UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2014

Commission File Number: 001-34936

NOAH HOLDINGS

LIMITED

No. 32 Qinhuangdao Road, Building C,

Shanghai 200082, People’s Republic of China

(86-21) 3860-2301

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7): ¨

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| NOAH HOLDINGS LIMITED |

|

|

| By: |

|

/s/ Ching Tao |

|

|

| Name: |

|

Ching Tao |

| Title: |

|

Chief Financial Officer |

Date: November 12, 2014

EXHIBIT INDEX

Exhibit 99.1 – Press Release

Exhibit 99.1

NOAH HOLDINGS LIMITED ANNOUNCES UNAUDITED FINANCIAL RESULTS FOR THE THIRD QUARTER OF 2014 AND APPOINTS NEW CHIEF FINANCIAL OFFICER

SHANGHAI, CHINA — November 11, 2014 — Noah Holdings Limited (“Noah” or the “Company”) (NYSE: NOAH), a leading wealth

management service provider focusing on distributing wealth management products to the high net worth population in China, today announced its unaudited financial results for the third quarter of 2014.

THIRD QUARTER 2014 FINANCIAL HIGHLIGHTS

| |

• |

|

Net revenues in the third quarter of 2014 were US$62.9 million, a 51.7% increase from the corresponding period in 2013. |

| |

• |

|

Income from operations in the third quarter of 2014 was US$22.9 million, a 34.6% increase from the corresponding period in 2013. |

| |

• |

|

Operating margin in the third quarter of 2014 was 36.4%, compared to 41.0% in the corresponding period in 2013. |

| |

• |

|

Net income attributable to Noah shareholders in the third quarter of 2014 was US$17.9 million, a 28.0% increase from the corresponding period in 2013.

Non-GAAP1 net income attributable to Noah shareholders in the third quarter of 2014 was US$19.5 million, a 27.6% increase from the corresponding period in 2013. |

| |

• |

|

Net income per basic and diluted ADS in the third quarter of 2014 were both US$0.32. Non-GAAP net income per diluted ADS in the third quarter of 2014 was US$0.34. |

THIRD QUARTER 2014 OPERATIONAL HIGHLIGHTS

| |

• |

|

Total number of registered clients as of September 30, 2014 increased by 31.9% year-over-year to 66,069 this figure includes 63,236 registered individual clients, 2,714 registered enterprise clients and 119

wholesale clients that have entered into cooperation agreements with the Company. |

| |

• |

|

Active clients2 during the third quarter of 2014 were 4,091, an 82.2% increase from the corresponding period in 2013. The aggregate value of wealth

management products distributed by the Company during the third quarter of 2014 was RMB18.4 billion (approximately US$3.0 billion)3, a 52.8% increase from the corresponding period in 2013. Of

this aggregate value, fixed income products accounted for 53.9%, private equity fund products accounted for 9.9%, equity products accounted 30.2% and other products, including mutual fund products and insurance products, accounted for 6.0%. The

average transaction value per client4 excluded mutual fund products in the third quarter of 2014 was RMB4.2 million (approximately US$0.7 million), a 21.6% decrease from the corresponding

period in 2013. |

| |

• |

|

Coverage network as of September 30, 2014 included 60 branches, increased from 57 branches as of June 30, 2014 and up from 56 branches as of September 30, 2013. The number of relationship

managers was 775 as of September 30, 2014, up from 540 as of September 30, 2013 and 690 as of June 30, 2014. |

| 1 |

Noah’s Non-GAAP financial measures are its corresponding GAAP financial measures as adjusted by excluding the effects of all forms of share-based compensation. |

| 2 |

“Active clients” refers to those registered clients who purchased wealth management products distributed by Noah during any given period. |

| 3 |

The amount in RMB was translated into U.S. dollars using the average rate for the period as set forth in the H.10 statistical release of the Federal Reserve Board. |

| 4 |

“Average transaction value per client” refers to the average value of wealth management products distributed by Noah that are purchased by active clients during a given period. |

APPOINTMENT OF NEW CHIEF FINANCIAL OFFICER

The Company appointed Ms. Ching Tao as its Chief Financial Officer replacing Ms. Chia-Yue Chang, effective November 7, 2014. Ms. Chang will

continue her role as executive director of the Company. Ms. Tao has more than 18 years of experience in investment and finance management. Prior to joining the Company, she served as the Chief Financial Officer of Charter Group Holdings Ltd., a

high-end, large-scale Chinese department store operator from 2011 to 2014. Ms. Tao worked at Goldman Sachs in Hong Kong, New York and Beijing from 1996 to 2011 and most recently was an Executive Director of the Investment Banking Division of

Goldman Sachs Gao Hua Securities Company Ltd. in Beijing. Ms. Tao received an MBA from Columbia Business School in 1996.

Ms. Jingbo Wang,

Co-founder, Chairwoman of the Board of Directors and Chief Executive Officer, commented, “We are very pleased to welcome Ms. Tao to the management team. She brings to the Company more than 18 years of financial and investment industry

experience and has a proven track record of leading and enhancing companies’ financial strategies.”

Ms. Wang commented, “Our business

maintained strong growth momentum and good performance in the third quarter. In the next 5 to 10 years, wealth management demand will have tremendous potential to grow. We will continue to benefit from our end-to-end and asset light business model,

established comprehensive service platform, highly selective asset management strategy with our core capabilities of seeking high quality assets and risk management to further grow market share and improve profitability.”

THIRD QUARTER 2014 FINANCIAL RESULTS

Net Revenues

Net revenues for the third quarter of 2014 were US$62.9 million, a 51.7% increase from the corresponding period in 2013, mainly due to

increases in one-time commission revenues along with increased transaction value and recurring service fees.

Net revenues from one-time

commissions for the third quarter of 2014 were US$25.1million, a 41.5% increase from the corresponding period in 2013. The year-over-year increase for the third quarter of 2014 was primarily due to an increase of 43.9% in transaction value,

despite a slight decrease in average commission rate.

Net revenues from recurring service fees for the third quarter of 2014 were US$34.8 million,

a 61.8% increase from the corresponding period in 2013. The year-over-year increase for the third quarter of 2014 was mainly due to the cumulative effect of private equity funds previously distributed by the Company and an increase in assets under

management by the Company since the second half of 2013.

Operating Margin

Operating margin for the third quarter of 2014 was 36.4%, as compared to 41.0% for the corresponding period in 2013. The year-over-year decrease for the

third quarter of 2014 was primarily due to the development of the internet finance business and other value added services in the third quarter.

Operating Cost and Expenses

Operating cost and

expenses for the third quarter of 2014, including cost of revenues, selling expenses, G&A expenses and other operating income, were US$40.0 million, a 63.6% increase from the corresponding period in 2013.

Cost of revenues for the third quarter of 2014 totaled US$14.5 million, a 62.1% increase from the

corresponding period in 2013. The year-over-year increase for the third quarter of 2014 was primarily due to increase in salary paid to relationship managers as a result of the increase in the number of relationship managers, as well as increase in

performance-based compensation paid to relationship managers as result of the increase in transaction value, and growth of new business. Cost of revenues as a percentage of net revenues for the third quarter of 2014 was 23.0%, as compared to 21.5%

for the corresponding period in 2013.

Selling expenses for the third quarter of 2014 were US$12.5 million, a 23.4% increase from the corresponding

period in 2013. The year-over-year increase for the third quarter of 2014 was primarily due to increases in personnel expenses, general marketing activities and rental expenses. Selling expenses as a percentage of net revenues for the third quarter

of 2014 was 19.8%, as compared to 24.4% for the corresponding period in 2013.

G&A expenses for the third quarter of 2014 were US$16.3 million,

a 70.6% increase from the corresponding period in 2013. The year-over-year increase for the third quarter of 2014 was primarily due to increases in personnel expenses, share-based compensation and professional fee. G&A expenses as a percentage

of net revenues for the third quarter of 2014 was 25.8%, as compared to 23.0% for the corresponding period in 2013.

Government subsidies for the

third quarter of 2014 were US$3.2 million, as compared to US$4.1 million for the corresponding period in 2013. Government subsidies represent cash subsidies received in the PRC from local governments for general corporate purposes.

Income Tax Expenses

Income tax expenses

for the third quarter of 2014 were US$5.9 million, an 18.8% increase from the corresponding period in 2013. The year-over-year increase for the third quarter of 2014 was primarily due to increase in taxable income.

Net Income

Net income for the third

quarter of 2014 was US$18.8 million, a 28.8% increase from the corresponding period in 2013. Net margin for the third quarter of 2014 was 29.8%, as compared to 35.1% for the corresponding period in 2013.

Net income attributable to Noah shareholders for the third quarter of 2014 was US$17.9 million, a 28.0% increase from the corresponding period in 2013.

Net income per basic and diluted ADS for the third quarter of 2014 were both US$0.32 as compared to US$0.25 for the corresponding period in 2013.

Non-GAAP net income for the third quarter of 2014 was US$20.3 million, a 28.3% increase from the corresponding period in 2013. Non-GAAP net

margin for the third quarter of 2014 was 32.3%, as compared to 38.2% for the corresponding period in 2013.

Non-GAAP net income attributable to

Noah shareholders for the third quarter of 2014 was US$19.5 million, a 27.6% increase from the corresponding period in 2013. Non-GAAP net income per diluted ADS for the third quarter of 2014 was US$0.34, as compared to US$0.27 for the

corresponding period in 2013.

Balance Sheet and Cash Flow

As of September 30, 2014, the Company had US$258.5 million in cash and cash equivalents, an increase of US$43.8 million from US$214.7 million as of

June 30, 2014. In the third quarter of 2014, the Company generated US$16.3 million cash inflow from its operating activities and a net US$24.9 million cash inflow from its investing activities.

2014 FORECAST

The Company estimates that non-GAAP net

income attributable to Noah shareholders for the full year 2014 is expected to be in a range of US$72.0 million and US$76.0 million, representing a year-over-year increase in the range of 27.0% and 34.1%. This estimate reflects management’s

current business outlook and is subject to change.

CONFERENCE CALL

Senior management will host a conference call on Tuesday, November 11, 2014 at 8:00 pm (Eastern) / 5:00 pm (Pacific) / 9:00 am (Hong Kong, Wednesday,

November 12, 2014) to discuss its third quarter 2014 unaudited financial results and recent business activity. The conference call may be accessed by calling the following numbers:

|

|

|

| |

|

Toll Free |

| United States |

|

+1-877-870-4263 |

| China |

|

4001-201203 |

| Hong Kong |

|

800-90-5945 |

| International |

|

+1-412-317-0790 |

|

|

| Conference ID # |

|

10055453 |

A telephone replay will be available shortly after the call until November 19, 2014 at +1-877-344-7529 (US Local Toll) or

+1-412-317-0088 (International). Conference ID #10055453.

A live webcast of the conference call and replay will be available in the investor relations

section of the Company’s website at http://ir.noahwm.com.

DISCUSSION OF NON-GAAP FINANCIAL MEASURES:

In addition to disclosing financial results prepared in accordance with U.S. GAAP, the Company’s earnings release contains non-GAAP financial measures

that exclude the effects of all forms of share-based compensation. The reconciliation of these non-GAAP financial measures to the nearest GAAP measures is set forth in the table captioned “Reconciliation of GAAP to Non-GAAP Results” below.

The non-GAAP financial measures disclosed by the Company should not be considered a substitute for financial measures prepared in accordance with U.S.

GAAP. The financial results reported in accordance with U.S. GAAP and reconciliation of GAAP to non-GAAP results should be carefully evaluated. The non-GAAP financial measure used by the Company may be prepared differently from and, therefore, may

not be comparable to similarly titled measures used by other companies.

When evaluating the Company’s operating performance in the periods

presented, management reviewed non-GAAP net income results reflecting adjustments to exclude the impacts of share-based compensation to supplement U.S. GAAP financial data. As such, the Company believes that the presentation of the non-GAAP net

income, non-GAAP income per diluted ADS and non-GAAP net margin provides important supplemental information to investors regarding financial and business trends relating to the Company’s financial condition and results of operations in a manner

consistent with that used by management. Pursuant to U.S. GAAP, the Company recognized significant amounts of expenses for the restricted shares and share options in the periods presented. To make financial results comparable period by period, the

Company utilized the non-GAAP financial results to better understand its historical business operations.

ABOUT NOAH HOLDINGS LIMITED

Noah Holdings Limited is a leading wealth management service provider focusing on distributing wealth management products to the high net worth population in

China. Noah distributes wealth management products, including primarily fixed income products, private equity funds, private securities investment funds and mutual funds. Noah is also equipped with asset management services capability, managing its

own fund of funds and real estate fund products. With 775 relationship managers covers 60 cities in 91 branch offices as of September 30, 2014, Noah’s total coverage network encompasses China’s most economically developed regions

where the high net worth population is concentrated. Through this extensive coverage network, product sophistication, and client knowledge, the Company caters to the wealth management needs of China’s high net worth population. For more

information please visit the Company’s website at http://www.noahwm.com.

SAFE HARBOR STATEMENT

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” “confident” and similar statements. Among other things, the outlook for the full year 2014 and quotations from management in this announcement, as well as Noah’s strategic and operational

plans, contain forward-looking statements. Noah may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and other

written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Noah’s beliefs and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: its goals and

strategies; its future business development, financial condition and results of operations; the expected growth of the wealth management market in China and internationally; its expectations regarding demand for and market acceptance of the products

it distributes; its expectations regarding keeping and strengthening its relationships with key clients; relevant government policies and regulations relating to its industry; its ability to attract and retain quality employees; its ability to stay

abreast of market trends and technological advances; its plans to invest in research and development to enhance its product choices and service offerings; competition in its industry in China and internationally; general economic and business

conditions in China; and its ability to effectively protect its intellectual property rights and not infringe on the intellectual property rights of others. Further information regarding these and other risks is included in Noah’s filings with

the Securities and Exchange Commission, including its annual report on Form 20-F. Noah does not undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under

applicable law. All information provided in this press release and in the attachments is as of the date of this press release, and Noah undertakes no duty to update such information, except as required under applicable law.

Contacts:

Noah Holdings Limited

Jing Ou-Yang, Director of IR

Tel: +86 21 2510 0889

ir@noahwm.com

— FINANCIAL AND OPERATIONAL

TABLES FOLLOW —

Noah Holdings Limited

Condensed Consolidated Balance Sheets

(In U.S. dollars)

(unaudited)

|

|

|

|

|

|

|

|

|

| |

|

As of |

|

| |

|

June 30, 2014 |

|

|

September 30, 2014 |

|

| |

|

$ |

|

|

$ |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

214,661,861 |

|

|

|

258,459,924 |

|

| Restricted cash |

|

|

161,197 |

|

|

|

162,920 |

|

| Short-term investments |

|

|

48,413,577 |

|

|

|

26,037,694 |

|

| Accounts receivable, net of allowance for doubtful accounts of nil at June 30, 2014 and September 30, 2014 |

|

|

17,738,509 |

|

|

|

22,840,267 |

|

| Loans receivable |

|

|

15,056,822 |

|

|

|

8,577,462 |

|

| Deferred tax assets |

|

|

782,783 |

|

|

|

789,145 |

|

| Amounts due from related parties |

|

|

21,003,828 |

|

|

|

24,446,914 |

|

| Other current assets |

|

|

6,100,505 |

|

|

|

7,119,402 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

323,919,082 |

|

|

|

348,433,728 |

|

|

|

|

| Long-term investments |

|

|

10,273,068 |

|

|

|

11,789,800 |

|

| Investment in affiliates |

|

|

18,393,796 |

|

|

|

19,867,059 |

|

| Property and equipment, net |

|

|

10,102,932 |

|

|

|

12,970,238 |

|

| Non-current deferred tax assets |

|

|

1,517,931 |

|

|

|

1,571,197 |

|

| Other non-current assets |

|

|

1,874,288 |

|

|

|

1,985,605 |

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

|

366,081,097 |

|

|

|

396,617,627 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accrued payroll and welfare expenses |

|

|

36,024,534 |

|

|

|

41,517,860 |

|

| Income tax payable |

|

|

6,571,251 |

|

|

|

4,902,151 |

|

| Amounts due to related parties |

|

|

10,834 |

|

|

|

36,334 |

|

| Deferred revenues |

|

|

20,058,907 |

|

|

|

19,784,572 |

|

| Short-term bank loans |

|

|

8,076,628 |

|

|

|

8,145,976 |

|

| Other current liabilities |

|

|

14,682,721 |

|

|

|

17,761,287 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

85,424,875 |

|

|

|

92,148,180 |

|

|

|

|

| Non-current uncertain tax position liabilities |

|

|

1,666,812 |

|

|

|

1,762,402 |

|

| Other non-current liabilities |

|

|

3,626,924 |

|

|

|

3,401,455 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

|

90,718,611 |

|

|

|

97,312,037 |

|

|

|

|

| Equity |

|

|

275,362,486 |

|

|

|

299,305,590 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Equity |

|

|

366,081,097 |

|

|

|

396,617,627 |

|

|

|

|

|

|

|

|

|

|

Noah Holdings Limited

Condensed Consolidated Income Statements

(In U.S. dollars, except for ADS data, per ADS data and percentages)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

|

|

| |

|

September 30,

2013 |

|

|

September 30,

2014 |

|

|

Change |

|

| |

|

$ |

|

|

$ |

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| Third-party revenues |

|

|

|

|

|

|

|

|

|

|

|

|

| One-time commissions |

|

|

13,838,399 |

|

|

|

21,135,919 |

|

|

|

52.7 |

% |

| Recurring service fees |

|

|

8,517,585 |

|

|

|

12,883,079 |

|

|

|

51.3 |

% |

| Other service fees |

|

|

1,534,366 |

|

|

|

2,766,390 |

|

|

|

80.3 |

% |

| Total third-party revenues |

|

|

23,890,350 |

|

|

|

36,785,388 |

|

|

|

54.0 |

% |

| Related party revenues |

|

|

|

|

|

|

|

|

|

|

|

|

| One-time commissions |

|

|

4,955,790 |

|

|

|

5,425,115 |

|

|

|

9.5 |

% |

| Recurring service fees |

|

|

14,265,186 |

|

|

|

23,932,765 |

|

|

|

67.8 |

% |

| Other service fees |

|

|

789,952 |

|

|

|

366,117 |

|

|

|

(53.7 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Related party revenues |

|

|

20,010,928 |

|

|

|

29,723,997 |

|

|

|

48.5 |

% |

| Total revenues |

|

|

43,901,278 |

|

|

|

66,509,385 |

|

|

|

51.5 |

% |

| Less: business taxes and related surcharges |

|

|

(2,442,749 |

) |

|

|

(3,616,959 |

) |

|

|

48.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

|

|

41,458,529 |

|

|

|

62,892,426 |

|

|

|

51.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating cost and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

(8,924,684 |

) |

|

|

(14,465,340 |

) |

|

|

62.1 |

% |

| Selling expenses |

|

|

(10,109,459 |

) |

|

|

(12,473,249 |

) |

|

|

23.4 |

% |

| General and administrative expenses |

|

|

(9,525,521 |

) |

|

|

(16,253,783 |

) |

|

|

70.6 |

% |

| Government subsidies |

|

|

4,090,866 |

|

|

|

3,171,460 |

|

|

|

(22.5 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating cost and expenses |

|

|

(24,468,798 |

) |

|

|

(40,020,912 |

) |

|

|

63.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

16,989,731 |

|

|

|

22,871,514 |

|

|

|

34.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

822,357 |

|

|

|

1,894,561 |

|

|

|

130.4 |

% |

| Investment income |

|

|

1,048,252 |

|

|

|

584,770 |

|

|

|

(44.2 |

%) |

| Other income (expenses) |

|

|

77,788 |

|

|

|

(1,883,864 |

) |

|

|

(2521.8 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other income |

|

|

1,948,397 |

|

|

|

595,467 |

|

|

|

(69.4 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before taxes and loss from equity in Affiliates |

|

|

18,938,128 |

|

|

|

23,466,981 |

|

|

|

23.9 |

% |

| Income tax expense |

|

|

(4,935,006 |

) |

|

|

(5,865,157 |

) |

|

|

18.8 |

% |

| Income from equity in affiliates |

|

|

567,462 |

|

|

|

1,162,466 |

|

|

|

104.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

14,570,584 |

|

|

|

18,764,290 |

|

|

|

28.8 |

% |

| Less: net income attributable to non-controlling Interests |

|

|

586,000 |

|

|

|

859,002 |

|

|

|

46.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Noah Shareholders |

|

|

13,984,584 |

|

|

|

17,905,288 |

|

|

|

28.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income per ADS, basic |

|

|

0.25 |

|

|

|

0.32 |

|

|

|

28.0 |

% |

| Income per ADS, diluted |

|

|

0.25 |

|

|

|

0.32 |

|

|

|

28.0 |

% |

| Margin analysis: |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating margin |

|

|

41.0 |

% |

|

|

36.4 |

% |

|

|

|

|

| Net margin |

|

|

35.1 |

% |

|

|

29.8 |

% |

|

|

|

|

| Weighted average ADS equivalent: [1] |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

54,993,576 |

|

|

|

55,825,466 |

|

|

|

|

|

| Diluted |

|

|

56,191,252 |

|

|

|

56,489,300 |

|

|

|

|

|

| ADS equivalent outstanding at end of period |

|

|

55,117,298 |

|

|

|

55,956,509 |

|

|

|

|

|

| [1] |

Assumes all outstanding ordinary shares are represented by ADSs. Each ordinary share represents two ADSs |

Noah Holdings Limited

Condensed Comprehensive Income Statements

(In U.S. dollars)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

|

|

| |

|

September 30,

2013 |

|

|

September 30,

2014 |

|

|

Change |

|

| |

|

$ |

|

|

$ |

|

|

|

|

| Net income |

|

|

13,984,584 |

|

|

|

18,764,290 |

|

|

|

34.2 |

% |

| Other comprehensive income, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation adjustments |

|

|

462,039 |

|

|

|

3,015,916 |

|

|

|

552.7 |

% |

| Fair value fluctuation of available for sale Investment (after tax) |

|

|

— |

|

|

|

357,449 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive income |

|

|

14,446,623 |

|

|

|

22,137,655 |

|

|

|

53.2 |

% |

| Less: Comprehensive income attributable to non-controlling interests |

|

|

612,214 |

|

|

|

954,374 |

|

|

|

55.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive income attributable to Noah Shareholders |

|

|

13,834,409 |

|

|

|

21,183,281 |

|

|

|

53.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Noah Holdings Limited

Supplemental Information

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of |

|

|

|

|

| |

|

September 30, 2013 |

|

|

September 30, 2014 |

|

|

Change |

|

|

|

|

|

| Number of registered clients |

|

|

50,084 |

|

|

|

66,069 |

|

|

|

31.9 |

% |

| Number of relationship managers |

|

|

540 |

|

|

|

775 |

|

|

|

43.5 |

% |

| Number of branch offices |

|

|

56 |

|

|

|

57 |

|

|

|

1.8 |

% |

|

|

|

| |

|

Three months ended |

|

|

|

|

| |

|

September 30, 2013 |

|

|

September 30, 2014 |

|

|

Change |

|

| |

|

(in millions of RMB, except number of active clients and

percentages) |

|

| Number of active clients |

|

|

2,245 |

|

|

|

4,091 |

|

|

|

82.2 |

% |

| Transaction value: |

|

|

|

|

|

|

|

|

|

|

|

|

| Fixed income products |

|

|

9,093 |

|

|

|

9,912 |

|

|

|

9.0 |

% |

| Private equity fund products |

|

|

2,351 |

|

|

|

1,817 |

|

|

|

(22.7 |

%) |

| Other products, including mutual fund products, private securities investment funds and insurance products |

|

|

584 |

|

|

|

5,581 |

|

|

|

855.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total transaction value |

|

|

12,029 |

|

|

|

17,310 |

|

|

|

43.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average transaction value per client |

|

|

5.4 |

|

|

|

4.23 |

|

|

|

(21.7 |

%) |

Noah Holdings Limited

Reconciliation of GAAP to Non-GAAP Results

(In U.S. dollars, except for ADS data and percentages)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

|

|

| |

|

September 30,

2013 |

|

|

September 30,

2014 |

|

|

Change |

|

| |

|

$ |

|

|

$ |

|

|

|

|

| Net income |

|

|

14,570,584 |

|

|

|

18,764,290 |

|

|

|

28.8 |

% |

| Adjustment for share-based compensation related to: |

|

|

|

|

|

|

|

|

|

|

|

|

| Share options |

|

|

55,298 |

|

|

|

519,324 |

|

|

|

839.1 |

% |

| Restricted shares |

|

|

1,223,451 |

|

|

|

1,046,438 |

|

|

|

(14.5 |

%) |

| Adjusted net income (non-GAAP)* |

|

|

15,849,333 |

|

|

|

20,330,052 |

|

|

|

28.3 |

% |

| Net margin |

|

|

35.1 |

% |

|

|

29.8 |

% |

|

|

|

|

| Adjusted net margin (non-GAAP)* |

|

|

38.2 |

% |

|

|

32.3 |

% |

|

|

|

|

|

|

|

|

| Net income attributable to Noah Shareholders |

|

|

13,984,584 |

|

|

|

17,905,288 |

|

|

|

28.0 |

% |

| Adjustment for share-based compensation related to: |

|

|

|

|

|

|

|

|

|

|

|

|

| Share options |

|

|

55,298 |

|

|

|

519,324 |

|

|

|

839.1 |

% |

| Restricted shares |

|

|

1,223,451 |

|

|

|

1,046,437 |

|

|

|

(14.5 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income attributable to Noah Shareholders (non-GAAP)* |

|

|

15,263,333 |

|

|

|

19,471,050 |

|

|

|

27.6 |

% |

|

|

|

|

| Net income attributable to Noah Shareholders per ADS, diluted |

|

|

0.25 |

|

|

|

0.32 |

|

|

|

28.0 |

% |

| Adjusted net income attributable to Noah Shareholders per ADS, diluted (non-GAAP)* |

|

|

0.27 |

|

|

|

0.34 |

|

|

|

25.9 |

% |

| * |

The non-GAAP adjustments do not take into consideration the impact of taxes on such adjustments. |

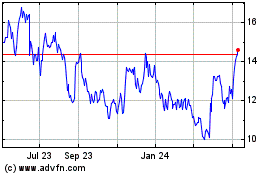

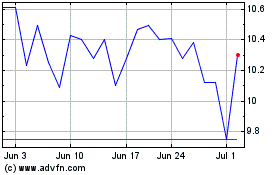

Noah (NYSE:NOAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Noah (NYSE:NOAH)

Historical Stock Chart

From Apr 2023 to Apr 2024