The proliferation of ETFs has brought countless strategies to

the fingertips of average investors in recent years; through the

use of a single ticker, virtually anyone with an online brokerage

account can access a variety of asset classes from all around

the globe or tap into a professionally managed portfolio that was

once simply unreachable by self-directed investors [see also 101

ETF Lessons Every Financial Advisor Should Learn].

We recently had an opportunity to talk with Wesley Gray, Ph.D,

the leader behind Alpha Architect and the recently launched U.S.

Quantitative Value ETF (QVAL); he shares insights about his firm,

core investment beliefs, and the “secret sauce” that sets QVAL

apart from competitors.

ETF Database (ETFdb): What exactly is Alpha

Architect?

Wesley Gray (WG): We are an

asset management firm that delivers high-conviction tax-efficient

strategies at affordable costs. I would describe us in a few simple

words: Affordable, Active, Alpha. We offer our strategies via

active Exchange-Traded Funds (ETFs) and Separately Managed Accounts

(SMAs).

Wesley Gray (WG): We are an

asset management firm that delivers high-conviction tax-efficient

strategies at affordable costs. I would describe us in a few simple

words: Affordable, Active, Alpha. We offer our strategies via

active Exchange-Traded Funds (ETFs) and Separately Managed Accounts

(SMAs).

Perhaps a more relevant question is the following: What do we

believe? There is certainly no shortage of asset managers who want

you to simply have faith in their proprietary methodology and

“special sauce.” Our experience with academia and

ultra-high-net-worth individuals has culminated in three core

beliefs that permeate everything we do:

- We believe in Systematic Decision-Making, not ad-hoc

decision-making. Disciplined and repeatable processes are more

reliable than discretionary judgment.

- We believe in Empirical-Based Investing, not story

based-investing. Rigorous, data-driven research drives success;

stories drive sales.

- We believe in Transparency, not black-boxes. We are

committed to having investors understand what we are doing.

So we are the antithesis of the stockpicker who relies on his

intuition and his compelling story, and who won’t tell you how he

makes his decisions, and therefore feels justified in charging you

high fees. We don’t buy this. By contrast, our firm is driven by

research and a desire to challenge this traditional way of doing

business in financial services. I have an MBA and a PhD in finance

from the University of Chicago and spent four years as a finance

professor. I have developed a deep respect for the value of

research, empiricism and discipline as it relates to applied

investing and behavioral finance.

My research team consists of my top PhD and Masters students. We

have worked together for nearly five years now on academic and

practitioner research questions and our faith in the research

process, on investing systematically, and on being up-front and

honest about what we are doing is continually reinforced the more

we work together. We find that the beliefs outlined above offer the

best framework for financial management and innovation [see also

Why Passive Investing Is More Active Than You Think].

ETFdb: What is your overarching philosophy with regard to

portfolio management? Please elaborate beyond the passive

versus active debate.

WG: We recognize the passive versus active debate can cause

people to fall into different camps. We’re not dogmatic about that.

Our philosophy does not involve strong views that one camp is right

and the other is wrong, since we think each has merits and can play

a role in an investment portfolio. Given this, we take a simple

approach to portfolio management and ask a simple question: What

are the FACTS? The FACTS are Fees, Access, Complexity, Taxes and

Search/Due Diligence. Once we have clarity on the FACTS, it then

becomes a simple comparison of costs versus benefits.

Our experience suggests that the majority of taxable investors

should focus on strategies with lower costs, higher accessibility

and liquidity, easily understood investment processes, higher

tax-efficiency, and limited due diligence requirements. So on its

face, this view would seem to make a strong case for passive

investing, but it also applies to questions related to active

management.

For instance, we often meet high net worth individuals (and even

RIAs) who are unaware of the tax deferral features within the ETF

vehicle or why an equal weight portfolio might make more sense than

some whiz-bang mean variance approach. Before we start debating

whether a strategy can yield an incremental 200 bps of so-called

“Alpha,” let’s make sure we address the big picture and minimize

fees, taxes, and due diligence headaches [see list

of Actively-Managed ETFs].

Generally speaking, the FACTS suggest that investors should make

use of more managed accounts and ’40 Act products, and rely less on

expensive, private funds. The academic evidence is overwhelmingly

in favor of simple, transparent, tax-efficient strategies versus

expense “black box” approaches.

ETFdb: What was the inspiration behind creating

the U.S. Quantitative Value ETF (QVAL)?

WG: We were inspired by two distinct sources: the limited

and expensive options provided by the market today for a

high-conviction high expected performance value strategy, and the

demand we observed from investors for a cheaper, more tax efficient

alternative to mutual funds and/or hedge funds.

Let’s start with the market itself. There are very few

high-conviction (<50 stocks) active ETFs in the market today,

and any non-ETF products out there are expensive. So if I want to

be a value investor and express my true conviction as such, I

either have to 1) save fees by doing the work myself and then get

killed on taxes OR 2) pay hedge fund / mutual fund fees to get that

effective high conviction exposure, and still get killed on taxes.

I cannot overstate this point on taxes: the taxes incurred during

any rebalancing make virtually every traditional vehicle

unattractive on an after-tax basis. That’s just the brutal reality

of options available to investors.

On the investor side, we had a deluge of interest from investors

with <$1M in investable assets. They were saying, “We want to do

this. How can we do this?” This demand reinforced our belief that

the market wanted an active ETF solution. You don’t have to be an

investing genius to see why this could make sense. So we reached

out to our multi-billion dollar family office partners and they

loved the idea. It was a perfect fit: a tax efficient, high

conviction strategy that suited both HNW investors and Main Street

investors [see also The Cheapest ETF for Every Investment

Objective].

With an active ETF, we can manage any account of almost any

size, and at an affordable price. You get a first class product,

and you don’t need to be a family office to negotiate a low fee.

Compared to other active options, such as mutual funds, quant hedge

funds, and the like, our management fee is a bargain. Second, we

capture the tax advantages of ETFs and apply them to an intelligent

active strategy. This is an issue that plagues “traditional” active

managers, since they can be forced to make buying and selling

decisions based on tax considerations, rather than based on

valuation and fundamentals.

ETFdb: What is QVAL’s objective and how does it actually

work? How does it differentiate itself from existing value-focused

funds?

WG: The QVAL objective is straightforward: Buy the

cheapest, highest quality value stocks. We deploy a five-step

process to accomplish our objective (see graphic below):

- Identify Investable Universe: Our universe generally

consists of mid- to large-capitalization U.S. exchange-traded

stocks.

- Forensic Accounting Screens: We conduct financial

statement analysis with statistical models to avoid firms at risk

for financial distress or financial statement manipulation.

- Valuation Screens: We screen for stocks with low

enterprise values relative to operating earnings.

- Quality Screens: We rank the cheapest stocks on their

long-term business fundamentals and current financial

strength.

- Invest with Conviction: We seek to invest in a

concentrated portfolio of the cheapest, highest quality value

stocks, which maximizes our expected returns over the long run.

This form of investing is by definition contrarian, and requires

disciplined commitment, as well as a thorough understanding of its

theoretical and intellectual underpinnings in order to stick with

it, since it may underperform in the short run.

As for the second part of your question, as to how we are

differentiated from our competitors, there are a few factors.

First, we offer a rigorous, statistics-based defense against

permanent capital impairment. Second, we offer a very smart way to

screen for price, and have a lot of evidence to back up why we

think so. Third, we use a lot of the quality signals from the

philosophy of value investing that you often see used in

fundamental research shops, but we do so systematically across the

entire equity universe to identify the very highest quality

companies.

In the end, we systematically form our portfolio, rather than

picking a stock story we like and then back into some of the

value-related characteristics the stock happens to have [see also

When the Fine Print Matters for ETF Investors].

For example, you won’t hear us say, as you might hear a

fundamental shop say, “Hey, this stock looks pretty cheap based on

its P/E, and it has nice returns on capital and boy do we have a

good feeling about management.” Instead we are going to say, “This

stock is liquid enough not to cause problems, it is not

showing statistical signs something very bad is likely to happen,

it is objectively cheap using the best valuation tools we can find,

and it is doing these 10, 12 or 15 financial things right that Ben

Graham and very bright academics have shown us we should pay

attention to, therefore it sure looks like a decent statistical bet

on its own but we want to include it as part of a basket of other

similar securities, and equal weight them to give you the best

chance to succeed over time.”

That is a very different investment proposition than relying on

the hot manager du jour, who relies on what their gut is saying, is

subject to behavioral biases, and who claims to be a value

investor. We just don’t believe there are many value investors out

there of this latter ilk who are worth paying what they are

charging for their services.

One of our clients was describing us to another investor and

said, “These guys are not quants, they are value investors.” And

that’s right. We really are value investors just like any of these

fundamental managers are, or claim to be, since we are looking at

exactly the same accounting-based measures and metrics, BUT — and

here’s the difference — we are doing so in a rigorous and

systematic way, using academic research, and quantitative tools,

and eliminating the chance we will be influenced by our faulty

human biases. Finally, we do so cheaply and in a tax-efficient

wrapper via the ETF. These are what differentiate us from the

competition.

The Bottom Line

Utilizing a value-focused investment approach is

as desirable as it is difficult. For those looking to tap into

an actively-managed portfolio that offers concentrated exposure to

high-quality, undervalued equities, QVAL most certainly warrants a

closer look; this product separates itself from the pack by

adhering to a strict process that takes emotion and bias out of the

equation all the while relying on hard data to steer allocation

decisions rather than compelling stories.

Follow me on Twitter @SBojinov

[For more ETF analysis, make sure to sign up for our free ETF

newsletter]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

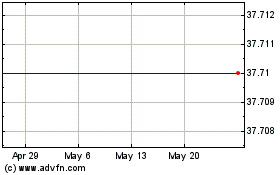

Alpha Architect US Quant... (AMEX:QVAL)

Historical Stock Chart

From Aug 2024 to Sep 2024

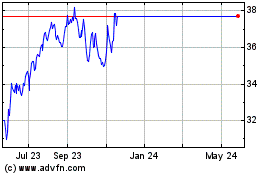

Alpha Architect US Quant... (AMEX:QVAL)

Historical Stock Chart

From Sep 2023 to Sep 2024