Company posts record sales for a third

quarter of $202.6 million, up 7.5 percent;Diluted EPS

increased 12.5 percent to $0.63;Company raises 2014 full

year sales outlook and narrows earnings range

Tennant Company (NYSE:TNC), a world leader in designing,

manufacturing and marketing of solutions that help create a

cleaner, safer, healthier world, today reported net earnings of

$11.8 million, or $0.63 per diluted share, on net sales of $202.6

million for the third quarter ended September 30, 2014. In the 2013

third quarter, Tennant reported net earnings of $10.6 million, or

$0.56 per diluted share, on net sales of $188.5 million.

Commented Chris Killingstad, Tennant Company's president and

chief executive officer: “We are very pleased with the impact our

new growth strategies have had on Tennant’s sales in 2014. Today,

we are announcing the highest sales for a third quarter in

Tennant’s history, driven by strong growth in the Americas and EMEA

regions. Year-to-date sales are up approximately 9 percent. The

gross margin in the quarter, however, was below our expectations

and constrained by supply chain challenges, as we ramped up

production and launched new products. These are short-term growing

pains; they are fixable and we are taking the necessary steps for

improvement.”

Added Killingstad: “Our strong order position going into the

2014 fourth quarter gives us confidence in our outlook for the full

year. We anticipate sales in our APAC region will return to growth

in the 2014 fourth quarter. We are committed to our growth goal of

$1 billion in sales by 2017 and a 12 percent or above operating

profit margin.”

Tennant plans to meet its growth objectives through a strong new

product pipeline in both the core business and in the Orbio

Technologies Group, continued gains in emerging markets, growth in

Europe, focus on strategic accounts and an enhanced go-to-market

strategy, designed to significantly expand its global market

coverage and customer base.

Third Quarter Operating

Review

The company's 2014 third quarter consolidated net sales of

$202.6 million rose 7.5 percent versus the prior year quarter. The

foreign currency exchange effects on consolidated net sales were

essentially flat compared to the same quarter last year.

Contributing to 2014 third quarter results were increased sales to

strategic accounts and through distribution, and continued demand

for new products such as the compact T12 and mid-size T17 rider

scrubbers, and walk-behind burnishers.

Geographically, sales increased 9.3 percent in Tennant’s largest

region, the Americas. Unfavorable foreign currency exchange reduced

sales by approximately 0.5 percent. Organic sales, which exclude

the impact of foreign currency exchange (and acquisitions when

applicable), increased approximately 9.8 percent. Sales in Europe,

Middle East and Africa (EMEA) were up 8.5 percent, or approximately

6.5 percent organically, excluding a favorable foreign currency

exchange impact of about 2.0 percent. Growth in EMEA was broad

based, and the company anticipates continued organic growth in this

region in the 2014 fourth quarter. Sales in the Asia Pacific (APAC)

region were down 5.6 percent, or down approximately 5.1 percent

organically, excluding an unfavorable foreign currency exchange

impact of about 0.5 percent. Economic uncertainties in the key

markets of Australia, Japan, and China lengthened sales cycles,

which impacted the timing of orders and shipments in the 2014 third

quarter. Tennant expects positive sales growth in the 2014 fourth

quarter and full year. APAC sales for the 2014 first nine months

increased 8.7 percent, or approximately 11.7 percent organically,

excluding an unfavorable foreign currency impact of about 3.0

percent, driven by growth in China of approximately 20 percent.

In the 2014 third quarter, gross margin was 43.0 percent -

within the company’s target range but lower than the 43.4 percent

in the prior year quarter. The 40 basis point decline was primarily

due to supply chain challenges with increased costs related to

hiring and training additional manufacturing employees and

temporary workers to support higher production levels, including

the continued ramp up to meet the growing demand for new

products.

Research and development (R&D) expense for the 2014 third

quarter totaled $6.8 million, or 3.4 percent of sales, compared to

$8.0 million, or 4.2 percent of sales, in the prior year quarter.

The company continued to invest in developing innovative new

products for its traditional core business, as well as in its Orbio

Technologies Group, which is focused on advancing a suite of

sustainable cleaning technologies.

Selling and administrative (S&A) expense in the 2014 third

quarter totaled $63.2 million, or 31.2 percent of sales. S&A in

the 2013 third quarter was $57.7 million, or 30.6 percent of sales.

Reflecting the company’s growth priorities, Tennant continued to

make investments in direct sales, distribution and marketing to

build organic sales.

Tennant's 2014 third quarter operating profit was $17.1 million,

or 8.4 percent of sales, versus an operating profit of $16.2

million, or 8.6 percent of sales, in the year ago quarter.

Robust Product and Technology

Pipeline

Tennant Company continues to have the most robust new product

pipeline in its history. Year to date in 2014, Tennant has

introduced 10 new products, with six additional products planned

for unveiling in the fourth quarter. The company is on track to

launch more than 63 new products and technologies between 2014 and

2016, on top of 37 new products from 2012 to 2013.

During the 2014 third quarter, Tennant launched the S30 mid-size

rider sweeper, which provides innovative indoor and outdoor

sweeping performance with optimized dust control in both light- and

heavy-duty applications. Other major 2014 launches that have

already occurred include: the T17 mid-size battery-powered rider

scrubber with the largest available battery capacity in its class,

making it highly productive; and walk-behind battery-operated

burnishers that are emissions-free and deliver propane-like gloss

results. In addition, the Orbio Technologies Group from Tennant

Company launched the Orbio® os3, which delivers on-site generation

of an anti-microbial solution, as well as an effective

multi-surface cleaner, for use in a wide variety of customer

segments.

“On top of the sales momentum our new offerings have generated

to date, we look forward to announcing several more new products at

the upcoming ISSA industry trade show in early November, including

a prototype of our next generation ec-H2O™ technology that we

anticipate offering on select scrubbers in the first quarter of

2015,” stated Killingstad.

Tennant remains committed to being an industry innovation leader

and aims to set the standard for sustainable cleaning around the

world.

2014 First Nine Month

Results

For the nine months ended September 30, 2014, Tennant’s net

earnings totaled $33.1 million, or $1.77 per diluted share, on net

sales of $605.7 million. In the prior year first nine months,

Tennant reported adjusted net earnings of $30.4 million, or $1.61

per diluted share, as adjusted, on net sales of $556.9 million.

(See the Supplemental Non-GAAP Financial Table.)

Year-to-date 2014 gross margin was 42.8 percent versus 43.5

percent in the prior year period. R&D expense in the 2014 first

nine months was $22.0 million, or 3.6 percent of sales, compared to

$23.3 million, or 4.2 percent of sales in the previous year.

S&A expense in the 2014 first nine months totaled $187.9

million, or 31.0 percent of sales, versus $174.1 million, or 31.3

percent of sales, and $172.6 million, or 31.0 percent of sales, as

adjusted, in the first nine months of 2013.

Operating profit in the 2014 first nine months rose to $49.5

million, or 8.2 percent of sales, compared to $44.7 million, or 8.0

percent of sales, and $46.2 million, or 8.3 percent of sales, as

adjusted, in the first nine months of 2013.

Tennant generated $36.8 million in cash from operations in the

2014 first nine months. Cash on the balance sheet at September 30,

2014, totaled $79.8 million, up from $65.3 million a year ago. The

company's total debt was $28.2 million, down from $32.0 million at

the end of the 2013 first nine months. During the 2014 first nine

months, Tennant paid a total of $10.9 million in cash dividends to

shareholders and repurchased 217,534 shares of common stock at a

cost of $13.6 million.

Business Outlook

Based on its year-to-date results and expectations of

performance for the remainder of the year, Tennant Company is

raising its estimate for net sales to the range of $810 million to

$820 million and is narrowing its estimate for 2014 full year

earnings to the range of $2.60 to $2.70 per diluted share.

Previously, Tennant anticipated 2014 net sales in the range of $800

million to $815 million and full year earnings in the range of

$2.60 to $2.80 per diluted share. For the 2013 full year, adjusted

diluted earnings per share totaled $2.26 on net sales of $752

million. (See the Supplemental Non-GAAP Financial Table.)

The company's 2014 annual financial outlook includes the

following expectations:

- Modest economic improvement in North

America and Europe, and growth in emerging markets;

- Foreign currency impact on sales for

the full year in the range of neutral to an unfavorable 1

percent;

- Gross margin performance of

approximately 43 percent;

- R&D expense of approximately 4

percent of sales, as the company continues to invest in its core

products and in water-based cleaning technologies; and

- Capital expenditures in the range of

$20 million to $22 million.

“We are encouraged by our performance against our growth agenda

year to date, and are on track to deliver robust sales and earnings

growth in the 2014 fourth quarter,” said Killingstad. “Tennant’s

future prospects are exciting. Our focus is on executing our growth

strategies and working to resolve short-term supply chain

challenges, in order to achieve our profitability objectives.”

Conference Call

Tennant will host a conference call to discuss the 2014 third

quarter results today, October 23, 2014, at 10 a.m. Central Time

(11 a.m. Eastern Time). The conference call will be available via

webcast on the investor portion of Tennant's website. To listen to

the call live, go to www.tennantco.com

and click on Company, Investors. A taped replay of the conference

call will be available at www.tennantco.com for approximately two weeks

after the call.

About Tennant Company

Minneapolis-based Tennant Company (NYSE: TNC) is a world leader in designing, manufacturing

and marketing solutions that help create a cleaner, safer,

healthier world. Its products include equipment for maintaining

surfaces in industrial, commercial and outdoor environments;

chemical-free and other sustainable cleaning technologies; and

coatings for protecting, repairing and upgrading surfaces.

Tennant's global field service network is the most extensive in the

industry. Tennant has manufacturing operations in Minneapolis,

Minn.; Holland, Mich.; Louisville, Ky.; Uden, The Netherlands; the

United Kingdom; São Paulo, Brazil; and Shanghai, China; and sells

products directly in 15 countries and through distributors in more

than 80 countries. For more information, visit www.tennantco.com.

Forward-Looking

Statements

Certain statements contained in this document, as well as other

written and oral statements made by us from time to time, are

considered “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act. These statements do not

relate to strictly historical or current facts and provide current

expectations or forecasts of future events. Any such expectations

or forecasts of future events are subject to a variety of factors.

These include factors that affect all businesses operating in a

global market as well as matters specific to us and the markets we

serve. Particular risks and uncertainties presently facing us

include: geopolitical and economic uncertainty throughout the

world; the competition in our business; our ability to attract and

retain key personnel; our ability to successfully upgrade, evolve

and protect our information technology systems; our ability to

develop and commercialize new innovative products and services; our

ability to comply with laws and regulations; fluctuations in the

cost or availability of raw materials and purchased components;

unforeseen product liability claims or product quality issues; the

occurrence of a significant business interruption; the occurrence

of disruptions to our supply and delivery chains; and the relative

strength of the U.S. dollar, which affects the cost of our

materials and products purchased and sold internationally.

We caution that forward-looking statements must be considered

carefully and that actual results may differ in material ways due

to risks and uncertainties both known and unknown. Shareholders,

potential investors and other readers are urged to consider these

factors in evaluating forward-looking statements and are cautioned

not to place undue reliance on such forward-looking statements. For

additional information about factors that could materially affect

Tennant's results, please see our other Securities and Exchange

Commission filings, including disclosures under “Risk Factors.”

We do not undertake to update any forward-looking statement, and

investors are advised to consult any further disclosures by us on

this matter in our filings with the Securities and Exchange

Commission and in other written statements we make from time to

time. It is not possible to anticipate or foresee all risk factors,

and investors should not consider any list of such factors to be an

exhaustive or complete list of all risks or uncertainties.

Non-GAAP Financial

Measures

This news release includes presentations of non-GAAP measures

that include or exclude special items. Management believes that the

non-GAAP measures provide useful information to investors regarding

the company's results of operations and financial condition because

they permit a more meaningful comparison and understanding of

Tennant Company's operating performance for the current, past or

future periods. Management uses these non-GAAP measures to monitor

and evaluate ongoing operating results and trends, and to gain an

understanding of the comparative operating performance of the

company. See the Supplemental Non-GAAP Financial Table.

TENNANT COMPANY CONDENSED CONSOLIDATED STATEMENTS

OF EARNINGS (Unaudited) (In

thousands, except shares and per share data)

Three Months

Ended Nine Months Ended September 30 September

30 2014 2013 2014

2013 Net Sales $ 202,643 $ 188,541 $ 605,706 $

556,871 Cost of Sales 115,480 106,679

346,363 314,745 Gross Profit

87,163 81,862 259,343

242,126 Gross Margin 43.0 % 43.4 % 42.8 % 43.5 % Operating

Expense: Research and Development Expense 6,844 7,970 21,976 23,309

Selling and Administrative Expense 63,215

57,663 187,885 174,083 Total

Operating Expense 70,059 65,633

209,861 197,392 Profit from Operations 17,104

16,229 49,482 44,734 Operating Margin 8.4 % 8.6 % 8.2 % 8.0 % Other

Income (Expense): Interest Income 84 67 254 295 Interest Expense

(396 ) (440 ) (1,301 ) (1,318 ) Net Foreign Currency Losses (276 )

(303 ) (156 ) (1,046 ) Other Expense, Net (162 ) (157

) (282 ) (238 ) Total Other Expense, Net (750

) (833 ) (1,485 ) (2,307 ) Profit

Before Income Taxes 16,354 15,396 47,997 42,427 Income Tax Expense

4,562 4,779 14,887

12,497 Net Earnings $ 11,792 $ 10,617 $ 33,110

$ 29,930 Net Earnings per Share: Basic $ 0.65

$ 0.58 $ 1.82 $ 1.64 Diluted $ 0.63

$ 0.56 $ 1.77 $ 1.59 Weighted

Average Shares Outstanding: Basic 18,120,729 18,267,828 18,201,291

18,288,083 Diluted 18,635,287 18,811,638 18,727,818 18,823,745

Cash Dividends Declared per Common Share $ 0.20 $ 0.18 $

0.58 $ 0.54

GEOGRAPHICAL NET SALES(1)

(Unaudited)

(In thousands)

Three Months Ended Nine Months

Ended September 30 September 30 2014

2013

%

2014 2013

%

Americas $ 142,149 $ 130,037 9.3 $ 418,236 $ 382,877 9.2 Europe,

Middle East and Africa 40,610 37,436 8.5 124,946 116,465 7.3 Asia

Pacific 19,884 21,068 (5.6 ) 62,524

57,529 8.7 Total $ 202,643 $ 188,541 7.5 $ 605,706 $ 556,871

8.8

(1) Net of intercompany sales.

TENNANT COMPANY CONDENSED CONSOLIDATED

BALANCE SHEETS (Unaudited)

(In thousands)

September 30, December 31,

September 30, 2014 2013 2013 ASSETS

Current Assets: Cash and Cash Equivalents $ 79,784 $ 80,984 $

65,309 Restricted Cash 395 393 404 Net Receivables 141,771 140,182

139,813 Inventories 83,964 66,906 67,390 Prepaid Expenses 13,473

11,426 12,111 Deferred Income Taxes, Current Portion 8,200 13,723

8,986 Other Current Assets 1,658 1,682

1,696 Total Current Assets 329,245

315,296 295,709 Property, Plant and

Equipment 311,704 300,906 305,381 Accumulated Depreciation

(226,513 ) (217,430 ) (220,899 ) Property, Plant and

Equipment, Net 85,191 83,476 84,482 Deferred Income Taxes,

Long-Term Portion 6,072 2,423 12,830 Goodwill 18,725 18,929 19,246

Intangible Assets, Net 16,680 19,028 19,411 Other Assets

15,337 17,154 7,303 Total Assets

$ 471,250 $ 456,306 $ 438,981

LIABILITIES AND SHAREHOLDERS’ EQUITY Current Liabilities:

Short-Term Borrowings and Current Portion of Long-Term Debt $ 3,717

$ 3,803 $ 3,935 Accounts Payable 57,896 53,079 49,295 Employee

Compensation and Benefits 33,549 29,756 31,096 Income Taxes Payable

1,140 812 1,349 Other Current Liabilities 43,209

44,076 40,512 Total Current Liabilities

139,511 131,526 126,187

Long-Term Liabilities: Long-Term Debt 24,450 28,000 28,042

Employee-Related Benefits 24,407 25,173 25,988 Deferred Income

Taxes, Long-Term Portion 4,553 2,870 2,834 Other Liabilities

4,961 4,891 4,701 Total

Long-Term Liabilities 58,371 60,934

61,565 Total Liabilities 197,882

192,460 187,752 Shareholders’ Equity:

Preferred Stock — — — Common Stock 6,903 6,934 6,864 Additional

Paid-In Capital 24,271 31,956 28,828 Retained Earnings 272,183

249,927 246,093 Accumulated Other Comprehensive Loss (29,989

) (24,971 ) (30,556 ) Total Shareholders’ Equity

273,368 263,846 251,229

Total Liabilities and Shareholders’ Equity $ 471,250 $

456,306 $ 438,981

TENNANT

COMPANY CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

Nine Months Ended September

30 2014 2013 OPERATING

ACTIVITIES Net Earnings

$

33,110 $ 29,930 Adjustments to reconcile Net Earnings to Net Cash

Provided by Operating Activities: Depreciation 13,186 13,178

Amortization 1,812 1,914 Deferred Income Taxes 3,136 (4 )

Share-Based Compensation Expense 5,261 5,106 Allowance for Doubtful

Accounts and Returns 1,248 1,153 Other, Net (45 ) 155 Changes in

Operating Assets and Liabilities: Receivables (6,077 ) (6,551 )

Inventories (21,720 ) (11,798 ) Accounts Payable 5,879 2,826

Employee Compensation and Benefits 1,755 (2,620 ) Other Current

Liabilities 216 1,716 Income Taxes 137 940 Other Assets and

Liabilities (1,073 ) 863 Net Cash Provided by

Operating Activities 36,825 36,808

INVESTING

ACTIVITIES Purchases of Property, Plant and Equipment (13,476 )

(11,380 ) Proceeds from Disposals of Property, Plant and Equipment

235 97 Acquisition of Business, Net of Cash Acquired — (750 )

Proceeds from Sale of Business 1,418 3,520 Increase in Restricted

Cash (12 ) (224 ) Net Cash Used for Investing

Activities (11,835 ) (8,737 )

FINANCING ACTIVITIES

Payments of Short-Term Debt (1,500 ) — Short-Term Debt Borrowings —

1,500 Payments of Long-Term Debt (2,015 ) (938 ) Purchases of

Common Stock (13,609 ) (16,626 ) Proceeds from Issuances of Common

Stock 1,650 5,994 Tax Benefit on Stock Plans 1,620 2,944 Dividends

Paid (10,854 ) (9,918 ) Net Cash Used for Financing

Activities (24,708 ) (17,044 ) Effect of Exchange Rate

Changes on Cash and Cash Equivalents (1,482 ) 342

Net Increase (Decrease) in Cash and Cash Equivalents

(1,200 ) 11,369 Cash and Cash Equivalents at Beginning of

Period 80,984 53,940 Cash and Cash Equivalents at End

of Period $ 79,784 $ 65,309

TENNANT

COMPANY SUPPLEMENTAL NON-GAAP FINANCIAL TABLE (In

thousands, except per share data)

Three Months

Ended Nine Months Ended September

30 September 30 2014 2013

2014 2013 Net Sales

$ 202,643 $ 188,541

$ 605,706 $ 556,871 Cost

of Sales 115,480 106,679 346,363

314,745 Gross Profit - as reported

87,163 81,862 259,343

242,126 Gross Margin 43.0 % 43.4 % 42.8 % 43.5 %

Operating Expense: Research and Development Expense 6,844 7,970

21,976 23,309 Selling and Administrative Expense 63,215

57,663 187,885 174,083

Total Operating Expense 70,059 65,633

209,861 197,392 Profit

from Operations - as reported $ 17,104 $ 16,229 $ 49,482 $ 44,734

Operating Margin - as reported 8.4 % 8.6 % 8.2 % 8.0 %

Adjustments:

Restructuring Charge — — —

1,440 Profit from Operations - as adjusted $

17,104 $ 16,229 $ 49,482 $ 46,174

Operating Margin - as adjusted 8.4 %

8.6 % 8.2 %

8.3 % Other Income (Expense): Interest Income 84 67 254 295

Interest Expense (396 ) (440 ) (1,301 ) (1,318 ) Net Foreign

Currency Transaction Losses (276 ) (303 ) (156 ) (1,046 ) Other

Expense, Net (162 ) (157 ) (282 ) (238

) Total Other Expense, Net (750 ) (833 ) (1,485 ) (2,307 )

Profit Before Income Taxes - as reported $ 16,354 $ 15,396 $ 47,997

$ 42,427

Adjustments:

Restructuring Charge — — —

1,440 Profit Before Income Taxes - as adjusted

$ 16,354 $ 15,396

$ 47,997 $ 43,867 Income

Tax Expense - as reported $ 4,562 $ 4,779 $ 14,887 $ 12,497

Adjustments:

Restructuring Charge — — — 417 Discrete Tax Item Related to 2012

R&D Tax Credit — — —

582 Income Tax Expense - as adjusted $

4,562 $ 4,779 $ 14,887

$ 13,496

TENNANT COMPANY SUPPLEMENTAL NON-GAAP FINANCIAL TABLE

(In thousands, except per share data)

Three Months Ended Nine Months Ended September

30 September 30 2014 2013

2014 2013 Net Earnings - as reported $ 11,792

$ 10,617 $ 33,110 $ 29,930

Adjustments:

Restructuring Charge — — — 1,023 Discrete Tax Item Related to 2012

R&D Tax Credit — — — (582 ) Net

Earnings - as adjusted $ 11,792 $ 10,617 $ 33,110 $ 30,371

Net Earnings per Share - as reported:

Basic $ 0.65 $ 0.58 $ 1.82 $ 1.64 Diluted $ 0.63 $ 0.56 $

1.77 $ 1.59

Adjustments:

Restructuring Charge — — — 0.05 Discrete Tax Item Related to 2012

R&D Tax Credit — — — (0.03 )

Diluted Net Earnings per Share - as adjusted $ 0.63 $ 0.56 $ 1.77 $

1.61

Full

Year

2013

Diluted Earnings per Share - as reported $ 2.14

Adjustments: Restructuring Charges 0.15 Discrete Tax Item Related

to 2012 R&D Tax Credit (0.03 ) Diluted Earnings

per Share - as adjusted $ 2.26

Tennant CompanyInvestor Contact:Tom Paulson,

763-540-1204Senior Vice President and Chief Financial

OfficerorMedia Contact:Kathryn Lovik, 763-540-1212Global

Communications Director

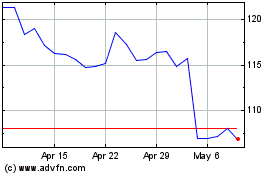

Tennant (NYSE:TNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

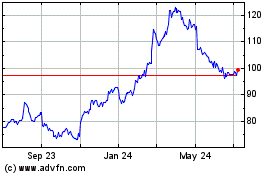

Tennant (NYSE:TNC)

Historical Stock Chart

From Apr 2023 to Apr 2024