UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 21, 2014

Harley-Davidson, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Wisconsin | | 1-9183 | | 39-1382325 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

3700 West Juneau Avenue, Milwaukee, Wisconsin 53208

(Address of principal executive offices, including zip code)

(414) 342-4680

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

|

| |

Item 2.02. | Results of Operations and Financial Condition. |

On October 21, 2014, Harley-Davidson, Inc. (the “Company”) issued a press release (the “Press Release”) announcing the Company’s third quarter results for the financial period ended September 28, 2014. A copy of the Press Release is being furnished as Exhibit 99.1 to this Current Report.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

| |

(d) | Exhibits. The following exhibit is being furnished herewith: |

| |

(99.1) | Press Release of Harley-Davidson, Inc., dated October 21, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | HARLEY-DAVIDSON, INC. |

| | | |

Date: October 21, 2014 | | | | By: | | /s/ Stephen W. Boettinger |

| | | | | | Stephen W. Boettinger |

| | | | | | Assistant Secretary |

Exhibit 99.1

Media Contact: Bob Klein, (414) 343-8664

Financial Contact: Amy Giuffre, (414) 343-8002

HARLEY-DAVIDSON THIRD-QUARTER RETAIL MOTORCYCLE SALES RISE

Dealer New Motorcycle Sales Grow 3.8 Percent Worldwide, 3.4 Percent in U.S. on Strength of August Launch of 2015 Motorcycles

EPS Rises 20.1 Percent through Nine Months

MILWAUKEE, October 21, 2014 -- Harley-Davidson, Inc. (NYSE: HOG) dealer new motorcycle sales grew worldwide and in the U.S. in the third quarter of 2014, topping a strong prior-year quarter. The Company’s diluted earnings per share were $0.69 for the quarter, net income was $150.1 million and consolidated revenue was $1.30 billion compared to diluted EPS of $0.73, net income of $162.7 million and revenue of $1.34 billion in the year-ago period. Third-quarter results reflect lower motorcycle shipments, as planned, compared to last year’s third quarter.

Through nine months, Harley-Davidson 2014 consolidated revenue grew 6.8 percent, net income increased 16.9 percent and diluted EPS rose 20.1 percent to $3.52 compared to the year-ago period.

“Harley-Davidson’s third-quarter financial results were in line with our expectations, and we are on track for a year of growth and strong financial performance in 2014,” said Harley-Davidson, Inc. Chairman, President and Chief Executive Officer Keith Wandell. “We continue to see the success of our product, manufacturing and retail strategies, which are delivering an outstanding customer experience, driving bottom-line improvement and expanding the reach of the brand.”

Retail Harley-Davidson Motorcycle Sales

Dealers worldwide sold 73,217 new Harley-Davidson® motorcycles in the third quarter of 2014 compared to 70,517 motorcycles in the year-ago quarter.

“With the successful launch of the 2015 motorcycles in late August, including the return of the Road Glide models, and the outstanding efforts of our dealers, third-quarter retail Harley-Davidson motorcycle sales topped the strong growth of the year-ago quarter. A rebound in Sportster motorcycle sales from this year’s second quarter and increased availability of the Street 750 and Street 500 motorcycles also contributed to these positive results,” said Wandell.

In last year’s third quarter, the Company launched its game-changing Project Rushmore line of touring motorcycles, which spurred year-over-year retail sales growth of 20.1 percent in the U.S. and 15.5 percent worldwide, giving the third quarter of 2013 one of the strongest single-quarter retail increases in recent years for Harley-Davidson.

This year, U.S. dealers sold 50,167 new Harley-Davidson motorcycles in the third quarter, up 3.4 percent compared to sales of 48,529 motorcycles in the year-ago period.

In international markets, dealers sold 23,050 new Harley-Davidson motorcycles in the third quarter compared to 21,988 motorcycles in the year-ago period, with sales up 12.8 percent in the Asia Pacific Region, 1.7 percent in the EMEA Region and 7.0 percent in the Latin America Region and down 5.8 percent in Canada.

Through the first nine months of 2014, dealers sold 220,850 new Harley-Davidson motorcycles worldwide compared to 214,964 motorcycles in the year-ago period, with retail unit sales up 1.9 percent in the U.S., 11.0 percent in the Asia Pacific Region, 5.9 percent in the EMEA Region and 1.2 percent in the Latin America Region and down 11.4 percent in Canada compared to the year-ago period.

Harley-Davidson Motorcycles and Related Products Segment Results

Third-Quarter Results: Operating income from motorcycles and related products was $146.3 million compared to operating income of $175.5 million in the year-ago period. The 16.6 percent decrease in third-quarter operating income resulted primarily from a decline in revenue driven by the planned reduction in motorcycle shipments.

Revenue from motorcycles was $815.4 million compared to revenue of $857.0 million in the year-ago period, a 4.9 percent decrease. The Company shipped 50,670 motorcycles to dealers and distributors worldwide during the quarter, in line with guidance and a 6.2 percent decrease compared to shipments of 54,025 motorcycles in the year-ago period.

Revenue from motorcycle parts and accessories was $239.7 million during the quarter, down 4.2 percent, and revenue from general merchandise, which includes MotorClothes® apparel and accessories, was $69.3 million, up 4.8 percent compared to the year-ago period.

Gross margin was 34.9 percent in the third quarter of 2014, compared to 35.3 percent in the third quarter of 2013. Third-quarter operating margin from motorcycles and related products was 12.9 percent, compared to operating margin of 14.9 percent in last year's third quarter.

Nine-Month Results: Through nine months the Company shipped 223,569 motorcycles to dealers and distributors worldwide, a 4.5 percent increase compared to the year-ago period. Nine-month revenue from motorcycles grew 9.6 percent to $3.60 billion, revenue from parts and accessories increased 0.8 percent to $709.4 million and revenue from general merchandise decreased 4.6 percent to $209.8 million compared to the first nine months of 2013. Gross margin through nine months was 37.7 percent and operating margin was 21.3 percent, compared to 36.4 percent and 19.2 percent respectively in the year-ago period.

Financial Services Segment Results

Operating income from financial services was $77.8 million in the third quarter of 2014, a 2.2 percent increase compared to operating income of $76.1 million in last year's third quarter. Third-quarter financial services results reflect favorable net interest income and a higher provision for credit losses. Through nine months, operating income from financial services was $215.4 million, compared to operating income of $221.8 million in the year-ago period.

Guidance

Harley-Davidson continues to expect to ship 270,000 to 275,000 motorcycles to dealers and distributors worldwide in 2014, an approximate 3-1/2 percent to 5-1/2 percent increase from 2013. The Company continues to expect full-year 2014 operating margin of 17.5 percent to 18.5 percent in the Motorcycles

segment. The Company also continues to expect capital expenditures of $215 million to $235 million in 2014.

Income Tax Rate

Through nine months, the Company's effective income tax rate was 34.9 percent compared to 34.3 percent in the year-ago period. The higher 2014 rate primarily reflects the absence of the Research and Development Tax Credit, which expired at the end of 2013. The Company now expects its full-year 2014 effective tax rate to be approximately 35.0 percent, down a half percentage point from prior guidance due to a higher projected benefit from the U.S. manufacturing deduction.

Cash Flow

Cash and marketable securities totaled $1.04 billion at the end of the third quarter compared to $1.15 billion at the end of last year's third quarter. During the first nine months of 2014, Harley-Davidson generated cash from operating activities of $966.9 million compared to $825.1 million in the year-ago period. On a discretionary basis, the Company repurchased 2.6 million shares of Harley-Davidson, Inc. common stock during the third quarter of 2014 at a cost of $169.6 million. In the third quarter of 2014, there were approximately 216.9 million weighted-average diluted common shares outstanding. At the end of the third quarter of 2014, 24.0 million shares remained on board-approved share-repurchase authorizations.

Company Background

Harley-Davidson, Inc. is the parent company of Harley-Davidson Motor Company and Harley-Davidson Financial Services. Harley-Davidson Motor Company produces custom, cruiser and touring motorcycles and offers a complete line of Harley-Davidson motorcycle parts, accessories, riding gear and apparel, and general merchandise. Harley-Davidson Financial Services provides wholesale and retail financing, insurance, extended service and other protection plans and credit card programs to Harley-Davidson dealers and riders in the U.S., Canada and other select international markets. For more information, visit Harley-Davidson's Web site at www.harley-davidson.com.

Conference Call and Webcast Presentation

Harley-Davidson will discuss third-quarter results on a Webcast at 8:00 a.m. CT today. The supporting slides will be posted prior to the call and can be accessed at http://investor.harley-davidson.com/. Click "Events and Presentations" under "Resources." The audio portion of today's call will also be posted at harley-davidson.com beginning approximately two hours after the conclusion of the call for one year. The audio may also be accessed through Nov. 4, 2014 by calling 404-537-3406 or toll-free in the U.S. at 855-859-2056, pin number 8150664#.

Forward-Looking Statements

The Company intends that certain matters discussed in this release are "forward-looking statements" intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements can generally be identified as such because the context of the statement will include words such as the Company "believes," "anticipates," "expects," "plans," or "estimates" or words of similar meaning. Similarly, statements that describe future plans, objectives, outlooks, targets, guidance or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those anticipated as of the date of this release. Certain of such risks and uncertainties are described below.

Shareholders, potential investors, and other readers are urged to consider these factors in evaluating the forward-looking statements and cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included in this release are only made as of the date of this release, and the Company disclaims any obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

The Company's ability to meet the targets and expectations noted depends upon, among other factors, the Company's ability to (i) execute its business strategy, (ii) adjust to fluctuations in foreign currency exchange rates, interest rates and commodity prices, (iii) manage through inconsistent economic conditions, including changing capital, credit and retail markets, (iv) manage through the effects inconsistent and unpredictable weather patterns may have on retail sales of motorcycles, (v) manage supply chain issues, including any unexpected interruptions or price increases caused by raw material shortages or natural disasters, (vi) manage changes and prepare for requirements in legislative and regulatory environments for its products, services and operations, (vii) develop and implement sales and marketing plans that retain existing retail customers and attract new retail customers in an increasingly competitive marketplace, (viii) implement and manage enterprise-wide information technology solutions, including solutions at its manufacturing facilities, and secure data contained in those systems, (ix) anticipate the level of consumer confidence in the economy, (x) continue to realize production efficiencies at its production facilities and manage operating costs including materials, labor and overhead, (xi) manage production capacity and production changes, (xii) provide products, services and experiences that are successful in the marketplace, (xiii) manage risks that arise through expanding international manufacturing, operations and sales, (xiv) manage the credit quality, the loan servicing and collection activities, and the recovery rates of HDFS' loan portfolio, (xv) continue to manage the relationships and agreements that it has with its labor unions to help drive long-term competitiveness, (xvi) adjust to healthcare inflation and reform, pension reform and tax changes, (xvii) retain and attract talented employees, (xviii) manage the risks that our independent dealers may have difficulty obtaining capital and managing through changing economic conditions and consumer demand, (xix) continue to have access to reliable sources of capital funding and adjust to fluctuations in the cost of capital, (xx) continue to develop the capabilities of its distributor and dealer network, and (xxi) detect any issues with our motorcycles or manufacturing processes to avoid delays in new model launches, recall campaigns, increased warranty costs or litigation.

In addition, the Company could experience delays or disruptions in its operations as a result of work stoppages, strikes, natural causes, terrorism or other factors. Other factors are described in risk factors that the Company has disclosed in documents previously filed with the Securities and Exchange Commission.

The Company's ability to sell its motorcycles and related products and services and to meet its financial expectations also depends on the ability of the Company's independent dealers to sell its motorcycles and related products and services to retail customers. The Company depends on the capability and financial capacity of its independent dealers and distributors to develop and implement effective retail sales plans to create demand for the motorcycles and related products and services they purchase from the Company. In addition, the Company's independent dealers and distributors may experience difficulties in operating their businesses and selling Harley-Davidson motorcycles and related products and services as a result of weather, economic conditions or other factors.

# # #

Harley-Davidson, Inc.

Condensed Consolidated Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Three months ended | | Nine months ended |

| | September 28,

2014 | | September 29,

2013 | | September 28,

2014 | | September 29,

2013 |

Motorcycles & Related Products revenue | | $ | 1,130,558 |

| | $ | 1,180,284 |

| | $ | 4,536,531 |

| | $ | 4,225,998 |

|

Gross profit | | 394,600 |

| | 416,315 |

| | 1,710,870 |

| | 1,537,627 |

|

Selling, administrative and engineering expense | | 248,286 |

| | 240,198 |

| | 743,608 |

| | 729,443 |

|

Restructuring expense (benefit) | | — |

| | 646 |

| | — |

| | (1,713 | ) |

Operating income from Motorcycles & Related Products | | 146,314 |

| | 175,471 |

| | 967,262 |

| | 809,897 |

|

| | | | | | | | |

Financial Services revenue | | 171,046 |

| | 163,434 |

| | 491,820 |

| | 483,240 |

|

Financial Services expense | | 93,287 |

| | 87,366 |

| | 276,432 |

| | 261,471 |

|

Operating income from Financial Services | | 77,759 |

| | 76,068 |

| | 215,388 |

| | 221,769 |

|

| | | | | | | | |

Operating income | | 224,073 |

| | 251,539 |

| | 1,182,650 |

| | 1,031,666 |

|

Investment income | | 1,509 |

| | 1,161 |

| | 4,940 |

| | 4,546 |

|

Interest expense | | 77 |

| | 11,369 |

| | 4,147 |

| | 33,998 |

|

Income before income taxes | | 225,505 |

| | 241,331 |

| | 1,183,443 |

| | 1,002,214 |

|

Provision for income taxes | | 75,439 |

| | 78,615 |

| | 413,307 |

| | 343,630 |

|

Net income | | $ | 150,066 |

| | $ | 162,716 |

| | $ | 770,136 |

| | $ | 658,584 |

|

| | | | | | | | |

Earnings per common share: | | | | | | | | |

Basic | | $ | 0.70 |

| | $ | 0.73 |

| | $ | 3.54 |

| | $ | 2.95 |

|

Diluted | | $ | 0.69 |

| | $ | 0.73 |

| | $ | 3.52 |

| | $ | 2.93 |

|

| | | | | | | | |

Weighted-average common shares: | | | | | | | | |

Basic | | 215,572 |

| | 221,936 |

| | 217,429 |

| | 223,134 |

|

Diluted | | 216,893 |

| | 223,486 |

| | 218,838 |

| | 224,696 |

|

| | | | | | | | |

Cash dividends per common share | | $ | 0.275 |

| | $ | 0.210 |

| | $ | 0.825 |

| | $ | 0.630 |

|

Harley-Davidson, Inc.

Condensed Consolidated Balance Sheets

(In thousands)

|

| | | | | | | | | | | | |

| | (Unaudited) | | | | (Unaudited) |

| | September 28,

2014 | | December 31,

2013 | | September 29,

2013 |

ASSETS | | | | | | |

Current assets: | | | | | | |

Cash and cash equivalents | | $ | 979,866 |

| | $ | 1,066,612 |

| | $ | 1,029,955 |

|

Marketable securities | | 57,579 |

| | 99,009 |

| | 122,234 |

|

Accounts receivable, net | | 286,256 |

| | 261,065 |

| | 290,158 |

|

Finance receivable, net | | 2,012,466 |

| | 1,773,686 |

| | 1,829,612 |

|

Inventories | | 460,958 |

| | 424,507 |

| | 401,199 |

|

Restricted cash | | 142,286 |

| | 144,807 |

| | 194,329 |

|

Other current assets | | 263,067 |

| | 219,117 |

| | 225,188 |

|

Total current assets | | 4,202,478 |

| | 3,988,803 |

| | 4,092,675 |

|

Finance receivables, net | | 4,653,034 |

| | 4,225,877 |

| | 4,355,278 |

|

Prepaid pension costs | | 261,983 |

| | 244,871 |

| | — |

|

Other long-term assets | | 908,011 |

| | 945,489 |

| | 1,036,055 |

|

| | $ | 10,025,506 |

| | $ | 9,405,040 |

| | $ | 9,484,008 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | |

Current liabilities: | | | | | | |

Accounts payable & accrued liabilities | | $ | 836,294 |

| | $ | 667,129 |

| | $ | 865,940 |

|

Short-term debt | | 352,430 |

| | 666,317 |

| | 394,460 |

|

Current portion of long-term debt | | 1,518,320 |

| | 1,176,140 |

| | 721,316 |

|

Total current liabilities | | 2,707,044 |

| | 2,509,586 |

| | 1,981,716 |

|

Long-term debt | | 3,573,118 |

| | 3,416,713 |

| | 4,067,733 |

|

Pension and postretirement healthcare liabilities | | 243,484 |

| | 252,536 |

| | 412,482 |

|

Other long-term liabilities | | 217,497 |

| | 216,719 |

| | 140,230 |

|

| | | | | | |

Total shareholders’ equity | | 3,284,363 |

| | 3,009,486 |

| | 2,881,847 |

|

| | $ | 10,025,506 |

| | $ | 9,405,040 |

| | $ | 9,484,008 |

|

Harley-Davidson, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

| | | | | | | | |

| | Nine months ended |

| | September 28,

2014 | | September 29,

2013 |

Net cash provided by operating activities | | $ | 966,868 |

| | $ | 825,103 |

|

| | | | |

Cash flows from investing activities: | | | | |

Capital expenditures | | (120,316 | ) | | (111,690 | ) |

Finance receivables, net | | (610,644 | ) | | (446,181 | ) |

Net change in marketable securities | | 41,010 |

| | 12,107 |

|

Other | | 275 |

| | 6,721 |

|

Net cash used by investing activities | | (689,675 | ) | | (539,043 | ) |

| | | | |

Cash flows from financing activities: | | | | |

Repayments of senior unsecured notes | | (303,000 | ) | | — |

|

Proceeds from issuance of medium-term notes | | 594,431 |

| | — |

|

Repayments of medium-term notes securitization debt | | (7,220 | ) | | (27,858 | ) |

Proceeds from securitization debt | | 847,126 |

| | 647,516 |

|

Repayments of securitization debt | | (631,302 | ) | | (650,424 | ) |

Net (decrease) increase in credit facilities and unsecured commercial paper | | (315,278 | ) | | 99,416 |

|

Borrowings of asset-backed commercial paper | | 57,669 |

| | 69,555 |

|

Repayments of asset-backed commercial paper | | (58,717 | ) | | (58,990 | ) |

Net change in restricted cash | | 2,521 |

| | (6,321 | ) |

Dividends paid | | (179,860 | ) | | (140,772 | ) |

Purchase of common stock for treasury | | (393,459 | ) | | (302,196 | ) |

Excess tax benefits from share-based payments | | 8,873 |

| | 18,444 |

|

Issuance of common stock under employee stock option plans | | 28,850 |

| | 39,145 |

|

Net cash used by financing activities | | (349,366 | ) | | (312,485 | ) |

| | | | |

Effect of exchange rate changes on cash and cash equivalents | | (14,573 | ) | | (11,758 | ) |

| | | | |

Net decrease in cash and cash equivalents | | $ | (86,746 | ) | | $ | (38,183 | ) |

| | | | |

Cash and cash equivalents: | | | | |

Cash and cash equivalents - beginning of period | | 1,066,612 |

| | 1,068,138 |

|

Net decrease in cash and cash equivalents | | (86,746 | ) | | (38,183 | ) |

Cash and cash equivalents - end of period | | $ | 979,866 |

| | $ | 1,029,955 |

|

Motorcycles and Related Products Revenue and

Motorcycle Shipment Data

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Three months ended | | Nine months ended |

| | September 28,

2014 | | September 29,

2013 | | September 28,

2014 | | September 29,

2013 |

MOTORCYCLES AND RELATED PRODUCTS REVENUE (in thousands) | | | | | | | | |

Motorcycles | | $ | 815,375 |

| | $ | 857,029 |

| | $ | 3,601,328 |

| | $ | 3,285,738 |

|

Parts & Accessories | | 239,731 |

| | 250,153 |

| | 709,438 |

| | 703,779 |

|

General Merchandise | | 69,282 |

| | 66,134 |

| | 209,782 |

| | 219,978 |

|

Other | | 6,170 |

| | 6,968 |

| | 15,983 |

| | 16,503 |

|

| | $ | 1,130,558 |

| | $ | 1,180,284 |

| | $ | 4,536,531 |

| | $ | 4,225,998 |

|

MOTORCYCLE SHIPMENTS: | | | | | | | | |

United States | | 28,106 |

| | 32,061 |

| | 145,440 |

| | 139,814 |

|

International | | 22,564 |

| | 21,964 |

| | 78,129 |

| | 74,039 |

|

Total | | 50,670 |

| | 54,025 |

| | 223,569 |

| | 213,853 |

|

MOTORCYCLE PRODUCT MIX: | | | | | | | | |

Touring | | 22,844 |

| | 23,011 |

| | 100,117 |

| | 86,727 |

|

Custom | | 14,722 |

| | 19,111 |

| | 76,102 |

| | 84,728 |

|

Sportster® / Street | | 13,104 |

| | 11,903 |

| | 47,350 |

| | 42,398 |

|

Total | | 50,670 |

| | 54,025 |

| | 223,569 |

| | 213,853 |

|

Worldwide Retail Sales of Harley-Davidson Motorcycles(1)

|

| | | | | | | | | | | | |

| | Three months ended | | Nine months ended |

| | September 30,

2014 | | September 30,

2013 | | September 30,

2014 | | September 30,

2013 |

North America Region | | | | | | | | |

United States | | 50,167 |

| | 48,529 |

| | 144,122 |

| | 141,476 |

|

Canada | | 2,598 |

| | 2,759 |

| | 8,753 |

| | 9,876 |

|

Total North America Region | | 52,765 |

| | 51,288 |

| | 152,875 |

| | 151,352 |

|

Europe, Middle East and Africa Region (EMEA) | | | | | | | | |

Europe(2) | | 8,255 |

| | 8,071 |

| | 32,376 |

| | 30,440 |

|

Other | | 1,541 |

| | 1,558 |

| | 5,124 |

| | 4,970 |

|

Total EMEA Region | | 9,796 |

| | 9,629 |

| | 37,500 |

| | 35,410 |

|

Asia Pacific Region | | | | | | | | |

Japan | | 2,621 |

| | 2,821 |

| | 8,024 |

| | 8,168 |

|

Other | | 4,852 |

| | 3,805 |

| | 13,929 |

| | 11,609 |

|

Total Asia Pacific Region | | 7,473 |

| | 6,626 |

| | 21,953 |

| | 19,777 |

|

Latin America Region | | 3,183 |

| | 2,974 |

| | 8,522 |

| | 8,425 |

|

Total Worldwide Retail Sales | | 73,217 |

| | 70,517 |

| | 220,850 |

| | 214,964 |

|

Total International Retail Sales | | 23,050 |

| | 21,988 |

| | 76,728 |

| | 73,488 |

|

(1) Data source for retail sales figures shown above is new sales warranty and registration information provided by Harley-Davidson dealers and compiled by the Company. The Company must rely on information that its dealers supply concerning new retail sales, and this information is subject to revision.

(2) Europe data includes Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Luxembourg, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

Motorcycle Registration Data(1)

|

| | | | | | |

| | Nine months ended |

| | September 30,

2014 | | September 30,

2013 |

United States(2) | | 261,851 |

| | 256,476 |

|

| | Nine months ended |

| | September 30,

2014 | | September 30,

2013 |

Europe(3) | | 284,382 |

| | 251,280 |

|

(1) Data includes on-road 601+cc models. On-road 601+cc models include on-highway, dual purpose models and three-wheeled vehicles.

(2) United States data is derived from information provided by Motorcycle Industry Council (MIC). This third party data is subject to revision and update.

(3) Europe data includes Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Luxembourg, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom. Industry retail motorcycle registration data includes 601+cc models derived from information provided by Association des Constructeurs Europeens de Motocycles (ACEM), an independent agency. This third-party data is subject to revision and update.

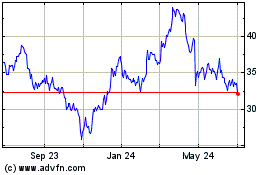

Harley Davidson (NYSE:HOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

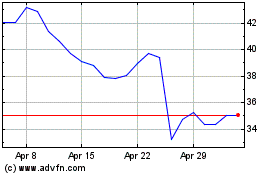

Harley Davidson (NYSE:HOG)

Historical Stock Chart

From Apr 2023 to Apr 2024