Current Report Filing (8-k)

January 16 2015 - 8:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 15, 2015

PARKERVISION, INC.

(Exact Name of Registrant as Specified in Charter)

|

Florida

|

000-22904

|

59-2971472

|

|

(State or Other Jurisdiction

|

(Commission

|

(IRS Employer

|

|

of Incorporation)

|

File Number)

|

Identification No.)

|

|

7915 Baymeadow Way, Jacksonville, Florida

|

32256

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(904) 732-6100

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c))

|

On January 15, 2015, ParkerVision, Inc. (the “Company”) consummated the sale of three warrants (“Warrants”), each for the purchase of up to 1,884,058 shares of common stock, par value $0.01 per share (“Common Stock”), at exercise prices of $1.50, $2.50 and $3.50 per share, respectively. The Warrants were sold to 1624 PV LLC for a purchase price of $1.3 million pursuant to a Warrant Subscription Agreement, dated December 23, 2014 between the parties.

The Warrant is more fully described in the Company’s Current Report on Form 8-K, filed on December 23, 2014, and such description is incorporated herein by reference.

The press release announcing the consummation of the sale is attached hereto as Exhibit 99.1.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 16, 2015

| |

PARKERVISION, INC.

|

| |

|

|

|

| |

By:

|

/s/ Cynthia Poehlman

|

|

| |

|

Cynthia Poehlman

|

|

| |

|

Chief Financial Officer

|

|

NEWS RELEASE

FOR IMMEDIATE RELEASE:

PARKERVISION CLOSES PREVIOUSLY ANNOUNCED SALE OF WARRANTS

Jacksonville, Fla., January 16, 2015 – ParkerVision, Inc. (Nasdaq: PRKR) (“ParkerVision”) announced the closing on January 15, 2015 of its previously announced sale of warrants to 1624 PV LLC for an aggregate purchase price of $1,300,000. ParkerVision issued three warrants, each exercisable for up to 1,884,058 shares of common stock at exercise prices of $1.50, $2.50 and $3.50 per share, respectively. The warrants are exercisable for a period of three years from the date of issuance.

This press release does not constitute an offer to sell, or the solicitation of an offer to buy, the shares of common stock or the warrants, nor shall there be any sale of the shares of common stock or warrants in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification of the shares and warrants under the securities laws of any such state or jurisdiction.

About ParkerVision, Inc.

ParkerVision designs, develops and sells its proprietary RF technologies which enable advanced wireless communications for current and next generation mobile communications networks. ParkerVision is headquartered in Jacksonville, Florida. (PRKR-G)

Safe Harbor Statement

This press release contains forward-looking information. Readers are cautioned not to place undue reliance on any such forward-looking statements, each of which speaks only as of the date made. Such statements are subject to certain risks and uncertainties which are disclosed in ParkerVision’s SEC reports, including the Form 10-K for the year ended December 31, 2013, and the Forms 10-Q for the quarters ended March 31, June 30, and September 30, 2014. These risks and uncertainties could cause actual results to differ materially from those currently anticipated or projected.

Contact:

|

Cindy Poehlman

|

|

Don Markley or

|

|

Chief Financial Officer

|

or

|

Glenn Garmont

|

|

ParkerVision, Inc.

|

|

The Piacente Group

|

|

904-732-6100, cpoehlman@parkervision.com

|

|

212-481-2050, parkervision@tpg-ir.com

|

###

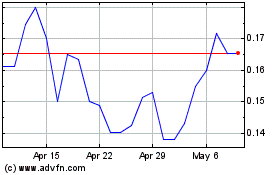

ParkerVision (QB) (USOTC:PRKR)

Historical Stock Chart

From Aug 2024 to Sep 2024

ParkerVision (QB) (USOTC:PRKR)

Historical Stock Chart

From Sep 2023 to Sep 2024