UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities and Exchange Act of 1934

Date of Report (Date of earliest reported): March 13, 2015

|

MANHATTAN SCIENTIFICS, INC.

|

|

(Exact name of registrant as specified in charter)

|

|

Delaware

|

|

000-28411

|

|

85-0460639

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

The Chrysler Building

405 Lexington Avenue, 26th Floor

New York, New York, 10174

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including area code: (212) 541-2405

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 3.02 Unregistered Sales of Equity Securities

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On March 13, 2015, Marvin Maslow was elected as a member of the Board of Directors of Manhattan Scientifics Inc. (the “Company”). There is no understanding or arrangement between Mr. Maslow and any other person pursuant to which he was appointed as director. Mr. Maslow does not have any family relationship with any director, executive officer or person nominated or chosen by us to become a director or an executive officer. Since the beginning of the Company's last fiscal year, Mr. Maslow has not had direct or indirect material interest in any transaction or proposed transaction, in which the Company was or is a proposed participant exceeding $120,000.

Marvin Maslow served as the CEO of the Company from January 1998 until November 2007 and served as Chairman Emeritus of the Company from 2008 through 2015. From June 1990 through September 1996, Mr. Maslow served as chief executive officer of Projectavision, Inc., a company he co-founded to develop and market video projection technology. For more than 20 years, Mr. Maslow has been President of Normandie Capital Corp., a private investment and consulting company. Mr. Maslow is credited with the starting up and financing of more than 20 enterprises during his career. Mr. Maslow received an A.A.S. degree from the Rochester Institute of Technology in 1957 and an honorable discharge from the U.S. Army Signal Corps in 1963. Mr. Maslow also serves as a Manager of the Company’s Senior Scientifics LLC subsidiary.

In consideration of legal services provided by Larry Schatz in connection with the litigation and settlement matters between the Company and Carpenter Technology Corporation, on March 13, 2015, the Company agreed to issue to Mr. Schatz 1,000,000 shares of common stock of the Company and warrants to acquire 2,500,000 shares of common stock. The common stock purchase warrants are exercisable for five (5) years at an exercise price of $0.12 per share. Mr. Schatz is a member of the Company's Board of Directors.

The issuance of the securities to Mr. Schatz was made in reliance upon exemptions from registration pursuant to Section 4(2) under the Securities Act of 1933 and/or Rule 506 promulgated under Regulation D thereunder. Larry Schatz is an accredited investor as defined in Rule 501 of Regulation D promulgated under the Securities Act of 1933.

The foregoing information is a summary of each of the agreements involved in the transactions described above, is not complete, and is qualified in its entirety by reference to the full text of those agreements, each of which is attached an exhibit to this Current Report on Form 8-K. Readers should review those agreements for a complete understanding of the terms and conditions associated with this transaction.

Item 9.01 Financial Statements and Exhibits

|

Exhibit No.

|

|

Description of Exhibit

|

| |

|

|

|

4.1

|

|

Form of Warrant

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

MANHATTAN SCIENTIFICS, INC. |

|

| |

|

|

|

|

By |

/s/ Emmanuel Tsoupanarias |

|

| |

Name: |

Emmanuel Tsoupanarias |

|

| |

Title: |

Chief Executive Officer |

|

| Date: |

March 18, 2015

|

| |

New York, New York

|

3

EXHIBIT 4.1

WARRANT

THE WARRANT EVIDENCED OR CONSTITUTED HEREBY, AND ALL SHARES OF COMMON STOCK DELIVERABLE UPON EXERCISE HEREUNDER, HAVE BEEN AND WILL BE ISSUED WITHOUT REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (“THE ACT”) AND MAY NOT BE SOLD, OFFERED FOR SALE, TRANSFERRED, PLEDGED OR HYPOTHECATED WITHOUT REGISTRATION UNDER THE ACT UNLESS EITHER (A) THE COMPANY HAS RECEIVED AN OPINION OF COUNSEL, IN FORM AND SUBSTANCE REASONABLY SATISFACTORY TO THE COMPANY, TO THE EFFECT THAT REGISTRATION IS NOT REQUIRED IN CONNECTION WITH SUCH DISPOSITION OR (B) THE SALE OF SUCH SECURITIES IS MADE PURSUANT TO SECURITIES AND EXCHANGE COMMISSION RULE 144.

Date: March 13, 2015

WARRANT TO PURCHASE COMMON STOCK

OF MANHATTAN SCIENTIFICS, INC.

THIS CERTIFIES THAT, for value received, LARRY SCHATZ (“Holder”), is entitled, subject to the terms and conditions of this Warrant, at any time or from time to time and after March 13, 2015 (the “Effective Date”), to purchase up to 2,500,000 shares of common stock, par value $0.001 per share (the “Warrant Shares”), from Manhattan Scientifics, Inc., a Delaware corporation (the “Company”), at an exercise price per share equal to $0.12 (the “Purchase Price”). This Warrant shall expire at 5:00 p.m., New York, time on that date which is five (5) years from the date of this Warrant (the “Expiration Date”). Both the Warrant Shares and the Purchase Price are subject to adjustment and change as provided herein.

1. CERTAIN DEFINITIONS. As used in this Warrant the following terms shall have the following respective meanings:

“1933 Act” shall mean the Securities Act of 1933, as amended.

“1934 Act” shall mean the Securities Exchange Act of 1934, as amended.

“Common Stock” shall mean the Common Stock of the Company and any other securities at any time receivable or issuable upon exercise of this Warrant.

“Person” means an individual, a corporation, a limited liability company, an association, a partnership, an estate, a trust or any other entity or organization, other than the Company or any of its affiliates.

“SEC” shall mean the Securities and Exchange Commission.

2. EXERCISE OF WARRANT

2.1 Payment. Subject to compliance with the terms and conditions of this Warrant and applicable securities laws, this Warrant may be exercised, in whole or in part at any time or from time to time, on or before the Expiration Date by the delivery (including, without limitation, delivery by facsimile) of the form of Notice of Exercise attached hereto as Exhibit 1 (the “Notice of Exercise”), duly executed by the Holder, at the address of the Company as set forth herein, and as soon as practicable after such date,

(a) surrendering this Warrant at the address of the Company, and

(b) providing payment, by check or by wire transfer, of an amount equal to the product obtained by multiplying the number of shares of Common Stock being purchased upon such exercise by the then effective Purchase Price (the “Exercise Amount”).

2.2 Cashless Exercise. This Warrant may also be exercised, in whole or in part, at such time by means of a “cashless exercise” in which the Holder shall be entitled to receive a certificate for the number of Warrant Shares equal to the quotient obtained by dividing [(A-B) (X)] by (A), where:

| |

|

(A) =

|

the average closing price on the thirty (30) trading days immediately preceding the date on which Holder elects to exercise this Warrant by means of a “cashless exercise,” as set forth in the applicable Notice of Exercise;

|

| |

|

|

|

| |

|

(B) =

|

the Exercise Price of this Warrant, as adjusted hereunder; and

|

| |

|

|

|

| |

|

(X) =

|

the number of Warrant Shares that would be issuable upon exercise of this Warrant in accordance with the terms of this Warrant if such exercise were by means of a cash exercise rather than a cashless exercise.

|

2.3 Common Stock Certificates; Fractional Shares. As soon as practicable on or after the date of an exercise of this Warrant, the Company shall deliver to the person or persons entitled to receive the same a certificate or certificates for the number of whole shares of Common Stock issuable upon such exercise. No fractional shares or scrip representing fractional shares of Common Stock shall be issued upon an exercise of this Warrant.

2.4 Partial Exercise: Effective Date of Exercise. In case of any partial exercise of this Warrant, the Holder and the Company shall cancel this Warrant upon surrender hereof and shall execute and deliver a new Warrant of like tenor and date for the balance of the shares of Common Stock purchasable hereunder. This Warrant shall be deemed to have been exercised on the close of business on the date of delivery of the Notice of Exercise as provided above. The Company acknowledges that the person entitled to receive the shares of Common Stock issuable upon exercise of this Warrant shall be treated for all purposes as the holder of record of such shares as of the close of business on the date the Holder is deemed to have exercised this Warrant.

3. TAXES. The Holder shall pay all taxes and other governmental charges that may be imposed in respect of the delivery of shares upon exercise of this Warrant.

4. ADJUSTMENT OF PURCHASE PRICE AND NUMBER OF COMMON STOCK. The number of shares of Common Stock deliverable upon exercise of this Warrant (or any shares of stock or other securities or property receivable upon exercise of this Warrant) and the Purchase Price are subject to adjustment upon occurrence of the following events:

4.1 Adjustment for Stock Splits, Stock Subdivisions or Combinations of Shares of Common Stock. The Purchase Price of this Warrant shall be proportionally decreased and the number of shares of Common Stock deliverable upon exercise of this Warrant (or any shares of stock or other securities at the time deliverable upon exercise of this Warrant) shall be proportionally increased to reflect any stock split or subdivision of the Company’s Common Stock. The Purchase Price of this Warrant shall be proportionally increased and the number of shares of Common Stock deliverable upon exercise of this Warrant (or any shares of stock or other securities at the time deliverable upon exercise of this Warrant) shall be proportionally decreased to reflect any combination of the Company’s Common Stock.

4.2 Reclassification. If the Company, by reclassification of securities or otherwise, shall change any of the securities as to which purchase rights under this Warrant exist into the same or a different number of securities of any other class or classes, this Warrant shall thereafter represent the right to acquire such number and kind of securities as would have been issuable as the result of such change with respect to the securities that were subject to the purchase rights under this Warrant immediately prior to such reclassification or other change and the Purchase Price therefore shall be appropriately adjusted, all subject to further adjustment as provided in this Section.

4.3 Adjustment for Capital Reorganization. Merger or Consolidation. In case of any capital reorganization of the capital stock of the Company (other than a combination, reclassification, exchange or subdivision of shares otherwise provided for herein), or any merger or consolidation of the Company with or into another entity, or the sale of all or substantially all the assets of the Company then, and in each such case, as a part of such reorganization, merger, consolidation, sale or transfer, lawful provision shall be made so that the Holder of this Warrant shall thereafter be entitled to receive upon exercise of this Warrant, during the period specified herein and upon payment of the Purchase Price then in effect, the number of shares of stock or other securities or property of the successor corporation resulting from such reorganization, merger, consolidation, sale or transfer that a holder of the shares deliverable upon exercise of this Warrant would have been entitled to receive in such reorganization, consolidation, merger, sale or transfer if this Warrant had been exercised immediately before such reorganization, merger, consolidation, sale or transfer, all subject to further adjustment as provided in this Section 4. The foregoing provisions of this Section 4.3 shall similarly apply to successive reorganizations, consolidations, mergers, sales and transfers and to the stock or securities of any other corporation that are at the time receivable upon the exercise of this Warrant. If the per-share consideration payable to the Holder hereof for shares in connection with any such transaction is in a form other than cash or marketable securities, then the value of such consideration shall be determined in good faith by the Company’s Board of Directors. In all events, appropriate adjustment (as determined in good faith by the Company’s Board of Directors) shall be made in the application of the provisions of this Warrant with respect to the rights and interests of the Holder after the transaction, to the end that the provisions of this Warrant shall be applicable after that event, as near as reasonably may be, in relation to any shares or other property deliverable after that event upon exercise of this Warrant.

5. LOSS OR MUTILATION. Upon receipt of evidence reasonably satisfactory the Company of the ownership of and the loss, theft, destruction or mutilation of this Warrant, and of indemnity reasonably satisfactory to the Company (provided no bond shall be required to be posted), and (in the case of mutilation) upon surrender and cancellation of this Warrant, the Company will cause to be executed and delivered in lieu thereof a new Warrant of like tenor as the lost, stolen, destroyed or mutilated Warrant.

6. REPRESENTATION. Subject to the Company increasing its authorized shares of common stock, the Company hereby covenants that all shares issuable upon exercise of this Warrant, when delivered upon such exercise, shall be free and clear of all liens, security interests, charges and other encumbrances or restrictions on sale and free and clear of all preemptive rights, except encumbrances or restrictions arising under federal or state securities laws. Further, the Company hereby covenants to reserve such number of authorized but unissued shares of Common Stock for issuance upon exercise of this Warrant. Additionally, the Company covenants that all shares which may be issued upon the exercise of the purchase rights represented by this Warrant will, upon exercise of the purchase rights represented by this Warrant and payment for such shares in accordance herewith, be duly authorized, validly issued, fully paid and nonassessable. Except and to the extent as waived or consented to by the Holder, the Company shall not by any action, including, without limitation, amending its certificate of incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Warrant, but will at all times in good faith assist in the carrying out of all such terms and in the taking of all such actions as may be necessary or appropriate to protect the rights of Holder as set forth in this Warrant against impairment.

7. RESTRICTIONS ON TRANSFER. The Holder, by acceptance hereof, agrees that, absent an effective registration statement filed with the SEC under the 1933 Act, covering the disposition or sale of this Warrant or the Common Stock issued or issuable upon exercise hereof or the Common Stock issuable upon conversion thereof, as the case may be, and registration or qualification under applicable state securities laws, such Holder will not sell, transfer, pledge, or hypothecate any or all such Warrants or Common Stock, as the case may be, unless either (i) the Company has received an opinion of counsel, in form and substance reasonably satisfactory to the Company, to the effect that such registration is not required in connection with such disposition or (ii) the sale of such securities is made pursuant to SEC Rule 144.

8. COMPLIANCE WITH SECURITIES LAWS. By acceptance of this Warrant, the Holder hereby represents, warrants and covenants that he/she/it is an “accredited investor” as that term is defined under Rule 501 of Regulation D, that any shares of stock purchased upon exercise of this Warrant or acquired upon conversion thereof shall be acquired for investment only and not with a view to, or for sale in connection with, any distribution thereof, that the Holder has had such opportunity as such Holder has deemed adequate to obtain from representatives of the Company such information as is necessary to permit the Holder to evaluate the merits and risks of its investment in the Company; that the Holder is able to bear the economic risk of holding such shares as may be acquired pursuant to the exercise of this Warrant for an indefinite period; that the Holder understands that the shares of stock acquired pursuant to the exercise of this Warrant or acquired upon conversion thereof will not be registered under the 1933 Act (unless otherwise required pursuant to exercise by the Holder of the registration rights, if any, granted to the Holder) and will be “restricted securities” within the meaning of Rule 144 under the 1933 Act and that the exemption from registration under Rule 144 will not be available for at least six months from the date of exercise of this Warrant, and even then will not be available unless a public market then exists for the stock, adequate information concerning the Company is then available to the public, and other terms and conditions of Rule 144 are complied with; and that all stock certificates representing shares of stock issued to the Holder upon exercise of this Warrant or upon conversion of such shares may have affixed thereto a legend substantially in the following form:

THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR UNDER THE SECURITIES LAWS OF ANY STATE. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE ACT AND ANY APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. INVESTORS SHOULD BE AWARE THAT THEY MAY BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME. THE ISSUER OF THESE SECURITIES MAY REQUIRE AN OPINION OF COUNSEL IN FORM AND SUBSTANCE SATISFACTORY TO THE ISSUER TO THE EFFECT THAT ANY PROPOSED TRANSFER OR RESALE IS IN COMPLIANCE WITH THE ACT AND ANY APPLICABLE STATE SECURITIES LAWS.

9. NO RIGHTS OR LIABILITIES AS STOCKHOLDERS. This Warrant shall not entitle the Holder to any voting rights or other rights as a shareholder of the Company. In the absence of affirmative action by such Holder to purchase Common Stock by exercise of this Warrant, no provisions of this Warrant, and no enumeration herein of the rights or privileges of the Holder hereof shall cause such Holder hereof to be a shareholder of the Company for any purpose.

10. NOTICES. All notices and other communications required or permitted hereunder shall be in writing and shall be mailed by registered or certified mail, postage prepaid, return receipt requested, or by telecopier, or by email or otherwise delivered by hand or by messenger, addressed or telecopied to the person to whom such notice or communication is being given at its address set forth on the related signature page. In order to be effective, a copy of any notice or communication sent by telecopier or email must be sent by registered or certified mail, postage prepaid, return receipt requested, or delivered personally to the person to whom such notice or communication is being at its address set forth after its signature hereto. If notice is provided by mail, notice shall be deemed to be given three (3) business days after proper deposit with the United States mail, one (1) business day after proper deposit with a nationally recognized overnight courier, or immediately upon personally delivery thereof, to person to whom such notice or communication is being at such address. If notice is provided by telecopier, notice shall be deemed to be given upon confirmation by the telecopier machine of the receipt of such notice at the telecopier number provided below. If notice is provided by email, notice shall be deemed to be given upon confirmation by the sender’s email program of the receipt of such notice at the email address provided after the signature of the person to whom such notice or communication is being delivered. The addresses set forth on the signature page hereto may be changed by written notice complying with the terms of this Section 10.

11. LAW GOVERNING. This Warrant shall be construed and enforced in accordance with, and governed by, the laws of the State of New York.

12. SEVERABILITY. If any term, provision, covenant or restriction of this Warrant is held by a court of competent jurisdiction to be invalid, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions of this Warrant shall remain in full force and effect and shall in no way be affected, impaired or invalidated.

13. COUNTERPARTS. For the convenience of the parties, any number of counterparts of this Warrant may be executed by the parties hereto and each such executed counterpart shall be, and shall be deemed to be, an original instrument.

IN WITNESS WHEREOF, the parties hereto have executed this Warrant as of date first written above.

| MANHATTAN SCIENTIFICS, INC. |

|

| |

|

|

| By: |

|

|

| Name: |

Emmanuel Tsoupanarias |

|

| Title: |

Chief Executive Officer |

|

405 Lexington Avenue, 26th Floor

New York, NY 10174

Fax: (614) 455-6714

EXHIBIT 1

NOTICE OF EXERCISE

(To be executed upon exercise of Warrant)

The undersigned hereby irrevocably elects to exercise the right of purchase represented by the within Warrant Certificate for, and to purchase thereunder, securities of Manhattan Scientifics, Inc., as provided for therein, and:

Payment shall take the form of (check applicable box):

¨ in lawful money of the United States; or

¨ the cancellation of such number of Warrant Shares as is necessary, in accordance with the formula set forth in subsection 2.2 to exercise this Warrant with respect to the maximum number of Warrant Shares purchasable pursuant to the cashless exercise procedure set forth in Section 2.2.

Accredited Investor. The undersigned is an “accredited investor” as defined in Regulation D promulgated under the Securities Act of 1933, as amended.

Please issue a certificate or certificates representing said Warrant Shares in the name of the undersigned (please print name, address and social security number):

Name: ____________________________

Address: __________________________

Signature: _________________________

Note: The above signature should correspond exactly with the name on the first page of this Warrant Certificate.

The Warrant Shares shall be delivered by physical delivery of a certificate to:

If said number of shares shall not be all the shares purchasable under the within Warrant Certificate, a new Warrant Certificate is to be issued in the name of said undersigned for the balance remaining of the shares purchasable thereunder rounded up to the next higher whole number of shares.

6

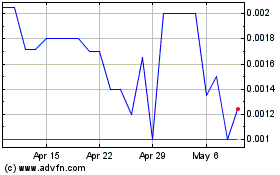

Manhattan Scientifics (PK) (USOTC:MHTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

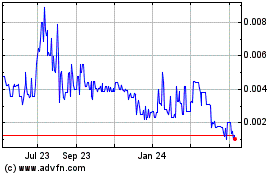

Manhattan Scientifics (PK) (USOTC:MHTX)

Historical Stock Chart

From Apr 2023 to Apr 2024