As filed with the Securities and Exchange Commission on October 17, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

______________________

CISCO SYSTEMS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

| | |

California | | 77-0059951 |

(State or Other Jurisdiction

of Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

170 West Tasman Drive

San Jose, California 95134-1706

(Address of Principal Executive Offices) (Zip Code)

Options to purchase stock granted under the Memoir Systems, Inc. 2009 Stock Incentive Plan, and restricted stock units granted under the Memoir Systems, Inc. 2014 Equity Incentive Plan, and assumed by the Registrant

(Full Title of the Plan)

______________________

John T. Chambers

Chairman and Chief Executive Officer

Cisco Systems, Inc.

300 East Tasman Drive

San Jose, California 95134-1706

(Name and Address of Agent For Service)

(408) 526-4000

(Telephone Number, including area code, of agent for service)

______________________

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| |

Large accelerated filer x | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o

|

CALCULATION OF REGISTRATION FEE |

| | | | |

Title of Securities To Be Registered | Amount To Be Registered (1) | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee |

In respect of assumed stock options: Common Stock, $0.001 par value per share (2) | 296,719 (2) | $2.57 (3) | $762,567.83 (3) | $88.62 (3) |

In respect of assumed restricted stock units: Common Stock, $0.001 par value per share (4) | 106,384 (4) | $23.19 (5) | $2,467,044.96 (5) | $286.68 (5) |

TOTAL | 403,103 | N/A | $3,229,612.79 | $375.30 |

| |

(1) | This Registration Statement shall also cover any additional shares of the Registrant's common stock that become issuable in respect of the securities identified in the above table by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the Registrant's receipt of consideration which results in an increase in the number of the outstanding shares of the Registrant's common stock. |

| |

(2) | Represents shares subject to issuance upon the exercise of stock options outstanding under the Memoir Systems, Inc. 2009 Stock Incentive Plan, and assumed by the Registrant on October 13, 2014 pursuant to an Agreement and Plan of Merger by and among the Registrant, Mendocino Merger Corp., Memoir Systems, Inc., and the Stockholders’ Agent, dated as of September 16, 2014 (the “Merger Agreement”). |

| |

(3) | Calculated solely for the purposes of this offering under Rule 457(h) of the Securities Act of 1933, as amended, on the basis of the weighted average exercise price of the outstanding options. |

| |

(4) | Represents shares subject to issuance in connection with restricted stock units outstanding under the Memoir Systems, Inc. 2014 Equity Incentive Plan, and assumed by the Registrant on October 13, 2014 pursuant to the Merger Agreement. |

| |

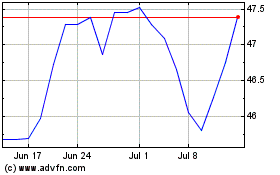

(5) | Calculated solely for the purposes of this offering under Rule 457(c) and (h) of the Securities Act of 1933, as amended, on the basis of the average of the high and low prices of the Registrant’s common stock as reported on The NASDAQ Global Select Market on October 13, 2014. |

TABLE OF CONTENTS

|

| | |

PART II | | |

Item 3. | | II-1 |

Item 4. | | II-1 |

Item 5. | | II-1 |

Item 6. | | II-1 |

Item 7. | | II-2 |

Item 8. | | II-2 |

Item 9. | | II-3 |

| | |

| | |

EXHIBIT INDEX

EXHIBIT 5.1

EXHIBIT 23.1

EXHIBIT 99.1

EXHIBIT 99.2

EXHIBIT 99.3

EXHIBIT 99.4

PART II

Information Required in the Registration Statement

Item 3. Incorporation of Documents by Reference.

Cisco Systems, Inc. (the “Registrant”) hereby incorporates by reference into this Registration Statement the following documents previously filed with the Securities and Exchange Commission (the “Commission”):

| |

(a) | The Registrant’s Annual Report on Form 10-K for the fiscal year ended July 26, 2014 filed with the Commission on September 9, 2014 pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”); |

| |

(b) | All other reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the Registrant’s Annual Report referred to in (a) above; and |

| |

(c) | The description of the Registrant’s Common Stock contained in the Registrant’s Registration Statement on Form 8-A (No. 000-18225) filed with the Commission on January 11, 1990, together with Amendment No. 1 on Form 8-A filed with the Commission on February 15, 1990, and including any other amendments or reports filed for the purpose of updating such description. |

All reports and definitive proxy or information statements filed pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the filing of this Registration Statement and prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which de-registers all securities then remaining unsold shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from the date of filing such documents, except as to specific sections of such statements as set forth therein. Unless expressly incorporated into this Registration Statement, a report furnished on Form 8-K prior or subsequent to the date hereof shall not be incorporated by reference into this Registration Statement. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in any subsequently filed document which also is deemed to be incorporated by reference herein modifies or supersedes such statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

As of the date of this Registration Statement, attorneys of Fenwick & West LLP beneficially own an aggregate of approximately 86,000 shares of the Registrant’s common stock.

Item 6. Indemnification of Directors and Officers.

Section 317 of the California Corporations Code authorizes a court to award or a corporation’s Board of Directors to grant indemnity to directors and officers in terms sufficiently broad to permit indemnification (including reimbursement of expenses incurred) under certain circumstances for liabilities arising under the Securities Act of 1933, as amended (the “Securities Act”). The Registrant’s Restated Articles of Incorporation, as amended, and Amended and Restated Bylaws provide for indemnification of its directors, officers, employees and other agents to the maximum extent permitted by the California Corporations Code. In addition, the Registrant has entered into Indemnification Agreements with each of its directors and officers, and maintains directors’ and officers’ liability insurance under which its directors and officers are insured against loss (as defined in the policy) as a result of certain claims brought against them in such capacities.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

|

| | | | | | |

Exhibit |

| Incorporated by Reference | Filed |

Number | Exhibit Description | Form | File No. | Exhibit | Filing Date | Herewith |

|

|

|

|

|

|

|

4.1 | Restated Articles of Incorporation of Cisco Systems, Inc., as currently in effect. | S-3 | 333-56004 | 4.1 | February 21, 2001 |

|

|

|

|

|

|

|

|

4.2 | Amended and Restated Bylaws of Cisco Systems, Inc., as currently in effect. | 8-K | 000-18225 | 3.1 | October 4, 2012 |

|

|

|

|

|

|

|

|

5.1 | Opinion and Consent of Fenwick & West LLP. |

|

|

|

| X |

|

|

|

|

|

|

|

23.1 | Consent of Independent Registered Public Accounting Firm. |

|

|

|

| X |

|

|

|

|

|

|

|

23.2 | Consent of Fenwick & West LLP (contained in Exhibit 5.1). |

|

|

|

| X |

|

|

|

|

|

|

|

24 | Power of Attorney (incorporated by reference to Page II‑4 of this Registration Statement). |

|

|

|

| X |

|

|

|

|

|

|

|

99.1 | Memoir Systems, Inc. 2009 Stock Incentive Plan. |

|

|

|

| X |

|

|

|

|

|

|

|

99.2 | Memoir Systems, Inc. 2014 Equity Incentive Plan. |

|

|

|

| X |

|

|

|

|

|

|

|

99.3 | Forms of Cisco Systems, Inc. Stock Option Assumption Agreement. | | | | | X |

| | | | | | |

99.4 | Forms of Cisco Systems, Inc. Restricted Stock Unit Assumption Agreement. |

|

|

|

| X |

Item 9. Undertakings.

A. The undersigned Registrant hereby undertakes: (1) to file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement: (i) to include any prospectus required by Section 10(a)(3) of the Securities Act; (ii) to reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration Statement — notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and (iii) to include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement; provided, however, that clauses (1)(i) and (1)(ii) shall not apply if the information required to be included in a post-effective amendment by those clauses is contained in periodic reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement; (2) that, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and (3) to remove from registration by means of a post-effective amendment any of the securities being registered that remain unsold at the termination of the offering.

B. The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference into this Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

C. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the indemnification provisions summarized in Item 6, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of San Jose, State of California, on October 17, 2014.

|

|

Cisco Systems, Inc. |

|

By: /s/ John T. Chambers |

John T. Chambers |

Chairman and Chief Executive Officer |

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below does hereby constitute and appoint John T. Chambers, Frank A. Calderoni and Mark Chandler, and each of them, with full power of substitution, such person’s true and lawful attorneys-in-fact and agents for such person, with full power and authority to do any and all acts and things and to execute any and all instruments which said attorneys and agents, and any one of them, determine may be necessary or advisable or required to enable said corporation to comply with the Securities Act of 1933, as amended, and any rules or regulations or requirements of the Securities and Exchange Commission in connection with this Registration Statement. Without limiting the generality of the foregoing power and authority, the powers granted include the power and authority to sign the names of the undersigned officers and directors in the capacities indicated below to this Registration Statement, to any and all amendments, both pre-effective and post-effective, and supplements to this Registration Statement, and to any and all instruments or documents filed as part of or in conjunction with this Registration Statement or amendments or supplements thereof, and each of the undersigned hereby ratifies and confirms that all said attorneys and agents, or any one of them, shall do or cause to be done by virtue hereof. This Power of Attorney may be signed in several counterparts.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons on behalf of the Registrant in the capacities and on the dates indicated.

|

| | |

Signature | Title | Date |

| | |

/s/ John T. Chambers | Chairman and Chief Executive Officer | October 17, 2014 |

John T. Chambers | (Principal Executive Officer) | |

| | |

/s/ Frank A. Calderoni | Executive Vice President and Chief Financial Officer | October 17, 2014 |

Frank A. Calderoni | (Principal Financial Officer) | |

| | |

/s/ Prat S. Bhatt | Senior Vice President, Corporate Controller and Chief Accounting Officer | October 17, 2014 |

Prat S. Bhatt | (Principal Accounting Officer) | |

| | |

| | |

| | |

|

| | |

Signature | Title | Date |

| | |

| | |

/s/ Carol A. Bartz | Lead Independent Director | October 17, 2014 |

Carol A. Bartz | | |

| | |

| Director | |

Marc Benioff | | |

| | |

/s/ M. Michele Burns | Director | October 17, 2014 |

M. Michele Burns | | |

| | |

/s/ Michael D. Capellas | Director | October 17, 2014 |

Michael D. Capellas | | |

| | |

/s/ Brian L. Halla | Director | October 17, 2014 |

Brian L. Halla | | |

| | |

/s/ John L. Hennessy | Director | October 17, 2014 |

Dr. John L. Hennessy | | |

| | |

/s/ Kristina M. Johnson | Director | October 17, 2014 |

Dr. Kristina M. Johnson | | |

| | |

/s/ Roderick C. McGeary | Director | October 17, 2014 |

Roderick C. McGeary | | |

| | |

| Director | |

Arun Sarin | | |

| | |

/s/ Steven M. West | Director | October 17, 2014 |

Steven M. West | | |

EXHIBIT INDEX

|

| | | | | | |

Exhibit |

| Incorporated by Reference | Filed |

Number | Exhibit Description | Form | File No. | Exhibit | Filing Date | Herewith |

| | | | | | |

4.1 | Restated Articles of Incorporation of Cisco Systems, Inc., as currently in effect. | S-3 | 333-56004 | 4.1 | February 21, 2001 |

|

| | | | | | |

4.2 | Amended and Restated Bylaws of Cisco Systems, Inc., as currently in effect. | 8-K | 000-18225 | 3.1 | October 4, 2012 |

|

| | | | | | |

5.1 | Opinion and Consent of Fenwick & West LLP. |

|

|

|

| X |

| | | | | | |

23.1 | Consent of Independent Registered Public Accounting Firm. |

|

|

|

| X |

| | | | | | |

23.2 | Consent of Fenwick & West LLP (contained in Exhibit 5.1). |

|

|

|

| X |

| | | | | | |

24 | Power of Attorney (incorporated by reference to Page II‑4 of this Registration Statement). |

|

|

|

| X |

| | | | | | |

99.1 | Memoir Systems, Inc. 2009 Stock Incentive Plan. |

|

|

|

| X |

| | | | | | |

99.2 | Memoir Systems, Inc. 2014 Equity Incentive Plan. |

|

|

|

| X |

| |

|

|

|

|

|

99.3 | Forms of Cisco Systems, Inc. Stock Option Assumption Agreement. | | | | | X |

| | | | | | |

99.4 | Forms of Cisco Systems, Inc. Restricted Stock Unit Assumption Agreement. |

|

|

|

| X |

Exhibit 5.1

October 17, 2014

Cisco Systems, Inc.

170 West Tasman Drive

San Jose, CA 95134-1706

Dear Gentlemen/Ladies:

At your request, we have examined the Registration Statement on Form S-8 (the “Registration Statement”) to be filed by Cisco Systems, Inc., a California corporation (“Cisco” or the “Company”), with the Securities and Exchange Commission (the “Commission”) on or about October 17, 2014 in connection with the registration under the Securities Act of 1933, as amended, of an aggregate of 403,103 shares of Cisco’s Common Stock (the “Shares”) subject to issuance by Cisco upon the exercise of stock options (the “Options”) granted under the Memoir Systems, Inc. 2009 Stock Incentive Plan (the “2009 Plan”) and the settlement of Restricted Stock Units (the “RSUs”) granted under the Memoir Systems, Inc. 2014 Equity Incentive Plan (the “2014 Plan” and collectively with the 2009 Plan, the “Plans”) and assumed by Cisco in accordance with the terms of an Agreement and Plan of Merger, dated as of September 16, 2014 (the “Merger Agreement”) by and among Cisco, Mendocino Merger Corp., a Delaware corporation and a wholly-owned subsidiary of Cisco, Memoir Systems, Inc., a Delaware corporation (“Memoir Systems”) and the Shareholder Representative (as that term is defined in the Merger Agreement). In rendering this opinion, we have examined such matters of law and fact as we have deemed necessary in order to render the opinion set forth herein, which included examination of the following:

| |

(1) | the Company’s Restated Articles of Incorporation, filed with the California Secretary of State on January 18, 2001 and certified by the California Secretary of State on March 4, 2011, as filed with the Commission as an exhibit to the Form S-3 registration statement filed by the Company with the Commission on February 21, 2001 (the “Restated Articles”); |

| |

(2) | the Company’s Amended and Restated Bylaws, as filed with the Commission as an exhibit to the Form 8-K filed by the Company with the Commission on October 4, 2012 (the “Restated Bylaws”); |

| |

(3) | the Registration Statement, together with the Exhibits filed as a part thereof or incorporated therein by reference; |

| |

(4) | the Prospectus prepared in connection with the Registration Statement; |

| |

(5) | the minutes of meetings and actions by written consent of the Company’s Board of Directors at which, or pursuant to which, the Restated Articles and Restated Bylaws were approved and resolutions that a representative of the Company has represented to us were adopted at a meeting of the Compensation and Management Development Committee of the Company’s Board of Directors assuming the Options and the RSUs; |

| |

(6) | the stock records that the Company has provided to us (consisting of (i) a report from the Company’s transfer agent as to the outstanding shares of the Company’s capital stock as of October 16, 2014 and a verbal confirmation from the Company’s transfer agent as to the outstanding shares of the Company’s |

capital stock on October 17, 2014; and (ii) a summary report from the Company as of October 16, 2014 of outstanding restricted stock units, options and warrants to purchase the Company’s capital stock and stock reserved for issuance thereunder upon the exercise or settlement of restricted stock units, options and warrants to be granted in the future);

| |

(7) | the Merger Agreement and all exhibits thereto, as well as the Certificate of Merger filed with the Delaware Secretary of State with respect to the Merger Agreement on October 13, 2014; |

| |

(8) | the Plans, and the forms of agreements used thereunder furnished to us by the Company (such forms of agreements, the “Plan Agreements”); |

| |

(9) | the forms of Cisco’s Stock Option Assumption Agreements (the “Option Assumption Agreements”) and Restricted Stock Unit Assumption Agreements (the “RSU Assumption Agreements”) to be used by the Company to assume the Options and RSUs originally issued under the Plans and assumed by the Company under the Merger Agreement, as filed by the Company with the Commission as exhibits to the Registration Statement; |

| |

(10) | a Certificate of Status issued by the office of the Secretary of State of the State of California, on October 14, 2014, stating that the Company is a California corporation, in good standing (together with the certificate of good standing described in item 11 below, the “Certificates of Good Standing”); and |

| |

(11) | a Certificate of Good Standing from the California Franchise Tax Board, dated October 15, 2014, stating that the Company is in good standing with that agency. |

In our examination of documents for purposes of this opinion, we have assumed, and express no opinion as to, the genuineness of all signatures on original documents, the authenticity and completeness of all documents submitted to us as originals, the conformity to originals and completeness of all documents submitted to us as copies, the legal capacity of all persons or entities executing the same, the lack of any undisclosed termination, modification, waiver or amendment to any such document and the due authorization, execution and delivery of all such documents where due authorization, execution and delivery are prerequisites to the effectiveness thereof. We have also assumed that the certificates representing the Shares have been, or will be, when issued, properly signed by authorized officers of the Company or their agents.

As to matters of fact relevant to this opinion, we have relied solely upon our examination of the documents referred to above and representations made to us by representatives of the Company and have assumed the current accuracy and completeness of the information obtained from such documents and representations. We have made no independent investigation or other attempt to verify the accuracy of any of such information or to determine the existence or non-existence of any other factual matters.

With respect to our opinion expressed in paragraph (1) below as to the valid existence and good standing of the Company with the State of California, we have relied solely upon the Certificates of Good Standing and representations made to us by the Company.

We are admitted to practice law in the State of California, and we render this opinion only with respect to, and express no opinion herein concerning the application or effect of the laws of any jurisdiction other than, the existing laws of the United States of America and of the State of California.

This opinion is based upon the customary practice of lawyers who regularly give, and lawyers who regularly advise opinion recipients regarding, opinions of the kind set forth in this opinion letter, including customary practice as described in bar association reports.

Based upon the foregoing, it is our opinion that:

(1) The Company is a corporation validly existing, in good standing, under the laws of the State of California; and

(2) The 403,103 Shares that may be issued and sold by the Company upon the exercise of the Options and the settlement of the RSUs, when issued, sold and delivered in accordance with the Plans, the applicable Plan Agreements, Option Assumption Agreements, and notices of restricted stock unit agreements and RSU Assumption Agreements entered into thereunder, and in the manner and for the consideration stated in the Registration Statement and the Prospectus, will be validly issued, fully paid and nonassessable.

We consent to the use of this opinion as an exhibit to the Registration Statement and further consent to all references to us, if any, in the Registration Statement, the Prospectus constituting a part thereof and any amendments thereto. This opinion is intended solely for use in connection with issuance and sale of the Shares subject to the Registration Statement and is not to be relied upon for any other purpose. This opinion is rendered as of the date first written above and is based solely on our understanding of facts in existence as of such date after the aforementioned examination. We assume no obligation to advise you of any fact, circumstance, event or change in the law or the facts that may hereafter be brought to our attention whether or not such occurrence would affect or modify any of the opinions expressed herein.

|

| |

| Yours truly, FENWICK & WEST LLP By: /s/ Daniel J. Winnike Daniel J. Winnike, a Partner |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated September 9, 2014 relating to the consolidated financial statements, financial statement schedule and the effectiveness of internal control over financial reporting, which appears in Cisco Systems, Inc.’s Annual Report on Form 10-K for the year ended July 26, 2014.

/s/ PricewaterhouseCoopers LLP

San Jose, California

October 17, 2014

MEMOIR SYSTEMS, INC.

2009 STOCK INCENTIVE PLAN

Adopted by the Board on April 21, 2009

Approved by the Shareholders on April 21, 2009

TABLE OF CONTENTS

|

| | | |

| | Page |

SECTION 1. | PURPOSE. | 1 |

|

SECTION 2. | DEFINITIONS. | 1 |

|

2.1 | “Board” | 1 |

|

2.2 | “Change in Control” | 1 |

|

2.3 | “Code” | 2 |

|

2.4 | “Committee” | 2 |

|

2.5 | “Company” | 2 |

|

2.6 | “Consultant” | 2 |

|

2.7 | “Disability” | 2 |

|

2.8 | “Employee” | 2 |

|

2.9 | “Exchange Act” | 2 |

|

2.10 | “Exercise Price” | 2 |

|

2.11 | “Fair Market Value” | 2 |

|

2.12 | “ISO” | 2 |

|

2.13 | “NSO” | 3 |

|

2.14 | “Option” | 3 |

|

2.15 | “Optionee” | 3 |

|

2.16 | “Outside Director” | 3 |

|

2.17 | “Parent” | 3 |

|

2.18 | “Plan” | 3 |

|

2.19 | “Purchase Price” | 3 |

|

2.20 | “Purchaser” | 3 |

|

2.21 | “Restricted Share Agreement” | 3 |

|

2.22 | “Securities Act” | 3 |

|

2.23 | “Service” | 3 |

|

2.24 | “Share” | 3 |

|

2.25 | “Stock” | 3 |

|

2.26 | “Stock Option Agreement” | 4 |

|

2.27 | “Subsidiary” | 4 |

|

2.28 | “Ten-Percent Shareholder” | 4 |

|

SECTION 3. | ADMINISTRATION. | 4 |

|

3.1 | General Rule | 4 |

|

3.2 | Board Authority and Responsibility | 4 |

|

SECTION 4. | ELIGIBILITY. | 4 |

|

4.1 | General Rule | 4 |

|

SECTION 5. | STOCK SUBJECT TO PLAN. | 4 |

|

5.1 | Share Limit | 4 |

|

5.2 | Additional Shares | 5 |

|

|

| | | |

SECTION 6. | RESTRICTED SHARES. | 5 |

|

6.1 | Restricted Share Agreement | 5 |

|

6.2 | Duration of Offers and Nontransferability of Purchase Rights | 5 |

|

6.3 | Purchase Price | 5 |

|

6.4 | Repurchase Rights and Transfer Restrictions | 5 |

|

SECTION 7. | STOCK OPTIONS. | 5 |

|

7.1 | Stock Option Agreement | 5 |

|

7.2 | Number of Shares; Kind of Option | 5 |

|

7.3 | Exercise Price | 6 |

|

7.4 | Term | 6 |

|

7.5 | Exercisability | 6 |

|

7.6 | Repurchase Rights and Transfer Restrictions | 6 |

|

7.7 | Transferability of Options | 6 |

|

7.8 | Exercise of Options on Termination of Service | 7 |

|

7.9 | No Rights as a Shareholder | 7 |

|

7.10 | Modification, Extension and Renewal of Options | 7 |

|

SECTION 8. | PAYMENT FOR SHARES. | 7 |

|

8.1 | General | 7 |

|

8.2 | Surrender of Stock | 7 |

|

8.3 | Services Rendered | 8 |

|

8.4 | Promissory Notes | 8 |

|

8.5 | Exercise/Sale | 8 |

|

8.6 | Exercise/Pledge | 8 |

|

8.7 | Other Forms of Payment | 8 |

|

SECTION 9. | ADJUSTMENT OF SHARES. | 8 |

|

9.1 | General | 8 |

|

9.2 | Dissolution or Liquidation | 9 |

|

9.3 | Mergers and Consolidations | 9 |

|

9.4 | Reservation of Rights | 9 |

|

SECTION 10. | REPURCHASE RIGHTS. | 9 |

|

10.1 | Company’s Right To Repurchase Shares | 9 |

|

SECTION 11. | WITHHOLDING AND OTHER TAXES. | 9 |

|

11.1 | General | 9 |

|

11.2 | Share Withholding | 10 |

|

11.3 | Cashless Exercise/Pledge | 10 |

|

11.4 | Other Forms of Payment | 10 |

|

11.5 | Employer Fringe Benefit Taxes | 10 |

|

SECTION 12. | SECURITIES LAW REQUIREMENTS. | 10 |

|

12.1 | General | 10 |

|

12.2 | Dividend Rights | 10 |

|

SECTION 13. | NO RETENTION RIGHTS. | 10 |

|

SECTION 14. | DURATION AND AMENDMENTS. | 11 |

|

14.1 | Term of the Plan | 11 |

|

|

| | | |

14.2 | Right to Amend or Terminate the Plan | 11 |

|

14.3 | Effect of Amendment or Termination | 11 |

|

SECTION 15. | EXECUTION. | 11 |

|

MEMOIR SYSTEMS, INC.

2009 STOCK INCENTIVE PLAN

SECTION 1.PURPOSE.

The Plan was adopted by the Board of Directors effective April 21, 2009. The purpose of the Plan is to offer selected service providers the opportunity to acquire equity in the Company through awards of Options (which may constitute incentive stock options or nonstatutory stock options) and the award or sale of Shares.

The award of Options and the award or sale of Shares under the Plan is intended to be exempt from the securities qualification requirements of the California Corporations Code by satisfying the exemption under section 25102(o) of the California Corporations Code. However, awards of Options and the award or sale of Shares may be made in reliance upon other state securities law exemptions. To the extent that such other exemptions are relied upon, the terms of this Plan which are included only to comply with section 25102(o) shall be disregarded to the extent provided in the Stock Option Agreement or Restricted Share Agreement. In addition, to the extent that section 25102(o) or the regulations promulgated thereunder are amended to delete any requirements set forth in such law or regulations, the terms of this Plan which are included only to comply with section 25102(o) or the regulations promulgated thereunder as in effect prior to any such amendment shall be disregarded to the extent permitted by applicable law.

SECTION 2. DEFINITIONS.

| |

2.1 | “Board” shall mean the Board of Directors of the Company, as constituted from time to time. |

| |

2.2 | “Change in Control” shall mean the occurrence of any of the following events: |

| |

(a) | The consummation of a merger or consolidation of the Company with or into another entity or any other corporate reorganization, if persons who were not shareholders of the Company immediately prior to such merger, consolidation or other reorganization own immediately after such merger, consolidation or other reorganization fifty percent (50%) or more of the voting power of the outstanding securities of each of (A) the continuing or surviving entity and (B) any direct or indirect parent corporation of such continuing or surviving entity; |

| |

(b) | The consummation of the sale, transfer or other disposition of all or substantially all of the Company’s assets or the shareholders of the Company approve a plan of complete liquidation of the Company; or |

| |

(c) | Any “person” (as defined below) who, by the acquisition or aggregation of securities, is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company representing fifty percent (50%) or more of the combined voting power of the Company’s then outstanding securities ordinarily (and apart from rights accruing under special circumstances) having the right to vote at elections of directors (the “Base Capital Stock”); except |

that any change in the relative beneficial ownership of the Company’s securities by any person resulting solely from a reduction in the aggregate number of outstanding shares of Base Capital Stock, and any decrease thereafter in such person’s ownership of securities, shall be disregarded until such person increases in any manner, directly or indirectly, such person’s beneficial ownership of any securities of the Company.

For purposes of Section 2.2(c), the term “person” shall have the same meaning as when used in sections 13(d) and 14(d) of the Exchange Act but shall exclude (1) a trustee or other fiduciary holding securities under an employee benefit plan maintained by the Company or a Parent or Subsidiary and (2) a corporation owned directly or indirectly by the shareholders of the Company in substantially the same proportions as their ownership of the Stock.

Notwithstanding the foregoing, the term “Change in Control” shall not include (a) a transaction the sole purpose of which is to change the state of the Company’s incorporation, (b) a transaction the sole purpose of which is to form a holding company that will be owned in substantially the same proportions by the persons who held the Company’s securities immediately before such transaction, (c) a transaction the sole purpose of which is to make an initial public offering of the Company’s Stock or (d) any change in the beneficial ownership of the securities of the Company as a result of a private financing of the Company that is approved by the Board.

| |

2.3 | “Code” shall mean the Internal Revenue Code of 1986, as amended. |

| |

2.4 | “Committee” shall mean the committee designated by the Board, which is authorized to administer the Plan, as described in Section 3 hereof. |

| |

2.5 | “Company” shall mean Memoir Systems, Inc., a California corporation. |

| |

2.6 | “Consultant” shall mean a consultant or advisor who is not an Employee or Outside Director and who performs bona fide services for the Company, a Parent or Subsidiary. |

| |

2.7 | “Disability” shall mean a condition that renders an individual unable to engage in substantial gainful activity by reason of any medically determinable physical or mental impairment. |

| |

2.8 | “Employee” shall mean any individual who is a common-law employee of the Company, a Parent or a Subsidiary and who is an “employee” within the meaning of section 3401(c) of the Code and regulations issued thereunder. |

| |

2.9 | “Exchange Act” shall mean the U.S. Securities and Exchange Act of 1934, as amended. |

| |

2.10 | “Exercise Price” shall mean the amount for which one Share may be purchased upon the exercise of an Option, as specified in a Stock Option Agreement. |

| |

2.11 | “Fair Market Value” means, with respect to a Share, the market price of one Share of Stock, determined by the Board in good faith. Such determination shall be conclusive and binding on all persons. |

| |

2.12 | “ISO” shall mean an incentive stock option described in section 422(b) of the Code. |

| |

2.13 | “NSO” shall mean a stock option that is not an ISO. |

| |

2.14 | “Option” shall mean an ISO or NSO granted under the Plan and entitling the holder to purchase Shares. |

| |

2.15 | “Optionee” shall mean an individual or estate that holds an Option. |

| |

2.16 | “Outside Director” shall mean a member of the Board of the Company, a Parent or a Subsidiary who is not an Employee. |

| |

2.17 | “Parent” shall mean any corporation (other than the Company) in an unbroken chain of corporations ending with the Company, if each of the corporations other than the Company owns stock possessing fifty percent (50%) or more of the total combined voting power of all classes of stock in one of the other corporations in such chain. A corporation that attains the status of a Parent on a date after the adoption of the Plan shall be considered a Parent commencing as of such date. |

| |

2.18 | “Plan” shall mean the Memoir Systems, Inc. 2009 Stock Incentive Plan. |

| |

2.19 | “Purchase Price” shall mean the consideration for which one Share may be acquired under the Plan (other than upon exercise of an Option). |

| |

2.20 | “Purchaser” shall mean a person to whom the Board has offered the right to acquire Shares under the Plan (other than upon exercise of an Option). |

| |

2.21 | “Restricted Share Agreement” shall mean the agreement between the Company and a Purchaser who acquires Shares under the Plan that contains the terms, conditions and restrictions pertaining to the acquisition of such Shares. |

| |

2.22 | “Securities Act” shall mean the U.S. Securities Act of 1933, as amended. |

| |

2.23 | “Service” shall mean service as an Employee, a Consultant or an Outside Director, subject to such further limitations as may be set forth in the applicable Stock Option Agreement or Restricted Share Agreement. Service shall be deemed to continue during a bona fide leave of absence approved by the Company in writing if and to the extent that continued crediting of Service for purposes of the Plan is expressly required by the terms of such leave or by applicable law, as determined by the Company. However, for purposes of determining whether an Option is entitled to ISO status, and to the extent required under the Code, an Employee’s employment will be treated as terminating ninety (90) days after such Employee went on leave, unless such Employee’s right to return to active work is guaranteed by law or by a contract or such Employee immediately returns to active work. The Company determines which leaves count toward Service, and when Service terminates for all purposes under the Plan. |

| |

2.24 | “Share” shall mean one share of Stock, as adjusted in accordance with Section 9 (if applicable). |

| |

2.25 | “Stock” shall mean the common stock of the Company. |

| |

2.26 | “Stock Option Agreement” shall mean the agreement between the Company and an Optionee which contains the terms, conditions and restrictions pertaining to the Optionee’s Option. |

| |

2.27 | “Subsidiary” means any corporation (other than the Company) in an unbroken chain of corporations beginning with the Company, if each of the corporations other than the last corporation in the unbroken chain owns stock possessing fifty percent (50%) or more of the total combined voting power of all classes of stock in one of the other corporations in such chain. A corporation that attains the status of a Subsidiary on a date after the adoption of the Plan shall be considered a Subsidiary commencing as of such date. |

| |

2.28 | “Ten-Percent Shareholder” means an individual who owns more than ten percent (10%) of the total combined voting power of all classes of outstanding stock of the Company, its Parent or any of its Subsidiaries. In determining stock ownership for purposes of this Section 2.28, the attribution rules of section 424(d) of the Code shall be applied. |

SECTION 3. ADMINISTRATION.

| |

3.1 | General Rule. The Plan shall be administered by the Board. However, the Board may delegate any or all administrative functions under the Plan otherwise exercisable by the Board to one or more Committees. Each Committee shall consist of at least two directors of the Board who have been appointed by the Board. Each Committee shall have the authority and be responsible for such functions as the Board has assigned to it. If a Committee has been appointed, any reference to the Board in the Plan shall be construed as a reference to the Committee to whom the Board has assigned a particular function. |

| |

3.2 | Board Authority and Responsibility. Subject to the provisions of the Plan, the Board shall have full authority and discretion to take any actions it deems necessary or advisable for the administration of the Plan. All decisions, interpretations and any other actions of the Board with respect to the Plan shall be final and binding on all persons deriving rights under the Plan. |

SECTION 4. ELIGIBILITY.

| |

4.1 | General Rule. Only Employees shall be eligible for the grant of ISOs. Only Employees, Consultants and Outside Directors shall be eligible for the grant of NSOs or the award or sale of Shares. |

SECTION 5. STOCK SUBJECT TO PLAN.

| |

5.1 | Share Limit. Subject to Sections 5.2 and 9, the aggregate number of Shares which may be issued under the Plan shall not exceed 1,000,000 Shares. The number of Shares which are subject to Options or other rights outstanding at any time shall not exceed the number of Shares which then remain available for issuance under the Plan. The Company, during the term of the Plan, shall at all times reserve and keep available sufficient Shares to satisfy the requirements of the Plan. Shares offered under the Plan may be authorized but unissued Shares. |

| |

5.2 | Additional Shares. In the event that any outstanding Option or other right expires or is canceled for any reason, the Shares allocable to the unexercised portion of such Option or other right shall remain available for issuance pursuant to the Plan. If a Share previously issued under the Plan is reacquired by the Company pursuant to a forfeiture provision, right of repurchase or right of first refusal, then such Share shall again become available for issuance under the Plan; provided, however, that unless the Share was acquired pursuant to a forfeiture provision, the reissuance of such Share shall reduce the number of Shares which then remain available for issuance under the Plan. |

SECTION 6. RESTRICTED SHARES.

| |

6.1 | Restricted Share Agreement. Each award or sale of Shares under the Plan (other than upon exercise of an Option) shall be evidenced by a Restricted Share Agreement between the Purchaser and the Company. Such award or sale shall be subject to all applicable terms and conditions of the Plan and may be subject to any other terms and conditions imposed by the Board, as set forth in the Restricted Share Agreement, that are not inconsistent with the Plan. The provisions of the various Restricted Share Agreements entered into under the Plan need not be identical. |

| |

6.2 | Duration of Offers and Nontransferability of Purchase Rights. Any right to acquire Shares (other than an Option) shall automatically expire if not exercised by the Purchaser within thirty (30) days after the Company communicates the grant of such right to the Purchaser. Such right shall be nontransferable and shall be exercisable only by the Purchaser to whom the right was granted. |

| |

6.3 | Purchase Price. The Board shall determine the amount of the Purchase Price in its sole discretion. The Purchase Price shall be payable in a form described in Section 8. |

| |

6.4 | Repurchase Rights and Transfer Restrictions. Each award or sale of Shares shall be subject to such forfeiture conditions, rights of repurchase, rights of first refusal and other transfer restrictions as the Board may determine, subject to the requirements of Section 10. Such restrictions shall be set forth in the applicable Restricted Share Agreement and shall apply in addition to any restrictions otherwise applicable to holders of Shares generally. |

SECTION 7. STOCK OPTIONS.

| |

7.1 | Stock Option Agreement. Each grant of an Option under the Plan shall be evidenced by a Stock Option Agreement between the Optionee and the Company. The Option shall be subject to all applicable terms and conditions of the Plan and may be subject to any other terms and conditions imposed by the Board, as set forth in the Stock Option Agreement, which are not inconsistent with the Plan. The provisions of the various Stock Option Agreements entered into under the Plan need not be identical. |

| |

7.2 | Number of Shares; Kind of Option. Each Stock Option Agreement shall specify the number of Shares that are subject to the Option and shall provide for the adjustment of such number in accordance with Section 9. The Stock Option Agreement shall also specify whether the Option is intended to be an ISO or an NSO. |

| |

7.3 | Exercise Price. Each Stock Option Agreement shall set forth the Exercise Price, which shall be payable in a form described in Section 8. Subject to the following requirements, the Exercise Price under any Option shall be determined by the Board in its sole discretion: |

| |

(a) | Minimum Exercise Price for ISOs. The Exercise Price per Share of an ISO shall not be less than one hundred percent (100%) of the Fair Market Value of a Share on the date of grant; provided, however, that the Exercise Price per Share of an ISO granted to a Ten-Percent Shareholder shall not be less than one hundred ten percent (110%) of the Fair Market Value of a Share on the date of grant. |

| |

(b) | Minimum Exercise Price for NSOs. The Exercise Price per Share of an NSO shall not be less than one-hundred percent (100%) of the Fair Market Value of a Share on the date of grant. |

| |

7.4 | Term. Each Stock Option Agreement shall specify the term of the Option. The term of an Option shall in no event exceed ten (10) years from the date of grant. The term of an ISO granted to a Ten-Percent Shareholder shall not exceed five (5) years from the date of grant. Subject to the foregoing, the Board in its sole discretion shall determine when an Option shall expire. |

| |

7.5 | Exercisability. Each Stock Option Agreement shall specify the date when all or any installment of the Option is to become exercisable; provided, however, that no Option shall be exercisable unless the Optionee has delivered to the Company an executed copy of the Stock Option Agreement. Subject to the following restrictions, the Board in its sole discretion shall determine when all or any installment of an Option is to become exercisable and may, in its discretion, provide for accelerated exercisability in the event of a Change in Control or other events: |

| |

(a) | Options Granted to Outside Directors. The exercisability of an Option granted to an Optionee for service as an Outside Director shall be automatically accelerated in full in the event of a Change in Control. |

| |

(b) | Early Exercise. A Stock Option Agreement may permit the Optionee to exercise the Option as to Shares that are subject to a right of repurchase by the Company in accordance with the requirements of Section 10.1. |

| |

7.6 | Repurchase Rights and Transfer Restrictions. Shares purchased on exercise of Options shall be subject to such forfeiture conditions, rights of repurchase, rights of first refusal and other transfer restrictions as the Board may determine, subject to the requirements of Section 10. Such restrictions shall be set forth in the applicable Stock Option Agreement and shall apply in addition to any restrictions otherwise applicable to holders of Shares generally. |

| |

7.7 | Transferability of Options. During an Optionee’s lifetime, his or her Options shall be exercisable only by the Optionee or by the Optionee’s guardian or legal representatives, and shall not be transferable other than by beneficiary designation, will or the laws of descent and distribution. Notwithstanding the foregoing, however, to the extent permitted by the Board in its sole discretion, an NSO may be transferred by the Optionee to a revocable trust |

or to one or more family members or a trust established for the benefit of the Optionee and/or one or more family members to the extent permitted by section 260.140.41(c) of Title 10 of the California Code of Regulations and Rule 701 of the Securities Act.

| |

7.8 | Exercise of Options on Termination of Service. Each Option shall set forth the extent to which the Optionee shall have the right to exercise the Option following termination of the Optionee’s Service. Each Stock Option Agreement shall provide the Optionee with the right to exercise the Option following the Optionee’s termination of Service during the Option term, to the extent the Option was exercisable for vested Shares upon termination of Service, for at least thirty (30) days if termination of Service is due to any reason other than cause, death or Disability, and for at least six (6) months after termination of Service if due to death or Disability (but in no event later than the expiration of the Option term). If the Optionee’s Service is terminated for cause, the Stock Option Agreement may provide that the Optionee’s right to exercise the Option terminates immediately on the effective date of the Optionee’s termination. To the extent the Option was not exercisable for vested Shares upon termination of Service, the Option shall terminate when the Optionee’s Service terminates. Subject to the foregoing, such provisions shall be determined in the sole discretion of the Board, need not be uniform among all Options issued pursuant to the Plan, and may reflect distinctions based on the reasons for termination of Service. |

| |

7.9 | No Rights as a Shareholder. An Optionee, or a transferee of an Optionee, shall have no rights as a shareholder with respect to any Shares covered by the Option until such person becomes entitled to receive such Shares by filing a notice of exercise and paying the Exercise Price pursuant to the terms of the Option. No adjustments shall be made, except as provided in Section 9. |

| |

7.10 | Modification, Extension and Renewal of Options. Within the limitations of the Plan, the Board may modify, extend or renew outstanding Options or may accept the cancellation of outstanding Options (to the extent not previously exercised), whether or not granted hereunder, in return for the grant of new Options for the same or a different number of Shares and at the same or a different Exercise Price. The foregoing notwithstanding, no modification of an Option shall, without the consent of the Optionee, materially impair his or her rights or increase the Optionee’s obligations under such Option. |

SECTION 8. PAYMENT FOR SHARES.

| |

8.1 | General. The entire Purchase Price or Exercise Price of Shares issued under the Plan shall be payable in cash, cash equivalents or one of the other forms provided in this Section 8. |

| |

8.2 | Surrender of Stock. To the extent permitted by the Board in its sole discretion, payment may be made in whole or in part by surrendering (in good form for transfer), or attesting to ownership of, Shares which have already been owned by the Optionee; provided, however, that payment may not be made in such form if such action would cause the Company to recognize any (or additional) compensation expense with respect to the Option for financial reporting purposes. Such Shares shall be valued at their Fair Market Value on the date of Option exercise. |

| |

8.3 | Services Rendered. As determined by the Board in its discretion, Shares may be awarded under the Plan in consideration of past services rendered to the Company, a Parent or Subsidiary. |

| |

8.4 | Promissory Notes. To the extent permitted by the Board in its sole discretion, payment may be made in whole or in part with a full-recourse promissory note executed by the Optionee or Purchaser. The interest rate payable under the promissory note shall not be less than the minimum rate required to avoid the imputation of income for U.S. federal income tax purposes. Shares shall be pledged as security for payment of the principal amount of the promissory note, and interest thereon; provided that if the Optionee or Purchaser is a Consultant, such note must be collateralized with such additional security to the extent required by applicable laws. In no event shall the stock certificate(s) representing such Shares be released to the Optionee or Purchaser until such note is paid in full. Subject to the foregoing, the Board shall determine the term, interest rate and other provisions of the note. |

| |

8.5 | Exercise/Sale. To the extent permitted by the Board in its sole discretion, and if a public market for the Shares exists, payment may be made in whole or in part by delivery (on a form prescribed by the Company) of an irrevocable direction to a securities broker approved by the Company to sell Shares and to deliver all or part of the sale proceeds to the Company in payment of all or part of the Exercise Price and any withholding taxes. |

| |

8.6 | Exercise/Pledge. To the extent permitted by the Board in its sole discretion, and if a public market for the Shares exists, payment may be made in whole or in part by delivery (on a form prescribed by the Company) of an irrevocable direction to a securities broker or lender approved by the Company to pledge Shares, as security for a loan, and to deliver all or part of the loan proceeds to the Company in payment of all or part of the Exercise Price and any withholding taxes. |

| |

8.7 | Other Forms of Payment. To the extent permitted by the Board in its sole discretion, payment may be made in any other form that is consistent with applicable laws, regulations and rules. |

SECTION 9. ADJUSTMENT OF SHARES.

| |

9.1 | General. In the event of a subdivision of the outstanding Stock, a declaration of a dividend payable in Shares, a declaration of an extraordinary dividend payable in a form other than Shares in an amount that has a material effect on the Fair Market Value of the Stock, a combination or consolidation of the outstanding Stock into a lesser number of Shares, a recapitalization, a spin-off, a reclassification, or a similar occurrence, the Board shall make equitable adjustments to the following: (i) the number of Shares available for future awards under Section 5; (ii) the number of Shares covered by each outstanding Option; (iii) the Exercise Price under each outstanding Option; and (iv) the price of Shares subject to the Company’s right of repurchase. |

| |

9.2 | Dissolution or Liquidation. To the extent not previously exercised or settled, Options shall terminate immediately prior to the dissolution or liquidation of the Company. |

| |

9.3 | Mergers and Consolidations. In the event that the Company is a party to a merger or other consolidation, or in the event of a transaction providing for the sale of all or substantially all of the Company’s stock or assets, outstanding Options shall be subject to the agreement of merger, consolidation or sale. Such agreement may provide for one or more of the following: (i) the continuation of the outstanding Options by the Company, if the Company is a surviving corporation; (ii) the assumption of the Plan and outstanding Options by the surviving corporation or its parent; (iii) the substitution by the surviving corporation or its parent of options with substantially the same terms for such outstanding Options; (iv) immediate exercisability of such outstanding Options followed by the cancellation of such Options; or (v) settlement of the intrinsic value of the outstanding Options (whether or not then exercisable) in cash or cash equivalents or equity (including cash or equity subject to deferred vesting and delivery consistent with the vesting restrictions applicable to such Options or the underlying Shares) followed by the cancellation of such Options; in each case without the Optionee’s consent. |

| |

9.4 | Reservation of Rights. Except as provided in this Section 9, an Optionee or offeree shall have no rights by reason of any subdivision or consolidation of shares of stock of any class, the payment of any dividend or any other increase or decrease in the number of shares of stock of any class. Any issuance by the Company of shares of stock of any class, or securities convertible into shares of stock of any class, shall not affect, and no adjustment by reason thereof shall be made with respect to, the number or Exercise Price of Shares subject to an Option. The grant of an Option pursuant to the Plan shall not affect in any way the right or power of the Company to make adjustments, reclassifications, reorganizations or changes of its capital or business structure, to merge or consolidate or to dissolve, liquidate, sell or transfer all or any part of its business or assets. |

SECTION 10. REPURCHASE RIGHTS.

| |

10.1 | Company’s Right To Repurchase Shares. The Company shall have the right to repurchase Shares that have been acquired through an award or sale of Shares or exercise of an Option upon termination of the Purchaser’s or Optionee’s Service if provided in the applicable Restricted Share Agreement or Stock Option Agreement. The Board in its sole discretion shall determine when the right to repurchase shall lapse as to all or any portion of the Shares, and may, in its discretion, provide for accelerated vesting in the event of a Change in Control or other events; provided, however, that the right to repurchase shall lapse as to all of the Shares issued to an Outside Director for service as an Outside Director in the event of a Change in Control. |

SECTION 11. WITHHOLDING AND OTHER TAXES.

| |

11.1 | General. An Optionee or Purchaser or his or her successor shall pay, or make arrangements satisfactory to the Board for the satisfaction of, any federal, state, local or foreign withholding tax obligations that may arise in connection with the Plan. The Company shall not be required |

to issue any Shares or make any cash payment under the Plan until such obligations are satisfied.

| |

11.2 | Share Withholding. The Board may permit an Optionee or Purchaser to satisfy all or part of his or her withholding or income tax obligations by having the Company withhold all or a portion of any Shares that would otherwise would be issued to him or her upon exercise of an Option, or by surrendering all or a portion of any Shares that he or she previously acquired; provided, however, that in no event may an Optionee or Purchaser surrender Shares in excess of the legally required withholding amount based on the minimum statutory withholding rates for federal and state tax purposes that apply to supplemental taxable income. Such Shares shall be valued at their Fair Market Value on the date when taxes otherwise would be withheld in cash. Any payment of taxes by assigning Shares to the Company may be subject to restrictions, including any restrictions required by rules of any federal or state regulatory body or other authority. All elections by Optionees or Purchasers to have Shares withheld for this purpose shall be made in such form and under such conditions as the Board may deem necessary or advisable. |

| |

11.3 | Cashless Exercise/Pledge. The Board may provide that if Company Shares are publicly traded at the time of exercise, arrangements may be made to meet the Optionee’s or Purchaser’s withholding obligation by cashless exercise or pledge. |

| |

11.4 | Other Forms of Payment. The Board may permit such other means of tax withholding as it deems appropriate. |

| |

11.5 | Employer Fringe Benefit Taxes. To the extent permitted by applicable federal, state, local and foreign law, an Optionee or Purchaser shall be liable for any fringe benefit tax that may be payable by the Company and/or the Optionee’s or Purchaser’s employer in connection with any award granted to the Optionee or Purchaser under the Plan, which the Company and/or employer may collect by any reasonable method established by the Company and/or employer. |

SECTION 12. SECURITIES LAW REQUIREMENTS.

| |

12.1 | General. Shares shall not be issued under the Plan unless the issuance and delivery of such Shares complies with (or is exempt from) all applicable requirements of law, including (without limitation) the Securities Act, the rules and regulations promulgated thereunder, state securities laws and regulations, and the regulations of any stock exchange or other securities market on which the Company’s securities may then be listed. |

| |

12.2 | Dividend Rights. A Restricted Share Agreement may require that the holders of Shares invest any cash dividends received in additional Shares. Such additional Shares shall be subject to the same conditions and restrictions as the award with respect to which the dividends were paid. |

SECTION 13. NO RETENTION RIGHTS.

No provision of the Plan, or any right or Option granted under the Plan, shall be construed to give any Optionee or Purchaser any right to become an Employee, to be treated as an Employee,

or to continue in Service for any period of time, or restrict in any way the rights of the Company (or Parent or subsidiary to whom the Optionee or Purchaser provides Service), which rights are expressly reserved, to terminate the Service of such person at any time and for any reason, with or without cause, without thereby incurring any liability to him or her.

SECTION 14. DURATION AND AMENDMENTS.

| |

14.1 | Term of the Plan. The Plan, as set forth herein, shall become effective on the date of its adoption by the Board, subject to the approval of the Company’s shareholders. In the event that the shareholders fail to approve the Plan within twelve (12) months after its adoption by the Board, any grants, exercises or sales that have already occurred under the Plan shall be rescinded, and no additional grants, exercises or sales shall be made under the Plan after such date. The Plan shall terminate automatically ten (10) years after its adoption by the Board. The Plan may be terminated on any earlier date pursuant to Section 14.2 below. |

| |

14.2 | Right to Amend or Terminate the Plan. The Board may amend, suspend, or terminate the Plan at any time and for any reason. An amendment of the Plan shall not be subject to the approval of the Company’s shareholders unless it (i) increases the number of Shares available for issuance under the Plan (except as provided in Section 9) or (ii) materially changes the class of persons who are eligible for the grant of Options or the award or sale of Shares. |

| |

14.3 | Effect of Amendment or Termination. No Shares shall be issued or sold under the Plan after the termination thereof, except upon exercise of an Option granted prior to such termination. The termination of the Plan, or any amendment thereof, shall not adversely affect any Shares previously issued or any Option previously granted under the Plan without the holder’s consent. |

SECTION 15. EXECUTION.

To record the adoption of the Plan by the Board on April 21, 2009, effective on such date, the Company has caused its authorized officer to execute the same.

|

|

MEMOIR SYSTEMS, INC. |

/s/ Sundar Iyer |

Sundar Iyer |

President and Chief Executive Officer |

MEMOIR SYSTEMS, INC.

2014 EQUITY INCENTIVE PLAN

SECTION 1.INTRODUCTION.

The Memoir Systems, Inc. 2014 Equity Incentive Plan became effective upon its adoption by the Company’s Board of Directors on the Effective Date, and must be approved by the stockholders of the Company, when required by applicable laws, within twelve (12) months following such date. If the Company’s stockholders do not approve this Plan, no Awards will be granted under this Plan.

The purpose of the Plan is to promote the long-term success of the Company and the creation of stockholder value by offering designated Employees and Consultants an opportunity to share in such long-term success by acquiring a proprietary interest in the Company. The Plan seeks to achieve this purpose by providing for discretionary long-term incentive awards in the form of Awards.

The Plan shall be governed by, and construed in accordance with, the laws of the State of California (except its choice-of-law provisions). Capitalized terms shall have the meaning provided in Section 2 unless otherwise provided in this Plan or any related Stock Option Agreement or Stock Unit Agreement.

SECTION 2. DEFINITIONS.

(a) “Affiliate” means any entity other than a Subsidiary, if the Company and/or one or more Subsidiaries own not less than 50% of such entity.

(b) “Award” means any award of an Option or Stock Unit under the Plan.

(c) “Board” means the Board of Directors of the Company, as constituted from time to time.

(d) “Cashless Exercise” means, to the extent that a Stock Option Agreement so provides and as permitted by applicable law, a program approved by the Committee in which payment may be made all or in part by delivery (on a form prescribed by the Committee) of an irrevocable direction to a securities broker to sell Shares and to deliver all or part of the sale proceeds to the Company in payment of the aggregate Exercise Price and, if applicable, the amount necessary to satisfy the Company’s withholding obligations at the minimum statutory withholding rates, including, but not limited to, U.S. federal and state income taxes, payroll taxes, and foreign taxes, if applicable.

(e) “Cause” means, except as may otherwise be provided in a Participant’s employment agreement or Award agreement, a conviction of a Participant for a felony crime or the failure of a Participant to contest prosecution for a felony crime, or a Participant’s misconduct, fraud or dishonesty (as such terms are defined by the Committee in its sole discretion), or any unauthorized use or disclosure of confidential information or trade secrets, in each case as determined by the Committee, and the Committee’s determination shall be conclusive and binding.

(f) “Change In Control” means, except as may otherwise be provided in a Participant’s employment agreement, Stock Option Agreement or Stock Unit Agreement, the occurrence of any of the following:

(i)A change in the composition of the Board over a period of thirty-six consecutive months or less such that a majority of the Board members ceases, by reason of one or more contested elections for Board membership, to be comprised of individuals who either (A) have been Board members continuously since the beginning of such period or (B) have been elected or nominated for election as Board members during such period by at least a majority of the Board members described in clause (A) who were still in office at the time the Board approved such election or nomination; or

(ii)The acquisition, directly or indirectly, by any person or related group of persons (other than the Company or a person that directly or indirectly controls, is controlled by, or is under common control with, the Company) of beneficial ownership (within the meaning of Rule 13d-3 under the Exchange Act) of securities of the Company representing more than 35% of the total combined voting power of the Company’s then outstanding securities pursuant to a tender or exchange offer made directly to the Company’s shareholders which the Board does not recommend such shareholders accept.

(g) “Code” means the Internal Revenue Code of 1986, as amended, and the regulations and interpretations promulgated thereunder.

(h) “Committee” means a committee described in Section 3.

(i) “Common Stock” means the Company’s common stock.

(j) “Company” means Memoir Systems, Inc., a California corporation.

(k) “Consultant” means an individual who performs bona fide services to the Company, a Parent, a Subsidiary or an Affiliate, other than as an Employee or Director or Non-Employee Director.

(l) “Corporate Transaction” means, except as may otherwise be provided in a Participant’s employment agreement or Award agreement, the occurrence of any of the following shareholder approved transactions:

(i)The consummation of a merger or consolidation of the Company with or into another entity or any other corporate reorganization, if more than 50% of the combined voting power of the continuing or surviving entity’s securities outstanding immediately after such merger, consolidation or other reorganization is owned by persons who were not shareholders of the Company immediately prior to such merger, consolidation or other reorganization; or

(ii)The sale, transfer or other disposition of all or substantially all of the Company’s assets.

A transaction shall not constitute a Corporate Transaction if its sole purpose is to change the state of the Company's incorporation or to create a holding company that will be owned in substantially the same proportions by the persons who held the Company's securities immediately before such transactions.

(m) “Director” means a member of the Board who is also an Employee.

(n) “Disability” means that the Participant is classified as disabled under a long‑term disability policy of the Company or, if no such policy applies, the Participant is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months.

(o) “Effective Date” means September 15, 2014, the date the Plan was adopted by the Company Board of Directors.

(p) “Employee” means any individual who is a common-law employee of the Company, a Parent, a Subsidiary or an Affiliate.

(q) “Exchange Act” means the Securities Exchange Act of 1934, as amended.

(r) “Exercise Price” means, in the case of an Option, the amount for which a Share may be purchased upon exercise of such Option, as specified in the applicable Stock Option Agreement.

(s) “Fair Market Value” means the market price of a Share as determined in good faith by the Committee. The Fair Market Value shall be determined by the following:

(i)If the Shares were traded over-the-counter or listed with NASDAQ on the date in question, then the Fair Market Value shall be equal to the last transaction price quoted by the NASDAQ system for the date in question; or

(ii)if the Common Stock is listed on the New York Stock Exchange or the American Stock Exchange on the date in question, the Fair Market Value is the closing selling price for the Common Stock as such price is officially quoted in the composite tape of transactions on the exchange determined by the Committee to be the primary market for the Common Stock for the date in question; provided, however, that if there is no such reported price for the Common Stock for the date in question under (i) or (ii), then if available such price on the last preceding date for which such price exists shall be determinative of Fair Market Value.

If neither (i) or (ii) are applicable, then the Fair Market Value shall be determined by the Committee in good faith on such basis as it deems appropriate.

Whenever possible, the determination of Fair Market Value by the Committee shall be based on the prices reported in the Western Edition of The Wall Street Journal. Such determination shall be conclusive and binding on all persons.

(t) “Grant” means any grant of an Award under the Plan.

(u) “Incentive Stock Option” or “ISO” means an incentive stock option described in Code 422.

(v) “Non-Employee Director” means a member of the Board who is not an Employee.

(w) “Nonstatuatory Stock Option” or “NSO” means a stock option that is not an ISO.

(x) “Option” means a stock option granted under the Plan entitling the Optionee to purchase Shares.

(y) “Optionee” means an individual, estate or other entity that holds an Option.

(z) “Parent” means any corporation (other than the Company) in an unbroken chain of corporations ending with the Company, if each of the corporations other than the Company owns stock possessing 50% or more of the total combined voting power of all classes of stock in one of the other corporations in such chain. A corporation that attains the status of a Parent on a date after the adoption of the Plan shall be considered a Parent commencing as of such date.

(aa) “Participant” means an individual or estate or other entity that holds an Award.

(bb) “Plan” means this Memoir Systems, Inc. 2014 Equity Incentive Plan, as it may be amended from time to time.

(cc) “SEC” means the Securities and Exchange Commission.

(dd) “Securities Act” means the Securities Act of 1933, as amended.

(ee) “Service” means service as an Employee, Director, Non-Employee Director or Consultant. A Participant’s Service does not terminate when continued service crediting is required by applicable law. Service terminates in any event when an approved leave ends, unless such Employee immediately returns to active work. The Committee determines which leaves count toward Service, and when Service terminates for all purposes under the Plan. Further, unless otherwise determined by the Committee, a Participant’s Service shall not be deemed to have terminated merely because of a change in the capacity in which the Participant provides service to the Company, a Parent, Subsidiary or Affiliate, or a transfer between entities (the Company or any Parent, Subsidiary, or Affiliate); provided that there is no interruption or other termination of Service.

(ff) “Share” means one share of Common Stock, as adjusted pursuant to Sections 8 and 9, and any successor security.

(gg) “Specified Employee” means an Employee, Director, Non-Employee Director or Consultant who has been selected by the Committee to receive a Stock Unit under the Plan.

(hh) “Stock Option Agreement” means the agreement described in Section 6 evidencing each award of an Option.

(ii) “Stock Unit” means a bookkeeping entry representing the equivalent of one Share, as awarded under the Plan.

(jj) “Stock Unit Agreement” means the agreement described in Section 8 evidencing each Award of a Stock Unit.

(kk) “Subsidiary” means any corporation (other than the Company) in an unbroken chain of corporations beginning with the Company, if each of the corporations other than the last corporation in the unbroken chain owns stock possessing 50% or more of the total combined voting power of all classes of stock in one of the other corporations in such chain. A corporation that attains the status of a Subsidiary on a date after the adoption of the Plan shall be considered a Subsidiary commencing as of such date.

SECTION 3. ADMINISTRATION.

(a) General. The Board or a Committee appointed by the Board shall administer the Plan. Members of the Committee shall serve for such period of time as the Board may determine and shall be subject to removal by the Board at any time. The Board may also at any time terminate the functions of the Committee and reassume all powers and authority previously delegated to the Committee.

(b) Authority of the Committee. Subject to the provisions of the Plan, the Committee shall have full authority and sole discretion to take any actions it deems necessary or advisable for the administration of the Plan. Such actions shall include:

(i) selecting Participants who are to receive Options under the Plan;

| |

(ii) | determining the type, number, vesting requirements and other features and conditions of such Options and amending such Options; |

| |

(iii) | selecting Specified Employees who are to receive Stock Units under the Plan; |

| |

(iv) | determining the type, number, vesting requirements and other features and conditions of such Stock Units and amending such Stock Units; |

| |