UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) January 30, 2015

SAIA, INC.

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-49983 |

|

48-1229851 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

|

|

|

|

|

| 11465 Johns Creek Parkway, Suite 400, Johns Creek, GA |

|

30097 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (770) 232-5067

No Changes.

(Former name

or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition |

On January 30, 2015 Saia, Inc. issued a press

release announcing its fourth quarter 2014 results. A copy of the press release is attached as Exhibit 99.1 to this Report on Form 8-K.

The information

furnished under this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the

liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Registrant under the Securities Act of 1933, as amended, of the Exchange Act, except as otherwise expressly stated in any such filing.

| Item 9.01 |

Financial Statements and Exhibits |

|

|

|

| 99.1 |

|

Press release of Saia, Inc. dated January 30, 2015 announcing results of operations. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

SAIA, INC. |

|

|

|

|

|

| Date: January 30, 2015 |

|

/s/ Frederick J. Holzgrefe, III |

|

|

|

|

Frederick J. Holzgrefe, III Vice President

of Finance and Chief Financial Officer |

|

|

Exhibit 99.1

Saia Reports Fourth Quarter Earnings per Share of $0.53

JOHNS CREEK, GA. – January 30, 2015 – Saia, Inc. (NASDAQ: SAIA), a leading transportation provider offering multi-regional less-than-truckload

(LTL), non-asset truckload and logistics services, today reported record fourth quarter and full year 2014 results. Diluted earnings per share were $0.53 for the fourth quarter and include a $0.04 per share positive impact from tax credits for the

full year 2014, enacted in the fourth quarter. The Company earned $0.32 per diluted share in the fourth quarter of 2013.

Fourth Quarter 2014 Compared

to Fourth Quarter 2013 Results

| |

• |

|

Revenues were $310 million, an increase of 10.7% |

| |

• |

|

Operating income increased 40% to $20.6 million compared to $14.7 million |

| |

• |

|

Diluted earnings per share were $0.53 including $0.04 in tax credits enacted in the fourth quarter compared to $0.32 |

| |

• |

|

Operating ratio was 93.4 compared to 94.7 |

| |

• |

|

LTL tonnage increased 4.3% as LTL shipments were up 7.2% and average weight per LTL shipment fell by 2.7% |

| |

• |

|

LTL revenue per hundredweight increased by 6.0% |

“Demand in the quarter was consistent with seasonal

expectations and I am pleased with the work of our team to deliver 98% on-time service in the quarter. Our significant year-over-year increase in earnings per share was achieved through our balanced approach towards adding tonnage at a reasonable

price,” said Saia President and Chief Executive Officer Rick O’Dell.

“We are proud of Saia’s 90 year operating history celebrated in

2014 and it is gratifying to close that year with record revenue and earnings,” O’Dell added.

2014 Results Compared to 2013 Results

| |

• |

|

LTL tonnage increased 6.3%, while yield improved 4.4% |

| |

• |

|

Revenues were $1.3 billion compared to $1.1 billion |

| |

• |

|

Operating income was $85.7 million compared to $74.4 million |

| |

• |

|

Net income was $52.0 million compared to $43.6 million |

| |

• |

|

Diluted earnings per share were $2.04 compared to $1.73, which included $0.04 in tax credits enacted in 2013 retroactive to 2012 |

| |

• |

|

Operating ratio was 93.3 compared to 93.5 |

Saia, Inc. Fourth Quarter 2014 Results

Page

2

Financial Position and Capital Expenditures

Total debt was $83.0 million at December 31, 2014. Net of the Company’s $4.4 million cash balance at quarter end, net debt to total capital was

17.7%. This compares to total debt of $76.9 million and net debt to total capital of 20.1% at December 31, 2013.

Net capital expenditures in 2014

were $112 million inclusive of equipment acquired with capital leases. This compares to $122 million in the prior year. The Company currently plans net capital expenditures in 2015 of approximately $125 million. This expenditure level reflects

primarily replacement of revenue equipment, and investments in real estate projects and technology.

Conference Call

Management will hold a conference call to discuss quarterly results today at 11:00 a.m. Eastern Time. To participate in the call, please dial 888-359-3624 or

719-325-2495 referencing conference ID #5368032. Callers should dial in five to ten minutes in advance of the conference call. This call will be webcast live via the Company web site at www.saiacorp.com. A replay of the call will be offered two

hours after the completion of the call through February 5, 2015 at 2:00 p.m. Eastern Time. The replay will be available by dialing 1-888-203-1112 or 719-457-0820.

Saia, Inc. (NASDAQ: SAIA) offers customers a wide range of less-than-truckload, non-asset truckload, expedited and logistics services. With headquarters in

Georgia, Saia LTL Freight operates 147 terminals in 34 states. For more information on Saia, Inc. visit the Investor Relations section at www.saiacorp.com.

The Securities and Exchange Commission encourages companies to disclose forward-looking information so that investors can better understand the future

prospects of a company and make informed investment decisions. This news release contains these types of statements, which are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

Words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “may,” “plan,”

“predict,” “believe,” “should” and similar words or expressions are intended to identify forward-looking statements. Investors should not place undue reliance on forward-looking statements and the Company undertakes no

obligation to update or revise any forward-looking statements. All forward-looking statements reflect the present expectation of future events of our management as of the date of this news release and are subject to a number of important factors,

risks, uncertainties and assumptions that could cause actual results to differ materially from those described in any forward-looking statements. These factors, risks, assumptions and uncertainties include, but are not limited to, general economic

conditions including downturns in the business cycle; the creditworthiness of our customers and their ability to pay for services; competitive initiatives and pricing pressures, including in connection with fuel surcharge; loss of significant

customers; the Company’s need for capital and uncertainty of the current credit markets; the possibility of defaults under the Company’s debt agreements (including violation of financial covenants); possible issuance of equity which would

dilute stock ownership; integration risks; the effect of litigation including class action lawsuits; cost and availability of qualified drivers, fuel, purchased transportation, real property, revenue equipment and other assets; governmental

Saia, Inc. Fourth Quarter 2014 Results

Page

3

regulations, including but not limited to Hours of Service, engine emissions, the “Compliance, Safety, Accountability” (CSA) initiative, compliance with legislation requiring companies

to evaluate their internal control over financial reporting, changes in interpretation of accounting principles and Homeland Security; dependence on key employees; inclement weather; labor relations, including the adverse impact should a portion of

the Company’s workforce become unionized; cyber security risks; effectiveness of Company-specific performance improvement initiatives; terrorism risks; self-insurance claims and other expense volatility; increased costs as a result of recently

enacted healthcare reform legislation and other financial, operational and legal risks and uncertainties detailed from time to time in the Company’s SEC filings. As a result of these and other factors, no assurance can be given as to our future

results and achievements. A forward looking statement is neither a prediction nor a guarantee of future events or circumstances and those future events or circumstances may not occur.

# # #

CONTACT: Saia,

Inc.

Doug Col

dcol@saia.com

678.542.3910

Saia, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(Amounts in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

December 31,

2014 |

|

|

December 31,

2013 |

|

| ASSETS |

|

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

4,367 |

|

|

$ |

159 |

|

| Accounts receivable, net |

|

|

128,367 |

|

|

|

117,937 |

|

| Prepaid expenses and other |

|

|

56,902 |

|

|

|

52,157 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

189,636 |

|

|

|

170,253 |

|

|

|

|

| PROPERTY AND EQUIPMENT: |

|

|

|

|

|

|

|

|

| Cost |

|

|

891,145 |

|

|

|

797,527 |

|

| Less: accumulated depreciation |

|

|

407,505 |

|

|

|

365,301 |

|

|

|

|

|

|

|

|

|

|

| Net property and equipment |

|

|

483,640 |

|

|

|

432,226 |

|

|

|

|

| OTHER ASSETS |

|

|

13,169 |

|

|

|

14,322 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

686,445 |

|

|

$ |

616,801 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

42,388 |

|

|

$ |

50,799 |

|

| Wages and employees’ benefits |

|

|

28,777 |

|

|

|

35,248 |

|

| Other current liabilities |

|

|

50,176 |

|

|

|

47,667 |

|

| Current portion of long-term debt |

|

|

9,138 |

|

|

|

7,143 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

130,479 |

|

|

|

140,857 |

|

|

|

|

| OTHER LIABILITIES: |

|

|

|

|

|

|

|

|

| Long-term debt, less current portion |

|

|

73,897 |

|

|

|

69,740 |

|

| Deferred income taxes |

|

|

78,406 |

|

|

|

69,916 |

|

| Claims, insurance and other |

|

|

36,757 |

|

|

|

31,496 |

|

|

|

|

|

|

|

|

|

|

| Total other liabilities |

|

|

189,060 |

|

|

|

171,152 |

|

|

|

|

| STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

|

| Common stock |

|

|

25 |

|

|

|

24 |

|

| Additional paid-in capital |

|

|

223,713 |

|

|

|

213,648 |

|

| Deferred compensation trust |

|

|

(2,189 |

) |

|

|

(2,246 |

) |

| Retained earnings |

|

|

145,357 |

|

|

|

93,366 |

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

366,906 |

|

|

|

304,792 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

686,445 |

|

|

$ |

616,801 |

|

|

|

|

|

|

|

|

|

|

4

Saia, Inc. and Subsidiaries

Consolidated Statements of Operations

For the Quarters and Years Ended December 31, 2014 and 2013

(Amounts in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fourth Quarter |

|

|

Years |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| OPERATING REVENUE |

|

$ |

309,648 |

|

|

$ |

279,655 |

|

|

$ |

1,272,321 |

|

|

$ |

1,139,094 |

|

|

|

|

|

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries, wages and employees’ benefits |

|

|

162,854 |

|

|

|

144,019 |

|

|

|

639,633 |

|

|

|

572,487 |

|

| Purchased transportation |

|

|

22,214 |

|

|

|

17,952 |

|

|

|

99,610 |

|

|

|

72,975 |

|

| Fuel, operating expenses and supplies |

|

|

73,347 |

|

|

|

73,405 |

|

|

|

314,788 |

|

|

|

306,364 |

|

| Operating taxes and licenses |

|

|

9,027 |

|

|

|

8,530 |

|

|

|

36,028 |

|

|

|

36,513 |

|

| Claims and insurance |

|

|

6,912 |

|

|

|

7,409 |

|

|

|

37,563 |

|

|

|

25,494 |

|

| Depreciation and amortization |

|

|

14,758 |

|

|

|

13,799 |

|

|

|

59,022 |

|

|

|

51,564 |

|

| Operating gains, net |

|

|

(36 |

) |

|

|

(151 |

) |

|

|

(16 |

) |

|

|

(721 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

289,076 |

|

|

|

264,963 |

|

|

|

1,186,628 |

|

|

|

1,064,676 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING INCOME |

|

|

20,572 |

|

|

|

14,692 |

|

|

|

85,693 |

|

|

|

74,418 |

|

|

|

|

|

|

| NONOPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

1,007 |

|

|

|

1,584 |

|

|

|

4,564 |

|

|

|

6,490 |

|

| Other, net |

|

|

(50 |

) |

|

|

(37 |

) |

|

|

(99 |

) |

|

|

(217 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonoperating expenses, net |

|

|

957 |

|

|

|

1,547 |

|

|

|

4,465 |

|

|

|

6,273 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME TAXES |

|

|

19,615 |

|

|

|

13,145 |

|

|

|

81,228 |

|

|

|

68,145 |

|

| Income tax expense |

|

|

6,046 |

|

|

|

5,081 |

|

|

|

29,237 |

|

|

|

24,518 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

$ |

13,569 |

|

|

$ |

8,064 |

|

|

$ |

51,991 |

|

|

$ |

43,627 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common shares outstanding — basic |

|

|

24,624 |

|

|

|

24,246 |

|

|

|

24,505 |

|

|

|

24,154 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common shares outstanding — diluted |

|

|

25,565 |

|

|

|

25,289 |

|

|

|

25,463 |

|

|

|

25,205 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

|

$ |

0.55 |

|

|

$ |

0.33 |

|

|

$ |

2.12 |

|

|

$ |

1.81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share |

|

$ |

0.53 |

|

|

$ |

0.32 |

|

|

$ |

2.04 |

|

|

$ |

1.73 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5

Saia, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

For the Years Ended December 31, 2014 and 2013

(Amounts in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Years |

|

| |

|

2014 |

|

|

2013 |

|

| OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

$ |

102,170 |

|

|

$ |

101,312 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

102,170 |

|

|

|

101,312 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Acquisition of property and equipment |

|

|

(97,750 |

) |

|

|

(126,358 |

) |

| Proceeds from disposal of property and equipment |

|

|

2,905 |

|

|

|

4,338 |

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(94,845 |

) |

|

|

(122,020 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Repayment of long-term debt |

|

|

(7,143 |

) |

|

|

(22,143 |

) |

| Borrowings (repayment) of revolving credit agreement, net |

|

|

(3,317 |

) |

|

|

38,327 |

|

| Proceeds from stock option exercises |

|

|

7,623 |

|

|

|

4,948 |

|

| Other financing activities |

|

|

(280 |

) |

|

|

(586 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) financing activities |

|

|

(3,117 |

) |

|

|

20,546 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS |

|

|

4,208 |

|

|

|

(162 |

) |

| CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD |

|

|

159 |

|

|

|

321 |

|

|

|

|

|

|

|

|

|

|

| CASH AND CASH EQUIVALENTS, END OF PERIOD |

|

$ |

4,367 |

|

|

$ |

159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| NON-CASH ITEMS: |

|

|

|

|

|

|

|

|

| Acquisition of property and equipment financed with capital leases |

|

$ |

16,886 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

6

Saia, Inc. and Subsidiaries

Financial Information

For the Quarters Ended December 31, 2014 and 2013

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter |

|

|

|

|

| |

|

|

|

Fourth Quarter |

|

|

%

Change |

|

|

Amount/Workday |

|

|

%

Change |

|

| |

|

|

|

2014 |

|

|

2013 |

|

|

|

2014 |

|

|

2013 |

|

|

| Workdays |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

62 |

|

|

|

62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating ratio |

|

|

|

|

93.4 |

% |

|

|

94.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tonnage (1) |

|

LTL |

|

|

926 |

|

|

|

888 |

|

|

|

4.3 |

|

|

|

14.94 |

|

|

|

14.32 |

|

|

|

4.3 |

|

|

|

TL |

|

|

195 |

|

|

|

187 |

|

|

|

4.1 |

|

|

|

3.14 |

|

|

|

3.02 |

|

|

|

4.1 |

|

|

|

|

|

|

|

|

|

| Shipments (1) |

|

LTL |

|

|

1,597 |

|

|

|

1,490 |

|

|

|

7.2 |

|

|

|

25.77 |

|

|

|

24.04 |

|

|

|

7.2 |

|

|

|

TL |

|

|

28 |

|

|

|

27 |

|

|

|

4.5 |

|

|

|

0.45 |

|

|

|

0.43 |

|

|

|

4.5 |

|

|

|

|

|

|

|

|

|

| Revenue/cwt. (2) |

|

LTL |

|

$ |

15.33 |

|

|

$ |

14.46 |

|

|

|

6.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TL |

|

$ |

6.16 |

|

|

$ |

5.73 |

|

|

|

7.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue/shipment (2) |

|

LTL |

|

$ |

177.72 |

|

|

$ |

172.22 |

|

|

|

3.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TL |

|

$ |

858.96 |

|

|

$ |

802.35 |

|

|

|

7.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pounds/shipment |

|

LTL |

|

|

1,159 |

|

|

|

1,191 |

|

|

|

(2.7 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TL |

|

|

13,940 |

|

|

|

13,992 |

|

|

|

(0.4 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Length of Haul |

|

|

|

|

773 |

|

|

|

746 |

|

|

|

3.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (2) |

Revenue does not include the adjustment required for financial statement purposes in accordance with the Company’s revenue recognition policy and other revenue. |

7

Saia, Inc. and Subsidiaries

Financial Information

For the Years Ended December 31, 2014 and 2013

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Year Over Year |

|

|

|

|

| |

|

|

|

Year Over Year |

|

|

%

Change |

|

|

Amount/Workday |

|

|

%

Change |

|

| |

|

|

|

2014 |

|

|

2013 |

|

|

|

2014 |

|

|

2013 |

|

|

| Workdays |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

253 |

|

|

|

253 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating ratio |

|

|

|

|

93.3 |

% |

|

|

93.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tonnage (1) |

|

LTL |

|

|

3,902 |

|

|

|

3,670 |

|

|

|

6.3 |

|

|

|

15.42 |

|

|

|

14.51 |

|

|

|

6.3 |

|

|

|

TL |

|

|

853 |

|

|

|

708 |

|

|

|

20.6 |

|

|

|

3.37 |

|

|

|

2.80 |

|

|

|

20.6 |

|

|

|

|

|

|

|

|

|

| Shipments (1) |

|

LTL |

|

|

6,646 |

|

|

|

6,260 |

|

|

|

6.2 |

|

|

|

26.27 |

|

|

|

24.74 |

|

|

|

6.2 |

|

|

|

TL |

|

|

122 |

|

|

|

102 |

|

|

|

19.1 |

|

|

|

0.48 |

|

|

|

0.40 |

|

|

|

19.1 |

|

|

|

|

|

|

|

|

|

| Revenue/cwt. (2) |

|

LTL |

|

$ |

14.96 |

|

|

$ |

14.33 |

|

|

|

4.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TL |

|

$ |

5.87 |

|

|

$ |

5.84 |

|

|

|

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue/shipment (2) |

|

LTL |

|

$ |

175.71 |

|

|

$ |

168.06 |

|

|

|

4.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TL |

|

$ |

821.46 |

|

|

$ |

807.21 |

|

|

|

1.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pounds/shipment |

|

LTL |

|

|

1,174 |

|

|

|

1,173 |

|

|

|

0.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TL |

|

|

13,993 |

|

|

|

13,821 |

|

|

|

1.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Length of Haul |

|

|

|

|

763 |

|

|

|

741 |

|

|

|

3.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (2) |

Revenue does not include the adjustment required for financial statement purposes in accordance with the Company’s revenue recognition policy and other revenue. |

8

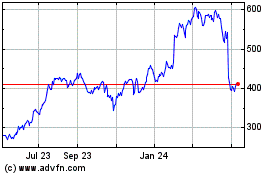

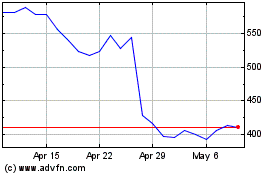

Saia (NASDAQ:SAIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Saia (NASDAQ:SAIA)

Historical Stock Chart

From Apr 2023 to Apr 2024