UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________

FORM 8-K

_____________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | |

| | |

Date of Report (Date of Earliest Event Reported): | | November 10, 2014 |

________________________

HALOZYME THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

________________________

|

| | | |

Delaware | 001-32335 | | 88-0488686 |

(State or other jurisdiction of incorporation) | (Commission File Number) | | (IRS Employer Identification No.) |

|

| |

11388 Sorrento Valley Road, San Diego, California | 92121 |

(Address of principal executive offices) | (Zip Code) |

|

| | |

Registrant’s telephone number, including area code: | | (858) 794-8889 |

Not Applicable

(Former name or former address, if changed since last report)

_________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On November 10, 2014, Halozyme Therapeutics, Inc. issued a press release to announce its financial results for the quarter ended September 30, 2014. A copy of the press release is attached hereto as Exhibit 99.1 to this current report.

The foregoing information, including Exhibit 99.1, is being furnished under Item 2.02 and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the "Exchange Act") or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

|

| |

Exhibit No. | Description |

| |

99.1 | Press release dated November 10, 2014 |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | HALOZYME THERAPEUTICS, INC. |

| | | | |

November 10, 2014 | | By: | | /s/ David A.Ramsay |

| | | | |

| | Name: | | David A. Ramsay |

| | Title: | | Vice President and Chief Financial Officer |

Exhibit Index

|

| | |

| | |

Exhibit No. | | Description |

| | |

99.1 | | Press release dated November 10, 2014 |

Exhibit 99.1

Investor Contact:

Schond Greenway

Halozyme Therapeutics

858-704-8352

ir@halozyme.com

Media Contact:

Susan Neath Francis

212-301-7182

sfrancis@w2ogroup.com

HALOZYME REPORTS THIRD QUARTER 2014 FINANCIAL RESULTS

-Halozyme completes corporate strategy review and affirms priority focus on advancing PEGPH20 and ENHANZE™-

-New patient enrollment underway in Study 202 with 25 patients enrolled and more than 40 clinical sites with IRB approval-

-Royalty revenues of $2.9M, up 71% from the prior quarter-

-Launch of HYQVIA® underway in the U.S.-

-Second target disclosed in Pfizer collaboration-

SAN DIEGO, November 10, 2014 -- Halozyme Therapeutics, Inc. (NASDAQ: HALO) today reported financial results for the third quarter ended September 30, 2014. Financial highlights for the third quarter include revenues of $14.6 million and a net loss of $20.3 million, or $0.16 per share. This compares to revenues of $16.0 million and a net loss of $19.3 million, or $0.17 per share, for the third quarter of 2013.

“The third quarter was notable for completion of a review and update to our corporate strategy based on a portfolio assessment. The recent Fast Track and Orphan Drug designations for PEGPH20, new pre-clinical data further supporting the pan-tumor potential for PEGPH20 and strong investigator interest in both pancreatic and lung cancer trials have confirmed this as our priority proprietary product for investment. The growth in the number of approvals for ENHANZE™- based products and the launch success of Roche’s Herceptin SC affirms our confidence in the growth potential of the ENHANZE platform,” stated Dr. Helen Torley, President and Chief Executive Officer. “Our pursuit of Hylenex® in Type 1 diabetes is a potential opportunity to expand the indication and increase sales of Hylenex. While discussions with the FDA are ongoing, we have learned that the FDA will likely request additional clinical data for a label update translating to potentially higher projected costs and longer time to market than had originally been anticipated. In the ongoing weeks, we intend to continue to seek clarity with FDA on what data will be required, if any. Once we have gained clarity as to the regulatory requirements for a label update, we intend to enter into collaborations with third parties or explore other strategic alternatives in order to exploit this opportunity. I am excited by the opportunity to focus our resources on advancing PEGPH20 and to expand utilization of our ENHANZE platform.”

Third Quarter 2014 Highlights

| |

• | Royalty revenues of $2.9 million represent over 70% growth from second quarter: Royalty revenues represent April to June sales as a result of the one quarter lag in royalty reports. The Herceptin SC launch is progressing well with approximately 20% market share in the markets launched through October. A notable recent milestone for Herceptin SC is the recent reimbursement approval and launch in France, traditionally one of the largest EU oncology markets. |

| |

• | HYQVIA® approved by the FDA and launched in the U.S.: In September, the U.S. Food and Drug Administration (FDA) approved HYQVIA for the treatment of primary immunodeficiency (PI) in adults and Baxter began commercial introduction of the product on October 20th. HYQVIA is the first subcutaneous immune globulin (IG) treatment approved for PI patients with a dosing regimen requiring only one infusion up to once per month (every three to four weeks) and one injection site per infusion to deliver a full therapeutic dose of IG. |

| |

• | PEGPH20 (PEGylated recombinant human hyaluronidase) received Fast Track and Orphan Drug designation for pancreatic cancer: The FDA has granted Fast Track designation for Halozyme's program investigating PEGPH20 in combination with gemcitabine and nab-paclitaxel for the treatment of patients with metastatic pancreatic cancer. The FDA Office of Orphan Products Development also granted Orphan Drug status for PEGylated recombinant human hyaluronidase for the treatment of pancreatic cancer which grants this designation to medical products that demonstrate promise for the treatment of rare diseases or conditions. |

| |

• | PEGPH20 (PEGylated recombinant human hyaluronidase) enrollment progressing: 42 of 44 sites have received IRB approval for the Study 202 protocol amendment. A total of 25 of the target of approximately 100 new patients have been enrolled to date. |

| |

• | SWOG resumes clinical trial of PEGPH20 in combination with modified FOLFIRINOX for advanced pancreatic cancer: SWOG Cancer Research has resumed patient enrollment and dosing of PEGPH20 in its ongoing Phase 1b/2 clinical trial (S1313). The trial is designed to evaluate PEGPH20 in combination with modified FOLFIRINOX chemotherapy (mFOLFIRINOX) in patients with metastatic pancreatic adenocarcinoma. The study has resumed under a revised protocol approved by the Independent Review Boards at the participating clinical trial sites. |

| |

• | CONSISTENT 1 trial of Hylenex in patients with Type1 diabetes to be ended after first year: While discussions with FDA are ongoing, we have determined that with all patients having completed 12 months on the trial at this time, we do not need additional data contribution from the second year of CONSISTENT 1 and we will be stopping the study. |

| |

• | Second disclosed program under the Halozyme-Pfizer collaboration: Pfizer intends to investigate a subcutaneous formulation using Halozyme’s Enhanze technology with rivipansel. Rivipansel is an investigational compound under evaluation for the treatment of vaso-occlusive crisis in individuals with sickle cell disease. |

| |

• | Reduction in force of approximately 13% completed in November 2014 to align with strategic priorities: We completed a corporate reorganization to align with strategic priorities. This reorganization resulted in a workforce reduction of 22 employees. We will incur a one-time charge in the fourth quarter of 2014 that will be largely offset by reduced compensation expenses during the quarter. |

Third Quarter and Nine Months 2014 Financial Highlights

| |

• | Revenues for the third quarter of 2014 were $14.6 million, compared to $16.0 million for the third quarter of 2013. Revenues in the third quarter included $5.8 million in product sales of bulk rHuPH20 for use in manufacturing Roche’s collaboration products, $3.6 million in Hylenex product sales, $2.9 million in royalty revenue from sales of products under our collaborations and $2.1 million in collaboration revenues. Revenues for the nine months were $45.0 million compared to $42.3 million for the same period in the previous year. |

| |

• | Research and development expenses for the third quarter of 2014 were $19.9 million, compared to $25.7 million for the third quarter of 2013. The decrease was primarily due to the inclusion in this quarter of manufacturing expenses in cost of product sales instead of research and development expenses as in the prior period last year. |

| |

• | Selling, general and administrative expenses for the third quarter of 2014 were $8.6 million, compared to $8.1 million for the third quarter of 2013. The increase was mainly due to an increase in patent expenses. |

| |

• | The net loss for the third quarter of 2014 was $20.3 million, or $0.16 per share, compared to a net loss for the third quarter of 2013 of $19.3 million, or $0.17 per share. The net loss for the nine months to date totaled $63.1 million, or $0.52 per share, compared to a net loss of $61.5 million, or $0.55 per share, for the first nine months of 2013. |

| |

• | Cash, cash equivalents and marketable securities were $134.5 million at September 30, 2014, compared to $147.6 million at June 30, 2014. Net cash used in the third quarter of 2014 was approximately $13.1 million. |

Webcast and Conference Call

Halozyme will webcast its quarterly update conference call today, November 10, 2014 at 4:30 p.m. EDT/1:30 p.m. PDT. During the call, management will discuss the financial results for the third quarter of 2014 and provide a business update. To listen to the live webcast please visit the "Investors" section of Halozyme's corporate website at www.halozyme.com. A webcast replay will be available shortly after the call at the same address. To participate by phone, please dial (866) 710-0179 (domestic callers) or (334) 323-7224 (international callers) using passcode 769890. A telephone replay will be available shortly after the call by dialing (877) 919-4059 (domestic callers) or (334) 323-0140 (international callers) using replay ID number 45298549.

About Halozyme

Halozyme Therapeutics is a biopharmaceutical company dedicated to developing and commercializing innovative products that advance patient care. With a diversified portfolio of enzymes that target the extracellular matrix, the company's research focuses primarily on a family of human enzymes, known as hyaluronidases, which increase the dispersion and absorption of biologics, drugs and fluids. Halozyme's pipeline addresses therapeutic areas, including oncology, diabetes and dermatology that have significant unmet medical need today. The company markets Hylenex® recombinant (hyaluronidase human injection) and has partnerships with Roche, Pfizer and Baxter. Halozyme is headquartered in San Diego. For more information on how we are innovating, please visit our corporate website at www.halozyme.com.

Safe Harbor Statement

In addition to historical information, the statements set forth above include forward-looking statements (including, without limitation, statements concerning the Company's future expectations and plans for enrollment of patients in Study 202 for PEGPH20, the development and commercialization of product candidates including planned clinical trials, the potential benefits and attributes of such product candidates, gaining clarity as to the regulatory pathway for updating the Hylenex® label for use in Type 1 diabetes, entering into new collaborations and potential royalty revenue from products from collaborations) that involve risk and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. The forward-looking statements are typically, but not always, identified through use of the words "believe," "enable," "may," "will," "could," "intends," "estimate," "anticipate," "plan," "predict," "probable," "potential," "possible," "should," "continue," and other words of similar

meaning. Actual results could differ materially from the expectations contained in forward-looking statements as a result of several factors, including unexpected expenditures and costs, unexpected fluctuations or changes in revenues from collaborators, unexpected results or delays in development and regulatory review, regulatory approval requirements, unexpected adverse events and competitive conditions. These and other factors that may result in differences are discussed in greater detail in the Company's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on November 10, 2014.

Halozyme Therapeutics, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

(in thousands, except per share data)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

Revenues: | | | | | | | |

Product sales, net | $ | 9,617 |

| | $ | 10,025 |

| | 27,679 |

| | $ | 14,634 |

|

Royalties | 2,895 |

| | — |

| | 5,382 |

| | — |

|

Revenues under collaborative agreements | 2,094 |

| | 5,988 |

| | 11,896 |

| | 27,667 |

|

Total revenues | 14,606 |

| | 16,013 |

| | 44,957 |

| | 42,301 |

|

Operating expenses: | | | | | | | |

Cost of product sales | 5,141 |

| | 683 |

| | 16,585 |

| | 2,706 |

|

Research and development | 19,904 |

| | 25,689 |

| | 59,968 |

| | 75,714 |

|

Selling, general and administrative | 8,587 |

| | 8,135 |

| | 27,589 |

| | 22,991 |

|

Total operating expenses | 33,632 |

| | 34,507 |

| | 104,142 |

| | 101,411 |

|

| | | | | | | |

Operating loss | (19,026 | ) | | (18,494 | ) | | (59,185 | ) | | (59,110 | ) |

| | | | | | | |

Investment and other income, net | 122 |

| | 52 |

| | 287 |

| | 165 |

|

Interest expense | (1,376 | ) | | (850 | ) | | (4,203 | ) | | (2,547 | ) |

Net Loss | $ | (20,280 | ) | | $ | (19,292 | ) | | $ | (63,101 | ) | | $ | (61,492 | ) |

| | | | | | | |

Basic and diluted net loss per share | $ | (0.16 | ) | | $ | (0.17 | ) | | $ | (0.52 | ) | | $ | (0.55 | ) |

| | | | | | | |

Shares used in computing basic and diluted net loss per share | 124,041 |

| | 112,765 |

| | 122,157 |

| | 112,554 |

|

Halozyme Therapeutics, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

(in thousands)

|

| | | | | | | |

| September 30,

2014 | | December 31,

2013 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 46,375 |

| | $ | 27,357 |

|

Marketable securities, available-for-sale | 88,089 |

| | 44,146 |

|

Accounts receivable, net | 8,275 |

| | 9,097 |

|

Inventories | 6,916 |

| | 6,170 |

|

Prepaid expenses and other assets | 8,945 |

| | 8,425 |

|

Total current assets | 158,600 |

| | 95,195 |

|

Property and equipment, net | 3,249 |

| | 3,422 |

|

Prepaid expenses and other assets | 2,277 |

| | 2,676 |

|

Restricted cash | 500 |

| | 500 |

|

Total Assets | $ | 164,626 |

| | $ | 101,793 |

|

| | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | | |

Current liabilities: | | | |

Accounts payable | $ | 4,342 |

| | $ | 3,135 |

|

Accrued expenses | 15,023 |

| | 14,369 |

|

Deferred revenue, current portion | 5,153 |

| | 7,398 |

|

Current portion of long-term debt, net | 10,075 |

| | — |

|

Total current liabilities | 34,593 |

| | 24,902 |

|

Deferred revenue, net of current portion | 47,572 |

| | 45,745 |

|

Long-term debt, net | 39,762 |

| | 49,772 |

|

Other long-term liabilities | 2,759 |

| | 1,364 |

|

| | | |

Stockholders’ equity (deficit): | | | |

Common stock | 125 |

| | 115 |

|

Additional paid-in capital | 485,014 |

| | 361,930 |

|

Accumulated other comprehensive (loss) income | (46 | ) | | 17 |

|

Accumulated deficit | (445,153 | ) | | (382,052 | ) |

Total stockholders’ equity (deficit) | 39,940 |

| | (19,990 | ) |

Total Liabilities and Stockholders’ Equity (Deficit) | $ | 164,626 |

| | $ | 101,793 |

|

###

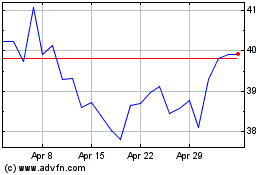

Halozyme Therapeutics (NASDAQ:HALO)

Historical Stock Chart

From Aug 2024 to Sep 2024

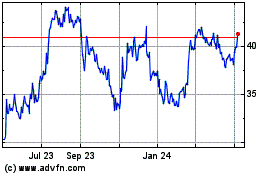

Halozyme Therapeutics (NASDAQ:HALO)

Historical Stock Chart

From Sep 2023 to Sep 2024