El Paso Electric Company (NYSE:EE):

Overview

- For the third quarter of 2014, El Paso

Electric Company ("EE" or the "Company") reported net income of

$52.5 million, or $1.30 basic and diluted earnings per share. In

the third quarter of 2013, EE reported net income of $50.6 million,

or $1.26 basic and diluted earnings per share.

- For the nine months ended September 30,

2014, EE reported net income of $87.2 million, or $2.16 basic and

diluted earnings per share. Net income for the nine months ended

September 30, 2013 was $87.4 million, or $2.17 basic and diluted

earnings per share.

“We were able to achieve several key milestones in our strategic

plan for the future of El Paso Electric Company during the third

quarter of 2014,” said Tom Shockley, Chief Executive Officer. “Mary

Kipp was named President of the Company on September 16, 2014,

which is a significant step in our succession plan. Furthermore, we

are pleased with the progress of the construction of our Montana

Power Station during the quarter. We now expect the first two units

to be placed in commercial operation during the first quarter of

2015. Overall, net income for the quarter ended September 30, 2014

increased by approximately 3.8%, compared to the same quarter last

year, and was consistent with our expectations.”

Earnings Summary

The table and explanations below present the major factors

affecting 2014 net income relative to 2013 net income:

Quarter

Ended Nine Months Ended Pre-Tax

Effect

After-Tax

NetIncome

BasicEPS

Pre-TaxEffect

After-TaxNetIncome

BasicEPS

September 30, 2013 $ 50,565 $ 1.26 $ 87,392 $ 2.17 Changes in:

Income taxes 2,857 0.07 3,029 0.07 Allowance for funds used during

construction $ 2,372 2,089 0.05 $ 4,071 3,609 0.09 Investment and

interest income 287 281 — 3,368 2,715 0.07 Taxes other than income

taxes 189 123 — (4,101 ) (2,665 ) (0.07 ) Palo Verde performance

rewards, net — — — 2,143 1,393 0.04 Operations and maintenance at

fossil-fuel generating plants (3,052 ) (1,984 ) (0.05 ) (3,799 )

(2,469 ) (0.06 ) Retail non-fuel base revenues (1,276 ) (830 )

(0.02 ) (6,952 ) (4,519 ) (0.11 ) Depreciation and amortization

expense (269 ) (174 ) — (2,990 ) (1,944 ) (0.05 ) Other (451 )

(0.01 ) 646 0.01 September 30, 2014 $ 52,476 $

1.30 $ 87,187 $ 2.16

Third Quarter 2014

Income for the quarter ended September 30, 2014, when compared

to the same period last year, was positively affected by:

- Income taxes, not reflected in other

income items below, decreased primarily due to a domestic

production activities deduction in 2014, whereas there was no such

deduction in 2013.

- Increased allowance for funds used

during construction ("AFUDC") due to higher balances of

construction work in progress including the Montana Power

Station.

Income for the quarter ended September 30, 2014, when compared

to the same period last year, was negatively affected by:

- Increased operation and maintenance

expense related to our fossil-fuel plants, primarily due to

maintenance at the Rio Grande and Newman generating plants in 2014,

with no comparable maintenance expense in the same period last

year.

- Decreased retail non-fuel base revenues

primarily due to a $3.0 million reduction in non-fuel base revenues

from sales to public authorities, which reflects increased use of

an interruptible rate at a military installation in our service

territory, as well as other energy saving programs at military

installations.

Other items impacting earnings included increased investment and

interest income due to increased realized gains on equity

investments in our Palo Verde decommissioning trust funds in 2014,

and reduced taxes other than income taxes. These increases to

income were partially offset by increased depreciation and

amortization due to increased depreciable plant balances.

Year to Date

Income for the nine months ended September 30, 2014, when

compared to the same period last year, was positively affected

by:

- Increased AFUDC due to higher balances

of construction work in progress, including the Montana Power

Station.

- Income taxes not reflected in other

income items below decreased primarily due to a domestic production

activities deduction in 2014, whereas there was no such deduction

in 2013.

- Increased investment and interest

income primarily due to increased gains on the sales of equity

investments in our Palo Verde decommissioning trust funds compared

to the same period last year.

- Recognition of Palo Verde performance

rewards associated with the 2009 to 2012 performance periods, net

of disallowed fuel and purchased power costs related to the

resolution of the Texas fuel reconciliation proceeding designated

as PUCT Docket No. 41852.

Income for the nine months ended September 30, 2014, when

compared to the same period last year, was negatively affected

by:

- Decreased retail non-fuel base

revenues, primarily due to a $3.5 million reduction in non-fuel

base revenues from sales to our residential customers, reflecting a

2.4% decrease in kWh sales due to milder weather in 2014, primarily

in the first quarter, when compared to the same period last year

and a $2.8 million reduction in non-fuel base revenues from sales

to public authorities which reflects increased use of an

interruptible rate at a military installation in our service

territory as well as other energy saving programs at military

installations.

- Increased taxes other than income

taxes, primarily due to higher property taxes, including a one-time

adjustment to the 2013 Arizona property tax rate recorded during

the first quarter of 2014.

- Increased operation and maintenance

expense related to our fossil-fuel plants, primarily due to

maintenance at the Rio Grande and Newman generating plants in 2014,

with no comparable maintenance expense in the same period last

year.

- Increased depreciation and amortization

due to increased depreciable plant balances including Rio Grande

Unit 9, which began commercial operation on May 13, 2013.

Retail Non-fuel Base Revenues

Retail non-fuel base revenues decreased $1.3 million, pre-tax,

or 0.7% in the third quarter of 2014 compared to the same period in

2013. This decrease reflects a $3.0 million reduction in non-fuel

base revenues from sales to public authorities, which is primarily

due to increased use of an interruptible rate at a military

installation in our service territory which is lower than the

previous rate applied for those services, as well as energy savings

from energy conservation and efficiency programs and use of solar

distributed generation at military installations, and reduced sales

to a local water utility primarily due to reduced ground water

pumping in the third quarter of 2014. Cooling degree days decreased

2.0% for the third quarter of 2014, compared to the same quarter

last year, and were 4.0% lower than the 10-year average. The

decrease in retail non-fuel base revenues was partially offset by

$1.3 million increase in non-fuel base revenues from sales to

residential customers. KWh sales to residential customers increased

by 1.6% due to a 1.3% increase in the average number of residential

customers served. KWh sales to small commercial and industrial

customers in the third quarter of 2014 increased 2.1%, compared to

the same quarter in 2013, reflecting a 1.9% increase in the average

number of customers served. Non-fuel base revenues and kWh sales

are provided by customer class on page 10 of this release.

For the nine months ended September 30, 2014, retail non-fuel

base revenues decreased $7.0 million, pre-tax, or 1.6%, compared to

the same period in 2013. This decrease reflects milder weather in

2014, primarily in the first quarter, which impacted sales to

residential, small commercial and industrial, and to a lesser

extent public authority customers. Heating degree days decreased

26.6% for the nine months of 2014, compared to the same period last

year, and were 17.0% below the 10-year average. Cooling degree days

decreased 3.1%, compared to the same period last year, and were

relatively unchanged from the 10-year average. Non-fuel base

revenues from sales to residential customers decreased $3.5 million

reflecting a decrease of 2.4% in kWh sales to residential customers

despite a 1.3% increase in the average number of residential

customers served. Non-fuel base revenues from sales to public

authorities decreased $2.8 million, which reflects increased use of

an interruptible rate at a military installation in our service

territory, as well as other energy savings from energy conservation

and efficiency programs and use of solar distributed generation at

military installations, and reduced sales to a local water utility

in the third quarter of 2014. Non-fuel base revenues from sales to

small commercial and industrial customers increased slightly, when

compared to the same period in 2013, due to a 2.0% increase in the

average number of customers served partially offset by milder

weather. KWh sales to large commercial and industrial customers

decreased 2.2%, and non-fuel base revenues decreased 2.5% as

several customers ceased operations. Non-fuel base revenues and kWh

sales are provided by customer class on page 12 of this

release.

Capital and Liquidity

We continue to maintain a strong capital structure to ensure

access to capital markets at reasonable rates. At September 30,

2014, common stock equity represented 48.3% of our capitalization

(common stock equity, long-term debt, current maturities of

long-term debt, and short-term borrowings under the revolving

credit facility (the "RCF")). At September 30, 2014, we had a

balance of $13.4 million in cash and cash equivalents. We expect to

issue long-term debt in the capital markets in late 2014 or early

2015 to repay short-term borrowings and finance capital

requirements. Based on current projections, we believe that we will

have adequate liquidity through the issuance of long-term debt, our

current cash balances, cash from operations, and available

borrowings under the RCF to meet all of our anticipated cash

requirements for the next twelve months.

Cash flows from operations for the nine months ended September

30, 2014 were $174.6 million compared to $184.9 million in the

corresponding period in 2013. The primary factors affecting the

decreased cash flow from operations were a decrease in deferred

income taxes and an increase in accounts receivable due to the

timing of certain non-trade receivables offset by a decrease in the

under-collection of fuel revenues. The difference between fuel

revenues collected and fuel expense incurred is deferred to be

either refunded (over-recoveries) or surcharged (under-recoveries)

to customers in the future. During the nine months ended September

30, 2014, the Company had a fuel under-recovery of $1.2 million

compared to an under-recovery of fuel costs of $8.4 million during

the nine months ended September 30, 2013. At September 30, 2014, we

had a net fuel under-recovery balance of $7.4 million, including an

under-recovery balance of $10.7 million in Texas and an

over-recovery balance of $3.3 million in New Mexico. Effective with

May 2014 billings, we increased our Texas fixed fuel factor by 6.9%

to reflect increases in prices for natural gas.

During the nine months ended September 30, 2014, our primary

capital requirements were for the construction and purchase of

electric utility plant, payment of common stock dividends, and

purchases of nuclear fuel. Capital requirements for new electric

plant were $189.3 million for the nine months ended September 30,

2014 and $165.3 million for the nine months ended September 30,

2013. Capital expenditures for 2014 are expected to be $306.0

million as we construct the Montana Power Station and related

transmission facilities. Capital requirements for purchases of

nuclear fuel were $28.8 million for the nine months ended September

30, 2014 and $19.9 million for the nine months ended September

30, 2013.

On September 30, 2014, we paid a quarterly cash dividend of

$0.28 per share, or $11.3 million, to shareholders of record on

September 15, 2014. We paid a total of $33.3 million in cash

dividends during the nine months ended September 30, 2014. At the

current dividend rate, we expect to pay cash dividends of

approximately $44.6 million during 2014.

No shares of common stock were repurchased during the nine

months ended September 30, 2014. As of September 30, 2014, a total

of 393,816 shares remain available for repurchase under the

currently authorized stock repurchase program. The Company may

repurchase shares in the open market from time to time.

We maintain the RCF for working capital and general corporate

purposes and financing of nuclear fuel through the Rio Grande

Resources Trust (the "RGRT"). The RGRT, the trust through which we

finance our portion of nuclear fuel for Palo Verde, is consolidated

in the Company's financial statements. The RCF has a term ending

January 14, 2019. The aggregate unsecured borrowing available under

the RCF is $300 million. We may increase the RCF by up to $100

million (up to a total of $400 million) during the term of the

agreement, upon the satisfaction of certain conditions, more fully

set forth in the agreement, including obtaining commitments from

lenders or third party financial institutions. The amounts we

borrow under the RCF may be used for working capital and general

corporate purposes. The total amount borrowed for nuclear fuel by

the RGRT was $127.5 million at September 30, 2014, of which $17.5

million had been borrowed under the RCF, and $110 million was

borrowed through senior notes. Borrowings by the RGRT for nuclear

fuel were $125.5 million as of September 30, 2013, of which $15.5

million had been borrowed under the RCF and $110 million was

borrowed through senior notes. Interest costs on borrowings to

finance nuclear fuel are accumulated by the RGRT and charged to us

as fuel is consumed and recovered through fuel recovery charges. At

September 30, 2014, $72.0 million was outstanding under the RCF for

working capital and general corporate purposes and we expect to

refinance the working capital and general corporate borrowings on

the RCF with long-term debt in late 2014 or early 2015. No

borrowings were outstanding at September 30, 2013 under the RCF for

working capital and general corporate purposes.

2014 Earnings Guidance

We are narrowing our earnings guidance for 2014 to $2.20 to

$2.35 per basic share from the previous range of $2.15 to $2.40 per

basic share.

Conference Call

A conference call to discuss third quarter 2014 financial

results is scheduled for 10:30 A.M. Eastern Time, on November

5, 2014. The dial-in number is 888-312-3048 with a conference ID

number of 5393015. The international dial-in number is

719-325-2354. The conference leader will be Lisa Budtke, Assistant

Treasurer. A replay will run through November 19, 2014 with a

dial-in number of 888-203-1112 and a conference ID number of

5393015. The replay international dial-in number is 719-457-0820.

The conference call and presentation slides will be webcast live on

the Company's website found at http://www.epelectric.com. A replay of the webcast

will be available shortly after the call.

Safe Harbor

This news release includes statements that may constitute

forward-looking statements made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

This information may involve risks and uncertainties that could

cause actual results to differ materially from such forward-looking

statements. Factors that could cause or contribute to such

differences include, but are not limited to: (i) increased prices

for fuel and purchased power and the possibility that regulators

may not permit EE to pass through all such increased costs to

customers or to recover previously incurred fuel costs in rates;

(ii) recovery of capital investments and operating costs

through rates in Texas and New Mexico; (iii) uncertainties and

instability in the general economy and the resulting impact on EE's

sales and profitability; (iv) changes in customers' demand for

electricity as a result of energy efficiency initiatives and

emerging competing services and technologies; (v) unanticipated

increased costs associated with scheduled and unscheduled outages

of generating plant; (vi) the size of our construction program and

our ability to complete construction on budget; (vii) potential

delays in our construction schedule due to legal challenges or

other reasons; (viii) costs at Palo Verde;

(ix) deregulation and competition in the electric utility

industry; (x) possible increased costs of compliance with

environmental or other laws, regulations and policies;

(xi) possible income tax and interest payments as a result of

audit adjustments proposed by the IRS or state taxing authorities;

(xii) uncertainties and instability in the financial markets

and the resulting impact on EE's ability to access the capital and

credit markets; and (xiii) other factors detailed by EE in its

public filings with the Securities and Exchange Commission. EE's

filings are available from the Securities and Exchange Commission

or may be obtained through EE's website, http://www.epelectric.com. Any such

forward-looking statement is qualified by reference to these risks

and factors. EE cautions that these risks and factors are not

exclusive. EE does not undertake to update any forward-looking

statement that may be made from time to time by or on behalf of EE

except as required by law.

El Paso Electric CompanyStatements of

OperationsQuarter Ended September 30, 2014 and

2013(In thousands except for per share

data)(Unaudited)

2014 2013 Variance Operating

revenues, net of energy expenses: Base revenues $ 183,405 $ 184,687

$ (1,282 ) (a) Deregulated Palo Verde Unit 3 revenues 3,944 3,047

897 Other 7,702 8,264 (562 )

Operating Revenues

Net of Energy Expenses 195,051 195,998

(947 ) Other operating expenses: Other

operations and maintenance 54,417 51,519 2,898 Palo Verde

operations and maintenance 20,489 20,014 475 Taxes other than

income taxes 17,964 18,153 (189 ) Other income 1,389 1,561

(172 )

Earnings Before Interest, Taxes, Depreciation and

Amortization 103,570 107,873 (4,303

) (b) Depreciation and amortization 20,685 20,416 269

Interest on long-term debt 14,617 14,623 (6 ) AFUDC and capitalized

interest 7,308 4,968 2,340 Other interest expense 438 153

285

Income Before Income Taxes 75,138

77,649 (2,511 ) Income tax expense

22,662 27,084 (4,422 )

Net Income

$ 52,476 $ 50,565

$ 1,911 Basic Earnings per Share

$ 1.30 $ 1.26 $

0.04 Diluted Earnings per Share

$ 1.30 $ 1.26 $

0.04 Dividends declared per share of common

stock $ 0.28 $ 0.265 $ 0.015 Weighted

average number of shares outstanding 40,214 40,132 82

Weighted average number of shares and

dilutive potential shares outstanding

42,065 40,132 1,933 (a) Base revenues

exclude fuel recovered through New Mexico base rates of $22.4

million and $22.7 million, respectively. (b) Earnings before

interest, taxes, depreciation and amortization ("EBITDA") is a

non-generally accepted accounting principles ("GAAP") financial

measure and is not a substitute for net income or other measures of

financial performance in accordance with GAAP.

El

Paso Electric CompanyStatements of OperationsNine

Months Ended September 30, 2014 and 2013(In thousands except

for per share data)(Unaudited) 2014

2013 Variance Operating revenues, net of

energy expenses: Base revenues $ 438,613 $ 445,533 $ (6,920 ) (a)

Deregulated Palo Verde Unit 3 revenues 11,903 9,260 2,643 Palo

Verde performance rewards, net 2,220 — 2,220 Other 22,331

23,990 (1,659 )

Operating Revenues Net of Energy

Expenses 475,067 478,783 (3,716 )

Other operating expenses: Other operations and maintenance

153,515 147,600 5,915 Palo Verde operations and maintenance 68,041

67,470 571 Taxes other than income taxes 48,883 44,782 4,101 Other

income 8,642 2,524 6,118

Earnings Before

Interest, Taxes, Depreciation and Amortization 213,270

221,455 (8,185 ) (b) Depreciation and

amortization 62,336 59,346 2,990 Interest on long-term debt 43,803

43,829 (26 ) AFUDC and capitalized interest 19,853 15,896 3,957

Other interest expense 899 456 443

Income

Before Income Taxes 126,085 133,720 (7,635

) Income tax expense 38,898 46,328

(7,430 )

Net Income $ 87,187

$ 87,392 $ (205 )

Basic Earnings per Share $ 2.16

$ 2.17 $ (0.01 )

Diluted Earnings per Share $ 2.16

$ 2.17 $ (0.01 )

Dividends declared per share of common stock $ 0.825 $ 0.78

$ 0.045 Weighted average number of shares

outstanding 40,181 40,108 73

Weighted average number of shares and

dilutive potential shares outstanding

40,209 40,124 85 (a) Base revenues

exclude fuel recovered through New Mexico base rates of $55.6

million and $57.2 million, respectively. (b) EBITDA is a non-GAAP

financial measure and is not a substitute for net income or other

measures of financial performance in accordance with GAAP.

El Paso Electric CompanyCash Flow

SummaryNine Months Ended September 30, 2014 and

2013(In thousands and Unaudited)

2014 2013 Cash

flows from operating activities: Net income $ 87,187 $ 87,392

Adjustments to reconcile net income to net cash provided by

operations: Depreciation and amortization of electric plant in

service 62,336 59,346 Amortization of nuclear fuel 33,942 33,621

Deferred income taxes, net 35,990 45,479 Other (1,680 ) 4,396

Change in: Accounts receivable (47,331 ) (35,097 ) Net

undercollection of fuel revenues (1,233 ) (8,362 ) Accounts payable

3,557 (3,729 ) Other 1,869 1,865

Net cash provided

by operating activities 174,637 184,911

Cash flows from investing activities: Cash

additions to utility property, plant and equipment (189,273 )

(165,303 ) Cash additions to nuclear fuel (28,772 ) (19,895 )

Decommissioning trust funds (6,988 ) (6,994 ) Other (2,805 ) (3,575

)

Net cash used for investing activities (227,838

) (195,767 ) Cash flows from

financing activities: Dividends paid (33,261 ) (31,379 )

Borrowings under the revolving credit facility, net 75,176 (6,664 )

Other (896 ) (210 )

Net cash provided by (used for) financing

activities 41,019 (38,253 )

Net decrease in cash and cash equivalents (12,182

) (49,109 ) Cash and cash

equivalents at beginning of period 25,592

111,057 Cash and cash equivalents at end of

period $ 13,410 $ 61,948

El Paso Electric CompanyQuarter

Ended September 30, 2014 and 2013Sales and Revenues

Statistics

Increase (Decrease) 2014 2013 Amount

Percentage

kWh sales (in

thousands):

Retail: Residential 894,525 880,105 14,420 1.6 % Commercial and

industrial, small 694,928 680,380 14,548 2.1 % Commercial and

industrial, large 276,226 276,232 (6 ) — Public authorities 424,445

449,469 (25,024 ) (5.6 )% Total retail sales

2,290,124 2,286,186 3,938 0.2 % Wholesale:

Sales for resale 19,211 20,173 (962 ) (4.8 )% Off-system sales

740,153 683,600 56,553 8.3 % Total wholesale

sales 759,364 703,773 55,591 7.9 % Total kWh

sales 3,049,488 2,989,959 59,529 2.0 %

Operating

revenues (in thousands):

Non-fuel base revenues: Retail: Residential $ 81,296 $ 80,003 $

1,293 1.6 % Commercial and industrial, small 61,143 60,259 884 1.5

% Commercial and industrial, large 11,929 12,426 (497 ) (4.0 )%

Public authorities 28,266 31,222 (2,956 ) (9.5 )%

Total retail non-fuel base revenues 182,634 183,910 (1,276 ) (0.7

)% Wholesale: Sales for resale 771 777 (6 ) (0.8 )%

Total non-fuel base revenues 183,405 184,687 (1,282 )

(0.7 )% Fuel revenues: Recovered from customers during the period

54,405 42,962 11,443 26.6 % Over collection of fuel (a) (12,136 )

(577 ) (11,559 ) — New Mexico fuel in base rates 22,416

22,662 (246 ) (1.1 )% Total fuel revenues (b) 64,685

65,047 (362 ) (0.6 )% Off-system sales: Fuel cost 22,007

20,223 1,784 8.8 % Shared margins 5,126 4,007 1,119 27.9 % Retained

margins 605 478 127 26.6 % Total off-system

sales 27,738 24,708 3,030 12.3 % Other (c) 7,817 8,219

(402 ) (4.9 )% Total operating revenues $ 283,645 $

282,661 $ 984 0.3 % (a) 2014 includes a

Department of Energy refund related to spent fuel storage of $8.3

million. (b) Includes deregulated Palo Verde Unit 3 revenues for

the New Mexico jurisdiction of $3.9 million and $3.0 million,

respectively. (c) Represents revenues with no related kWh sales.

El Paso Electric CompanyQuarter Ended

September 30, 2014 and 2013Other Statistical Data

Increase

(Decrease) 2014 2013 Amount

Percentage

Average number of

retail customers: (a)

Residential 353,075 348,557 4,518 1.3 % Commercial and industrial,

small 39,730 38,971 759 1.9 % Commercial and industrial, large 49

51 (2 ) (3.9 )% Public authorities 5,112 5,009 103

2.1 % Total 397,966 392,588 5,378 1.4 %

Number of retail

customers (end of period): (a)

Residential 353,640 349,077 4,563 1.3 % Commercial and industrial,

small 39,813 38,926 887 2.3 % Commercial and industrial, large 49

51 (2 ) (3.9 )% Public authorities 5,126 5,044 82

1.6 % Total 398,628 393,098 5,530 1.4 %

Weather

statistics: (b)

10-Yr Average Heating degree days — — 1 Cooling degree days

1,415 1,444 1,474

Generation and

purchased power (kWh, in thousands):

Increase (Decrease) 2014 2013 Amount

Percentage Palo Verde 1,370,091 1,369,267 824 0.1 %

Four Corners 164,665 162,474 2,191 1.3 % Gas plants 1,289,419

1,235,419 54,000 4.4 % Total generation

2,824,175 2,767,160 57,015 2.1 % Purchased power: Photovoltaic

65,854 31,035 34,819 — Other 320,869 390,260 (69,391

) (17.8 )% Total purchased power 386,723 421,295

(34,572 ) (8.2 )% Total available energy 3,210,898 3,188,455 22,443

0.7 % Line losses and Company use 161,410 198,496

(37,086 ) (18.7 )% Total kWh sold 3,049,488 2,989,959

59,529 2.0 % Palo Verde capacity factor 99.8 %

99.7

%

0.1 % (a) The number of retail customers is based on

the number of service locations. (b) A degree day is

recorded for each degree that the average outdoor temperature

varies from a standard of 65 degrees Fahrenheit.

El Paso Electric CompanyNine Months Ended September 30,

2014 and 2013Sales and Revenues Statistics

Increase (Decrease) 2014 2013

Amount Percentage

kWh sales (in

thousands):

Retail: Residential 2,087,558 2,138,436 (50,878 ) (2.4 )%

Commercial and industrial, small 1,809,477 1,813,330 (3,853 ) (0.2

)% Commercial and industrial, large 794,891 813,099 (18,208 ) (2.2

)% Public authorities 1,202,403 1,245,801 (43,398 )

(3.5 )% Total retail sales 5,894,329 6,010,666

(116,337 ) (1.9 )% Wholesale: Sales for resale 51,931 52,313 (382 )

(0.7 )% Off-system sales 2,003,020 1,891,861 111,159

5.9 % Total wholesale sales 2,054,951 1,944,174

110,777 5.7 % Total kWh sales 7,949,280

7,954,840 (5,560 ) (0.1 )%

Operating

revenues (in thousands):

Non-fuel base revenues: Retail: Residential $ 186,718 $ 190,242 $

(3,524 ) (1.9 )% Commercial and industrial, small 146,939 146,763

176 0.1 % Commercial and industrial, large 30,220 30,995 (775 )

(2.5 )% Public authorities 72,837 75,666 (2,829 )

(3.7 )% Total retail non-fuel base revenues 436,714 443,666 (6,952

) (1.6 )% Wholesale: Sales for resale 1,899 1,867 32

1.7 % Total non-fuel base revenues 438,613 445,533

(6,920 ) (1.6 )% Fuel revenues: Recovered from

customers during the period 126,107 102,057 24,050 23.6 % Under

collection of fuel (a) 1,223 8,369 (7,146 ) (85.4 )% New Mexico

fuel in base rates 55,643 57,213 (1,570 ) (2.7 )%

Total fuel revenues (b) 182,973 167,639 15,334

9.1 % Off-system sales: Fuel cost 61,470 51,379 10,091 19.6

% Shared margins 14,515 10,254 4,261 41.6 % Retained margins 1,729

1,227 502 40.9 % Total off-system sales 77,714

62,860 14,854 23.6 % Other (c) 21,662 24,033 (2,371 )

(9.9 )% Total operating revenues $ 720,962 $ 700,065

$ 20,897 3.0 % (a) 2014 includes a Department of

Energy refund related to spent fuel storage of $8.3 million and

$2.2 million related to Palo Verde performance rewards, net. (b)

Includes deregulated Palo Verde Unit 3 revenues for the New Mexico

jurisdiction of $11.9 million and $9.3 million, respectively. (c)

Represents revenues with no related kWh sales.

El

Paso Electric CompanyNine Months Ended September 30, 2014

and 2013Other Statistical Data

Increase (Decrease) 2014 2013 Amount

Percentage

Average number of

retail customers: (a)

Residential 351,813 347,357 4,456 1.3 % Commercial and industrial,

small 39,477 38,704 773 2.0 % Commercial and industrial, large 49

50 (1 ) (2.0 )% Public authorities 5,090 4,980 110

2.2 % Total 396,429 391,091 5,338 1.4 %

Number of retail

customers (end of period): (a)

Residential 353,640 349,077 4,563 1.3 % Commercial and industrial,

small 39,813 38,926 887 2.3 % Commercial and industrial, large 49

51 (2 ) (3.9 )% Public authorities 5,126 5,044 82

1.6 % Total 398,628 393,098 5,530 1.4 %

Weather

statistics: (b)

10-Yr Average Heating degree days 1,042 1,419 1,255 Cooling

degree days 2,535 2,615 2,551

Generation and

purchased power (kWh, in thousands):

Increase (Decrease) 2014 2013 Amount

Percentage Palo Verde 3,926,066 3,922,200 3,866 0.1 %

Four Corners 436,889 486,544 (49,655 ) (10.2 )% Gas plants

2,884,707 2,846,346 38,361 1.3 % Total

generation 7,247,662 7,255,090 (7,428 ) (0.1 )% Purchased power:

Photovoltaic 174,038 97,098 76,940 79.2 % Other 974,317

1,046,284 (71,967 ) (6.9 )% Total purchased power 1,148,355

1,143,382 4,973 0.4 % Total available energy

8,396,017 8,398,472 (2,455 ) — % Line losses and Company use

446,737 443,632 3,105 0.7 %

Total kWh sold

7,949,280 7,954,840 (5,560 ) (0.1 )% Palo Verde

capacity factor 96.4% 96.2 % 0.2 % (a) The number of

retail customers presented is based on the number of service

locations. (b) A degree day is recorded for each degree that

the average outdoor temperature varies from a standard of 65

degrees Fahrenheit.

El Paso Electric

CompanyFinancial StatisticsAt September 30, 2014 and

2013(In thousands, except number of shares, book value per

share, and ratios) Balance Sheet

2014 2013 Cash and cash equivalents $ 13,410

$ 61,948 Common stock equity $ 1,015,857 $

893,698 Long-term debt 984,688 999,598 Total

capitalization $ 2,000,545 $ 1,893,296 Current

maturities of long-term debt $ 15,000 $ —

Short-term borrowings under the revolving credit facility $ 89,528

$ 15,491 Number of shares - end of period

40,357,982 40,253,783 Book value per common

share $ 25.17 $ 22.20 Common equity ratio (a)

48.3 % 46.8 % Debt ratio 51.7 % 53.2 % (a) The

capitalization component includes common stock equity, long-term

debt and the current maturities of long-term debt, and short-term

borrowings under the RCF.

El Paso Electric CompanyMedia Contact:Eddie Gutierrez,

915-543-5763eduardo.gutierrez@epelectric.comorInvestor

Relations:Lisa Budtke,

915-543-5947lisa.budtke@epelectric.com

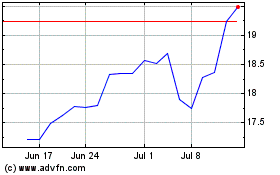

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Mar 2024 to Apr 2024

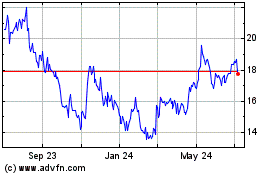

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Apr 2023 to Apr 2024