UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 14, 2014

SPANISH BROADCASTING SYSTEM, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

000-27823 |

|

13-3827791 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

7007 N.W. 77th Avenue, Miami, Florida |

|

33166 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(305) 441-6901

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d‑2(b)) |

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e‑4(c)) |

Item 2.02-Results of Operations and Financial Condition.

On November 14, 2014, Spanish Broadcasting System, Inc. (the “Company”) issued a press release announcing its financial results for the three- and nine-months ended September 30, 2014. A copy of the press release is attached hereto as Exhibit 99.1.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

99.1 |

|

Press Release of Spanish Broadcasting System, Inc., dated November 14, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SPANISH BROADCASTING SYSTEM, INC.

(Registrant) |

|

|

|

|

|

November 14, 2014 |

By: |

|

/s/ Joseph A. García |

|

|

|

|

Joseph A. García |

|

|

|

|

Chief Financial Officer, Chief Administrative

Officer, Senior Executive Vice President and Secretary |

Exhibit Index

|

Exhibit No. |

|

Description |

|

99.1 |

|

Press Release of Spanish Broadcasting System, Inc., dated November 14, 2014. |

Exhibit 99.1

SPANISH BROADCASTING SYSTEM, INC. REPORTS

RESULTS FOR THE THIRD QUARTER 2014

MIAMI, FLORIDA, November 14, 2014 – Spanish Broadcasting System, Inc. (the “Company” or “SBS”) (NASDAQ: SBSA) today reported financial results for the three- and nine-months ended September 30, 2014.

Financial Highlights

|

|

|

Quarter Ended |

|

|

|

|

|

Nine-Months Ended |

|

|

|

|

|

|

|

September 30, |

|

|

% |

|

|

September 30, |

|

|

% |

|

|

(in thousands) |

|

2014 |

|

|

2013 |

|

|

Change |

|

|

2014 |

|

|

2013 |

|

|

Change |

|

|

Net revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Radio |

|

$ |

32,713 |

|

|

|

35,428 |

|

|

|

(8 |

%) |

|

$ |

98,177 |

|

|

|

100,634 |

|

|

|

(2 |

%) |

|

Television |

|

|

3,565 |

|

|

|

5,654 |

|

|

|

(37 |

%) |

|

|

11,767 |

|

|

|

15,618 |

|

|

|

(25 |

%) |

|

Consolidated |

|

$ |

36,278 |

|

|

|

41,082 |

|

|

|

(12 |

%) |

|

$ |

109,944 |

|

|

|

116,252 |

|

|

|

(5 |

%) |

|

OIBDA, a non-GAAP measure*: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Radio |

|

$ |

12,151 |

|

|

|

13,571 |

|

|

|

(10 |

%) |

|

$ |

36,094 |

|

|

|

41,029 |

|

|

|

(12 |

%) |

|

Television |

|

|

(714 |

) |

|

|

117 |

|

|

|

NA |

|

|

|

(1,535 |

) |

|

|

68 |

|

|

|

NA |

|

|

Corporate |

|

|

(2,098 |

) |

|

|

(2,371 |

) |

|

|

(12 |

%) |

|

|

(7,546 |

) |

|

|

(7,413 |

) |

|

|

2 |

% |

|

Consolidated |

|

$ |

9,339 |

|

|

|

11,317 |

|

|

|

(17 |

%) |

|

$ |

27,013 |

|

|

|

33,684 |

|

|

|

(20 |

%) |

|

* |

Please refer to the Non-GAAP Financial Measures section for a definition of OIBDA and a reconciliation from OIBDA to the most directly comparable GAAP financial measure. |

Discussion and Results

“During the third quarter, we continued to execute our plan to support our market leading stations and strengthen our multi-media platform to position our company for long-term growth,” commented Raúl Alarcón, Jr., Chairman and CEO. “Our radio station clusters continue to rank among the most successful media properties serving the Spanish-speaking population in the nation’s largest Hispanic media markets. Building on our strong station brands, we are continuing to invest in our radio network and digital assets, in an effort to expand our audience nationally and compete for a larger pool of advertising dollars. We are pleased with our progress to date and believe our efforts will lead to improved results in the year ahead.”

Quarter Results

For the quarter-ended September 30, 2014, consolidated net revenues totaled $36.3 million compared to $41.1 million for the same prior year period, resulting in a decrease of $4.8 million or 12%. Our radio segment net revenues decreased $2.7 million or 8%, due to decreases in national, local and barter sales, which were partially offset by an increase in network sales. Our national sales decrease occurred throughout most of our markets, with the exception of our Puerto Rico market. Our local sales decreased in our Los Angeles, Puerto Rico and Miami markets and the decrease in barter sales occurred throughout most of our markets, with the exception of our Puerto Rico and Chicago markets. Our network sales increase was directly related to our new “AIRE Radio Networks” advertising platform, which we launched on January 1, 2014. Our television segment net revenues decreased $2.1 million or 37%, due to the decreases in special events revenue, paid-programming, and local and national spot sales.

|

|

Spanish Broadcasting System, Inc. |

Page 2 |

Consolidated OIBDA, a non-GAAP measure, totaled $9.3 million compared to $11.3 million for the same prior year period, representing a decrease of $2.0 million or 17%. Our radio segment OIBDA decreased $1.4 million or 10%, primarily due to the decrease in net revenues of $2.7 million, partially offset by the decrease in operating expenses of $1.3 million. Radio station operating expenses decreased mainly due to decreases in local and national commissions, legal settlements, barter expenses, music license fees, and compensation and benefits. Offsetting these decreases were expenses related to our new AIRE Radio Networks such as network-affiliate station compensation and employee compensation and benefits. Our television segment OIBDA decreased $0.8 million, due to the decrease in net revenues of $2.1 million, partially offset by the decrease in operating expenses of $1.3 million. Television station operating expenses decreased primarily due to decreases in special events expenses, taxes & licenses, ratings services and professional fees, which were offset by an increase in the allowance for doubtful accounts. Our corporate expenses decreased $0.3 million or 12%, mostly due to a decrease in professional fees.

Operating income totaled $8.1 million compared to $10.2 million for the same prior year period, representing a decrease of $2.1 million or 21%. This decrease in operating income was primarily due to the decrease in net revenues, which was partially offset by a decrease in operating expenses.

Nine-Months Ended Results

For the nine-months ended September 30, 2014, consolidated net revenues totaled $109.9 million compared to $116.2 million for the same prior year period, resulting in a decrease of $6.3 million or 5%. Our television segment net revenues decreased $3.8 million or 25%, due to the decreases in special events revenue, paid-programming and national spot sales. Our radio segment net revenues decreased $2.5 million or 2%, due to the decreases in national sales and special events revenue, which were offset by increases in local and network sales. Our national sales decrease occurred throughout all of our markets, and our special events revenue decreased in our Puerto Rico, Chicago and Miami markets. The increase in local sales occurred throughout most of our markets, with the exception of our Miami and Los Angeles markets. Our network sales increase was directly related to our new “AIRE Radio Networks” advertising platform, which we launched on January 1, 2014.

Consolidated OIBDA, a non-GAAP measure, totaled $27.0 million compared to $33.7 million for the same prior year period, representing a decrease of $6.7 million or 20%. Our radio segment OIBDA decreased $4.9 million or 12%, primarily due to the decrease in net revenues of $2.5 million and the increase in operating expenses of $2.4 million. Radio station operating expenses increased mainly due to expenses related to our new AIRE Radio Networks such as network-affiliate station compensation and employee compensation and benefits, and special event expenses, professional fees, and music licenses fees. Our television segment OIBDA decreased $1.6 million, due to the decrease in net revenues of $3.8 million, which were partially offset by the decrease in station operating expenses of $2.2 million. Television station operating expenses decreased primarily due to decreases in special event expenses and rating services, which were partially offset by increases in production costs and professional fees. Our corporate expenses increased by $0.1 million or 2%, mostly due to an increase in compensation and benefits, which was offset by a decrease in professional fees and travel & entertainment expenses.

Operating income totaled $24.5 million compared to $28.9 million for the same prior year period, representing a decrease of $4.4 million or 15%. This decrease in operating income was primarily due to the decrease in net revenues.

Third Quarter 2014 Conference Call

We will host a conference call to discuss our third quarter 2014 financial results on Monday, November 17, 2014 at 11:00 a.m. Eastern Time. To access the teleconference, please dial 412-317-6789 ten minutes prior to the start time.

If you cannot listen to the teleconference at its scheduled time, there will be a replay available through Monday, December 1, 2014, which can be accessed by dialing 877-344-7529 (U.S.) or 412-317-0088 (Int’l), passcode: 10056234.

There will also be a live webcast of the teleconference, located on the investor portion of our corporate Web site, at www.spanishbroadcasting.com/webcasts.shtml . A seven day archived replay of the webcast will also be available at that link.

|

|

Spanish Broadcasting System, Inc. |

Page 3 |

About Spanish Broadcasting System, Inc.

Spanish Broadcasting System, Inc. is the largest publicly traded Hispanic-controlled media and entertainment company in the United States. SBS owns and/or operates 20 radio stations located in the top U.S. Hispanic markets of New York, Los Angeles, Miami, Chicago, San Francisco and Puerto Rico, airing the Spanish Tropical, Regional Mexican, Spanish Adult Contemporary, Top 40 and Latin Rhythmic format genres. The Company also owns and operates MegaTV, a television operation with over-the-air, cable and satellite distribution and affiliates throughout the U.S. and Puerto Rico. SBS also produces live concerts and events and owns 21 bilingual websites, including www.LaMusica.com, a bilingual Spanish-English online site providing content related to Latin music, entertainment, news and culture. The Company’s corporate Web site can be accessed at www.spanishbroadcasting.com.

This press release contains certain forward-looking statements. These forward-looking statements, which are included in accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, may involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results and performance in future periods to be materially different from any future results or performance suggested by the forward-looking statements in this press release. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that actual results will not differ materially from these expectations. Forward-looking statements, which are based upon certain assumptions and describe future plans, strategies and expectations of the Company, are generally identifiable by use of the words “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” “might,” or “continue” or the negative or other variations thereof or comparable terminology. Factors that could cause actual results, events and developments to differ are included from time to time in the Company’s public reports filed with the Securities and Exchange Commission. All forward-looking statements made herein are qualified by these cautionary statements and there can be no assurance that the actual results, events or developments referenced herein will occur or be realized. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results.

(Financial Table Follows)

Contacts:

|

Analysts and Investors |

|

Analysts, Investors or Media |

|

José I. Molina |

|

Brad Edwards |

|

Vice President of Finance |

|

Brainerd Communicators, Inc. |

|

(305) 441-6901 |

|

(212) 986-6667 |

|

|

Spanish Broadcasting System, Inc. |

Page 4 |

Below are the Unaudited Condensed Consolidated Statements of Operations for the three- and nine-months ended September 30, 2014 and 2013.

|

|

|

Three-Months Ended |

|

|

Nine-Months Ended |

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

Amounts in thousands, except per share amounts |

|

|

(Unaudited) |

|

|

|

(Unaudited) |

|

|

Net revenue |

|

$ |

36,278 |

|

|

|

41,082 |

|

|

$ |

109,944 |

|

|

|

116,252 |

|

|

Station operating expenses |

|

|

24,841 |

|

|

|

27,394 |

|

|

|

75,385 |

|

|

|

75,155 |

|

|

Corporate expenses |

|

|

2,098 |

|

|

|

2,371 |

|

|

|

7,546 |

|

|

|

7,413 |

|

|

Depreciation and amortization |

|

|

1,272 |

|

|

|

1,237 |

|

|

|

3,806 |

|

|

|

3,911 |

|

|

(Gain) loss on the disposal of assets, net |

|

|

— |

|

|

|

(3 |

) |

|

|

(1,204 |

) |

|

|

(25 |

) |

|

Impairment charges and restructuring costs |

|

|

(30 |

) |

|

|

(136 |

) |

|

|

(103 |

) |

|

|

889 |

|

|

Operating income |

|

|

8,097 |

|

|

|

10,219 |

|

|

|

24,514 |

|

|

|

28,909 |

|

|

Interest expense, net |

|

|

(9,927 |

) |

|

|

(9,924 |

) |

|

|

(29,797 |

) |

|

|

(29,794 |

) |

|

Dividends on Series B preferred stock classified as

interest expense |

|

|

(2,433 |

) |

|

|

— |

|

|

|

(7,300 |

) |

|

|

— |

|

|

(Loss) income before income taxes |

|

|

(4,263 |

) |

|

|

295 |

|

|

|

(12,583 |

) |

|

|

(885 |

) |

|

Income tax expense |

|

|

402 |

|

|

|

189 |

|

|

|

1,402 |

|

|

|

512 |

|

|

Net (loss) income |

|

|

(4,665 |

) |

|

|

106 |

|

|

|

(13,985 |

) |

|

|

(1,397 |

) |

|

Dividends on Series B preferred stock |

|

|

— |

|

|

|

(2,482 |

) |

|

|

— |

|

|

|

(7,446 |

) |

|

Net loss applicable to common stockholders |

|

$ |

(4,665 |

) |

|

|

(2,376 |

) |

|

$ |

(13,985 |

) |

|

|

(8,843 |

) |

|

Net loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic & Diluted |

|

$ |

(0.64 |

) |

|

|

(0.33 |

) |

|

$ |

(1.92 |

) |

|

|

(1.22 |

) |

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic & Diluted |

|

|

7,267 |

|

|

|

7,267 |

|

|

|

7,267 |

|

|

|

7,267 |

|

|

|

Spanish Broadcasting System, Inc. |

Page 5 |

Non-GAAP Financial Measures

Operating Income (Loss) before Depreciation and Amortization, (Gain) Loss on the Disposal of Assets, net, and Impairment Charges and Restructuring Costs (“OIBDA”) is not a measure of performance or liquidity determined in accordance with Generally Accepted Accounting Principles (“GAAP”) in the United States. However, we believe that this measure is useful in evaluating our performance because it reflects a measure of performance for our stations before considering costs and expenses related to our capital structure and dispositions. This measure is widely used in the broadcast industry to evaluate a company’s operating performance and is used by us for internal budgeting purposes and to evaluate the performance of our stations, segments, management and consolidated operations. However, this measure should not be considered in isolation or as a substitute for Operating Income, Net Income, Cash Flows from Operating Activities or any other measure used in determining our operating performance or liquidity that is calculated in accordance with GAAP. In addition, because OIBDA is not calculated in accordance with GAAP, it is not necessarily comparable to similarly titled measures used by other companies.

Included below are tables that reconcile OIBDA to operating income (loss) for each segment and consolidated operating income (loss), which is the most directly comparable GAAP financial measure.

|

|

|

Quarter Ended September 30, 2014 |

|

|

(Unaudited and in thousands) |

|

Consolidated |

|

|

Radio |

|

|

Television |

|

|

Corporate |

|

|

OIBDA |

|

$ |

9,339 |

|

|

|

12,151 |

|

|

|

(714 |

) |

|

|

(2,098 |

) |

|

Less expenses excluded from OIBDA but included in operating income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,272 |

|

|

|

487 |

|

|

|

684 |

|

|

|

101 |

|

|

(Gain) loss on the disposal of assets, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Impairment charges and restructuring costs |

|

|

(30 |

) |

|

|

— |

|

|

|

— |

|

|

|

(30 |

) |

|

Operating Income (Loss) |

|

$ |

8,097 |

|

|

|

11,664 |

|

|

|

(1,398 |

) |

|

|

(2,169 |

) |

|

|

|

Quarter Ended September 30, 2013 |

|

|

(Unaudited and in thousands) |

|

Consolidated |

|

|

Radio |

|

|

Television |

|

|

Corporate |

|

|

OIBDA |

|

$ |

11,317 |

|

|

|

13,571 |

|

|

|

117 |

|

|

|

(2,371 |

) |

|

Less expenses excluded from OIBDA but included in operating income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,237 |

|

|

|

470 |

|

|

|

692 |

|

|

|

75 |

|

|

(Gain) loss on the disposal of assets, net |

|

|

(3 |

) |

|

|

(3 |

) |

|

|

— |

|

|

|

— |

|

|

Impairment charges and restructuring costs |

|

|

(136 |

) |

|

|

— |

|

|

|

— |

|

|

|

(136 |

) |

|

Operating Income (Loss) |

|

$ |

10,219 |

|

|

|

13,104 |

|

|

|

(575 |

) |

|

|

(2,310 |

) |

|

|

|

Nine-Months Ended September 30, 2014 |

|

|

(Unaudited and in thousands) |

|

Consolidated |

|

|

Radio |

|

|

Television |

|

|

Corporate |

|

|

OIBDA |

|

$ |

27,013 |

|

|

|

36,094 |

|

|

|

(1,535 |

) |

|

|

(7,546 |

) |

|

Less expenses excluded from OIBDA but included in operating income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

3,806 |

|

|

|

1,468 |

|

|

|

2,066 |

|

|

|

272 |

|

|

(Gain) loss on the disposal of assets, net |

|

|

(1,204 |

) |

|

|

(1,204 |

) |

|

|

— |

|

|

|

— |

|

|

Impairment charges and restructuring costs |

|

|

(103 |

) |

|

|

— |

|

|

|

— |

|

|

|

(103 |

) |

|

Operating Income (Loss) |

|

$ |

24,514 |

|

|

|

35,830 |

|

|

|

(3,601 |

) |

|

|

(7,715 |

) |

|

|

|

Nine-Months Ended September 30, 2013 |

|

|

(Unaudited and in thousands) |

|

Consolidated |

|

|

Radio |

|

|

Television |

|

|

Corporate |

|

|

OIBDA |

|

$ |

33,684 |

|

|

|

41,029 |

|

|

|

68 |

|

|

|

(7,413 |

) |

|

Less expenses excluded from OIBDA but included in operating income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

3,911 |

|

|

|

1,462 |

|

|

|

2,227 |

|

|

|

222 |

|

|

(Gain) loss on the disposal of assets, net |

|

|

(25 |

) |

|

|

(12 |

) |

|

|

— |

|

|

|

(13 |

) |

|

Impairment charges and restructuring costs |

|

|

889 |

|

|

|

86 |

|

|

|

1,000 |

|

|

|

(197 |

) |

|

Operating Income (Loss) |

|

$ |

28,909 |

|

|

|

39,493 |

|

|

|

(3,159 |

) |

|

|

(7,425 |

) |

|

|

Spanish Broadcasting System, Inc. |

Page 6 |

Unaudited Segment Data

We have two reportable segments: radio and television. The following summary table presents separate financial data for each of our operating segments:

|

|

|

Quarter Ended |

|

|

Nine-Months Ended |

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

Net revenue: |

|

(In thousands) |

|

|

(In thousands) |

|

|

Radio |

|

$ |

32,713 |

|

|

|

35,428 |

|

|

|

98,177 |

|

|

|

100,634 |

|

|

Television |

|

|

3,565 |

|

|

|

5,654 |

|

|

|

11,767 |

|

|

|

15,618 |

|

|

Consolidated |

|

$ |

36,278 |

|

|

|

41,082 |

|

|

|

109,944 |

|

|

|

116,252 |

|

|

Engineering and programming expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Radio |

|

$ |

5,508 |

|

|

|

6,086 |

|

|

|

15,938 |

|

|

|

15,795 |

|

|

Television |

|

|

2,398 |

|

|

|

2,355 |

|

|

|

7,054 |

|

|

|

6,393 |

|

|

Consolidated |

|

$ |

7,906 |

|

|

|

8,441 |

|

|

|

22,992 |

|

|

|

22,188 |

|

|

Selling, general and administrative expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Radio |

|

$ |

15,054 |

|

|

|

15,771 |

|

|

|

46,145 |

|

|

|

43,810 |

|

|

Television |

|

|

1,881 |

|

|

|

3,182 |

|

|

|

6,248 |

|

|

|

9,157 |

|

|

Consolidated |

|

$ |

16,935 |

|

|

|

18,953 |

|

|

|

52,393 |

|

|

|

52,967 |

|

|

Corporate expenses: |

|

$ |

2,098 |

|

|

|

2,371 |

|

|

|

7,546 |

|

|

|

7,413 |

|

|

Depreciation and amortization: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Radio |

|

$ |

487 |

|

|

|

470 |

|

|

|

1,468 |

|

|

|

1,462 |

|

|

Television |

|

|

684 |

|

|

|

692 |

|

|

|

2,066 |

|

|

|

2,227 |

|

|

Corporate |

|

|

101 |

|

|

|

75 |

|

|

|

272 |

|

|

|

222 |

|

|

Consolidated |

|

$ |

1,272 |

|

|

|

1,237 |

|

|

|

3,806 |

|

|

|

3,911 |

|

|

(Gain) loss on the disposal of assets, net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Radio |

|

$ |

— |

|

|

|

(3 |

) |

|

|

(1,204 |

) |

|

|

(12 |

) |

|

Television |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Corporate |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(13 |

) |

|

Consolidated |

|

$ |

— |

|

|

|

(3 |

) |

|

|

(1,204 |

) |

|

|

(25 |

) |

|

Impairment charges and restructuring costs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Radio |

|

$ |

— |

|

|

|

— |

|

|

|

— |

|

|

|

86 |

|

|

Television |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,000 |

|

|

Corporate |

|

|

(30 |

) |

|

|

(136 |

) |

|

|

(103 |

) |

|

|

(197 |

) |

|

Consolidated |

|

$ |

(30 |

) |

|

|

(136 |

) |

|

|

(103 |

) |

|

|

889 |

|

|

Operating income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Radio |

|

$ |

11,664 |

|

|

|

13,104 |

|

|

|

35,830 |

|

|

|

39,493 |

|

|

Television |

|

|

(1,398 |

) |

|

|

(575 |

) |

|

|

(3,601 |

) |

|

|

(3,159 |

) |

|

Corporate |

|

|

(2,169 |

) |

|

|

(2,310 |

) |

|

|

(7,715 |

) |

|

|

(7,425 |

) |

|

Consolidated |

|

$ |

8,097 |

|

|

|

10,219 |

|

|

|

24,514 |

|

|

|

28,909 |

|

|

|

Spanish Broadcasting System, Inc. |

Page 7 |

Selected Unaudited Balance Sheet Information and Other Data:

|

|

|

As of |

|

|

(Amounts in thousands) |

|

September 30, 2014 |

|

|

Cash and cash equivalents |

|

$ |

30,770 |

|

|

Total assets |

|

$ |

461,394 |

|

|

12.5% Senior Secured Notes due 2017, net |

|

$ |

270,258 |

|

|

Other debt |

|

|

5,343 |

|

|

Total debt |

|

$ |

275,601 |

|

|

Series B preferred stock |

|

$ |

90,549 |

|

|

Accrued Series B preferred stock dividends payable |

|

|

43,397 |

|

|

Total |

|

$ |

133,946 |

|

|

Total stockholders’ deficit |

|

$ |

(68,287 |

) |

|

Total capitalization |

|

$ |

341,260 |

|

|

|

|

For the Nine-Months Ended September 30, |

|

|

|

|

2014 |

|

|

2013 |

|

|

Capital expenditures |

|

$ |

1,868 |

|

|

|

1,469 |

|

|

Cash paid for income taxes |

|

$ |

358 |

|

|

|

— |

|

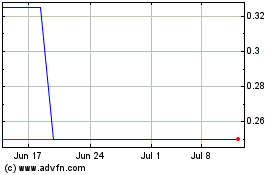

Spanish Broadcasting Sys... (PK) (USOTC:SBSAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

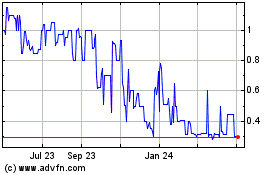

Spanish Broadcasting Sys... (PK) (USOTC:SBSAA)

Historical Stock Chart

From Apr 2023 to Apr 2024