UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities and Exchange Act of 1934

Date of Report (Date of earliest event reported): October 27, 2014

CBIZ, INC.

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-32961 |

|

22-2769024 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 6050 Oak Tree Boulevard, South, Suite 500

Cleveland, Ohio |

|

44131 |

| (Address of principal executive offices) |

|

(Zip Code) |

216-447-9000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition. |

On October 27, 2014, CBIZ, Inc. (the

“Company”) issued a press release announcing its financial results for the three and nine months ended September 30, 2014. A copy of the press release is furnished herewith as Exhibit 99.1. A transcript of CBIZ’s earnings

conference call held on October 27, 2014 is furnished herewith as Exhibit 99.2. The exhibits contain, and may implicate, forward-looking statements regarding the Company and include cautionary statements identifying important factors that could

cause actual results to differ materially from those anticipated.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| 99.1 |

|

Press Release of CBIZ, Inc. dated October 27, 2014, announcing its financial results for the three and nine months ended September 30, 2014. |

|

|

| 99.2 |

|

Transcript of earnings conference call held on October 27, 2014, discussing CBIZ’s financial results for the three and nine months ended September 30, 2014. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

| October 31, 2014 |

|

|

|

CBIZ, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Ware H. Grove |

|

|

|

|

Name: |

|

Ware H. Grove |

|

|

|

|

Title: |

|

Chief Financial Officer |

Exhibit 99.1

|

|

|

|

|

| FOR IMMEDIATE RELEASE |

|

CONTACT: |

|

Ware Grove |

|

|

|

|

Chief Financial Officer |

|

|

|

|

-or- |

|

|

|

|

Lori Novickis |

|

|

|

|

Director, Corporate Relations |

|

|

|

|

CBIZ, Inc. |

|

|

|

|

Cleveland, Ohio |

|

|

|

|

(216) 447-9000 |

CBIZ REPORTS THIRD-QUARTER AND NINE-MONTHS 2014 RESULTS

THIRD-QUARTER REVENUE UP 8.9%; NINE MONTHS UP 5.8%

NINE-MONTHS INCOME FROM CONTINUING OPERATIONS UP 11.7%; EPS $0.61

NINE-MONTHS ADJUSTED EPS $0.64 EXCLUDING SHARE COUNT IMPACT OF CONVERTIBLE NOTES

Cleveland, Ohio (October 27, 2014)—CBIZ, Inc. (NYSE: CBZ) (“Company”) today announced third-quarter and nine-month results for the period ended

September 30, 2014.

For the third quarter ended September 30, 2014, CBIZ reported revenue of $183.8 million, an increase of $15.0 million, or

8.9%, compared with $168.8 million for the third quarter of 2013. Same-unit organic revenue increased by $8.4 million, or 5.0%, for the 2014 third quarter, compared with the same period a year ago. Newly acquired operations contributed $6.6 million,

or 3.9%, to revenue in the 2014 third quarter. Income from continuing operations was $7.3 million, or $0.14 per diluted share, compared with $5.5 million, or $0.11 per diluted share, reported in the third quarter of 2013. Adjusted EBITDA for the

quarter ended September 30, 2014 was $19.7 million, compared with $16.7 million for the 2013 third quarter.

For the nine-month period ended

September 30, 2014, CBIZ reported revenue of $573.6 million, an increase of $31.4 million, or 5.8%, over the $542.2 million recorded for the comparable nine-month period a year ago. Same-unit organic revenue increased by $15.0 million, or 2.8%,

for the first nine months of 2014 compared with the same period a year ago. Acquisitions contributed $16.4 million, or 3.0%, to revenue growth for the first nine months of 2014. Income from continuing operations was $31.5 million, or $0.61 per

diluted share, for the first nine months of 2014 compared with $28.2 million, or $0.57 per diluted share, for the first nine months of 2013. Adjusted EBITDA was $78.2 million for the nine months ended September 30, 2014, compared with $73.6

million for the same period a year ago.

6050 Oak Tree Boulevard,

South • Suite 500 • Cleveland, OH 44131 • Phone (216) 447-9000 • Fax (216) 447-9007

Page 1 of 7

Steven L. Gerard, CBIZ Chairman and CEO, stated, “We have seen a trend of improved same-unit revenue growth

so far this year and we anticipate continued strength through the remainder of the year. Our business is performing well and we are continuing to manage an active pipeline of potential future acquisitions. We made one acquisition in the third

quarter and we have completed a total of five acquisitions to date in 2014.”

The fully diluted weighted average share count for the first nine

months of 2014 increased to 51.5 million shares at September 30, 2014, from 49.5 million shares a year ago, primarily due to the accounting for approximately 2.0 million common share equivalents related to the 2010 Convertible

Notes (“Notes”). Normalized to exclude the impact of the increase in share equivalents related to the Notes, fully diluted earnings per share were $0.15 for the third quarter and $0.64 for the first nine months of 2014.

During the first nine months of 2014, the Company used $32.6 million for acquisition-related payments and $19.0 million to repurchase 2.2 million shares

of its common stock. Since September 30, 2014, the Company repurchased an additional 0.8 million shares for $6.5 million under a 10(b) 5-1 program for a total of 3.0 million shares repurchased through October 24, 2014. The

outstanding balance on the Company’s unsecured bank line of credit at September 30, 2014, was $108.0 million compared with a balance of $48.5 million at December 31, 2013.

On July 28, 2014, the Company replaced its $275 million unsecured credit facility with a new $400 million unsecured facility with a five-year term. The

new credit facility will provide the Company with the continued ability to grow through strategic acquisitions and the flexibility to refinance its Notes due October 1, 2015. In addition, the new credit facility will enable the Company to lower

borrowing costs and simplify its capital structure. The new credit facility will expire in July 2019.

During the third quarter, in two separate privately

negotiated transactions, the Company repurchased and retired a total of $32.4 million of its outstanding Notes due October 1, 2015. The Company recorded a charge of approximately $1.5 million in the third quarter of 2014 related to the

repurchase and early retirement of these Notes. The impact of these charges on fully diluted earnings per share in the third quarter and for the nine months year to date is approximately $0.02. Following these transactions, the principal amount

outstanding on the Notes has been reduced from $130.0 million to $97.6 million. These transactions combined are expected to result in lower interest expense of approximately $1.2 million annually.

“We are pleased to have the financial flexibility to retire $32.4 million of our Notes in the third quarter and we will continue to look at additional

early repurchase opportunities between now and the Note maturity date of October 1, 2015. Assuming a constant share count with 2013, and excluding the impact of the charges related to early retirement of Notes, EPS has increased nearly 16.0%

for the first nine months this year,” concluded Mr. Gerard.

2014 Outlook: For 2014, the Company expects continued improvement in

same-unit revenue growth rates, total revenue growth within a range of 5% to 7%, and growth in diluted earnings per share from continuing operations within a range of 15% to 18% over 2013, assuming a constant share count compared with 2013. Cash

flow is expected to continue to be positive, and Adjusted EBITDA is projected to increase within a range of 8% to 12% over the $75.6 million reported for 2013.

6050 Oak Tree Boulevard,

South • Suite 500 • Cleveland, OH 44131 • Phone (216) 447-9000 • Fax (216) 447-9007

Page 2 of 7

CBIZ will host a conference call at 11:00 a.m. this morning to discuss its results. The call will be webcast in a

listen-only mode over the internet for the media and the public, and can be accessed at www.cbiz.com. Shareholders and analysts who would like to participate in the call can register at http://dpregister.com/10053652 to receive the

dial-in number and unique pin number. Participants may register at any time, including up to and after the call start time.

A replay of the webcast will

be available approximately two hours following the call on the Company’s web site at www.cbiz.com. For those without internet access, a replay of the call will also be available starting at approximately 1:00 p.m. (ET) October 27,

through 5:00 p.m. (ET), October 31, 2014. The dial-in number for the replay is 1-877-344-7529. If you are listening from outside the United States, dial 1-412-317-0088. The access code for the replay is 10053652.

CBIZ, Inc. provides professional business services that help clients better manage their finances and employees. CBIZ provides its clients with financial

services including accounting, tax, financial advisory, government health care consulting, risk advisory, real estate consulting, and valuation services. Employee services include employee benefits consulting, property and casualty insurance,

retirement plan consulting, payroll, life insurance, HR consulting, and executive recruitment. As one of the largest accounting, insurance brokerage and valuation companies in the United States, the Company’s services are provided through 100

Company offices in 32 states.

Forward-looking statements in this release are made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. Such risks and uncertainties include, but are not limited to,

the Company’s ability to adequately manage and sustain its growth; the Company’s dependence on the current trend of outsourcing business services; the Company’s dependence on the services of its CEO and other key employees;

competitive pricing pressures; general business and economic conditions; and changes in governmental regulation and tax laws affecting the Company’s insurance business or its business services operations. A more detailed description of such

risks and uncertainties may be found in the Company’s filings with the Securities and Exchange Commission.

For further information

regarding CBIZ, call our Investor Relations Office at (216) 447-9000 or visit our web site at www.cbiz.com.

6050 Oak Tree Boulevard,

South • Suite 500 • Cleveland, OH 44131 • Phone (216) 447-9000 • Fax (216) 447-9007

Page 3 of 7

CBIZ, INC.

FINANCIAL HIGHLIGHTS (UNAUDITED)

THREE MONTHS ENDED SEPTEMBER 30, 2014 AND 2013

(In thousands, except percentages and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

THREE MONTHS ENDED

SEPTEMBER 30, |

|

| |

|

2014 |

|

|

% |

|

|

2013 (1) |

|

|

% |

|

|

|

|

|

|

| Revenue |

|

$ |

183,799 |

|

|

|

100.0 |

% |

|

$ |

168,779 |

|

|

|

100.0 |

% |

|

|

|

|

|

| Operating expenses (2) |

|

|

159,026 |

|

|

|

86.5 |

% |

|

|

150,258 |

|

|

|

89.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

24,773 |

|

|

|

13.5 |

% |

|

|

18,521 |

|

|

|

11.0 |

% |

|

|

|

|

|

| Corporate general and administrative expenses (3) |

|

|

8,889 |

|

|

|

4.9 |

% |

|

|

8,944 |

|

|

|

5.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

15,884 |

|

|

|

8.6 |

% |

|

|

9,577 |

|

|

|

5.7 |

% |

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(3,123 |

) |

|

|

–1.7 |

% |

|

|

(3,815 |

) |

|

|

–2.3 |

% |

| Gain on sale of operations, net |

|

|

17 |

|

|

|

0.0 |

% |

|

|

6 |

|

|

|

0.0 |

% |

| Other (expense) income, net (4) (5) |

|

|

(1,368 |

) |

|

|

–0.7 |

% |

|

|

2,371 |

|

|

|

1.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other expense, net |

|

|

(4,474 |

) |

|

|

–2.4 |

% |

|

|

(1,438 |

) |

|

|

–0.9 |

% |

|

|

|

|

|

| Income from continuing operations before income tax expense |

|

|

11,410 |

|

|

|

6.2 |

% |

|

|

8,139 |

|

|

|

4.8 |

% |

|

|

|

|

|

| Income tax expense |

|

|

4,126 |

|

|

|

|

|

|

|

2,663 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations |

|

|

7,284 |

|

|

|

4.0 |

% |

|

|

5,476 |

|

|

|

3.2 |

% |

|

|

|

|

|

| (Loss) income from operations of discontinued businesses, net of tax |

|

|

(203 |

) |

|

|

|

|

|

|

569 |

|

|

|

|

|

| Gain on disposal of discontinued businesses, net of tax |

|

|

607 |

|

|

|

|

|

|

|

56,315 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

7,688 |

|

|

|

4.2 |

% |

|

$ |

62,360 |

|

|

|

36.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

0.14 |

|

|

|

|

|

|

$ |

0.11 |

|

|

|

|

|

| Discontinued operations |

|

|

0.01 |

|

|

|

|

|

|

|

1.16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

0.15 |

|

|

|

|

|

|

$ |

1.27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted weighted average common shares outstanding |

|

|

51,209 |

|

|

|

|

|

|

|

49,003 |

|

|

|

|

|

|

|

|

|

|

| Other data from continuing operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBIT (6) |

|

$ |

14,516 |

|

|

|

|

|

|

$ |

11,948 |

|

|

|

|

|

| Adjusted EBITDA (6) |

|

$ |

19,704 |

|

|

|

|

|

|

$ |

16,718 |

|

|

|

|

|

| (1) |

Certain amounts in the 2013 financial data have been reclassified to conform to the current year presentation and revised to reflect the impact of discontinued operations. |

| (2) |

Includes a benefit of $639 and an expense of $2,190 for the three months ended September 30, 2014 and 2013, respectively, in compensation expense associated with net losses and net gains from the Company’s

deferred compensation plan (see note 4). Excluding this item, “operating expenses” would be $159,665 and $148,068, or 86.9% and 87.7% of revenue, for the three months ended September 30, 2014 and 2013, respectively. |

| (3) |

Includes a benefit of $68 and an expense of $231 for the three months ended September 30, 2014 and 2013, respectively, in compensation associated with net losses and net gains from the Company’s deferred

compensation plan (see note 4). Excluding this item, “corporate general and administrative expenses” would be $8,957 and $8,713, or 4.9% and 5.2% of revenue, for the three months ended September 30, 2014 and 2013, respectively.

|

| (4) |

Includes a net loss of $707 and a net gain of $2,421 for the three months ended September 30, 2014 and 2013, respectively, attributable to assets held in the Company’s deferred compensation plan. The net loss

and net gain do not impact “income from continuing operations before income tax expense” as they are directly offset by compensation adjustments included in “operating expenses” and “corporate general and administrative

expenses.” |

| (5) |

During the three months ended September 30, 2014, CBIZ recorded a $1.5 million loss from the early retirement of $32.4 million face value of its 2010 convertible senior subordinated notes that mature in 2015. Also

included in other (expense) income, net, for the three months ended September 30, 2014 and 2013, is income of $608 and expense of $186, respectively, related to net decreases and increases in the fair value of contingent consideration related

to CBIZ’s prior acquisitions. |

| (6) |

Adjusted EBIT represents income from continuing operations before income taxes, interest expense, and gain on sale of operations, net. Adjusted EBITDA represents Adjusted EBIT before depreciation and amortization

expense of $5,188 and $4,770 for the three months ended September 30, 2014 and 2013, respectively. The Company has included Adjusted EBIT and Adjusted EBITDA data because such data is commonly used as a performance measure by analysts and

investors and as a measure of the Company’s ability to service debt. Adjusted EBIT and Adjusted EBITDA should not be regarded as an alternative or replacement to any measurement of performance or cash flow under generally accepted accounting

principles. |

6050 Oak Tree Boulevard,

South • Suite 500 • Cleveland, OH 44131 • Phone (216) 447-9000 • Fax (216) 447-9007

Page 4 of 7

CBIZ, INC.

FINANCIAL HIGHLIGHTS (UNAUDITED)

NINE MONTHS ENDED SEPTEMBER 30, 2014 AND 2013

(In thousands, except percentages and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

NINE MONTHS ENDED

SEPTEMBER 30, |

|

| |

|

2014 |

|

|

% |

|

|

2013 (1) |

|

|

% |

|

|

|

|

|

|

| Revenue |

|

$ |

573,592 |

|

|

|

100.0 |

% |

|

$ |

542,197 |

|

|

|

100.0 |

% |

|

|

|

|

|

| Operating expenses (2) |

|

|

487,520 |

|

|

|

85.0 |

% |

|

|

460,738 |

|

|

|

85.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

86,072 |

|

|

|

15.0 |

% |

|

|

81,459 |

|

|

|

15.0 |

% |

|

|

|

|

|

| Corporate general and administrative expenses (3) |

|

|

27,454 |

|

|

|

4.8 |

% |

|

|

26,577 |

|

|

|

4.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

58,618 |

|

|

|

10.2 |

% |

|

|

54,882 |

|

|

|

10.1 |

% |

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(10,133 |

) |

|

|

–1.7 |

% |

|

|

(12,016 |

) |

|

|

–2.2 |

% |

| Gain on sale of operations, net |

|

|

93 |

|

|

|

0.0 |

% |

|

|

72 |

|

|

|

0.0 |

% |

| Other income, net (4) (5) |

|

|

4,543 |

|

|

|

0.8 |

% |

|

|

4,614 |

|

|

|

0.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other expense, net |

|

|

(5,497 |

) |

|

|

–0.9 |

% |

|

|

(7,330 |

) |

|

|

–1.3 |

% |

|

|

|

|

|

| Income from continuing operations before income tax expense |

|

|

53,121 |

|

|

|

9.3 |

% |

|

|

47,552 |

|

|

|

8.8 |

% |

|

|

|

|

|

| Income tax expense |

|

|

21,615 |

|

|

|

|

|

|

|

19,335 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations |

|

|

31,506 |

|

|

|

5.5 |

% |

|

|

28,217 |

|

|

|

5.2 |

% |

|

|

|

|

|

| (Loss) income from operations of discontinued businesses, net of tax |

|

|

(528 |

) |

|

|

|

|

|

|

3,350 |

|

|

|

|

|

| Gain on disposal of discontinued businesses, net of tax |

|

|

106 |

|

|

|

|

|

|

|

58,243 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

31,084 |

|

|

|

5.4 |

% |

|

$ |

89,810 |

|

|

|

16.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

0.61 |

|

|

|

|

|

|

$ |

0.57 |

|

|

|

|

|

| Discontinued operations |

|

|

(0.01 |

) |

|

|

|

|

|

|

1.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

0.60 |

|

|

|

|

|

|

$ |

1.81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted weighted average common shares outstanding |

|

|

51,469 |

|

|

|

|

|

|

|

49,537 |

|

|

|

|

|

|

|

|

|

|

| Other data from continuing operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBIT (6) |

|

$ |

63,161 |

|

|

|

|

|

|

$ |

59,496 |

|

|

|

|

|

| Adjusted EBITDA (6) |

|

$ |

78,161 |

|

|

|

|

|

|

$ |

73,640 |

|

|

|

|

|

| (1) |

Certain amounts in the 2013 financial data have been reclassified to conform to the current year presentation and revised to reflect the impact of discontinued operations. |

| (2) |

Includes expenses of $1,654 and $4,571 for the nine months ended September 30, 2014 and 2013, respectively, in compensation associated with net gains from the Company’s deferred compensation plan (see note 4).

Excluding this item, “operating expenses” would be $485,866 and $456,167, or 84.7% and 84.1% of revenue, for the nine months ended September 30, 2014 and 2013, respectively. |

| (3) |

Includes expenses of $278 and $472 for the nine months ended September 30, 2014 and 2013, respectively, in compensation associated with gains from the Company’s deferred compensation plan (see note 4).

Excluding this item, corporate general and administrative expenses would be $27,176 and $26,105, or 4.7% and 4.8% of revenue, for the nine months ended September 30, 2014 and 2013, respectively. |

| (4) |

Includes net gains of $1,932 and $5,043 for the nine months ended September 30, 2014 and 2013, respectively, attributable to assets held in the Company’s deferred compensation plan. These net gains do not

impact “income from continuing operations before income tax expense” as they are directly offset by compensation adjustments included in “operating expenses” and “corporate general and administrative expenses.”

|

| (5) |

During the nine months ended September 30, 2014, CBIZ recorded a $1.5 million loss from the early retirement of $32.4 million face value of its 2010 convertible senior subordinated notes that mature in 2015. Also

included in other income, net, for the nine months ended September 30, 2014 and 2013, is income of $3,592 and expense of $1,090, respectively, related to net decreases and increases in the fair value of contingent consideration related to

CBIZ’s prior acquisitions. |

| (6) |

Adjusted EBIT represents income from continuing operations before income taxes, interest expense, and gain on sale of operations, net. Adjusted EBITDA represents Adjusted EBIT before depreciation and amortization

expense of $15,000 and $14,144 for the nine months ended September 30, 2014 and 2013, respectively. The Company has included Adjusted EBIT and Adjusted EBITDA data because such data is commonly used as a performance measure by analysts and

investors and as a measure of the Company’s ability to service debt. Adjusted EBIT and Adjusted EBITDA should not be regarded as an alternative or replacement to any measurement of performance or cash flow under generally accepted accounting

principles. |

6050 Oak Tree Boulevard,

South • Suite 500 • Cleveland, OH 44131 • Phone (216) 447-9000 • Fax (216) 447-9007

Page 5 of 7

CBIZ, INC.

FINANCIAL HIGHLIGHTS (UNAUDITED)

(In thousands, except per share data)

SELECT SEGMENT DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

THREE MONTHS ENDED

SEPTEMBER 30, |

|

|

NINE MONTHS ENDED

SEPTEMBER 30, |

|

| |

|

2014 |

|

|

2013 (1) |

|

|

2014 |

|

|

2013 (1) |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Services |

|

$ |

119,462 |

|

|

$ |

110,552 |

|

|

$ |

383,964 |

|

|

$ |

365,004 |

|

| Employee Services |

|

|

56,891 |

|

|

|

50,415 |

|

|

|

167,479 |

|

|

|

154,681 |

|

| National Practices |

|

|

7,446 |

|

|

|

7,812 |

|

|

|

22,149 |

|

|

|

22,512 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

183,799 |

|

|

$ |

168,779 |

|

|

$ |

573,592 |

|

|

$ |

542,197 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Margin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Services |

|

$ |

16,673 |

|

|

$ |

13,553 |

|

|

$ |

66,562 |

|

|

$ |

64,402 |

|

| Employee Services |

|

|

9,697 |

|

|

|

8,360 |

|

|

|

28,614 |

|

|

|

27,136 |

|

| National Practices |

|

|

863 |

|

|

|

1,195 |

|

|

|

2,248 |

|

|

|

2,070 |

|

| Operating expenses - unallocated (2): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

|

(3,099 |

) |

|

|

(2,397 |

) |

|

|

(9,698 |

) |

|

|

(7,578 |

) |

| Deferred compensation |

|

|

639 |

|

|

|

(2,190 |

) |

|

|

(1,654 |

) |

|

|

(4,571 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

24,773 |

|

|

$ |

18,521 |

|

|

$ |

86,072 |

|

|

$ |

81,459 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Certain amounts in the 2013 financial data have been reclassified to conform to the current year presentation and revised to reflect the impact of discontinued operations. |

| (2) |

Represents operating expenses not directly allocated to individual businesses, including stock-based compensation, consolidation and integration charges and certain advertising expenses. “Operating expenses -

unallocated” also include gains or losses attributable to the assets held in the Company’s deferred compensation plan. These gains or losses do not impact “income from continuing operations before income tax expense” as they are

directly offset by the same adjustment to “other income, net” in the consolidated statements of comprehensive income. Gains or losses recognized from adjustments to the fair value of the assets held in the deferred compensation plan are

recorded as compensation expense in “operating expenses” and as income or expense in “other income, net.” |

NON-GAAP EARNINGS AND PER SHARE DATA

Reconciliation of Income from Continuing Operations to Non-GAAP Earnings from Continuing Operations (3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

THREE MONTHS ENDED SEPTEMBER 30, |

|

| |

|

2014 |

|

|

Per Share |

|

|

2013 (1) |

|

|

Per Share |

|

| Income from Continuing Operations |

|

$ |

7,284 |

|

|

$ |

0.14 |

|

|

$ |

5,476 |

|

|

$ |

0.11 |

|

|

|

|

|

|

| Selected non-cash items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization |

|

|

3,795 |

|

|

|

0.07 |

|

|

|

3,520 |

|

|

|

0.07 |

|

| Depreciation |

|

|

1,393 |

|

|

|

0.03 |

|

|

|

1,250 |

|

|

|

0.03 |

|

| Non-cash interest on convertible notes |

|

|

633 |

|

|

|

0.01 |

|

|

|

710 |

|

|

|

0.02 |

|

| Stock-based compensation |

|

|

1,825 |

|

|

|

0.04 |

|

|

|

1,350 |

|

|

|

0.03 |

|

| Adjustment to contingent earnouts |

|

|

(608 |

) |

|

|

(0.01 |

) |

|

|

186 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-cash items |

|

|

7,038 |

|

|

|

0.14 |

|

|

|

7,016 |

|

|

|

0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP earnings - Continuing Operations |

|

$ |

14,322 |

|

|

$ |

0.28 |

|

|

$ |

12,492 |

|

|

$ |

0.26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

NINE MONTHS ENDED SEPTEMBER 30, |

|

| |

|

2014 |

|

|

Per Share |

|

|

2013 (1) |

|

|

Per Share |

|

| Income from Continuing Operations |

|

$ |

31,506 |

|

|

$ |

0.61 |

|

|

$ |

28,217 |

|

|

$ |

0.57 |

|

|

|

|

|

|

| Selected non-cash items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization |

|

|

11,069 |

|

|

|

0.22 |

|

|

|

10,562 |

|

|

|

0.21 |

|

| Depreciation (4) |

|

|

3,931 |

|

|

|

0.08 |

|

|

|

3,582 |

|

|

|

0.07 |

|

| Non-cash interest on convertible notes |

|

|

2,133 |

|

|

|

0.04 |

|

|

|

2,103 |

|

|

|

0.04 |

|

| Stock-based compensation |

|

|

4,812 |

|

|

|

0.09 |

|

|

|

4,274 |

|

|

|

0.09 |

|

| Adjustment to contingent earnouts |

|

|

(3,592 |

) |

|

|

(0.07 |

) |

|

|

1,090 |

|

|

|

0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-cash items |

|

|

18,353 |

|

|

|

0.36 |

|

|

|

21,611 |

|

|

|

0.44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP earnings - Continuing Operations |

|

$ |

49,859 |

|

|

$ |

0.97 |

|

|

$ |

49,828 |

|

|

$ |

1.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (3) |

The Company believes Non-GAAP earnings and Non-GAAP earnings per diluted share more clearly illustrate the impact of certain non-cash charges and credits to “income from continuing operations” and are a useful

measure for the Company and its analysts. Non-GAAP earnings is defined as income from continuing operations excluding: depreciation and amortization, non-cash interest expense, non-cash stock-based compensation expense, and adjustments to the fair

value of contingent consideration related to prior acquisitions. Non-GAAP earnings per diluted share is calculated by dividing Non-GAAP earnings by the number of weighted average diluted common shares outstanding for the period indicated. Non-GAAP

earnings and Non-GAAP earnings per diluted share should not be regarded as a replacement or alternative to any measurement of performance under generally accepted accounting principles. |

| (4) |

Capital spending was $1.4 million and $1.5 million for the three months ended September 30, 2014 and 2013, and $4.0 million and $4.3 million for the nine months ended September 30, 2014 and 2013, respectively.

|

6050 Oak Tree Boulevard,

South • Suite 500 • Cleveland, OH 44131 • Phone (216) 447-9000 • Fax (216) 447-9007

Page 6 of 7

CBIZ, INC.

FINANCIAL HIGHLIGHTS (UNAUDITED)

(In thousands, except percentages and ratios)

SELECT BALANCE SHEET DATA AND RATIOS

|

|

|

|

|

|

|

|

|

| |

|

SEPTEMBER 30,

2014 |

|

|

DECEMBER 31,

2013 (1) |

|

| Cash and cash equivalents |

|

$ |

397 |

|

|

$ |

771 |

|

| Restricted cash |

|

$ |

24,780 |

|

|

$ |

22,112 |

|

| Accounts receivable, net |

|

$ |

179,790 |

|

|

$ |

143,107 |

|

| Current assets before funds held for clients |

|

$ |

224,361 |

|

|

$ |

186,086 |

|

| Funds held for clients - current and non-current |

|

$ |

110,110 |

|

|

$ |

164,389 |

|

| Goodwill and other intangible assets, net |

|

$ |

505,633 |

|

|

$ |

469,083 |

|

|

|

|

| Total assets |

|

$ |

924,478 |

|

|

$ |

897,458 |

|

|

|

|

| Notes payable - current |

|

$ |

— |

|

|

$ |

1,602 |

|

| Current liabilities before client fund obligations |

|

$ |

116,381 |

|

|

$ |

103,103 |

|

| Client fund obligations |

|

$ |

110,164 |

|

|

$ |

164,311 |

|

| Bank debt |

|

$ |

108,000 |

|

|

$ |

48,500 |

|

| Convertible notes - non-current |

|

$ |

95,974 |

|

|

$ |

125,256 |

|

|

|

|

| Total liabilities |

|

$ |

520,845 |

|

|

$ |

523,012 |

|

|

|

|

| Treasury stock |

|

$ |

(418,027 |

) |

|

$ |

(397,548 |

) |

|

|

|

| Total stockholders’ equity |

|

$ |

403,633 |

|

|

$ |

374,446 |

|

|

|

|

| Debt to equity (2) |

|

|

50.5 |

% |

|

|

46.8 |

% |

| Days sales outstanding (DSO) - continuing operations (3) |

|

|

87 |

|

|

|

74 |

|

|

|

|

| Shares outstanding |

|

|

49,894 |

|

|

|

48,964 |

|

| Basic weighted average common shares outstanding |

|

|

48,303 |

|

|

|

48,632 |

|

| Diluted weighted average common shares outstanding |

|

|

51,469 |

|

|

|

49,141 |

|

| (1) |

Certain amounts in the 2013 financial data have been reclassified to conform to the current year presentation and revised to reflect the impact of discontinued operations. |

| (2) |

Ratio is convertible notes, bank debt and notes payable divided by total stockholders’ equity. |

| (3) |

DSO is provided for continuing operations and represents accounts receivable, net and unbilled revenue (net of realization adjustments) at the end of the period, divided by trailing twelve month daily revenue. The

Company has included DSO data because such data is commonly used as a performance measure by analysts and investors and as a measure of the Company’s ability to collect on receivables in a timely manner. DSO should not be regarded as an

alternative or replacement to any measurement of performance under generally accepted accounting principles. DSO at September 30, 2013 was 85. |

6050 Oak Tree Boulevard,

South • Suite 500 • Cleveland, OH 44131 • Phone (216) 447-9000 • Fax (216) 447-9007

Page 7 of 7

Exhibit 99.2

CORPORATE PARTICIPANTS

Steven Gerard CBIZ,

Inc. - Chairman, CEO

Ware Grove CBIZ, Inc. - SVP, CFO

CONFERENCE CALL PARTICIPANTS

Jim MacDonald

PRESENTATION

Operator

Good morning and welcome to the CBIZ third-quarter and nine-month 2014 results conference call. All participants will be in listen-only mode. (Operator

Instructions). After today’s presentation, there will be an opportunity to ask questions. (Operator Instructions). Please note this event is being recorded.

I would now like to turn the conference over to Steven Gerard, Chairman and CEO. Please go ahead.

Steven Gerard - CBIZ, Inc. - Chairman, CEO

Thank you Laura. Good morning, everyone, and thank you for calling in to CBIZ’s third-quarter and nine-month results conference call.

Before I begin my comments, I’d like to remind you of a few things. As with all our conference calls, this call is intended to answer the questions of

our shareholders and analysts. If there are media representatives on the call, you are welcome to listen in. However, I ask that if you have questions you hold them until after the call and we will be happy to address them at that time. The call is

also being webcast and you can access the call on our website.

You should have all received a copy of the release we issued this morning, and if you did

not, you can access that on the website as well.

Finally, please remember that, during the course of our call, we may make forward-looking statements.

These statements represent our intentions, hopes, beliefs, expectations and predictions of the future. Actual results can and sometimes do differ materially from those projected in the forward-looking statements. Additional information concerning

the factors that could cause actual results to differ materially from those in the forward-looking statements is contained in our SEC filings, Form 10-K, and prior press releases.

Join me on the call this morning is Jerry Grisko, our President and Chief Operating Officer, and Ware Grove, our Chief Financial Officer. Prior to the opening

this morning, we were pleased to announce our third-quarter and nine-month results, which as we had expected have come in very strong with growth in revenue, growth in margin, and growth in earnings per share.

The third quarter has been one of the stronger quarters and our nine-month results are as strong if not stronger than anything we’ve been able to produce

since 2008. I will have some comments at the end as to how we see the market and the impact of our various activities, but I’d like to turn the call over to Ware, who will give you the details.

Ware Grove - CBIZ, Inc. - SVP, CFO

Thank you Steve and good morning everyone. As is our normal practice, I want to take a few minutes to run through the highlights of the third-quarter and

nine-month results that we released earlier today for the period ended September 30, 2014. Now, as a quick reminder, please remember that results for 2013 are restated to reflect the impact of the sale of Medical Management Professionals which

occurred in August of last year.

Now, thanks to the efforts of our CBIZ associates who are working hard to serve clients in our markets throughout the

US, we are very pleased to report that total revenue for the third quarter increased $183.8 million, an increase of 8.9% over the $168.8 million in the third quarter a year ago. Same-unit revenue increased by $8.4 million, or 5.0%, compared with the

third quarter a year ago. And acquisitions contributed $6.6 million, or 3.9%, to revenue growth in the third quarter compared with a year ago. We are pleased that pretax income margin improved by 140 basis points in the third quarter, and as a

result, we reported fully diluted earnings per share of $0.14 in the third quarter this year compared with $0.11 per share a year ago.

Turning to the

nine months ending September 30, 2014, total revenue increased by $31.4 million, or 5.8%, compared with a year ago. Same-unit revenue grew by $15 million, or 2.8%, compared with the same period a year ago. Acquisition related revenue

contributed $16.4 million, or 3.0%, to revenue growth compared with a year ago. For the nine months ended September 30, 2014, pretax income margin improved by 50 basis points and fully diluted earnings per share were $0.61 compared with $0.57

for the nine months a year ago.

Within the financial services group, total revenue increased by 8.1% in the third quarter and by 5.2% for the

nine months this year compared with a year ago. Same-unit revenue increased by 5.5% in the third quarter and increased by 2.9% for the nine months compared with a year ago. This is consistent with the expectations we outlined earlier this year, and

we are seeing improving growth in our core accounting services as well as continued growth in our government healthcare consulting business as the robust pipeline of RFPs for this business is converting into new engagements.

Within the employee services group, total revenue has increased by 12.8% in the third quarter, and increased by 8.3% for the nine months this year compared

with year-ago. Same-unit revenue increased by 5.4% in the third quarter, and increased by 3.1% for the nine months this year compared with a year ago. With the exception of life insurance, which is transactional in nature, we are seeing organic

revenue growth in all areas of our employee services group.

For the nine months ended September 30, 2014, we made five acquisitions that are

expected to annually contribute approximately $24 million to revenue with approximately $6.1 million of EBITDA. For the nine months this year, spending on acquisitions, including earn-out payments on acquisitions completed in prior years, was

approximately $32.6 million. Earn-out payments for the balance of 2014 are estimated at $2 million. And in future years, payments are estimated at $14.1 million in 2015, $7.7 million in 2016, and $5.1 million in 2017.

Capital spending for the first nine months is at $4 million through the third quarter this year. And for the full year of 2014, we expect capital spending

will be within a range of $5 million to $6 million.

Days sales outstanding on receivables stood at 87 days at September 30 this year compared with

85 days a year ago. Bad debt expense for the nine months this year is at 70 basis points of revenue compared with 64 basis points of revenue a year ago.

Now, through September 30, 2014, we have repurchased 2.2 million shares of our common stock at a cost of $19 million. Since September 30, we

have continued to be active through a 10b5-1 program repurchasing shares and through October 24, we have repurchased a total of 3 million shares at a cost of $25.5 million. Now, as a reminder, our reported fully diluted earnings per share

is impacted by share equivalents that are related to the 4 7/8% convertible note that is due October of 2015. GAAP requires that for any quarterly period where the average share price exceeds the $7.41 conversion price, share equivalents are

calculated and are added to the share count with the assumption that shares will be issued to settle any gain over the $7.41 conversion price. Upon maturity, I want to remind you that CBIZ has the option to settle this conversion gain either by

issuing shares or we can settle in cash, in which case no additional shares would be issued.

Now, at the end of the third quarter, there were $97.6

million of convertible notes outstanding, and based on an average share price of $8.53 in the third quarter, this resulted in an additional 1.7 million shares for the third quarter. For the nine months ended September 30, the average share

price was $8.73, and this resulted in an additional 2.0 million share equivalents that were added to the diluted weighted average share count. Due to the very unpredictable nature of this share accounting requirement, I want to remind you that

our guidance on earnings per share for 2014 continues to be based on using a constant share count compared with prior year. As a result of our repurchase activity to date, except for the share equivalents that are accounted for under the convertible

notes, our weighted average share count at the end of the third quarter is very close to the prior year, and we expect fully diluted weighted average share count for the full year 2014 to be approximately 49.5 million shares, or approximately

the same number of shares that was reported in 2013. And again, that excludes the share equivalents that may be calculated. Adjusting share count and earnings per share to eliminate the impact of share equivalents related to the convertible notes,

earnings per share in the third quarter was $0.15 compared with $0.11 a year ago and for the nine months earnings per share was $0.64 compared with $0.57 a year ago.

During the third quarter, we announced that we had completed two privately negotiated transactions to repurchase approximately $32.4 million of the

convertible notes from current holders. In connection with these transactions, in the third quarter, CBIZ recorded a loss of $1.5 million related to the repurchase of these notes, and this impacted reported earnings per share by $0.02. We may

explore further repurchase transactions with debtholders prior to maturity, but it is unclear if additional transactions can be completed or in what timing or on what terms.

With our new $400 million unsecured credit facility that we announced earlier this year, we have the financing capacity and the flexibility to proactively

address the upcoming October 2015 maturity of the convertible notes in an orderly manner, and lower our interest expense. The cost of borrowing under our bank facility is currently at LIBOR plus a spread of 175 basis points. And when compared with

the current 7.5% interest cost that is being recognized on the convertible notes, we estimate the interest cost reduction related to the note repurchase transactions already done may be approximately $1.2 million annually.

Now, the balance outstanding on our $400 million unsecured credit facility at September 30 was $108 million, so we have plenty of capacity to address our

refinancing needs and continue to conduct a very active acquisition program. It continues to be our priority to use capital in support of our acquisition program, and we will then opportunistically repurchase shares with an intention of maintaining

a constant share count over time.

2

The effective tax rate through nine months this year is 40.7%, which is essentially unchanged from a year ago. We

recorded several favorable items in the third quarter and with additional favorable items expected to be recorded in the fourth quarter, we are continuing to project an effective tax rate for the full year of 2014 of approximately 40%.

So, as we look at the remainder of 2014, we continue to project total revenue for the full year within a 5% to 7% — growth within a 5% to 7% range over

the $692 million reported for 2013 with fully diluted earnings per share increasing by 15% to 18% over the $0.51 reported for 2013. Growth in earnings per share assumes a constant share count in 2014 compared to 2013 and does not include the impact

of any share equivalents that are related to the convertible notes.

Full-year cash flow is expected to continue to be strong, and adjusted EBITDA is

projected to increase within an 8% to 12% range over the $75.6 million reported for 2013.

With these comments, I will conclude and I’ll turn it back

over to Steve.

Steven Gerard - CBIZ, Inc. - Chairman, CEO

Thank you Ware. Let me make a couple other comments. First, as Ware points out, our acquisition pipeline continues to be strong in both our financial services

and our employee services groups, so we are opportunistically looking at acquisitions over the next year, and will probably be able to do our typical three to five to three to six transactions per year as we have done in the past.

Our sense of the market today is that our clients remain cautious, as we had indicated years ago that the climb out from the recession was going to be slow,

but very long. We are still seeing that.

And the advice we want to give is that while our clients are feeling somewhat better, starting to invest,

starting to hire, it will not be robust for the next year or two. We are not expecting that it will be. But our clients are in fact feeling better about themselves and about the services that we are able to provide.

Notwithstanding the fact that we had a very strong quarter and notwithstanding the fact that we are doing very, very well this year, it still remains our

position that no one quarter either up or down in the year should be taken as a significant indicator of the economy. We are comfortable with our guidance for the rest of this year. We think this will be a very strong year for us. So we are pleased

to both reiterate the guidance that we gave in January and be actually able to come through in the third quarter on that slope.

With that, I’d like

to stop and open the call to questions from our analysts and shareholders.

QUESTION AND ANSWER

Operator

(Operator Instructions). Jim MacDonald, First

Analysis.

Jim MacDonald

Good morning guys. Great quarter. Could you

talk a little more about the strength in financial services? I think we had expected some rebound in the government services area, but was there also rebound from some of the weather losses earlier in the year on the accounting side, or is it the

economy, or how would you divvy it all up?

Steven Gerard - CBIZ, Inc. - Chairman, CEO

I think certainly the expected recovery in our government services business is happening, and that’s continuing to be a good, strong contributor. We are

starting to see some additional business coming out of our more traditional accounting group, a number of large transactions started in the end of the second and the third quarter, and our overall sense is there’s a little bit of momentum there

as well. So, it’s really a combination of both the traditional accounting business as well as our government services business.

3

Jim MacDonald

Okay. And moving over to the employee

services side, that was also up nicely. Where are you seeing the positioning of that business and any impact from the Affordable Care Act at this point?

Steven Gerard - CBIZ, Inc. - Chairman,

CEO

We are seeing a little bit of — we are seeing a pickup, quite, frankly in each of our areas. Our benefits group, our retirement

group, our P&C group, our payroll business are all doing better. I can’t say that we are seeing anything dramatically being driven by the Affordable Care Act. If anything, the Affordable Care Act is probably helping the financial services

group as they do their work for the state Medicaid services. Other than that, we’ve picked up some businesses we’ve reported previously as a result of the Affordable Care Act.

Our clients remain not only somewhat confused, but as I’m sure you know, there are incremental reporting requirements now that are required that we are

helping our clients with. There are now other plans being developed in terms of how to use the exchanges, whether or not you try and put your workforce on Medicaid, so there’s really a lot going on in that sector. And any time those kinds of

questions exist, the play right into our consultants practice on the benefit business. But it’s very hard to quantify whether there’s any specific uptick just because of Affordable Care on the EN side.

Jim MacDonald

Great. I had a number of little technical

questions if you don’t mind. What was the tax impact on the $1.5 million repurchase expense?

Ware Grove - CBIZ, Inc. - SVP,

CFO

Yes, Jim, I think it’s fair to assume that the tax impact would be at roughly our 40% incremental rate. No special treatment on

that.

Jim MacDonald

Okay. And G&A was a bit high this

quarter. Anything happening there?

Ware Grove - CBIZ, Inc. - SVP, CFO

Nothing on G&A. There might have been a slight impact on the deferred comp accruals for the gains, but I think we are continuing to leverage G&A. It

rose a little bit, but not as fast as revenue, so we are leveraging G&A as a percent of revenue.

Jim MacDonald

Right. And can you tell me what your bank availability is of the $400 million?

Ware Grove - CBIZ, Inc. - SVP,

CFO

It’s about 3 1/2 to 3 3/4 times our underlying EBITDA. So, it would be, if I stop to calculate it, in the high $200 million, low

$300 million range.

Jim MacDonald

And one final one and maybe I’ll get

back in. Gross margins were strong this quarter. Any comments there?

Ware Grove - CBIZ, Inc. - SVP,

CFO

I think it’s just a result — you may recall earlier in the year we talked about the slow start and we talked about

sequestration-related permanent reductions in some of the engagements and therefore some rightsizing needed to occur, which has. And now that we are through busy seasons, typically those things happen in the second half of the year, so those things

have an impact along with just the stronger revenue growth and leveraging the newly acquired businesses is helpful to gross margins.

4

Steven Gerard - CBIZ, Inc. - Chairman, CEO

I think that’s the real key. There’s more revenue coming through with the same expense base because we didn’t need to ramp up expenses in the

third quarter. So that’s what really contributed to the margin.

Jim MacDonald

Great. Thanks a lot. I’ll let someone else ask.

Operator

(Operator Instructions). And showing no further questions, I would like to turn the conference back over to Steven Gerard for closing remarks.

Steven Gerard - CBIZ, Inc. - Chairman, CEO

Okay. Jim, if you have any further questions, give us a call. With that, I thank everyone who called in, and most important our 4,000 associates who worked

very, very hard this quarter to produce what was really truly outstanding results. And I have every confidence that we are going to finish the year in a stronger position, if not stronger. So I thank you all in advance for your hard work in the

fourth quarter and we look forward to releasing our numbers come first of the year. Thank you and goodbye.

Operator

The conference has now concluded. Thank you for attending today’s presentation. You may now disconnect.

5

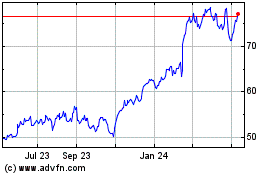

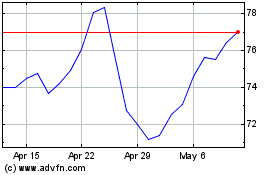

CBIZ (NYSE:CBZ)

Historical Stock Chart

From Aug 2024 to Sep 2024

CBIZ (NYSE:CBZ)

Historical Stock Chart

From Sep 2023 to Sep 2024