UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 13, 2014

SIGNET JEWELERS LIMITED

(Exact name of registrant as specified in its charter)

Commission

File Number: 1-32349

|

|

|

| Bermuda |

|

Not Applicable |

| (State or other jurisdiction

of incorporation) |

|

(IRS Employer

Identification No.) |

Clarendon House

2 Church Street

Hamilton

HM11

Bermuda

(Address of principal executive offices, including zip code)

441 296 5872

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

On October 14, 2014, Signet Jewelers Limited (“Signet”) issued a press release

announcing that Signet has appointed Mark Light as Chief Executive Officer of Signet (“CEO”) with effect from November 1, 2014, and the resignation on October 13, 2014 of Michael W. Barnes as CEO with effect from October 31,

2014. Mr. Light, who is currently Signet’s President and Chief Operating Officer, will become Signet’s Chief Executive Officer effective November 1, 2014 and will also join Signet’s board of directors. A copy of the press

release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

Mr. Light, age 52, has been employed

by a wholly-owned subsidiary of Signet, Sterling Jewelers Inc. (the “Company”), and has served as President and Chief Operating Officer for Signet. Previously, Mr. Light was Chief Executive Officer of the Company from 2006 to 2014,

having been President and Chief Operating Officer since 2002.

There is no arrangement or understanding between Mr. Light and any other persons

pursuant to which he was appointed as an officer of Signet, and there is no family relationship between Mr. Light and any directors or executive officers of Signet. Mr. Light is not currently engaged, and has not during the last fiscal

year been engaged, in any transactions with Signet or its subsidiaries that are required to be disclosed under Item 404(a) of Regulation S-K, nor have any such transactions been proposed.

Mr. Light’s employment as CEO will be governed by an employment agreement (the “Employment Agreement”) between Mr. Light and the

Company. During the term of employment, Mr. Light will (i) receive a starting base salary equal to $1,050,000, (ii) be eligible for an annual bonus with a target of 125% of base salary (with a maximum of 250% of base salary),

(iii) be eligible for a long term incentive bonus, and (iv) receive deferred compensation and welfare benefits made available generally from time to time to executive officers of the Company.

During the term of employment and for specified periods thereafter Mr. Light will be subject to confidentiality, non-solicitation, and non-competition

restrictions. In addition, Mr. Light will be subject to all written policies of the Board of Directors of Signet in effect from time to time, including any policies relating to the clawback of compensation.

The Employment Agreement may be terminated for any reason and at any time by the Company, and upon 360 days’ prior written notice by Mr. Light. In

the event that Mr. Light’s employment is terminated by the Company without “cause” (as defined in the Employment Agreement), in addition to any accrued but unpaid benefits or obligations as of the date of termination,

Mr. Light will be entitled to (i) continued payment of base salary then in effect for 12 months, (ii) a pro-rata portion of the annual bonus (if any) for which he was then eligible as of the date of termination for the fiscal year in

which such termination occurs, based on actual performance, and (iii) a lump sum payment equal to the cost of the COBRA premium for 12 months of coverage at the same level as in effect immediately prior to the date of termination. The

Employment Agreement also includes other customary terms, including with respect to disability and death. If Mr. Light is terminated by the Company for cause, he will be entitled to accrued and unpaid salary. If Mr. Light resigns, he will

be entitled to accrued and unpaid benefits. All severance payments and benefits (that were not accrued prior to termination) will be conditioned on the execution of a general release of claims against the Company, its affiliates, subsidiaries and

related parties, and on continued compliance with the restrictive covenants discussed above.

On October 13, 2014, Signet entered into a separation

agreement with Mr. Barnes (the “Separation Agreement”) in connection with his resignation as CEO effective October 31, 2014 (the “Termination Date”). Subject to Mr. Barnes’s continued employment with Signet

through the Termination Date, he will be entitled to receive, in addition to any accrued but unpaid benefits or obligations, (i) continued payment of base salary then in effect for 12 months following the Termination Date, and paid in

accordance with Signet’s standard payroll practices, (ii) an annual bonus for the fiscal year ended

January 31, 2015 (the “2015 Fiscal Year”), based on actual performance for the full 2015 Fiscal Year, (iii) pro-rata vesting in a number of shares of restricted stock that

were granted pursuant to Time-Based Restricted Stock Award Agreements dated as of April 23, 2012, April 26, 2013 and May 8, 2014, and (iv) pro-rata vesting of the portion of restricted stock units (“RSUs”) that

were granted pursuant to RSU Agreements as of April 23, 2012, April 26, 2013 and May 8, 2014, based on actual performance during the applicable performance period for such RSUs.

The termination payments and benefits set forth in the Separation Agreement shall be the sole and exclusive payments and benefits to which Mr. Barnes

shall be entitled in respect of his termination of employment with Signet.

For a period of two years after the Termination Date, Mr. Barnes will be

subject to non-solicitation restrictions. In addition, for a period of one year after the Termination Date, Mr. Barnes will be subject to non-competition restrictions. Mr. Barnes will also be subject to ongoing confidentiality

restrictions. The Separation Agreement also contains other customary provisions.

All severance payments and benefits (that were not accrued prior to

termination) will be conditioned on Mr. Barnes’s (a) execution of a general release of claims against Signet, its affiliates and related parties, (b) full and continued cooperation in good faith with Signet, its subsidiaries and

affiliates in connection with certain matters relating to Signet, its subsidiaries and affiliates, and (c) continued compliance with the restrictive covenants discussed above.

The foregoing description is not complete and is qualified in its entirety by the Separation Agreement dated October 13, 2014 between Signet and

Mr. Barnes, attached as Exhibit 10.1 to this Current Report on Form 8-K, and incorporated herein by reference.

Item 9.01. Financial

Statements and Exhibits.

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 10.1 |

|

Separation Agreement dated October 13, 2014 between Signet Jewelers Limited and Michael W. Barnes. |

|

|

| 99.1 |

|

Press Release of Signet Jewelers Limited, dated October 14, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

| |

|

|

|

SIGNET JEWELERS LIMITED |

|

|

|

| Date: October 14, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Mark A. Jenkins |

|

|

|

|

Name: |

|

Mark A. Jenkins |

|

|

|

|

Title: |

|

Chief Legal Officer & Corporate Secretary |

EXHIBIT INDEX

|

|

|

Exhibit

No. |

|

Description |

|

|

| 10.1 |

|

Separation Agreement dated October 13, 2014 between Signet Jewelers Limited and Michael W. Barnes. |

|

|

| 99.1 |

|

Press Release of Signet Jewelers Limited, dated October 14, 2014. |

Exhibit 10.1

CONFIDENTIAL SEPARATION AGREEMENT

This Confidential Separation Agreement (the “Separation Agreement”) is made this October 13, 2014 (the

“Effective Date”), by and between Signet Jewelers Limited, a Bermuda corporation (including its successors and assigns, and together with its affiliates, the “Company”), and Michael W. Barnes (the

“Executive”).

WHEREAS, Sterling Jewelers, Inc. (“Sterling”) and the Executive previously entered into a

Termination Protection Agreement effective as of February 1, 2014 (the “Protection Agreement”);

WHEREAS, any

capitalized terms not defined herein shall have the meaning as defined in the Protection Agreement; and

WHEREAS, pursuant to the

terms and conditions of the Company’s Long Term Incentive Plan (“Incentive Plan”), the Executive was granted restricted shares of common stock of the Company covering performance periods that include the Company’s fiscal

year ending February 1, 2015 (“Fiscal 2015”) (the “Restricted Stock”) pursuant to Time-Based Restricted Stock Award Agreements dated as of April 23, 2012, April 26, 2013, and May 8, 2014

(the “Restricted Stock Agreements”), and performance-based vesting restricted stock units covering shares of common stock of the Company covering performance periods that include Fiscal 2015 (the “RSUs” and,

together with the Restricted Stock, the “Equity Incentive Awards”) dated as of April 23, 2012, April 26, 2013, and May 8, 2014 (the “RSU Agreements” and, together with the Restricted Stock

Agreements, the “Equity Incentive Agreements”);

WHEREAS, the Executive and the Company both desire to terminate

the Executive’s employment with the Company and its subsidiaries and affiliates pursuant to the terms and conditions of this Separation Agreement, effective as of the Effective Date.

NOW, THEREFORE, in consideration of such services and the mutual covenants and promises herein contained, the Company and the Executive

hereby agree as follows:

1. Termination of Employment. Effective October 31, 2014 (the “Termination Date”),

the Executive’s employment with the Company will be terminated and the Executive will resign from, and/or absent prompt resignation, the Executive agrees to be removed from, his position as Chief Executive Officer of the Company, and from all

offices and directorships held by him in the Company or any of its subsidiaries or affiliates, and shall execute any and all documents reasonably necessary to effect such resignations as requested by the Company. Between the Effective Date and the

Termination Date, the Executive will support a smooth transition of all ongoing and outstanding work in the best interests of the Company, as expressly requested and authorized by the Company.

2. Severance.

(a)

Accrued Benefits. The Executive shall be entitled to receive: (i) the Executive’s base salary in effect at the Termination Date and accrued and unused vacation through the Termination Date in accordance with the Company’s

normal payroll practices; and (ii) Annual Bonus or Incentive Plan payment that has been earned by the Executive for a

completed fiscal year (or with respect to an Incentive Plan payment, a completed performance cycle) ending prior to the Executive’s Termination Date but which remains unpaid as of such

Termination Date.

(b) Termination Payments and Benefits. Subject to the Executive’s continued employment with the Company

through the Termination Date or, if earlier, the Executive’s termination of employment due to death, and the Executive’s timely execution, delivery and non-revocation of this Separation Agreement and the Supplemental Release Agreement

described in Section 4 of this Separation Agreement, the Executive shall be entitled to receive the following termination payments and benefits:

(i) Salary Continuation. The Executive shall be entitled to receive continued payment of the Executive’s annual base salary in

effect immediately at the Termination Date for a period of twelve (12) months following the Termination Date, paid in accordance with the Company’s standard payroll practices as in effect at the Termination Date, with such payments

commencing no earlier than the later date of: (i) ten (10) days following the Supplemental Release Agreement Effective Date as defined in Section 4 of this Separation Agreement; or (ii) the first payroll cycle following

the Supplemental Release Agreement Effective Date, provided, however, any payments due prior to the sixtieth (60th) day after the Termination Date shall be made on such sixtieth (60th) day.

If the Executive participated in the ePaperless Payroll program as of the Termination Date, the Executive’s payments will be direct

deposited on regularly scheduled paydays. If the Executive did not participate in the ePaperless Payroll program, the Executive’s payments will be issued as a live check and mailed to the Executive’s home address.

(ii) Annual Bonus. The Executive shall be entitled to receive the Annual Bonus the Executive otherwise would have received for Fiscal

Year 2015, based on actual performance, which shall be paid to the Executive in a single lump sum during the period commencing on the 15th of April and ending on the 31st of May, 2015.

(iii) Equity Incentive Awards. The Executive shall be entitled to receive, as of the Termination Date, a lump sum payment equal to the

sum (if applicable) of the Incentive Plan payment (or payments, if applicable) in respect of each ongoing performance cycle as of the Termination Date, with the amount to be paid in respect of each performance cycle calculated as:

(A) Restricted Stock: Based on the award the Executive otherwise would have received for a performance cycle, prorated based on the number of calendar days that have elapsed since the beginning of the applicable performance cycle through

the Termination Date, payable in accordance with the Incentive Plan; and (B) RSUs: For each completed fiscal year during a performance cycle, based on actual performance against the portion of the target allocable to such fiscal year,

and for Fiscal Year 2015, based on actual performance against the portion of the target allocable to Fiscal Year 2015, with payment prorated based on the number of calendar days elapsed since the beginning of Fiscal Year 2015 through the Termination

Date, payable upon the conclusion of the applicable performance cycle in accordance with the Incentive Plan (but no later than the “short term deferral” period under Section 409A).

2

(iv) Health Care Coverage. If the Executive elects continued group health insurance

coverage under the Consolidated Omnibus Budget Reconciliation Act (“COBRA”) within the time prescribed by law, the Executive shall be permitted to continue group medical coverage for the Executive and the Executive’s eligible

dependents upon the same terms as provided to senior executive officers of the Company and at the same cost to the Executive and at the same coverage levels as in effect immediately prior to the Termination Date (except to the extent such cost and

coverage would have changed if the Executive had remained employed), provided that such continued group medical coverage shall immediately cease upon the earlier of: (A) twelve (12) months following the Termination Date; or

(B) the first date the Executive becomes employed by another employer, and eligible for substantially similar coverage, as applicable, with such other employer.

3. Sole Payments and Benefits. The termination payments and benefits in Section 2 of this Separation Agreement shall be the

sole and exclusive payments and benefits to which the Executive shall be entitled in respect of his termination of employment with the Company.

4. Supplemental Release Agreement. The Executive agrees to execute and deliver, within twenty-one (21) days following the

Termination Date, the Supplemental Release Agreement attached as Exhibit A (the “Supplemental Release Agreement”). The Supplemental Release Agreement shall contain a general release of claims co-extensive and substantially

similar to the release set forth in Section 8 below, to cover the period from the date of the execution of this Separation Agreement through and including the date of execution of the Supplemental Release Agreement. Because of the right

to revoke the Supplemental Release Agreement within the seven (7)-day revocation period, the Executive acknowledges that the Supplemental Release Agreement shall not become effective until the eighth (8th) day after the Executive executes and

delivers the Supplemental Release Agreement (the “Supplemental Release Agreement Effective Date”), and the Executive will not be paid any amounts under the Separation Agreement before such Supplemental Release Effective Date.

5. Entitlement to Payments. The Executive’s entitlement to the termination payments set forth in Section 2(b) shall be

subject to and contingent upon the Executive’s timely execution and delivery to the Company, and expiration of the revocation period with no revocation, of: (i) this Separation Agreement; and (ii) the Supplemental Release Agreement.

The Executive agrees that he shall remain bound by the terms of the Signet Code for Securities Transactions up to and including January 31, 2015. The Executive’s entitlement to the termination payments set forth in Section 2(b)

of this Separation Agreement shall be subject to the Executive’s continued compliance with the terms of the Signet Code for Securities Transactions as set forth in the preceding sentence. The Executive shall also be subject to the written

policies of the Board applicable to executives, including without limitation any Board policy relating to claw back of compensation, as they existed during the Executive’s employment with the Company.

6. Confidentiality; Ownership of Developments

(a) During the term of the Executive’s employment with the Company or any of its subsidiaries or affiliates and for all time thereafter,

the Executive shall keep secret and retain in strictest confidence and not divulge, disclose, discuss, copy or otherwise use or suffer to

3

be used in any manner, except in connection with the Business of the Company and of any of the subsidiaries or affiliates of the Company, any trade secrets, confidential or proprietary

information and documents or materials owned, developed or possessed by the Company or any of the subsidiaries or affiliates of the Company pertaining to the Business of the Company or any of its subsidiaries or affiliates; provided that such

information referred to in this Section 6(a) shall not include information that is or has become generally known to the public or the jewelry trade without violation of this Section 6. The payments in Section 2(b)

of this Separation Agreement shall be conditioned on the Executive’s continued compliance with this Section 6(a).

(b)

The Executive acknowledges that all developments, including, without limitation, inventions (patentable or otherwise), discoveries, improvements, patents, trade secrets, designs, reports, computer software, flow charts and diagrams, data,

documentation, writings and applications thereof (collectively, “Works”) relating to the Business or planned business of the Company or any of the subsidiaries or affiliates of the Company that, alone or jointly with others, the

Executive may have created, made, developed or acquired during the Executive’s employment with the Company or any of its subsidiaries or affiliates (collectively, the “Developments”) are works made for hire and shall remain the

sole and exclusive property of the Company and its subsidiaries and affiliates and the Executive hereby assigns to the Company all of his right, title and interest in and to all such Developments. Notwithstanding any provision of this Agreement to

the contrary, “Developments” shall not include Works that do not relate to the Business or planned business of the Company or any of the subsidiaries or affiliates of the Company. The payments described in Section 2(b) of this

Separation Agreement shall be conditioned upon the Executive’s continued compliance with this Section 6(b).

7.

Restrictive Covenants. The Executive agrees that Executive shall not, directly or indirectly, without the prior written consent of the Company:

(a) During his employment with the Company or any of its subsidiaries or affiliates and for a period of two (2) years following the

Termination Date solicit, entice, persuade or induce any employee, consultant, agent or independent contractor of the Company or of any of the subsidiaries or affiliates of the Company to terminate employment or engagement with the Company or such

subsidiary or affiliate, to become employed by any person, firm or corporation other than the Company or such subsidiary or affiliate or approach any such employee, consultant, agent or independent contractor for any of the foregoing purposes.

(b) During his employment with the Company or any of its subsidiaries or affiliates and for a period of one (1) year following the

Termination Date, directly or indirectly own, manage, control, invest or participate in any way in, consult with or render services to or for any person or entity (other than for the Company or any of the subsidiaries or affiliates of the Company)

which is primarily engaged in the retail jewelry business (“primarily” meaning having a product mix consisting of 25% or more jewelry sales per year); provided, however, that the restrictions of this Section 7(b)

shall not extend to ownership, management or control of a retail jewelry business by the Executive following the Termination Date provided that such activity is no less than five (5) miles distant from any retail jewelry store of the Company at

the time of the Termination Date; provided that notwithstanding the foregoing, the Executive shall be entitled to own up to 1% of any class of outstanding securities of any company whose common stock is listed on a national securities

exchange or included for trading on the NASDAQ Stock Market.

4

(c) The Executive acknowledges that the services to be rendered by the Executive are of a

special, unique and extraordinary character and, in connection with such services, the Executive will have access to confidential information vital to the Business of the Company and the subsidiaries and affiliates of the Company. By reason of this,

the Executive consents and agrees that if the Executive violates any of the provisions of Sections 6 or Section 7 of this Separation Agreement, the Company and the subsidiaries and affiliates of the Company would sustain

irreparable injury and that monetary damages will not provide adequate remedy to the Company and that the Company shall be entitled to have Sections 6 or Section 7 specifically enforced by any court having equity jurisdiction.

Nothing contained herein shall be construed as prohibiting the Company or any of the subsidiaries or affiliates of the Company from pursuing any other remedies available to it for such breach or threatened breach, including, without limitation, the

recovery of damages from the Executive or cessation of payments hereunder without requirement for posting a bond.

8. General

Release. For and in consideration of the payments and benefits provided by the Company under this Separation Agreement, the Executive, on his own behalf and on behalf of his heirs, estate and beneficiaries, does hereby release the Company, and

in such capacities, any of its subsidiaries or affiliates, and each past or present officer, director, agent, employee, shareholder, and insurer of any such entities (“Released Parties”), from any and all claims made, to be made, or

which might have been made of whatever nature, whether known or unknown, from the beginning of time, including those that arose as a consequence of his employment with the Company, or arising out of the severance of such employment relationship, or

arising out of any act committed or omitted during or after the existence of such employment relationship, all up through and including the date on which this Release is executed, including, without limitation, any tort and/or contract claims,

common law or statutory claims, claims under any local, state or federal wage and hour law, wage collection law or labor relations law, claims under any common law or other statute, claims of age, race, sex, sexual orientation, religious,

disability, national origin, ancestry, citizenship, retaliation or any other claim of employment discrimination, including under Title VII of the Civil Rights Acts of 1964 and 1991, as amended (42 U.S.C. §§ 2000e et seq.), Age

Discrimination in Employment Act, as amended (29 U.S.C. §§ 621, et seq.); the Americans with Disabilities Act (42 U.S.C. §§ 12101 et seq.), the Rehabilitation Act of 1973 (29 U.S.C. 701 et seq.), the Family

and Medical Leave Act (29 U.S.C. §§ 2601 et seq.), the Fair Labor Standards Act (29 U.S.C. §§ 201 et seq.), the Employee Retirement Income Security Act of 1974 (29 U.S.C. §§ 1001 et seq.) and any

other law (including any state or local law or ordinance) prohibiting employment discrimination or relating to employment, retaliation in employment, termination of employment, wages, benefits or otherwise. If any arbitrator or court rules that such

waiver of rights to file, or have filed on his behalf, any administrative or judicial charges or complaints is ineffective, the Executive agrees not to seek or accept any money damages or any other relief upon the filing of any such administrative

or judicial charges or complaints. The Executive acknowledges and agrees that even though claims and facts in addition to those now known or believed to exist may subsequently be discovered, it is the Executive’s intention to fully settle and

release all claims the Executive may have against the Released Parties, whether known, unknown or suspected.

5

The Executive relinquishes any right to future employment with the Company or any of the Released

Parties, and the Company and the Released Parties shall have the right to refuse to re-employ the Executive, in each case without liability of the Executive or the Company.

The Company and the Executive acknowledge and agree that the release in this Section 8 does not, and shall not be construed to,

release or limit the scope of any existing obligation of the Company and/or any of its parent corporation, subsidiaries or affiliates (i) to indemnify the Executive for his acts as an officer or director of the Company in accordance with the

Certificate of Incorporation and all agreements thereunder, (ii) to pay any amounts or benefits to which the Executive is entitled under this Separation Agreement, or (iii) any rights in respect of payments under the Equity Incentive

Agreements, or with respect to the Executive’s rights as a shareholder of the Company, its parent corporation or any of their subsidiaries.

It is the intention of the Executive and the Company in executing this Separation Agreement that the general release in this

Section 8 shall be effective as a full and final accord and satisfaction, and release of and from all liabilities, disputes, claims and matters covered under the general release in this Section 8, known or unknown, suspected

or unsuspected.

The provisions of this Section 8 shall, without any limitation as to time, survive the expiration or

termination of this Separation Agreement.

9. Cooperation. All payments and benefits pursuant to Section 2(b) of this

Separation Agreement are conditioned upon the Executive’s full and continued cooperation in good faith with the Company, its subsidiaries and affiliates and its legal counsel, as may be necessary or appropriate, (i) to respond truthfully

to any inquiries that may arise with respect to matters that the Executive was responsible for or involved with during his employment with the Company, (ii) to furnish to the Company, as reasonably requested by the Company, from time to time,

the Executive’s honest and good faith advice, information, judgment and knowledge with respect to labor and employment practices at the Company, and employees of the Company, (iii) in connection with any defense, prosecution or

investigation of any and all actual, threatened, potential or pending court or administrative proceedings or other legal matters in which Executive may be involved as a party and/or in which the Company determines, in its sole discretion, that

Executive is a relevant witness and/or possesses relevant information, and (iv) in connection with any and all legal matters relating to the Company, its subsidiaries and affiliates, and each of their respective past and present employees,

managers, directors, officers, administrators, shareholders, members, agents, and attorneys, in which the Executive may be called as an involuntary witness (by subpoena or other compulsory process) served by any third-party, including, without

limitation, providing the Company with written notice of any subpoena or other compulsory process served on Executive within forty-eight (48) hours of its occurrence.

In connection with the matters described in this Section 9, the Executive agrees to notify, truthfully communicate and, provided

there is no conflict of interest between the Executive and the Company, be represented by, and provide requested information to, the Company’s counsel, to fully cooperate and work in good faith with such counsel with respect to, and in

preparation for, any response to a subpoena or other compulsory process served upon the Executive, any depositions, interviews, responses, appearances or other legal matters, and to testify truthfully and honestly with respect to all matters. For

the avoidance of doubt, the Company has no obligation to provide the Executive with counsel in connection with any matter.

6

The Company shall reimburse the Executive for reasonable expenses, such as travel, lodging and

meal expenses, incurred by the Executive pursuant to this Section 9 at the Company’s request, and consistent with the Company’s policies for employee expenses.

The Executive further acknowledges that all documents prepared by the Company pertaining to the affairs of the Company or any legal matter

relating to the Company, which may be provided to the Executive or to which the Executive may be given access pursuant to this Section 9 in connection with the Executive’s cooperation hereunder with respect to any legal matter

relating to the Company, are, and shall remain, the property of the Company at all times. Except as required by applicable law or court order, the Executive shall not disclose any information or materials received in connection with any legal

matter relating to the Company.

All communications by the Company, its subsidiaries and/or affiliates, and its lawyers to the Executive

and all communications by the Executive to the Company, its subsidiaries and/or affiliates and its lawyers, in connection with any legal matter relating to the Company, its subsidiaries and/or affiliates, shall, to the fullest extent permitted by

law, be privileged and confidential and subject to the work product doctrine. No such communication, information, or work product shall be divulged by the Executive to any person or entity, except at the specific direction of an authorized

representative of the Company and its lawyers.

The provisions of this Section 9 shall, without any limitation as to time,

survive the expiration or termination of this Separation Agreement.

10. Return of Property and Documents. As a material provision

of this Separation Agreement, prior to the Termination Date, the Executive shall return to the Company all Company property (including, without limitation, any and all computers, phones, identification cards, card key passes, fobs, corporate credit

cards, corporate phone cards, corporate motor vehicles, files, memoranda, keys and software) in the Executive’s possession and the Executive shall not retain any duplicates or reproductions of such items. The Executive further agrees that, as a

material provision of this Separation Agreement, prior to the Termination Date, he shall deliver to the Company all copies of any confidential information of the Company in his possession, custody or control, including all copies of any analyses,

compilations, studies or other documents in his possession, custody or control that contain any such confidential information (whether in electronic or paper form), and that as of the Termination Date, he shall no longer possesses any such Company

property or confidential information in any form. The payments described in Section 2(b) of this Separation Agreement shall be conditioned upon the Executive’s continued compliance with this Section 10.

The provisions of this Section 10 shall, without any limitation as to time, survive the expiration or termination of this

Separation Agreement.

11. Non-Disparagement. The Executive shall not at any time, publicly or privately, verbally or in writing,

make any false, disparaging, derogatory or otherwise inflammatory remarks or portray in a negative light the Company or any of its affiliates, or any of their respective officers, directors, stockholders, employees, or agents or any other Released

Parties.

7

The provisions of this Section 11 shall, without any limitation as to time, survive

the expiration or termination of this Separation Agreement.

12. Inquiries from Prospective Employers. The Executive and the

Company agree that in the event the Company receives inquiries from prospective employers, it shall be the policy of the Company to respond by advising that the Company’s policy is to provide information only as to service dates and positions

held, and by providing such information.

13. Severability. In the event that any provision of this Separation Agreement is held to

be invalid, illegal or unenforceable, the validity, legality and enforceability of the remainder of this Separation Agreement shall not in any way be affected or impaired thereby.

14. Waiver. No waiver by either party of breach by the other party of any condition or provision of this Separation Agreement to be

performed by such other party shall be deemed a waiver of any other provision or condition at the time or at any prior or subsequent time.

15. Governing Law and Forum. This Separation Agreement shall be subject to, and governed by, the laws of the State of Ohio applicable

to contracts made and to be performed therein, without regard to conflict of laws principles thereof. Any action to enforce any of the provisions of this Separation Agreement shall be brought in a court of the State of Ohio located in Summit County

or in a Federal court located in Cleveland, Ohio. The parties consent to the personal and subject matter jurisdiction of such courts and to the service of process in any manner provided by Ohio law. Each party irrevocably waives any objection which

it may now or hereafter have to the laying of the venue of any such suit, action, or proceeding brought in such court and any claim that such suit, action, or proceeding brought in such court has been brought in an inconvenient forum and agrees that

service of process in accordance with the foregoing sentences shall be deemed in every respect effective and valid personal service of process upon such party.

16. Withholding. The Company may withhold from any amounts payable under this Separation Agreement such Federal, state and local taxes

as may be required to be withheld pursuant to any applicable law or regulation.

17. Entire Agreement. This Separation Agreement

and the Supplemental Release Agreement, constitute the entire agreement and understanding of the parties with respect to the subject matter herein and supersede all prior agreements, including but not limited to the Protection Agreement,

arrangements and understandings, whether written or oral, between the parties. The Executive acknowledges and agrees that he is not relying on any representations or promises by any representative of the Company concerning the meaning of this

Separation Agreement or the Supplemental Release Agreement. This Separation Agreement and the Supplemental Release Agreement may not be altered or modified other than in a writing signed by the Executive and an authorized representative of the

Company.

8

18. Notices. All notices given hereunder shall be given in writing, shall specifically

refer to this Separation Agreement and shall be personally delivered or sent by telecopy or other electronic facsimile transmission or by registered or certified mail, return receipt requested, to the addresses set forth below or at such other

addresses as may hereafter be designated by notice given in compliance with the terms hereof:

|

|

|

| If to the Executive: |

|

Michael W. Barnes 5008 Monterey Drive

Frisco, TX 75034 |

|

|

| If to the Company: |

|

c/o Sterling Jewelers Inc. 375 Ghent Road

Akron, Ohio 44313 Fax: (330) 668-5291

Attn: Lynn Dennison |

|

|

|

|

Signet Jewelers Limited C/O Signet Group

Limited 110 Cannon Street London, EC4N 6EU

Fax: 44(207) 621 0835 Attn: Mark A. Jenkins |

|

|

| with a copy to: |

|

Weil, Gotshal & Manges LLP 767 Fifth

Avenue New York, NY 10153 Telephone: (212) 310-8000

Facsimile: (212) 310-8007 Attn: Jeffrey S. Klein,

Esq. |

If notice is mailed, it shall be effective upon mailing, or if notice is personally delivered or sent by

telecopy or other electronic facsimile transmission, it shall be effective upon receipt.

19. Successors and Assigns. This

Separation Agreement is intended to bind and inure to the benefit of and be enforceable by the Executive, the Company and their respective heirs, successors and assigns, except that the Executive may not assign his rights or delegate his obligations

hereunder without the prior written consent of the Company.

20. Section 409A.

(a) The intent of the parties is that payments and benefit under this Separation Agreement comply with or be exempt from Internal Revenue Code

Section 409A and the regulations and guidance promulgated thereunder (collectively, “Section 409A”) and, accordingly, to the maximum extent permitted, this Separation Agreement shall be interpreted to be in compliance therewith

or exempt therefrom, as applicable. If the Executive notifies the Company that the Executive has received advice of tax counsel of a national reputation with

9

expertise in Section 409A that any provision of this Separation Agreement (or of any award of compensation, including equity compensation or benefits) would cause the Executive to incur any

additional tax or interest under Section 409A (with specificity as to the reason therefor) or the Company independently makes such determination, the Company shall, after consulting with the Executive, reform such provision to try to comply

with Section 409A through good faith modifications to the minimum extent reasonably appropriate to conform with Section 409A. To the extent that any provision hereof is modified in order to comply with or be exempt from Section 409A,

such modification shall be made in good faith and shall, to the maximum extent reasonably possible, maintain the original intent and economic benefit to the Executive and the Company of the applicable provision without violating the provisions of

Section 409A.

(b) A termination of employment shall not be deemed to have occurred for purposes of this Separation Agreement

providing for the payment of any amounts or benefits that are considered nonqualified deferred compensation under Section 409A upon or following a termination of employment, unless such termination is also a “separation from service”

within the meaning of Section 409A and the payment thereof prior to a “separation from service” would violate Section 409A. For purposes of any such provision of this Separation Agreement relating to any such payments or

benefits, references to a “termination,” “termination of employment” or like terms shall mean “separation from service.” If the Executive is deemed on the Termination Date to be a “specified employee” within

the meaning of that term under Section 409A(a)(2)(B), then, notwithstanding any other provision herein, with regard to any payment or the provision of any benefit that is considered nonqualified deferred compensation under Section 409A

payable on account of a “separation from service,” such payment or benefit shall not be made or provided prior to the date which is the earlier of (A) the expiration of the six-month period measured from the date of such

“separation from service” of the Executive, and (B) the date of the Executive’s death (the “Delay Period”). Upon the expiration of the Delay Period, all payments and benefits delayed pursuant to this

Section 20(b) (whether they would have otherwise been payable in a single lump sum or in installments in the absence of such delay) shall be paid or reimbursed to the Executive in a lump sum on the first business day following the Delay Period,

and any remaining payments and benefits due under this Separation Agreement shall be paid or provided in accordance with the normal payment dates specified for them herein.

(c) (i) All expenses or other reimbursements as provided herein shall be payable in accordance with the Company’s policies in effect from

time to time, but in any event shall be made on or prior to the last day of the taxable year following the taxable year in which such expenses were incurred by the Executive; (ii) no such reimbursement or expenses eligible for reimbursement in

any taxable year shall in any way affect the expenses eligible for reimbursement in any other taxable year; and (iii) the right to reimbursement or in-kind benefits shall not be subject to liquidation or exchanged for another benefit.

(d) For purposes of Section 409A, the Executive’s right to receive any installment payments pursuant to this Separation Agreement

shall be treated as a right to receive a series of separate and distinct payments. Whenever a payment under this Separation Agreement specifies a payment period with reference to a number of days (e.g., “payment shall be made within thirty days

following the date of termination”), the actual date of payment within the specified period shall be within the sole discretion of the Company.

10

(e) Nothing contained in this Separation Agreement shall constitute any representation or

warranty by the Company regarding compliance with Section 409A. Subject to the above provisions of this Section 20, (i) the Company has no obligation to take any action to prevent the assessment of any additional income tax, interest

or penalties under Section 409A on any person and (ii) the Company, its subsidiaries and affiliates, and each of their employees and representatives shall not have any liability to the Executive with respect thereto.

21. Knowing and Voluntary Time to Consider and Revoke. The Executive acknowledges that pursuant to Section 8 of this

Separation Agreement, the Executive is waiving and releasing any rights he may have under the ADEA, and that the Executive’s waiver and release of such rights is knowing and voluntary. The Executive acknowledges that the consideration given for

the ADEA release under Section 8 is in addition to that which the Executive was entitled. The Executive further acknowledges he is advised by this writing that:

(a) The Executive should consult with an attorney prior to executing this Separation Agreement and has had an opportunity to do so;

(b) The Executive has been provided at least twenty-one (21) days within which to consider this Separation Agreement, that this

twenty-one (21) day period shall run from the date the Executive receives this Separation Agreement, and that the parties’ modifications to the Separation Agreement prior to its execution shall not restart, or otherwise affect, this

twenty-one (21) day period;

(c) The Executive has seven (7) days following the Executive’s execution of this Separation

Agreement to revoke it, but only by providing written notice of revocation, received within the seven (7) day revocation period, to the Company in accordance with the “Notices” provision in Section 18 of this Separation

Agreement;

(d) This Separation Agreement shall not be effective and enforceable until the seven (7) day revocation period has

expired; and

22. Authority. The Executive represents that he has full power and authority to enter into this Separation Agreement,

and further represents that entering into this Separation Agreement will not result in a conflict of interest with a party to any pending litigation relating to or against the Company, with attorneys representing a party to any pending litigation

relating to or against the Company, or with any governmental or administrative agency.

23. Counterparts. This Separation Agreement

may be executed in counterparts, each of which shall be an original but all together shall constitute one and the same instrument.

[SIGNATURE PAGE FOLLOWS]

11

IN WITNESS WHEREOF, the parties hereto have executed this Separation Agreement as of the last

date set forth above.

|

|

|

| SIGNET JEWELERS LIMITED |

|

|

| By: |

|

/s/ Mark A. Jenkins |

| Name: |

|

Mark A. Jenkins |

| Title: |

|

Chief Legal Officer & Corporate Secretary |

|

| EXECUTIVE |

|

|

| By: |

|

/s/ Michael Barnes |

| Name: |

|

Michael W. Barnes |

[SIGNATURE PAGE TO CONFIDENTIAL SEPARATION AGREEMENT]

Exhibit A

SUPPLEMENTAL RELEASE AGREEMENT

THIS SUPPLEMENTAL RELEASE AGREEMENT (the “Supplemental Release Agreement”) dated as of

, 2014, is made by and between Signet Jewelers Limited, a Bermuda corporation (including its successors and assigns, and together with its affiliates, the

“Company”), and Michael W. Barnes (the “Executive”).

WHEREAS, the Company and the Executive

previously entered into a Confidential Separation Agreement dated as of October 13, 2014 (the “Separation Agreement”) detailing the terms of Executive’s termination from the Company, and as described in Section 8 of

the Separation Agreement, the Executive’s general release of claims through the Termination Date;

WHEREAS, this Supplemental

Release Agreement was part of the Separation Agreement, expressly incorporated, and attached as Exhibit A to the Separation Agreement; and

WHEREAS, pursuant to Section 4 of the Separation Agreement, Executive agreed to execute and deliver to the Company, within

twenty-one (21) days of the Termination Date, this Supplemental Release Agreement containing a general release of claims co-extensive and substantially similar to the general release set forth Section 8 of the Separation Agreement;

WHEREAS, capitalized terms not defined herein shall have the meaning as defined under the Separation Agreement and the Protection

Agreement.

NOW, THEREFORE, in consideration of the premises and mutual agreements, including but not limited to the payments and

benefits detailed in the Separation Agreement, the Company and the Executive agree as follows:

1. In consideration of the

Executive’s release under Section 2 hereof, the Company shall pay to the Executive or provide benefits to the Executive as set forth in Section 2(b) of the Separation Agreement, which is attached hereto and made a part

hereof.

2. For and in consideration of the payments and benefits provided by the Company under this Separation Agreement, the Executive,

on his own behalf and on behalf of his heirs, estate and beneficiaries, does hereby release the Company, and in such capacities, any of its subsidiaries or affiliates, and each past or present officer, director, agent, employee, shareholder, and

insurer of any such entities (“Released Parties”), from any and all claims made, to be made, or which might have been made of whatever nature, whether known or unknown, from the beginning of time, including those that arose as a

consequence of his employment with the Company, or arising out of the severance of such employment relationship, or arising out of any act committed or omitted during or after the existence of such employment relationship, all up through and

including the date on which this Release is executed, including, without limitation, any tort and/or contract claims, common law or statutory claims, claims under any local, state or federal wage and hour law, wage collection law or labor relations

law, claims under any common law or other statute, claims of age, race, sex, sexual orientation, religious, disability, national origin, ancestry, citizenship, retaliation or any other claim of employment discrimination,

including under Title VII of the Civil Rights Acts of 1964 and 1991, as amended (42 U.S.C. §§ 2000e et seq.), Age Discrimination in Employment Act, as amended (29 U.S.C. §§

621, et seq.); the Americans with Disabilities Act (42 U.S.C. §§ 12101 et seq.), the Rehabilitation Act of 1973 (29 U.S.C. 701 et seq.), the Family and Medical Leave Act (29 U.S.C. §§ 2601 et seq.), the Fair Labor Standards Act

(29 U.S.C. §§ 201 et seq.), the Employee Retirement Income Security Act of 1974 (29 U.S.C. §§ 1001 et seq.) and any other law (including any state or local law or ordinance) prohibiting employment discrimination or relating to

employment, retaliation in employment, termination of employment, wages, benefits or otherwise. If any arbitrator or court rules that such waiver of rights to file, or have filed on his behalf, any administrative or judicial charges or complaints is

ineffective, the Executive agrees not to seek or accept any money damages or any other relief upon the filing of any such administrative or judicial charges or complaints. The Executive acknowledges and agrees that even though claims and facts in

addition to those now known or believed to exist may subsequently be discovered, it is the Executive’s intention to fully settle and release all claims the Executive may have against the Released Parties, whether known, unknown or suspected.

The Executive relinquishes any right to future employment with the Company or any of the Released Parties, and the Company and the

Released Parties shall have the right to refuse to re-employ the Executive, in each case without liability of the Executive or the Company.

The Company and the Executive acknowledge and agree that the release in this Section 2 does not, and shall not be construed to,

release or limit the scope of any existing obligation of the Company and/or any of its parent corporation, subsidiaries or affiliates (i) to indemnify the Executive for his acts as an officer or director of Company in accordance with the

Certificate of Incorporation and all agreements thereunder, (ii) to pay any amounts or benefits to which the Executive is entitled under the Separation Agreement, or (iii) any rights in respect of payments under the Equity Incentive

Agreements, or with respect to the Executive’s rights as a shareholder of the Company, its parent corporation or any of their subsidiaries.

3. The Executive acknowledges that pursuant to Section 2 of this Supplemental Release Agreement, the Executive is waiving and

releasing any rights he may have under the ADEA, and that the Executive’s waiver and release of such rights is knowing and voluntary. Executive acknowledges that the consideration given for the ADEA waiver and release under this Supplemental

Release Agreement is in addition to anything of value to which the Executive was already entitled. The Executive further acknowledges that he is advised by this writing that:

(a) The Executive should consult with an attorney prior to executing this Supplemental Release Agreement, and has had an opportunity to do so;

(b) The Executive has been provided at least twenty-one (21) days within which to consider this Supplemental Release Agreement, that

this twenty-one (21) day period shall run from the date the Executive receives this Supplemental Release Agreement, and that the parties’ modifications to this Supplemental Release Agreement prior to its execution shall not restart, or

otherwise affect, this twenty-one (21) day period;

2

(c) The Executive has seven (7) days following the Executive’s execution of this

Supplemental Release Agreement to revoke it, but only by providing written notice of revocation, received within the seven (7) day revocation period, to the Company in accordance with the “Notices” provision in Section 18

of the Separation Agreement;

(d) This Supplemental Release Agreement shall not be effective and enforceable until the seven (7) day

revocation period has expired; and

4. It is the intention of the Executive and the Company in executing this Supplemental Release

Agreement that it shall be effective as a full and final accord and satisfaction and release of and from all liabilities, disputes, claims and matters covered under this Supplemental Release Agreement, known or unknown, suspected or unsuspected.

5. Because of the right to revoke this Supplemental Release Agreement within the seven (7)-day revocation period, the Executive

acknowledges that this Supplemental Release Agreement shall not become effective until the eighth (8th) day after the Executive executes and returns this Supplemental Release Agreement (the “Supplemental Release Effective

Date”) to the Company, and that the Executive will not be paid any amounts under the Separation Agreement before such Supplemental Release Effective Date.

[SIGNATURE PAGE FOLLOWS]

3

IN WITNESS WHEREOF, the parties hereto have executed this Separation Agreement as of the last

date set forth above.

|

|

|

| SIGNET JEWELERS LIMITED |

|

|

| By: |

|

|

| Name: |

|

Mark A. Jenkins |

| Title: |

|

Chief Legal Officer & Corporate Secretary |

|

| EXECUTIVE |

|

|

| By: |

|

|

| Name: |

|

Michael W. Barnes |

[SIGNATURE PAGE TO SUPPLEMENTAL RELEASE AGREEMENT]

Exhibit 99.1

SIGNET JEWELERS ANNOUNCES NEW CEO

Signet Reaffirms Financial Guidance

Zale Integration Progressing As-Expected

HAMILTON, Bermuda, October 14, 2014 — Signet Jewelers Limited (“Signet”) (NYSE and LSE: SIG), the largest specialty jewelry

retailer in the US, UK and Canada, today announced that Michael Barnes has resigned from his position as Chief Executive Officer and from Signet’s board of directors, effective October 31, 2014, and Mark Light, currently Signet’s

President and Chief Operating Officer, will succeed Mr. Barnes as Chief Executive Officer of Signet following his departure and will also join Signet’s board of directors. Signet is also reaffirming its financial guidance initiated in its

second quarter earnings release on August 28, 2014.

Todd Stitzer, Chairman said “We are delighted to announce Mark’s promotion to Chief

Executive Officer of Signet. Mark is an experienced, strategic leader who has been deeply involved in the company’s Vision 2020 Strategy, the Zale acquisition and its ongoing integration. In addition he has a meticulous approach to operational

details, and has been the main architect of our Sterling division’s consistently profitable growth and has played a key role in defining and executing Signet’s growth strategy. He has also been an advisor to our UK Managing Director since

2013 and became formally responsible for that business in mid-2014. These valuable attributes have been developed during his long and successful career of over 30 years with Signet, and the Board of Directors is confident that Mark is the right

person to lead the Company forward as Signet enhances its position as a leading retailer in the US, UK and Canada.”

Commenting on

Mr. Barnes’ resignation, Mr. Stitzer added, “Mike has been the leader of the Signet executive management team during a period of outstanding transformation and growth. Since he joined Signet in 2010, Mike has been an instrumental

part of Signet’s success. He has played a critical role in Signet’s recent acquisition of Zale Corporation and its continuing integration. He has also led the development of Signet’s Vision 2020 Initiative for the future. We

understand and respect his personal desire to relocate nearer to his family and pursue opportunities closer to his home in Dallas at this time. On behalf of Signet, I thank Mike for his many contributions to Signet and wish him well in his future

endeavors.”

“I’ve enjoyed working closely with Mike Barnes to develop and implement successful strategies to accelerate the growth of

Signet organically and through acquisitions,” said Mark Light. “I am extremely pleased with the progress we are making integrating the Zale division, and I remain confident that we will achieve our 3-year synergy expectations of $150

million to $175 million. More broadly, I’m honored to take the helm of this enterprise to move Signet forward as a leader in the retail jewelry industry, bringing ever greater innovation in products, store concepts, customer service and

marketing as we continue to grow our market share. Our strategic planning, operational excellence, and superior collaboration executed by our industry-leading teams, will continue to drive our success into the future.”

“It has been a privilege to have the opportunity to lead the outstanding Signet team through a period of

significant transformation,” said Mike Barnes. Over these several years, I’ve worked closely with Mark, collaborating with him on all of Signet’s strategic initiatives, including the Zale acquisition and ongoing integration. “I

have every confidence in Mark and wish him success in his new role.”

Contacts:

|

|

|

|

|

| Investors: |

|

James Grant, VP Investor Relations, Signet |

|

+1 (330) 668 5412 |

| Press: |

|

Alecia Pulman, ICR, Inc. |

|

+1 (203) 682 8224 |

About Signet and Safe Harbor Statement

Signet Jewelers Limited is the largest specialty jewelry retailer in the US, UK, and Canada. Signet’s Sterling division operates over 1,400 stores in

all 50 states primarily under the name brands of Kay Jewelers and Jared The Galleria Of Jewelry. Signet’s UK division operates approximately 500 stores primarily under the name brands of H.Samuel and Ernest Jones. Signet’s Zale division

operates over 1,600 locations in the US and Canada primarily under the name brands of Zales, People’s, and Piercing Pagoda. Further information on Signet is available at www.signetjewelers.com. See also www.kay.com, www.jared.com,

www.hsamuel.co.uk, www.ernestjones.co.uk, www.zales.com, and www.peoplesjewellers.com.

This release contains statements which

are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, based upon management’s beliefs and expectations as well as on assumptions made by and data currently available to

management, include statements regarding, among other things, Signet’s results of operation, financial condition, liquidity, prospects, growth, strategies and the industry in which Signet operates. The use of the words “expects,”

“intends,” “anticipates,” “estimates,” “predicts,” “believes,” “should,” “potential,” “may,” “forecast,” “objective,” “plan,” or

“target,” and other similar expressions are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to a number of risks and uncertainties, including but

not limited to general economic conditions, risks relating to Signet being a Bermuda corporation, the merchandising, pricing and inventory policies followed by Signet, the reputation of Signet and its brands, the level of competition in the jewelry

sector, the cost and availability of diamonds, gold and other precious metals, regulations relating to consumer credit, seasonality of Signet’s business, financial market risks, deterioration in consumers’ financial condition, exchange

rate fluctuations, changes in consumer attitudes regarding jewelry, management of social, ethical and environmental risks, security breaches and other disruptions to Signet’s information technology infrastructure and databases, inadequacy in

and disruptions to internal controls and systems, changes in assumptions used in making accounting estimates relating to items such as extended service plans and pensions, the impact of the Zale acquisition on relationships, including with

employees, suppliers, customers and competitors and any related impact on integration and anticipated synergies, the impact of stockholder litigation with respect to the Zale acquisition, and our ability to successfully integrate Zale’s

operations and to realize synergies from the transaction.

For a discussion of these and other risks and uncertainties which could cause actual

results to differ materially from those expressed in any forward-looking statement, see the “Risk Factors” section of Signet’s Fiscal 2014 Annual Report on Form 10-K filed with the SEC on March 27, 2014 and the “Risk

Factors” section of Signet’s Quarterly Report on Form 10-Q filed with the SEC on September 10, 2014. Signet undertakes no obligation to update or revise any forward-looking statements to reflect subsequent events or circumstances, except

as required by law.

2

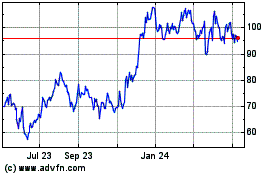

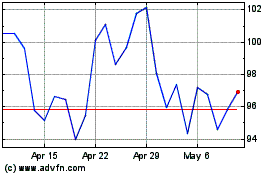

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Apr 2023 to Apr 2024