SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

(Rule 14d-100)

Tender Offer Statement under

Section 14(d)(1) or 13(e)(1) of the Securities Exchange Act of 1934

GILAT SATELLITE NETWORKS LTD.

(Name of Subject Company (Issuer))

FIMI OPPORTUNITY IV, L.P.

FIMI ISRAEL OPPORTUNITY IV, LIMITED PARTNERSHIP

FIMI OPPORTUNITY V, L.P.

FIMI ISRAEL OPPORTUNITY FIVE, LIMITED PARTNERSHIP

FIMI IV 2007 LTD.

FIMI FIVE 2012 LTD.

SHIRA AND ISHAY DAVIDI MANAGEMENT LTD.

ISHAY DAVIDI

(Name of Filing Person (Offeror))

ORDINARY SHARES, PAR VALUE NIS 0.20 PER SHARE

(Title of Class of Securities)

M51474118

(CUSIP Number of Class of Securities)

Amiram Boehm

FIMI FIVE 2012 Ltd.

Electra Tower, 98 Yigal Alon St., Tel-Aviv 6789141, Israel

Telephone: +972-3-565-2244

(Name, address and telephone numbers of person authorized to receive

notices and communications on behalf of filing persons)

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

Sharon Amir, Adv.

Naschitz, Brandes, Amir & Co.

5 Tuval Street

Tel-Aviv 6789717, Israel

Telephone: +972-3-623-5000

|

|

Andrew D. Thorpe

Orrick, Herrington & Sutcliffe LLP

405 Howard Street

San Francisco, CA 94105-2669

Telephone: (415) 773-5700

|

|

CALCULATION OF FILING FEE

|

|

Transaction Valuation*

$25,573,423

|

|

Amount of Filing Fee**

$2,972

|

|

*

|

For purposes of calculating the filing fee only, this amount is based on the offer to purchase 5,166,348 ordinary shares of Gilat Satellite Networks Ltd. at a purchase price of $4.95 cash per share.

|

|

**

|

Calculated in accordance with Section 14(g) of the Securities Exchange Act of 1934, as amended, as updated by Fee Advisory #1 for Fiscal Year 2015, by multiplying the transaction valuation by 0.0001162.

|

|

£

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

Amount Previously Paid: None.

Form or Registration No.: Not Applicable.

|

Filing Party: Not Applicable.

Date Filed: Not Applicable.

|

|

£

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

|

Check the appropriate boxes below to designate any transaction to which the statement relates:

|

|

S

|

third-party tender offer subject to Rule 14d-1

|

|

£

|

issuer tender offer subject to Rule 13e-4

|

|

£

|

going-private transaction subject to Rule 13e-3

|

|

£

|

amendment to Schedule 13D under Rule 13d-2

|

Check the following box if the filing is a final amendment reporting the results of the tender offer: £

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

☐Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

This Tender Offer Statement on Schedule TO (this “Schedule TO”) is filed by FIMI Opportunity IV, L.P, a limited partnership organized under the laws of the State of Delaware, FIMI Israel Opportunity IV, Limited Partnership, a limited partnership organized under the laws of the State of Israel, FIMI Opportunity V, L.P, a limited partnership organized under the laws of the State of Delaware and FIMI Israel Opportunity Five, Limited Partnership, a limited partnership organized under the laws of the State of Israel (collectively, the “Bidder”), FIMI IV 2007 Ltd., FIMI Five 2012 Ltd., Shira and Ishay Davidi Management Ltd. and Ishay Davidi, and relates to the offer by the Bidder to purchase 5,166,348 outstanding ordinary shares, nominal (par) value NIS 0.20 per share (the “Shares”), of Gilat Satellite Networks Ltd. (“Gilat”), at $4.95 per Share, net to the seller in cash, less any applicable withholding taxes, and without interest, upon the terms of, and subject to the conditions to, the Offer to Purchase, dated October 24, 2014 (the “Offer to Purchase”) and the related Letter of Transmittal, copies of which are attached hereto as Exhibits (a)(1)(A) and (a)(1)(B), respectively (which, together with any amendments or supplements thereto, constitute the “Offer”).

This Schedule TO is intended to satisfy the reporting requirements of Rule 14d-1 under the Securities Exchange Act of 1934, as amended. Pursuant to General Instruction F to Schedule TO, the information contained in the Offer to Purchase and the Letter of Transmittal is incorporated herein by reference in response to all of the items of this Schedule TO as more particularly described below. Capitalized terms used herein but not otherwise defined have the meaning ascribed to such terms in the Offer to Purchase.

ITEM 1. SUMMARY TERM SHEET.

The information set forth under “Summary Term Sheet” in the Offer to Purchase is incorporated herein by reference.

ITEM 2. SUBJECT COMPANY INFORMATION.

(a) The information set forth in Section 8 (“Information Concerning Gilat”) of the Offer to Purchase is incorporated herein by reference.

(b) The information set forth under “Introduction” in the Offer to Purchase is incorporated herein by reference.

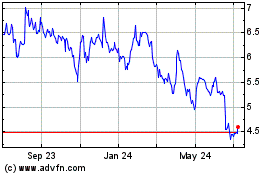

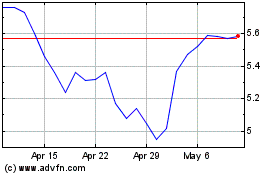

(c) The information set forth under in Section 6 (“Price Range of the Shares Etc.”) in the Offer to Purchase is incorporated herein by reference.

ITEM 3. IDENTITY AND BACKGROUND OF FILING PERSON.

(a), (b) and (c) The information set forth in the Offer to Purchase under “Introduction,” Section 9 (“Information Concerning the Bidder Group”) and in Schedule I to the Offer to Purchase is incorporated herein by reference.

ITEM 4. TERMS OF THE TRANSACTION.

(a) The information set forth in the following sections of the Offer to Purchase is incorporated herein by reference:

“Summary Term Sheet;”

“Introduction;”

Section 1 (“Terms of the Offer; Proration; Expiration Date”);

Section 2 (“Acceptance for Payment and Payment”);

Section 3 (“Procedures for Tendering Shares or Notifying Us of Your Objection to the Offer”);

Section 4 (“Withdrawal Rights”);

Section 5 (“Material U.S. Federal Income Tax and Israeli Income Tax Consequences”);

Section 11 (“Conditions of the Offer”); and

Section 14 (“Miscellaneous”).

The information set forth in the Letter of Transmittal and the Notice of Objection, copies of which are attached hereto as Exhibits (a)(1)(B) and (a)(1)(F), respectively, is also incorporated herein by reference.

ITEM 5. PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS.

(a) and (b) The information set forth in the Offer to Purchase under “Introduction,” “Background to the Offer—Related Party Transactions,” Section 9 (“Information Concerning the Bidder Group”) and Schedule I to the Offer to Purchase is incorporated herein by reference.

ITEM 6. PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS.

(a) The information set forth in the Offer to Purchase under “Summary Term Sheet,” “Background to the Offer—Background” and “Background to the Offer—Purpose of the Offer; Reasons for the Offer” is incorporated herein by reference.

(c)(1) through (c)(7) The information set forth in the Offer to Purchase under “Background to the Offer—Plans for Gilat after the Offer; Certain Effects of the Offer,” Section 7 (“Effects of the Offer on the Market for Shares; Registration under the Exchange Act”) and Section 9 (“Information Concerning the Bidder Group”) is incorporated herein by reference.

ITEM 7. SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION.

(a), (b) and (d) The information set forth in the Offer to Purchase under “Summary Term Sheet,” “Background to the Offer—Background” and Section 10 (“Sources and Amount of Funds”) is incorporated herein by reference.

ITEM 8. INTEREST IN SECURITIES OF THE SUBJECT COMPANY.

(a) and (b) The information set forth in the Offer to Purchase under “Introduction,” “Background to the Offer—Related Party Transactions,” Section 9 (“Information Concerning the Bidder Group”) and in Schedule I to the Offer to Purchase is incorporated herein by reference.

ITEM 9. PERSONS/ASSETS, RETAINED, EMPLOYED, COMPENSATED OR USED.

(a) The information set forth in the Offer to Purchase under Section 13 (“Fees and Expenses”) is incorporated herein by reference.

ITEM 10. FINANCIAL STATEMENTS.

(a) and (b) Financial and pro forma information with respect to the Bidder has not been included in this Schedule TO because each member of the Bidder Group believes that such financial statements are not material to the decision of holders of Shares whether to sell, tender or hold the Shares in the Offer. The members of the Bidder Group believe that the financial condition of the Bidder is not material because (i) the consideration offered for the Shares consists solely of cash, (ii) the Offer is not subject to any financing condition, and (iii) the Bidder has sufficient sources of cash, including credit lines, to purchase the Shares and, as described in the Offer to Purchase, (A) the Israeli Depositary has agreed to guarantee the Bidder’s obligation to pay for the Shares tendered in the Offer and (B) to secure this guarantee, the Bidder has engaged the Israeli Depositary to act as an escrow agent and has deposited cash into an escrow account in an amount sufficient to pay for the maximum number of Shares that the Bidder is offering to purchase in the Offer.

ITEM 11. ADDITIONAL INFORMATION.

(a) The information set forth in the Offer to Purchase under “Background to the Offer—Interest of Persons in the Offer,” “Background to the Offer—Related Party Transactions,” Section 7 (“Effect of the Offer on the Market for Shares; Registration Under the Exchange Act”), Section 9 (“Information Concerning the Bidder Group”) and Section 12 (“Legal Matters and Regulatory Approvals”) is incorporated herein by reference. The Bidder is not aware of any pending material legal proceedings relating to the Offer.

(c) The information set forth in the Offer to Purchase and the Letter of Transmittal is incorporated herein by reference.

On October 24, 2014, the Bidder issued a press release announcing the commencement of the Offer, a copy of which is filed as Exhibit (a)(5)(A) to this Schedule TO and is incorporated herein by reference.

ITEM 12. EXHIBITS.

|

NO.

|

|

DESCRIPTION

|

|

(a)(1)(A)

|

|

Offer to Purchase dated October 24, 2014.

|

|

(a)(1)(B)

|

|

Letter of Transmittal.

|

|

(a)(1)(C)

|

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

|

(a)(1)(D)

|

|

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

|

(a)(1)(E)

|

|

Guidelines for Certification of Taxpayer Identification Number on Substitute W-9.

|

|

(a)(1)(F)

|

|

Notice of Objection.

|

|

(a)(1)(G)

|

|

Declaration Form (“Declaration of Status for Israeli Income Tax Purposes”).

|

|

(a)(5)(A)

|

|

Text of Press Release issued by the Bidder on October 24, 2014.

|

|

(a)(5)(B)

|

|

Form of Cover of ‘Mifrat’ to be filed with the Israeli Securities Authority on October 24, 2014.*

|

|

(a)(5)(C)

|

|

Form of Acceptance Notice and Notice of Objection to be filed with the Israeli Securities Authority on October 24, 2014.*

|

|

(b)

|

|

Not applicable.

|

|

(c)

|

|

Not applicable.

|

|

(d)

|

|

Agreement, dated September 17, 2014, by and among (1) FIMI Opportunity Fund IV, L.P., FIMI Israel Opportunity Fund IV, Limited Partnership, FIMI Opportunity V, L.P. and FIMI Israel Opportunity V, Limited Partnership, and (2) York Capital Management, L.P., York Multi-Strategy Master Fund, L.P., York Credit Opportunities Fund, L.P., York Credit Opportunities Fund, L.P., York Credit Opportunities Master Fund, L.P., Jorvik Multi-Strategy Master Fund, L.P. and Permal York Ltd. (incorporated by reference to Exhibit 3 to Amendment No. 10 to Schedule 13D filed on September 18, 2014 by York Capital Management Global Advisors, LLC (File No. 005-49455).

|

|

(e)

|

|

Not applicable.

|

|

(f)

|

|

Not applicable.

|

|

(g)

|

|

Not applicable.

|

|

(h)

|

|

Not applicable.

|

|

*

|

English translation from Hebrew.

|

ITEM 13. INFORMATION REQUIRED BY SCHEDULE 13E-3.

Not applicable.

SIGNATURES

After due inquiry and to the best of the knowledge and belief of the undersigned, the undersigned certify that the information set forth in this statement is true, complete and correct.

|

FIMI OPPORTUNITY IV, L.P.

By: FIMI IV 2007 LTD., its general partner

By: /s/ Ishay Davidi

Name: Ishay Davidi

Title: Chief Executive Officer

|

|

FIMI ISRAEL OPPORTUNITY IV, LIMITED PARTNERSHIP

By: FIMI IV 2007 LTD., its general partner

By: /s/ Ishay Davidi

Name: Ishay Davidi

Title: Chief Executive Officer

|

|

FIMI OPPORTUNITY V, L.P.

By: FIMI FIVE 2012 LTD., its general partner

Name: Ishay Davidi

Title: Chief Executive Officer

|

|

FIMI ISRAEL OPPORTUNITY FIVE, LIMITED PARTNERSHIP

By: FIMI FIVE 2012 LTD., its general partner

Name: Ishay Davidi

Title: Chief Executive Officer

|

|

FIMI IV 2007 LTD.

By: /s/ Ishay Davidi

Name: Ishay Davidi

Title: Chief Executive Officer

|

|

FIMI FIVE 2012 LTD.

By: /s/ Ishay Davidi

Name: Ishay Davidi

Title: Chief Executive Officer

|

|

SHIRA AND ISHAY DAVIDI MANAGEMENT LTD.

By: /s/ Ishay Davidi

Name: Ishay Davidi

Title: Chief Executive Officer

|

|

/s/ Ishay Davidi

Ishay Davidi

|

Dated: October 24, 2014

EXHIBIT INDEX

|

NO.

|

|

DESCRIPTION

|

|

(a)(1)(A)

|

|

Offer to Purchase dated October 24, 2014.

|

|

(a)(1)(B)

|

|

Letter of Transmittal.

|

|

(a)(1)(C)

|

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

|

(a)(1)(D)

|

|

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

|

(a)(1)(E)

|

|

Guidelines for Certification of Taxpayer Identification Number on Substitute W-9.

|

|

(a)(1)(F)

|

|

Notice of Objection.

|

|

(a)(1)(G)

|

|

Declaration Form (“Declaration of Status for Israeli Income Tax Purposes”).

|

|

(a)(5)(A)

|

|

Text of Press Release issued by the Bidder on October 24, 2014.

|

|

(a)(5)(B)

|

|

Form of Cover of ‘Mifrat’ to be filed with the Israeli Securities Authority on October 24, 2014.*

|

|

(a)(5)(C)

|

|

Form of Acceptance Notice and Notice of Objection to be filed with the Israeli Securities Authority on October 24, 2014.*

|

|

(b)

|

|

Not applicable.

|

|

(c)

|

|

Not applicable.

|

|

(d)

|

|

Agreement, dated September 17, 2014, by and among (1) FIMI Opportunity Fund IV, L.P., FIMI Israel Opportunity Fund IV, Limited Partnership, FIMI Opportunity V, L.P. and FIMI Israel Opportunity V, Limited Partnership, and (2) York Capital Management, L.P., York Multi-Strategy Master Fund, L.P., York Credit Opportunities Fund, L.P., York Credit Opportunities Master Fund, L.P., Jorvik Multi-Strategy Master Fund, L.P. and Permal York Ltd. (incorporated by reference to Exhibit 3 to Amendment No. 10 to Schedule 13D filed on September 18, 2014 by York Capital Management Global Advisors, LLC (File No. 005-49455).

|

|

(e)

|

|

Not applicable.

|

|

(f)

|

|

Not applicable.

|

|

(g)

|

|

Not applicable.

|

|

(h)

|

|

Not applicable.

|

|

*

|

|

|

|

English translation from Hebrew.

|

8

Exihibt (a)(1)(a)

OFFER TO PURCHASE FOR CASH

5,166,348 ORDINARY SHARES

of

GILAT SATELLITE NETWORKS LTD.

at

$4.95 NET PER SHARE

by

FIMI OPPORTUNITY IV, L.P.

FIMI ISRAEL OPPORTUNITY IV, LIMITED PARTNERSHIP

FIMI OPPORTUNITY V, L.P.

FIMI ISRAEL OPPORTUNITY FIVE, LIMITED PARTNERSHIP

IN AN OFFER BEING CONDUCTED IN THE UNITED STATES AND ISRAEL

|

THE INITIAL OFFER PERIOD AND WITHDRAWAL RIGHTS WILL EXPIRE AT 10:00 A.M.,

NEW YORK TIME, OR 5:00 P.M., ISRAEL TIME, ON NOVEMBER 25, 2014, UNLESS THE OFFER IS EXTENDED.

|

We, FIMI Opportunity IV, L.P, a limited partnership organized under the laws of the State of Delaware, FIMI Israel Opportunity IV, Limited Partnership, a limited partnership organized under the laws of the State of Israel, FIMI Opportunity V, L.P, a limited partnership organized under the laws of the State of Delaware and FIMI Israel Opportunity Five, Limited Partnership, a limited partnership organized under the laws of the State of Israel (collectively, “FIMI”), are offering to purchase 5,166,348 ordinary shares, NIS 0.20 par value per share, of Gilat Satellite Networks Ltd., or Gilat shares, at the price of $4.95 per Gilat share, net to you (subject to withholding taxes, as applicable), in cash, without interest. As of September 30, 2014, there was a total of 42,601,899 Gilat shares issued and outstanding.

|

|

THE OFFER IS CONDITIONED UPON, AMONG OTHER THINGS, THE FOLLOWING:

|

|

|

(I)

|

GILAT SHARES THAT REPRESENT 5.0% OF THE ISSUED AND OUTSTANDING SHARES AND VOTING POWER OF GILAT (CURRENTLY, 2,130,095 GILAT SHARES) ON THE INITIAL COMPLETION DATE (AS DEFINED BELOW) ARE VALIDLY TENDERED AND NOT PROPERLY WITHDRAWN PRIOR TO THE COMPLETION OF THE INITIAL OFFER PERIOD (AS DEFINED BELOW);

|

|

|

(II)

|

IN ACCORDANCE WITH ISRAELI LAW, AT THE COMPLETION OF THE INITIAL OFFER PERIOD, THE AGGREGATE NUMBER OF GILAT SHARES VALIDLY TENDERED AND NOT PROPERLY WITHDRAWN IS GREATER THAN THE AGGREGATE NUMBER OF GILAT SHARES REPRESENTED BY NOTICES OF OBJECTION TO THE CONSUMMATION OF THE OFFER; AND

|

|

|

(III)

|

THE APPROVAL OF THE ISRAELI ANTITRUST AUTHORITY TO THE INCREASE OF FIMI'S SHAREHOLDINGS IN GILAT TO MORE THAN 25% OF GILAT'S ISSUED AND OUTSTANDING SHARE CAPITAL.

|

THE OFFER IS ALSO SUBJECT TO CERTAIN OTHER CONDITIONS CONTAINED IN THIS OFFER TO PURCHASE. SEE SECTION 11, WHICH SETS FORTH IN FULL THE CONDITIONS OF THE OFFER.

THE OFFER IS NOT CONDITIONED ON THE AVAILABILITY OF FINANCING OR THE APPROVAL OF THE BOARD OF DIRECTORS OF THE COMPANY.

IF MORE THAN 5,166,348 GILAT SHARES ARE VALIDLY TENDERED AND NOT PROPERLY WITHDRAWN IN THE UNITED STATES AND ISRAEL IN THE AGGREGATE, WE WILL PURCHASE A PRO RATA NUMBER OF GILAT SHARES FROM ALL TENDERING SHAREHOLDERS, SO THAT WE WOULD PURCHASE NO MORE THAN 5,166,348 GILAT SHARES.

THE INITIAL PERIOD OF THE OFFER WILL EXPIRE AT 10:00 A.M., NEW YORK TIME, OR 5:00 P.M., ISRAEL TIME, ON NOVEMBER 25, 2014, UNLESS THE INITIAL PERIOD OF THE OFFER IS EXTENDED. WE REFER TO THIS PERIOD, AS MAY BE EXTENDED, AS THE INITIAL OFFER PERIOD. UPON THE TERMS AND SUBJECT TO THE CONDITIONS OF THE OFFER, IF PRIOR TO THE COMPLETION OF THE INITIAL OFFER PERIOD, ALL THE CONDITIONS OF THE OFFER ARE SATISFIED OR, SUBJECT TO APPLICABLE LAW, WAIVED BY US, WE WILL PROVIDE YOU WITH AN ADDITIONAL FOUR CALENDAR-DAY PERIOD, UNTIL 10:00 A.M., NEW YORK TIME, OR 5:00 P.M., ISRAEL TIME, ON NOVEMBER 29, 2014, DURING WHICH YOU MAY TENDER YOUR GILAT SHARES. WE REFER TO THIS ADDITIONAL PERIOD AS THE ADDITIONAL OFFER PERIOD. THE EXPIRATION OF THE ADDITIONAL OFFER PERIOD WILL CHANGE IF WE DECIDE TO EXTEND THE INITIAL OFFER PERIOD. SEE SECTION 1 AND SECTION 11.

The Gilat shares are listed on the Nasdaq Global Select Market, or Nasdaq, under the ticker symbol “GILT” and on the Tel Aviv Stock Exchange Ltd., or the TASE. On September 16, 2014, the last trading day before we announced our intention to commence the offer, the closing sale price of the Gilat shares was $4.79 on Nasdaq and NIS 17.37 ($4.77 based on an exchange rate of NIS 3.641 per United States dollar as of September 16, 2014) on the TASE. We encourage you to obtain current market quotations for the Gilat shares before deciding whether to tender your Gilat shares. See Section 6.

In the United States, the Information Agent for the Offer is:

D.F. King & Co., Inc.

In Israel, information concerning the offer is available from our legal counsel:

Naschitz, Brandes, Amir & Co., Advocates

October 24, 2014

IMPORTANT

The offer is being conducted simultaneously in the United States and Israel. Pursuant to the Israeli Securities Law, 5728-1968 and the regulations promulgated thereunder relating to tender offers, to which we collectively refer as the Israeli Securities Law, we have filed this offer to purchase together with a cover statement in the Hebrew language with the Israeli Securities Authority, or the ISA, and the TASE. We have also filed an English translation of the cover statement from the Hebrew language as an exhibit to the Schedule TO that we filed with the United States Securities and Exchange Commission, or the SEC.

The offer has not been approved or disapproved by the SEC, any state securities commission, or the ISA, nor has the SEC, any state securities commission or the ISA passed upon the fairness or merits of the offer or upon the accuracy or adequacy of the information contained in this offer to purchase. Any representation to the contrary is a criminal offense.

We have not authorized any person to make any recommendation on our behalf as to whether you should or should not tender your Gilat shares in the offer. You should rely only on the information contained in this offer to purchase and the other related documents delivered to you or to which we have referred you. We have not authorized any person to give any information or to make any representation in connection with the offer, other than those contained in this offer to purchase and the other related documents delivered to you or to which we have referred you. If anyone makes any recommendation or representation to you or gives you any information, you must not rely on that recommendation, representation or information as having been authorized by us.

Holders of Gilat shares who hold their Gilat shares through a TASE member, or who are named as holders of Gilat shares in the Register of Shareholders of Gilat in Israel, should tender their Gilat shares to Bank of Jerusalem Ltd., who, with its affiliates, serves as the Israeli Depositary, pursuant to the applicable instructions in Section 3. All other holders of Gilat shares should tender their Gilat shares to American Stock Transfer & Trust Company, the U.S. Depositary (which we refer to, together with the Israeli Depositary, as the Depositaries), pursuant to the applicable instructions in Section 3. For the addresses and telephone numbers of our Depositaries, see the back cover of this offer to purchase.

Upon the terms and subject to the conditions of the offer (including any terms and conditions of any extension or amendment), subject to proration, we will accept for payment and pay for the Gilat shares that are validly tendered and not properly withdrawn prior to 10:00 a.m., New York time, or 5:00 p.m., Israel time, on November 25, 2014, unless we extend the period of time during which the initial period of the offer is open. This period, as may be extended, is referred to as the Initial Offer Period, and the date of completion of the Initial Offer Period is referred to as the Initial Completion Date. We will publicly announce in accordance with applicable law, and in any event issue a press release by 9:00 a.m., New York time, or 4:00 p.m., Israel time, on the U.S. business day following the Initial Completion Date, stating whether or not the conditions of the offer have been satisfied or, subject to applicable law, waived by us. As required by Israeli law, if the conditions of the offer are satisfied or, subject to applicable law, waived by us, then if, with respect to each Gilat share owned by you,

|

|

·

|

you have not yet responded to the offer,

|

|

|

·

|

you have notified us of your objection to the offer, or

|

|

|

·

|

you have validly tendered such Gilat share but have properly withdrawn your tender during the Initial Offer Period,

|

then you will be afforded an additional four calendar-day period, until 10:00 a.m., New York time, or 5:00 p.m., Israel time, on November 29, 2014, during which you may tender each such Gilat share. We refer to this additional period as the Additional Offer Period. The date of completion of the Additional Offer Period will change if we decide to extend the Initial Offer Period. Gilat shares tendered during the Initial Offer Period may be withdrawn at any time prior to 10:00 a.m., New York time, or 5:00 p.m., Israel time, on the Initial Completion Date, but not during the Additional Offer Period. See Section 1, Section 4 and Section 11.

Any questions and requests for assistance may be directed to D.F. King & Co., Inc., our Information Agent in the United States, or Naschitz, Brandes, Amir & Co., Advocates, our legal counsel in Israel, at their addresses and telephone numbers set forth on the back cover of this offer to purchase.

Additional copies of this offer to purchase, the Letter of Transmittal and other related materials may be obtained from the Information Agent or the Israeli Depositary upon request.

|

|

1

|

|

|

6

|

|

|

8

|

|

|

9

|

|

Background

|

9

|

|

Purpose of the Offer; Reasons for the Offer

|

9

|

|

Plans for Gilat after the Offer; Certain Effects of the Offer

|

10

|

|

Rights of Shareholders Who Do Not Accept the Offer

|

11

|

|

Interest of Persons in the Offer

|

11

|

|

Related Party Transactions

|

11

|

|

|

12

|

|

1. TERMS OF THE OFFER; PRORATION; EXPIRATION DATE

|

12

|

|

2. ACCEPTANCE FOR PAYMENT AND PAYMENT

|

14

|

|

3. PROCEDURES FOR TENDERING SHARES OR NOTIFYING US OF YOUR OBJECTION TO THE OFFER

|

15

|

|

4. WITHDRAWAL RIGHTS

|

20

|

|

5. MATERIAL U.S. FEDERAL INCOME TAX AND ISRAELI INCOME TAX CONSEQUENCES

|

21

|

|

6. PRICE RANGE OF THE SHARES ETC.

|

25

|

|

7. EFFECTS OF THE OFFER ON THE MARKET FOR SHARES; REGISTRATION UNDER THE EXCHANGE ACT

|

27

|

|

8. INFORMATION CONCERNING GILAT

|

27

|

|

9. INFORMATION CONCERNING THE BIDDER GROUP

|

28

|

|

10. SOURCES AND AMOUNT OF FUNDS

|

29

|

|

11. CONDITIONS OF THE OFFER

|

29

|

|

12. LEGAL MATTERS AND REGULATORY APPROVALS

|

31

|

|

13. FEES AND EXPENSES

|

32

|

|

14. MISCELLANEOUS

|

32

|

|

|

34

|

|

|

35

|

|

|

36

|

| |

Unless the context otherwise requires, all references in this offer to purchase to “FIMI,” “us,” “we,” and “our” are to FIMI Opportunity IV, L.P, a limited partnership organized under the laws of the State of Delaware, FIMI Israel Opportunity IV, Limited Partnership, a limited partnership organized under the laws of the State of Israel,

FIMI Opportunity V, L.P, a limited partnership organized under the laws of the State of Delaware and FIMI Israel Opportunity Five, Limited Partnership, a limited partnership organized under the laws of the State of Israel, all references to “Gilat” are to Gilat Satellite Networks Ltd., all references to “Nasdaq” are to the Nasdaq Global Select Market, all references to “TASE” are to the Tel Aviv Stock Exchange Ltd., all references to “dollars” or “$” are to United States dollars, all references to “NIS” are to New Israeli Shekels, and all references to the “Israeli Companies Law” are to the Israeli Companies Law 5759-1999, as amended.

Unless the context otherwise requires, the percentages of the issued and outstanding Gilat shares and the percentages of the voting power of Gilat stated throughout this offer to purchase are based on 42,601,899 shares issued and outstanding as of September 30, 2014.

Unless otherwise indicated or the context otherwise requires, for purposes of this offer to purchase, (i) an “Israeli business day” means any day other than a Friday, Saturday, or any other day on which the banks in both Israel and the U.S. are permitted not to be open for business and (ii) a “U.S. business day” means any day other than a Saturday, Sunday, U.S. federal holiday or any other day on which the banks in the U.S. are permitted not to be open for business.

This summary term sheet is a brief summary of the material provisions of this offer to purchase 5,166,348 ordinary shares of Gilat, par value NIS 0.20 per share (which we refer to as Gilat shares) being made by FIMI, and is meant to help you understand the offer. This summary term sheet is not meant to be a substitute for the information contained in the remainder of this offer to purchase, and the information contained in this summary term sheet is qualified in its entirety by the fuller descriptions and explanations contained in the later pages of this offer to purchase. The following are some of the questions you, as a shareholder of Gilat, may have about us and the offer and answers to those questions. We recommend that you read carefully this entire offer to purchase, the Letter of Transmittal and other related documents delivered to you prior to making any decision regarding whether to tender your shares.

WHO IS OFFERING TO BUY MY SECURITIES?

|

|

|

·

|

We, FIMI Opportunity IV Fund, L.P., FIMI Israel Opportunity Fund IV, Limited Partnership, FIMI Opportunity V, L.P. and FIMI Israel Opportunity Five, Limited Partnership, are limited partnerships that are part of a group of private equity funds known as the FIMI Funds. The FIMI Funds invest in companies that are predominantly located in Israel or that have significant ties or relations to Israel.

|

|

·

|

We are controlled by our general partners FIMI IV 2007 Ltd., a private company limited by shares and FIMI Five 2012 Ltd., a private company limited by shares, the two managing general partners of the FIMI Funds, and each entity in a chain of ownership that leads up to Mr. Ishay Davidi, the founder of the FIMI Funds. This chain of entities consists, in addition to FIMI IV 2007 Ltd. and FIMI Five 2012 Ltd., of Shira and Ishay Davidi Management Ltd. See Section 9. Because FIMI IV 2007 Ltd., FIMI Five 2012 Ltd., Shira and Ishay Davidi Management Ltd. and Ishay Davidi control us and helped to structure our offer, our offer may be deemed to be made on behalf of these controlling persons, and in this offer to purchase we refer to them and us collectively as our “bidder group.”

|

|

HOW MANY SHARES ARE SOUGHT IN THIS OFFER?

|

|

·

|

Subject to certain conditions, we are offering to purchase 5,166,348 Gilat shares, representing approximately 12.1% of the issued and outstanding Gilat shares and of the voting power of Gilat. See Section 1.

|

|

·

|

If more than 5,166,348 shares are validly tendered and not properly withdrawn, we will purchase 5,166,348 shares on a pro rata basis from all shareholders who have validly tendered their shares in the Initial Offer Period and the Additional Offer Period and have not properly withdrawn their shares before the completion of the Initial Offer Period. The number of shares that we will purchase from each tendering shareholder will be based on the total number of shares validly tendered by all shareholders in the Initial Offer Period and the Additional Offer Period and not properly withdrawn before the completion of the Initial Offer Period. You may only withdraw previously tendered shares prior to the completion of the Initial Offer Period. See Section 1 and Section 4.

|

|

·

|

Pursuant to an Agreement, dated as of September 17, 2014 among (i) FIMI and (ii) York Credit Management, L.P., York Multi-Strategy Master Fund, L.P., York Credit Opportunities Fund, L.P., York Credit Opportunities Master Fund, L.P., Jorvik Multi-Strategy Master Fund, L.P. and Permal York Ltd. (collectively, “York”), (a) we undertook to make a public “special tender offer” pursuant to Israeli Law, on or prior to October 24, 2014, to acquire 5,166,348 Gilat shares at a price of $4.95 per Gilat share, and (b) York undertook to accept the offer in respect of the 5,166,348 Gilat Shares held by it in consideration for a price of $4.95 per Gilat share.

|

|

WHY ARE YOU CONDUCTING THIS OFFER?

We are conducting the offer to increase our interest in Gilat because we believe in the long-term value of Gilat and in order to comply with the requirements of Israeli law. Under Israeli law, a purchase of shares of a public company may not be made other than by way of a “special tender offer” meeting certain requirements if, among other things, as a result of the purchase, the purchaser would own or would be deemed to beneficially own more than 25.0% of the aggregate voting power of the company and no other person owns at least 25.0% of the aggregate voting power of the company. As of October 23, 2014 we beneficially held 9,776,324 Gilat Shares, representing approximately 23% of the issued and outstanding Gilat shares. Accordingly, in order for us to purchase additional Gilat shares that would increase our voting power in Gilat to more than 25.0%, we are required to conduct the offer as a “special tender offer” meeting the requirements of Israeli law. See “Background to the Offer – Background” and “Background to the Offer – Purpose of the Offer; Reasons for the Offer.”

HOW MUCH ARE YOU OFFERING TO PAY AND WHAT IS THE FORM OF PAYMENT?

|

|

·

|

We are offering to pay $4.95 per Gilat share, net to you (subject to withholding taxes, as applicable), in cash, without interest. All shareholders tendering their Gilat shares in the offer will be paid solely in United States dollars. See “Introduction”, Section 1 and Section 2, and, with respect to withholding taxes, Section 5.

|

|

WHAT PERCENTAGE OF THE GILAT SHARES DO YOU CURRENTLY OWN AND HOW MUCH WILL YOU OWN IF THE OFFER IS COMPLETED?

|

|

·

|

We currently beneficially own 9,776,324 Gilat shares, representing approximately 23% of the issued and outstanding Gilat shares.

|

|

·

|

Following the consummation of the offer, we will beneficially own 14,942,672 Gilat shares, representing approximately 35.1% of the issued and outstanding Gilat shares.

See “Introduction” and Section 11.

|

|

WHAT IS THE MARKET VALUE OF MY GILAT SHARES AS OF A RECENT DATE?

|

|

·

|

On September 16, 2014, the last trading day before we announced our intention to commence the offer, the closing sale price of the Gilat shares was $4.79 on Nasdaq and NIS 17.37 ($4.77 based on an exchange rate of NIS 3.641 per United States dollar as of September 16, 2014) on the TASE. We recommend that you obtain a recent quotation for your Gilat shares prior to deciding whether or not to tender your Gilat shares. See Section 6.

|

|

DO YOU HAVE THE FINANCIAL RESOURCES TO PAY THE PURCHASE PRICE IN THE OFFER?

|

|

·

|

Yes. We possess all of the necessary funds to consummate the offer from cash on hand. The offer is not conditioned on the availability of financing.

|

|

·

|

According to Israeli law, to secure the payment for the Gilat shares tendered pursuant to the offer, the Israeli Depositary, which is a member of the TASE, has agreed to guarantee our obligation to pay for the Gilat shares. To secure this guarantee, we have engaged the Israeli Depositary to act as an escrow agent and have deposited cash into an escrow account in an amount sufficient to pay for the maximum number of Gilat shares that we are offering to purchase.

See Section 2 and Section 10.

|

|

IS YOUR FINANCIAL CONDITION RELEVANT TO MY DECISION ON WHETHER TO TENDER IN THE OFFER?

|

|

·

|

No. Because our offer is not conditioned on the availability of financing, we possess all of the necessary funds to consummate the offer from cash on hand, and we have deposited cash into an escrow account with the Israeli Depositary in an amount sufficient to pay for the maximum number of Gilat shares that we are offering to purchase.

See Section 2 and Section 10.

|

|

CAN I OBJECT TO THE OFFER?

|

|

·

|

Yes. Pursuant to Israeli law, you may object to the offer. If you want to notify us of your objection to the offer you must complete and sign the accompanying Notice of Objection and deliver it prior to the completion of the Initial Offer Period on November 25, 2014 (as may be extended) by following the applicable procedures and instructions described in Section 3. Under Israeli law, since following the consummation of the offer we will be beneficial owners of more than 25.0% of the voting power of Gilat, the aggregate number of Gilat shares validly tendered pursuant to the offer and not properly withdrawn at the completion of the Initial Offer Period must exceed the aggregate number of Gilat shares represented by Notices of Objection to the offer. This is one of the conditions of the offer, and if it is not met, we will be prohibited from purchasing any Gilat shares tendered pursuant to the offer.

See the answer to the question “What are the most significant conditions of the offer?” below, “Background to the Offer – Rights of Shareholders Who Do Not Accept the Offer” Section 3 and Section 11.

|

|

WHAT ARE THE MOST SIGNIFICANT CONDITIONS OF THE OFFER?

|

|

·

|

Gilat shares representing 5.0% of the issued and outstanding shares and voting power of Gilat on the Initial Completion Date (currently, 2,130,095 Gilat shares) must be validly tendered and not properly withdrawn prior to the completion of the Initial Offer Period;

|

|

·

|

At the completion of the Initial Offer Period, the aggregate number of Gilat shares validly tendered pursuant to the offer and not properly withdrawn (excluding Gilat shares held by us) must be greater than the aggregate number of Gilat shares represented by Notices of Objection to the offer; and

|

|

·

|

The approval of the Israeli Antitrust Authority to the increase of FIMI's shareholdings in Gilat to more than 25% of Gilat's issued and outstanding share capital.

The offer is not conditioned on the availability of financing or the approval of the board of directors of Gilat.

See “Background to the Offer – Rights of Shareholders Who Do Not Accept the Offer” and Section 11, which sets forth in full the conditions of the offer and describes those conditions of the offer that may be waived by us.

|

|

WHAT WILL HAPPEN IF THE CONDITIONS OF THE OFFER ARE NOT SATISFIED?

|

|

·

|

If any condition is not satisfied, we may elect not to purchase, or may be prohibited from purchasing, any Gilat shares tendered pursuant to the offer, or, subject to applicable law, we may waive such conditions. See “Introduction”, Section 1 and Section 11.

|

|

HOW LONG DO I HAVE TO DECIDE WHETHER TO ACCEPT THE OFFER AND TENDER MY SHARES?

|

|

·

|

You may tender your Gilat shares until 10:00 a.m., New York time, or 5:00 p.m., Israel time, on November 25, 2014 (as may be extended). We refer to this period, as may be extended, as the Initial Offer Period, and the date of completion of the Initial Offer Period is referred to as the Initial Completion Date.

|

|

·

|

We will publicly announce in accordance with applicable law, and in any event issue a press release by 9:00 a.m., New York time, or 4:00 p.m., Israel time, on the U.S. business day following the Initial Completion Date, stating whether or not the conditions of the offer have been satisfied or, subject to applicable law, waived by us. As required by Israeli law, if the conditions of the offer are satisfied or, subject to applicable law, waived by us, then if, with respect to each Gilat share owned by you,

|

|

|

·

|

you have not yet responded to the offer,

|

|

|

·

|

you have notified us of your objection to the offer, or

|

|

|

·

|

you have validly tendered such Gilat share but have properly withdrawn your tender during the Initial Offer Period, you will be afforded an additional four calendar-day period following the Initial Completion Date, until 10:00 a.m., New York time, or 5:00 p.m., Israel time, on November 29, 2014, during which you may tender each such Gilat share. We refer to this additional period as the Additional Offer Period and the date of expiration of the Additional Offer Period is referred to as the Final Expiration Date. The Final Expiration Date will change if we decide to extend the Initial Offer Period.

See “Introduction,” Section 1, Section 3 and Section 11.

|

| HOW DO I TENDER MY GILAT SHARES AND TO WHICH DEPOSITARY SHOULD I TENDER?

This depends on the manner in which you hold your Gilat shares:

|

|

·

|

If you hold your Gilat shares through a TASE member or you are named as a holder of the Gilat shares in the Register of Shareholders of Gilat in Israel, you should tender your Gilat shares to the Israeli Depositary by following the applicable procedures and instructions described in Section 3; and

|

|

·

|

All other holders of Gilat shares should tender their Gilat shares to the U.S. Depositary by following the applicable procedures and instructions described in Section 3.

|

|

CAN I TENDER MY GILAT SHARES USING A GUARANTEED DELIVERY PROCEDURE?

|

|

·

|

No. You may only tender your Gilat shares by following the applicable procedures and instructions described in Section 3.

|

|

WHEN CAN I WITHDRAW THE GILAT SHARES I TENDERED PURSUANT TO THE OFFER?

|

|

·

|

You may withdraw any previously tendered Gilat shares at any time prior to the completion of the Initial Offer Period, but not during the Additional Offer Period. In addition, under U.S. law, tendered Gilat shares may be withdrawn at any time after 60 days from the date of the commencement of the offer if the Gilat shares have not yet been accepted for payment by us. See Section 1 and Section 4.

|

|

WHEN WILL YOU PAY FOR THE GILAT SHARES TENDERED IN THE OFFER?

|

|

·

|

All of the Gilat shares validly tendered pursuant to the offer and not properly withdrawn will be paid for promptly following the Final Expiration Date, subject to proration. We expect to make such payment, including in the event that proration of tendered Gilat shares is required, within four U.S. business days following the Final Expiration Date. See Section 1, Section 2 and Section 11.

|

|

CAN THE OFFER BE EXTENDED, AND UNDER WHAT CIRCUMSTANCES?

|

|

·

|

We have the right, in our sole discretion, to extend the Initial Offer Period, subject to applicable law. In addition, in certain circumstances, we may be required by law to extend the Initial Offer Period. See Section 1.

|

|

HOW WILL I BE NOTIFIED IF THE OFFER IS EXTENDED?

|

|

·

|

If we decide to extend the Initial Offer Period, we will inform the Depositaries, the Information Agent and our Israeli legal counsel of that fact. We will also publicly announce the new Initial Completion Date in accordance with applicable law, and in any event issue a press release to this effect no later than 9:00 a.m., New York time, or 4:00 p.m., Israel time, on the first U.S. business day following the day on which we decide to extend the Initial Offer Period. Under Israeli law, we are required to publicly announce the new expiration date no later than one Israeli business day prior to the Initial Completion Date. See Section 1.

|

|

HAS GILAT OR ITS BOARD OF DIRECTORS ADOPTED A POSITION ON THE OFFER?

|

|

·

|

Under applicable U.S. law, no later than ten U.S. business days from the date of this offer to purchase, Gilat is required to publish, send or give to you a statement disclosing that it either recommends acceptance or rejection of the offer, expresses no opinion and remains neutral toward the offer, or is unable to take a position with respect to the offer.

|

|

·

|

Under Israeli law, Gilat’s board of directors is required, no later than five Israeli business days prior to the Initial Completion Date, to express its opinion to the shareholders on the advisability of the offer. Gilat’s board of directors may refrain from expressing an opinion if it cannot do so, as long as it gives the reasons for not providing an opinion.

As of the date of this offer to purchase, Gilat’s board of directors has not made any recommendation regarding acceptance or rejection of the offer or expressed an opinion regarding the advisability of the offer.

|

|

ARE THERE ANY CONFLICTS OF INTEREST IN THE OFFER?

|

|

·

|

Yes. Ishay Davidi may have a conflict between his interest, as the controlling person of our bidder group, to complete this offer at the lowest possible cost to us, and his duty, as a director of Gilat, to act in the best interests of Gilat.

|

|

·

|

Two members of the board of directors of Gilat, Ishay Davidi and Amiram Boehm, a partner in the FIMI Funds, were designated by us to Gilat's board of directors.

See “Background to the Offer – Purpose of the Offer; Reasons for the Offer” and “Background to the Offer – Interest of Persons in the Offer”.

|

|

WHAT ARE THE TAX CONSEQUENCES OF THE OFFER?

|

|

·

|

The receipt of cash for Gilat shares accepted for payment by us from tendering shareholders who are “United States persons” for United States federal income tax purposes will be treated as a taxable transaction for United States federal income tax purposes.

|

|

·

|

The receipt of cash for Gilat shares accepted for payment by us from tendering shareholders generally will be a taxable transaction for Israeli income tax purposes for both Israeli residents and non-Israeli residents, unless a specific exemption is available or a tax treaty between Israel and the shareholder’s country of residence provides otherwise.

|

|

·

|

We have obtained an approval from the Israeli Tax Authority with respect to the Israeli withholding tax rates applicable to shareholders as a result of the sale of Gilat shares pursuant to the offer. The approval provides, among other things, that (1) tendering shareholders who acquired their Gilat shares after Gilat’s initial public offering on Nasdaq in 1993 and who certify that they are non-Israeli residents (and, in the case of a corporation, that no Israeli residents (x) hold 25.0% or more of the means to control such corporation or (y) are the beneficiaries of, or are entitled to, 25.0% or more of the revenues or profits of such corporation, whether directly or indirectly), will not be subject to Israeli withholding tax, (2) payments to be made to tendering shareholders who acquired their Gilat shares after Gilat’s initial public offering on Nasdaq in 1993 and who hold their Gilat shares through an Israeli broker or Israeli financial institution will be made by us without any Israeli withholding at source, and the relevant Israeli broker or Israeli financial institution will withhold Israeli tax, if any, as required by Israeli law. The approval does not address shareholders who are not described in clauses (1) and (2) above, and therefore they will be subject to Israeli withholding tax at the applicable rate of the gross proceeds payable to them pursuant to the offer as prescribed by Israeli tax law.

We recommend that you seek professional advice from your own advisors concerning the tax consequences applicable to your particular situation. See Section 5.

|

|

WILL THE OFFER RESULT IN THE DELISTING OF THE GILAT SHARES?

|

|

·

|

No. Gilat shares will continue to trade on Nasdaq and the TASE following completion of the offer. See Section 7.

|

|

WITH WHOM MAY I TALK IF I HAVE QUESTIONS ABOUT THE OFFER?

|

|

·

|

You can call D.F. King & Co., Inc., our Information Agent in the United States, at 212-493-3910 or Toll Free 866-406-2288, or our legal counsel in Israel, Naschitz, Brandes, Amir & Co., Advocates, at +972-3623-5000, during their respective normal business hours. See the back cover of this offer to purchase.

|

We, FIMI Opportunity IV, L.P, a limited partnership organized under the laws of the State of Delaware, FIMI Israel Opportunity IV, Limited Partnership, a limited partnership organized under the laws of the State of Israel, FIMI Opportunity V, L.P, a limited partnership organized under the laws of the State of Delaware and FIMI Israel Opportunity Five, Limited Partnership, a limited partnership organized under the laws of the State of Israel (collectively, “FIMI”), hereby offer to purchase 5,166,348 ordinary shares, par value NIS 0.20 per share, of Gilat Satellite Networks Ltd., or Gilat shares, at a price of $4.95 per share, net to you (subject to withholding taxes, as applicable), in cash, without interest. The offer is subject to the terms and conditions set forth in this offer to purchase, the Letter of Transmittal and the other related documents delivered to you.

Gilat shares are listed on the Nasdaq Global Select Market, or Nasdaq, under the ticker symbol “GILT” and on the Tel Aviv Stock Exchange Ltd., or the TASE. As of September 30, 2014, there was a total of 42,601,899 Gilat shares issued and outstanding. As of the date of this offer to purchase, we beneficially own 9,776,324 Gilat shares, representing approximately 23.0% of the issued and outstanding Gilat shares. As a result, if we purchase 5,166,348 Gilat shares pursuant to the offer, we would beneficially own 14,942,672 Gilat shares, representing approximately 35.1% of the issued and outstanding Gilat shares.

FIMI is part of a group of private equity funds known as the FIMI Funds. The FIMI Funds invest in companies that are predominantly located in Israel or that have significant ties or relations to Israel.

We are controlled by our general partners FIMI IV 2007 Ltd. and FIMI Five 2012 Ltd. and an entity in a chain of ownership that leads up to Ishay Davidi, the founder of the FIMI Funds. This entity is Shira and Ishay Davidi Management Ltd. Because FIMI IV 2007 Ltd., FIMI Five 2012 Ltd ., Shira and Ishay Davidi Management Ltd. and Ishay Davidi control us and helped structure our offer, our offer may be deemed to be made on behalf of these controlling persons, and in this offer to purchase we refer to them and us collectively as our “bidder group.”

Ishay Davidi may have a conflict between his interest, as the ultimate controlling person of our bidder group, to complete this offer at the lowest possible cost to us, and his duty, as a director of Gilat, to act in the best interests of Gilat. Two members of Gilat’s board of directors, including Ishay Davidi, were designated by us to Gilat's board of directors.

The offer is being conducted simultaneously in the United States and in Israel. The initial period of the offer will be completed at 10:00 a.m., New York time, or 5:00 p.m., Israel time, on November 25, 2014. We refer to this period, as may be extended, as the Initial Offer Period, and the date of completion of the Initial Offer Period is referred to as the Initial Completion Date. We will publicly announce in accordance with applicable law, and in any event issue a press release by 9:00 a.m., New York time, or 4:00 p.m., Israel time, on the U.S. business day following the Initial Completion Date, stating whether or not the conditions of the offer have been satisfied or, subject to applicable law, waived by us. As required by Israeli law, if the conditions of the offer have been satisfied or, subject to applicable law, waived by us, then if, with respect to each Gilat share owned by you, (a) you have not yet responded to the offer, (b) you have notified us of your objection to the offer, or (c) you have validly tendered such Gilat share but have properly withdrawn your tender during the Initial Offer Period, then you will be afforded an additional four calendar-day period, until 10:00 a.m., New York time, or 5:00 p.m., Israel time, on November 29, 2014, during which you may tender each such Gilat share. We refer to this additional period as the Additional Offer Period and the date of expiration of the Additional Offer Period is referred to as the Final Expiration Date. The Final Expiration Date will change if we decide to extend the Initial Offer Period.

We have applied to the SEC for exemptive relief from Rule 14d-7(a) and no-action relief under the provisions of Rule 14e-1(c) to provide the four-day additional offering period without withdrawal rights.

If you are a record owner of Gilat shares and tender directly to American Stock Transfer & Trust Company, the U.S. Depositary, or to Bank of Jerusalem Ltd., the Israeli Depositary (which we refer to together as the Depositaries), you generally will not be obligated to pay brokerage fees or commissions, service fees or commissions or, except as set forth in the Letter of Transmittal, share transfer taxes with respect to the sale of your Gilat shares in the offer. If you hold your Gilat shares through a bank or broker, we recommend that you check whether they charge any service or other fees.

We will pay the fees and expenses of the Depositaries in connection with the offer. The Depositaries will act as agents for tendering shareholders for the purpose of receiving payment from us and transmitting payments to tendering shareholders whose Gilat shares are accepted for payment. We will also pay the fees and expenses of D.F. King & Co., Inc., our Information Agent, and Naschitz, Brandes, Amir & Co., Advocates, our Israeli legal counsel, who will both facilitate and answer questions concerning the offer during their respective normal business hours.

The offer is conditioned on Gilat shares representing 5.0% of the issued and outstanding shares and voting power of Gilat on the Initial Completion Date (currently, 2,130,095 Gilat shares), being validly tendered and not properly withdrawn, and we may terminate the offer if the total number of Gilat shares validly tendered and not properly withdrawn prior to 10:00 a.m., New York time, or 5:00 p.m., Israel time, on the Initial Completion Date is less than 5.0% of the issued and outstanding shares and voting power of Gilat on the Initial Completion Date. Certain other conditions to the consummation of the offer are described in Section 11. We reserve the right (subject to applicable law and the rules of the United States Securities and Exchange Commission, or the SEC) to amend or, other than the conditions set forth in clause (a) and clause (c) of Section 11, waive any one or more of the terms and conditions of the offer. However, if any of these conditions is not satisfied, we may elect not to purchase, or may be prohibited from purchasing any Gilat shares tendered pursuant to the offer. The offer is not conditioned on the availability of financing or the approval of the board of directors of Gilat. See Section 1, Section 10 and Section 11.

Under applicable U.S. law, no later than ten U.S. business days from the date of this offer to purchase, Gilat is required to publish, send or give to you a statement disclosing that it either recommends acceptance or rejection of the offer, expresses no opinion and remains neutral toward the offer, or is unable to take a position with respect to the offer. Under Israeli law, Gilat’s board of directors is required, no later than five Israeli business days prior to the Initial Completion Date, to express its opinion to the shareholders on the advisability of the offer. Gilat’s board of directors may refrain from expressing an opinion if it cannot do so, as long as it gives the reasons for not providing an opinion. As of the date of this offer to purchase Gilat’s board of directors has not made such a statement.

This offer to purchase, the Letter of Transmittal and the other related documents delivered to you contain important information which should be read carefully before any decision is made with respect to the offer.

FORWARD-LOOKING STATEMENTS

This offer to purchase, the Letter of Transmittal and the other related documents delivered to you and/or incorporated by reference herein include “forward-looking statements” that are not purely historical regarding our intentions, hopes, beliefs, expectations and strategies for the future, including, without limitation:

|

|

·

|

statements regarding the public float of Gilat shares following consummation of the offer;

|

|

|

·

|

statements regarding whether the Gilat shares will continue to be “margin securities” following consummation of the offer;

|

|

|

·

|

statements regarding whether the Gilat shares will continue to be traded on Nasdaq or the TASE or registered under the United States Securities Exchange Act of 1934, as amended, following consummation of the offer;

|

|

|

·

|

statements regarding the plans, objectives or expectations regarding the future operations or status of us or Gilat; and

|

|

|

·

|

any statement of assumptions underlying any of the foregoing.

|

Forward-looking statements that are based on various assumptions (some of which are beyond our control) may be identified by the use of forward-looking terminology, such as “may,” “can be,” “will,” “expects,” “anticipates,” “intends,” “believes,” “believe in the value,” and similar words and phrases. Such forward-looking statements are inherently subject to known and unknown risks and uncertainties. Actual results could differ materially from those set forth in forward-looking statements due to a variety of factors, including, but not limited to:

|

|

·

|

changes in domestic and foreign economic and market conditions;

|

|

|

·

|

changes in the ownership of Gilat shares, particularly any substantial accumulations by persons who are not affiliated with us;

|

|

|

·

|

uncertainty as to the completion of the offer; and

|

|

|

·

|

the risk factors detailed in Gilat’s most recent annual report on Form 20-F and its other filings with the SEC.

|

See Section 9 of this offer to purchase for a discussion of certain information relating to us. Except as may be required by law, we do not undertake, and specifically disclaim, any obligation to publicly release the results of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such forward-looking statements.

You should assume that the information appearing in this offer to purchase is accurate as of the date on the front cover of this offer to purchase only.

Background

We originally made an investment in Gilat in September 9, 2012 by purchasing a total of 4,424,858 Gilat shares from Menora Mivtachim Holdings Ltd.

On November 12, 2012 and November 14, 2012, we purchased additional Gilat shares in the amounts of 1,639,835 and 1,605,510, respectively, in the open market.

Pursuant to an agreement dated February 3, 2014 with York Capital Management, L.P., York Multi-Strategy Master Fund, L.P., York Credit Opportunities Fund, L.P., York Credit Opportunities Master Fund, L.P., Jorvik Multi-Strategy Master Fund, L.P. and Permal York Ltd. (collectively, “York”), we purchased 2,106,121of additional Gilat shares from York.

In the ordinary course of our business, we from time to time review the performance of our investments and consider possible strategies for enhancing value. As part of our ongoing review of our investment in Gilat, we explore, from time to time, the possibilities of acquiring additional Gilat shares.

After the purchase of Gilat shares from York in February 2014, our management began considering the possibility of purchasing additional Gilat shares. In connection therewith, we conducted an analysis of the legal requirements relating to the purchase of Gilat shares and the tender offer requirements, including the feasibility of conducting a simultaneous tender offer in the U.S. and Israel. The analysis was made with the assistance of Israeli and U.S. legal counsel.

Under Israeli law, a purchase of the shares of a public company may not be made other than by way of a “special tender offer” meeting certain requirements, if, among other things, as a result of the purchase, the purchaser would own or would be deemed to own more than 25.0% of the aggregate voting power of the company and no other person owns at least 25.0% of the voting power.

Accordingly, due to the fact that under Israeli laws we are obligated to initiate a “special tender offer” in order to own more than 25% of Gilat's issued and outstanding share capital, we entered into an agreement, on September 17, 2014, with York pursuant to which (a) we undertook to make a public “special tender offer” pursuant to Israeli law, on or prior to October 24, 2014, to acquire 5,166,348 Gilat shares at a price of $4.95 per Gilat share, and (b) York undertook to accept the offer in respect of the 5,166,348 Gilat shares held by it in consideration of $4.95 per Gilat share. York currently holds 5,166,348 Gilat shares representing approximately 12.1% of the issued and outstanding share capital of Gilat. For further information regarding the agreement between FIMI and York, you may refer to Schedule 13D/A filed by FIMI with the SEC on September 17, 2014.

Beginning on September 18, 2014 through the date of this offer to purchase, we continued with preparations to enable us to commence the offer. In addition, we, with the assistance of Israeli and U.S. legal counsel, applied to the SEC and the ISA for relief from certain provisions of the U.S. and Israeli securities laws to enable us to structure a tender offer that would comply with applicable law and regulations in both the U.S. and Israel. We have requested from the Israeli Tax Authority, or the ITA, an approval with respect to the Israeli withholding tax rates applicable to the offer, and have filed a merger notice with the Israeli Comptroller of Restrictive Trade Practices, to which we also refer in this offer to purchase as the Israeli Antitrust Authority, with respect to the potential increase of our shareholdings in Gilat to more than 25% of the Gilat shares.

On October 7, 2014, we received the exemptive relief that we requested from the ISA. We are waiting for a determination as to the exemptive relief that we applied for from the SEC.

On October 22, 2014, we received from the ITA an approval with respect to the Israeli withholding tax rates applicable to sales of shares pursuant to the offer.

On October 20, 2014, we filed an application with respect to the offer with the Israeli Antitrust Authority.

Purpose of the Offer; Reasons for the Offer

Our bidder group’s purpose of the offer is for FIMI to increase its beneficial ownership of the issued and outstanding Gilat shares from its current level of approximately 23.0% up to approximately 35.1%. This is because each member of our bidder group believes in the long-term value of Gilat. According to Israeli law, we are not permitted to acquire additional Gilat shares if such acquisition would result in our percentage ownership of the voting power of Gilat exceeding 25.0%, other than by means of a tender offer.

Plans for Gilat after the Offer; Certain Effects of the Offer

Except as otherwise described below or elsewhere in this offer to purchase, none of the members of our bidder group, and to the best of our knowledge none of the other persons listed in Schedule I to this offer to purchase, has any current plans, proposals or negotiations that relate to or would result in the following:

|

|

·

|

an extraordinary corporate transaction, merger, reorganization or liquidation involving Gilat or any of its subsidiaries;

|

|

|

·

|

a purchase, sale or transfer of a material amount of the assets of Gilat or any of its subsidiaries;

|

|

|

·

|

any material change in the present dividend rate or policy or indebtedness or capitalization of Gilat;

|

|

|

·

|

any change in the present board of directors and management of Gilat (including any plan or proposal to change the number or term of directors or to fill any existing vacancy on the board or to change any material term of the employment contract of any executive officer), other than a filling of the vacancy created by the resignation, on September 30, 2014, of Mr. Jeremy Blank, a principal at York, from Gilat's board of directors;

|

|

|

·

|

any other material change in Gilat's corporate structure or business;

|

|

|

·

|

a delisting of the Gilat shares; or

|

|

|

·

|

the Gilat shares becoming eligible for termination of registration under the United States Securities Exchange Act of 1934, as amended, or the Exchange Act.

|

We expect that from time to time there may be significant developments or transactions involving our portfolio companies (including Gilat) or their securities, or offers, proposals or discussions related thereto, which may involve acquisitions or sales by us of our holdings in such entities (including Gilat) or acquisitions or sales of securities, assets or business operations by such entities.

We intend to review on a continuing basis our investment in Gilat shares and take such actions with respect to our investment as we deem appropriate in light of the circumstances existing from time to time. Such actions could include, among other things, additional purchases of Gilat shares pursuant to one or more open-market purchase programs, through private transactions or through tender offers or otherwise, subject to applicable U.S. and Israeli law. Future purchases may be on the same terms or on terms that are more or less favorable to Gilat’s shareholders than the terms of the offer. Any possible future purchases will depend on many factors, including the results of the offer, the market price of Gilat shares, our business and financial position, and general economic and market conditions. In addition, following the consummation of the offer, we may also determine to dispose of our Gilat shares, in whole or in part, at any time and from time to time, subject to applicable laws. Any such decision would be based on our assessment of a number of different factors, including, without limitation, the business, prospects and affairs of Gilat, the market for the Gilat shares, the condition of the securities markets, general economic and industry conditions and other opportunities available to us.

Under Israeli law, if a shareholder owns or is deemed to beneficially own in excess of 25.0% of the voting power of a company, such shareholder may purchase shares in the open market or through private transactions, and not solely by means of a tender offer, unless as a result of the purchase the shareholder would own or would be deemed to beneficially own in excess of 45.0% of the issued and outstanding shares of the company and no other person owns at least 45.0% of the voting power. Accordingly, following the consummation of the offer, we may purchase Gilat shares in the open market or through private transactions, and not solely by means of a tender offer, as long as our aggregate percentage ownership of issued and outstanding Gilat shares does not reach 45.0% (and no other person owns at least 45.0% of the voting power).

However, under Israeli law, we, our controlling shareholders and any corporation under our or their control, are prohibited from conducting an additional tender offer for Gilat shares and from merging with Gilat within 12 months from the date of this offer to purchase.

The offer may limit the ability of Gilat to use U.S. federal income net operating tax loss carry forwards. The Annual Report on Form 20-F of Gilat for the year ended December 31, 2013, states that as of December 31, 2013, the U.S. subsidiaries of Gilat had U.S. federal net operating tax loss carry forwards of approximately $67,000,000. Subject to certain limitations, net operating tax loss carry forwards may be used to offset future taxable income and thereby reduce U.S. federal income taxes otherwise payable. Section 382 of the Internal Revenue Code of 1986, as amended, referred to as the Code, imposes an annual limitation on the ability of a corporation that undergoes an “ownership change” to use its net operating tax loss carry forwards to reduce its tax liability. It is possible that the U.S. subsidiaries of Gilat may experience “ownership changes” as defined in Section 382 of the Code because of changes in the ownership of Gilat’s shares, including as a result of the consummation of the offer. Accordingly, the use of net operating tax loss carry forwards by the U.S. subsidiaries of Gilat may be limited by the annual limitation described in Section 382 of the Code. Any limitation on the use of net operating tax loss carry forwards could increase the U.S. federal income tax liability of the U.S. subsidiaries of Gilat.

Rights of Shareholders Who Do Not Accept the Offer

You will have no appraisal or similar rights with respect to the offer. Under Section 331 of the Israeli Companies Law, you may respond to the offer by accepting the offer or notifying us of your objection to the offer. Alternatively, you may simply not respond to the offer and not tender your Gilat shares. It is a condition to the offer that, at the completion of the Initial Offer Period, the aggregate number of Gilat shares validly tendered pursuant to the offer and not properly withdrawn is greater than the aggregate number of Gilat shares represented by Notices of Objection. As required by Section 331(c) of the Israeli Companies Law, in making this calculation, we exclude Gilat shares held by us.

An excerpt of Section 331 of the Israeli Companies Law is attached as Annex A.

Please see Section 3 for instructions on how to notify us of your objection to the offer.

Interest of Persons in the Offer

Ishay Davidi is a member of Gilat’s board of directors. Ishay Davidi is the founder of the FIMI Funds and the chief executive officer of each of FIMI IV 2007 Ltd. and FIMI Five 2012 Ltd. Amiram Boehm, a partner in the FIMI Funds is also a member of Gilat’s board of directors.

Related Party Transactions

FIMI IV 2007 Ltd., the managing general partner of FIMI Opportunity IV Fund, L.P. and FIMI Israel Opportunity Fund IV, Limited Partnership, was granted options to purchase 100,000 Gilat shares, as approved by Gilat's audit committee, board of directors and shareholders' meeting. In addition, FIMI IV 2007 Ltd. receives compensation for the services of Ishay Davidi and Amiram Boehm as members of Gilat's board of directors equivalent to the amounts paid to other non-employee members of Gilat's board of directors (as was approved by the shareholders of Gilat in a shareholders' meeting that was convened on December 31, 2013. For more information, see the proxy statement filed on Form 6-K on November 26, 2013).

Naschitz, Brandes, Amir & Co. has provided legal advice to Gilat and certain members of its board of directors with respect to certain matters. Sharon A. Amir, Adv., a senior partner at Naschitz, Brandes, Amir & Co., is a member of the board of directors of FIMI IV 2007 Ltd.

Except as set forth in this offer to purchase, none of the members of our bidder group, nor any of the other persons listed in Schedule I to this offer to purchase, have had any transaction during the past two years with Gilat or any of its executive officers, directors or affiliates that is required to be described in this offer to purchase under applicable law. Except as set forth in this offer to purchase, there have been no negotiations, transactions or material contacts during the past two years between any of the members of our bidder group, or any of the other persons listed in Schedule I to this offer to purchase, on the one hand, and Gilat and its affiliates, on the other hand, concerning a merger, consolidation or acquisition, tender offer, exchange offer or other acquisitions of Gilat’s securities, an election of Gilat’s directors or a sale or other transfer of a material amount of the assets of Gilat.

YOU SHOULD READ THIS OFFER TO PURCHASE, THE LETTER OF TRANSMITTAL AND THE OTHER RELATED DOCUMENTS DELIVERED TO YOU CAREFULLY BEFORE YOU MAKE ANY DECISION WITH RESPECT TO THE OFFER.

1. TERMS OF THE OFFER; PRORATION; EXPIRATION DATE.

The offer is being made to all of Gilat’s shareholders. Upon the terms and subject to the conditions of the offer (including any terms and conditions of any extension or amendment), subject to proration, we will accept for payment and pay for Gilat shares, that are validly tendered and not properly withdrawn in accordance with Section 4 prior to 10:00 a.m., New York time, or 5:00 p.m., Israel time, on November 25, 2014, unless we extend the period of time during which the initial period of the offer is open. We refer to this period, as may be extended (as described below), as the Initial Offer Period, and the date of completion of the Initial Offer Period is referred to as the Initial Completion Date.

We will publicly announce in accordance with applicable law, and in any event issue a press release by 9:00 a.m., New York time, or 4:00 p.m., Israel time, on the U.S. business day following the Initial Completion Date, stating whether or not the conditions of the offer have been satisfied or, subject to applicable law, waived by us. Under Israeli law, if the conditions of the offer have been satisfied or, subject to applicable law, waived by us, then the shareholders who have, with respect to each Gilat share owned by them,

|

|

·

|

not responded to the offer,

|

|

|

·

|

notified us of their objection to the offer, or

|

|

|

·

|

validly tendered such Gilat share but have properly withdrawn their tender during the Initial Offer Period,

|

will be entitled to tender each such Gilat share during an additional four calendar-day period commencing at the completion of the Initial Offer Period. We refer to this period as the Additional Offer Period and to the expiration of such period as the Final Expiration Date. Shares tendered during the Initial Offer Period may be withdrawn at any time prior to 10:00 a.m., New York time, or 5:00 p.m., Israel time, on the Initial Completion Date, but not during the Additional Offer Period. In this respect, we recommend that you read Section 4 and Section 11 of this offer to purchase.

Subject to proration, we will also accept for payment and pay for all Gilat shares validly tendered and not properly withdrawn in accordance with Section 4 prior to 10:00 a.m., New York time, or 5:00 p.m., Israel time, on the Final Expiration Date. We expect to make such payment, including in the event that proration of tendered Gilat shares is required, within four U.S. business days following the Final Expiration Date.

No fractional Gilat shares will be purchased by us in the offer.

Conditions of the offer include, among other things, that:

|

|

·

|

prior to 10:00 a.m., New York time, or 5:00 p.m., Israel time, on the Initial Completion Date, there shall have been validly tendered and not properly withdrawn Gilat shares representing 5.0% of the issued and outstanding shares and voting power of Gilat on the Initial Completion Date (currently, 2,130,095 Gilat shares); and

|

|

|

·

|