UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report: (Date of earliest event reported): November 25, 2014

Chico’s FAS, Inc.

(Exact Name of Registrant as Specified in its Charter)

Florida

(State or Other Jurisdiction

of Incorporation)

|

| | |

| | |

001-16435 | | 59-2389435 |

(Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

| | |

11215 Metro Parkway, Fort Myers, Florida | | 33966 |

(Address of Principal Executive Offices) | | (Zip code) |

(239) 277-6200

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On November 25, 2014, Chico’s FAS, Inc. (the “Company”) held a conference call with the investment community to discuss its financial results for the third quarter ended November 1, 2014. A copy of the transcript of the conference call is attached hereto as Exhibit 99.1.

The information presented herein shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject the Company to liability pursuant to that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly stated by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

|

| | |

| | |

Exhibit 99.1 | | Transcript of conference call held by Chico’s FAS, Inc. on November 25, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | | CHICO’S FAS, INC. |

| | | |

Date: November 26, 2014 | | | | By: | | |

| | | | /s/ Todd E. Vogensen |

| | | | Todd E. Vogensen, Senior Vice President, |

| | | | Chief Financial Officer |

INDEX TO EXHIBITS

|

| | |

| | |

Exhibit Number | | Description |

| |

Exhibit 99.1 | | Transcript of conference call held by Chico’s FAS, Inc. on November 25, 2014 |

Exhibit 99.1

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

PARTICIPANTS

Corporate Participants

David Slater – Vice President – Investor Relations, Chico’s FAS, Inc.

David F. Dyer – President, Chief Executive Officer & Director, Chico’s FAS, Inc.

Todd Vogensen – Senior Vice President - Chief Financial Officer, Chico’s FAS, Inc.

Other Participants

Anna Andreeva – Analyst, Oppenheimer & Co., Inc. (Broker)

Matthew J. McClintock – Analyst, Barclays Capital, Inc.

Gene Vladimirov – Analyst, Nomura Securities International, Inc.

Tom A. Filandro – Analyst, Susquehanna Financial Group LLLP

Lindsay B. Drucker Mann – Analyst, Goldman Sachs & Co.

Neely J. N. Tamminga – Analyst, Piper Jaffray & Co (Broker)

Jennifer Black – Analyst, Jennifer Black & Associates LLC

Susan K. Anderson – Analyst, FBR Capital Markets & Co.

Betty Chen – Analyst, Mizuho Securities USA, Inc.

Pamela Quintiliano – Analyst, SunTrust Robinson Humphrey

Roxanne Meyer – Analyst, UBS Securities LLC

Kimberly C. Greenberger – Analyst, Morgan Stanley & Co. LLC

Dana L. Telsey – Analyst, Telsey Advisory Group LLC

Paul L. Lejuez – Analyst, Wells Fargo Securities LLC

Adrienne Yih-Tennant – Analyst, Janney Capital Markets

MANAGEMENT DISCUSSION SECTION

Operator: Good morning and welcome to the Chico’s FAS Third Quarter 2014 Earnings Conference Call. All participants will be in listen-only mode. [Operator Instructions]

I would now like to turn the conference over to Dave Slater, Vice President Investor Relations. Please go ahead.

David Slater, Vice President – Investor Relations

Thanks, Andrew, and good morning, everyone. Welcome to Chico’s FAS third quarter earnings conference call and webcast. Joining me today at our National Store Support Center in Fort Myers are Dave Dyer, CEO, and Todd Vogensen, CFO.

Before Dave begins his executive overview, we would like to remind you that our discussion this morning includes forward-looking statements and quarter-to-date data points, which are subject to and protected by the Safe Harbor Statement found in our SEC filings and in today’s earnings release. These forward-looking statements are subject to a number of factors and uncertainties that

1

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

could cause actual results to differ materially. The company does not undertake to publicly update or revise its forward-looking statements, even if experience or future changes make it clear that projected results expressed or implied by such statements will not be realized. Also, the prior-year results discussed on this call exclude goodwill and intangible impairment charges, as well as non-reoccurring acquisition and integration costs for Boston Proper. A reconciliation of GAAP results is included in today’s press release for your reference.

And with that, I’ll turn it over to Dave.

David F. Dyer, President, Chief Executive Officer & Director

Thanks, Dave, and good morning to everyone. While retail remains choppy, our third quarter performance was in line with the expectations we set forth at our last conference call, which were comp sales slightly negative, sequential improvement in the first half of the year in gross margin rate compared to last year, SG&A growth in line with square footage, less our strategic initiative spending. Earnings per share for the third quarter were $0.17, down from $0.22 in the third quarter of 2013. The total company comparable sales for the quarter were down 1.6%, on top of a negative 1.4% in the third quarter of 2013. Transaction count was once again positive, but it was offset by negative average dollar sale. A combination of continued promotional environment and a higher inventory level than desired negatively impacted our average dollar sale in the quarter.

Before diving into our third quarter results, I want to provide an update on our quarter-to-date sales. Through yesterday, total company sales were up approximately 4%, reflecting comp sales that are flat on our unaudited daily sales flash report.

Moving on, I’d like to provide a little color on our third quarter performance. A common positive fashion trend amongst all of our brands was the long-over-lean look. Tunics and leggings sold well in all brands. However, our initial fall deliveries did not perform to expectations, particularly in the Chico’s brand. We transitioned to our fall assortments in our normal cadence, but our customers weren’t quite ready for dark colors and sweaters, as the summer temperatures extended well into October.

Additionally, the well-documented West Coast port issues have caused delivery timing challenges, particularly at White House. We continue to work with our shipping partners to minimize the impact of delay on our fall and winter receipts, including diverting flow to the East Coast ports, as well as air-shipping merchandise in select critical categories of our holiday assortment.

Now, digging a little deeper into the third quarter brand-by-brand, let’s start with Soma. I’m extremely pleased to announce Soma’s 22nd consecutive quarter of positive comps. Soma continues to strengthen its position as the bra destination for women 35 and over. The recently launched Love Soma Rewards loyalty program is delivering on the key goal of increasing shopping frequency. Our customers have been redeeming their earned rewards at an impressive rate. Soma continues to see strength in the sleepwear and loungewear categories, which bodes well as we enter the holiday gift-giving period.

Additionally, I’d like to highlight two recent boutique openings, one in Tysons Corner in Virginia, the other at Downtown Summerlin in Las Vegas. Early reads in both locations have been very positive indicating that Soma is very much at home in these A malls. As you have heard, there are many exciting things going on at Soma as the brand continues to build on its positive momentum.

2

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Now turning to the Chico’s brand; despite the performance of our initial fall deliveries, Chico’s had a number of categories that performed well, including both bottoms and jackets. Strength in bottoms is led by leggings, jeggings and our new So Slimming Ponte pants. The jacket category also enjoyed strong performance during the quarter. As you may remember, we discussed jackets as a key initiative for the fall and are pleased with the results as we get back to our core with our uniquely Chico’s statement jackets.

Businesses in sweaters were soft during the third quarter as the demand for cooler weather product had not yet kicked in. Chico’s moved proactively to address inventory throughout the quarter to ensure seasonal sell through of the early fall deliveries, which decreased the average unit retail.

At White House | Black Market, the team continued to make strides in improving the balance between good, better, best and Lux product. Third quarter receipts were in balance with the appropriate mix of volume-driving basics and fashion product. Color was consistently and appropriately present throughout the quarter, as the colors in the pink and burgundy families complimented each other and linked to allow for smooth transition delivery-to-delivery. White House’s iconic collection in the Genius dress programs were successful during the third quarter as well.

I should note that the reinvigorated White House | Black Market’s Rewards program, loyalty program continues to deliver strong results as our best customers are shopping more frequently and adding more units to their checkouts.

At Boston Proper, I’m happy to report that the team has delivered a positive sales growth. Our return to Boston Proper’s roots has paid dividends as penetration in color, print and boho-chic styles have increased. They’re driving positive sales gains. Renewed focus on tried and true catalog marketing strategies have also proven successful. These are such as increased page density, page count optimization, and a more balanced price-point architecture have all played an important role in this turnaround. Boston Proper’s circulation is becoming increasingly targeted, which has made it more productive. The improved response rate we have achieved has more than offset the strategic decreases in circulation.

Before turning the call over to Todd, I’d like to briefly update everyone on our continued progress with two of our strategic initiatives, omni-channel or agile marketing and international. On omni-channel, we remained focused on creating a truly customer-centric experience. We have achieved our goal of having iPads in well over half of our stores prior to the holiday season. Our associates are using these tools to engage with our customers on an even more personal level. iPads allow our customers to access our digital commerce exclusive assortment, while shopping in our boutiques.

We are also making progress with our POS system replacement for 2015. We remain on target to begin the rollout in February. We have partnered with third parties to help us facilitate both the physical rollout and the necessary training and implementation on this new system.

Having visited a good number of stores recently, I can tell you that our associates are eagerly awaiting this upgrade. Mobile checkout and easy access to customer style preferences are just two of the customer-centric benefits that will come along with this new greatly enhanced system.

On the international front, we are happy with the results of our new boutiques in Canada. Chico’s new stores are exceeding our initial plans as we are generating traffic from both existing customers, as well as from those who are new to the brand. In Mexico, our franchise partnership with Liverpool continues to exceed projections as well. Our real estate rollout base has exceeded our original

3

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

plans and we remain on place to double our current footprint in Mexico in the back half of 2014. We’ll finish the year with four free-standing boutiques and 15 shop-in-shops in the Liverpool stores.

Now I’m going to turn the call over to Todd, but I’ll be back in a moment for some additional comments.

Todd Vogensen, Senior Vice President – Chief Financial Officer

Thanks, Dave, and good morning, everyone. Now, I’ll provide additional details on our third quarter financial results. Net sales were $665.6 million, an increase of 1.5% compared to $656 million in last year’s third quarter, with 87 net new stores, partially offset by a 1.6% decrease in comparable sales.

The comparable sales decline reflected a decrease in average dollar sale, partially offset by an increase in transaction count. As Dave mentioned, the sales results were consistent with our expectations as we entered the quarter.

Digging a layer deeper, for the third quarter, the combined Chico’s Soma brands comparable sales decreased 1.6%. The Chico’s brand experienced a low single-digit decrease in comparable sales versus a mid single-digit decrease in last year’s third quarter. Chico’s negative comp was driven by a reduction in average unit retail, or AUR, as the brand moved proactively throughout the quarter to ensure seasonal sell-through on early fall deliveries.

The Soma brand experienced a mid single-digit positive increase in comparable sales, on top of a high single-digit increase in last year’s third quarter, marking their 22nd consecutive quarter of positive comparable sales growth.

The White House | Black Market brand’s comparable sales decreased 1.4% following a 2.5% increase in last year’s third quarter. White House’s negative comp was driven by a reduction in units per transaction, or UPT. As Dave mentioned, White House felt the largest impact of product delays resulting from the labor issues at the West Coast ports. These delays left the brand with fewer units than planned, especially later in the quarter. And accordingly with fewer units, the decision was made to offer fewer promotions than last year, which positively impacted AUR, but negatively impacted UPT to a greater degree.

Moving down the P&L, gross margin dollars were flat with last year at $364 million. Gross margin rate was 54.7% of net sales, an 80 basis point decrease from last year’s results. The decline in rate was driven by a decline in AUR at Chico’s to move through their seasonal inventory, and the impact of White House | Black Market working through the remainder of their higher average unit cost goods from the first half.

The decline in rate versus last year showed a sequential improvement when compared to the first half of 2014. Total inventory per selling square foot increased 1.6%, excluding in-transit inventories. In-transit inventories increased by $10 million, primarily reflecting an increase in the length of in-transit times for ocean shipments, as well as delays at West Coast ports.

SG&A expenses for the third quarter were $322 million compared to $309 million last year. The SG&A rate was 48.3% of net sales, a 120 basis point increase from last year, primarily reflecting sales deleverage of store expenses, the impact of $5 million in strategic initiative spending, and cycling the reversal of incentive compensation in the prior year. Total strategic initiative SG&A for the full year of 2014 is now estimated to be $20 million.

4

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

For the third quarter, total SG&A less strategic initiative expenses increased 2.6% over the same period last year, which was well less than our square footage growth of 5.4%. Capital expenditures totaled $35 million in the third quarter, primarily for new stores in our strategic initiatives. We opened 38 new stores in the quarter and capital spending on strategic initiatives totaled approximately $9 million.

For the full year of 2014, we remain on track to spend between $125 million to $130 million in capital, including approximately $30 million on our strategic initiatives. During the third quarter, we returned over $11 million to our shareholders through our quarterly dividend program. There were no repurchases of shares during the period, but we do remain committed to returning excess cash to our shareholders. In fact, over the previous 12 months, we’ve returned $180 million to our shareholders via our share repurchase and dividend programs. During this timeframe, the return of cash represents over 150% for our free cash flow as defined by operating cash flow less capital expenditures.

As we’ve discussed, we are committed to growing with discipline and we have defined several key financial priorities as a part of this commitment, these include, keeping inventory growth in line with sales growth, ensuring that capital expenditures are lower than depreciation dollars, and maintaining SG&A in line with square footage growth. So let’s begin with inventory management.

Consistent with our expectations, we ended the third quarter with $5 million to $10 million more inventory than we would have liked. The lion’s share of the $80 million reduction in retail receipts, identified in our last earnings call, will take place in the fourth quarter. We anticipate that the impact of these receipt reductions will allow us to remain on target for inventory growth in line with sales growth by the end of the year.

The same blueprint for planning purchases off of a more conservative financial plan will be used on a go-forward basis. This methodology is key to both sales and margin rate improvement over the long term.

Next, I’d like to discuss our capital spending plan. As we continue to work through our 2015 plans, ensuring that capital expenditures are lower than depreciation dollars remains a priority. As Dave mentioned, we are rolling out our new POS system in 2015 and this will be a large component of our capital spend next year. One area helping to offset the incremental POS spend is a reduced new store opening cadence in 2015. Our latest real estate plan has new store openings in the 60 to 70 range next year, down from our previous estimate of 70 to 80. I’d like to provide a little more color on the likely composition of these new stores, inclusive of outlets by brand. Chico’s approximately 20 stores to 22 stores; White House | Black Market 10 stores to 13 stores, Soma 19 stores to 22 stores, Boston Proper 4 stores to 6 stores. And in addition, we plan to open approximately 7 locations in Canada. We believe that the balance of investments in technology and new store openings is the appropriate mix, which will allow us to grow in the long term.

Now, on to SG&A. Growing SG&A dollars in line with square footage growth is an area of continued focus. Our outlook for fourth quarter SG&A remains consistent. SG&A dollar growth is expected to be in line with square footage growth of approximately 5%, plus approximately $6 million in incremental strategic initiative expenses. As we look to 2015, the majority of strategic initiative spending will now become part of the base as we plan to continue omni-channel development, international expansion and Boston Proper new stores into the future. The one area of planned incremental expenses next year, assuming that we hit our performance metrics, will be a return to historical incentive compensation levels. This is an area that has been reduced significantly over the previous two years.

5

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

So looking ahead, by buying inventory more leanly, building conservative SG&A growth plans, maintaining capital spend at a lower rate than depreciation dollars and continuing to expand our growth brands and international footprint, we believe that we are well positioned to return to double-digit operating income levels over time. And with that, I’d like to pass the call back over to Dave, so he can provide some additional color on our expectations for the fourth quarter.

David F. Dyer, President, Chief Executive Officer & Director

As we enter the final quarter of our fiscal year, I can’t help but think back to the 2013 holiday season. As others throughout the industry have said, competing in the hyper promotional environment of last year’s fourth quarter was a real challenge. While we are hopeful that this year’s fourth quarter has a more rational promotional environment, we stand ready to compete in any environment. Our current fall assortments have been designed and planned on the assumption that the promotional environment is likely to continue into the fourth quarter. Strategic decisions were made in key categories where promotions have already been built into our plan. As Todd described earlier, we have significantly reduced the level of receipts during the quarter to a level that represents a more conservative financial plan. Reduced receipts will translate into a greater sell through in season, rather than low-margin clearance at the end of season. Fewer units will allow for more targeted promotions and less broad based all-store discounts.

We anticipate that these actions should protect our average unit retail greater than we were able to do last year. This AUR protection gives us confidence to expect positive comparable sales in fourth quarter, as well as the continued sequential improvement in our gross margin rate compared to last year. Most importantly, these actions are not limited to the fourth quarter. They are also part of a deliberate and fully considered ongoing strategy as we head into 2015 and beyond.

The fourth quarter is off to a good start, and we’re confident that our terrific family of associates and loyal customers are going to make it a strong quarter for Chico’s FAS.

Dave?

David Slater, Vice President – Investor Relations

Thank you, Dave. That concludes our prepared comments. At this time, we’d be happy to take your questions. In the interest of time and consideration of others, please limit yourself to one question. And with that, I’ll turn the call back over to Andrew.

6

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

QUESTION AND ANSWER SECTION

Operator: We will now begin the question-and-answer session. [Operator instructions] The first question comes from Anna Andreeva of Oppenheimer. Please go ahead.

<Q – Anna Andreeva – Oppenheimer & Co., Inc. (Broker)>: Great. Good morning. Good morning, guys. Thanks for taking my question. I was hoping to get some more color by division, Dave, for the quarter-to-date top-line trends that you mentioned. I guess are both businesses comping in a flattish range quarter-to-date? And curious on Soma, very solid growth there again, I was hoping you could parse out performance of the older stores versus newer stores and has the maturity curve changed meaningfully at this division? Thanks.

<A – Dave Dyer – Chico’s FAS, Inc.>: Well, regarding Soma, the maturity curve has not changed meaningfully at all. Older stores continue to comp in line with our newer stores and the overall business. Regarding further color on fourth quarter, the first couple of weeks of fourth quarter, what we give is really what we have given and we really are not prepared to give any more color on that.

<A – Dave Slater – Chico’s FAS, Inc.>: Thanks, Anna.

Operator: The next question comes from Matt McClintock of Barclays. Please go ahead.

<Q – Matt McClintock – Barclays Capital, Inc.>: Hi. Yes, good morning, everyone. Todd, you talked a little bit about the new level of investment spend, the new base for investment spend next year. Can you maybe just – as we think about SG&A expenses next year, investment spending next year as well, could you just maybe talk to the flexibility you have to adjust that plan as the year progresses should varying levels of outcomes happen?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Sure. So, I would say SG&A is something that we are always looking at, and always trying to make adjustments as we go, particularly as we look to the variable areas, be it store payroll, we are always evaluating our marketing spend and there’s also as we have seen over the last couple of years, a very heavy element of performance-based compensation that’s built into our SG&A structure. So, those are all things that kind of flux up and down, depending on performance and then there’s a lot of discretionary items in there that we continue to look at and to try to really plan to a very conservative level. So, we’ll always be looking at the things at the store level, like say supplies and so forth that can be managed to lower levels if need be.

<Q – Matt McClintock – Barclays Capital, Inc.>: Okay, thank you.

Operator: The next question comes from Simeon Siegel of Nomura Securities. Please go ahead.

<Q – Gene Vladimirov – Nomura Securities International, Inc.>: Good morning, this is actually Gene Vladimirov on for Simeon. Thanks for taking our question.

<A – Dave Slater – Chico’s FAS, Inc.>: Hi, Gene.

<Q – Gene Vladimirov – Nomura Securities International, Inc.>: How’s it going? I was wondering if guys, going into the holiday, if you could parse out kind of the gross margin pressure you expect to see by concept, whether you expect to see any discrepancies there?

<A – Todd Vogensen – Chico’s FAS, Inc.>: I don’t know that we would get into the level of by concept. But I can say in general, we do expect promotional environment to continue. We do see,

7

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

you know, ongoing continued disruption out of the West Coast ports. So those are things that we continue to watch that will likely put a little bit of pressure on margin. On the flip side, the positive is we really have pulled back on our receipts. So managing those receipts to a more lean level will give us more ability to control our promotions and more importantly, to control the amount of clearance that we have at end of season. So, as Dave mentioned, we would [audio gap] (24:38) expect to see sequential improvement in our gross margin as we get into Q4, excuse me, our gross margin compared to last year as we get into Q4.

<A – Dave Dyer – Chico’s FAS, Inc.>: The other thing is as we get into Q4, if we don’t have to pull the trigger, then that will be excess margin.

<Q – Gene Vladimirov – Nomura Securities International, Inc.>: Great, thanks. Good luck for the rest of holiday.

<A – Dave Dyer – Chico’s FAS, Inc.>: Thank you.

Operator: The next question comes from Tom Filandro of Susquehanna Financial Group. Please go ahead.

<Q – Tom Filandro – Susquehanna Financial Group LLLP>: Hi, thanks for taking my question. Dave, can you elaborate a little bit on that comment you made about positioning for a promotional environment. Did the brand specifically buy into categories with higher IMU to promote? What exactly were you referring to?

<A – Dave Dyer – Chico’s FAS, Inc.>: The answer is yes. Last year, we were caught pretty flat footed as we had not really built promotions into our, I would say, abnormal amount of promotions into our normal fourth quarter cadence. This year, we have recognized it has been a promotional environment, and we have targeted specific areas and categories for promotion, and have excess margins or initial markups to let us survive the promotional onslaught.

I would say that I think that the dumbest markdowns that a store can do are percent off of entire store. Those – all the good stuff goes first and the stuff that you need to get rid of remains.

<Q – Tom Filandro – Susquehanna Financial Group LLLP>: Right.

<A – Dave Dyer – Chico’s FAS, Inc.>: So I think there’s probably going to be some of that, it’s certainly not going to be the amount that we saw last year, certainly not from our brands. We are going to be much more targeted and specific. We will compete. We will be competitive promotionally, but we’re also going to be thoughtful about our promotions in the fourth quarter.

<Q – Tom Filandro – Susquehanna Financial Group LLLP>: Thank you very much. Best of luck.

<A – Dave Slater – Chico’s FAS, Inc.>: Thank you.

Operator: The next question comes from Lindsay Drucker Mann of Goldman Sachs. Please go ahead.

<Q – Lindsay Drucker Mann – Goldman Sachs & Co.>: Thanks. Good morning, everyone.

<A – Dave Dyer – Chico’s FAS, Inc.>: Good morning.

<Q – Lindsay Drucker Mann – Goldman Sachs & Co.>: I wanted to ask about the White House | Black Market, the product delays. I was actually curious, is any of that inventory that was delayed,

8

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

is that still sitting at retail and is that something in addition that you’ll have to clear out before holidays? So I guess my question is did logistical delays leave you with any sort of old product that you still need to push through.

<A – Dave Dyer – Chico’s FAS, Inc.>: Basically the timing has been about a two week difference. One to two weeks. It has affected White House more than the other brands because White House has had a practice of pre-selling before their floor sets. They’ll put a small rack of new arrivals back by the fitting room, and they will actually sell out of the backroom in advance of setting up their floor sets. Our other brands have been more, I guess, geared to a floor set and not set up for showing the new product until the floor set is actually – the timing of the floor set and they actually set it up. So that has affected White House more. I mean, you can take a look at some of the problems we had coming into this week, we started out with about 44 containers in the LA ports that were tied up. I think we’ve gotten about half of them out now. So we are focusing on the other half. Everything coming in December has been rerouted to other ports and out of the congestion. So I think that once we get through this current batch of containers that were en route and in the port, we will be in better shape as we move into our spring deliveries.

But, of course, anything that’s in cold weather, sweaters, holiday-specific items, where we could catch them, we aired them. If not, we are doing our best to expedite them to the stores in a timely basis. You can imagine, I think a couple of weeks ago; we had a ship that came in with 18,000 containers on it, of which we had 26. Trying to get your 26 out of 18,000 containers in the backed up port is like finding a needle in a haystack. We did do a pretty good job of getting them out, and again, the weeks that we have delayed have been somewhere between a week and two weeks depending on a particular situation.

<Q – Lindsay Drucker Mann – Goldman Sachs & Co.>: Great. And then, just a follow-up on your comp outlook for 4Q. You are looking for comps to be up. It sounds like based on your inventory buys that units will be down. So your guidance, I’m guessing implies that AURs are up nicely with the lower units.

<A – Dave Dyer – Chico’s FAS, Inc.>: Yes, that’s absolutely correct. I mean, one of the things that we saw when we looked at all of our KPIs, actually this year and especially in last fourth quarter, our transactions were up, our customer file is at an all-time high. Our conversion is at a record conversion, those things that we – the people that walk into a store that actually walk out with something is at an all-time high. Our one KPI that has been a problem has been average unit retail, which is driven by both the promotional environment and by our excess inventory where we had to liquidate. Both of those things, I think, that we certainly have a much better handle on this year. So yes, you are right. We are expecting to have a higher average unit retail.

<Q – Lindsay Drucker Mann – Goldman Sachs & Co.>: Okay. Thank you.

<A – Dave Slater – Chico’s FAS, Inc.>: Thank you.

Operator: The next question comes from Neely Tamminga of Piper Jaffray. Please go ahead.

<Q – Neely Tamminga – Piper Jaffray & Co (Broker)>: Thank you. Dave, on that note, I mean, we’re obviously seeing that price is one way to lead the consumer in, but you have a great history also of having events in your store. So have you rethought maybe how to engage her beyond just promotions to drive that traffic in the store? And anything you could share with us there would be helpful, thank you.

<A – Dave Dyer – Chico’s FAS, Inc.>: Yeah, absolutely, and that’s one of our major initiatives. That we talked about the iPads that are in the stores as just one of the things. I mean, one the

9

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

things that we know now, which we didn’t before, is when a customer who is a snowbird, we now see that she’s arrived in a store. So we will make a phone call from the right store to invite her in or send an email in our stores through the iPad. Our associates now have the ability to email those customers that have given us their email.

And if we know that a customer, which you can say our premium customers, are much more interested in new and fresh goods than they are in clearances. As a matter of fact, one of the least things that they are interested in is 30% off of already reduced styles. They are interested in new styles coming into the stores. Now we are able to tailor our communication to them, specifically on what they like.

We have also done what we call GRO events in our stores, particularly the Chico’s bit. GRO means Grass Roots Outreach. That’s where we actually go out to the customers and to organizations and I think that we have honed that skill. And so there’s a lot of things that we are doing at the store level with our outreach and with our customer contacts that are different than we have been able to do in past years.

<Q – Neely Tamminga – Piper Jaffray & Co (Broker)>: Thank you.

<A – Dave Dyer – Chico’s FAS, Inc.>: Thank you.

Operator: The next question comes from Jennifer Black of Jennifer Black & Associates. Please go ahead.

<Q – Jennifer Black – Jennifer Black & Associates LLC>: Good morning. I wondered if you could talk a little bit about the consumer psyche, as it seems the customer is more item-driven versus outfit-driven. How are you influencing additional purchases to increase your average dollar sale? I know you have done a lot of training with your employees. If you could talk about that, that would be great.

<A – Dave Dyer – Chico’s FAS, Inc.>: Well, I think that because of the kind of rise of digital commerce, it really has made customers perhaps more item driven. One of the item driven, certainly online. So there are ways that we are beginning to work on how we can build the wardrobe online. As you know, in our stores, our most amazing personal service is really one of our key core competencies. When we get a customer in, we can start with an item and build a wardrobe. That is harder and harder to do online, and even while she may come into the store, having browsed on her iPad at home, while watching TV, and come into the store looking for an item, we still, when she’s in the store, have the ability to build that outfit. To not only sell her the bottom, but to put it together with a terrific top and add jewelry to complete the outfit. So, that’s one of the key things that we are doing is how we wardrobe and how we build the outfit. But the only thing that we need to make sure is that the item that she selects, that we are her first choice. So she comes to our store to shop for that item and then we have the opportunity to see if she’s interested in building the entire wardrobe.

<A – Todd Vogensen – Chico’s FAS, Inc.>: And there’s probably iPads in stores as well opening up just a broader assortment to our customers.

<A – Dave Dyer – Chico’s FAS, Inc.>: That’s true, the iPads in the stores, we can now sell our entire online exclusives and in Boston Proper’s case they can sell probably 50% of the items that are not in the store. But the online exclusives that we have and the ability to access them at the store location and sell them to a customer while she’s in the store is becoming a larger and larger part of our business.

10

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<Q – Jennifer Black – Jennifer Black & Associates LLC>: Okay, great. Can I ask a follow-up question? I just wanted to know with your Merry campaign at Chico’s, are you planning to flow more newness throughout the month of December, since your customer may make multiple trips into the store throughout the month?

<A – Dave Dyer – Chico’s FAS, Inc.>: Yes, there will be continual flow in, in December, and I think you will see that our last holiday book actually has a resort section in it.

<Q – Jennifer Black – Jennifer Black & Associates LLC>: Okay, great. Thanks a lot and good luck.

<A – Dave Slater – Chico’s FAS, Inc.>: Thank you.

Operator: The next question comes from Susan Anderson of FBR Capital Markets. Please go ahead.

<Q – Susan Anderson – FBR Capital Markets & Co.>: Good morning. Thanks for taking my question. I wanted to follow up on the gross margin. So, I think you guys had sequential improvement. Should we assume improvement year-over-year too with AUR improving? And then also maybe if you could just give a little bit of color on what’s driving the improvement. Is it mainly better full-price selling and lower clearance or also is it kind of 50%-50% with the – you know, just buying better to promote? Thanks.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yes. So, this is Todd. So, as we look at gross margin, we were down about 80 basis points in Q3, which was sequential improvement over the first half. And we would look for that to get better as we go through the fourth quarter. And it truly is a matter of inventory management and buying to a leaner inventory plan and making sure that we can be more targeted in those promotions that we are doing. So, as we are more targeted, have less of the all-store discounts, have less inventory left over end of season for clearance. All those things should be positive for AUR and flow through to the margin rate as well.

<Q – Susan Anderson – FBR Capital Markets & Co.>: Got it. And then should we expect AUC to be about flattish next quarter too?

<A – Todd Vogensen – Chico’s FAS, Inc.>: You’re probably getting a layer deeper than we have gone. I think, generally, we are working in our sourcing organization to improve our costing wherever possible. There’s the offset that Dave mentioned of potentially expediting some shipments to get goods in and around the West Coast ports. So, generally, we are still working through the plans and probably more to come is the safest answer.

<Q – Susan Anderson – FBR Capital Markets & Co.>: Okay. That’s helpful. Thank you.

Operator: The next question comes from Betty Chen of Mizuho Securities. Please go ahead.

<Q – Betty Chen – Mizuho Securities USA, Inc.>: Good morning, everyone. I was wondering, a clarification, Todd, if I missed it earlier. Did you quantify the impact of maybe rerouting the West Coast port receipts and the incremental air freight? And then my question is for Dave. Dave, now that you have got even more time under your belt with the omni-channel initiative, can you remind us of the store count opportunity by brand and how that may split between full price and outlet.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Absolutely. So, first on the West Coast ports, we actually were in pretty good shape going through first part of the quarter. It really was towards the back end of the quarter where we started to see impact. So, I would tell you there was less impact

11

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

from air freight in Q3 than maybe what we might see in Q4. The bigger issue was really just availability of goods, making sure that the goods were hitting the stores at the right time. And as we backed into it we saw it being about a 1% impact to our total sales during the course of the quarter.

And in terms of store counts, yes, store counts for Chico’s; we said looking for around 700 plus front line stores, and 125 outlet stores to 150 outlet stores. For White House | Black Market, looking at 400 front-line stores to 500 front-line stores, and then, again, 100 outlets to 125 outlets. Soma, we’ve said 600 plus. We are obviously early in the growth stage, so as we get closer, we will define how much of a plus that is and Boston Proper is really just getting started. So it’s probably a little bit premature to give you a total store count. We need to get a little further into it.

<Q – Betty Chen – Mizuho Securities USA, Inc.>: Todd, in terms of Boston Proper, I think in the past you’ve talked that as being the most productive within the portfolio. Is that remaining true? Or has that sort of picked up given the positive sales growth we saw in the third quarter?

<A – Todd Vogensen – Chico’s FAS, Inc.>: I would say the stores are still starting off strong in their grand openings. We are still seeing those grand openings drive a lot of new customers and we are pleased with the direction they are headed and the productivity. Again, we think a small box is really the way to go. And having that nice, tight box for Boston Proper does give us a lot of opportunity to drive sales productivity that maybe other companies might not have. So we’re very happy with the start. We’re using 2015 to continue testing out different layouts, technologies, merchandising and so forth to narrow in on the final prototype. But very pleased with what we are seeing so far.

<Q – Betty Chen – Mizuho Securities USA, Inc.>: That’s great. Best of luck for the holidays.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thank you.

<A – Dave Slater – Chico’s FAS, Inc.>: Thank you.

Operator: The next question comes from Pamela Quintiliano of SunTrust. Please go ahead.

<Q – Pamela Quintiliano – SunTrust Robinson Humphrey>: Thanks so much for taking my question and congrats on executing well in a very challenging environment. So, one quick one that I may have missed, I apologize about this. How do you feel about the fall carryover at each division at this point in time? And then just another question on the quarter-to-date commentary, what do you attribute the improvement to? Is it product, weather, macro, a combination of all, something else out there, if you could just shed any light on that as well.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Absolutely. So in terms of carryover, we did mention that we have probably $5 million to $10 million more in inventory than we would have liked going into the quarter, which in the big scheme of things is not a massive amount, but we have bought our receipts much more leanly as we go through the quarter. So, we would expect that would give us benefits really as we get further and further into the quarter and as we start lapping around on softer numbers from last year. And now I’m forgetting the second half of the question.

<A – Dave Dyer – Chico’s FAS, Inc.>: I do, too.

<Q – Pamela Quintiliano – SunTrust Robinson Humphrey>: The quarter-to-date commentary, just in terms of the improvement that you’ve seen thus far. Do you think it’s more product related, weather related, is she feeling better macro wise with some of the improvements we have seen out there, a combination of all, something else?

12

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Todd Vogensen – Chico’s FAS, Inc.>: I think there are a lot of things going on.

<A – Dave Dyer – Chico’s FAS, Inc.>: It’s certainly product related.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yes. The big thing is as we get into this holiday season and the weather does turn on us, we feel like we are really well positioned for the holiday season.

<Q – Pamela Quintiliano – SunTrust Robinson Humphrey>: And that’s across all brands you feel equally confident in that?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yes, absolutely.

<A – Dave Dyer – Chico’s FAS, Inc.>: Absolutely, yes.

<Q – Pamela Quintiliano – SunTrust Robinson Humphrey>: Great. Well, thank you very much, best of luck.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Okay. Thank you.

Operator: The next question comes from Roxanne Meyer of UBS. Please go ahead.

<Q – Roxanne Meyer – UBS Securities LLC>: Great, good morning. My question is on inventory. Obviously, you’ve got a big opportunity to improve margin as you rein in inventory and plan to grow it in line with sales. But I’m just wondering in line – just given that inventories have been high in the past, how much room do you actually see for inventory to be reduced on a net basis over the long term, or should we really be, beginning in 2015, still be expecting for growth, it’s just moderated growth, how should we think about that?

<A – Todd Vogensen – Chico’s FAS, Inc.>: We would hope that our top line would show positive trends, so you would see moderated growth. As we look at it, inventory in line with sales is really that long-term objective where we see opportunities where we feel like we might have been a little bit heavy, we will go back to look to capture that, but the overriding principle is going to be looking at inventory in line with sales.

<Q – Roxanne Meyer – UBS Securities LLC>: Okay, great. And then, just a question on Chico’s.

<A – Todd Vogensen – Chico’s FAS, Inc.>: I’m sorry.

<A – Dave Dyer – Chico’s FAS, Inc.>: I was going to say, the real key is the receipt flow as we go forward, and I think as we are planning much more conservatively in financial plans, our buy will be a more conservative buy. We are willing to do more chase and to turn slightly faster. So I think that the real key in inventory is the receipt flow. And I think we have got a good handle on that now.

<Q – Roxanne Meyer – UBS Securities LLC>: Is there any color that you can provide us in terms of how much – to what extent you will be buying up front versus leaving the ability to chase inventory?

<A – Dave Dyer – Chico’s FAS, Inc.>: Well, we are trying to leave inventory open in every division that we have. We are not going to buy a 100% of what we have got. You know, normally, when you are buying out as far as we buy out, we have been buying pretty close to 100 or maybe even a little bit on top of that, if we are expecting sales to be strong, which we did actually last spring. We took a shot and we were wrong, and that kind of lump of inventory has followed us for a couple of

13

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

quarters. We are being much more conservative, leaving open to buy on the table for our brands, so we can chase in season. We are looking at our flow of basics much more critically and conservatively and the idea is just to manage inventory a lot differently than perhaps we have in the last year.

<Q – Roxanne Meyer – UBS Securities LLC>: Great. That’s certainly an amazing opportunity. Thanks so much and best of luck for holiday.

<A – Todd Vogensen – Chico’s FAS, Inc.>: All right, thanks, Roxanne.

Operator: The next question comes from Kimberly Greenberger of Morgan Stanley. Please go ahead.

<Q – Kimberly Greenberger – Morgan Stanley & Co. LLC>: Great. Thank you so much. My question, Dave, is about the double digit operating margins and I don’t know if you or Todd want to address this. It looks to me like based on your fourth quarter SG&A guidance, you will hit about 47.8% of – an SG&A rate that’s going to be around 47.8% this year. It looks like that’s going to be the highest rate in the last – in this five-year window.

So, I’m wondering if you think that the bridge to double digit operating margins rests solely on the shoulders of the gross margin line or if you think perhaps in the future you might have an opportunity to cut back on some of your SG&A dollars, or thirdly, is it simply a matter of you need to deliver an x-percent comp every year for a number of years in order to sort of leverage your way out of it? Maybe just help us build that path to that double digit margin. Thanks so much.

<A – Dave Dyer – Chico’s FAS, Inc.>: I think that we can be much more efficient in our SG&A and we are looking at ways that we can gain those efficiencies from SG&A, but however, any retailer is really driven by sales and margin. And I think that when Todd – when we were in Toronto, at the analyst meeting, he gave a walk back to how to get back to double digit margins and in that, I believe it was 50 basis points to 80 basis points in SG&A improvement and 250 basis points in gross margin improvement. That 250 points in gross margin improvement is only half of what we have given back. So basically, we have had our peak in 2012. We were 500 basis points higher in gross margins. So while there is SG&A leverage that we can continue to work on, the big prize is the gross margin and I think that that is probably the clearest path, but that doesn’t mean that we’re not going to be vigilant about SG&A expense.

<A – Todd Vogensen – Chico’s FAS, Inc.>: And the other piece of SG&A as well, Kimberly, as we have grown some of our smaller growth brands or begun some of our international operations, there’s been a little bit of investment in SG&A as we get more mature at brands like Soma, as we see continued recovery of Boston Proper, those things are probably as much SG&A driven as anything else. So there will be a combination of both.

<Q – Kimberly Greenberger – Morgan Stanley & Co. LLC>: So I could be looking at the wrong numbers, Dave, so correct me if I’m wrong here, but it looks to me like the gross margin rate in 2012 was 56.2% and this year, based on we’re expecting some modest improvement in Q4 at about a 53.6% gross margin rate this year, that looks to me only to be about 250 basis points lower. So I’m just not sure where the 500 basis point number comes from.

<A – Todd Vogensen – Chico’s FAS, Inc.>: That was pure AUR. There’s obviously other things that impact gross margins.

<Q – Kimberly Greenberger – Morgan Stanley & Co. LLC>: Okay. So you are expecting to get back to your peak gross margin is what you are saying from 2012?

14

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Todd Vogensen – Chico’s FAS, Inc.>: We are expecting to get back to near that 2012 gross margin, yes. I don’t know if I would call that our peak but – yes, definitely that is the goal.

<Q – Kimberly Greenberger – Morgan Stanley & Co. LLC>: Great. Thanks so much.

<A – Todd Vogensen – Chico’s FAS, Inc.>: You bet.

Operator: The next question comes from Dana Telsey of Telsey Advisory Group. Please go ahead.

<Q – Dana Telsey – Telsey Advisory Group LLC>: Good morning, everyone. Dave, as you think about inventory planning as you’re going into next year, how are you thinking of rate of inventory increase relative to square footage growth. And then of the store – on the slower rate of new store growth, is it outlets? Is it any particular concept? What’s the difference between the two and have there been any changes in new store productivity that you see by brand? Thank you.

<A – Dave Dyer – Chico’s FAS, Inc.>: Our inventory growth that we see is flat to up to low-single digits.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yes.

<A – Dave Dyer – Chico’s FAS, Inc.>: So, and I think that that’s probably the general thing that we are looking at in terms of inventory. The other question, Todd?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yes, the slower store growth. So really what we have done is to be very selective in where we are opening those stores. We are still seeing opportunities for Chico’s outlets, which we reflected in that Chico’s number you saw or you heard and overall, just trying to balance the portfolio to make sure that we are getting the best opportunities next year. I think really part of it is Boston Proper, which we had accelerated new stores this year, up to 15 and next year looking at 4 stores to 6 stores, but it’s really pretty well spread. I think in terms of productivity, one of your questions was have we seen a change in productivity of new stores?

Overall, what I’d tell you is we opened more smaller-market stores, particularly in White House and Chico’s. We talked about before, those stores will have lower sales per store, but then, they also end up having a lot lower occupancy. So they end up from a profitability perspective being very positive, but you will probably see an element of the productivity coming through on those stores.

<A – Dave Dyer – Chico’s FAS, Inc.>: And when you open up Soma stores with them taking three years to build, obviously they deleverage – will deleverage your store base in the beginning. Over time, the Soma stores are similarly productive to our best apparel brands.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yes.

<Q – Dana Telsey – Telsey Advisory Group LLC>: Thank you.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thank you.

Operator: The next question comes from Paul Lejuez of Wells Fargo. Please go ahead.

<Q – Paul Lejuez – Wells Fargo Securities LLC>: Hey, guys. Can you talk about the performance in the outlet channel by brand, just wondering how the comp metrics there might be different from the full-line stores, and also specifically on White House, where are you in terms of the percent of product that is made for that channel versus last year. Thanks.

15

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yes. So, in terms of sales productivity, our outlet stores are right in line with the rest of the fleet. Actually, we look at it by center type, including outlet centers and we are really directionally consistent across all of the different types of store formats. In terms of – your other question was...

<Q – Paul Lejuez – Wells Fargo Securities LLC>: Well, Todd, on that one, I was actually wondering about comp performance. Comp performance during the quarter was kind of what I was looking for there.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah, so comp performance has been consistent across the different formats. And in terms of [ph] MFO (52:28) for White House, we continue to increase it modestly, I think putting a lot of plans in place to continue to grow it. We are probably in the high 60%-ish range now and heading towards 80% plus.

<Q – Paul Lejuez – Wells Fargo Securities LLC>: And where were you last year, Todd?

<A – Todd Vogensen – Chico’s FAS, Inc.>: It was probably in that mid-60% range.

<Q – Paul Lejuez – Wells Fargo Securities LLC>: Got you. Thanks. Good luck.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thank you.

Operator: The next question comes from Adrienne Tennant of Janney Capital Markets. Please go ahead.

<Q – Adrienne Tennant – Janney Capital Markets>: Good morning. Nice job on the SG&A and inventory discipline. Dave, I wanted to ask you, we’ve been noticing at White House | Black Market a nice sequential improvement in promotions and certainly the stores look much better. I was wondering if you can just talk about the product progress that we heard at the Analyst Day, where you think that that brand is with regard to the target customer, and if there’s additional room for improvement as we go into spring?

And then, for Todd, really quickly, on AUC trends, I know cotton is not a big impact on you as we go into spring. But do you have opportunities in either shifting the manufacturing base or cost engineering to reduce AUC? Thank you.

<A – Dave Dyer – Chico’s FAS, Inc.>: Well, I would say product for White House, I would say, we are back. I think that the balance of the assortments, the way that they are handling color, the portion of color, the balance between basics and the fashion, high fashion items, is back to where it needs to be. I have reviewed the spring assortments of all of our brands. I think that we are very well positioned going into spring, and especially White House. I think they have done a terrific job of bringing it back. Their average unit cost is back in line. Actually, I think it’s slightly down from where they were before we got into this mess.

White House definitely had product issues for a few quarters. They have actually run a more positive business over the last two years than our other – well, than certainly than Chico’s and Boston Proper. So they had about three quarters of some problems, and I do think they are back product-wise and I think that they look very good going forward. All the issues that they had product-wise, I believe, we have corrected. And I also believe that we are ready to promote in this environment, this fourth quarter, which we were caught a little flat footed on last year. We didn’t have enough inventory, we had high average unit retail, which gave us low units. So when you took percent off, you didn’t have enough units to drive the volume.

16

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<Q – Adrienne Tennant – Janney Capital Markets>: Right.

<A – Dave Dyer – Chico’s FAS, Inc.>: This year with the retails more in line traditionally, with the promotion, we do have the units to drive the necessary volumes. So we think that it will be a much better fourth quarter and feel good about spring.

<A – Todd Vogensen – Chico’s FAS, Inc.>: And in terms of average unit cost, yeah, so we have our global sourcing organization very focused on a variety of places that we can look for cost savings. In many cases, it’s offsetting wage inflation that might be taking place in certain countries.

<Q – Adrienne Tennant – Janney Capital Markets>: Right.

<A – Todd Vogensen – Chico’s FAS, Inc.>: But we continue to look at diversifying our country of origin mix, mostly coming out of China and into other Southeast Asian countries. We also have seen a very positive shift in our FOB goods, where we take ownership for it overseas and don’t have to pay the markup on transportation and the like. So that piece of the business has continued to trend positive, and should be yet one more thing that we use to help offset any inflationary pressures on AUC.

<Q – Adrienne Tennant – Janney Capital Markets>: Okay, great. Thanks so much. Stores look great.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thank you.

Operator: The next question comes from Ed Yruma of KeyBanc Capital Markets. Please go ahead.

[Music] (56:50 – 56:55)

<A – Dave Dyer – Chico’s FAS, Inc.>: Ed’s taking a little break.

Operator: Okay. And in that case, this concludes our question-and-answer session. I would like to turn the conference back over to Dave Slater for any closing remarks.

David Slater, Vice President – Investor Relations

Thank you, Andrew. So this concludes our call for this morning. We apologize to those questions that we did not get to today in the hour or so we were on the call.

David F. Dyer, President, Chief Executive Officer & Director

Looks like we got to them all.

David Slater, Vice President – Investor Relations

As always, I’m available for any follow-up questions as necessary. Thank you all for joining us this morning and we appreciate your continued interest in Chico’s FAS.

17

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

| | | |

| | corrected transcript |

Chico's FAS, Inc. | CHS | Q3 2014 Earnings Call | Nov. 25, 2014 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Operator: The conference has now concluded. Thank you for attending today’s presentation. You may now disconnect.

Disclaimer

The information herein is based on sources we believe to be reliable but is not guaranteed by us and does not purport to be a complete or error-free statement or summary of the available data. As such, we do not warrant, endorse or guarantee the completeness, accuracy, integrity, or timeliness of the information. You must evaluate, and bear all risks associated with, the use of any information provided hereunder, including any reliance on the accuracy, completeness, safety or usefulness of such information. This information is not intended to be used as the primary basis of investment decisions. It should not be construed as advice designed to meet the particular investment needs of any investor. This report is published solely for information purposes, and is not to be construed as financial or other advice or as an offer to sell or the solicitation of an offer to buy any security in any state where such an offer or solicitation would be illegal. Any information expressed herein on this date is subject to change without notice. Any opinions or assertions contained in this information do not represent the opinions or beliefs of FactSet CallStreet, LLC. FactSet CallStreet, LLC, or one or more of its employees, including the writer of this report, may have a position in any of the securities discussed herein.

THE INFORMATION PROVIDED TO YOU HEREUNDER IS PROVIDED "AS IS," AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, FactSet CallStreet, LLC AND ITS LICENSORS, BUSINESS ASSOCIATES AND SUPPLIERS DISCLAIM ALL WARRANTIES WITH RESPECT TO THE SAME, EXPRESS, IMPLIED AND STATUTORY, INCLUDING WITHOUT LIMITATION ANY IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY, COMPLETENESS, AND NON-INFRINGEMENT. TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, NEITHER FACTSET CALLSTREET, LLC NOR ITS OFFICERS, MEMBERS, DIRECTORS, PARTNERS, AFFILIATES, BUSINESS ASSOCIATES, LICENSORS OR SUPPLIERS WILL BE LIABLE FOR ANY INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR PUNITIVE DAMAGES, INCLUDING WITHOUT LIMITATION DAMAGES FOR LOST PROFITS OR REVENUES, GOODWILL, WORK STOPPAGE, SECURITY BREACHES, VIRUSES, COMPUTER FAILURE OR MALFUNCTION, USE, DATA OR OTHER INTANGIBLE LOSSES OR COMMERCIAL DAMAGES, EVEN IF ANY OF SUCH PARTIES IS ADVISED OF THE POSSIBILITY OF SUCH LOSSES, ARISING UNDER OR IN CONNECTION WITH THE INFORMATION PROVIDED HEREIN OR ANY OTHER SUBJECT MATTER HEREOF.

The contents and appearance of this report are Copyrighted FactSet CallStreet, LLC 2014. CallStreet and FactSet CallStreet, LLC are trademarks and service marks of FactSet CallStreet, LLC. All other trademarks mentioned are trademarks of their respective companies. All rights reserved.

18

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

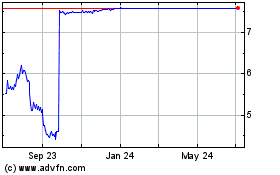

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Apr 2023 to Apr 2024