Current Report Filing (8-k)

December 02 2014 - 7:25AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 2, 2014

ALTISOURCE PORTFOLIO SOLUTIONS S.A.

(Exact name of Registrant as specified in its charter)

|

Luxembourg |

|

001-34354 |

|

98-0554932 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

40, avenue Monterey

L-2163 Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices including zip code)

+352 2469 7900

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 Regulation FD Disclosure.

Altisource Portfolio Solutions S.A. (the “Company”) has made available on its corporate website (www.altisource.com) its most recent investor presentation. The Company intends to use the investor presentation at the Bank of America Merrill Lynch 2014 Leveraged Finance Conference on December 2, 2014 and from time to time in conversations with investors, analysts and others. A copy of the presentation dated December 2014 is filed herewith as Exhibit 99.1.

The Company is furnishing this 8-K pursuant to Item 7.01, “Regulation FD Disclosure.” The information contained in this 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

|

|

Exhibit 99.1 |

|

Altisource Portfolio Solutions S.A. Investor Presentation dated December 2014 |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 2, 2014

|

|

Altisource Portfolio Solutions S.A. |

|

|

|

|

|

By: |

/s/ Michelle D. Esterman |

|

|

Name: |

Michelle D. Esterman |

|

|

Title: |

Chief Financial Officer |

3

Exhibit 99.1

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. December 2014

Bank of America Merrill Lynch 2014 Leveraged Finance Conference

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 1

Forward-Looking Statements / Non-GAAP Measures This presentation contains

forward-looking statements. These statements may be identified by words such

as “anticipate,” “intend,” “expect,” “may,” “could,” “should,” “would,”

“plan,” “estimate,” “seek,” “believe” and similar expressions. We caution

that forward-looking statements are qualified to certain risks and

uncertainties that could cause actual results and events to differ materially

from what is contemplated by the forward-looking statements. Factors which could

cause actual results to differ materially from these forward-looking

statements may include, without limitation, general economic conditions,

conditions in the markets in which Altisource is engaged, behavior of

customers, suppliers and/or competitors, technological developments and

regulatory rules. In addition, financial risks such as currency movements,

liquidity and credit risks could influence future results. The foregoing list

of factors should not be construed as exhaustive. Altisource disclaims any

intention or obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or

otherwise. Altisource management utilizes certain non-GAAP measures such as

earnings before interest, taxes, depreciation and amortization (“EBITDA”),

earnings before interest and taxes (“EBIT”) and EBITDA minus capital

expenditures (“Free Cash Flow”) as key metrics in evaluating its financial

performance. EBITDA, EBIT and Free Cash Flow should be considered in addition

to, rather than as a substitute for, income before income taxes, net income

attributable to Altisource and cash flows from operations. These non-GAAP

measures are presented as supplemental information and reconciled to net

income attributable to Altisource in the Appendix.

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 2 Table

of Contents Business Overview 3 Growth Initiatives 8 Financial Performance 11

Appendix . 15

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 3

Business Overview

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 4

Business Overview . Services to the real estate and mortgage marketplaces

that are typically outsourced by loan servicers, originators and home owners

. Accounts receivable management and customer relationship management

services . Business process management solutions and distribution solutions

to enable the real estate and mortgage marketplaces and infrastructure support

Technology Services Mortgage Services Consolidated Altisource - 9/30/2014 LTM

Service Revenue: $913.3mm Operating Income: $207.7mm EBITDA(1): $270.1mm

Financial Services (1) EBITDA is defined as net income attributable to

Altisource plus income taxes, net interest expense, depreciation and

amortization. Please see appendix for reconciliation

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 5

Mortgage Services – Summary (1) Operating margin is calculated using service

revenue, which we define as revenue less revenue from expense reimbursement

and non-controlling interest (2) Does not include eliminations. Some

categories include default and originations related revenue 55.0 71.7 135.7

224.9 351.9 490.3 644.7 $0 $100 $200 $300 $400 $500 $600 $700 2008 2009 2010

2011 2012 2013 9/30/14 LTM Segment Service Revenue ($mm) . Service revenue

growth principally from growth of Ocwen and services expansion . Operating

margins are lower in 2013 and 2014 due to amortization of the intangible

assets associated with the 2013 acquisition of the fee-based businesses

Overview 13.5 26.3 55.7 94.6 142.1 174.9 232.0 24.6% 36.7% 41.1% 42.1% 40.4%

35.7% 36.0% 0% 10% 20% 30% 40% 50% $0 $50 $100 $150 $200 $250 2008 2009 2010

2011 2012 2013 9/30/14 LTM Operating Income ($mm) (2) Operating Margin % (1)

Asset Management Services, 52% Insurance Services, 26% Residential Property

Valuation Services, 16% Default Management Services, 4% Origination

Management Services, 2% 9/30/14 LTM Service Revenue Composition (2)

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 6

Financial Services – Summary (1) Operating margin is calculated using service

revenue, which we define as revenue less revenue from expense reimbursement

and non-controlling interest (2) Operating income and margin exclude $2.8mm

of goodwill impairment recognized in 2010 55 . During 2013, asset recovery

management significantly expanded its higher margin mortgage charge-off

collections services . Operating margins have expanded due to our expense

management initiatives and customer base evolution toward the more stable and

profitable customer relationship management and mortgage charge-off

collections businesses Overview 62.8 51.0 45.2 37.4 29.6 46.8 50.6 11.1 28.7

29.6 31.9 34.4 45.7 52.1 73.8 79.7 74.7 69.2 64.0 92.5 102.7 $0 $20 $40 $60

$80 $100 $120 2008 2009 2010 2011 2012 2013 9/30/14 LTM Segment Service

Revenue ($mm) Asset Recovery Management Customer Relationship Management

(5.9) 2.7 3.1 4.5 4.4 22.1 21.8 -8.0% 3.4% 4.2% 6.4% 6.8% 23.9% 21.3% -10% 0%

10% 20% 30% -$10 $0 $10 $20 $30 2008 2009 2010 2011 2012 2013 9/30/14 LTM

Operating Income ($mm) (1) (2) Operating Margin % Asset Recovery Management,

49% Customer Relationship Management, 51% 9/30/14 LTM Service Revenue

Composition

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 7

Technology Services – Summary 45.3 47.5 52.0 56.1 74.2 103.9 200.9 $0 $30 $60

$90 $120 $150 $180 $210 $240 2008 2009 2010 2011 2012 2013 9/30/14 LTM Segment

Service Revenue ($mm) . Revenue growth primarily from Ocwen’s portfolio

growth and the 2013 Equator acquisition . Operating margins have recently

declined as we invest in personnel to accelerate our next generation

technology development to support our anticipated growth and amortization of

the intangible asset associated with the 2013 acquisitions of the feebased

businesses and Equator Overview (1) Operating margin is calculated using

service revenue, which we define as revenue less revenue from expense

reimbursement and non-controlling interest 9.4 18.2 18.1 14.4 10.7 6.9 7.9

20.7% 38.4% 34.8% 25.6% 14.4% 6.7% 3.9% 0% 10% 20% 30% 40% 50% $0 $5 $10 $15

$20 2008 2009 2010 2011 2012 2013 9/30/14 LTM Operating Income ($mm) (1)

Operating Margin % REALSuiteTM, Equator and Mortgage Builder, 70% IT

Infrastructure Services, 30% 9/30/14 LTM Service Revenue Composition

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 8

Growth Initiatives

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 9 —

Supporting Ocwen — Expanding Hubzu to other institutions and the

non-distressed home sale market — Providing asset management services to the

single family rental market Marketplace: Real Estate — Supporting Ocwen —

Growing our origination and cooperative related services — Growing our

customer base — Developing NextGen REALDoc®, REALAnalytics™, REALTrans®,

REALRemit® technologies, among others — Deploying platform business process

outsourcing offerings leveraging our next generation software with

traditional BPO services Marketplace: Mortgage Distribution and Transaction

Solutions Growth Initiatives

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 10

Owners.com Acquisition About Owners.com . One of the largest

for-sale-by-owner and flat fee nationwide Multiple Listing Service . Offers

home sellers access to the key professional listing boards necessary to

market a home and professional transaction support during the process . Last

year consumers listed approximately 35,000 properties for sale on Owners.com

with an aggregate asking price of approximately $11.5 billion . Generated

revenue of approximately $4.4 million and EBITDA of approximately $1.5

million during the nine months ended September 30, 2014 Market Opportunity .

Approximately 30% of the total 5.0 million annual home sales are limited

service and self-directed real estate transactions (1) Strategy . Leverage

Altisource’s national brokerage operations to provide Owners.com’s customers

with an improved experience and better outcomes . Offer Hubzu to Owners.com

customers . Offer ancillary services to buyers and sellers of homes on

Owners.com (e.g. title and escrow) Purchase Consideration . Upfront

consideration of $20.0 million . Earn-out consideration of up to $7.0 million

linked to achievement of revenue targets in each of the first two years (1)

Source: National Association of Realtors

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 11 Financial

Performance

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 12

Historical Performance 186.7 247.0 334.8 466.9 662.1 913.3 20% 22% 26% 27%

24% 23% 0% 10% 20% 30% $0 $100 $200 $300 $400 $500 $600 $700 $800 2009 2010

2011 2012 2013 9/30/14 LTM Service Revenue ($ millions)(2) Operating Margin %

47.3 61.0 92.8 138.2 205.1 270.1 25% 25% 28% 30% 31% 30% -2% 3% 8% 13% 18%

23% 28% 33% 38% $0 $50 $100 $150 $200 $250 $300 2009 2010 2011 2012 2013

9/30/14 LTM EBITDA (1)(2) ($ millions) % of Service Revenue (1) EBITDA is

defined as net income attributable to Altisource plus income taxes, net

interest expense, depreciation and amortization. Please see appendix for

reconciliation (2) On November 12, 2014, Altisource announced that it is

discontinuing its Lender Placed Insurance brokerage line of business. The

discontinuation of this business line is expected to reduce Altisource’s

quarterly diluted earnings per share by an average of $0.50 - $0.65 for the

period October 1, 2014 through December 31, 2015

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 13 26.0

49.3 71.1 110.6 130.0 171.5 14% 20% 21% 24% 20% 19% -2% 3% 8% 13% 18% 23% 28%

33% 38% $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 2009 2010 2011 2012

2013 9/30/14 LTM Net Income Attributable to Altisource(2) ($ millions) % of

Service Revenue Historical Performance 39.8 49.4 76.3 102.6 171.0 208.3 $0

$50 $100 $150 $200 $250 2009 2010 2011 2012 2013 9/30/14 LTM Free Cash Flow

(1)(2) ($ millions) (1) Free cash flow is defined as EBITDA minus capital

expenditures. Please see appendix for reconciliation (2) On November 12,

2014, Altisource announced that it is discontinuing its Lender Placed

Insurance brokerage line of business. The discontinuation of this business

line is expected to reduce Altisource’s quarterly diluted earnings per share

by an average of $0.50 - $0.65 for the period October 1, 2014 through

December 31, 2015

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 14 Key

Debt Metrics (1) Interest coverage is defined as EBIT as a ratio of interest

expense. EBIT is defined as net income attributable to Altisource plus income

taxes and net interest expense. Please see appendix for reconciliation (2)

Debt represents outstanding balance at the end of the period (3) Net debt is

defined as debt minus cash and cash equivalents at the end of the period 9.3x

2.2x 1.5x $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 Interest Coverage Debt / EBITDA

Net Debt / EBITDA Twelve Months Ended September 30, 2014 (1) (2) (3)

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 15

Appendix

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 16

Historical Financial Information – Non-GAAP Reconciliation Year Ended

December 31, LTM ($ mm) 2009 2010 2011 2012 2013 9/30/14 Net Income

Attributable to Altisource $26.0 $49.3 $71.1 $110.6 $130.0 $171.5 Income tax

provision 11.6 (0.4) 7.9 8.8 8.5 11.6 Interest expense, net of interest income

1.6 0.1 0.1 1.0 19.4 22.0 EBIT $39.2 $49.0 $79.1 $120.4 $157.9 $205.1

Depreciation and amortization 8.1 12.0 13.7 17.8 47.2 65.0 EBITDA $47.3 $61.0

$92.8 $138.2 $205.1 $270.1 Capital Expenditures 7.5 11.6 16.5 35.6 34.1 61.8

Free Cash Flow $39.8 $49.4 $76.3 $102.6 $171.0 $208.3

|

|

|

© 2014

Altisource. All rights reserved. Proprietary and Confidential. Page | 17

About Altisource We are a premier marketplace and transaction solutions

provider for the real estate, mortgage and consumer debt industries offering

both distribution and content. We leverage proprietary business process,

vendor and electronic payment management software and behavioral science

based analytics to improve outcomes for marketplace participants. Contact

Information All Investor Relations inquiries should be sent to:

shareholders@altisource.lu Exchange NASDAQ Global Select Market Ticker ASPS

Headquarters Luxembourg Employees More than 9,300 Investor Relations

Information

|

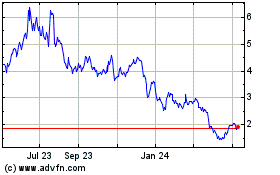

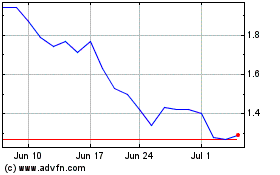

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Apr 2024 to May 2024

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From May 2023 to May 2024