UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 23, 2014

PENN NATIONAL GAMING, INC.

Commission file number 0-24206

Incorporated Pursuant to the Laws of the Commonwealth of Pennsylvania

IRS Employer Identification No. 23-2234473

825 Berkshire Blvd., Suite 200

Wyomissing, PA 19610

610-373-2400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On October 23, 2014, Penn National Gaming, Inc. (the “Company”) issued a press release announcing its financial results for the nine months ended September 30, 2014. The full text of the press release is attached as Exhibit 99.1 and incorporated herein by reference.

The information in Item 2.02 of this Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

Number |

|

Description

|

|

|

|

|

|

99.1 |

|

Press Release dated October 23, 2014 of Penn National Gaming, Inc. announcing its financial results for the nine months ended September 30, 2014. |

* * *

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

Dated: October 23, 2014 |

PENN NATIONAL GAMING, INC. |

|

|

|

|

|

By: |

/s/ Robert S. Ippolito |

|

|

Name: |

Robert S. Ippolito |

|

|

Title: |

Vice President, Secretary and Treasurer |

3

Exhibit 99.1

|

News Announcement |

|

|

CONTACT: |

|

|

|

Saul V. Reibstein |

|

Joseph N. Jaffoni, Richard Land |

|

Chief Financial Officer |

|

JCIR |

|

610/401-2049 |

|

212/835-8500 or penn@jcir.com |

FOR IMMEDIATE RELEASE

|

Conference Call: |

Today, October 23, 2014 at 10:00 a.m. ET |

|

Dial-in number: |

212/231-2930 |

|

Webcast: |

www.pngaming.com |

|

Replay information provided below |

PENN NATIONAL GAMING REPORTS THIRD QUARTER REVENUE

OF $645.9 MILLION AND ADJUSTED EBITDA OF $65.7 MILLION,

INCLUSIVE OF $104.6 MILLION OF RENT EXPENSE

- Establishes 2014 Fourth Quarter Guidance and Updates 2014 Full Year Guidance -

Wyomissing, PA (October 23, 2014) — Penn National Gaming, Inc. (PENN: Nasdaq) (“Penn National Gaming”, “Penn” or the “Company”) today reported third quarter operating results for the three months ended September 30, 2014, as summarized below.

Summary of Third Quarter Results

|

|

|

Three Months Ended

September 30, |

|

|

(in millions, except per share data) |

|

2014 Actual |

|

2014 Guidance (3) |

|

2013 Actual |

|

|

Net revenues |

|

$ |

645.9 |

|

$ |

633.5 |

|

$ |

714.4 |

|

|

Adjusted EBITDAR (1) |

|

170.3 |

|

164.4 |

|

185.0 |

|

|

Rental expense related to Master Lease |

|

(104.6 |

) |

(104.0 |

) |

— |

|

|

Adjusted EBITDA (2) |

|

65.7 |

|

60.4 |

|

185.0 |

|

|

Less: Impact of stock compensation, insurance recoveries, non-operating items for Kansas JV, depreciation and amortization, gain/loss on disposal of assets, interest expense - net, income taxes and other expenses |

|

(57.2 |

) |

(55.1 |

) |

(143.7 |

) |

|

Net income |

|

$ |

8.5 |

|

$ |

5.3 |

|

$ |

41.3 |

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per common share |

|

$ |

0.10 |

|

$ |

0.06 |

|

$ |

0.40 |

|

(1) Adjusted EBITDAR is adjusted EBITDA excluding rent expense associated with our Master Lease with Gaming and Leisure Properties, Inc. (“GLPI”). Results for the three months ended September 30, 2013 included net revenues of $39.6 million and adjusted EBITDAR of $9.3 million related to Hollywood Casino Perryville and Hollywood Casino Baton Rouge, which were contributed to GLPI on November 1, 2013 as part of the spin-off.

(2) Adjusted EBITDA is income (loss) from operations, excluding the impact of stock compensation, impairment losses, insurance recoveries and deductible charges, depreciation and amortization and gain or loss on disposal of assets. Adjusted EBITDA is also inclusive of income or loss from unconsolidated affiliates, with our share of the non-operating items added back for our joint venture in Kansas Entertainment, LLC (“Kansas Entertainment”). A reconciliation of net income (loss) per accounting principles generally accepted in the United States of America (“GAAP”) to adjusted EBITDA and adjusted EBITDAR, as well as income (loss) from operations per GAAP to adjusted EBITDA and adjusted EBITDAR, is included in the accompanying financial schedules.

(3) The guidance figures in the table above present the guidance Penn National Gaming provided on July 24, 2014 for the three months ended September 30, 2014.

1

Review of Third Quarter 2014 Results vs. Guidance

|

|

|

Three Months |

|

|

|

|

Ended |

|

|

|

|

September 30, 2014 |

|

|

|

|

Pre-tax |

|

After-tax |

|

|

|

|

(in thousands) |

|

|

Income, per guidance (1) |

|

$ |

3,995 |

|

$ |

5,261 |

|

|

|

|

|

|

|

|

|

EBITDA variances: |

|

|

|

|

|

|

Positive operating segment variance excluding Argosy Casino Sioux City |

|

6,662 |

|

3,865 |

|

|

Argosy Casino Sioux City favorable variance |

|

1,066 |

|

661 |

|

|

Lobbying costs related to the November Massachusetts referendum |

|

(2,299 |

) |

(2,299 |

) |

|

Other |

|

(156 |

) |

(91 |

) |

|

Total EBITDA variances from guidance |

|

5,273 |

|

2,136 |

|

|

|

|

|

|

|

|

|

Insurance recoveries for St. Louis tornado |

|

5,674 |

|

3,422 |

|

|

Foreign currency translation gain and other |

|

1,599 |

|

968 |

|

|

Tax variance |

|

|

|

(3,288 |

) |

|

Income, as reported |

|

$ |

16,541 |

|

$ |

8,499 |

|

|

|

|

Three Months Ended |

|

|

|

|

September 30, |

|

|

|

|

2014 |

|

2014 Guidance (1) |

|

|

Diluted earnings per common share |

|

$ |

0.10 |

|

$ |

0.06 |

|

|

Argosy Casino Sioux City favorable variance |

|

(0.01 |

) |

— |

|

|

Lobbying costs related to the November Massachusetts referendum |

|

0.03 |

|

— |

|

|

Insurance recoveries for St. Louis tornado |

|

(0.04 |

) |

— |

|

|

Foreign currency translation gain |

|

(0.01 |

) |

— |

|

|

Tax variance |

|

— |

|

(0.03 |

) |

|

Total |

|

$ |

0.07 |

|

$ |

0.03 |

|

(1) The guidance figures in the tables above present the guidance Penn National Gaming provided on July 24, 2014 for the three months ended September 30, 2014.

Timothy J. Wilmott, President and Chief Executive Officer of Penn National Gaming, commented, “Third quarter consolidated revenue, adjusted EBITDAR and adjusted EBITDA exceeded guidance, largely reflecting better than projected property operating results including outperformance at some of our larger properties, solid initial partial quarter contributions from Hollywood Gaming at Dayton Raceway and Hollywood Gaming at Mahoning Valley Race Course, and ongoing success in delivering strong consolidated adjusted EBITDAR margins.

“Overall, third quarter adjusted EBITDA exceeded guidance by $5.3 million, inclusive of a $7.7 million positive operating segment variance and one-time costs of $2.3 million related to the November Massachusetts referendum, which were excluded from the guidance provided in July. Reflecting the strong leverage in our operating model, and excluding the impact of Massachusetts lobbying expenses and the results of Argosy Casino Sioux City which closed on July 30, the 1.7% revenue outperformance relative to guidance drove a 10.7% increase in adjusted EBITDA relative to guidance.

“Penn National Gaming is performing relatively well in the current operating environment, underscoring the value of our efforts to pair property-level adjusted EBITDAR growth through a disciplined approach to facility management and ongoing margin improvements with new facility openings. In addition, bottom line results continue to benefit from corporate expense management initiatives. On a year-over-year basis, third quarter corporate overhead (inclusive of third quarter lobbying costs) declined 19.3% to $19.7 million and we remain on track to realize full year 2014 corporate overhead expense reductions of approximately 21% (after excluding $25 million of spin-off costs incurred in 2013).

2

“During the third quarter we generated adjusted EBITDAR margin improvements in our Southern Plains and West operating segments. These results offset a slight decline in our East/Midwest segment which was primarily attributable to pre-opening costs at Hollywood Gaming at Dayton Raceway and Hollywood Gaming at Mahoning Valley Race Course and an unanticipated, one time promotional-related expense at Hollywood Gaming at Dayton Raceway in early September. Demonstrating the effective implementation of strategies to improve operating efficiencies, consolidated third quarter 2014 adjusted EBITDAR margin grew approximately 50 basis points on a year over year basis to 26.4%.

“During the quarter Penn National Gaming successfully opened our Dayton and Austintown video lottery terminal facilities in Ohio. Hollywood Gaming at Dayton Raceway opened on August 28 with 1,000 gaming devices and has been well received by the local community. On September 17, Hollywood Gaming at Mahoning Valley Race Course opened in Austintown with 850 gaming devices. On August 28, we also opened our new $26 million, 154-room hotel at Zia Park Casino. Consistent with the Company’s long-term record, all three projects opened on time and on budget.

“In Massachusetts we recently reached the half-way point in construction on our $225 million Plainridge Park Casino. Plainridge Park Casino is expected to open in June 2015, creating 1,000 construction jobs and 500 permanent jobs in addition to protecting the jobs of over 100 employees currently employed at Plainridge Racecourse. We recently announced that we have far exceeded our construction diversity vendor goals, with more than 40% of contracts awarded to date going to minority, women-owned and veteran businesses. During the third quarter, Penn National Gaming continued to actively participate in a broad-based coalition effort to support the 2011 gaming legislation which is the subject of an Election Day referendum. We estimate that by Election Day, Penn National will have invested more than $100 million in our Plainridge project, inclusive of the $42 million purchase price and the $25 million license fee.

“Recent public opinion polls continue to indicate that Massachusetts voters recognize the importance of the gaming act and that residents understand and appreciate the substantial economic and employment benefits that gaming will bring to the Commonwealth. We urge residents to vote NO on Question 3 at the ballot box on November 4, supporting our efforts to further help small businesses in Massachusetts and preserve the 6,500 construction jobs and 10,000 good paying permanent jobs with benefits that our industry will collectively generate.

“Elsewhere, construction continues to move forward on the $360 million Hollywood Casino-branded gaming facility on the Jamul Indian Village’s land in trust, which is located approximately twenty miles east of downtown San Diego, directly off of State Route 94. Hollywood Casino Jamul-San Diego is expected to open in mid-2016 as the closest casino to downtown San Diego. When complete, the property will include a three-story gaming and entertainment facility of approximately 200,000 square feet, including more than 1,700 slot machines, 50 live table games, multiple restaurants, bars and lounges and 1,900 parking spaces. This project has already created significant new construction jobs and will result in hundreds of new permanent jobs in the region while

3

enabling the Jamul Indian Village of California to become economically self-sufficient. Penn National Gaming expects to participate in the success of the project through management and branding fees, as well as interest payments on funds advanced to develop the project.

“Last month, Penn National Gaming and our joint venture partner, The Cordish Companies, made one of the sixteen presentations to New York State officials who are expected to grant up to four new gaming licenses sometime before year-end. Our presentation highlighted the community and statewide employment and tax revenue benefits associated with the planned development of ‘Live! Hotel & Casino New York,’ a world-class gaming facility and resort proposed for Orange County, New York with a budget of over $750 million. The proposed facility would be owned and managed by a 50/50 joint venture which brings together two of the industry’s most financially sound companies with excellent balance sheets and extensive records of developing and operating world-class gaming facilities in competitive environments. The Penn National and Cordish presentation also highlighted our unrivalled records of job creation, employment diversity and community involvement.

“As presented, our Orange County plans include an upscale boutique hotel with over 300 rooms and luxury suites; a destination spa and fitness center; over 3,000 slot machines; more than 250 live poker and table games; several marquee restaurants including Bobby Flay Steak, Smorgasburg, The Cheesecake Factory, Fornino, and Bobby’s Burger Palace; a live entertainment venue; and a spacious conference center. The proposal from Penn National Gaming and Cordish Companies reflects our companies’ unwavering appreciation for our customers, employees and the local communities in which we operate and we look forward to New York State’s near-term decision.

“Earlier this month, we were proud to have been named by Spectrum Gaming Group as the gaming industry’s ‘Employer of First Choice’ in the 14th Annual Bristol Associates/Spectrumetrix™ Executive Satisfaction Survey. Penn National Gaming placed ahead of fourteen prominent gaming companies in this year’s survey, including destination and regional gaming operators, Macau operators and major Native American gaming operators. This distinction is a testament to the strength of our senior management, corporate staff, and our General Managers and their respective operating teams, which together foster a collaborative workplace environment that prioritizes a deep appreciation for our customers and the local communities in which we operate, all of which we bring to bear in our efforts to generate enhanced shareholder value.”

4

Development and Expansion Projects

The table below summarizes Penn National Gaming’s current facility development projects:

|

Project/Scope |

|

New

Gaming

Positions |

|

Planned

Total

Budget |

|

Amount Expended

through

September 30,

2014 |

|

Expected

Opening

Date |

|

|

|

|

|

|

(Unaudited, in millions) |

|

|

|

|

Zia Park Casino (NM) -Opened a 154 room, five story hotel which includes six suites, a breakfast room, a business center, meeting and exercise rooms, as well as additional surface parking. |

|

— |

|

$ |

26 |

|

$ |

21.5 |

|

Opened August 28, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Dayton Raceway (OH) - Opened our new Hollywood themed facility featuring a new 5/8 mile harness racetrack and simulcasting and the ability to hold up to 1,500 video lottery terminals, as well as various restaurants, bars and other amenities. |

|

1,000 |

|

$ |

165 |

(1)(2) |

$ |

57.1 |

|

Opened August 28, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mahoning Valley Race Track (OH) - Opened our new Hollywood themed facility featuring a new one-mile thoroughbred racetrack and simulcasting and the ability to hold up to 1,000 video lottery terminals, as well as various restaurants, bars and other amenities. |

|

850 |

|

$ |

161 |

(1)(2) |

$ |

52.1 |

|

Opened September 17, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Plainridge Park Casino (MA) - Construction is underway at the site of the Plainridge Racecourse for our new gaming operation, which will be integrated with the existing live harness racing and simulcasting, featuring 1,250 slot machines, as well as various dining and entertainment options. |

|

1,250 |

|

$ |

225 |

(3) |

$ |

91.1 |

|

June 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Jamul Indian Village project (CA) - Construction is underway at the site for this new Hollywood Casino branded gaming operation which Penn will manage. The facility is anticipated to feature over 1,700 slot machines, 50 live table games including poker, multiple restaurants, bars and lounges. |

|

2,100 |

|

$ |

360 |

(4) |

$ |

36.4 |

|

Mid-2016 |

|

|

(1) Includes a $50 million license fee and a relocation fee of $75 million based on the present value of the contractual obligation. We paid $7.5 million of the relocation fee upon opening, and will pay 18 additional semi-annual payments of $4.8 million beginning one year after opening. For the license fee, we paid $10 million in the second quarter of 2014 as well as $15 million upon opening, and will pay the remaining license fee of $25 million on the one year anniversary of the opening. As of September 30, 2014, the amount capitalized on the balance sheet for Dayton Raceway and Mahoning Valley Race Track was $149.7 million and $144.9 million, respectively. |

|

(2) GLPI is responsible for certain construction related real estate costs associated with these projects that are not included in the budgeted figures above. |

|

(3) Includes a $25 million license fee, which was paid in March 2014, and $42 million purchase price, both of which are included in the amount above. |

|

(4) As disclosed previously, funds advanced for this project will be accounted for as a loan. |

5

Financial Guidance

Reflecting current operating trends, the table below sets forth 2014 fourth quarter and full year guidance targets for financial results, based on the following assumptions:

· Miami Valley Gaming in Lebanon, Ohio, opened in December 2013 and continues to impact Hollywood Casino Lawrenceburg and Hollywood Casino Columbus;

· Belterra Park in Cincinnati, opened in May 2014, impacting Hollywood Casino Lawrenceburg;

· Horseshoe Baltimore opened in late August 2014, impacting Hollywood Casino at Charles Town Races;

· Argosy Casino Sioux City ceased operations in July, with minimal ongoing expenses;

· A full year contribution from the Company’s management contract for Casino Rama;

· Full year 2014 rent expense of $420.2 million, with $106.7 million to be incurred in the fourth quarter of 2014, excluding any potential rent escalator;

· Full year 2014 pre-opening expenses of $9.9 million, with $1.1 million to be incurred in the fourth quarter of 2014;

· Includes $2.3 million of costs incurred in the nine months ended September 30, 2014 related to the November Massachusetts referendum in the third quarter and excludes additional expenses being incurred in the fourth quarter;

· Depreciation and amortization charges in 2014 of $178.1 million, with $43.3 million in the fourth quarter of 2014;

· Our share of non-operating items (such as depreciation and amortization expense) associated with our joint venture in Kansas Entertainment total $11.8 million for 2014, with $3.0 million to be incurred in the fourth quarter of 2014;

· Estimated non-cash stock compensation expenses of $10.7 million for 2014, with $2.7 million to be incurred in the fourth quarter of 2014;

· LIBOR is based on the forward yield curve;

· A diluted share count of approximately 88.8 million shares for the full year 2014; and

· There will be no material changes in applicable legislation, regulatory environment, world events, weather, recent consumer trends, economic conditions, competitive landscape (other than listed above) or other circumstances beyond our control that may adversely affect the Company’s results of operations.

|

|

|

Three Months Ending December 31, |

|

Full Year Ending December 31, |

|

|

(in millions, except per share data) |

|

2014 Guidance |

|

2013 Actual |

|

2014 Updated

Guidance |

|

2014 Prior

Guidance (1) |

|

2013 Actual |

|

|

Net revenues |

|

$ |

621.1 |

|

$ |

644.7 |

|

$ |

2,560.2 |

|

$ |

2,547.8 |

|

$ |

2,918.8 |

|

|

Adjusted EBITDAR |

|

162.4 |

|

153.2 |

|

697.1 |

|

690.9 |

|

776.1 |

|

|

Rental expense related to Master Lease |

|

(106.7 |

) |

(69.5 |

) |

(420.2 |

) |

(419.3 |

) |

(69.5 |

) |

|

Adjusted EBITDA |

|

55.7 |

|

83.7 |

|

276.9 |

|

271.6 |

|

706.6 |

|

|

Less: Impact of stock compensation, impairment losses, insurance recoveries and deductible charges, depreciation and amortization, gain/loss on disposal of assets, interest expense - net, income taxes, loss on early extinguishment of debt and other expenses |

|

(61.8 |

) |

(972.4 |

) |

(265.8 |

) |

(269.6 |

) |

(1,500.9 |

) |

|

Net income (loss) |

|

$ |

(6.1 |

) |

$ |

(888.7 |

) |

$ |

11.1 |

|

$ |

2.0 |

|

$ |

(794.3 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings (loss) per common share |

|

$ |

(0.07 |

) |

$ |

(11.40 |

) |

$ |

0.13 |

|

$ |

0.02 |

|

$ |

(10.17 |

) |

(1) The guidance figures in the table above present the guidance Penn National Gaming provided on July 24, 2014 for the full year ended December 31, 2014.

6

PENN NATIONAL GAMING, INC. AND SUBSIDIARIES

Segment Information — Operations

(in thousands) (unaudited)

|

|

|

NET REVENUES |

|

ADJUSTED EBITDAR |

|

|

|

|

Three Months Ended September 30, |

|

Three Months Ended September 30, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

East/Midwest (1) |

|

$ |

371,505 |

|

$ |

403,900 |

|

$ |

110,347 |

|

$ |

124,944 |

|

|

West (2) |

|

58,626 |

|

57,463 |

|

13,960 |

|

10,905 |

|

|

Southern Plains (3) |

|

210,309 |

|

246,443 |

|

65,959 |

|

73,480 |

|

|

Other (4) |

|

5,500 |

|

6,629 |

|

(19,936 |

) |

(24,357 |

) |

|

Total |

|

$ |

645,940 |

|

$ |

714,435 |

|

$ |

170,330 |

|

$ |

184,972 |

|

|

|

|

NET REVENUES |

|

ADJUSTED EBITDAR |

|

|

|

|

Nine Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

East/Midwest (1) |

|

$ |

1,082,310 |

|

$ |

1,293,391 |

|

$ |

324,307 |

|

$ |

410,884 |

|

|

West (2) |

|

178,579 |

|

181,057 |

|

49,516 |

|

46,419 |

|

|

Southern Plains (3) |

|

658,792 |

|

773,548 |

|

212,907 |

|

241,791 |

|

|

Other (4) |

|

19,485 |

|

26,056 |

|

(52,070 |

) |

(76,195 |

) |

|

Total |

|

$ |

1,939,166 |

|

$ |

2,274,052 |

|

$ |

534,660 |

|

$ |

622,899 |

|

(1) The East/Midwest reportable segment consists of the following properties: Hollywood Casino at Charles Town Races, Hollywood Casino Bangor, Hollywood Casino at Penn National Race Course, Hollywood Casino Lawrenceburg, Hollywood Casino Toledo, Hollywood Casino Columbus, Hollywood Gaming at Dayton Raceway, which opened on August 28, 2014, and Hollywood Gaming at Mahoning Valley Race Course, which opened on September 17, 2014. It also includes the Company’s Casino Rama management service contract and the Plainville project in Massachusetts, which the Company expects to open in the second quarter of 2015. Current year results do not include results for Hollywood Casino Perryville as it was contributed to GLPI on November 1, 2013. This property had net revenues of $22.7 million and $70.4 million and adjusted EBITDAR of $4.6 million and $13.9 million for the three and nine months ended September 30, 2013, respectively. Our East/Midwest segment results for the three and nine months ended September 30, 2014 included preopening costs of $5.6 million and $8.4 million, respectively, whereas results for the nine months ended September 30, 2013 included preopening charges of $0.2 million.

(2) The West reportable segment consists of the following properties: Zia Park Casino and the M Resort, as well as the Jamul development project, which the Company anticipates completing in mid-2016. Results for the three and nine months ended September 30, 2013 included spin-off transaction costs of $3.8 million.

(3) The Southern Plains reportable segment consists of the following properties: Hollywood Casino Aurora, Hollywood Casino Joliet, Argosy Casino Alton, Argosy Casino Riverside, Hollywood Casino Tunica, Hollywood Casino Gulf Coast, Boomtown Biloxi, and Hollywood Casino St. Louis, and includes the Company’s 50% investment in Kansas Entertainment, which owns the Hollywood Casino at Kansas Speedway. On July 30, 2014, the Company closed Argosy Casino Sioux City. Starting with the second quarter of 2014, adjusted EBITDA and adjusted EBITDAR from our joint venture in Kansas Entertainment exclude our share of the impact of non-operating items (such as depreciation and amortization expense). The prior year amounts were restated to conform to this new presentation. Additionally, current year results do not include results for Hollywood Casino Baton Rouge as it was contributed to GLPI on November 1, 2013. This property had net revenues of $16.9 million and $58.0 million and adjusted EBITDAR of $4.7 million and $18.4 million for the three and nine months ended September 30, 2013, respectively.

7

(4) The Other category consists of the Company’s standalone racing operations, namely Rosecroft Raceway, Sanford-Orlando Kennel Club, and the Company’s joint venture interests in Sam Houston Race Park, Valley Race Park, and Freehold Raceway, as well as the Company’s 50% joint venture with the Cordish Companies in New York. Results in the prior year also included the Company’s Bullwhackers property which was sold in July 2013. If the Company is successful in obtaining gaming operations at these locations, they would be assigned to one of the Company’s regional executives and reported in their respective reportable segment. The Other category also includes the Company’s corporate overhead costs, which was $19.7 million and $49.8 million for the three and nine months ended September 30, 2014, respectively, as compared to corporate overhead costs of $24.4 million and $77.3 million for the three and nine months ended September 30, 2013, respectively. Corporate overhead costs decreased by $4.7 million for the three months ended September 30, 2014, as compared to the corresponding period in the prior year, primarily due to lower spin-off transaction and development costs of $7.3 million, partially offset by higher lobbying costs of $1.6 million and a favorable franchise tax resolution for $1.1 million in the third quarter of 2013. Corporate overhead costs decreased by $27.5 million for the nine months ended September 30, 2014, as compared to the corresponding period in the prior year, primarily due to lower payroll costs of $8.0 million due to the fact that certain members of Penn’s executive management team transferred their employment to GLPI as part of the spin-off, lower spin-off transaction and development costs of $15.2 million, lower lobbying costs of $0.3 million, transition service fees received from GLPI of $1.5 million, and a reduction in various other items due to cost containment measures, all of which was partially offset by a favorable franchise tax resolution for $1.1 million in the third quarter of 2013. Additionally, the Other category includes $0.1 million and $1.0 million for the three and nine months ended September 30, 2014, respectively, in costs from our New York joint venture.

8

Reconciliation of Net income (loss) (GAAP) to Adjusted EBITDA and Adjusted EBITDAR

PENN NATIONAL GAMING, INC. AND SUBSIDIARIES

(in thousands) (unaudited)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

Net income |

|

$ |

8,499 |

|

$ |

41,317 |

|

$ |

17,212 |

|

$ |

94,408 |

|

|

Income tax provision |

|

8,042 |

|

29,132 |

|

23,596 |

|

110,466 |

|

|

Other |

|

(1,583 |

) |

436 |

|

(1,391 |

) |

(2,630 |

) |

|

Income from unconsolidated affiliates |

|

(2,291 |

) |

(2,296 |

) |

(6,247 |

) |

(7,838 |

) |

|

Interest income |

|

(1,025 |

) |

(369 |

) |

(2,282 |

) |

(974 |

) |

|

Interest expense |

|

11,189 |

|

25,060 |

|

33,376 |

|

80,044 |

|

|

Income from operations |

|

$ |

22,831 |

|

$ |

93,280 |

|

$ |

64,264 |

|

$ |

273,476 |

|

|

Loss on disposal of assets |

|

145 |

|

157 |

|

98 |

|

2,833 |

|

|

Insurance (recoveries) deductible charges |

|

(5,674 |

) |

— |

|

(5,674 |

) |

2,500 |

|

|

Impairment losses |

|

— |

|

— |

|

4,560 |

|

71,846 |

|

|

Charge for stock compensation |

|

2,915 |

|

6,369 |

|

8,012 |

|

18,070 |

|

|

Depreciation and amortization |

|

40,253 |

|

79,968 |

|

134,802 |

|

237,654 |

|

|

Income from unconsolidated affiliates |

|

2,291 |

|

2,296 |

|

6,247 |

|

7,838 |

|

|

Non-operating items for Kansas JV |

|

2,944 |

|

2,902 |

|

8,804 |

|

8,682 |

|

|

Adjusted EBITDA |

|

$ |

65,705 |

|

$ |

184,972 |

|

$ |

221,113 |

|

$ |

622,899 |

|

|

Rental expense related to Master Lease |

|

104,625 |

|

— |

|

313,547 |

|

— |

|

|

Adjusted EBITDAR |

|

$ |

170,330 |

|

$ |

184,972 |

|

$ |

534,660 |

|

$ |

622,899 |

|

9

Reconciliation of Income (loss) from operations (GAAP) to Adjusted EBITDA and Adjusted EBITDAR

PENN NATIONAL GAMING, INC. AND SUBSIDIARIES

Segment Information

(in thousands) (unaudited)

Three Months Ended September 30, 2014

|

|

|

East/Midwest |

|

West |

|

Southern Plains |

|

Other |

|

Total |

|

|

Income (loss) from operations |

|

$ |

17,842 |

|

$ |

5,054 |

|

$ |

24,195 |

|

$ |

(24,260 |

) |

$ |

22,831 |

|

|

Charge for stock compensation |

|

— |

|

— |

|

— |

|

2,915 |

|

2,915 |

|

|

Insurance recoveries |

|

— |

|

— |

|

(5,674 |

) |

— |

|

(5,674 |

) |

|

Depreciation and amortization |

|

24,304 |

|

2,018 |

|

12,264 |

|

1,667 |

|

40,253 |

|

|

Loss (gain) on disposal of assets |

|

12 |

|

47 |

|

89 |

|

(3 |

) |

145 |

|

|

Income (loss) from unconsolidated affiliates |

|

— |

|

— |

|

2,546 |

|

(255 |

) |

2,291 |

|

|

Non-operating items for Kansas JV (1) |

|

— |

|

— |

|

2,944 |

|

— |

|

2,944 |

|

|

Adjusted EBITDA |

|

$ |

42,158 |

|

$ |

7,119 |

|

$ |

36,364 |

|

$ |

(19,936 |

) |

$ |

65,705 |

|

|

Rental expense related to Master Lease |

|

68,189 |

|

6,841 |

|

29,595 |

|

— |

|

104,625 |

|

|

Adjusted EBITDAR |

|

$ |

110,347 |

|

$ |

13,960 |

|

$ |

65,959 |

|

$ |

(19,936 |

) |

$ |

170,330 |

|

Three Months Ended September 30, 2013

|

|

|

East/Midwest |

|

West |

|

Southern Plains |

|

Other |

|

Total |

|

|

Income (loss) from operations |

|

$ |

85,162 |

|

$ |

7,402 |

|

$ |

35,176 |

|

$ |

(34,460 |

) |

$ |

93,280 |

|

|

Charge for stock compensation |

|

— |

|

— |

|

— |

|

6,369 |

|

6,369 |

|

|

Depreciation and amortization |

|

39,741 |

|

3,487 |

|

32,697 |

|

4,043 |

|

79,968 |

|

|

Loss (gain) on disposal of assets |

|

41 |

|

16 |

|

106 |

|

(6 |

) |

157 |

|

|

Income (loss) from unconsolidated affiliates |

|

— |

|

— |

|

2,599 |

|

(303 |

) |

2,296 |

|

|

Non-operating items for Kansas JV (1) |

|

— |

|

— |

|

2,902 |

|

— |

|

2,902 |

|

|

Adjusted EBITDA |

|

$ |

124,944 |

|

$ |

10,905 |

|

$ |

73,480 |

|

$ |

(24,357 |

) |

$ |

184,972 |

|

Nine Months Ended September 30, 2014

|

|

|

East/Midwest |

|

West |

|

Southern Plains |

|

Other |

|

Total |

|

|

Income (loss) from operations |

|

$ |

44,447 |

|

$ |

20,536 |

|

$ |

63,392 |

|

$ |

(64,111 |

) |

$ |

64,264 |

|

|

Charge for stock compensation |

|

— |

|

— |

|

— |

|

8,012 |

|

8,012 |

|

|

Impairment losses |

|

4,560 |

|

— |

|

— |

|

— |

|

4,560 |

|

|

Insurance recoveries |

|

— |

|

— |

|

(5,674 |

) |

— |

|

(5,674 |

) |

|

Depreciation and amortization |

|

77,038 |

|

5,259 |

|

47,088 |

|

5,417 |

|

134,802 |

|

|

(Gain) loss on disposal of assets |

|

(104 |

) |

112 |

|

106 |

|

(16 |

) |

98 |

|

|

Income (loss) from unconsolidated affiliates |

|

— |

|

— |

|

7,619 |

|

(1,372 |

) |

6,247 |

|

|

Non-operating items for Kansas JV (1) |

|

— |

|

— |

|

8,804 |

|

— |

|

8,804 |

|

|

Adjusted EBITDA |

|

125,941 |

|

25,907 |

|

121,335 |

|

(52,070 |

) |

221,113 |

|

|

Rental expense related to Master Lease |

|

198,366 |

|

23,609 |

|

91,572 |

|

— |

|

313,547 |

|

|

Adjusted EBITDAR |

|

$ |

324,307 |

|

$ |

49,516 |

|

$ |

212,907 |

|

$ |

(52,070 |

) |

$ |

534,660 |

|

Nine Months Ended September 30, 2013

|

|

|

East/Midwest |

|

West |

|

Southern Plains |

|

Other |

|

Total |

|

|

Income (loss) from operations |

|

$ |

288,808 |

|

$ |

33,708 |

|

$ |

56,595 |

|

$ |

(105,635 |

) |

$ |

273,476 |

|

|

Charge for stock compensation |

|

— |

|

— |

|

— |

|

18,070 |

|

18,070 |

|

|

Impairment losses |

|

— |

|

— |

|

71,846 |

|

— |

|

71,846 |

|

|

Insurance deductible charges |

|

— |

|

— |

|

2,500 |

|

— |

|

2,500 |

|

|

Depreciation and amortization |

|

121,898 |

|

10,115 |

|

93,411 |

|

12,230 |

|

237,654 |

|

|

Loss (gain) on disposal of assets |

|

178 |

|

2,596 |

|

374 |

|

(315 |

) |

2,833 |

|

|

Income (loss) from unconsolidated affiliates |

|

— |

|

— |

|

8,383 |

|

(545 |

) |

7,838 |

|

|

Non-operating items for Kansas JV (1) |

|

— |

|

— |

|

8,682 |

|

— |

|

8,682 |

|

|

Adjusted EBITDA |

|

$ |

410,884 |

|

$ |

46,419 |

|

$ |

241,791 |

|

$ |

(76,195 |

) |

$ |

622,899 |

|

(1) Starting with the second quarter of 2014, adjusted EBITDA and adjusted EBITDAR from our joint venture in Kansas Entertainment exclude our share of the impact of non-operating items (such as depreciation and amortization expense). Prior periods were restated to conform to this new presentation.

10

PENN NATIONAL GAMING, INC. AND SUBSIDIARIES

Consolidated Statements of Operations

(in thousands, except per share data) (unaudited)

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

Gaming |

|

$ |

573,216 |

|

$ |

641,777 |

|

$ |

1,720,057 |

|

$ |

2,039,531 |

|

|

Food, beverage and other |

|

107,266 |

|

112,687 |

|

322,710 |

|

355,591 |

|

|

Management service fee |

|

3,240 |

|

3,685 |

|

8,803 |

|

10,399 |

|

|

Revenues |

|

683,722 |

|

758,149 |

|

2,051,570 |

|

2,405,521 |

|

|

Less promotional allowances |

|

(37,782 |

) |

(43,714 |

) |

(112,404 |

) |

(131,469 |

) |

|

Net revenues |

|

645,940 |

|

714,435 |

|

1,939,166 |

|

2,274,052 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

Gaming |

|

288,355 |

|

325,576 |

|

858,539 |

|

1,029,483 |

|

|

Food, beverage and other |

|

79,040 |

|

84,471 |

|

236,981 |

|

263,646 |

|

|

General and administrative |

|

116,510 |

|

131,140 |

|

332,147 |

|

395,447 |

|

|

Rental expense related to Master Lease |

|

104,625 |

|

— |

|

313,547 |

|

— |

|

|

Depreciation and amortization |

|

40,253 |

|

79,968 |

|

134,802 |

|

237,654 |

|

|

Impairment losses |

|

— |

|

— |

|

4,560 |

|

71,846 |

|

|

Insurance (recoveries) deductible charges |

|

(5,674 |

) |

— |

|

(5,674 |

) |

2,500 |

|

|

Total operating expenses |

|

623,109 |

|

621,155 |

|

1,874,902 |

|

2,000,576 |

|

|

Income from operations |

|

22,831 |

|

93,280 |

|

64,264 |

|

273,476 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses) |

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(11,189 |

) |

(25,060 |

) |

(33,376 |

) |

(80,044 |

) |

|

Interest income |

|

1,025 |

|

369 |

|

2,282 |

|

974 |

|

|

Income from unconsolidated affiliates |

|

2,291 |

|

2,296 |

|

6,247 |

|

7,838 |

|

|

Other |

|

1,583 |

|

(436 |

) |

1,391 |

|

2,630 |

|

|

Total other expenses |

|

(6,290 |

) |

(22,831 |

) |

(23,456 |

) |

(68,602 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations before income taxes |

|

16,541 |

|

70,449 |

|

40,808 |

|

204,874 |

|

|

Income tax provision |

|

8,042 |

|

29,132 |

|

23,596 |

|

110,466 |

|

|

Net income |

|

$ |

8,499 |

|

$ |

41,317 |

|

$ |

17,212 |

|

$ |

94,408 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share |

|

$ |

0.10 |

|

$ |

0.43 |

|

$ |

0.20 |

|

$ |

0.98 |

|

|

Diluted earnings per common share |

|

$ |

0.10 |

|

$ |

0.40 |

|

$ |

0.19 |

|

$ |

0.92 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

78,510 |

|

78,635 |

|

78,297 |

|

78,169 |

|

|

Diluted |

|

89,017 |

|

103,442 |

|

89,001 |

|

103,107 |

|

11

PENN NATIONAL GAMING, INC. AND SUBSIDIARIES

Supplemental information

(in thousands) (unaudited)

|

|

|

September 30, 2014 |

|

December 31, 2013 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

230,707 |

|

$ |

292,995 |

|

|

|

|

|

|

|

|

|

Bank Debt |

|

$ |

773,277 |

|

$ |

748,777 |

|

|

Notes |

|

300,000 |

|

300,000 |

|

|

Other long term obligations |

|

156,118 |

(1) |

2,015 |

|

|

Total Debt (2) |

|

$ |

1,229,395 |

|

$ |

1,050,792 |

|

(1) Other long term obligations include the present value of the relocation fees due for both Hollywood Gaming at Dayton Raceway and Hollywood Gaming at Mahoning Valley Race Course of $135.5 million. See Note 1 on page 5 of this release for further details. It also includes a liability of $18.5 million based on the estimated fair value of contingent purchase price consideration that is payable over ten years to the previous owners of Plainridge Racecourse.

(2) Although our joint venture in Kansas Entertainment is accounted for as an equity method investment and is not consolidated, this joint venture had no debt outstanding at September 30, 2014 or December 31, 2013.

During the second quarter of 2014, Penn refined its definition of adjusted EBITDA and adjusted EBITDAR to add back our share of the impact of non-operating items (such as depreciation and amortization) at our joint ventures which have gaming operations. At this time, Kansas Entertainment, the operator of Hollywood Casino at Kansas Speedway, is Penn’s only joint venture that meets this definition. Kansas Entertainment does not currently have, nor has it ever had, any indebtedness. Attached below is a quarterly summary of the Company’s historical and revised adjusted EBITDA that Penn reported over the past five quarters. We have also presented the cash flow distributions we have received from this investment for the three and nine months ended September 30, 2014 and 2013.

|

|

|

Three months ended |

|

|

|

|

March 31, 2014 |

|

December 31, 2013 |

|

September 30, 2013 |

|

June 30, 2013 |

|

March 31, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA as historically reported |

|

$ |

70,429 |

|

$ |

80,779 |

|

$ |

182,070 |

|

$ |

211,398 |

|

$ |

220,748 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-operating items for Kansas JV |

|

2,921 |

|

2,913 |

|

2,902 |

|

2,922 |

|

2,859 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBTIDA as revised |

|

$ |

73,350 |

|

$ |

83,692 |

|

$ |

184,972 |

|

$ |

214,320 |

|

$ |

223,607 |

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flow distributions |

|

$ |

6,500 |

|

$ |

8,000 |

|

$ |

17,500 |

|

$ |

17,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12

Diluted Share Count Methodology

In connection with the spin-off, Penn National Gaming completed its exchange and repurchase transaction with an affiliate of Fortress Investment Group, LLC (“Fortress”) on October 11, 2013, which resulted in the repurchase of $627 million of its Series B Preferred Stock and the issuance of 8,624 shares of Series C Preferred Stock, which is equivalent to 8,624,000 common shares upon sale by Fortress to a third party.

Reconciliation of GAAP to Non-GAAP Measures

Adjusted EBITDA and adjusted EBITDAR are used by management as the primary measure of the Company’s operating performance. We define adjusted EBITDA as earnings before interest, taxes, stock compensation, debt extinguishment charges, impairment charges, insurance recoveries and deductible charges, depreciation and amortization, gain or loss on disposal of assets, and other income or expenses. Adjusted EBITDA is also inclusive of income or loss from unconsolidated affiliates, with our share of non-operating items (such as depreciation and amortization) added back for our joint venture in Kansas Entertainment. Adjusted EBITDAR is adjusted EBITDA excluding rent expense associated with our Master Lease agreement with GLPI. Adjusted EBITDA and adjusted EBITDAR have economic substance because they are used by management as a performance measure to analyze the performance of our business, and are especially relevant in evaluating large, long-lived casino projects because they provide a perspective on the current effects of operating decisions separated from the substantial non-operational depreciation charges and financing costs of such projects. We also present adjusted EBITDA and adjusted EBITDAR because they are used by some investors and creditors as an indicator of the strength and performance of ongoing business operations, including our ability to service debt, fund capital expenditures, acquisitions and operations. These calculations are commonly used as a basis for investors, analysts and credit rating agencies to evaluate and compare operating performance and value companies within our industry. In addition, gaming companies have historically reported adjusted EBITDA as a supplement to financial measures in accordance with GAAP. In order to view the operations of their casinos on a more stand-alone basis, gaming companies, including us, have historically excluded from their adjusted EBITDA calculations certain corporate expenses that do not relate to the management of specific casino properties. However, adjusted EBITDA and adjusted EBITDAR are not a measure of performance or liquidity calculated in accordance with GAAP. Adjusted EBITDA and adjusted EBITDAR information is presented as a supplemental disclosure, as management believes that it is a widely used measure of performance in the gaming industry, is the principal basis for the valuation of gaming companies, and that it is considered by many to be a better indicator of the Company’s operating results than net income (loss) per GAAP. Management uses adjusted EBITDA and adjusted EBITDAR as the primary measures of the operating performance of its segments, including the evaluation of operating personnel. Adjusted EBITDA and adjusted EBITDAR should not be construed as alternatives to operating income, as indicators of the Company’s operating performance, as alternatives to cash flows from operating activities, as measures of liquidity, or as any other measures of performance determined in accordance with GAAP. The Company has significant uses of cash flows, including capital expenditures, interest payments, taxes and debt principal repayments, which are not reflected in adjusted EBITDA and adjusted EBITDAR. It should also be noted that other gaming companies that report adjusted EBITDA information may calculate adjusted EBITDA in a different manner than the Company and therefore, comparability may be limited.

13

A reconciliation of the Company’s net income (loss) per GAAP to adjusted EBITDA and adjusted EBITDAR, as well as the Company’s income (loss) from operations per GAAP to adjusted EBITDA and adjusted EBITDAR, is included above. Additionally, a reconciliation of each segment’s income (loss) from operations to adjusted EBITDA and adjusted EBITDAR is also included above. On a segment level, income (loss) from operations per GAAP, rather than net income (loss) per GAAP is reconciled to adjusted EBITDA and adjusted EBITDAR due to, among other things, the impracticability of allocating interest expense, interest income, income taxes and certain other items to the Company’s segments on a segment by segment basis. Management believes that this presentation is more meaningful to investors in evaluating the performance of the Company’s segments and is consistent with the reporting of other gaming companies.

Conference Call, Webcast and Replay Details

Penn National Gaming is hosting a conference call and simultaneous webcast at 10:00 am ET today, both of which are open to the general public. The conference call number is 212/231-2930. Please call five minutes in advance to ensure that you are connected prior to the presentation. Questions will be reserved for call-in analysts and investors. Interested parties may also access the live call on the Internet at www.pngaming.com. Please allow 15 minutes to register and download and install any necessary software. A replay of the call can be accessed for thirty days on the Internet at www.pngaming.com.

This press release, which includes financial information to be discussed by management during the conference call and disclosure and reconciliation of non-GAAP financial measures, is available on the Company’s web site, www.pngaming.com, in the “Investors” section (select link for “Press Releases”).

About Penn National Gaming

Penn National Gaming owns, operates or has ownership interests in gaming and racing facilities with a focus on slot machine entertainment. At September 30, 2014, the Company operated twenty-six facilities in seventeen jurisdictions, including Florida, Illinois, Indiana, Kansas, Maine, Massachusetts, Maryland, Mississippi, Missouri, Nevada, New Jersey, New Mexico, Ohio, Pennsylvania, Texas, West Virginia, and Ontario. At September 30, 2014, in aggregate, Penn National Gaming’s operated facilities featured approximately 31,000 gaming machines, 760 table games and 3,100 hotel rooms.

Forward-looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the use of forward looking terminology such as “expects,” “believes,” “estimates,” “projects,” “intends,” “plans,” “seeks,” “may,” “will,” “should” or “anticipates” or the negative or other variations of these or similar words, or by discussions of future events, strategies or risks and uncertainties, including future plans, strategies, performance, developments, acquisitions, capital expenditures, and operating results. Actual results may vary materially from expectations. Although the Company believes that our expectations are based on reasonable assumptions within the bounds of our knowledge of our business, there can be no assurance that actual results will not differ materially from our expectations. Meaningful factors that could cause actual results to differ from expectations include, but are not limited to, risks related to the following: our ability to obtain timely regulatory approvals required to own, develop and/or operate our facilities, or other delays or impediments to completing our

14

planned acquisitions or projects, including favorable resolution of any related litigation, including the ongoing appeal by the Ohio Roundtable addressing the legality of video lottery terminals in Ohio; our ability to secure federal, state and local permits and approvals necessary for our construction projects; construction factors, including delays, unexpected remediation costs, local opposition, organized labor, and increased cost of labor and materials; our ability to maintain agreements with our horsemen, pari-mutuel clerks and other organized labor groups; with respect to the proposed Jamul project near San Diego, California, particular risks associated with financing a project of this type, sovereign immunity, local opposition (including several pending lawsuits), and building a complex project on a relatively small parcel; the passage of state, federal or local legislation (including referenda) that would expand, restrict, further tax, prevent or negatively impact operations in or adjacent to the jurisdictions in which we do or seek to do business (such as a smoking ban at any of our facilities); with respect to our Massachusetts project, the ultimate location of the other gaming facilities in the state and, more significantly, the outcome of the referendum to repeal the gaming legislation in Massachusetts which could result in substantial litigation as well as a significant loss to our investment in the state; with respect to our joint venture project in New York, risks related to our ability to secure local support for our site, licensing from the state and the extent and location of other applications and competition; the effects of local and national economic, credit, capital market, housing, and energy conditions on the economy in general and on the gaming and lodging industries in particular; the activities of our competitors and the rapid emergence of new competitors (traditional, internet and sweepstakes based and taverns); increases in the effective rate of taxation at any of our properties or at the corporate level; our ability to identify attractive acquisition and development opportunities and to agree to terms with partners/municipalities for such transactions; the costs and risks involved in the pursuit of such opportunities and our ability to complete the acquisition or development of, and achieve the expected returns from, such opportunities; our expectations for the continued availability and cost of capital; the outcome of pending legal proceedings; changes in accounting standards; our dependence on key personnel; the impact of terrorism and other international hostilities; the impact of weather; and other factors as discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013, subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, each as filed with the United States Securities and Exchange Commission. The Company does not intend to update publicly any forward-looking statements except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this press release may not occur.

# # #

15

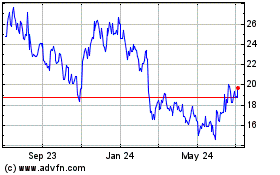

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

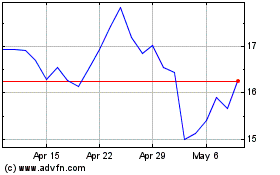

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024