background in finance

and law, combined with his experience in the oil and natural gas industry is an asset to Westport's Board of Directors and

its committees. Mr. Hodge is the President, Chief Executive Officer and Director of Pine Cliff Energy Ltd., a Canadian junior

oil and natural gas company listed on the Toronto Venture Exchange since January 2012. Mr. Hodge most recently

held the positions of Vice President, Business Development and Vice President Acquisitions and Divestments at Penn West Exploration,

one of the largest conventional oil and natural gas producers in North America. Prior to that, Mr. Hodge was a

Managing Director at Mackie Research Capital Corporation and J.F. Mackie & Co., Calgary based investment banks. From

2000 to 2006, Mr. Hodge was Vice-President and General Counsel of Westport where he was responsible for legal, corporate governance,

strategic partnership and corporate development functions, as well as the formation and growth of the company's business in

China. Prior to 2000, Mr. Hodge was a partner at Bennett Jones LLP, a Canadian national law firm, practicing in

that firm's securities and mergers and acquisitions teams in its Calgary office. Mr. Hodge has a Bachelor of Commerce

and Bachelor of Law from the University of Alberta. |

Chair of the Nominating and Corporate Governance

Committee

Member of the Strategy Committee

20,594 Common Shares(2)

17,379 Units(2)

|

| Dr.

Dezsö J. Horváth (72), a Canadian citizen, of Toronto, Ontario, Canada, has been a member of the Board of

Directors since September of 2001 and is Chair of the Strategy Committee. Dr. Horváth's rich history in

strategy and academia brings the necessary process and attention to detail that helps turn the board and management's vision

into a reality. Dr. Horváth is an internationally renowned strategist and educator with recognition as a Member of

the Order of Canada and the recipient of the Queen's Diamond Jubilee Medal in recognition of his achievements and significant

contributions to Canada. He is currently Chair of the Strategy Committee. He is the Dean and holds the Tanna H. Schulich

Chair in Strategic Management at the Schulich School of Business at York University in Toronto, Ontario, where he has taught

since 1977. He is an Electrical Engineer and holds several degrees in management (MBA, Licentiate, PhD) from Swedish

universities. After an early R&D career with the Swedish multinational ASEA (now ABB) in the electrical industry,

he accepted senior academic appointments at Swedish and then Canadian universities. In addition to publishing books

and articles on strategic management and international business, Dr. Horváth has been engaged by major corporations

and governments as a consultant in these fields. In addition to his membership on corporate boards in the past,

Dr. Horváth is currently a director of Inscape Corporation (since 2003), Samuel, Son & Co. Limited (since 2007)

and UBS Bank (Canada) (2009). He is also a director of The Toronto Leadership Centre (since 1998) and the Canada-India

Business Council (C-IBC) (since 2009). As well, he is on the International Advisory Council of the St. Petersburg

University School of Management, Russia (since 1996), Guanghua School of Management, Peking University, China (since 2007),

Fundaçäo Dom Cabral (FDC), Brazil (since 2009). Dr. Horváth is a member of the Strategic

Management Society (SMS), the Academy of Management (AOM) and the Academy of International Business (AIB). In 2004,

he was named AIB International Dean of the Year. Dr. Horváth was chosen as a Member of the Order of Canada

in July 2008 for his academic leadership and sustained commitment to business education in Canada. In 2012, he

received the Queen's Diamond Jubilee Medal in recognition of his achievements and significant contributions to Canada. |

Chair of the Strategy Committee

Member of the Audit Committee(1)

63,843 Common Shares(2)

8,570 Options(2)

17,889 Units(2) |

| Douglas

R. King (72) a US citizen, of Hillsborough, California, USA, has been a member of the Board of Directors since January

of 2012. Mr. King's appointment highlights the Corporation's commitment to strong corporate governance and financial

oversight. Mr. King's extensive experience in finance, accounting and public company audits, combined with his experience

in the technology and alternative fuel industries, is an asset to Westport's Board of Directors and its committees. Mr. King

is a Certified Public Accountant with significant experience in the accounting industry, including over 30 years of auditing

experience at Ernst & Young LLP where he served in various capacities in multiple offices. Mr. King served

as the Managing Partner at the San Francisco office of Ernst & Young LLP from 1998 to 2002. Currently, Mr.

King is a member of the board of directors, Chairman of the audit committee, and member of the nominating and corporate governance

committee at Silicon Graphics International Corp. ; member of the board of directors, Chairman of the audit committee, member

of the nominating and corporate governance and finance committees at SJW Corp.; and a member of the board of directors, Chairman

of the audit committee and member of the executive compensation committee of the private company Adaptive Spectrum and Signal

Alignment, Inc. Previously, Mr. King was a member of the board of directors, Chairman of the audit committee, and

member of the nominating and corporate governance committee at Fuel Systems Solutions from April 2006 until July 2010 and

a member of the board of directors, Chairman of the audit committee and member of executive compensation and special

committees of Marvell Technology Group from April 2004 until October 2007. Mr. King has a Bachelor of Science degree

from the University of Wisconsin (Madison) and a Masters of Business Administration degree from the University of Arkansas. |

Chair of the Audit Committee(1)

Member of the Nominating and Corporate Governance

Committee

11,738 Common Shares(2)

17,889 Units(2)

|

| Gottfried

(Guff) Muench (63), a Canadian citizen, of West Vancouver, British Columbia, Canada,

joined the Board of Directors in July of 2010. Mr. Muench has a strong history in the natural gas transport industry

serving as the first President of Cummins Westport from 2001 to 2002. His career experience and success at Cummins as one

of the leading Cummins distributors is of great assistance to Westport and the Board of Directors as the Corporation focuses

its efforts on product commercialization. Mr. Muench obtained a Masters of Business Administration degree (1981) from the

University of Western Ontario, and from 1981 to 2010, Mr. Muench held various senior positions within Cummins Inc., including

Canadian General Sales Manager–Parts in Oakville, Ontario, and Vice-President, Distribution & Customer Support for

Cummins Engine Company in Columbus, Indiana. In 1986, Mr. Muench became the owner and principal of Cummins British Columbia,

now Cummins Western Canada, the Cummins distributor for western Canada that now serves customers in eight different provinces

and territories. |

Member of the Innovation Committee

Member of the Strategy Committee

25,563 Common Shares(2)

16,231 Units(2)

|

| Douglas

G. Pearce (62), a Canadian citizen of Kelowna, British Columbia, Canada has over 35 years of experience in financial management

and capital markets. Mr. Pearce was the founding Chief Executive Officer and Chief Information Officer of the British

Columbia Investment Management Corporation ("bcIMC") from 1999 until his retirement in 2014 and also led

bcIMC’s predecessor as Director of Investments from 1988. bcIMC manages a globally diversified portfolio

on behalf of more than 500,000 pension plan beneficiaries and clients: public sector pension plans, public trusts, and insurance

funds. Mr. Pearce was responsible for the safety of these assets under management that demanded his sound investment

judgment and a socially responsible perspective while growing the portfolio from C$9.4 billion in 1988 to C$114 billion by

2014. Over this time, Mr. Pearce introduced new asset types and international markets to the portfolio including

infrastructure projects in Chile, real estate in China, and private equity in India, and has shown his tenacity at being able

to actively respond to market changes while continuing to build for the future. Mr. Pearce brings proven leadership

skills in strategy development, risk management, and strong governance practices. Mr. Pearce was the Director of

the Canadian Coalition for Good Governance from 2006 to 2008 and then Chair from 2008 to 20012, and promotes standards that

are fair, transparent, and informed. Doug has also served as a Director at Bentall Kennedy LLP since 2013 (previously

on the board of Bentall Corporation), as an Advisory Board Member at the University of British Columbia’s Sauder School

of Business since 2006, and became an Advisory Board Member at the Pacific Pension Institute in 2014 where he also served

as past Chairman from 2000 to 2005. The Pacific Pension Institute is a nonprofit educational organization that

assists investment funds worldwide with carrying out their fiduciary responsibilities, especially with respect to Asia and

the Pacific region. Mr. Pearce has a Bachelor of Commerce from the University of Calgary, has completed executive

education programs at Harvard Business School and the London School of Business, and holds an ICD.D designation from the Institute

of Corporate Directors in Canada. |

0 Common Shares(2)

0 Units(2)

|

Notes:

| (1) | For further information on the Audit Committee's composition, mandate and other matters please

refer to the section entitled "Audit Committee Matters" in Westport's Annual Information Form. |

| | | |

| (2) | The number of Common Shares, Options, and Units beneficially owned or controlled are provided as

at March 11, 2015. The information as to this number, not being within the knowledge of Westport, has been furnished by the respective

nominees. The number of Common Shares held by directors vary in shareholding positions primarily due to purchase price or grant

amounts at varying times and share prices. |

| | | |

| (3) | Certain of such Units are subject to a performance factor and may result in the issuance of more

(up to two times) or less Common Shares then represented by the number of Units. |

Westport has a compensation policy for its non-management

directors of primarily compensating such directors with an annual retainer payment and equity-based compensation. See information

in this Circular under the heading "Director Compensation".

Nomination of Directors

To identify new candidates for nomination to the Board

of Directors, the Board of Directors has appointed an NCG Committee whose responsibilities are described below under the heading

"Nominating and Corporate Governance Committee".

Any new appointees or nominees to the Board of Directors

must have a favorable track record in general business management, special expertise in areas of strategic interest to Westport,

and the ability to devote the time required and a willingness to serve as a director.

MANDATE

AND CHARTER OF THE BOARD OF DIRECTORS

In general terms, the Board of Directors is responsible

for the overall stewardship of Westport and is charged with overseeing the management of the business and affairs of Westport pursuant

to its bylaws and applicable law, and together with executive management, pursuing the creation of long term shareholder value.

Each director and officer of Westport, in exercising

his or her powers and discharging his or her duties, is required by law to: (i) act honestly and in good faith with a view to the

best interests of Westport; and (ii) exercise the care, diligence and skill that a reasonably prudent person would exercise in

comparable circumstances.

The Board of Directors conducts its business under

the guidance of the Westport Board of Directors Charter (the "Charter"), which is attached as Schedule "A"

to this document. The Charter is reviewed every year and is updated in accordance with new regulation and new governance practices.

The Charter also works in conjunction with the various charters of the committees of the Board of Directors (the "Committees")

and with the various position descriptions of the Board and executive management. All of these documents can be found on our website

at http://www.westport.com/investors/corporate-governance.

As can be seen from the Charter, the Board of Directors

has a number of core responsibilities, including developing and fostering appropriate corporate culture, executive leadership and

oversight, corporate communications, corporate governance, overseeing long-term strategic planning, approving an annual operating

plan and budget, reviewing material financing activities, reviewing and approving material transactions including acquisitions

or divestitures, and establishing and overseeing Westport's risk assessment and internal controls processes.

STRUCTURE AND COMPOSITION OF THE BOARD & ELECTION OF DIRECTORS

The NCG Committee has the responsibility of recommending

the size of the Board of Directors. Currently the Board of Directors consists of ten directors. The NCG Committee also has the

responsibility to determine the optimum mix of business skills, experience, and diversity of the members of the Board of Directors

in order to effectively fulfill its mission. To that end the NCG Committee annually reviews the composition of the Board of Directors

and individual director contributions, as well as potential candidates for election as Westport directors, and recommends directors

for election by Shareholders.

Directors are individually nominated and elected annually

at Westport's Shareholder meetings. There are no term limits for directors since the directors are subject to an election by shareholders

each year. If a nominated director fails to achieve a majority of votes for their appointment in an uncontested election, that

nominated director will immediately submit his or her resignation to the Chair of the Board of Directors (the "Board Chair")

in accordance with Westport’s Majority Voting Policy.

Duties of Directors

The fundamental responsibility of the directors is

to promote the long term best interests of Westport, rather than the interests of any individual shareholders, employees, creditors,

or other stakeholders except in exceptional circumstances and with full transparency and disclosure.

All directors have both fiduciary and statutory duties

and responsibilities defined by law and by good governance practices.

Board Leadership

The Board Chair sits at the intersection between the

Board of Directors and executive management and although the Board Chair is also a director and shares all of the duties and responsibilities

of any director, the Board Chair has several unique duties and responsibilities:

| · | He or she will preside at all meetings of the Board of Directors and at meetings of Shareholders,

or delegate a substitute chair if necessary. |

| · | He or she will represent the Board of Directors in discussions with third parties, including Westport

shareholders and other stakeholders as well as business partners, suppliers, regulators and professional advisors of all kinds. |

| · | The Board Chair will appoint all Committee chairs annually. |

| · | In conjunction with the NCG Committee Chair, he or she is responsible for assessing the overall

effectiveness of the Board of Directors and each of the committees of the Board (the "Committees") and taking

appropriate action to improve Board of Directors performance. |

| · | He or she will often lead special projects or take on special assignments from the Board of Directors. |

| · | He or she is responsible for ensuring that the Board of Directors in fact operates independently

from management and, for example, will ensure executive sessions of independent directors will be held at each meeting of the Board

of Directors. |

The Board Chair is elected annually by the independent

directors immediately after the annual shareholder meeting.

Board Independence and Effectiveness

Westport believes an effective Board of Directors necessarily

has a high degree of independence from management and, although a working culture of trust and collaboration must exist with executive

management in order for Westport to succeed, the Board of Directors must exercise its duties and responsibilities in accordance

with its own best judgment and its own views of the long-term interests of Westport and its Shareholders. To that end, the Board

of Directors has adopted several organizational principles:

| · | The Board of Directors must have a majority of independent directors. Today, all directors except

Mr. Demers, who is the CEO, are considered to be independent within the meaning of National Policy 58-201 – Corporate

Governance Guidelines and the listing rules of the NASDAQ Stock Market (the "NASDAQ"). |

| · | The Board of Directors has formed three standing Committees and delegated specific responsibilities

to each Committee. Each Committee will operate under a charter, and has a Chair responsible for leadership and overall operation

of the Committee. The Standing Committees are: the Audit Committee, the HRC Committee, and the NCG Committee. |

| · | The Board in 2014 also had two other operating Committees, the Strategy Committee and the Innovation

Committee. These operating Committees work closely with the CEO and management to develop engagement and understanding of key strategic

challenges and projects within the Corporation during the year. |

| · | The Audit Chair, the NCG Chair and the HRC Chair will only be held by independent directors and

all members of these Committees will be independent directors. |

| · | At every Board and standing Committee meeting, time is set aside for discussion among the independent

directors after management has been dismissed. |

| · | The Board of Directors has also formed an advisory board (the "Advisory Board")

to provide incremental specialist knowledge and insight from highly qualified individuals who will be available throughout the

year to advise the directors. |

Certain functions shall be the exclusive responsibility

of independent directors, consulting closely with the CEO and Board Chair, who will then bring recommendations to the full Board

of Directors for approval. These functions include:

| (a) | revising the Charter from time to time; |

| (b) | developing a position description for the Board Chair (and Lead Director, if the Board Chair is

not an independent director) and the Chairs of each Committee; and |

| (c) | developing a position description for the CEO, as well as indicators to measure the CEO's performance. |

Position Description for the Board Chair and Committee Chairs

The Board of Directors has established written descriptions

of the positions of the Board Chair, and a general position description for the chair of the Committees. A copy is posted and

available on the Westport website at http://www.westport.com/company/investors/corporate-governance.

Position Description for Chief Executive Officer

The Board of Directors has adopted a written position

description for the CEO a copy of which is posted and available on the Westport website at http://www.westport.com/company/investors/corporate-governance.

Orientation and Continuing Education

Westport's orientation program includes meetings with

the Board Chair to better understand the role of the Board of Directors, its Committees and its directors and with executive officers

to understand the nature and operations of Westport's business. New members of the Board of Directors are also provided with copies

of the Charter and charters of the Committees, the most recent strategic plan and other pertinent information. Additionally, the

Board of Directors periodically receives advice from outside legal counsel and its auditors regarding changes in the regulations

applicable to Westport. Westport encourages its directors to undertake additional continuing education and budgets an amount equal

to $2,000 per director, per year, for such continuing education.

Meetings of the Board of Directors

The Board of Directors meets as necessary during the

year. Quorum for Board of Directors meetings requires a majority of the Board of Directors members to be in attendance, including

at least 25% resident Canadian directors.

The Board of Directors had seven meetings in Westport's

last fiscal year, four times in person, and five times by telephone conference call. At every meeting time is set aside for independent

directors to meet without management present to discuss any procedural or substantive issues.

The Audit Committee meets at least four times per calendar

year in conjunction with the review and approval of annual and quarterly financial statements, management's discussion and analysis

("MD&A"), and related filings. The HRC Committee meets at least twice annually.

The following table reflects the attendance of each

of the directors for the year ended December 31, 2014 for meetings of the Board of Directors and the Audit Committee.

|

Name |

Board

Meetings In

Person |

Board Meetings

Telephonic(1) |

Audit

Committee(2) |

In Person Board and Audit

Committee Meetings

(if a member)

Individual Attendance Rate |

| Dr. Warren J. Baker |

4 of 4 = 100% |

3 of 5 = 60% |

— |

100% |

| John A. Beaulieu |

4 of 4 = 100% |

5 of 5 = 100% |

5 of 6 = 83% |

100% |

| M.A. (Jill) Bodkin |

4 of 4 = 100% |

5 of 5= 100% |

12 of 12= 100% |

100% |

| Joseph P. Caron |

1 of 1 = 100% |

2 of 2 = 100% |

— |

100% |

| David R. Demers |

4 of 4 = 100% |

5 of 5 = 100% |

— |

100% |

| Brenda J. Eprile |

4 of 4 = 100% |

4 of 5 = 80% |

8 of 8 = 100% |

100% |

| Philip B. Hodge |

4 of 4 = 100% |

5 of 5 = 100% |

6 of 6 = 100% |

100% |

| Dr. Dezsö J. Horváth |

4 of 4 = 100% |

4 of 5 = 80% |

11 of 12 = 92% |

100% |

| Douglas R. King |

4 of 4 = 100% |

5 of 5 = 100% |

12 of 12 = 100% |

100% |

| Gottfried (Guff) Muench |

4 of 4 = 100% |

4 of 5 = 80% |

— |

100% |

Notes:

| (1) | Board telephonic meetings are typically for informational updates or for decisions that require

immediate action, so advance scheduling may not allow every director to participate in all meetings. Directors are expected to

attend scheduled in-person meetings. |

| | | |

| (2) | Board meetings were held as necessary to approve the financial statements immediately after the

Audit Committee meetings. |

DIRECTOR COMPENSATION

The Board of Directors annually reviews and approves

director compensation that recognizes the directors' time commitments and compensation to ensure compensation is in line with other

directors of comparable companies.

In 2014, non-management directors were paid a base

retainer of $55,000, with the Board Chair receiving a retainer of $110,000. Directors receive a fixed annual retainer for

services rather than a fee per meeting. Members of the NCG Committee also receive an additional retainer of $7,500; the Chair of

the NCG Committee receives $15,000. Members of the HRC Committee or the Audit Committee receive an additional retainer of $8,500;

the Chair of the HRC Committee receives $15,000 and the Chair of the Audit Committee receives $20,000. Members also receive $7,500

for participating in the Operating Committees.

In 2014, each non-management director who was not a

Committee Chair or the Board Chair received an amount equal to $150,000 in Units. The Committee Chairs each received an amount

equal to $170,000 in Units and the Board Chair received an amount equal to $190,000 in Units.

Directors are also reimbursed for travel and other

reasonable expenses incurred in connection with Board or Committee meetings.

In October 2014, Directors voluntarily agreed to waive

15% of their cash retainer for 2015 and accept RSUs valued at C$6.65 per RSU for the balance. A special grant of RSUs was made

as a result, which vested 50% on the date of grant and 50% one year from the date of grant. In addition, consistent with the decision

to pull ahead the 2015 long-term incentive (“LTI”) grants to senior executives as described further on page

43, Directors were also granted awards for the planned 2015 share-based award, which vested 50% on the date of grant and 50% one

year from the date of grant. These amounts are shown in the 2014 Director Compensation Summary Table below, under the heading "2014

Special and Extraordinary Share Based Awards".

2014 Director Compensation Summary Table

The following table sets forth all compensation (excluding

expense reimbursement) paid, payable, awarded, granted, given, or otherwise provided, directly or indirectly, by Westport to the

following individuals who were directors of Westport during the 2014 fiscal year, excluding Mr. Demers who was an NEO as defined

in Form 51-102F6 – Statement of Executive Compensation ("Form 51-102F6") and receives no compensation

for his service as a director.

No Options are granted to directors and there is no

other non-equity incentive program.

| Name |

Fees

earned

(US$) |

2014

Ordinary

Share-based

awards

(US$)(1) |

2014

Special and

Extraordinary

Share-based

awards

(US$)(2) |

All other

compensation

(US$)(3) |

Total

(US$) |

| John A. Beaulieu |

101,771 |

191,326 |

140,355 |

$ 45,000 |

331,726 |

| Dr. Warren J. Baker |

83,937 |

171,194 |

159,924 |

N/A |

331,118 |

| M.A. (Jill) Bodkin |

104,375 |

171,194 |

186,807 |

N/A |

358,001 |

| Joseph P. Caron(4) |

16,937 |

50,051 |

140,355 |

N/A |

190,406 |

| Brenda J. Eprile |

67,812 |

176,038 |

159,924 |

N/A |

335,962 |

| Philip B. Hodge |

73,812 |

151,042 |

159,924 |

N/A |

310,966 |

| Dr. Dezsö J. Horváth |

76,437 |

171,194 |

159,924 |

N/A |

331,118 |

| Douglas R. King |

80,437 |

171,193 |

159,924 |

N/A |

331,118 |

| Name |

Fees

earned

(US$) |

2014

Ordinary

Share-based

awards

(US$)(1) |

2014

Special and

Extraordinary

Share-based

awards

(US$)(2) |

All other

compensation

(US$)(3) |

Total

(US$) |

| Gottfried (Guff) Muench |

68,187 |

171,194 |

140,355 |

N/A |

311,549 |

Notes:

| (1) | This represents the total deemed value of the Units granted to each director representing the ordinary

retainer equity component as described above. This amount represents the accounting fair value determined at the time of grant,

not the value of share units that vested during the year or the value actually received by the Director. Equity grants typically

vest over multiple years and actual value received depends on the share price upon vesting. |

| | | |

| (2) | This represents the total deemed value of the extraordinary pull-ahead Units granted to each director

in October 2014 to provide continuity through the 2015 calendar year, and the special grants in lieu of the 15% reduction in cash

retainer agreed to by all directors. These special and extraordinary grants vest 50% immediately and 50% on the first anniversary.

The amount reported is based on the grant date fair market value of the award. |

| | | |

| (3) | John Beaulieu retired as Chairman of the Board on July 31, 2014 after many years as a director

and Board Chair. Westport awarded Mr. Beaulieu a 2012 Ford F250 truck equipped with the Westport WiNG™ Power System, previously

used as a sales demonstration unit, as a retirement gift and in recognition of his efforts to establish compressed natural gas

refueling infrastructure in his home state of Oregon. The value shown is the depreciated value of the truck grossed up for tax

paid on Mr. Beaulieu’s behalf. |

| | | |

| (4) | Joseph Caron was appointed to the Board of Directors effective August 14, 2014. Mr. Caron was previously

a member of Westport’s Advisory Board. |

Incentive Plan Awards

The following table and notes thereto set out information

concerning all option-based and share-based awards outstanding at December 31, 2014 for the following individuals who were directors

of Westport during the year ended December 31, 2014, excluding Mr. Demers who was also a NEO and receives no compensation for his

service as a director.

|

|

Option-based Awards |

Share-based Awards |

|

Name |

Number of

securities

underlying

unexercised

Options

(#) |

Option

exercise

price

(US$) |

Option

Expiration

Date |

Value of

unexercised

in-the-money

Options

(US$)(1) |

Number of

Common

Shares or

Units of

Common

Shares that

have not

vested

(#)(2) |

Market or

payout

value

of share-

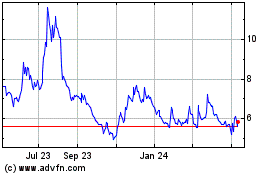

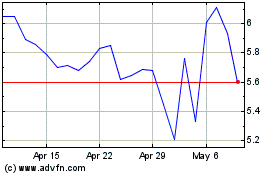

based

awards that

have not

vested

(US$)(3) |

| John A. Beaulieu |

N/A |

N/A |

N/A |

N/A |

16,740 |

62,609 |

| Dr. Warren J. Baker |

4,285

4,285 |

9.03