SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

(RULE 14C-101)

SCHEDULE 14C INFORMATION

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF

THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

| x |

Preliminary Information Statement

|

| |

|

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-5(d) (1))

|

| |

|

| ¨ |

Definitive Information Statement

|

| GREENFIELD FARMS FOOD, INC. |

| (Name of Registrant as Specified In Its Charter) |

Payment of Filing Fee (Check the appropriate box):

| x |

No Fee Required

|

| |

|

| ¨ |

Fee Computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

| |

1.

|

Title of each class of securities to which transaction applies:

|

| |

|

|

| |

2.

|

Aggregate number of securities to which transaction applies:

|

| |

|

|

| |

3.

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

|

| |

4.

|

Proposed aggregate offering price:

|

| |

|

|

| |

5.

|

Total fee paid:

|

| ¨ |

Fee paid previously with preliminary materials.

|

| |

|

| ¨ |

Check box is any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

1.

|

Amount previously paid:

|

| |

|

|

| |

2.

|

Form, schedule, or registration statement number:

|

| |

|

|

| |

3.

|

Filing party:

|

| |

|

|

| |

4.

|

Date filed:

|

GREENFIELD FARMS FOOD, INC.

319 Clematis Street, Suite 400

West Palm Beach, Florida 33401

(561) 514-9042

October 10, 2014

Dear Shareholder:

This Information Statement is furnished to holders of shares of common stock, $.001 par value (the "Common Stock") of GREENFIELD FARMS FOOD, INC. (the "Company"). We are sending you this Information Statement to inform you that on September 29, 2014, the Board of Directors of the Company unanimously adopted a resolution to seek shareholder approval to an amendment of the Company's Articles of Incorporation to increase the Company's authorized capital to 4,000,000,000 shares comprising 3,950,000,000 shares of Common Stock par value $.001 per share and 50,000,000 shares of Preferred Stock par value $0.001 per share.

Thereafter, on September 29, 2014, pursuant to the By-Laws of the Company and applicable Nevada law, a certain holder of the Company’s Series D Preferred Stock (identified in the section entitled "Voting Securities and Principal Holders Thereof") holding 1,000 shares of Series A Preferred Stock, representing 100% of the total issued and outstanding Series D Preferred Stock, adopted a resolution to authorize the Board of Directors to enact an amendment of the Company's Articles of Incorporation to increase the Company's authorized capital to 4,000,000,000 shares comprising 3,950,000,000 shares of Common Stock par value $.001 per share and 50,000,000,000_ shares of Preferred Stock par value $0.001 per share. Pursuant to the Certificate of Designations for such Series D Preferred Stock, the holders of such Series D Preferred Stock are entitled to cast 51% of the vote on any matter submitted to the shareholders of the Company. The Board of Directors believes that the proposed increase in authorized capital is beneficial to the Company because it provides the Company with the flexibility it needs to consider various strategic alternatives and permit the issuance of additional shares to stock to new investors or on the conversion of existing convertible securities.

WE ARE NOT ASKING YOU FOR A PROXY AND YOUR ARE NOT REQUESTED

TO SEND US A PROXY

The enclosed Information Statement is being furnished to you to inform you that the foregoing action has been approved by the holders of a majority of the outstanding shares of our stock entitled to vote on the matter. The resolutions will not become effective before the date which is 20 days after this Information Statement was first mailed to shareholders. You are urged to read the Information Statement in its entirety for a description of the action taken by the Board of Directors and a majority of the shareholders of the Company entitled to vote on the matter.

This Information Statement is being mailed on or about October 15, 2014 to shareholders of record on October 1, 2014 (the "Record Date").

|

|

/s/ Henry Fong |

|

| |

|

Henry Fong |

|

| |

|

Principal Financial Officer |

|

GREENFIELD FARMS FOOD, INC.

319 Clematis Street, Suite 400

West Palm Beach, Florida 33401

(561) 514-9042

________________________________

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14C-2 THEREUNDER

________________________________

NO VOTE OR OTHER ACTION OF THE COMPANY'S SHAREHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED

NOT TO SEND US A PROXY

The Company is distributing this Information Statement to its shareholders in full satisfaction of any notice requirements it may have under Securities Exchange Act of 1934, as amended, and applicable Nevada law. No additional action will be undertaken by the Company with respect to the receipt of written consents, and no dissenters' rights with respect to the receipt of the written consents, and no dissenters' rights under the Nevada Revised Statutes are afforded to the Company's shareholders as a result of the adoption of these resolutions.

Expenses in connection with the distribution of this Information Statement, which are anticipated to be less than $2,000.00, will be paid by the Company.

Our Business

Greenfield Farms Food, Inc. (“GRAS” or the "Company") was incorporated under the laws of the State of Nevada on June 2, 2008. In October 2013, the Company entered into an Asset Purchase Agreement (the “Agreement”) with COHP, LLC (”COHP”) through which the Company acquired certain of the assets and liabilities of COHP including the operations of Carmela’s Pizzeria (“Carmela’s”) through a newly formed wholly-owned subsidiary Carmela’s Pizzeria CO, Inc. Carmela's Pizzeria presently has three Dayton, Ohio area locations offering authentic New York style pizza. Carmela's offers a full service menu for Dine In, Carry out and Delivery as well as pizza buffets in select stores.

The Company is currently considering a number of strategic business alternatives and believes that it may not have sufficient authorized, but unissued, shares of its Common Stock to facilitate the issuance of additional shares in connection with such alternatives and as required by the Company’s covenants in certain of its convertible debt instruments. As of this date, no new strategic business alternatives have been adopted or finalized. In order to facilitate any strategic business alternative, which may be essential to the Company’s continued operations, the Company's Board of Directors believes that the proposed increase in authorized capital is beneficial to the Company because it provides the Company with the flexibility it needs to adopt any such alternatives and continue to comply with its convertible debt covenants. At this time, the Company has not made any commitments with respect to any new strategic business alternative.

The Board of Directors intends to implement the increase in the Company’s authorized capital twenty days following the mailing of this Information Statement to the Company’s shareholders.

No further action on the part of shareholders will be required to increase the Company’s authorized capital.

ADVANTAGES AND DISADVANTAGES OF INCREASING AUTHORIZED COMMON STOCK AND DECREASING THE PAR VALUE OF THE STOCK

There are certain advantages and disadvantages of increasing the Company's authorized common stock. The advantages include:

- The ability to issue shares of the Company’s Common Stock in exchange for the Company’s convertible debt.

- The ability to raise capital by issuing capital stock under future financing transactions, if any.

- To have shares of common stock available to pursue business expansion opportunities, if any.

The disadvantages include:

- Dilution to the existing shareholders, including a decrease in our net income per share in future periods. This could cause the market price of our stock to decline.

- The issuance of authorized but unissued stock could be used to deter a potential takeover of the Company that may otherwise be beneficial to shareholders by diluting the shares held by a potential suitor or issuing shares to a shareholder that will vote in accordance with the desires of the Company's Board of Directors, at that time. A takeover may be beneficial to independent shareholders because, among other reasons, a potential suitor may offer such shareholders a premium for their shares of stock compared to the then-existing market price. The Company does not have any plans or proposals to adopt provisions or enter into agreements that may have material anti-takeover consequences.

SHAREHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

AUTHORIZED SHARES

As of October 9, 2014, 2014, we had 950,000,000 shares of authorized Common Stock and 848,375,324 shares of Common Stock issued and outstanding together with 50,000,000 shares of Preferred Stock and 96,623 shares of Series A Convertible Preferred Stock, 44,000 shares of Series B Convertible Preferred Stock and 1,000 shares of Series D Preferred Stock outstanding. Following the increase in authorized shares proposed by the Company’s board of directors, we will have 3,950,000,000 shares of authorized Common Stock and 848,375,324 shares of Common Stock issued and outstanding together with 50,000,000 shares of Preferred Stock and 96,623 shares of Series A Convertible Preferred Stock, 44,000 shares of Series B Convertible Preferred Stock and 1,000 shares of Series D Preferred Stock outstanding. Authorized but unissued shares will be available for issuance, and we may issue such shares in the future. If we issue additional shares, the ownership interest of holders of the Company's Common Stock will be diluted.

ACCOUNTING MATTERS

There will be no changes to the Company’s balance sheet and stated capital will be unchanged.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The following table lists, as of October 1, 2014, the number of shares of Common Stock and Preferred Stock beneficially owned by (i) each person or entity known to the Company to be the beneficial owner of more than 5% of the outstanding Common Stock; (ii) each officer and director of the Company; and (iii) all officers and directors as a group. Information relating to beneficial ownership of Common Stock by our principal shareholders and management is based upon information furnished by each person using "beneficial ownership" concepts under the rules of the Securities and Exchange Commission. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest.

The following table sets forth certain information with respect to the beneficial ownership of our voting securities by (i) any person or group owning more than 5% of any class of voting securities, (ii) each director, (iii) our chief executive officer and president and (iv) all executive officers and directors as a group as of October 1, 2014. Unless noted, the address for the following beneficial owners and management is:

Greenfield Farms Food, Inc.

319 Clematis Street, Suite 400

West Palm Beach, Florida 33401 (561) 514-9042

|

Name of Beneficial Owner

|

|

Number of Shares Beneficially

Owned(1)

|

|

|

Preferred

Stock(2) |

|

|

Warrants |

|

|

Total Shares Beneficially Owned(6) |

|

|

Percent of

Class(7) |

|

|

Darren Dulsky (3)

|

|

|

24,883,823

|

|

|

|

0

|

|

|

|

25,633,821

|

|

|

|

50,517,644

|

|

|

|

5.8

|

%

|

|

Ronald Heineman (3)(4) Chief Executive Officer

|

|

|

24,883,823

|

|

|

|

1,000

|

|

|

|

25,633,821

|

|

|

|

50,517,644

|

|

|

|

56.8

|

%

|

|

Henry Fong (2)(5)(6)(7) Chief Financial Officer

|

|

|

0

|

|

|

|

70,715

|

|

|

|

|

|

|

|

4,950,050

|

|

|

|

0.6

|

%

|

|

All Executive Officers and Directors as a Group (2 persons) (2)(3)(4)(5)(6)(7)

|

|

|

24,883,823

|

|

|

|

71,715

|

|

|

|

25,633,821

|

|

|

|

55,467,694

|

|

|

|

57.0

|

%

|

_____________

|

(1)

|

As of October 9, 2014, 848,375,224 shares of our common stock were outstanding. Beneficial ownership is determined in accordance with the rules of the SEC, and includes general voting power and/or investment power with respect to securities. Shares of common stock subject to options or warrants currently exercisable or exercisable within 60 days of the record date are deemed outstanding for computing the beneficial ownership percentage of the person holding such options or warrants but are not deemed outstanding for computing the beneficial ownership percentage of any other person. Except as indicated by footnote, the persons named in the table above have the sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them.

|

|

(2)

|

In March 2011, the Company authorized the issuance of up to 100,000 shares of $0.001 par value Series A Convertible Voting Preferred Stock (the "Series A Preferred") of which there were 96,623 shares outstanding as of December 31, 2013. Each share of Series A Preferred is convertible into 70 shares of common stock. If all shares of Series A Preferred were to be converted to shares of common stock as of December 31, 2013, a total of 6,763,610 shares would be issued to the holders of the Series A Preferred including 4,950,050 that would be beneficially owned by Mr. Fong through his wife. The Series A Preferred also carries voting rights on an "as if converted" basis.

|

|

|

In September 2014, the Company authorized the issuance of up to 1,000 shares of $0.001 par value Series D Preferred Stock. The Mr. Heineman as holder of the Series D Preferred Stock is entitled to cast 51% of the vote on any matter submitted to the shareholders of the Company.

|

|

(3)

|

Includes warrants exercisable until October 2018 at the following exercise prices: 8,544,607 at $0.015; 8,544,607 at $0.02; and 8,544,607 at $0.025.

|

|

(4)

|

Includes 24,883,823 shares held by a trust owned by Mr. Heineman’s spouse.

|

|

(5)

|

Includes 70,715 shares of Series A Preferred Stock owned by a company controlled by Mr. Fong's spouse.

|

|

(6)

|

Includes 4,950,050 shares of common stock issuable upon conversion of Series A owned by Mr. Fong’s spouse

|

|

(7)

|

The Series D Preferred Stock held by Mr. Heinemann has the right, voting as a class, to vote 51% of the vote on any and all shareholder matters. Therefore 51% is added to Mr. Heineman’s 5.8% ownership respresenting total voting power of 56.8%.

|

INTEREST OF CERTAIN PERSONS IN OR IN OPPOSITION TO MATTERS TO BE ACTED UPON

No director, executive officer, associate of any director or executive officer or any other person has any substantial interest, direct or indirect, by security holdings or otherwise, in the proposal to amend the Articles of Incorporation and take all other proposed actions which is not shared by all other holders of the Company's Common Stock.

OTHER MATTERS

The Board knows of no other matters other than those described in this Information Statement which have been approved or considered by the holders of a majority of the shares of the Company's voting stock.

IF YOU HAVE ANY QUESTIONS REGARDING THIS INFORMATION STATEMENT, PLEASE CONTACT:

Greenfield Farms Food, Inc.

Mr. Henry Fong, Principal Financial Officer

319 Clematis Street, Suite 400

West Palm Beach, Florida 33401

(561) 514-9042

BY ORDER OF THE BOARD OF DIRECTORS OF GREENFIELD FARMS FOOD, INC.

EXHIBIT A

CERTIFICATE OF AMENDMENT TO ARTICLES OF INCORPORATION

7

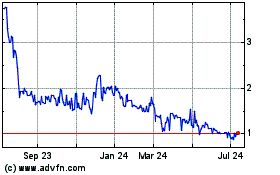

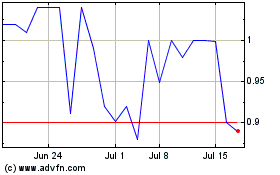

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Apr 2023 to Apr 2024