UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2015

THE MOSAIC COMPANY

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-32327 | | 20-1026454 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

3033 Campus Drive Suite E490 Plymouth, Minnesota | | 55441 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (800) 918-8270

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

The following information is being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing:

On February 11, 2015, The Mosaic Company hosted a conference call discussing its financial results for the quarter and year ended December 31, 2014. Furnished herewith as Exhibits 99.1 and 99.2 and incorporated by reference herein are copies of the transcript of the conference call and slides that were shown during the webcast of the conference call.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Reference is made to the Exhibit Index hereto with respect to the exhibits furnished herewith. The exhibits listed in the Exhibit Index hereto are being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall they be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | | THE MOSAIC COMPANY |

| | | |

Date: February 17, 2015 | | | | By: | | /s/ Mark J. Isaacson |

| | | | Name: | | Mark J. Isaacson |

| | | | Title: | | Vice President, General Counsel |

| | | | | | and Corporate Secretary |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| |

99.1 | | Transcript of conference call of The Mosaic Company held on February 11, 2015 |

| |

99.2 | | Slides shown during the webcast of the conference call of The Mosaic Company held on February 11, 2015 |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

PARTICIPANTS

Corporate Participants

Laura C. Gagnon – Vice President Investor Relations, The Mosaic Co.

James T. Prokopanko – President and Chief Executive Officer, The Mosaic Co.

Richard L. Mack – Executive Vice President and Chief Financial Officer, The Mosaic Co.

Richard N. McLellan – Senior Vice President-Commercial, The Mosaic Co.

Mike Rahm – Vice President-Market Analysis & Strategic Planning, The Mosaic Co.

James O’Rourke – Executive Vice President-Operations & Chief Operating Officer, The Mosaic Co.

Other Participants

Joel D. Jackson – Analyst, BMO Capital Markets (Canada)

Vincent Stephen Andrews – Analyst, Morgan Stanley & Co. LLC

Don D. Carson – Analyst, Susquehanna Financial Group LLLP

Ben Isaacson – Analyst, Scotia Capital Markets

Christopher S. Parkinson – Analyst, Credit Suisse Securities (USA) LLC (Broker)

Jeffrey J. Zekauskas – Analyst, JPMorgan Securities LLC

P.J. Juvekar – Analyst, Citigroup Global Markets, Inc. (Broker)

Kevin W. McCarthy – Analyst, Bank of America Merrill Lynch

Mark W. Connelly – Analyst, CLSA Americas LLC

Yonah Weisz – Analyst, HSBC Bank Plc (Tel Aviv Branch)

Andrew D. Wong – Analyst, RBC Capital Markets Asset Management

Matthew James Korn – Analyst, Barclays Capital, Inc.

Adam Samuelson – Analyst, Goldman Sachs & Co.

MANAGEMENT DISCUSSION SECTION

Operator: Good morning, ladies and gentlemen, and welcome to The Mosaic Company’s Fourth Quarter 2014 Earnings Conference Call. At this time, all participants have been placed in a listen-only mode. After the company completes their prepared remarks, the lines will be opened to take your questions. Your host for today’s call is Laura Gagnon, Vice President, Investor Relations of The Mosaic Company. Ms. Gagnon, you may begin.

Laura C. Gagnon, Vice President Investor Relations

Thank you, and welcome to our fourth quarter 2014 earnings call. Presenting today will be Jim Prokopanko, President and Chief Executive Officer; and Rich Mack, Executive Vice President and Chief Financial Officer. We also have members of the senior leadership team available to answer your questions after our prepared remarks.

After my introductory comments, Jim will review Mosaic’s accomplishments for the quarter and our views on current and future market conditions. Rich will share his insights into our results and our

1

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

future expectations. The presentation slides we are using during the call are available on our website at mosaicco.com.

We will be making forward-looking statements during this conference call. The statements include, but are not limited to, statements about future financial and operating results. They are based on management’s beliefs and expectations as of today’s date, February 11, 2015, and are subject to significant risks and uncertainties. Actual results may differ materially from projected results. Factors that could cause actual results to differ materially from those in the forward-looking statements are included in our press release issued this morning and in our reports filed with the Securities and Exchange Commission.

Now, I’d like to turn it over to Jim.

James T. Prokopanko, President and Chief Executive Officer

Good morning to you all. Thank you for joining our fourth quarter earnings meeting. A year ago, on our fourth quarter 2013 earnings call, I said the following, “We’re starting to see some rays of sunlight at the end of this tunnel, and Mosaic is well-positioned for the daylight to come.” Well, our predictions don’t always come true, but in this case, it’s very gratifying to be proven right. The sunlight was real, and Mosaic was and is in excellent position to benefit in better parts of the business cycle.

Given that we updated our earnings expectations in mid-January, we realize our results don’t come as a surprise. So, today, we will focus on the drivers behind our strong finish to the year, and we’ll discuss our outlook for 2015.

Our key messages for today are, first, our earnings are beginning to reflect the leverage we built into the business through our many strategic moves. I want to emphasize that we outperformed expectations without significant appreciation in prices for our products or in the prices of grains and oilseeds.

Second, robust demand for our products and good execution were the primary drivers of our earnings, and we expect global demand to remain strong in 2015. And third, we are successfully executing our strategic initiatives, and many of them are now fully operationalized.

For the quarter, Mosaic earned $361 million or $0.97 per share, including a positive impact of $0.10 per share of notable items, an increase of roughly threefold from a year ago. Our revenues for the quarter were $2.4 billion, up 9% over the fourth quarter of 2013. Both of Mosaic’s business segments outperformed our expectations; in Phosphates, our volumes exceeded the top of our initial guidance range by 450,000 tonnes as customers sought to position inventory in anticipation of a strong spring application season.

The Phosphates segment generated $286 million in gross margin and improved its gross margin rate to 18.2% during the quarter. The Potash segment exceeded our gross margin guidance by several percentage points as cost per tonne dropped and we operated at very high operating rates, mostly because of a highly successful Canpotex proving run at Colonsay.

We also continued to generate strong operating cash flow of $382 million during the quarter, bringing our full year cash flow from operations to $2.3 billion, an almost $300 million improvement over 2013. We are putting our cash to use by continuing to invest in the business, both organically and strategically and repurchasing our shares and we ended the quarter with $2.4 billion of cash and cash equivalents.

2

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

For the full year of 2014, we delivered good results despite the choppy market conditions throughout the year. Mosaic earned $1.0 billion on revenues of $9.1 billion, both essentially flat when compared with 2013 but with significantly more positive trends exiting the year. We have built a business model that is both resilient to challenging market conditions and position to accelerate quickly as conditions improve. Our results for the quarter and the year corroborate both of these concepts.

Market conditions stabilized in the fourth quarter, but grain and oilseed prices remained relatively low. Demand for our products on the other hand was extremely strong. Our fourth quarter is typically a seasonally slow period for us. But our customers came to the market in force. We met the demand with excellent operational performance. Our Potash mines ran at 91% of capacity, higher than expected because of the strong demand and the Colonsay proving run I mentioned earlier.

Going into the quarter, producer inventories were very low, and despite running all out, we shipped rather than stored, the vast majority of the potash tonnes we produced. The phosphates story has also been good. Global demand for phosphates has been strong for some time and the trend continued in the fourth quarter.

In November, we announced and executed a phosphate production curtailment in response to high raw material costs. Ammonia prices softened and customers stepped in to purchase our products. And as a result, we were able to exit the fourth quarter without building high cost inventory for the spring season. This is a good illustration of our market leadership in phosphates.

I’d now like to highlight some of the other progress we made during the quarter and the year. As I mentioned, we completed a successful Canpotex proving run at Colonsay, significantly exceeding targeted production. As a result, our peaking capacity increased by 700,000 tonnes and our Canpotex entitlement is now 40.6%, effective January 2015.

In total, our proving runs for Esterhazy and Colonsay added 1.7 million tonnes compared to the expected increase of 1.3 million tonnes, almost 30% higher. These exceptional results were delivered on budget and on time.

The CF acquisition and integration are for all intents and purposes complete and we are generating better than expected financial and operational synergies from the additional facilities.

The ADM distribution acquisition in Brazil and Paraguay closed near the end of the year and integration work is proceeding well. We are now a major player in South America with the capacity to distribute 6 million tonnes of product.

We continue to be on track for the first phase of our Esterhazy K3 project which is expected to begin delivering tonnes in 2017. The board has approved the modification of the original scope to accelerate the second phase of K3 development. The accelerated construction plan will move up the timeframe when we could execute the option to replace underground mining operations at K1 and K2 and thus entirely eliminate brine management costs. We’ll discuss the Esterhazy expansion and the options it gives us in more detail at our Analyst Day next month.

We completed the divestitures of our Southern Cone operations, sold our Hersey mine and discontinued higher cost MOP production at our Carlsbad mine. Those facilities were not meeting our return expectations and those moves are behind us.

We’re significantly ahead of plan in our expense savings initiatives with identified savings of $500 million to be realized over a five-year period.

3

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Rich Mack, our CFO, will cover the capital and balance sheet work we accomplished this year in more detail. But I would like to note that we reached our debt leverage target while returning more than $3.1 billion to shareholders.

And last but not the least, the Ma’aden project continues to rise from the desert. And we have included a couple of recent photos of the facility in our slide presentation today.

2014 was a busy year for Mosaic but we are not resting. As we move into this year, we’re proceeding with the evaluation of the debottlenecking project at our Faustina, Louisiana, ammonia plant. Our MicroEssentials® conversion at New Wales is well underway and we are also building a sulfur melter at our New Wales, Florida, plant in close proximity to other chemical plants so that we will be more self-sufficient in Phosphate raw material sourcing.

We believe the investments we’re making will allow us to maintain our advantage as a low-cost producer. We accomplished all this work, and all the normal course of business work, while once again improving our safety performance. We set records in our key safety measures for the third consecutive year, which is a real source of pride for the Mosaic team.

This long list of accomplishments distinguishes Mosaic by our ability to execute on projects that will benefit our shareholders. Mosaic is indeed a much more powerful franchise at the end of 2014 than just a year ago.

We’re thrilled with our progress and we’re excited about the future. Before I talk about our outlook for this year, I would like to ask Rich Mack to provide more detail on the quarter, and our capital. Rich?

Richard L. Mack, Executive Vice President and Chief Financial Officer

Thank you, Jim, and good morning. To continue Jim’s message, a quarter ago, we suggested that the weak market sentiment that was then pervasive across agriculture was overblown. The results we reported today demonstrate that markets are much more stable than some might think and that we can generate a lot of cash even when commodity markets are not moving upward. This morning, I will provide a bit more color on our segment results, give some insight on our capital plan now that many of our strategic initiatives have been completed, and lay out our new guidance for 2015.

In the Phosphates segment, our discipline paid off. After curtailing some phosphate production during the fourth quarter, raw material cost declined and dealers stepped in. We avoided building high cost inventory which was the main objective of the curtailment, especially when we saw ammonia and sulfur prices moving opposite of ag commodity prices.

Our margins in this segment were higher than expected as a result of both lower mine rock costs and a $10 million pricing adjustment on purchased rock from Miski Mayo, which is not expected to recur in the first quarter.

In the Potash segment, margins improved dramatically due to our high operating rates and our aggressive cost-reduction program. We delivered record production and delivered near record low MOP cash costs of $91 per tonne, which includes brine management expenses of $17 per tonne.

I’d like to reinforce Jim’s message regarding our potash expansions. They are proceeding very well. We have successfully executed Canpotex proving runs at Colonsay and Esterhazy K2. And the massive K3 project remains on schedule and on budget. These expansions are good examples of

4

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

our prudent capital stewardship which is underpinned by rigorous planning and solid execution. Like our other major investments, the potash projects have outperformed our initial expectations.

Transitioning to capital as we move into 2015; our overall philosophy on capital management has not changed in any meaningful way. Our priorities, in order, are to maintain our assets, as well as our dividend policy, to invest in growth on our organic projects and strategic opportunities that have attractive risk adjusted returns, and finally, to return cash in excess of our stated liquidity buffer to shareholders.

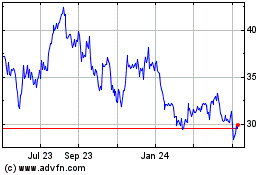

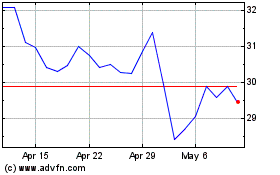

I am happy to say that we delivered on all forefronts in 2014, which we believe is a distinguishing characteristic for Mosaic. The transformation of Mosaic’s balance sheet in the past 13 months has been remarkable, and I would especially highlight our shareholder distributions. Since our restrictions on share repurchases expired in November 2013, we have repurchased $2.8 billion of stock. In the fourth quarter, we repurchased $259 million of common stock, a clear sign that we find our stock to be a compelling buy-in opportunity right now. Of course, we also maintained our $1 per share annual dividend.

We are committed to maintaining our balance sheet targets, and our excess cash balance is estimated to be around $500 million once we complete our current share repurchase authorization.

While 2014 was a very active year, we will continue to execute against this philosophy in 2015 and beyond. And I’ll have more information and updates on our capital plans at our Analyst Day next month.

Before I move on to guidance, let me provide an update on our upcoming segment reporting changes. With the acquisition of ADM’s distribution business in Brazil and Paraguay, we intend to manage and report a new International Distribution segment. Beginning with the first quarter of 2015, we will report four segments; Phosphates, Potash, International Distribution, and Corporate, with the Phosphates segment splitting out manufacturing from International Distribution, and a separate Corporate segment containing our legacy Argentinean and Chilean businesses, as well as mark to market adjustments on derivatives. The objective of creating a new segment is to increase transparency and improve peer benchmarking and business modeling. Note that we plan to make historical financials available in early March, and we will provide additional guidance at that time.

Now, let’s move on to our guidance for the first quarter and 2015 under our current reporting structure. In Phosphates, we expect margins to be in the mid-teens as a result of higher expected realized phosphate rock costs, with operating rates expected to be in the 80% to 85% range.

Sales volumes are expected to range from 2.8 million tonnes to 3.1 million tonnes for the first quarter. This compares to 2.7 million tonnes in last year’s period. We expect to see the full benefit of tonnes shipped to the former ADM distribution business in 2015. We expect our realized prices for DAP to range from $440 per tonne to $465 per tonne during the first quarter.

In Potash, we anticipate that our mines will operate at high rates to meet global demand. Our operating rate is expected to be in the range of 85% to 90%. We expect potash sales volumes to be in the range of 2.0 million tonnes to 2.3 million tonnes during the first quarter, compared with actual volumes of 2.4 million tonnes in the same period last year. We expect average realized potash prices to be in the range of $270 per tonne to $295 per tonne, with a marginally higher mix of standard grade international shipments and with limited upside given North American shipment constraints and inventory availability. The gross margin rate for the Potash segment is expected to be in the upper 30% range.

5

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

For the full year, we expect Canadian resource taxes and royalties to be in a range of $215 million to $275 million. Our guidance for full year brine management expenses is $180 million to $200 million.

We expect SG&A for the year to be in the range of $360 million to $380 million, which includes the SG&A inherited from our recent acquisitions that will be more than offset by the benefits from our expense reduction initiatives.

For the year, we estimate an effective tax rate, excluding discrete items, in the low 20% to mid-20% range. Our tax rate for 2014 was higher due to our decision to repatriate cash from Esterhazy, which was used for our investment activity and to return capital to shareholders.

We expect capital expenditures and equity investments for 2015 to be in the range of $1.1 billion to $1.4 billion.

And finally, we are adding two new data points to our annual guidance. For 2015, we expect annual Phosphate sales volumes, including International Distribution volumes, to be in the range of 14.5 million tonnes to 15 million tonnes, and Potash sales volumes to range from 8.5 million tonnes to 9 million tonnes.

At our Analyst Day in late March, we will provide a longer-term outlook for our business, including capital expenditures and investments. The event will be held at Streamsong Resort in Florida and will be webcast. I would encourage you to participate. It’s a pretty good place to be, especially at the end of March.

With that, I will turn the call back now to Jim for his closing thoughts.

James T. Prokopanko, President and Chief Executive Officer

Thank you, Rich. This was a strong quarter for Mosaic and it gave us solid momentum as we moved out of a challenging 2014. All indications point to continuing strength in global demand for potash and phosphates through the North American spring. That is not to say that the outlook for agricultural markets is certain. The conditions that were creating weak sentiment last fall still exist.

Two consecutive record global harvests have taken a bite out of grain and oilseed prices. And another record crop in 2015 would probably cause more pain for the world’s farmers. As always, weather and commodity cycles will affect agriculture and Mosaic.

Nevertheless, we continue to believe that the negative sentiment toward our industry has been overblown -- because farmers will farm, and when they do, they will nourish their crops. And because those consecutive record crops remove record amounts of nutrients from the soil, nutrients that must be replaced.

Mosaic is ideally situated to generate strong returns over the coming decades. We’ve made bold investments for growth. We reduced our costs and we’ll reduce them even more in the future. We built an efficient balance sheet and generated cash return to our shareholders. We have the scale, the talent, the assets, and the financial resources to lead this market in the years ahead.

Now, we’ll take your questions. Operator?

6

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

QUESTION AND ANSWER SECTION

Operator: [Operator Instructions] Thank you. Our first question comes from the line of Joel Jackson, BMO Capital Markets. Your line is open. Joel Jackson, your line is open.

<Q – Joel Jackson – BMO Capital Markets (Canada)>: Oh, excuse me. Sorry. I was on mute. Two questions; first question on Q1 potash, the guide; could you break that down on volumes between North America and international, and could you comment on whether the delayed China contract is holding back volumes in other offshore markets?

<A – Jim Prokopanko – The Mosaic Co.>: Good morning, Joel, Jim Prokopanko here. Welcome to the call. I should have said something at the beginning of the call. I’ll just do that now. We’re doing this, hosting this call from Phoenix, Arizona. We’re attending the TFI winter meeting. So, we’re in a room that isn’t as secure as we normally seem – has been, so you might hear some noise and a little racket in the back, and so we apologize for that.

But, Joel, two questions that you asked. You asked about the China contract and impacts on demand in other markets and the question about potash. I’ll take the first one about the Canpotex contract, and then I’ll turn it over to Rich Mack to talk about the timing of the sales.

China contract is – a lot of people are waiting for it. We’re quite patient about it here at Mosaic. We expect something could happen in the first quarter with respect to China. We don’t have a need to get something in the book right now. We’re completely booked on shipments for the Q1 quarter. We just don’t have any capacity to ship if we wanted to. So, there’s no rush from our point of view on getting that contract done. People are looking at it as a reference marker, but people are continuing to buy products being shipped into China, and we’re seeing some signs of our rising prices in other Southeast Asian, our Asian market. So, it’s not brought the market to a halt by any means, and it’ll get all sorted out in due time and we expect it’ll be good volumes and we’re sticking to our guns on the increase that we’re looking for with the Chinese. So, just stay tuned.

Rich, would you talk of the timing of the sale?

<A – Rich Mack – The Mosaic Co.>: Sure, Jim. Good morning, Joel. In the fourth quarter, just for a reference point, the North American split for potash sales was 42% and international was roughly in the low 50%, call it, 53%-ish range. I think as we go into Q1, as we noted in our remarks, you’re going to see that international component up slightly from those Q4 numbers.

Operator: Your next question comes from the line of Vincent Andrews, Morgan Stanley. Your line is open.

<Q – Vincent Andrews – Morgan Stanley & Co. LLC>: Thanks and good morning, everyone. I guess maybe just a question for you, Rich, first. If I heard your numbers correctly on the call, it sounds like there’s – as you know – I’ll take that back. Jim, can I just ask you, you said that you’re sold out for 1Q in potash but then you’ve got a range of 2 million tonnes to 2.3 million tonnes of Potash for the quarter. So, what’s going to delineate that 2 million tonnes to 2.3 million tonnes if you’re sold out?

<A – Jim Prokopanko – The Mosaic Co.>: Good morning, Vincent. Glad to have you on the call. I hope you’re well. We’re sold out of Q1 production. We’ve got everything that we’re producing fully committed and sold, going in with low inventories. We do have more that we’ll sell, but we are just completely committed on the production we have. Rick McLellan wants to add a comment about that.

7

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Rick McLellan – The Mosaic Co.>: Yes. I think with anything, Vincent, there’s a range for it because it’s still – we may have it sold, but it’s around execution. So, we have rail risks. We have weather risks. And so, that’s what the range reflects. We’re very well sold into this marketplace and continue to execute very well, but there always is riskin execution.

<A – Jim Prokopanko – The Mosaic Co.>: Okay. Second question was to – you didn’t have a question for Rich? That was it? Okay.

Operator: Your next question comes from the line of Don Carson, Susquehanna Financial. Your line is open.

<Q – Don Carson – Susquehanna Financial Group LLLP>: Yes. Thank you. Couple of questions on the domestic potash market; what impact does the Vanscoy restart and expansion have on your domestic volumes, and how have you factored that into your volume guidance for the year?

And then as Mike Rahm has pointed out, freight rates are down significantly. Vancouver to China is down $10 since November. We’re seeing declines in some of your phosphate rates as well. So, are you assuming that you can hang on to those lower freight rates and get higher netbacks in both P and K?

<A – Jim Prokopanko – The Mosaic Co.>: Good day, Don. Good to hear from you. I’ll take that first question, just talk to the – your question about Vanscoy. My colleagues will answer your second freight question. Vanscoy reports that we hear, it’s starting. They’re working on it. They’re starting to bring it up, but I’m not sure at what pace they will bring that up but we’re, at this point, not anticipating any kind of disruptions in the marketplace. Certainly, not in the first half and given the low inventories that producers have in Canada.

With that said, North America is a very competitive market. Like the second half, we may find that some of the additional Agrium tonnes are not required. But our practice, I’m just speaking for Mosaic, has been to produce to demand. We’ll continue to practice that. We do not see material changes coming on with respect to market shares in North America and the market will find equilibrium.

Some changes and I’ll just add, we’re seeing some importers attempting to bring product into North America this spring. That is not being disruptive as far as what we can see. We have one traditional import supplier that’s had a flooded mine. I expect the other Eastern European supplier might fill those shoes and if they do. So, we’re seeing it being a very tight North American market, and as we’ve said, production is fully committed in the first quarter and we expect a strong second quarter. So, we don’t see excess capacity in the potash market.

The second question was about transportation, Don. And, Rick, do you want to answer that? Rick McLellan, our Commercial leader.

<A – Rick McLellan – The Mosaic Co.>: Yes. Good morning, Don. Mike did do a good job of outlining just how low the Baltic Indexes rate now, plus, the impact of low bunker prices we’re seeing in freight rates right now both on potash and phosphates. Our sense is that a portion of that we will get to capture and right now, it’s just sorting itself out, but there are some significant changes have occurred. And Mike wants to add a piece.

<A – Mike Rahm – The Mosaic Co.>: Oh, hi, Don. Yes. I think it boils down to the relative strength of supply and demand in terms of how that is split and right now, it is much like raw material costs in phosphate in terms of who keeps that gain and it’s the relative strength of demand. And the markets right now look positive and I think that bodes pretty well in terms of what producers can hang on to in terms of both lower raw material costs in the case of phosphate as well as lower freight rates.

8

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Operator: Your next question comes from the line of Ben Isaacson from Scotiabank. Your line is open.

<Q – Ben Isaacson – Scotia Capital Markets>: Hi. Thank you. Is there an opportunity to review your dividend policy in the near-term? And how do you think about your yield versus your peers? I guess Mosaic has come a long way in the last two years or three years since you last raised your dividend.

<A – Jim Prokopanko – The Mosaic Co.>: Thanks for that question, Ben. I’m going to ask Rich Mack, our CFO, to address that question.

<A – Rich Mack – The Mosaic Co.>: Thanks, Ben, a relevant question. The way that we look at it I think is in connection with the overall capital management philosophy that we articulated in – for the first time I think it was May of 2013 and since that time, I think it has served us well. Our current dividend yield is about 2% which is in line with the S&P. And as you’d probably remember, we said that we’re going to grow the dividend as our business grows and since that time, of course, we have acquired CF Industries. We just closed on ADM. We brought a lot of incremental potash capacity online. And so our business is growing and in the future years ahead of us, we would expect that we would see commensurate growth in our EBITDA.

So, I think with Mosaic what you could be thinking about is balance. It’s not only dividends, but its share repurchases. And at the current equity price that we were at during the greater part of 2014, we deployed about $2.8 billion in share repurchases because we felt as though our stock was undervalued, especially an under appreciation in my view of our phosphates business.

And so, what I would say is stay tuned. We do have the Analyst Day coming up next month at Streamsong and we do intend to spend some additional time on capital management which would include some commentary on dividends at that point.

<A – Jim Prokopanko – The Mosaic Co.>: Thanks, Rich. I’m going to just add to that and just reinforce what our capital philosophy has been. We’ve been, first of all, committed to maintaining our investment grade ratings and our financial flexibility. And that comes with a sizeable liquidity buffer. Second, we will satisfy the capital that’s necessary to sustain our operating assets and maintain the dividends you’re seeing. Next, and you’ve seen it, we will invest in organic growth. And fourth, we pursue acquisitions.

We’ve done a few of those in joint ventures. We’re doing that. And finally, the excess cash that we see, we return to shareholders that needs to be reinforced. We’ve not been chintzy about it. I think the number we gave is, the last couple of years, we’ve returned $3.1 billion in cash to shareholders. So, stay tuned. We’re not cabbaging away soft piles of cash and we’re going to be reasonable and prudent about keeping the right kind of balance sheet. So, thanks for that question, Ben.

Operator: Your next question comes from the line of Chris Parkinson, Credit Suisse. Your line is open.

<Q – Chris Parkinson – Credit Suisse Securities (USA) LLC (Broker)>: Perfect. Thank you. Given the rally in several sulfur for overseas and abroad, can you talk a little more about your expectations for Tampa pricing over both the short-term and the long-term?

<A – Jim Prokopanko – The Mosaic Co.>: I’ll give it over to Joc O’Rourke, our COO. Joc?

<A – Joc O’Rourke – The Mosaic Co.>: Yes. Chris, the quarter one sulfur prices have been settled at $147, which was up $18, but not up substantially over last year, and that gives us price

9

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

stability for the rest of this quarter and somewhat into the second quarter in terms of what goes into our products.

So, we’ve got short-term stability at about $30 below the China market, let’s call it. Longer-term, really, it’s going to be about the U.S. refineries building up to the summer shipping period. So, we’ll have better supply once those U.S. refineries are running hard, which should be a moderator to any kind of demand increases.

And then the other thing worthy of mentioning in that is by building our sulfur melter, we’re really giving ourselves the flexibility to participate in any market, depending on what gives us the best value.

<Q – Chris Parkinson – Credit Suisse Securities (USA) LLC (Broker)>: Perfect. And just a quick follow-up; I understand you probably don’t want to front run your Analyst Day, but can you just give us a little more insight or potential insight for debottlenecking of Faustina, particularly anything on volume potential and any preliminary thoughts on timeline?

<A – Joc O’Rourke – The Mosaic Co.>: So, yes, we will discuss this in more detail in our Analyst Day. But as sort of a quick estimate, it’s probably a couple of years, and we were looking at in the range of 15% to 20% increase in production from that facility, still in the range of, let’s call it, 80,000 incremental tonnes to 100,000 incremental tonnes.

Operator: Your next question comes from the line of Jeff Zekauskas, JPMorgan. Your line is open.

<Q – Jeff Zekauskas – JPMorgan Securities LLC>: Thanks very much. You talked about your potash taxes being between $215 million and $275 million for 2015, which is about a 30% difference. I was wondering, is that wide gap because it’s hard to calculate what you’re going to earn in potash or it’s hard to calculate the taxes?

And then secondly, I was hoping you might comment on why global phosphate prices appear to be rising.

<A – Jim Prokopanko – The Mosaic Co.>: Welcome to the call, Jeff. I’m going to have Rich address the question about the resource taxes on Potash.

<Q – Jeff Zekauskas – JPMorgan Securities LLC>: Yes.

<A – Rich Mack – The Mosaic Co.>: Hey, Jeff, nice to hear from you. I think the answer is yes to both of your components. First, we do expect that we are going to have more profitability in our Potash business in 2015, and so that is one component. And probably the bigger swing and maybe the reason for the wider range, is what constitutes as deductible capital and whether or not that actually happens in 2015. So, higher profits and overall lower deductible capital in 2015 is the reason why the projections for the CRT will be higher next year.

<A – Jim Prokopanko – The Mosaic Co.>: Your second question was about the phosphate prices going up. Really, really glad it’s happened, and glad you’re noticing it. Mike’s got a good analysis on why – what we think is behind the increasing prices and why we have a solid foundation in that market.

<A – Mike Rahm – The Mosaic Co.>: Thanks, Jim, and good morning, Jeff. Yes, I think the story on phosphate, on one hand, it’s a good demand story, even absent one of the most important buyers for all intents and purposes, namely India. And I think, going forward, we fully expect that India is going to be back in the market in a much bigger way this year and really for the rest of this decade.

10

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

But I think the other fact that’s not fully appreciated is what’s happened on the supply side. If you’d go down the list of major suppliers and take a look at some of the adjustments that have taken place over the last year or two years, there’s some pretty dramatic changes. You can probably calculate 2.5 million tonnes to 3 million tonnes of supply that is no longer producing.

So, in the United States, the PotashCorp Suwannee River plant has been shut down, about 400,000 tonnes of MAP equivalent there. The MissPhos plant has shut down close to 600,000 tonnes there. And even around the globe, for example, the EuroChem plant in Voskresensk, Russia shut down last January because it couldn’t negotiate a reasonable rock contract. The Tunisians are producing at half of their rate due to labor unrest, environmental issues. OCP is in a turnaround with many of their plants converting to wet rock as opposed to dry rock.

And even in places like Brazil, if you look at their production numbers for the last year, their MAP production was off about 11% equal to about 140,000 tonnes, their SSP production down 6%, over 300,000 tonnes. So, good demand coupled with the fact that there’d been some supply issues and a lot of attention has been placed on the Chinese export 8 million tonnes of product last year. The fact is, I think the market needed that given the demand and supply developments.

<A – Jim Prokopanko – The Mosaic Co.>: Jeff, I encourage you and your colleagues, all, to just pay closer attention to this phosphate market. It’s a story we’ve been – the drum we’ve been beating for a couple of years now. This is a market that’s not fully understood and by that, not fully appreciated. This is a good – the phosphate is a good market. It’s really transformed over the last five years, six years. We’ve seen the structure change. We’ve seen the alternative suppliers find higher costs. Demand has just been outstanding.

We’re going to be over, well over, I think, 65 million tonnes, 66 million tonnes of phosphate production and it’s just as one that keeps on going and just hasn’t had the spotlight. Well, I think phosphate’s day has come and investors have to be mindful of that and be mindful of who the largest producer of finished phosphates in the world is, and that’s Mosaic, if you didn’t know.

Operator: Your next question comes from the line of P.J. Juvekar, Citibank. Your line is open.

<Q – P.J. Juvekar – Citigroup Global Markets, Inc. (Broker)>: Yes. Hi. Thank you. Two questions; first, in your December monthly Mosaic update, you talked about P and K volumes being down 22%, 25% for the fall and then in January, you reported robust volumes. So I guess my first question is what changed between sort of December and January?

<A – Jim Prokopanko – The Mosaic Co.>: Well, welcome, P.J. I’ll just give you a quick recap and then I’ll let my colleagues, either Rick McLellan or Mike Rahm add their perspective and it’s caught our attention. How could we be off and at the time that we looked at that November period, the early November, we’re looking at a big crop coming off in North America. We saw commodity prices, grain and oilseed, wheat prices weakening and we expected some lower, frankly, quite a bit lower corn prices and we were getting ready for a hard landing. The fact was that demand for grains and oilseeds picked up. The crop wasn’t quite as big as we thought and we saw grain and oilseed prices stabilize. With that, it was clear that farmers were going to farm again. And even with lower prices, farmers aren’t going to grow a smaller crop. They need to grow a bigger crop.

So, we knew they’d be coming to the market. We weren’t quite sure when and when it became clear that grain and oilseed prices weren’t going to fall off the table, dealers started coming back. Farmers started to play their hand that they were going to buy product again and here we go again. Rick, do you want to add something?

11

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Rick McLellan – The Mosaic Co.>: Yes. Good morning, P.J. We talked in market Mosaic and I’ll let Mike talk about the thought process there. But we talked about application being down. And we made the point that a lot of it is weather related and farmers that were applying and did get the chance to apply, applied at normal rates.

And the second piece that changed in December and it came quite quickly was the fact that farmers came in to retailers and bought prepaid fertilizer for this spring’s application at much higher amounts than last year. So, that forced the dealers to step in and buy. It’s a real good situation and you can’t confuse shipments versus applications.

<A – Mike Rahm – The Mosaic Co.>: Yes. Rick, and I’d just add a couple of things. One, I think weather. The fall application season ended pretty early in November and that’s when we made the assessment that usage on the farm was probably off 20% to 25% from normal. It was off, as Rick pointed out, not due to cutbacks in application rates necessarily, but simply that farmers couldn’t spread as many acres as they wanted to because of weather.

One other factor that I think came into play is that while November was a bad month weather-wise, December turned out to be pretty mild. And I recall talking to several dealers at our Ag College in early January that December was a very good month in terms of on-farm application in certain parts of the United States. So, there was a pretty good tail on to the end of the season.

And then the other factor, in terms of retailers, I think retailers saw that good tail application. And then at the same time, you’ll recall that prices bottomed in November and began to increase throughout December and into January, and certainly that provided dealers with some incentive to step up and position some product. And then throw on top of that, all the concerns that people have had about logistics and getting product in place. So, people were sort of, since the bottom was in, concerned about logistics, let’s fill up. And so retail dealers began to fill at that time.

Operator: Your next question comes from the line of Kevin McCarthy, Bank of America. Your line is open.

<Q – Kevin McCarthy – Bank of America Merrill Lynch>: Yes. Good morning. If we look at your Phosphate sales volume guidance for 2015 of 14.5 million tonnes to 15 million tonnes, it seems to suggest a much more rapid growth rate in your own phosphate volumes relative to the global market volumes that you outlined on slide five. And so I was wondering if you could clarify, does that 14.5 million tonnes to 15 million tonnes compare apples-to-apples with your, it looks like, 12.6 million tonnes in 2014? And if so, perhaps you could elaborate on why you would expect to gain share apparently as the year progresses?

<A – Jim Prokopanko – The Mosaic Co.>: Hey. Welcome to the call, Kevin. I’m going to turn it over to Rick McLellan, our Commercial leader to address that.

<A – Rick McLellan – The Mosaic Co.>: Morning, Kevin. I think the range 14.5 million tonnes to 15 million tonnes really affects – it really shows two things; one, is the full year impact of the CF production that we’re going to sell, the business that we’ve got from CF, and the ADM sales volumes that will come in to 2015.

<A – Rich Mack – The Mosaic Co.>: And, Kevin, this is Rich. In early March, when we post the historical financials for our Phosphates segment, we will have a revised guidance for the new segment, so for the manufacturing part of the business and the International Distribution component of the business, and nobody will be happier than me when we break those down into two separate reporting segments. So, you’ll get more information in a few weeks.

12

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Jim Prokopanko – The Mosaic Co.>: Kevin, to you and other listeners, we’ve been talking for the last 24 months at Mosaic about the various things we’re doing to improve our business to expand and grow our business, and we’re starting to see the results of many of these actions over the last 24 months. The CF – it’s coming to market now. We’re seeing the benefits. We’re seeing the lower costs that were unscaled that that brings with us. ADM, we’ve only owned that for about six weeks now. I was in Brazil last week. The market is a little late. As in North America, farmers are a little slow to come to market, but it’s going to work out very, very well for us. That access to tour the ports, to tour the inland distribution warehouses and the blend plants. We are extraordinarily well-positioned, perhaps, the best in the country, the best phosphate, potash producer to get our products to those customers. So, you’re going to see the payback from this.

Thanks for the question, Kevin.

Operator: Your next question comes from the line of Mark Connelly, CLSA. Your line is open.

<Q – Mark Connelly – CLSA Americas LLC>: Thanks. Just two things, I’m curious how the road delays in Brazil affect your thoughts about ramping up new initiatives with those distribution assets? And second, I’m curious if the Carlsbad closing had a meaningful impact on the margins that we should be taking into account when we’re thinking about the future course?

<A – Jim Prokopanko – The Mosaic Co.>: Hello and good morning, Mark. I’ll take the first question about Brazil, having just literally got back. And I’ll have Joc address the second question. I think you said it’s the rail delays or road?

<Q – Mark Connelly – CLSA Americas LLC>: The road delays. I mean, this stuff was supposed to be finished in December and now they’re saying it’s not even close.

<A – Jim Prokopanko – The Mosaic Co.>: That’s the road up to the Amazon Santarém. The big chunk of it is completed, but there’s pieces in the middle that aren’t completed. Rainy season is tough to fully utilize that road. It’s not really disrupting our efforts. We are working at – we brought a vessel in to the Amazon and tried that out. So that road is going to get built. Logistics are a challenge in Brazil, you’re absolutely right.

That’s why it was so important for us to make this investment with the ADM distribution business. Gives us additional port access, allows us the time with the additional warehouse capacity and space in-country in Mato Grasso, the northern states, northern locations in soybean growing area. It gives us the opportunity to get product much closer to the producer than we previously have.

The other part is just to comment about this season. Farmers are coming to the market a little later. We’ve had some economic issues in Brazil. The country has – the real has devalued which in the end means soybean farmers are going to get more cash, more U.S. dollars for their soybeans. So farmers are just being as in North America, a little more cautious.

But that doesn’t mean that they’re not going to buy in style. So we’re optimistic about yet another good season ahead of us in Brazil. So it’s all working out and that’s one thing about Brazil. As big as the challenges are, they somehow make that place work and we’ve really enhanced our position with additional port and interior distribution. Joc, your turn.

<A – Joc O’Rourke – The Mosaic Co.>: Yes, so Carlsbad, of course, the strategic reasoning behind Carlsbad is with the new production that we’ve brought on through K2 expansion and now Colonsay expansion, we can deliver to the U.S. markets more economically from our Canadian mines. And what that means overall is a margin improvement of probably in the range of $4 a tonne all coming from the cost of delivery.

13

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Operator: Your next question comes from the line of Yonah Weisz, HSBC. Your line is open.

<Q – Yonah Weisz – HSBC Bank Plc (Tel Aviv Branch)>: Hi there. That’s Yonah Wiesz from HSBC. Thank you, very much. If I may ask a question on India demand, both for potash and for phosphates and then maybe just one quick follow-up clarification. But in India, we had an agricultural report out I believe todaythat stated 5 million tonnes of potash amount in the coming year and I’m wondering if you could give some detail or color of how you see that market, both on a regulatory point of view or capacity point of view as well as the actual demand on the ground, both of course for potash and also very significantly for phosphates, if you feel that there’s going to be a stronger demand in South America than I guess in India, to which would have a greater impact. I’m wondering if you could give more detail on that.

And then a second quick clarification question, I think perhaps, Jim, did you say earlier on that potash shipments are still continuing to China or did I mishear that?

<A – Jim Prokopanko – The Mosaic Co.>: Good morning, Yonah. Sorry. Your line was just breaking up a bit. The second question aboutpPotash was, could you repeat that please?

<Q – Yonah Weisz – HSBC Bank Plc (Tel Aviv Branch)>: Did I hear you possibly say that potash shipments are still continuing to China?

<A – Jim Prokopanko – The Mosaic Co.>: Okay. Yes. I got you. I’ll take that question and then Mike can address your question about Indian potash, phosphate demand. Yes, there is some – some of the suppliers in the world are providing continued shipments although in a much reduced rate, even without a contract. So product is moving.

Nothing near what the Chinese need to China, so we had good shipments ourselves to China in the second half. And as I said, we do not have the tonnes to ship this quarter but we have seen some other people move product into position, un-priced and that all yet has to be priced and that will happen as it feels now sometime after the Chinese New Year. But definitely in this first quarter, the Chinese need to have product move in earnest to China, certainly by sometime in April.

Mike, over to you.

<A – Mike Rahm – The Mosaic Co.>: Sure. With respect to India, and good morning, Yonah. Good to talk with you again. I think there are several factors that make us think the stars and moons are lining up in India for very strong import demand. If you start at the farm, farm economics in India remain very good, given some of the increases in their minimum support prices, given the fact that subsidies are in place for fertilizer.

We believe that the pipeline in India is at extremely low levels, and there’s a real need to replenish that. When I talk about the pipeline, I’m referring primarily to the retail pipeline, the tens of thousands of shops that have a few bags of fertilizer in the back storage room. We think that’s where the pipeline is pretty much bare.

And then a couple of other factors; the rupee has performed reasonably well, given the chaos that’s taken place in the rest of the world. And then finally, I think if India is going to make any change in subsidy programs, this is a year where there is some potential for that. And when you look at the fact that oil prices have dropped in half, and oil is the largest import in India, it gives them a few more degrees of freedom, I think, to modify their subsidy.

So, I think the bottom line is, India needs P and K imports. Stars and moons are lined up. And we think as the government is deliberating the 2015-2016 budget, that they will make import economics work simply because the product is needed.

14

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

And then when we look out longer-term, I think India, as everyone knows, there’s simply – have a tremendous nutrient imbalance. They need to use a lot more phosphate and potash over time, and we’re of the view that Indian phosphate imports could double between now and the end of this decade, and they would still be just slightly above peak imports of 2010. So, we’re sort of banking on India in many ways, and we think that this is the year that India comes through.

Operator: Your next question comes from the line of Andrew Wong, RBC Capital. Your line is open.

<Q – Andrew Wong – RBC Capital Markets Asset Management>: Hi. Thanks for taking my questions. So, first would be just I want to ask about the leverage. I mean, it looks like you’re comfortably within your target range, 1.5 times to 2 times debt-to-EBITDA. How can we expect to see that evolve over time? Are you comfortable with that, maintaining that level or could we see that maybe going up over time or maybe it’ll come down as your EBITDA grows?

And then my second question will just be on the phosphate side of things. We’ve seen a few acquisitions. You have the Ma’aden project coming on line. Are you satisfied with that phosphates footprint or are there more opportunities to grow that? Thanks.

<A – Jim Prokopanko – The Mosaic Co.>: Welcome to the call, and thanks for your interest, Andrew. I’m going to have Rich speak to the question of leverage.

<A – Rich Mack – The Mosaic Co.>: Andrew, I think what I would say is I don’t want to steal our thunder for Analyst Day, but we will have more information on our balance sheet targets in late March. I do agree with you that the ratio will come down just through the fact that EBITDA growth is going to enhance obviously over the course of the next several years, and I think you have to take a look at our leverage ratios and our liquidity buffer in tandem and look at our overall capital management philosophy in terms of what we’re going to do with excess cash and returning that to shareholders.

So, we look forward to having that conversation and providing some additional insight in late March, and we look forward to talking to you then.

<A – Jim Prokopanko – The Mosaic Co.>: Andrew, I’ll take your question. It’s Jim here. I’ll take your question about the phosphate and the degree to which we’re satisfied with our current footprint. This is a market that we continue to be positive about. The market, as I said earlier, has changed. The structure of the industry has changed for the better, and the barriers to entry are huge. And so we feel very good about the market. If that’s signaling that we’re interested in growing in the phosphate market, you absolutely heard right.

We’d like to have a bigger footprint in the market. That’s in part the reason we invested in the Ma’aden joint venture. Some years out, there could be a Ma’aden Phase 3, but we are going to continue to look for opportunities to be a bigger player in phosphate production and, ideally, to broaden our geographic presence. Latin America is an excellent – is one of the fastest-growing agricultural regions in the world. If there was some way to get into the phosphate business in Latin America, we’d be interested in doing that.

As you know, in North America, we’re pretty well limited on MAP and DAP production. However, we’re limited because of the mining capacity and plant capacity. But what we’ve done is transform that commodity MAP/DAP business with our MicroEssentials product. So, we will, I see, get to a point that virtually one-half of our approximate 10 million-tonne annual production will be a MicroEssentials product. This has been a tremendous product for the, first of all, for the customer, real value.

15

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

We have demand exceeding our supply capacity, which is behind our approximate $250 million in investing our MicroEssentials production capacity. And we’ve got a multi-year expansion plan for MicroEssentials that will get us, I think by the end of the decade, to close to one-half of all our phosphates being our proprietary, a highly valued MicroEssentials product. So, yes, I’m a booster of phosphates. It’s been underappreciated these years. Its day is here, and we’d like to grow that business.

Operator: Your next question comes from the line of Matthew Korn, Barclays. Your line is open.

<Q – Matthew Korn – Barclays Capital, Inc.>: Thank you. Good morning, Jim, Rich, everyone. Congratulations for the quarter and thanks for taking my questions. One question more tactical and one more big picture, I guess. First, if you could clarify, I think you mentioned that North American Potash shipments, you saw at least early on in the year, limited by inventory availability? Could you talk a little bit about what the underlying causes of this are? Are logistic constraints something that’s still holding back some distribution capacity here in the States?

And then second, Jim, you spoke well of how I think the company is preparing and executing as you wait for an improvement in market conditions. But where are we, in your opinion, on the process of kind of going through the cycle and seeing crop prices recover somewhat?

I took note. You mentioned how farmers surprised and that they still came to market. They’re planting heavily. So, is this year another one of the crop stock building, or do you kind of see this year-over-year decline in global K and P demand indicative of a meaningful turn in supply and better crop prices sooner than later? Thanks.

<A – Jim Prokopanko – The Mosaic Co.>: Good morning, Matthew. A couple of thoughtful questions. I’m going to have Mike Rahm address the question about North America potash inventory availability et cetera, and I’ll touch on where we believe we’re in the Ag cycle. Mike?

<A – Mike Rahm – The Mosaic Co.>: Well, I think in the case of potash and then, Rick, you certainly can comment. But we’ve seen a fair amount of inventory move from producers downstream into the channel. If you follow the IPNI statistics, just a tremendous drop, about a 1.7 million-tonne drop in producer held potash inventories in North America.

And then I think that has moved into the system. And I don’t think North American situation is unique. I think most producers around the globe have shipped very hard into the system and certainly the shipment numbers reflect that. You’ve probably seen our estimate of over 61 million tonnes and that’s probably at the low end of the range of some of the numbers that you’ve seen here recently.

So, I think the bottom line is there are inventories that have moved further downstream. And I think in the case of where those are, we think China has a bit of inventory build. And in the U.S., I think retailers are in a much better position this year than a year ago. They’ve learned from some of the logistical problems and constraints. I think they see probably better than expected demand earlier in the year. So, as you’d expect at this point in time, I think the system is pretty well loaded for the spring season.

<A – Jim Prokopanko – The Mosaic Co.>: Thanks, Mike. The question about – it’s a good one about where we are in the Ag cycle. And if you want to place I’d say somewhere in the trough of the cycle, we’ve gone through a couple of years where the world has grown bumper crops. We’ve seen world grain and oilseed stock to use ratios build and that’s taken some of the edge off of the grain prices. With that said, farmers still remain profitable. Farmers have had five great, great years to build their balance sheets, to build their farming enterprises, and where we go next from here is the

16

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

next crop that we’re going to be planting. We’re seeing Brazilian soybean crop that is okay, a long ways to go yet, some drought impact, so it’s not as big as we thought it is.

We have U.S. crop that by looking out my windows when I’m in Minneapolis, it looks like it’s going to be an early season, much of the, at least, the Midwest, Boston, New York aside. They don’t grow much corn. Other corn growing areas don’t have a lot of corn – or a lot of snow, I should say, in the field. So, it could be an early season. Farmers are going to get a lot of acreage planted and the supply of grain and oilseeds that we see come to market this next year is going to be telling.

So, that’s the ag side, grain and oilseed side. The other side as relates to fertilizer is the supply side, and we’ve got a tightening market. We’ve lost some potash production to mine losses and mine closures. We have some new mines coming onstream. phosphate, if anything, we’re seeing less availability of phosphate, so we feel good about the fundamentals of our crop nutrition industry.

And I’m going to just have Mike add one comment here.

<A – Mike Rahm – The Mosaic Co.>: I’ll just make a quick comment, Jim. As you’ve said, we’ve had tremendous crops, with average yields well above trend. If you simply do the math and far more spread sheets, I think as Vincent Andrews has coined, and take a look, if next year, we get a trend yield worldwide and we get trend growth in demand, we’re going to pull down inventories.

And I think that goes back to what we’ve always said that the long-term food story is still very much intact, that we’re going to have to continue to increase planted area and continue to grow crops and achieve trend yields in order to meet demand. And I think that’s the bottom line. We certainly haven’t changed our view in terms of long-term positive outlook for global agriculture.

<A – Jim Prokopanko – The Mosaic Co.>: Okay. Thanks, Mike. We’re running a bit late. We have time for one more question.

Operator: Your next question comes from the line of Adam Samuelson, Goldman Sachs. Your line is open.

<Q – Adam Samuelson – Goldman Sachs & Co.>: Great. Thanks very much and thanks for squeezing me in. Maybe two questions; first, in potash, can you talk, Jim, about the outlook for production cost, in 2015. Clearly there – you had the proving runs running in Colonsay very hard. Carlsbad is out of the system. That gives you a little bit of a cost tailwind but expectations on unit cost on potash.

And maybe second question and it ties in a little bit, can you think about the impact of a stronger U.S. dollar on your business? Clearly, there’s some Canadian dollar tailwind in potash, but impact on your customers as you think about a stronger dollar impact on commodity prices and production cost for some of your customers in emerging markets.

<A – Jim Prokopanko – The Mosaic Co.>: So, welcome, Adam. I’m going to ask Joc O’Rourke speak to the production costs for Potash in the coming year and I’ll have some comments about the currency question.

<A – Joc O’Rourke – The Mosaic Co.>: So, Adam, I’m going to incorporate a little bit of what you’ve asked Jim in this as well. So our production cost last quarter were $91 cash per tonne which included $17 of brine inflow cost. That really is probably the best indicator right now of where we are with respect to our cost per tonne.

Although we expect the improvement as we reduce some our cost initiative. But it really shows the leverage we’ve got now already. And if you look going forward, a lot of that is our cost savings not

17

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

just the U.S. dollar, but the Canadian dollar is also giving us a pretty good tailwind. So, we expect if we can run hard, we’re going to be in that kind of $74 a tonne plus the brine cost of, say, $17. So, that’s a pretty good indication where we’ll be going forward.

<A – Jim Prokopanko – The Mosaic Co.>: All right, Adam, on the currency question, stronger U.S. dollar, Joc made a good point that the potash business, we have a dollar denominated cost there that Canadian dollars come down relative to the U.S. dollar. But nothing like the ruble. The Belarusian and the Russian ruble are well, well off, we all know. So that has undoubtedly given the Russian and Belarusian producers some advantage yet it’s not – their business doesn’t all run on rubles. They have euro and U.S. denominated debt. Their suppliers are typically the miners and the equipment suppliers are typically other non-Russian company. So, they’re paying for much part of their expenses in U.S. dollars.

However, they’re going to have labor costs that are lower, and with time, that is going to adjust when you have these maxi devaluations that go on, you’ll see inflation come roaring into those geographies. So, we think this is going to be at most a temporary advantage to those producing in devalued currency.

On the farm side, many crops are denominated in U.S. dollars. So, with this decline in the Brazilian reais, I think we’re down 30% on the reais value. That is close to 30%. That is resulting in close to a 30% increase in the U.S. dollar and the amount of U.S. dollars that a Brazilian farmer gets. Their expenses are going to be a little higher but the margins they’re going to make, is going to be larger because of a stronger U.S. dollar.

So net-net, with lower fuel costs, low interest rates, I don’t think this is going to be damaging to our farmer customer by seeing the strong U.S. dollar.

James T. Prokopanko, President and Chief Executive Officer

With that, we’re going to conclude the call. Thanks for that last question, Adam. And to wrap up, I’d like to reiterate our key messages. First, our strategic moves have generated good earnings leverage and our results, as I’ve said, are beginning to demonstrate the potential we promised and that we’re building. Second, global demand for our products, have been very strong and we expect the high demand to continue through 2015.

And finally, we’ve demonstrated some tremendous execution capability. You just cannot imagine how proud I am of the 9,000 plus colleagues that I have at The Mosaic Company. Many among the long list of moves that we’ve announced over these past 18 months are now fully operationalized. I know we get some comments that we are initiative-heavy. Well, many of those initiatives have been completed according to plan and delivering the results that we promised.

With that, I’ll close the call with another invitation to attend our Analyst Day in March 30 at Streamsong in Florida. We hope to see you there. Have a great and safe day, everybody.

Operator: This concludes today’s conference call. You may now disconnect. Thank you.

18

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2014 Earnings Call | Feb. 11, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Disclaimer

The information herein is based on sources we believe to be reliable but is not guaranteed by us and does not purport to be a complete or error-free statement or summary of the available data. As such, we do not warrant, endorse or guarantee the completeness, accuracy, integrity, or timeliness of the information. You must evaluate, and bear all risks associated with, the use of any information provided hereunder, including any reliance on the accuracy, completeness, safety or usefulness of such information. This information is not intended to be used as the primary basis of investment decisions. It should not be construed as advice designed to meet the particular investment needs of any investor. This report is published solely for information purposes, and is not to be construed as financial or other advice or as an offer to sell or the solicitation of an offer to buy any security in any state where such an offer or solicitation would be illegal. Any information expressed herein on this date is subject to change without notice. Any opinions or assertions contained in this information do not represent the opinions or beliefs of FactSet CallStreet, LLC. FactSet CallStreet, LLC, or one or more of its employees, including the writer of this report, may have a position in any of the securities discussed herein.

THE INFORMATION PROVIDED TO YOU HEREUNDER IS PROVIDED "AS IS," AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, FactSet CallStreet, LLC AND ITS LICENSORS, BUSINESS ASSOCIATES AND SUPPLIERS DISCLAIM ALL WARRANTIES WITH RESPECT TO THE SAME, EXPRESS, IMPLIED AND STATUTORY, INCLUDING WITHOUT LIMITATION ANY IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY, COMPLETENESS, AND NON-INFRINGEMENT. TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, NEITHER FACTSET CALLSTREET, LLC NOR ITS OFFICERS, MEMBERS, DIRECTORS, PARTNERS, AFFILIATES, BUSINESS ASSOCIATES, LICENSORS OR SUPPLIERS WILL BE LIABLE FOR ANY INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR PUNITIVE DAMAGES, INCLUDING WITHOUT LIMITATION DAMAGES FOR LOST PROFITS OR REVENUES, GOODWILL, WORK STOPPAGE, SECURITY BREACHES, VIRUSES, COMPUTER FAILURE OR MALFUNCTION, USE, DATA OR OTHER INTANGIBLE LOSSES OR COMMERCIAL DAMAGES, EVEN IF ANY OF SUCH PARTIES IS ADVISED OF THE POSSIBILITY OF SUCH LOSSES, ARISING UNDER OR IN CONNECTION WITH THE INFORMATION PROVIDED HEREIN OR ANY OTHER SUBJECT MATTER HEREOF.

The contents and appearance of this report are Copyrighted FactSet CallStreet, LLC 2015. CallStreet and FactSet CallStreet, LLC are trademarks and service marks of FactSet CallStreet, LLC. All other trademarks mentioned are trademarks of their respective companies. All rights reserved.

19

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

The Mosaic Company Earnings Conference Call – Fourth Quarter and Full Year 2014 February 11, 2015 Jim Prokopanko, President and Chief Executive Officer Rich Mack, Executive Vice President and Chief Financial Officer Laura Gagnon, Vice President Investor Relations