UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

|

|

|

(Mark One)

|

(X) ANNUAL REPORT PURSUANT TO SECTION 13 OR

|

|

|

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2014

|

For the fiscal year ended December 31, 2013

|

|

|

|

( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR

|

|

15(d) OF THE SECURITIES ACT OF 1934

|

|

For the transition period from ________to__________

|

Commission file number 0-22904

PARKERVISION, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

Florida

|

|

59-2971472

|

|

(State of Incorporation)

|

|

(I.R.S. Employer ID No.)

|

7915 Baymeadows Way, Suite 400

Jacksonville, Florida 32256

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (904) 732-6100

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $.01 par value

|

|

The NASDAQ Stock Market

|

|

Common Stock Rights

|

|

The NASDAQ Stock Market

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ( ) No (X)

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act. Yes ( ) No (X)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes (X) No( )

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes (X) No ( )

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. (X )

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act. (Check one):

|

|

|

|

Large accelerated filer ( )

|

Accelerated filer (X)

|

|

Non-accelerated filer ( )

|

Smaller reporting company ( )

|

|

(Do not check if a smaller reporting company)

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act). Yes ( ) No (X)

As of June 30, 2014, the aggregate market value of the registrant’s common stock, $.01 par value, held by non-affiliates of the registrant was approximately $120,989,335 (based upon $1.48 share closing price on that date, as reported by NASDAQ).

As of March 11, 2015, 97,555,516 shares of the Issuer's Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement to be filed with the Commission pursuant to Regulation 14A in connection with the registrant’s 2015 Annual Meeting of Shareholders, to be filed not later than 120 days after the end of the fiscal year covered by this report, are incorporated by reference into Part III (Items 10, 11, 12, 13, and 14) of this report.

TABLE OF CONTENTS

|

3

|

|

|

INTRODUCTORY NOTE

|

4

|

|

|

|

|

PART I

|

|

|

Item 1. Business

|

4

|

|

Item 1A. Risk Factors

|

9

|

|

Item 1B. Unresolved Staff Comments

|

14

|

|

Item 2. Properties

|

14

|

|

Item 3. Legal Proceedings

|

14

|

|

Item 4. Mine Safety Disclosures

|

14

|

|

|

|

|

|

|

|

PART II

|

|

|

Item 5. Market for the Registrant’s Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity Securities

|

15

|

|

Item 6. Selected Financial Data

|

17

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of

Operations

|

17

|

|

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

|

23

|

|

Item 8. Financial Statements and Supplementary Data

|

24

|

|

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

51

|

|

Item 9A. Controls and Procedures

|

51

|

|

Item 9B. Other Information

|

52

|

|

|

|

|

PART III

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance

|

52

|

|

Item 11. Executive Compensation

|

52

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters

|

52

|

|

Item 13. Certain Relationships and Related Transactions and Director Independence

|

52

|

|

Item 14. Principal Accountant Fees and Services

|

52

|

|

|

|

|

PART IV

|

|

|

Item 15. Exhibits and Financial Statement Schedule

|

53

|

|

|

|

|

SIGNATURES

|

57

|

|

|

|

|

SCHEDULE

|

58

|

|

|

|

|

EXHIBIT INDEX

|

59

|

INTRODUCTORY NOTE

Unless the context otherwise requires, in this Annual Report on Form 10-K (“Annual Report”), “we”, “us”, “our” and the “Company” mean ParkerVision, Inc.

Forward-Looking Statements

We believe that it is important to communicate our future expectations to our shareholders and to the public. This Annual Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, in particular, statements about our future plans, objectives, and expectations under the headings “Item 1. Business” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” When used in this Annual Report and in future filings by the Company with the Securities and Exchange Commission (“SEC”), the words or phrases “will likely result”, “management expects”, “we expect”, “will continue”, “is anticipated”, “estimated” or similar expressions are intended to identify such “forward-looking statements.” Readers are cautioned not to place undue reliance on such forward-looking statements, each of which speaks only as of the date made. Such statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results and those presently anticipated or projected, including the risks and uncertainties set forth in this Annual Report under the heading “Item 1A. Risk Factors” and in our other periodic reports. Examples of such risks and uncertainties include general economic and business conditions, the outcome of litigation, competition, unexpected changes in technologies and technological advances, the timely development and commercial acceptance of new products and technologies, reliance on key business and sales relationships, reliance on our intellectual property, and the ability to obtain adequate financing in the future. We have no obligation to publicly release the results of any revisions which may be made to any forward-looking statements to reflect anticipated events or circumstances occurring after the date of such statements.

PART I

Item 1. Business.

We were incorporated under the laws of the state of Florida on August 22, 1989. We are in the business of innovating fundamental wireless technologies. We design, develop and market our proprietary radio frequency (“RF”) technologies and products for use in semiconductor circuits for wireless communication products. We have expended significant financial and other resources to research and develop our RF technologies and to obtain patent protection for those technologies in the United States (“U.S.”) and certain foreign jurisdictions. We believe certain patents protecting our proprietary technologies have been broadly infringed by others and therefore our business plan includes enforcement of our intellectual property rights through patent infringement litigation and licensing efforts.

Based on the manner in which our management views and evaluates our operations, we have determined that our business currently operates under a single segment. Refer to our financial statements in Item 8 of this Annual Report for financial data including net losses from operations and total assets.

Recent Developments

Litigation Funding Agreement

In December 2014, we entered into a funding agreement with 1624 PV, LLC (“1624”), an affiliate of 1624 LLC, a litigation investment firm, whereby 1624 committed to fund up to $7 million for legal fees and expenses for specified future patent infringement litigation. We will reimburse and compensate 1624 from the proceeds resulting from these actions. In addition, 1624 may receive a portion of our proceeds

from other patent litigation, licensing and patent-related monetization activities. 1624’s compensation is subject to a maximum which is determined as a multiple of the funds provided by 1624 under this agreement. We have not yet filed any patent infringement actions covered by this agreement.

Sale of Warrants

In December 2014, we also entered into an agreement for the sale of warrants to 1624 for an aggregate price of $1.3 million. This transaction closed on January 15, 2015 at which time we issued three warrants to 1624, each for the purchase of up to 1,884,058 shares of our common stock at exercise prices of $1.50, $2.50 and $3.50 per share, respectively. The warrants are exercisable through January 15, 2018. If the warrants are fully exercised in the future, we will receive aggregate exercise proceeds of approximately $14.1 million. We expect to file a registration statement with the SEC promptly after filing this report to cover the resale of all of the shares of common stock issuable upon exercise of the warrants.

Inter Partes Review

In 2014, RPX Corporation and Michael Farmwald filed petitions for Inter Partes review (“IPR”) with the Patent Trial and Appeal Board of the United States Patent and Trademark Office (“PTAB”) seeking to invalidate certain claims related to four of our patents. On December 18, 2014, the PTAB issued a decision to institute trial on certain claims included in three of the four IPR petitions and denied institution on one challenged claim. On January 8, 2015, the PTAB denied institution of trial for the fourth IPR petition. Refer to “Legal Proceedings” in Note 11 to our financial statements included in Item 8 for a complete discussion of our IPR proceedings.

General Development of Business

Our business has been primarily focused on the development, marketing and legal enforcement of our RF technologies for mobile and other wireless applications. Our technologies represent among other things, unique, proprietary methods for processing RF waveforms in wireless applications. Our technologies apply to both transmit and receive functions of transmitters, receivers, and transceivers as well as other related RF communications functions. A portion of our transmit technology is marketed as Direct2Power™, or d2p™, and enables the transformation of a baseband data signal to an RF carrier waveform, at the desired power output level, in a single unified operation. A portion of our receiver technology is marketed as Direct2Data™, or d2d™, and enables the direct conversion of an RF carrier to a baseband data signal. We have developed these and a number of additional innovations which are protected by the intellectual property we have secured in various patent families for RF and related functions in RF-based communications.

Strategy

We have a three-part growth strategy for commercializing our innovations that includes intellectual property licensing and/or product ventures, intellectual property enforcement, and product and component development, manufacturing and sales.

|

·

| |

Intellectual Property Licensing and Product Ventures. In 2014, we launched a licensing/product venture campaign to explore licensing and joint product development opportunities with wireless communications companies that make, use or sell chipsets and/or products that incorporate RF. We believe there are a number of communications companies that can benefit from the use of the RF technologies we have developed, whether through a license or, in certain cases, a joint product venture that may include licensing rights. We have engaged 3LP Advisors, LLC (“3LP”) under a licensing services agreement for the management of our licensing operation, largely on a commission basis. |

|

·

| |

Intellectual Property Enforcement. We are also involved in litigation against others in order to protect and defend our intellectual property rights. We are currently involved in two patent infringement cases against Qualcomm Incorporated (“Qualcomm”) for their unauthorized use of certain of our patents. One case was filed in July 2011 and is currently on appeal. The second case was served in August 2014 against Qualcomm and certain of its customers with a trial date currently scheduled for August 2016. Refer to “Legal Proceedings” in Note 11 to our financial statements included in Item 8 for a complete discussion of the proceedings in this matter. |

|

·

| |

Product and Component Sales. Our product development and marketing efforts are focused on our RF technologies in communications industries that do not use highly integrated semiconductors, such as infrastructure, industrial and military applications. In 2014, we established a network of sales representatives throughout the U.S. and Asia and also initiated production of component products in order to provide inventory to support our sales efforts. |

Since 2005, we have generated no royalty or product revenue from our RF technologies. Our ability to generate revenues sufficient to offset costs is subject to our ability to successfully enforce and defend our intellectual property rights, secure new product and/or licensing customers for our technologies, and successfully support those customers in completing their product designs.

We believe the investments we make in new technology innovations and obtaining intellectual property rights on those innovations are critical business processes and, as such, we have and will continue to devote substantial resources to research and development for this purpose. We protect our intellectual property rights by securing patent protection and, where necessary, defending those patents against infringement by others.

Products and Services

In order to utilize RF technology in a mobile handset or certain other wireless application, RF chipsets must interface with the baseband processor that generates the data to be transmitted and/or received. The development of the interface between the baseband processor and RF chipsets requires a cooperative effort with the baseband provider.

We have designed RF chipsets to interface specifically with baseband processors produced by VIA-Telecom, Inc. (“VIA”), a CDMA baseband provider. We have worked with VIA since 2009 on the joint development of reference platforms that incorporate our products and VIA baseband processors without the exchange of intellectual property rights. We also worked with VIA to co-develop a sample 3G mobile handset which verified our technology in a working implementation and tested our technology’s performance. The results of these efforts were utilized to market our product to VIA’s customers. Since 2010, we have modified our circuit layout and packaging to meet design requirements of specific VIA’s customers. In 2013, we entered into a formal development agreement with VIA whereby we would compensate VIA for the resources required for their development and ongoing support and maintenance of the custom interfaces between our products for a specific customer. Pursuant to the agreement, VIA completed the development of the custom interface for certain of its baseband processors. In 2014, we terminated our formal development agreement with VIA prior to VIA’s completion of the interface to its latest model baseband processor due to the uncertainty of the specific customer’s future use of the VIA baseband in its products.

We anticipate our future business will include licensing of our intellectual property, the joint development and/or sale of integrated circuits based on our technology for incorporation into wireless devices designed and manufactured by our customers, and the sale of products and components developed and manufactured by us. In addition, from time to time, we may provide engineering consulting and design

services to our customers, for a negotiated fee, to assist them in developing prototypes and/or products incorporating our technologies. Our technology is capable of being incorporated for any of the mobile handset standards, as well as numerous other communications protocols such as WiFi, Bluetooth, Zigbee, and GPS. By pursuing both licensing and product opportunities, we believe our technologies can be deployed in multiple markets that incorporate RF transmitters, receivers, and/or transceivers, including mobile handsets, tablets, femtocells, machine-to-machine, RF identification and infrastructure, among others. In order to secure proper compensation for the unauthorized use of our technologies by others, our licensing efforts also include enforcement actions against parties in these markets who we believe have already deployed products that infringe certain of our patented technologies.

Competitive Position

We operate in a highly competitive industry against companies with substantially greater financial, technical, and sales and marketing resources. Our technologies face competition from incumbent providers of transceivers, such as Broadcom, Fujitsu, Intel, MediaTek, NVidia, Qualcomm, STMicroelectronics, Marvell, Texas Instruments, and others, as well as incumbent providers of power amplifiers, including companies such as Anadigics, Qorvo, and Skyworks, among others. Each of our competitors, however, also has the potential of becoming a licensing or product customer for our technologies. Competition in our industry is generally based on price and technological performance.

To date, we are unaware of any competing or emerging RF technologies that provide all the simultaneous benefits that certain of our technologies enable. Our unique technologies process RF carriers in a more optimal manner than prior traditional technologies, thereby allowing the creation of handsets and other products that have extended battery life, lower operating temperatures, more easily incorporate multiple air interface standards and frequencies in smaller form factors, improve operational performance, and reduce manufacturing costs. One or more of these benefits enable some of the key features that can be found in high volume wireless products. Our technologies provide such attractive benefits, in part, because of their unique operational and/or circuit architectures. The benefits our technologies enable include highly accurate transmission and reception of RF carriers that use less power than traditional architectures and components, thereby extending battery life, reducing heat and enabling certain size, cost, performance, and packaging advantages.

We believe the most significant hurdle to the licensing and/or sale of our technologies and products is the widespread use of certain of our technologies in infringing products produced by companies with significantly greater financial, technical and sales and marketing resources. In some cases, the disruptive nature of our technologies, the required integration of our technologies with other sub-systems in semiconductor systems on-chip, and our lack of tenure in the markets we are targeting provide further hurdles to adoption. We believe we can gain adoption and/or secure licensing agreements with unauthorized current users of one or more of our technologies, and therefore compete, based on a solid and defensible patent portfolio and the advantages enabled by our unique circuit architectures. Our circuit architectures are capable of being compliant with all current mobile phone and numerous other wireless industry standards and can be configured to accept all standard baseband data interfaces with the cooperation of the baseband processor providers. In addition, we believe that one or more of our technology’s abilities to provide improved power efficiencies, highly accurate RF carrier waveforms, reduced cost, smaller form factors and better manufacturing yields, provides a sought-after solution to existing problems in applications for 3G, 4G, and next-generation mobile wireless standards, as well as in other applications where we believe our technologies can provide an attractive solution.

Production and Supply

In 2014, we initiated production of certain component products in order to provide inventory to support

our sales efforts. The integrated circuits which incorporate our RF technologies are produced through fabrication relationships with IBM Microelectronics (“IBM”) using a silicon germanium process and Taiwan Semiconductor Manufacturing Company Limited (“TSMC”) using a CMOS semiconductor process. We believe IBM and TSMC have sufficient capacity to meet our foreseeable needs. In addition, our integrated circuits have been and can be produced using different materials and processes, if necessary, to satisfy capacity requirements and/or customer preferences. In instances where our customer licenses our intellectual property, the production capacity risk shifts to that customer.

Patents and Trademarks

We consider our intellectual property, including patents, patent applications, trademarks, and trade secrets to be significant to our competitive positioning. We have a program to file applications for and obtain patents, copyrights, and trademarks in the U.S. and in selected foreign countries where we believe filing for such protection is appropriate to establish and maintain our proprietary rights in our technology and products. As of December 31, 2014, we had 179 U.S. and 88 foreign patents related to our RF technologies. In addition, we have approximately 45 U.S. and foreign patent applications pending. We estimate the economic lives of our patents to be fifteen to twenty years and our current portfolio of issued patents have expirations ranging from 2018 to 2032.

From time to time, we obtain licenses from others for standard industry circuit designs that are integrated into our own integrated circuits as supporting components that are peripheral to our core technologies. We believe there are multiple sources for these types of standard circuits and we estimate the economic lives of the licenses to be two to five years based on estimated technological obsolescence.

Research and Development

For the years ended December 31, 2014, 2013, and 2012 we spent approximately $8.5 million, $10.4 million, and $8.4 million, respectively, on Company-sponsored research and development activities. Our research and development efforts have been, and are expected to continue to be, devoted to the development and advancement of RF technologies, including the development of prototype integrated circuits for proof of concept purposes, the development of production-ready silicon samples and reference designs for specific applications, and the creation of test programs for quality control testing of our chipsets.

Employees

As of December 31, 2014, we had 47 full-time and 2 part-time employees, of which 30 are employed in engineering research and development, 6 in sales and marketing, and 13 in executive management, finance and administration. Our employees are not represented by a labor union. We consider our employee relations satisfactory.

Available Information and Access to Reports

We file annual reports on Forms 10-K, quarterly reports on Forms 10-Q, proxy statements and other reports, including any amendments thereto, electronically with the SEC. The SEC maintains an Internet site (http://www.sec.gov) where these reports may be obtained at no charge. Copies of these reports may also be obtained from the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the SEC Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. We also make copies of these reports available, free of charge through our website (http://www.parkervision.com) via the link “SEC filings” as soon as practicable after filing or furnishing such materials with the SEC. We also will provide copies of the annual report on Form 10-K and the

quarterly reports on Forms 10-Q filed during the current fiscal year, including any amendments thereto, upon written request to us at ParkerVision, Inc., Investor Relations, 7915 Baymeadows Way, Suite 400, Jacksonville, Florida, 32256. These reports will be provided at no charge. Exhibits to these reports may be obtained at a cost of $.25 per page plus $5.00 postage and handling.

Corporate Website

We webcast our earnings calls and certain events we participate in or host with members of the investment community in the investor relations section of our website. Additionally, we announce investor information, including news and commentary about our business, financial performance and related matters, SEC filings, notices of investor events, and our press and earnings releases, in the investor relations section of our website (http://ir.parkervision.com). Investors and others can receive notifications of new information posted in the investor relations section in real time by signing up for email alerts and/or RSS feeds. Further corporate governance information, including our governance guidelines, board committee charters, and code of conduct, is also available in the investor relations section of our website under the heading “Corporate Governance.” The content of our website is not incorporated by reference into this Annual Report or in any other report or document we file with the SEC, and any references to our website are intended to be inactive textual references only.

Item 1A. Risk Factors.

In addition to other risks and uncertainties described in this Annual Report, the following risk factors should be carefully considered in evaluating our business because such factors may have a significant impact on our business, operating results, liquidity and financial condition. As a result of the risk factors set forth below, actual results could differ materially from those projected in any forward-looking statements.

Our financial condition raises substantial doubt as to our ability to continue as a going concern.

Our independent registered certified public accounting firm has included in their audit opinion on our financial statements as of and for the year ended December 31, 2014 a statement with respect to substantial doubt regarding our ability to continue as a going concern. Our financial statements have been prepared assuming we will continue to operate as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. If we become unable to continue as a going concern, we may have to liquidate our assets and the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements. The substantial doubt as to our ability to continue as a going concern may adversely affect our ability to negotiate reasonable terms with our suppliers and may adversely affect our ability to raise additional capital in the future.

We have had a history of losses which may ultimately compromise our ability to implement our business plan and continue in operation.

We have had losses in each year since our inception in 1989, and continue to have an accumulated deficit which, at December 31, 2014, was approximately $313.6 million. The net loss for 2014 was approximately $23.6 million. To date, our technologies and products have not produced revenues sufficient to cover operating, research and development and overhead costs. We will continue to make expenditures on patent protection and enforcement, research and development, marketing, and general operations in order to secure and fulfill any contracts that we achieve for the sale of our products or technologies. We expect that our revenues in 2015 will not bring the Company to profitability and our current capital resources will not be sufficient to sustain our operations through 2015. If we are not able to generate sufficient revenues or obtain sufficient capital resources, we will not be able to implement our

business plan and investors will suffer a loss in their investment. This may also result in a change in our business strategies.

We expect to need additional capital in the future. Failure to raise such additional capital may prevent us from implementing our business plan as currently formulated.

Because we have had net losses and, to date, have not generated positive cash flow from operations, we have funded our operating losses from the sale of equity securities from time to time. We anticipate that our business plan will continue to require significant expenditures for patent protection and enforcement, research and development, marketing, and general operations. Furthermore, we expect that the implementation of significant cost reduction measures in order to reduce our cash needs may jeopardize our operations and future growth plans. Our current capital resources include cash and available-for-sale securities of $11.2 million at December 31, 2014 and $1.3 million in net proceeds from our January 2015 sale of warrants. In addition, we have a $7 million litigation funding commitment from a third-party; however, this funding is for specified use in future, not existing, patent enforcement actions. These capital resources will not be sufficient to meet our working capital needs for 2015 and we will require additional capital to fund our operations. Financing, if any, may be in the form of debt, contingent fee arrangements, or additional sales of equity securities, including common or preferred stock. The incurrence of debt or the sale of preferred stock may result in the imposition of operational limitations and other covenants and payment obligations, any of which may be burdensome to us. Contingent fee arrangements may result in a significant reduction in net earnings from litigation and/or licensing activities. The sale of equity securities, including common or preferred stock, may result in dilution to the current shareholders’ ownership. The long-term continuation of our business plan is dependent upon the generation of sufficient revenues from patent enforcement actions or the sale or license of our products or technologies, additional funding, reducing expenses or a combination of the foregoing. The failure to generate sufficient revenues, raise capital or reduce expenses will have a material adverse effect on our ability to achieve our long-term business objectives.

If our patents and intellectual property rights do not provide us with the anticipated market protections, our competitive position, business, and prospects will be impaired.

We rely on our intellectual property rights, including patents and patent applications, to provide competitive advantage and protect us from theft of our intellectual property. We believe that our patents are for entirely new technologies and that our patents are valid, enforceable and valuable. However, third parties have made claims of invalidity with respect to certain of our patents and other similar claims may be brought in the future. If our patents are shown not to be as broad as currently believed, or are otherwise challenged such that some or all of the protection is lost, we will suffer adverse effects from the loss of competitive advantage and our ability to offer unique products and technologies. As a result, there would be an adverse impact on our financial condition and business prospects. Furthermore, defending against challenges to our patents may give rise to material costs for defense and divert resources away from our other activities.

Our litigation can be time-consuming, costly and we cannot anticipate the results.

Since 2011, we have spent a significant amount of our financial and management resources to pursue patent infringement litigation against third parties. We believe this litigation, and others that we may in the future determine to pursue, could continue to consume management and financial resources for long periods of time. There can be no assurance that our current or future litigation matters will ultimately result in a favorable outcome for us. In addition, even if we obtain favorable interim rulings or verdicts in particular litigation matters, they may not be predictive of the ultimate resolution of the matter. Unfavorable outcomes could result in exhaustion of our financial resources and could otherwise hinder our ability to pursue licensing and/or product opportunities for our technologies which would have a material adverse impact on our financial condition, results of operations, cash flows, and business prospects. Furthermore, any litigation-based awards collected will be subject to contingency payments to

legal counsel and/or funding parties which will reduce the amount retained by us.

We are subject to outside influences beyond our control, including new legislation that could adversely affect our licensing and enforcement activities and have an adverse impact on the execution of our business plan.

Our licensing and enforcement activities are subject to numerous risks from outside influences, including new legislation, regulations and rules related to obtaining or enforcing patents. For instance, the U.S. recently enacted sweeping changes to the U.S. patent system including changes that transition the U.S. from a “first-to-invent” to a “first to file” system and that alter the processes for challenging issued patents. To the extent that we are unable to secure patent protection for our future technologies and/or our current patents are challenged such that some or all of our protection is lost, we will suffer adverse effects to our ability to offer unique products and technologies. As a result, there would be an adverse impact on our financial position, results of operations and cash flows and our ability to execute our business plan.

Our industry is subject to rapid technological changes which if we are unable to match or surpass, will result in a loss of competitive advantage and market opportunity.

Because of the rapid technological development that regularly occurs in the wireless technology industry, we must continually devote substantial resources to developing and improving our technology and introducing new product offerings. For example, in fiscal years 2014 and 2013, we spent approximately $8.5 million and $10.4 million, respectively, on research and development and, we expect to continue to spend a significant amount in this area in the future. These efforts and expenditures are necessary to establish market share and, ultimately, to generate revenues. If another company offers better products or technologies, a competitive position or market window opportunity may be lost, and therefore our revenues or revenue potential may be adversely affected.

If our technologies and/or products are not commercially accepted, our developmental investment will be lost and our ability to do business will be impaired.

There can be no assurance that our research and development will produce commercially viable technologies and products, or that our technologies and products will be established in the market as improvements over current competitive offerings. If our existing or new technologies and products are not commercially accepted, the funds expended will not be recoverable, and our competitive and financial position will be adversely affected. In addition, perception of our business prospects will be impaired with an adverse impact on our ability to do business and to attract capital and employees.

Our business is highly reliant on our business relationships with baseband suppliers for support of the interface of their product to our technology and the support of our sales and marketing efforts to their customers, the failure of which will have an adverse impact on our business.

The successful commercialization of our products will be impacted, in part, by factors outside of our control including the success and timing of product development and sales support activities of the suppliers of baseband processors with which our products interface. Delays in or failure of a baseband supplier’s product development or sales support activities will hinder the commercialization of our products which will have an adverse impact on our ability to generate revenues and recover development expenses.

We rely, in large part, on key business and sales relationships for the successful commercialization of our products, which if not developed or maintained, will have an adverse impact on achieving market awareness and acceptance and will result in a loss of business opportunity.

To achieve a wide market awareness and acceptance of our products and technologies, as part of our business strategy, we will attempt to enter into a variety of business relationships with other companies which will incorporate our technologies into their products and/or market products based on our

technologies. The successful commercialization of our products and technologies will depend in part on our ability to meet obligations under contracts with respect to the products and related development requirements. The failure of these business relationships will limit the commercialization of our products and technologies which will have an adverse impact on our business development and our ability to generate revenues and recover development expenses.

We are highly dependent on Mr. Jeffrey Parker as our chief executive officer and Mr. David Sorrells as our chief technology officer. If either of their services were lost, it would have an adverse impact on the execution of our business plan.

Because of Mr. Parker’s leadership position in the company and the respect he has garnered in both the industry in which we operate and the investment community, the loss of his services might be seen as an impediment to the execution of our business plan. Because of Mr. Sorrells’ technical expertise, the loss of his services could have an adverse impact on our research, technical support, and enforcement activities and impede the execution of our business plan. If either Mr. Parker or Mr. Sorrells were no longer available to the company, investors might experience an adverse impact on their investment. We currently have employment agreements with and maintain key-employee life insurance for our benefit for both Mr. Parker and Mr. Sorrells.

If we are unable to attract or retain key executives and other highly skilled employees, we will not be able to execute our current business plans.

Our business is very specialized, and therefore it is dependent on having skilled and specialized key executives and other employees to conduct our research, development and customer support activities. The inability to obtain or retain these key executives and other specialized employees would have an adverse impact on the research, development and technical customer support activities that our products require. These activities are instrumental to the successful execution of our business plan.

Our outstanding options, warrants, and restricted share units may affect the market price and liquidity of the common stock.

At December 31, 2014, we had 97,183,433 shares of common stock outstanding and had 9,880,352 options, warrants, and restricted share units (“RSU”) outstanding for the purchase and/or issuance of additional shares of common stock. Of these outstanding equity instruments, 7,209,938 were exercisable as of December 31, 2014. The majority of the shares of common stock underlying these securities is registered for sale to the holder or for public resale by the holder. The amount of common stock available for the sales may have an adverse impact on our ability to raise capital and may affect the price and liquidity of the common stock in the public market. In addition, the issuance of these shares of common stock will have a dilutive effect on current shareholders’ ownership.

The price of our common stock may be subject to substantial volatility.

The trading price of our common stock has been and may continue to be volatile. Between January 1, 2014 and December 31, 2014, the reported high and low sales prices for our common stock ranged between $0.80 and $5.80 per share. The price of our common stock may continue to be volatile as a result of a number of factors, some of which are beyond our control. These factors include, but are not limited to, developments in outstanding litigations, our performance and prospects, general conditions of the markets in which we compete, and economic and financial conditions. Such volatility could materially and adversely affect the market price of our common stock in future periods.

The bid price of our common stock has been below the minimum requirement for the NASDAQ Capital Market and there can be no assurance that we will continue to maintain compliance with the minimum bid price requirement for trading on that market or another national securities exchange.

From time to time, the closing bid price of our common stock has been below the NASDAQ minimum bid price requirement of $1. If the closing bid price remains below the minimum bid price requirement for a period of 30 consecutive business days, we will receive a non-compliance notice from the NASDAQ and will be afforded a 180-day period within which to regain compliance. We are currently in compliance with the NASDAQ minimum bid price requirement. There can be no assurance, however, that we will be able to maintain compliance. If we are unable to maintain or regain compliance, our common stock may no longer be listed on NASDAQ or another national securities exchange and the liquidity and market price of our common stock may be adversely affected.

We do not currently pay dividends on our common stock and thus stockholders must look to appreciation of our common stock to realize a gain on their investments.

We do not currently pay dividends on our common stock and intend to retain our cash and future earnings, if any, to fund our business plan. Our future dividend policy is within the discretion of our Board of Directors and will depend upon various factors, including our business, financial condition, results of operations and capital requirements. We therefore cannot offer any assurance that our Board of Directors will determine to pay special or regular dividends in the future. Accordingly, unless our Board of Directors determines to pay dividends, stockholders will be required to look to appreciation of our common stock to realize a gain on their investment. There can be no assurance that this appreciation will occur.

We may not be able to deliver shares of common stock upon exercise of our public warrants if such issuance has not been registered or qualified or deemed exempt under the securities laws of the state of residence of the holder of the warrant.

On November 3, 2010, we sold warrants to a limited number of institutional investors in an offering under one of our shelf registration statements. The issuance of common stock upon exercise of these warrants must qualify for exemption from registration under the securities laws of the state of residence of the warrant holder. The qualification for exemption from registration may differ in different states. As a result, a warrant may be held by a holder in a state where an exemption is not available for such exercise and we may be precluded from issuing such shares. If our common stock continues to be listed on the NASDAQ Capital Market or another national securities exchange, an exemption from registration for the issuance of common stock upon exercise of these warrants would be available in every state. However, we cannot assure you that our common stock will continue to be so listed. As a result, these warrants may be deprived of any value, the market for these warrants may be limited and the holders of these warrants may not be able to obtain shares of common stock upon exercise of the warrants if the common stock issuable upon such exercise is not qualified or otherwise exempt from qualification in the jurisdictions in which the holders of the warrants reside.

Provisions in our certificate of incorporation and by-laws could have effects that conflict with the interest of shareholders.

Some provisions in our certificate of incorporation and by-laws could make it more difficult for a third party to acquire control of us. For example, our board of directors is divided into three classes with directors having staggered terms of office, our board of directors has the ability to issue preferred stock without shareholder approval, and there are advance notification provisions for director nominations and submissions of proposals from shareholders to a vote by all the shareholders under the by-laws. Florida law also has anti-takeover provisions in its corporate statute.

We have a shareholder protection rights plan that may delay or discourage someone from making an offer to purchase the company without prior consultation with the board of directors and management, which may conflict with the interests of some of the shareholders.

On November 17, 2005, the board of directors adopted a shareholder protection rights plan which called for the issuance, on November 29, 2005, as a dividend, of rights to acquire fractional shares of preferred stock. The rights are attached to the shares of common stock and transfer with them. In the future the rights may become exchangeable for shares of preferred stock with various provisions that may discourage a takeover bid. Additionally, the rights have what are known as “flip-in” and “flip-over” provisions that could make any acquisition of the company more costly. The principal objective of the plan is to cause someone interested in acquiring the company to negotiate with the board of directors rather than launch an unsolicited bid. This plan may limit, prevent, or discourage a takeover offer that some shareholders may find more advantageous than a negotiated transaction. A negotiated transaction may not be in the best interests of the shareholders.

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

Our headquarters are located in a 14,000 square foot leased facility in Jacksonville, Florida. We have an additional 12,500 square foot leased facility in Lake Mary, Florida primarily for engineering design activities. Our facilities consist of general office space with laboratory facilities for circuit board layout and testing. We believe our properties are in good condition and suitable for the conduct of our business. Refer to “Lease Commitments” in Note 11 to our financial statements included in Item 8 for information regarding our outstanding lease obligations.

Item 3. Legal Proceedings.

Refer to “Legal Proceedings” in Note 11 to our financial statements included in Item 8 for a discussion of current legal proceedings.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

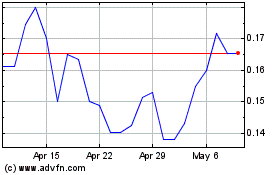

Our common stock is traded on NASDAQ under the symbol “PRKR.” Listed below is the range of the high and low sale prices of the common stock for the last two fiscal years, as reported by NASDAQ.

|

3

|

|

|

|

|

|

|

|

|

|

2014

|

|

2013

|

|

|

High

|

|

Low

|

|

High

|

|

Low

|

|

Quarter ended March 31

|

$ 5.80

|

|

$ 4.13

|

|

$ 4.39

|

|

$ 1.83

|

|

Quarter ended June 30

|

5.50

|

|

1.21

|

|

4.71

|

|

3.50

|

|

Quarter ended September 30

|

1.56

|

|

1.08

|

|

4.92

|

|

2.94

|

|

Quarter ended December 31

|

1.33

|

|

0.80

|

|

7.78

|

|

2.16

|

Holders

As of March 11, 2015, we had 111 holders of record and we believe there are approximately 6,900 beneficial holders of our common stock.

Dividends

To date, we have not paid any dividends on our common stock. The payment of dividends in the future is at the discretion of the board of directors and will depend upon our ability to generate earnings, our capital requirements and financial condition, and other relevant factors. We do not intend to declare any dividends in the foreseeable future, but instead intend to retain all earnings, if any, for use in the business.

Sales of Unregistered Securities

Information regarding all sales of unregistered equity securities during the period covered by this report has been previously disclosed.

Issuer Repurchase of Equity Securities

None.

Performance Graph

The following graph shows a five-year comparison of cumulative total shareholder returns for our company, the NASDAQ U.S. Stock Market Index, the NASDAQ Electronic Components Index and the NASDAQ Telecommunications Index for the five years ending December 31, 2014. The total shareholder returns assumes the investment on December 31, 2009 of $100 in our common stock, the NASDAQ U.S. Stock Market Index, the NASDAQ Electronic Components Index, and the NASDAQ Telecommunications Index at the beginning of the period, with immediate reinvestment of all dividends.

The data points for the performance graph are as follows:

|

|

|

|

|

|

|

|

|

|

12/31/09

|

12/31/10

|

12/31/11

|

12/31/12

|

12/31/13

|

12/31/14

|

|

|

|

|

|

|

|

|

|

ParkerVision, Inc.

|

$ 100.00

|

$ 25.14

|

$ 46.99

|

$ 110.93

|

$ 248.63

|

$ 49.73

|

|

NASDAQ Composite

|

$ 100.00

|

$ 118.02

|

$ 117.04

|

$ 137.47

|

$ 192.62

|

$ 221.02

|

|

NASDAQ Telecommunications

|

$ 100.00

|

$ 105.12

|

$ 93.37

|

$ 98.48

|

$ 125.36

|

$ 139.78

|

|

NASDAQ Electronic Components

|

$ 100.00

|

$ 104.28

|

$ 95.36

|

$ 97.34

|

$ 127.46

|

$ 164.20

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*100 invested on 12/31/09 in stock & index-including reinvestment of dividends.

Fiscal year ending December 31.

Item 6. Selected Financial Data.

The following table sets forth our financial data as of the dates and for the periods indicated. The data has been derived from our audited financial statements. The selected financial data should be read in conjunction with our financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the years ended December 31,

|

|

(in thousands, except per share amounts)

|

|

2014

|

|

2013

|

|

2012

|

|

2011

|

|

2010

|

|

Statement of Operations Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues, net

|

|

$ 0

|

|

$ 0

|

|

$ 0

|

|

$ 0

|

|

$ 64

|

|

Gross margin

|

|

0

|

|

0

|

|

0

|

|

0

|

|

17

|

|

Operating expenses

|

|

23,667

|

|

27,949

|

|

20,383

|

|

14,676

|

|

15,146

|

|

Net loss from continuing operations

|

|

(23,569)

|

|

(27,872)

|

|

(20,322)

|

|

(14,573)

|

|

(15,028)

|

|

Basic and diluted net loss per common share

from continuing operations

|

|

(0.24)

|

|

(0.31)

|

|

(0.27)

|

|

(0.24)

|

|

(0.35)

|

|

Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ 20,719

|

|

$ 26,595

|

|

$ 18,720

|

|

$ 15,842

|

|

$ 17,596

|

|

Long-term obligations

|

|

138

|

|

22

|

|

58

|

|

138

|

|

55

|

|

Shareholders’ equity

|

|

18,616

|

|

24,046

|

|

16,520

|

|

14,341

|

|

16,592

|

|

Working capital

|

|

10,118

|

|

15,206

|

|

7,175

|

|

4,658

|

|

6,134

|

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Executive Overview

We are in the business of innovating fundamental wireless technologies. We design, develop and market our proprietary RF technologies and products for use in semiconductor circuits for wireless communication products. We have expended significant financial and other resources to research and develop our RF technologies and to obtain patent protection for those technologies in the United States and certain foreign jurisdictions. We believe certain patents protecting our proprietary technologies have been broadly infringed by others and therefore our business plan includes enforcement of our intellectual property rights through patent infringement litigation and licensing efforts.

We have a three-part growth strategy that includes intellectual property licensing and/or product ventures, intellectual property enforcement, and product and component development, manufacturing and sales. We have actively launched a licensing/product venture campaign to explore licensing and joint product development opportunities with wireless communications companies that make, use or sell chipsets and/or products that incorporate RF. We have engaged the intellectual property firm of 3LP to assist in managing our licensing operations, largely on a commission basis. We believe there are a number of wireless communications companies that can benefit from the use of the RF technologies we have developed, whether through a license or, in certain cases, a joint product venture that may include licensing rights.

We are also involved in litigation against others in order to enforce our intellectual property rights. Since 2011, we have been involved in patent infringement litigation against Qualcomm for their unauthorized

use of our receiver technology. In October 2013, a jury found that Qualcomm was infringing four of our receiver patents and awarded us $172.7 million in past damages. In June 2014, the district court overturned the jury’s infringement verdict thereby nullifying the damages award. We have appealed this decision to the U.S. Federal Court of Appeals and expect a decision in mid to late 2015, although the court has no fixed deadline for its ruling. In May 2014, we filed a second infringement action against Qualcomm and certain Qualcomm customers for different patents and technologies. This action is currently scheduled for trial in August 2016. Refer to “Legal Proceedings” in Note 11 to our financial statements included in Item 8 for a complete discussion of our legal proceedings. Our primary legal counsel in these actions provides us with a substantial fee discount in return for a contingent fee; however, we continue to dedicate a meaningful portion of our working capital to litigation fees and expenses.

Our product development and marketing efforts are focused on our RF components products marketed to industries that do not use highly integrated semiconductors, such as infrastructure, industrial and military applications. In addition, we have developed RF chipsets that interface with certain VIA baseband processors. We are not currently working with VIA on the interface to their latest baseband product.

Since 2005, we have generated no product or royalty revenue from our wireless technologies. We have made significant investments in developing and protecting our technologies and products, the returns on which are dependent upon the generation of future revenues from licensing and/or product sales for realization.

Liquidity and Capital Resources

At December 31, 2014, we had working capital of approximately $10.1 million, a decrease of approximately $5.1 million from working capital of $15.2 million at December 31, 2013. We used cash for operations of approximately $18.5 million and $18.9 million in 2014 and 2013, respectively. In addition we invested approximately $1.1 million and $0.7 million in patents and other long-lived assets in 2014 and 2013, respectively. Our use of cash in 2014 and 2013 was partially offset by proceeds from the sale of equity securities and the exercise of employee and third party options and warrants totaling $13.6 million in 2014 and $28.4 million in 2013. Proceeds from the sale of equity securities are invested in available-for-sale securities and our use of cash is funded from the sale of these investments. At December 31, 2014, we were not subject to any significant commitments to make additional capital expenditures and we have no significant long-term debt obligations.

In December 2014, we entered into a litigation funding agreement with 1624 for the funding of up to $7 million of legal fees and expenses for specified future intellectual property enforcement actions that we expect to file. Under this funding agreement, 1624 will be reimbursed and compensated from the proceeds resulting from these actions, as well as the proceeds from other patent litigation, licensing and/or other patent monetization activities. 1624’s reimbursement is solely contingent upon our receipt of proceeds from patent enforcement and other related activities and 1624 has no security interest in any of our assets. In January 2015, we also received proceeds of $1.3 million from the sale of warrants to 1624. We expect to use these proceeds to fund additional litigation-related costs.

Our future business plans call for continued investment in intellectual property prosecution and enforcement, product and component development and sales, and marketing and customer support for our technologies and products. Our ability to generate revenues sufficient to offset costs is subject to our ability to successfully enforce our intellectual property rights, secure new product and/or licensing customers for our technologies, and successfully support those customers in completing their product designs. In addition to the litigation funding arrangement with 1624, we also have a partial contingent fee arrangement with McKool Smith, our litigation counsel in the Qualcomm actions. We are evaluating

additional financing arrangements with respect to our existing litigation; however there can be no assurance that such financing will be available to us. Any proceeds received from our patent enforcement actions will be shared with our legal counsel and/or third-party litigation funder based on the respective contingent fee arrangements that we have with such parties.

Revenue generated from patent enforcement actions, technology licenses and/or the sale of products in 2015 may not be sufficient to cover our operational expenses, and we expect that our continued losses and use of cash will be funded from available working capital. Our current capital resources include cash and available-for-sale securities of approximately $11.2 million at December 31, 2014, $1.3 million in proceeds from the sale of warrants received in January 2015, and $7 million in litigation funding commitments from 1624. These current capital resources will not be sufficient to support our liquidity requirements through 2015 without the generation of revenues from our operating activities, further litigation or other financing, and/or cost containment measures. Cost containment measures, if implemented, may jeopardize our ability to achieve our current business objectives.

The long-term continuation of our business plan is dependent upon the generation of sufficient revenues from our technologies and/or products to offset expenses. In the event that we do not generate sufficient revenues, we will be required to obtain additional funding through contingent funding arrangements, public or private financing and/or reductions in operating costs. Failure to generate sufficient revenues, raise additional capital through debt, equity, or contingent-based financings, and/or reduce operating costs could have a material adverse effect on our ability to meet our long-term liquidity needs and achieve our intended long-term business objectives. Our independent registered certified public accounting firm has included in their audit report an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern.

Results of Operations for Each of the Years Ended December 31, 2014, 2013, and 2012

Revenues and Gross Margins

We had no revenues for the years ended December 31, 2014, 2013, or 2012. Future revenues resulting from patent enforcement actions, if any, will not be recognized until such time that we have final court adjudications or executed settlement agreements, the amounts are fixed and determinable, and the collectibility is reasonably assured.

Revenues from patent enforcement actions, including non-litigation based licensing may be subject to contingent fees payable to legal counsel and other funding parties. Although each contingent fee arrangement is unique, generally the litigation funding party is entitled to receive priority reimbursement for any out-of-pocket funds disbursed by them. To date, none of the out-of-pocket costs related to our Qualcomm litigations have been funded by any third parties. After deduction of priority payments, if any, the remaining proceeds from patent enforcement actions will be shared between us, our legal counsel, and/or any additional funding party on a percentage basis. In some instances, the funding party’s contingent fee is capped based on a multiple of the funds invested by them. In other instances, the funding party’s contingent fee percentage declines as the amount of the proceeds increases.

Research and Development Expenses

Research and development expenses consist primarily of engineering and related management and support personnel costs; fees for outside engineering design services which we use from time to time to supplement our internal resources; amortization, depreciation, and maintenance expense related to our patents and other assets used in product development; prototype production and materials costs, which

represent the fabrication and packaging costs for prototype integrated circuits, as well as the cost of supporting components for prototype board development; software licensing and support costs, which represent the annual licensing and support maintenance for engineering design and other software tools; and rent and other overhead costs for our engineering design facility. Personnel costs include share-based compensation which represents the grant date fair value of equity-based awards to our employees which is attributed to expense over the service period of the award.

Research and development costs decreased approximately $1.9 million, or 18.3% from 2013 to 2014. This decrease is primarily the result of a decrease in outside consulting and other professional fees of approximately $946,000, and a decrease in personnel costs, including share-based compensation, of approximately $832,000. The decrease in outside consulting and other professional fees is primarily due to the termination of a development project with VIA in early 2014. The decrease in personnel costs is the result of a decrease in cash bonuses and share-based awards in 2014 when compared to 2013, as well as reduced share-based compensation expense as a result of previous years’ awards becoming fully vested in mid-2014.

Research and development costs increased approximately $2.0 million, or 23.2% from 2012 to 2013. This increase is primarily the result of an increase in employee share-based compensation of approximately $829,000, an increase in outside consulting and other professional fees of approximately $739,000, and an increase in personnel and related costs of approximately $479,000. The increase in share-based compensation expense is the result of long-term incentive equity awards granted to engineering executives and employees in July 2012 as well as restricted stock awards granted to employees as incentive compensation in 2013. The increase in outside professional fees is the result of an increase in fees for outside design services, including the VIA development arrangement, as well as an increase in legal fees related to maintenance of our patent portfolio. The increase in personnel and related costs is the result of an increase in personnel in early 2013 as well as an increase in performance bonuses to key engineering executives.

The markets for our products and technologies are characterized by rapidly changing technology, evolving industry standards and frequent new product introductions. Our ability to successfully develop and introduce, on a timely basis, new and enhanced products and technologies will be a significant factor in our ability to grow and remain competitive.

Marketing and Selling Expenses

Marketing and selling expenses consist primarily of personnel costs, including share-based compensation and travel costs, and outside professional fees which consist of various consulting and other professional fees related to sales and marketing activities.

Marketing and selling expenses increased by approximately $1.1 million, or 63.3%, from 2013 to 2014. This increase is primarily due to an increase in outside consulting and other professional fees of approximately $1,089,000. The increase in outside consulting and other professional fees is a result of business development activities, including fees paid to 3LP for support of our licensing operations. In 2015, our marketing and selling expenses are expected to be more directly correlated with revenues as much of our licensing activities will be compensated on a commission basis.

Marketing and selling expenses increased by approximately $0.1 million, or 7.1%, from 2012 to 2013. This increase is primarily due to an increase in share-based compensation of approximately $120,000 as a result of long-term incentive equity awards granted to executives and employees in July 2012 and restricted stock awards granted to employees as incentive compensation in 2013.

General and Administrative Expenses

General and administrative expenses consist primarily of executive, director, finance and administrative personnel costs, including share-based compensation, and costs incurred for insurance, shareholder relations and outside professional services, including litigation fees.

Our general and administrative expenses decreased by approximately $3.5 million, or 22.1%, from 2013 to 2014. This decrease was due primarily to decreases in litigation fees and expenses of approximately $1,935,000 and decreases in share-based compensation expense of approximately $1,770,000. The decrease in litigation fees and expenses is a result of the completion of our jury trial against Qualcomm in October 2013, offset somewhat by increases in litigation fees and expenses related to the appeal of the first Qualcomm action, the filing of a second Qualcomm action and the defense of our IPR actions. We expect to continue to dedicate a substantial portion of our available capital to enforcement of our patents in 2015, although some of these costs are expected to be offset by contingent litigation funding arrangements. The decrease in share-based compensation expense from 2013 to 2014 is a result of a reduction in share-based awards in 2014 when compared to 2013, as well as reduced expense attribution related to previous years’ awards that became fully vested in mid-2014.

Our general and administrative expenses increased by approximately $5.5 million, or 53.3%, from 2012 to 2013. This increase was due primarily to increases in litigation fees and expenses of approximately $3,400,000 and an increase in share-based compensation expense of approximately $2,430,000, partially offset by a decrease in various consulting fees of approximately $490,000. This increase in litigation fees and expenses in 2013 was the result of our patent infringement litigation against Qualcomm, including the costs associated with the jury trial in October 2013. The increase in share-based compensation expense in 2013 is primarily related to the expense attribution of long-term equity incentive awards granted to executives, other administrative employees, and non-employee directors in July 2012, and the expense recognized upon vesting of performance-based RSUs granted to a third-party in 2011. In addition, share-based compensation expense in 2013 included the value of a stock-based performance bonus awarded to our CEO in lieu of a cash bonus of $390,000. The decrease in consulting fees was the result of fewer outside engagements related to intellectual property strategies, investor relations and financial advisory fees in 2013 when compared to 2012.

Loss and Loss per Common Share

Our net loss decreased approximately $4.3 million, or $0.07 per common share, from 2013 to 2014. This decrease was a result of the $4.3 million decrease in operating expenses, which includes a $1.9 million decrease in litigation fees and expenses and a $2.4 million decrease in overall share-based compensation expense. The decrease in the loss per common share is a result of the decreased net loss and an 8% increase in weighted average shares outstanding for the period.

Our net loss increased approximately $7.6 million, or $0.04 per common share, from 2012 to 2013. This increase was the result of a $7.6 million increase in operating expenses, which includes a $3.4 million increase in litigation fees and expenses and a $3.4 million increase in overall share-based compensation expense. The increase in the loss per common share is a result of the increased net loss, offset by a 17% increase in weighted average shares outstanding for the period.

Critical Accounting Policies

We believe that the following are the critical accounting policies affecting the preparation of our financial statements:

Intangible Assets

Patents, copyrights and other intangible assets are amortized using the straight-line method over their estimated period of benefit. We estimate the economic lives of our patents and copyrights to be fifteen to twenty years. We estimate the economic lives of other intangible assets, including licenses, based on estimated technological obsolescence, to be two to five years, which is generally shorter than the contractual lives. Periodically, we evaluate the recoverability of our intangible assets and take into account events or circumstances that may warrant revised estimates of useful lives or that may indicate impairment exists (“Triggering Event”). Based on our cumulative net losses and negative cash flows from operations to date, we assess our working capital needs on an annual basis. This annual assessment of our working capital is considered to be a Triggering Event for purposes of evaluating the recoverability of our intangible assets. As a result of our evaluation at December 31, 2014, we determined that no impairment exists with regard to our intangible assets.

Accounting for Share-Based Compensation

We calculate the fair value of share-based equity awards to employees, including restricted stock, stock options and restricted stock units, on the date of grant and recognize the calculated fair value, net of estimated forfeitures, as compensation expense over the requisite service periods of the related awards. The fair value of share-based awards is determined using various valuation models which require the use of highly subjective assumptions and estimates including (i) how long employees will retain their stock options before exercising them, (ii) the volatility of our common stock price over the expected life of the equity award, and (iii) the rate at which equity awards will ultimately be forfeited by the recipients. Changes in these subjective assumptions can materially affect the estimate of fair value of share-based compensation and consequently, the related amount recognized as expense in the statements of comprehensive loss.

Income Taxes

The provision for income taxes is based on loss before taxes as reported in the accompanying statements of comprehensive loss. Deferred tax assets and liabilities are recognized for the expected future tax consequences of events that have been included in the financial statements or tax returns. Deferred tax assets and liabilities are determined based on differences between the financial statement carrying amounts and the tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Valuation allowances are established to reduce deferred tax assets when, based on available objective evidence, it is more likely than not that the benefit of such assets will not be realized. Our deferred tax assets exclude unrecognized tax benefits which do not meet a more-likely-than-not threshold for financial statement recognition for tax positions taken or expected to be taken in a tax return.

Off-Balance Sheet Transactions and Contractual Obligations

As of December 31, 2014, we have outstanding warrants to purchase 1,399,204 shares of common stock that were issued in connection with the sale of an equity security transaction in November 2010. These warrants have an exercise price of $0.54 per share and expire November 3, 2015. The estimated aggregate fair value of these warrants at their date of issuance of $355,778 is included in shareholders’ equity in our balance sheets. Refer to “Non-Plan Options and Warrants” in Note 8 to our financial statements included in Item 8 for information regarding the outstanding warrants.

Our contractual obligations and commercial commitments at December 31, 2014 were as follows (see “Lease Commitments” in Note 11 to the financial statements included in Item 8):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments due by period

|

|

|

|

Contractual Obligations:

|

Total

|

|

1 year or less

|

|

2 – 3 years

|

|

4 – 5 years

|

|

After 5 years

|

|

Capital leases

|

$ 53,300

|

|

$ 43,000

|

|

$ 10,300

|

|

$ 0

|

|

$ 0

|

|

Operating leases

|

1,640,000

|

|

585,700

|

|

1,040,100

|

|

14,200

|

|

0

|

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.